Key Insights

The Latin American jewelry market is projected to reach $8.58 billion by 2024, with a Compound Annual Growth Rate (CAGR) of 6.4% from its 2025 base year forecast. This dynamic sector is driven by evolving consumer preferences and economic expansion across key South American economies, notably Brazil. Growing disposable incomes and a burgeoning middle class are fueling demand for both fine and fashion jewelry. Consumers increasingly seek expressive, culturally resonant designs that reflect local heritage. The digital retail landscape is rapidly expanding, enhancing accessibility to diverse styles, while the enduring appeal of physical storefronts highlights the importance of the in-store experience. Key product categories such as necklaces, rings, and earrings continue to be popular, with charms and bracelets experiencing growth driven by personalization trends. However, market dynamics are influenced by economic volatility and fluctuations in precious metal prices, particularly impacting high-value fine jewelry purchases. The competitive environment is characterized by the presence of established global luxury brands, alongside robust local artisans and designers. Brazil, a significant market contributor with prominent domestic players, plays a pivotal role in market expansion, alongside other substantial economies in South America.

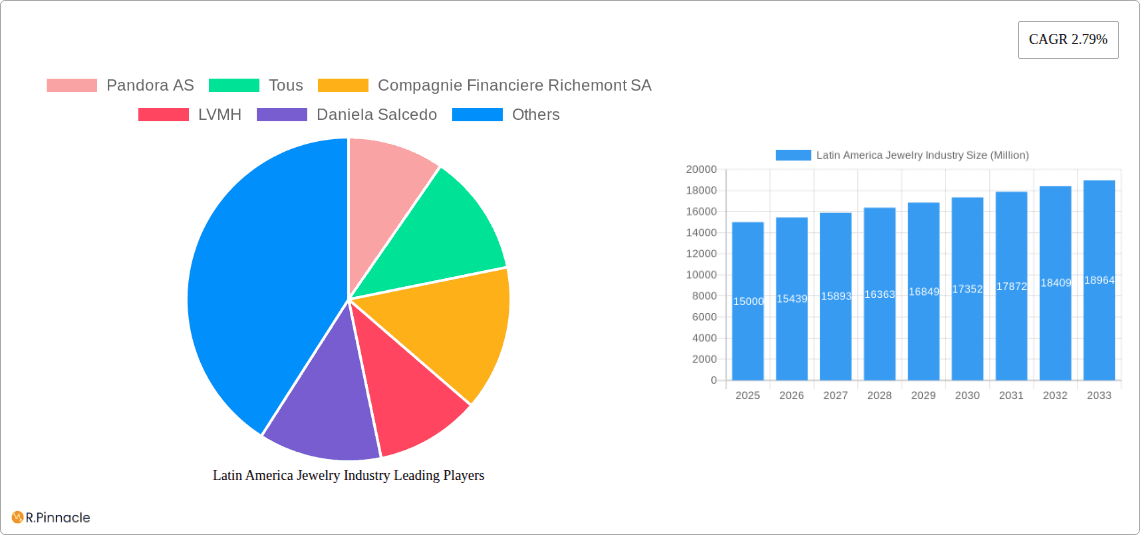

Latin America Jewelry Industry Market Size (In Billion)

The forecast period (2025-2033) indicates sustained growth, with strategic focus on consumer demand for sustainable and ethically sourced materials. Brands prioritizing transparency and responsible sourcing in their supply chains are well-positioned for success. Adapting to evolving consumer desires through advanced digital marketing and agile product development will be critical for maintaining a competitive advantage. Market segmentation by product type (fine vs. fashion jewelry), jewelry style (necklaces, rings, etc.), and distribution channels offers opportunities for targeted strategies. Deep understanding of segment-specific trends is vital for long-term market success.

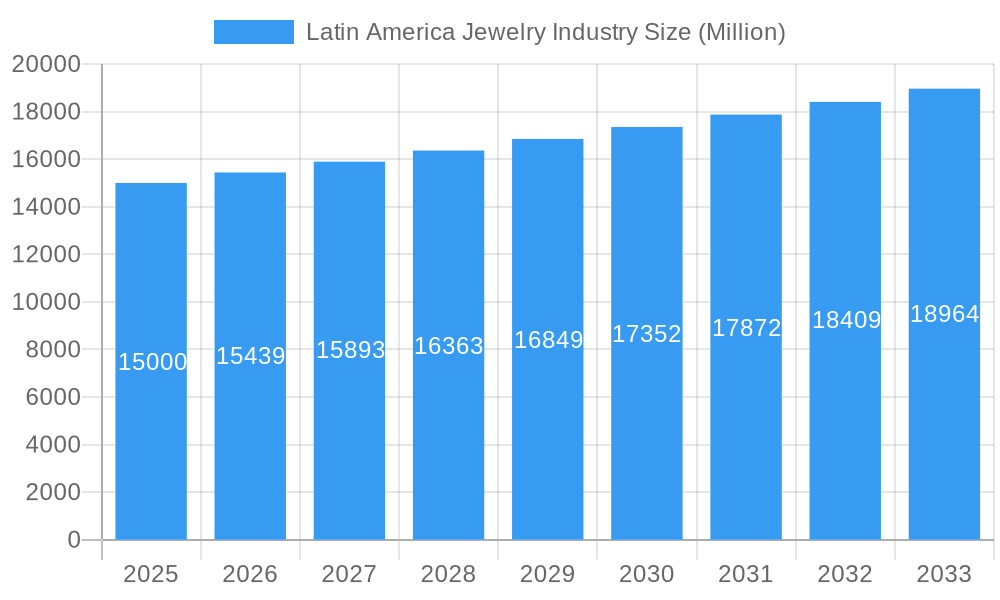

Latin America Jewelry Industry Company Market Share

Latin America Jewelry Industry Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the Latin America jewelry industry, offering crucial insights for industry professionals, investors, and strategists. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market trends, growth drivers, challenges, and opportunities within this dynamic sector. The report utilizes rigorous data analysis and expert insights to present a clear and actionable understanding of the Latin American jewelry market. The total market size in 2025 is estimated at $XX Million.

Latin America Jewelry Industry Market Structure & Innovation Trends

This section provides an in-depth analysis of the competitive landscape, key innovation drivers, and crucial regulatory factors shaping the dynamic Latin American jewelry market. The market is characterized by a robust ecosystem that blends the presence of well-established international luxury houses with highly successful and agile local brands. Market concentration is observed to be moderate, with a few dominant global players commanding significant market share. However, a substantial and vibrant segment of the market comprises smaller, highly specialized businesses, often excelling in artisanal craftsmanship and niche product offerings.

- Estimated Market Share (2025): While specific market share figures are subject to proprietary analysis, key players projected to hold substantial positions include Pandora AS, Tous, Compagnie Financiere Richemont SA, and LVMH, alongside a diverse array of significant local and international brands. The "Others" category represents a vital segment driven by independent designers and regional specialists.

- Key Innovation Drivers: The burgeoning demand for highly personalized and bespoke jewelry experiences is a paramount driver. Furthermore, the accelerating adoption of sophisticated e-commerce platforms and digital retail strategies is revolutionizing how consumers discover and purchase jewelry. Concurrently, there is a significant and growing consumer and industry emphasis on sustainable and ethically sourced materials, pushing brands towards greater transparency and responsible practices.

- Regulatory Framework: The report meticulously examines the multifaceted regulatory environment. This includes stringent regulations pertaining to the sourcing and certification of precious metals, robust consumer protection laws ensuring fair trade and product authenticity, and comprehensive import/export regulations that impact cross-border commerce within the region.

- Mergers & Acquisitions (M&A) Activity: The report details significant M&A activities that have shaped the industry's landscape during the historical period under review. These strategic consolidations, driven by a desire for market expansion into new territories and the acquisition of unique design capabilities or established brand portfolios, have seen substantial deal values. Specific examples and strategic rationales behind key acquisitions are thoroughly elaborated within the report.

- Threat of Product Substitutes: The increasing prevalence and sophisticated design of alternative materials and high-quality imitation jewelry present a discernible, though manageable, threat to the traditional real jewelry segment. This necessitates continuous innovation and value proposition enhancement by genuine jewelry manufacturers.

- End-User Demographics & Evolving Consumer Preferences: The report offers a detailed analysis of critical demographic trends, including age, income levels, and evolving lifestyle choices across Latin America. This analysis is crucial for understanding and predicting consumer preferences, purchasing behaviors, and the demand for specific jewelry styles and price points within the diverse regional market.

Latin America Jewelry Industry Market Dynamics & Trends

This section delves into the key dynamics shaping the growth trajectory of the Latin American jewelry market. The market exhibits a healthy CAGR of XX% during the forecast period (2025-2033), driven by several factors:

- Rising Disposable Incomes: Increasing disposable incomes in key Latin American economies are fueling demand for premium jewelry.

- Evolving Consumer Preferences: Changing consumer preferences towards personalized, unique designs and sustainable practices are driving innovation in product offerings.

- Technological Disruptions: The adoption of 3D printing and other technologies are impacting manufacturing processes and product design.

- Competitive Dynamics: Competition is intense, with both established global brands and local players vying for market share. The report analyses competitive strategies such as branding, product differentiation, and pricing.

- Market Penetration: Online retail channels are experiencing significant growth, increasing market penetration in previously underserved regions.

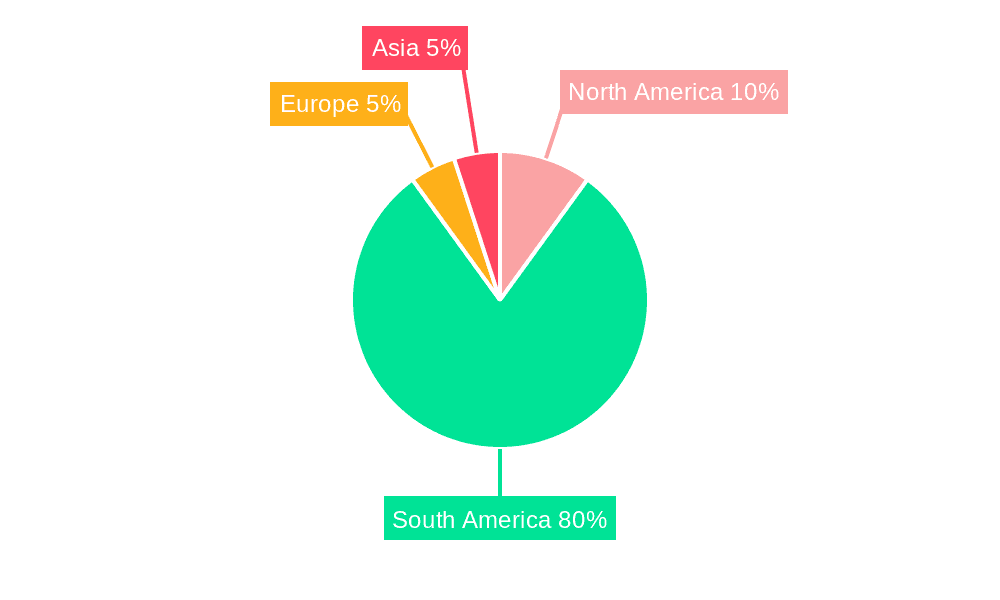

Dominant Regions & Segments in Latin America Jewelry Industry

This section provides a focused overview of the leading geographical regions and key market segments that define the Latin American jewelry landscape. Brazil and Mexico emerge as the preeminent markets, a position solidified by their robust economic growth trajectories, substantial population bases, and the presence of well-developed and sophisticated retail infrastructures.

Dominant Regions:

- Brazil: The market's strength is significantly amplified by a burgeoning middle class with increasing disposable income, a strong propensity for luxury goods consumption, and a deeply rooted and highly capable domestic jewelry manufacturing sector that fosters both innovation and skilled craftsmanship.

- Mexico: The sustained influx of tourism and a rapidly expanding affluent demographic are pivotal factors contributing to the dynamism and robust performance of Mexico's jewelry market.

Dominant Segments (Estimated for 2025):

- By Category: Real jewelry continues to command the largest share of the market, reflecting enduring consumer preference for intrinsic value and craftsmanship. Costume jewelry also holds a significant, though smaller, portion, catering to fashion-forward consumers seeking variety and affordability.

- By Type: Necklaces and earrings consistently emerge as the most popular jewelry types, indicating a strong and persistent consumer demand for these classic and versatile items across various styles and occasions.

- By Distribution Channel: While traditional offline retail stores still represent the dominant sales channel, reflecting the importance of physical browsing and personalized service, the penetration and influence of online channels are experiencing steady and significant growth, signaling a shifting consumer purchasing journey.

Latin America Jewelry Industry Product Innovations

Recent product innovations include the integration of technology into jewelry design, such as incorporating smart sensors and personalized engravings. Sustainable and ethically sourced materials are gaining popularity, aligning with growing consumer consciousness. These innovations enhance product value, create unique selling propositions, and cater to evolving consumer preferences, leading to a competitive advantage in the market.

Report Scope & Segmentation Analysis

This report segments the Latin American jewelry market by category (real and costume jewelry), type (necklaces, rings, earrings, charms & bracelets, others), and distribution channel (offline and online retail stores). Each segment’s growth projections, market size, and competitive dynamics are comprehensively analyzed, providing a granular understanding of the market structure. For instance, the online retail segment is projected to experience the highest CAGR during the forecast period.

Key Drivers of Latin America Jewelry Industry Growth

The growth trajectory of the Latin American jewelry industry is robustly propelled by several interconnected factors. A significant driver is the continuous rise in disposable incomes across key economies, empowering a larger segment of the population to invest in discretionary purchases such as jewelry. This is complemented by increasing urbanization, which often correlates with greater exposure to fashion trends and a higher demand for aspirational products. A deepening consumer preference for personalized, unique, and luxury jewelry items further fuels market expansion. Additionally, supportive economic policies and targeted government initiatives aimed at promoting and developing the jewelry sector play a crucial role. Furthermore, the integration of technological advancements, such as sophisticated 3D printing and advanced design software, is not only streamlining manufacturing and design processes but also fostering unprecedented levels of innovation, efficiency, and customization within the industry.

Challenges in the Latin America Jewelry Industry Sector

Challenges include economic volatility, fluctuating gold and precious metal prices, and potential supply chain disruptions. Counterfeit products and the informal market represent significant competitive pressures, impacting the growth of legitimate businesses. Regulatory complexities and varying standards across Latin American countries also present hurdles. The total impact of these challenges on the market is estimated to reduce overall growth by approximately XX% during the forecast period.

Emerging Opportunities in Latin America Jewelry Industry

The rapidly expanding landscape of e-commerce presents a transformative opportunity, enabling businesses to transcend geographical limitations and reach a significantly wider and more diverse consumer base across the entire region. Simultaneously, the escalating consumer and industry-wide demand for sustainable and ethically sourced jewelry creates lucrative avenues for brands that champion eco-friendly practices, transparency in sourcing, and fair labor conditions. There is also considerable potential for further diversification into highly specialized niche markets, such as bridal jewelry, men's jewelry, or bespoke artisanal pieces, and for the deep exploration of personalized and made-to-order jewelry designs, which can unlock substantial and sustained growth by catering to individual consumer desires and unique aesthetic preferences.

Leading Players in the Latin America Jewelry Industry Market

- Pandora AS

- Tous

- Compagnie Financiere Richemont SA

- LVMH

- Daniela Salcedo (Designer)

- H Stern Jewelers Inc (Brand)

- Manoel Bernardes SA (Brand)

- Joias Vivara (Brand)

- Haramara Jewelry (Brand)

- Daniel Espinosa Jewelry (Brand)

Key Developments in Latin America Jewelry Industry Industry

- 2022 Q4: LVMH announced a strategic investment in a Brazilian jewelry brand, signaling increased interest in the Latin American market.

- 2023 Q1: A major jewelry retailer launched a new e-commerce platform, significantly expanding its reach.

- 2024 Q2: New regulations were introduced in Mexico regarding the ethical sourcing of precious metals.

Future Outlook for Latin America Jewelry Industry Market

The Latin American jewelry market is poised for sustained growth, driven by economic expansion, increasing consumer spending, and the growing adoption of e-commerce. The market will continue to see innovation in design, materials, and distribution channels, creating opportunities for both established players and emerging brands. Strategic investments in sustainable practices and technology will be crucial for success in this dynamic sector.

Latin America Jewelry Industry Segmentation

-

1. Category

- 1.1. Real Jewelry

- 1.2. Costume Jewelry

-

2. Type

- 2.1. Necklaces

- 2.2. Rings

- 2.3. Earrings

- 2.4. Charms & Bracelets

- 2.5. Others

-

3. Distribution Channel

- 3.1. Offline Retail Stores

- 3.2. Online Retail Stores

-

4. Geography

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Colombia

- 4.4. Rest of Latin America

Latin America Jewelry Industry Segmentation By Geography

- 1. Brazil

- 2. Mexico

- 3. Colombia

- 4. Rest of Latin America

Latin America Jewelry Industry Regional Market Share

Geographic Coverage of Latin America Jewelry Industry

Latin America Jewelry Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Organic Baby Care Products; Increasing Product Innovation in the Market

- 3.3. Market Restrains

- 3.3.1. Possibility of Rashes and Allergic Reactions

- 3.4. Market Trends

- 3.4.1. Growing Demand for Diamond in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Jewelry Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Category

- 5.1.1. Real Jewelry

- 5.1.2. Costume Jewelry

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Necklaces

- 5.2.2. Rings

- 5.2.3. Earrings

- 5.2.4. Charms & Bracelets

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Offline Retail Stores

- 5.3.2. Online Retail Stores

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Brazil

- 5.4.2. Mexico

- 5.4.3. Colombia

- 5.4.4. Rest of Latin America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Brazil

- 5.5.2. Mexico

- 5.5.3. Colombia

- 5.5.4. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Category

- 6. Brazil Latin America Jewelry Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Category

- 6.1.1. Real Jewelry

- 6.1.2. Costume Jewelry

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Necklaces

- 6.2.2. Rings

- 6.2.3. Earrings

- 6.2.4. Charms & Bracelets

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Offline Retail Stores

- 6.3.2. Online Retail Stores

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Brazil

- 6.4.2. Mexico

- 6.4.3. Colombia

- 6.4.4. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Category

- 7. Mexico Latin America Jewelry Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Category

- 7.1.1. Real Jewelry

- 7.1.2. Costume Jewelry

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Necklaces

- 7.2.2. Rings

- 7.2.3. Earrings

- 7.2.4. Charms & Bracelets

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Offline Retail Stores

- 7.3.2. Online Retail Stores

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Brazil

- 7.4.2. Mexico

- 7.4.3. Colombia

- 7.4.4. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Category

- 8. Colombia Latin America Jewelry Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Category

- 8.1.1. Real Jewelry

- 8.1.2. Costume Jewelry

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Necklaces

- 8.2.2. Rings

- 8.2.3. Earrings

- 8.2.4. Charms & Bracelets

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Offline Retail Stores

- 8.3.2. Online Retail Stores

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Brazil

- 8.4.2. Mexico

- 8.4.3. Colombia

- 8.4.4. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Category

- 9. Rest of Latin America Latin America Jewelry Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Category

- 9.1.1. Real Jewelry

- 9.1.2. Costume Jewelry

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Necklaces

- 9.2.2. Rings

- 9.2.3. Earrings

- 9.2.4. Charms & Bracelets

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Offline Retail Stores

- 9.3.2. Online Retail Stores

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Brazil

- 9.4.2. Mexico

- 9.4.3. Colombia

- 9.4.4. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Category

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Pandora AS

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Tous

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Compagnie Financiere Richemont SA

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 LVMH

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Daniela Salcedo

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 H Stern Jewelers Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Manoel Bernardes SA

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Joias Vivara

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Haramara Jewelry*List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Daniel Espinosa Jewelry

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Pandora AS

List of Figures

- Figure 1: Latin America Jewelry Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Latin America Jewelry Industry Share (%) by Company 2025

List of Tables

- Table 1: Latin America Jewelry Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 2: Latin America Jewelry Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Latin America Jewelry Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Latin America Jewelry Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Latin America Jewelry Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Latin America Jewelry Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 7: Latin America Jewelry Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Latin America Jewelry Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 9: Latin America Jewelry Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Latin America Jewelry Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Latin America Jewelry Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 12: Latin America Jewelry Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 13: Latin America Jewelry Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 14: Latin America Jewelry Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Latin America Jewelry Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Latin America Jewelry Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 17: Latin America Jewelry Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Latin America Jewelry Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 19: Latin America Jewelry Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Latin America Jewelry Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Latin America Jewelry Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 22: Latin America Jewelry Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 23: Latin America Jewelry Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 24: Latin America Jewelry Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 25: Latin America Jewelry Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Jewelry Industry?

The projected CAGR is approximately 6.4%.

2. Which companies are prominent players in the Latin America Jewelry Industry?

Key companies in the market include Pandora AS, Tous, Compagnie Financiere Richemont SA, LVMH, Daniela Salcedo, H Stern Jewelers Inc, Manoel Bernardes SA, Joias Vivara, Haramara Jewelry*List Not Exhaustive, Daniel Espinosa Jewelry.

3. What are the main segments of the Latin America Jewelry Industry?

The market segments include Category, Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.58 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Organic Baby Care Products; Increasing Product Innovation in the Market.

6. What are the notable trends driving market growth?

Growing Demand for Diamond in the Market.

7. Are there any restraints impacting market growth?

Possibility of Rashes and Allergic Reactions.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Jewelry Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Jewelry Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Jewelry Industry?

To stay informed about further developments, trends, and reports in the Latin America Jewelry Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence