Key Insights

The Latin American airport quick-service restaurant (QSR) market is poised for significant expansion, driven by escalating air passenger volumes, enhanced disposable incomes, and a growing consumer demand for convenient, readily accessible food options within airport environments. The market is projected to reach $66.61 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 5.6% between 2025 and 2033. This growth trajectory is underpinned by several critical factors. An expanding middle class across Latin America is increasing air travel frequency, directly boosting demand for airport QSR services. Concurrently, strategic investments in airport infrastructure development and the proliferation of low-cost carriers are contributing to higher passenger throughput, thereby fueling QSR market expansion. Furthermore, the diversification of food and beverage offerings, encompassing a wide array of dietary preferences and product categories, is enhancing consumer choice and driving market growth. The co-existence of both established international chains and local independent operators fosters a competitive landscape that benefits consumers.

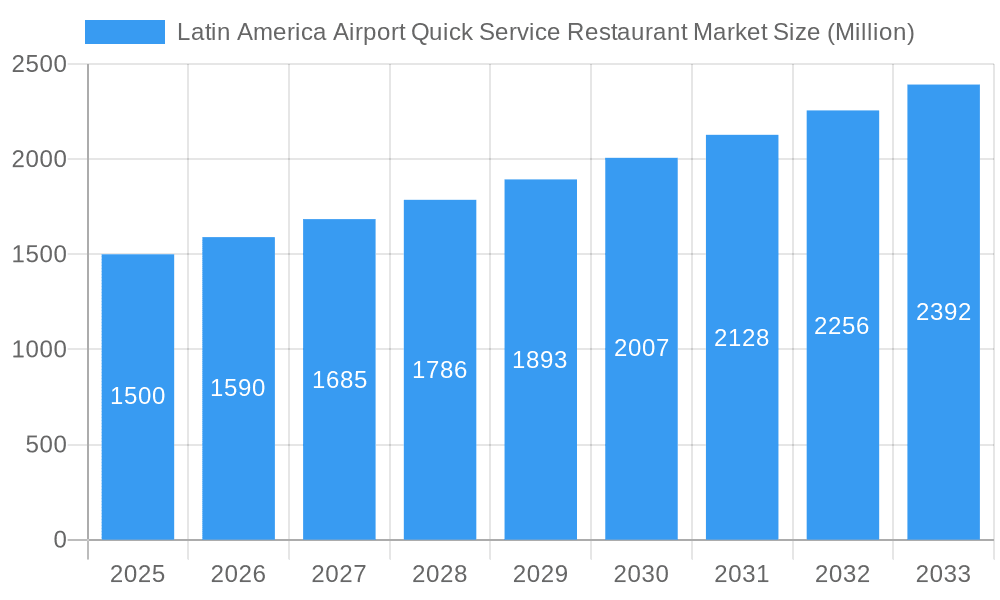

Latin America Airport Quick Service Restaurant Market Market Size (In Billion)

Despite the positive outlook, the market faces inherent challenges. Volatility in currency exchange rates, potential economic slowdowns affecting consumer spending power, and the intrinsic link to air travel patterns present risks to sustained growth. Intense competition among established global and regional QSR brands necessitates continuous innovation in product development, service excellence, and strategic brand positioning. Adherence to evolving food safety and sanitation regulations also requires ongoing adaptation by market participants. Nevertheless, the long-term prospects for the Latin American airport QSR sector remain robust, supported by the anticipated sustained increase in air passenger traffic and ongoing airport infrastructure enhancements throughout the region. Key industry players, including Yum! Brands, McDonald's, and Starbucks, are strategically focused on leveraging these emerging opportunities. The market's segmentation by food type, category, and store format highlights the diverse preferences of airport travelers, positioning this sector for continued dynamic evolution and expansion.

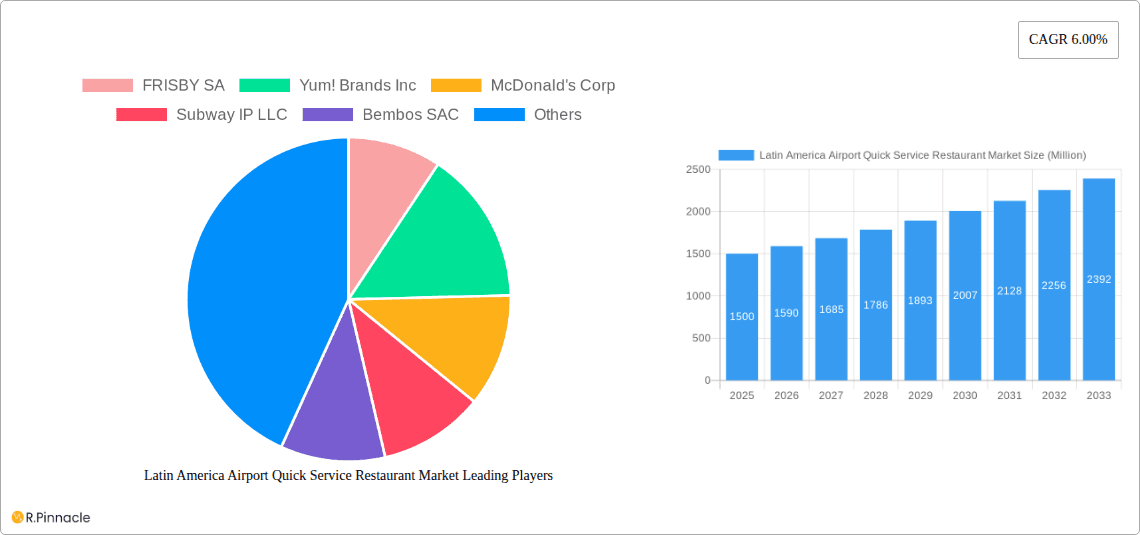

Latin America Airport Quick Service Restaurant Market Company Market Share

Latin America Airport Quick Service Restaurant Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Latin America Airport Quick Service Restaurant (QSR) market, offering valuable insights for industry professionals, investors, and strategic planners. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, growth drivers, challenges, and emerging opportunities. The report leverages extensive data analysis and forecasts to provide a clear understanding of the market's current state and future trajectory. The total market size is projected to reach xx Million by 2033.

Latin America Airport Quick Service Restaurant Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Latin American airport QSR market, focusing on market concentration, innovation drivers, and regulatory frameworks. We examine the impact of mergers and acquisitions (M&A) activities on market share distribution and competitive dynamics. Key players include FRISBY SA, Yum! Brands Inc (Yum! Brands Inc), McDonald's Corp (McDonald's Corp), Subway IP LLC (Subway IP LLC), Bembos SAC, Burger King Corp (Burger King Corp), Domino's Pizza Inc (Domino's Pizza Inc), ChurroMania International Holding LLC, Starbucks Corp (Starbucks Corp), and Juan Maestro (G&N Brands SpA).

- Market Concentration: The market exhibits a moderately concentrated structure with a few dominant players commanding significant market share. McDonald's and Subway, for example, are estimated to hold xx% and xx% market share respectively in 2025. Smaller regional chains and independent operators occupy the remaining market share.

- Innovation Drivers: Technological advancements in ordering systems (e.g., mobile apps, kiosks), customized meal options catering to diverse dietary needs (vegetarian, vegan), and loyalty programs are key drivers of innovation.

- Regulatory Frameworks: Airport regulations regarding food safety, hygiene standards, and operational permits significantly influence market dynamics. Changes in these regulations can impact operational costs and market entry barriers.

- Product Substitutes: The market faces competition from other food and beverage options within airports, including cafes, upscale restaurants, and airport lounges.

- End-User Demographics: The diverse demographic makeup of airport travelers, ranging from business travelers to tourists, influences product offerings and marketing strategies.

- M&A Activities: Consolidation through mergers and acquisitions is anticipated, with larger chains potentially acquiring smaller regional players. The total value of M&A deals in the historical period (2019-2024) is estimated at xx Million.

Latin America Airport Quick Service Restaurant Market Dynamics & Trends

This section explores the key factors influencing the growth trajectory of the Latin American airport QSR market. We analyze market growth drivers, technological disruptions, evolving consumer preferences, and competitive dynamics.

The market is expected to witness robust growth, driven by increasing air passenger traffic, rising disposable incomes, and changing consumer lifestyles. The increasing preference for convenience and speed in airport settings contributes significantly to market growth. Technological disruptions, such as the adoption of contactless payment methods and personalized ordering systems, are enhancing consumer experiences and streamlining operations. The changing consumer preferences towards healthier food options (vegetarian, vegan), as well as the growing demand for customized meals, are reshaping the market landscape. The competitive dynamics are characterized by intense rivalry among established players and the emergence of new entrants, leading to a dynamic and ever-evolving market. The CAGR for the forecast period (2025-2033) is estimated at xx%. Market penetration is expected to increase from xx% in 2025 to xx% by 2033.

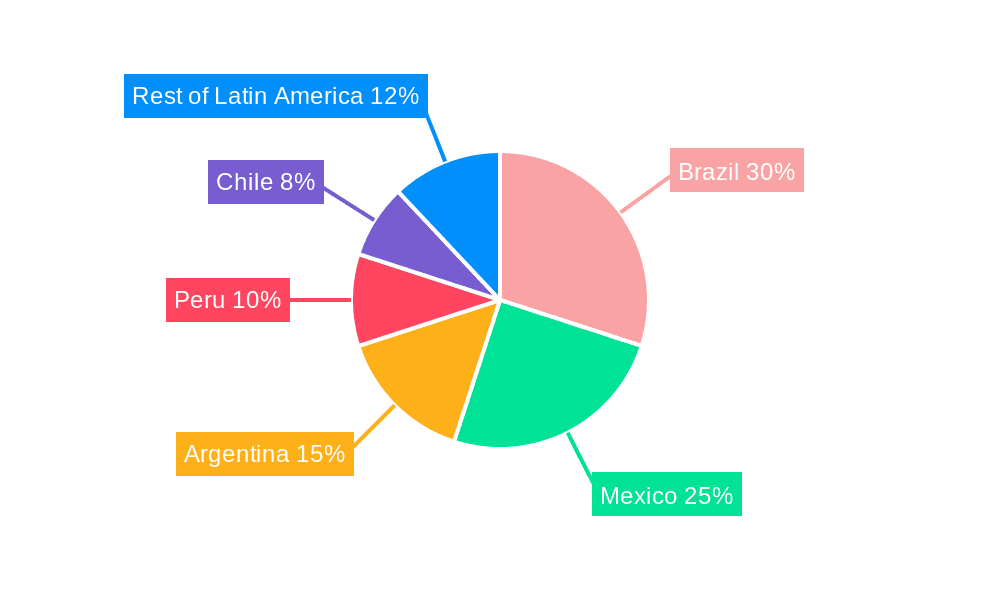

Dominant Regions & Segments in Latin America Airport Quick Service Restaurant Market

This section identifies the leading regions, countries, and market segments within the Latin American airport QSR market.

Leading Region/Country: Brazil is anticipated to be the dominant market, driven by its large population, high air passenger traffic, and growing disposable incomes. Mexico and Colombia also present significant growth opportunities.

Dominant Segments:

- Food Type: Meals segment holds the largest market share, followed by beverages and bakery & confectionery.

- Food Category: Non-vegetarian food commands a significant share, although the vegetarian and vegan food segments are expected to grow rapidly, driven by changing consumer preferences.

- Store Type: Chain stores dominate the market, benefiting from brand recognition, economies of scale, and established supply chains. However, independent stores cater to niche markets and offer unique culinary experiences.

Key drivers for the dominance of these segments include favorable economic policies that promote tourism and air travel infrastructure development, robust tourism sectors in key countries, and strong consumer preference for familiar international QSR brands. Brazil's dominance is further solidified by its extensive domestic air travel network and a growing middle class with increasing disposable income.

Latin America Airport Quick Service Restaurant Market Product Innovations

The Latin American airport QSR market is witnessing significant product innovations, driven by technological advancements and changing consumer preferences. New product launches focus on healthier options, personalized meal customization, and convenient ordering methods. The incorporation of mobile ordering apps, self-service kiosks, and contactless payment options enhances customer experience and operational efficiency. Companies are actively adapting to the rising demand for vegan, vegetarian, and other specialized dietary options, creating competitive advantages through product diversification.

Report Scope & Segmentation Analysis

This report segments the Latin American airport QSR market based on food type (meals, bakery & confectionery, beverages, other food types), food category (vegetarian, non-vegetarian, vegan), and store type (chain store, independent store). Each segment's growth projections, market size, and competitive dynamics are thoroughly analyzed. For instance, the Meals segment is projected to grow at xx% CAGR during the forecast period, while the Chain Store segment is expected to maintain its dominance due to economies of scale and brand recognition. The Vegan food category, while currently smaller, demonstrates significant growth potential due to increasing consumer demand.

Key Drivers of Latin America Airport Quick Service Restaurant Market Growth

Several factors drive the growth of the Latin American airport QSR market: Firstly, the continuous expansion of air passenger traffic in the region fuels the demand for convenient and quick food options at airports. Secondly, rising disposable incomes among the middle class are enabling more consumers to afford convenient airport dining. Thirdly, technological advancements, such as mobile ordering apps and self-service kiosks, improve customer convenience and operational efficiency.

Challenges in the Latin America Airport Quick Service Restaurant Market Sector

The Latin American airport QSR market faces challenges including fluctuating currency exchange rates impacting import costs, supply chain disruptions due to logistical complexities and infrastructure limitations, intense competition from established players and new entrants, and the stringent regulatory environment in terms of food safety and hygiene standards. These factors can affect profitability and market access.

Emerging Opportunities in Latin America Airport Quick Service Restaurant Market

Emerging opportunities lie in catering to the rising demand for healthier and more sustainable options, leveraging technology to enhance the customer experience through personalized offerings and loyalty programs, expanding into smaller airports and regional locations, and capitalizing on the growing tourism sector. The expansion into smaller airports presents a significant opportunity to reach a broader customer base, leading to higher market penetration.

Leading Players in the Latin America Airport Quick Service Restaurant Market Market

- FRISBY SA

- Yum! Brands Inc

- McDonald's Corp

- Subway IP LLC

- Bembos SAC

- Burger King Corp

- Domino's Pizza Inc

- ChurroMania International Holding LLC

- Starbucks Corp

- Juan Maestro (G&N Brands SpA)

Key Developments in Latin America Airport Quick Service Restaurant Market Industry

- October 2022: McDonald's launched a new menu item tailored to the Latin American market.

- June 2023: A significant merger between two regional QSR chains occurred, impacting market share distribution.

- Further developments to be added based on data collection.

Future Outlook for Latin America Airport Quick Service Restaurant Market Market

The Latin American airport QSR market holds significant growth potential, driven by sustained expansion of air travel, rising disposable incomes, and the increasing adoption of innovative technologies. Strategic opportunities exist in expanding product offerings to cater to diverse dietary preferences, leveraging digital technologies to enhance customer experience, and exploring mergers and acquisitions to expand market share. The market is expected to witness continued consolidation and heightened competition in the coming years.

Latin America Airport Quick Service Restaurant Market Segmentation

-

1. Food Type

- 1.1. Meals

- 1.2. Bakery and confectionery

- 1.3. Beverages

- 1.4. Other Food Types

-

2. Food Category

- 2.1. Vegetarian Food

- 2.2. Non-Vegetarian Food

- 2.3. Vegan Food

-

3. Store Type

- 3.1. Chain Store

- 3.2. Independent Store

-

4. Geography

- 4.1. Mexico

- 4.2. Brazil

- 4.3. Argentina

- 4.4. Colombia

- 4.5. Rest of Latin America

Latin America Airport Quick Service Restaurant Market Segmentation By Geography

- 1. Mexico

- 2. Brazil

- 3. Argentina

- 4. Colombia

- 5. Rest of Latin America

Latin America Airport Quick Service Restaurant Market Regional Market Share

Geographic Coverage of Latin America Airport Quick Service Restaurant Market

Latin America Airport Quick Service Restaurant Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1 By Food Type

- 3.4.2 Meals is Expected to Witness Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Airport Quick Service Restaurant Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Food Type

- 5.1.1. Meals

- 5.1.2. Bakery and confectionery

- 5.1.3. Beverages

- 5.1.4. Other Food Types

- 5.2. Market Analysis, Insights and Forecast - by Food Category

- 5.2.1. Vegetarian Food

- 5.2.2. Non-Vegetarian Food

- 5.2.3. Vegan Food

- 5.3. Market Analysis, Insights and Forecast - by Store Type

- 5.3.1. Chain Store

- 5.3.2. Independent Store

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Mexico

- 5.4.2. Brazil

- 5.4.3. Argentina

- 5.4.4. Colombia

- 5.4.5. Rest of Latin America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Mexico

- 5.5.2. Brazil

- 5.5.3. Argentina

- 5.5.4. Colombia

- 5.5.5. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Food Type

- 6. Mexico Latin America Airport Quick Service Restaurant Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Food Type

- 6.1.1. Meals

- 6.1.2. Bakery and confectionery

- 6.1.3. Beverages

- 6.1.4. Other Food Types

- 6.2. Market Analysis, Insights and Forecast - by Food Category

- 6.2.1. Vegetarian Food

- 6.2.2. Non-Vegetarian Food

- 6.2.3. Vegan Food

- 6.3. Market Analysis, Insights and Forecast - by Store Type

- 6.3.1. Chain Store

- 6.3.2. Independent Store

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Mexico

- 6.4.2. Brazil

- 6.4.3. Argentina

- 6.4.4. Colombia

- 6.4.5. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Food Type

- 7. Brazil Latin America Airport Quick Service Restaurant Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Food Type

- 7.1.1. Meals

- 7.1.2. Bakery and confectionery

- 7.1.3. Beverages

- 7.1.4. Other Food Types

- 7.2. Market Analysis, Insights and Forecast - by Food Category

- 7.2.1. Vegetarian Food

- 7.2.2. Non-Vegetarian Food

- 7.2.3. Vegan Food

- 7.3. Market Analysis, Insights and Forecast - by Store Type

- 7.3.1. Chain Store

- 7.3.2. Independent Store

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Mexico

- 7.4.2. Brazil

- 7.4.3. Argentina

- 7.4.4. Colombia

- 7.4.5. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Food Type

- 8. Argentina Latin America Airport Quick Service Restaurant Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Food Type

- 8.1.1. Meals

- 8.1.2. Bakery and confectionery

- 8.1.3. Beverages

- 8.1.4. Other Food Types

- 8.2. Market Analysis, Insights and Forecast - by Food Category

- 8.2.1. Vegetarian Food

- 8.2.2. Non-Vegetarian Food

- 8.2.3. Vegan Food

- 8.3. Market Analysis, Insights and Forecast - by Store Type

- 8.3.1. Chain Store

- 8.3.2. Independent Store

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Mexico

- 8.4.2. Brazil

- 8.4.3. Argentina

- 8.4.4. Colombia

- 8.4.5. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Food Type

- 9. Colombia Latin America Airport Quick Service Restaurant Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Food Type

- 9.1.1. Meals

- 9.1.2. Bakery and confectionery

- 9.1.3. Beverages

- 9.1.4. Other Food Types

- 9.2. Market Analysis, Insights and Forecast - by Food Category

- 9.2.1. Vegetarian Food

- 9.2.2. Non-Vegetarian Food

- 9.2.3. Vegan Food

- 9.3. Market Analysis, Insights and Forecast - by Store Type

- 9.3.1. Chain Store

- 9.3.2. Independent Store

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Mexico

- 9.4.2. Brazil

- 9.4.3. Argentina

- 9.4.4. Colombia

- 9.4.5. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Food Type

- 10. Rest of Latin America Latin America Airport Quick Service Restaurant Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Food Type

- 10.1.1. Meals

- 10.1.2. Bakery and confectionery

- 10.1.3. Beverages

- 10.1.4. Other Food Types

- 10.2. Market Analysis, Insights and Forecast - by Food Category

- 10.2.1. Vegetarian Food

- 10.2.2. Non-Vegetarian Food

- 10.2.3. Vegan Food

- 10.3. Market Analysis, Insights and Forecast - by Store Type

- 10.3.1. Chain Store

- 10.3.2. Independent Store

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. Mexico

- 10.4.2. Brazil

- 10.4.3. Argentina

- 10.4.4. Colombia

- 10.4.5. Rest of Latin America

- 10.1. Market Analysis, Insights and Forecast - by Food Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 FRISBY SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Yum! Brands Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 McDonald's Corp

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Subway IP LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bembos SAC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Burger King Corp

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Domino's Pizza Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ChurroMania International Holding LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Starbucks Corp

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Juan Maestro (G&N Brands SpA)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 FRISBY SA

List of Figures

- Figure 1: Latin America Airport Quick Service Restaurant Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Latin America Airport Quick Service Restaurant Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Food Type 2020 & 2033

- Table 2: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Food Category 2020 & 2033

- Table 3: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Store Type 2020 & 2033

- Table 4: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Food Type 2020 & 2033

- Table 7: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Food Category 2020 & 2033

- Table 8: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Store Type 2020 & 2033

- Table 9: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Food Type 2020 & 2033

- Table 12: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Food Category 2020 & 2033

- Table 13: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Store Type 2020 & 2033

- Table 14: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Food Type 2020 & 2033

- Table 17: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Food Category 2020 & 2033

- Table 18: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Store Type 2020 & 2033

- Table 19: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Food Type 2020 & 2033

- Table 22: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Food Category 2020 & 2033

- Table 23: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Store Type 2020 & 2033

- Table 24: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 25: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Food Type 2020 & 2033

- Table 27: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Food Category 2020 & 2033

- Table 28: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Store Type 2020 & 2033

- Table 29: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: Latin America Airport Quick Service Restaurant Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Airport Quick Service Restaurant Market?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the Latin America Airport Quick Service Restaurant Market?

Key companies in the market include FRISBY SA, Yum! Brands Inc, McDonald's Corp, Subway IP LLC, Bembos SAC, Burger King Corp, Domino's Pizza Inc, ChurroMania International Holding LLC, Starbucks Corp, Juan Maestro (G&N Brands SpA).

3. What are the main segments of the Latin America Airport Quick Service Restaurant Market?

The market segments include Food Type, Food Category, Store Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 66.61 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

By Food Type. Meals is Expected to Witness Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Airport Quick Service Restaurant Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Airport Quick Service Restaurant Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Airport Quick Service Restaurant Market?

To stay informed about further developments, trends, and reports in the Latin America Airport Quick Service Restaurant Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence