Key Insights

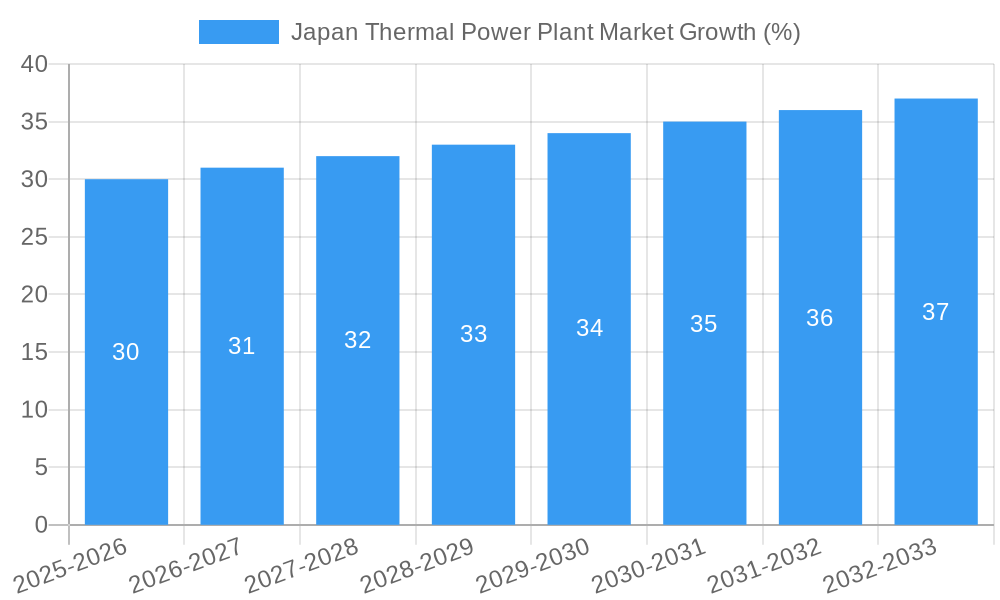

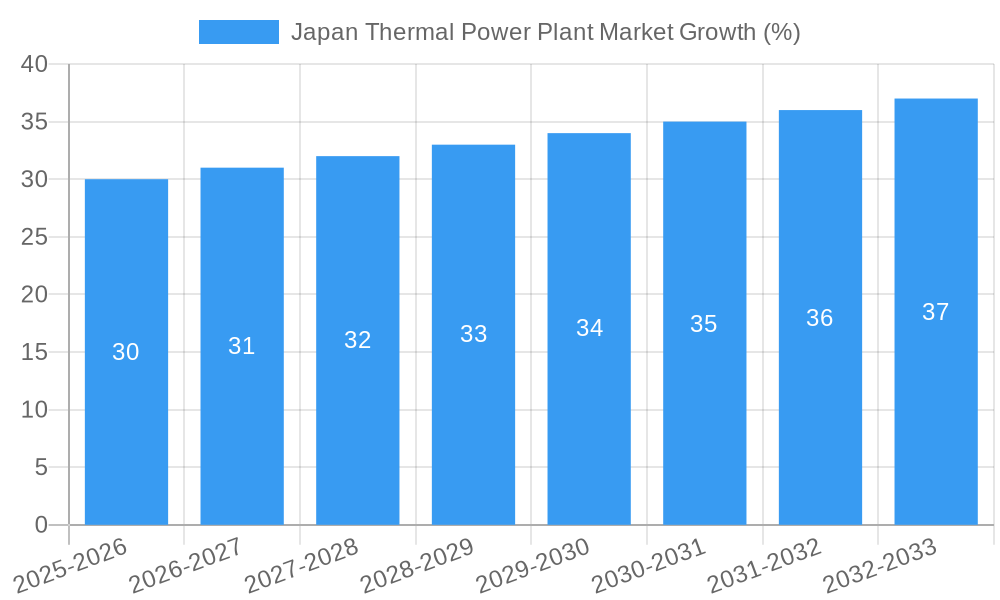

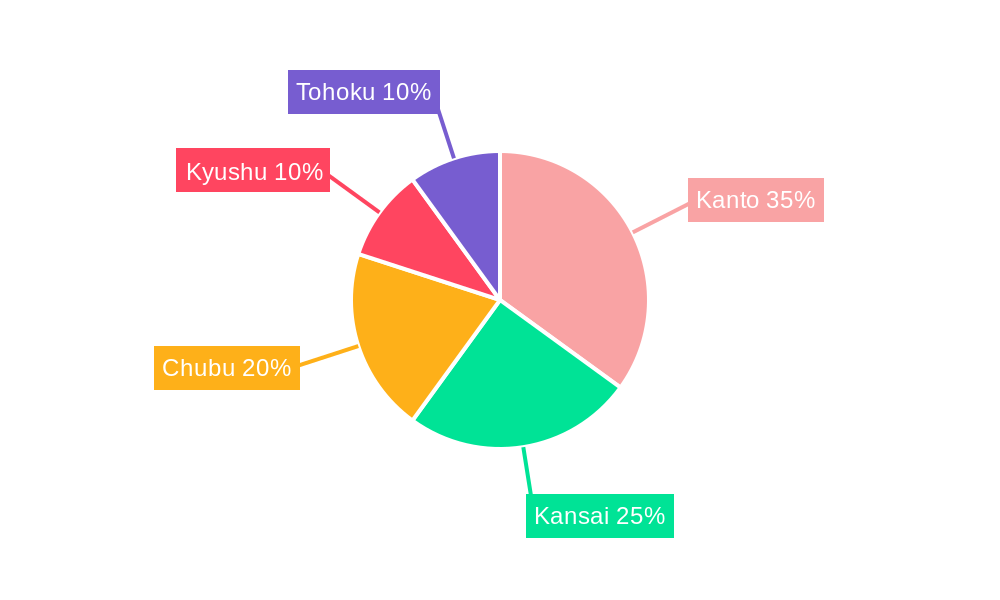

The Japan Thermal Power Plant market, valued at approximately ¥2 trillion (assuming a market size of XX is in the trillions of Yen, given the scale of involved companies and infrastructure) in 2025, is projected to experience steady growth with a Compound Annual Growth Rate (CAGR) exceeding 1.50% from 2025 to 2033. This growth is driven primarily by the increasing energy demand fueled by Japan's robust industrial sector and population growth, despite a push towards renewable energy sources. The reliance on thermal power plants for baseload electricity generation remains crucial, particularly during peak demand periods and times of low renewable energy output. Key segments include coal, gas, and nuclear power plants, with gas-fired plants experiencing relatively stronger growth due to their lower carbon emissions compared to coal, and ongoing efforts to diversify the energy mix. However, stricter environmental regulations aimed at reducing carbon emissions pose a significant restraint, pushing the market toward more efficient and cleaner technologies, including carbon capture and storage (CCS) implementations and a gradual shift towards gas. The dominance of major players such as Mitsubishi Heavy Industries, Toshiba, and Hitachi underscores the market's consolidated nature. Regional distribution sees concentration in the Kanto, Kansai, and Chubu regions, reflecting high population density and industrial activity.

Despite the challenges posed by environmental regulations and the rising adoption of renewable energy, the Japanese thermal power plant market is expected to maintain a consistent growth trajectory over the forecast period. This is driven by the need for reliable and stable baseload power, which necessitates the continued operation and even upgrading of existing thermal plants. The integration of advanced technologies like CCS, alongside efforts to optimize efficiency and reduce emissions, will likely shape the future of the sector. The presence of established industrial giants indicates a mature yet dynamic market with ongoing opportunities for technological advancements and efficiency improvements within the existing infrastructure. The shift in fuel type towards natural gas represents a key aspect of this evolution.

Japan Thermal Power Plant Market: 2019-2033 Forecast Report

This comprehensive report provides an in-depth analysis of the Japan Thermal Power Plant Market, offering valuable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report leverages rigorous research methodologies to provide accurate and actionable data. The market is segmented by fuel type: Coal, Gas, Nuclear, and Others. Key players like Mitsubishi Heavy Industries LTD, The Chugoku Electric Power co inc, Toshiba Corp, Hitachi Ltd, Sumitomo Group, Hirono IGCC Power GK, Japan Atomic Power Company, and Tokyo Electric Power Company Holdings Inc. are analyzed, but this list is not exhaustive. The report projects a xx Million market size in 2025, and explores the key trends shaping the future of this dynamic sector.

Japan Thermal Power Plant Market Structure & Innovation Trends

The Japanese thermal power plant market exhibits a moderately concentrated structure, with a few major players holding significant market share. Mitsubishi Heavy Industries LTD and Toshiba Corp, for example, command a substantial portion (estimated at xx%) of the overall market. Innovation is driven by the need for increased efficiency, reduced emissions, and enhanced grid stability, fueled by stringent environmental regulations and the push for energy security. The regulatory framework, including government subsidies and emission standards, significantly influences market dynamics. Product substitutes, primarily renewable energy sources, are gaining traction, impacting the market share of traditional thermal plants. End-user demographics primarily consist of electric utilities and industrial consumers. M&A activity in the sector has been moderate in recent years, with deal values averaging around xx Million annually (2019-2024). Key M&A activities have primarily focused on enhancing technological capabilities and expanding market reach.

- Market Concentration: Moderately concentrated, with key players holding xx% market share.

- Innovation Drivers: Efficiency gains, emission reduction, grid stability, and government regulations.

- Regulatory Framework: Stringent environmental standards and government incentives influence market dynamics.

- Product Substitutes: Growing adoption of renewable energy sources poses a challenge.

- M&A Activity: Moderate activity with an average deal value of approximately xx Million annually (2019-2024).

Japan Thermal Power Plant Market Dynamics & Trends

The Japan Thermal Power Plant market is characterized by a complex interplay of factors impacting its growth trajectory. The market is projected to witness a CAGR of xx% during the forecast period (2025-2033). Increased energy demand driven by economic growth and urbanization is a primary growth driver. However, the transition towards renewable energy sources presents both challenges and opportunities. Technological disruptions, such as advancements in combined cycle gas turbines (CCGT) and high-efficiency low-emission (HELE) coal plants, are altering the competitive landscape. Consumer preferences are shifting towards cleaner energy options, placing pressure on thermal power plants to adopt cleaner technologies and improve efficiency. The competitive dynamics are intense, with existing players investing heavily in upgrades and new technologies to maintain their market positions. Market penetration of CCGT technology is expected to reach xx% by 2033, driven by its superior efficiency and lower emissions compared to traditional coal plants.

Dominant Regions & Segments in Japan Thermal Power Plant Market

The Gas segment dominates the Japanese thermal power plant market due to its relatively lower emissions compared to coal and its adaptability to meet fluctuating energy demand. The Kanto region holds the largest market share due to high energy consumption from industrial hubs and densely populated urban areas.

Key Drivers for Gas Segment Dominance:

- Lower greenhouse gas emissions compared to coal.

- Flexibility in accommodating varying energy demands.

- Government policies promoting gas-based power generation.

Key Drivers for Kanto Region Dominance:

- High energy demand from industrial and residential sectors.

- Well-developed infrastructure for power transmission and distribution.

- Proximity to major energy supply sources.

The dominance of the gas segment and the Kanto region is further reinforced by government initiatives promoting cleaner energy sources and infrastructure development. However, regions like Kansai and Tohoku also exhibit significant growth potential due to ongoing industrialization and population growth. The nuclear segment's contribution is expected to increase gradually (with xx% growth in the forecast period), subject to stricter safety regulations following the Fukushima Daiichi nuclear disaster.

Japan Thermal Power Plant Market Product Innovations

Recent innovations focus on enhancing efficiency, reducing emissions, and improving operational reliability. Advancements in CCGT technology and the development of HELE coal plants are significant trends. These innovations deliver greater fuel efficiency, lower operating costs, and decreased environmental impact. The market is also witnessing a gradual shift towards incorporating carbon capture, utilization, and storage (CCUS) technologies in thermal power plants to mitigate greenhouse gas emissions. This aligns with the global push towards decarbonization and enhances the long-term viability of thermal power generation in Japan.

Report Scope & Segmentation Analysis

The report provides a comprehensive analysis of the Japan thermal power plant market segmented by fuel type: Coal, Gas, Nuclear, and Others. Each segment's market size, growth projections, and competitive dynamics are analyzed in detail. The Gas segment is expected to exhibit the highest growth, driven by its efficiency and relatively lower emissions. The Coal segment will gradually decline due to environmental concerns, while Nuclear power faces challenges in restarting decommissioned plants. The "Others" segment comprises smaller contributions from biomass and other renewable energy sources integrated with thermal plants.

Key Drivers of Japan Thermal Power Plant Market Growth

The growth of the Japanese thermal power plant market is fueled by several factors, including the increasing demand for electricity from a growing population and economy, industrialization, and infrastructure development. Government policies promoting energy security and supporting efficient power generation also play a vital role. Advancements in thermal power plant technologies leading to improved efficiency and reduced emissions further stimulate market growth. Furthermore, the continued reliance on thermal power for baseload electricity, despite the increasing adoption of renewables, ensures a sustained market demand.

Challenges in the Japan Thermal Power Plant Market Sector

The Japan thermal power plant market faces various challenges, including stringent environmental regulations that mandate emission reductions, leading to increased operational costs for upgrading existing plants. The increasing cost of fuel and the competition from renewable energy sources also significantly impact the sector's profitability. Further, the aging infrastructure of some thermal power plants requires substantial investment for maintenance and upgrades, posing a financial burden on operators. Supply chain disruptions and geopolitical uncertainties can also affect the availability and cost of fuel, impacting overall market stability.

Emerging Opportunities in Japan Thermal Power Plant Market

Opportunities exist in deploying advanced technologies such as CCGT and HELE plants to enhance efficiency and reduce emissions. Integrating renewable energy sources with thermal plants for hybrid power generation is another promising avenue. The focus on carbon capture and storage technologies provides an opportunity for thermal power plants to enhance their environmental profile and continue to play a role in the country's energy mix. Moreover, exploring potential markets for utilizing waste heat from thermal plants can create additional revenue streams.

Leading Players in the Japan Thermal Power Plant Market Market

- Mitsubishi Heavy Industries LTD

- The Chugoku Electric Power co inc

- Toshiba Corp

- Hitachi Ltd

- Sumitomo Group

- Hirono IGCC Power GK

- Japan Atomic Power Company

- Tokyo Electric Power Company Holdings Inc

Key Developments in Japan Thermal Power Plant Market Industry

- 2022 Q3: Mitsubishi Heavy Industries announced a significant investment in upgrading its CCGT technology.

- 2023 Q1: The Japanese government unveiled new regulations aimed at further reducing emissions from thermal power plants.

- 2024 Q2: Toshiba Corp launched a new line of high-efficiency boilers for thermal power plants. (Further developments to be added as they occur).

Future Outlook for Japan Thermal Power Plant Market Market

The future of the Japan thermal power plant market hinges on balancing energy security with environmental sustainability. While the increasing adoption of renewable energy sources will reduce the share of thermal power in the overall energy mix, thermal plants will continue to play a crucial role in providing baseload power. The focus will shift towards enhancing the efficiency and reducing the environmental impact of thermal plants through technological advancements and government policies promoting cleaner energy technologies. The market's long-term outlook remains positive, albeit at a slower growth rate compared to previous years, driven by the need for a reliable and resilient energy supply.

Japan Thermal Power Plant Market Segmentation

-

1. Fuel Type

- 1.1. Coal

- 1.2. Gas

- 1.3. Nuclear

- 1.4. Others

Japan Thermal Power Plant Market Segmentation By Geography

- 1. Japan

Japan Thermal Power Plant Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 1.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The High Amount of Waste Generation in the Country4.; The growing Focus on Non-Fossil Fuel Sources

- 3.3. Market Restrains

- 3.3.1. 4.; The Recycling Rate of Waste in Germany

- 3.4. Market Trends

- 3.4.1. Gas Power Plants to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Thermal Power Plant Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 5.1.1. Coal

- 5.1.2. Gas

- 5.1.3. Nuclear

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6. Kanto Japan Thermal Power Plant Market Analysis, Insights and Forecast, 2019-2031

- 7. Kansai Japan Thermal Power Plant Market Analysis, Insights and Forecast, 2019-2031

- 8. Chubu Japan Thermal Power Plant Market Analysis, Insights and Forecast, 2019-2031

- 9. Kyushu Japan Thermal Power Plant Market Analysis, Insights and Forecast, 2019-2031

- 10. Tohoku Japan Thermal Power Plant Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Mitsubishi Heavy Industries LTD *List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 The Chugoku Electric Power co inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Toshiba Corp

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hitachi Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sumitomo Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hirono IGCC Power GK

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Japan Atomic Power Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tokyo Electric Power Company Holdings Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Mitsubishi Heavy Industries LTD *List Not Exhaustive

List of Figures

- Figure 1: Japan Thermal Power Plant Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan Thermal Power Plant Market Share (%) by Company 2024

List of Tables

- Table 1: Japan Thermal Power Plant Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan Thermal Power Plant Market Volume K Units Forecast, by Region 2019 & 2032

- Table 3: Japan Thermal Power Plant Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 4: Japan Thermal Power Plant Market Volume K Units Forecast, by Fuel Type 2019 & 2032

- Table 5: Japan Thermal Power Plant Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Japan Thermal Power Plant Market Volume K Units Forecast, by Region 2019 & 2032

- Table 7: Japan Thermal Power Plant Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Japan Thermal Power Plant Market Volume K Units Forecast, by Country 2019 & 2032

- Table 9: Kanto Japan Thermal Power Plant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Kanto Japan Thermal Power Plant Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 11: Kansai Japan Thermal Power Plant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Kansai Japan Thermal Power Plant Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 13: Chubu Japan Thermal Power Plant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Chubu Japan Thermal Power Plant Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 15: Kyushu Japan Thermal Power Plant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Kyushu Japan Thermal Power Plant Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 17: Tohoku Japan Thermal Power Plant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Tohoku Japan Thermal Power Plant Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 19: Japan Thermal Power Plant Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 20: Japan Thermal Power Plant Market Volume K Units Forecast, by Fuel Type 2019 & 2032

- Table 21: Japan Thermal Power Plant Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Japan Thermal Power Plant Market Volume K Units Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Thermal Power Plant Market?

The projected CAGR is approximately > 1.50%.

2. Which companies are prominent players in the Japan Thermal Power Plant Market?

Key companies in the market include Mitsubishi Heavy Industries LTD *List Not Exhaustive, The Chugoku Electric Power co inc, Toshiba Corp, Hitachi Ltd, Sumitomo Group, Hirono IGCC Power GK, Japan Atomic Power Company, Tokyo Electric Power Company Holdings Inc.

3. What are the main segments of the Japan Thermal Power Plant Market?

The market segments include Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; The High Amount of Waste Generation in the Country4.; The growing Focus on Non-Fossil Fuel Sources.

6. What are the notable trends driving market growth?

Gas Power Plants to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Recycling Rate of Waste in Germany.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Thermal Power Plant Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Thermal Power Plant Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Thermal Power Plant Market?

To stay informed about further developments, trends, and reports in the Japan Thermal Power Plant Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence