Key Insights

The Middle East and Africa (MEA) ice cream market, valued at $3,343.49 million in 2025, is projected to experience robust growth, driven by rising disposable incomes, increasing urbanization, and a growing preference for convenient and indulgent treats. The market's Compound Annual Growth Rate (CAGR) of 5.41% from 2025 to 2033 signifies considerable expansion opportunities. Key growth drivers include the introduction of innovative flavors and product formats catering to diverse palates, a surge in popularity of artisanal ice cream reflecting a preference for premium quality, and the expansion of modern retail channels like supermarkets and convenience stores. The increasing adoption of online retail channels further fuels market accessibility. However, the market faces certain challenges, including price sensitivity amongst consumers in certain regions, particularly in some African nations, and potential fluctuations in raw material costs impacting profitability. Furthermore, the health-consciousness trend among consumers might necessitate the development of healthier ice cream options to maintain market share. Segmentation by product type (impulse, take-home, artisanal) and distribution channels (supermarkets, convenience stores, online) offers valuable insights for strategic market entry and expansion. Leading players such as Unilever, Nestlé, and regional brands are actively shaping the market dynamics through product diversification, strategic partnerships, and brand building initiatives. The continued focus on premiumization and the exploration of novel delivery systems (e.g., ice cream subscription services) will likely further define the future trajectory of the MEA ice cream market.

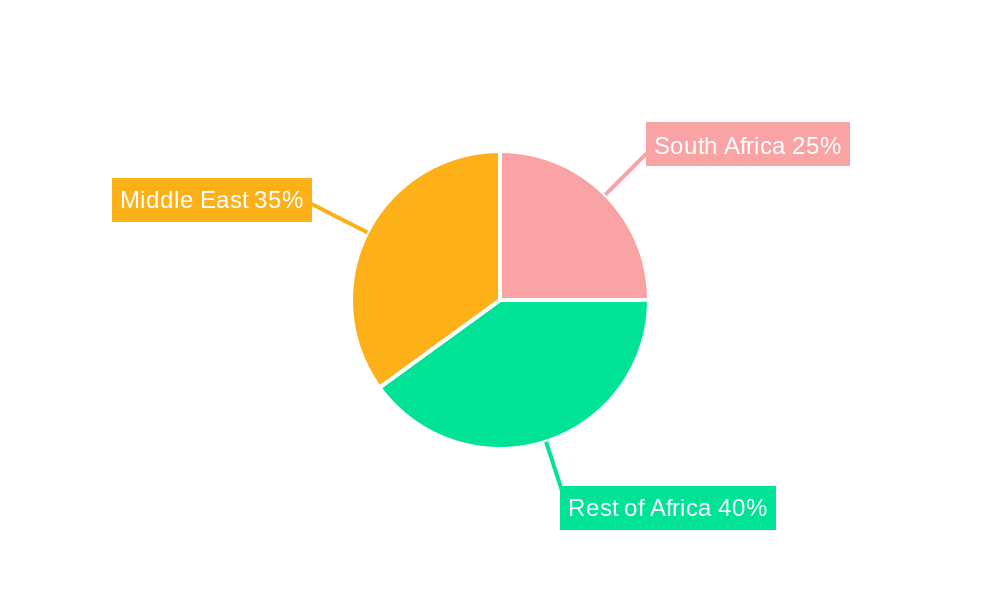

The regional variations within the MEA market are significant. While countries with higher per capita incomes are likely to demonstrate greater demand for premium ice cream and diverse product offerings, other regions may be more price-sensitive. South Africa, as a major economy in Africa, likely holds a substantial market share, followed by other rapidly developing economies within the region. The strategic focus of major players will need to consider these regional differences, tailoring product portfolios and marketing strategies accordingly to maximize success in diverse market segments. This includes careful consideration of distribution networks to ensure sufficient reach and penetration in both urban and rural areas. Successful players will leverage effective branding, strong distribution channels, and consumer-centric product innovation to navigate the complex dynamics of the MEA ice cream market.

Middle East & Africa Ice Cream Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Middle East & Africa ice cream industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report unveils market dynamics, growth drivers, and emerging opportunities within this dynamic sector. Expect detailed segmentation across product types and distribution channels, along with profiles of key players including Wells Enterprises Inc, Inspire Brands Inc, and Unilever PLC. Unlock the potential of this thriving market with actionable data and forward-looking projections.

Middle East Africa Ice Cream Industry Market Structure & Innovation Trends

The Middle East and Africa ice cream market presents a dynamic landscape characterized by a moderately concentrated structure. Major multinational players like Unilever PLC, Nestlé S.A., and Mars Incorporated command significant market share (estimated at [Insert Precise Percentage]% combined in 2025), yet a vibrant ecosystem of regional players and artisanal brands contributes significantly to market dynamism. Innovation is a key driver, fueled by evolving consumer preferences. This includes a strong demand for healthier options featuring natural and organic ingredients, premium offerings with high-quality ingredients, and exciting, unique flavors often inspired by local culinary traditions. The regulatory environment, with its emphasis on stringent food safety and clear labeling regulations, significantly influences product development and marketing strategies. Mergers and acquisitions (M&A) activity is moderate, with deal values exhibiting some fluctuation depending on prevailing market conditions. Recent transactions (2022-2023) have averaged [Insert Precise Average Deal Value] Million.

- Market Concentration: A blend of large multinational corporations and a thriving community of smaller, regional brands and artisanal producers.

- Innovation Drivers: Healthier choices (low-fat, organic, etc.), premium ingredients, unique and regionally-inspired flavors, and convenient packaging formats.

- Regulatory Framework: Stringent food safety and labeling regulations are paramount, shaping product development and marketing.

- Product Substitutes: Frozen yogurt, sorbet, gelato, and other frozen desserts compete for consumer preference.

- End-User Demographics: A growing middle class, rising disposable incomes, and a youthful population are key demographic drivers of market growth.

- M&A Activity: Moderate activity, with deal values reflecting the overall market health and investor sentiment.

Middle East Africa Ice Cream Industry Market Dynamics & Trends

The Middle East and Africa ice cream market demonstrates robust growth potential, fueled by several key factors. Rising disposable incomes, increasing urbanization leading to more convenient access to retail outlets, and a shift towards modern consumer lifestyles are all contributing to expanding market demand. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is projected at [Insert Precise CAGR]% resulting in an estimated market size of [Insert Precise Market Size] Million by 2033. Technological advancements, including automation in production processes and the expansion of online retail channels, are transforming the industry landscape. Consumer preferences are evolving towards healthier, convenient, and premium ice cream options, driving innovation across the sector. Intense competition between established players and emerging brands is shaping pricing strategies and fostering continuous product innovation. Market penetration rates vary significantly across different regions, influenced by factors like local climate, purchasing power parity, and unique cultural preferences.

Dominant Regions & Segments in Middle East Africa Ice Cream Industry

The Gulf Cooperation Council (GCC) countries (e.g., Saudi Arabia, UAE) represent the leading region within the Middle East and Africa ice cream market, driven by high per capita consumption and strong economic growth. Within product types, Take Home Ice Cream holds the largest market share, followed by Impulse Ice Cream. Supermarkets/Hypermarkets are the dominant distribution channel, although online retail is gaining traction.

Key Drivers in the GCC:

- High per capita income

- Strong economic growth

- Favorable climate conditions

- High consumer demand for premium and innovative products.

Dominant Product Type: Take Home Ice Cream (Reasons: Family consumption habits, larger packaging, better value perception)

Dominant Distribution Channel: Supermarkets/Hypermarkets (Reasons: Wide reach, established infrastructure, easy access for consumers)

The growth of Artisanal ice cream is significant in urban areas with higher disposable incomes and a growing demand for high-quality unique products. Convenience stores see strong growth in impulse purchases, while online retail is driven by convenience and increased access.

Middle East Africa Ice Cream Industry Product Innovations

The industry showcases a relentless pursuit of product innovation. This includes a strong focus on healthier options utilizing low-fat, organic, and natural ingredients; the development of unique flavors inspired by regional cuisines and local tastes; and the adoption of convenient and sustainable packaging formats. Technological advancements, such as enhanced freezing and dispensing technologies, are improving product quality, extending shelf life, and reducing waste. Companies are increasingly prioritizing eco-friendly packaging solutions to cater to the growing number of environmentally conscious consumers. These focused innovation strategies lead to sustainable competitive advantages by allowing businesses to target and satisfy niche consumer segments effectively.

Report Scope & Segmentation Analysis

This report segments the market by Product Type (Impulse Ice Cream, Take Home Ice Cream, Artisanal Ice Cream) and Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialist Stores, Online Retail Stores, Other Distribution Channels). Each segment’s market size, growth projections, and competitive dynamics are analyzed separately. For instance, the Take Home Ice Cream segment is expected to grow at a CAGR of xx% during the forecast period, while the online retail channel is poised for rapid expansion, driven by the increasing popularity of e-commerce.

Key Drivers of Middle East Africa Ice Cream Industry Growth

The growth of the Middle East and Africa ice cream industry is fueled by several key factors: a rising middle class with increased disposable income; urbanization and changing consumer lifestyles leading to higher demand for convenience and indulgence; favorable climatic conditions in many regions; and increasing tourism, boosting consumption in popular destinations. Government initiatives promoting food processing and retail infrastructure further stimulate market growth.

Challenges in the Middle East Africa Ice Cream Industry Sector

The Middle East and Africa ice cream industry faces several challenges. Fluctuating raw material prices, potential supply chain disruptions due to geopolitical factors or other unforeseen events, and intense competition within the market are key concerns. Compliance with stringent food safety regulations adds to the operational complexity. These factors can impact production costs and overall profitability, emphasizing the need for robust supply chain management, strategic pricing, and adaptable business models. Furthermore, the inherent seasonality of demand for ice cream presents ongoing challenges to maintain consistent profitability throughout the year.

Emerging Opportunities in Middle East Africa Ice Cream Industry

Significant opportunities exist in expanding into underserved markets, developing innovative product offerings tailored to specific regional tastes, and leveraging online retail channels for wider reach. The rising popularity of healthy and organic ice cream presents a major opportunity for companies to capture a growing segment of health-conscious consumers. Exploring opportunities in eco-friendly packaging further aligns with consumer preferences and sustainability goals.

Leading Players in the Middle East Africa Ice Cream Industry Market

- Wells Enterprises Inc

- Inspire Brands Inc

- Saudia Dairy & Foodstuff Co Ltd

- General Mills Inc

- Unilever PLC

- Mars Incorporated

- Graviss Group

- IFFCO Group

- Gatti Ice Cream

- Nestlé S.A

Key Developments in Middle East Africa Ice Cream Industry Industry

- May 2023: Siwar Foods partnered with Sarl So Mochi to distribute Mochi ice cream in the Middle East. This signals a growing interest in unique and innovative ice cream varieties within the region.

- May 2022: Baskin-Robbins launched a fusion product with Galaxy chocolate, expanding its product portfolio and enhancing brand appeal.

- March 2022: Baskin-Robbins opened its 1000th store in the Middle East, North Africa, and Australia, indicating strong market expansion and consumer demand.

Future Outlook for Middle East Africa Ice Cream Industry Market

The Middle East and Africa ice cream market is poised for sustained growth, driven by rising incomes, increasing urbanization, and continually evolving consumer preferences. Companies that strategically invest in product innovation, establish efficient distribution networks, and implement effective marketing strategies will be best positioned to capitalize on emerging opportunities and maintain a competitive edge in this dynamic market. The focus on healthier options, sustainable practices, and innovative, regionally-relevant flavors will continue to be pivotal factors shaping the future of the industry.

Middle East Africa Ice Cream Industry Segmentation

-

1. Product Type

- 1.1. Impulse Ice Cream

- 1.2. Take Home Ice Cream

- 1.3. Artisanal Ice Cream

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialist Stores

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

-

3. Geography

- 3.1. South Africa

- 3.2. Saudi Arabia

- 3.3. United Arab Emirates

- 3.4. Rest of Middle-East and Africa

Middle East Africa Ice Cream Industry Segmentation By Geography

- 1. South Africa

- 2. Saudi Arabia

- 3. United Arab Emirates

- 4. Rest of Middle East and Africa

Middle East Africa Ice Cream Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.41% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Low-fat and Non-Dairy Ice Cream Products; Growing Acceptance of Experimental Flavors

- 3.3. Market Restrains

- 3.3.1. Rising Concern over Health Issues Associated with Ice Cream

- 3.4. Market Trends

- 3.4.1. Demand for Low-fat and Non-dairy Ice Cream Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Africa Ice Cream Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Impulse Ice Cream

- 5.1.2. Take Home Ice Cream

- 5.1.3. Artisanal Ice Cream

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialist Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South Africa

- 5.3.2. Saudi Arabia

- 5.3.3. United Arab Emirates

- 5.3.4. Rest of Middle-East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.4.2. Saudi Arabia

- 5.4.3. United Arab Emirates

- 5.4.4. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. South Africa Middle East Africa Ice Cream Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Impulse Ice Cream

- 6.1.2. Take Home Ice Cream

- 6.1.3. Artisanal Ice Cream

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Specialist Stores

- 6.2.4. Online Retail Stores

- 6.2.5. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. South Africa

- 6.3.2. Saudi Arabia

- 6.3.3. United Arab Emirates

- 6.3.4. Rest of Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Saudi Arabia Middle East Africa Ice Cream Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Impulse Ice Cream

- 7.1.2. Take Home Ice Cream

- 7.1.3. Artisanal Ice Cream

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Specialist Stores

- 7.2.4. Online Retail Stores

- 7.2.5. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. South Africa

- 7.3.2. Saudi Arabia

- 7.3.3. United Arab Emirates

- 7.3.4. Rest of Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. United Arab Emirates Middle East Africa Ice Cream Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Impulse Ice Cream

- 8.1.2. Take Home Ice Cream

- 8.1.3. Artisanal Ice Cream

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Specialist Stores

- 8.2.4. Online Retail Stores

- 8.2.5. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. South Africa

- 8.3.2. Saudi Arabia

- 8.3.3. United Arab Emirates

- 8.3.4. Rest of Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of Middle East and Africa Middle East Africa Ice Cream Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Impulse Ice Cream

- 9.1.2. Take Home Ice Cream

- 9.1.3. Artisanal Ice Cream

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Specialist Stores

- 9.2.4. Online Retail Stores

- 9.2.5. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. South Africa

- 9.3.2. Saudi Arabia

- 9.3.3. United Arab Emirates

- 9.3.4. Rest of Middle-East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South Africa Middle East Africa Ice Cream Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sudan Middle East Africa Ice Cream Industry Analysis, Insights and Forecast, 2019-2031

- 12. Uganda Middle East Africa Ice Cream Industry Analysis, Insights and Forecast, 2019-2031

- 13. Tanzania Middle East Africa Ice Cream Industry Analysis, Insights and Forecast, 2019-2031

- 14. Kenya Middle East Africa Ice Cream Industry Analysis, Insights and Forecast, 2019-2031

- 15. Rest of Africa Middle East Africa Ice Cream Industry Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Wells Enterprises Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Inspire Brands Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Saudia Dairy & Foodstuff Co Ltd

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 General Mills Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Unilever PLC

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Mars Incorporated

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Graviss Group

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 IFFCO Group

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Gatti Ice Cream*List Not Exhaustive

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Nestlé S A

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Wells Enterprises Inc

List of Figures

- Figure 1: Middle East Africa Ice Cream Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East Africa Ice Cream Industry Share (%) by Company 2024

List of Tables

- Table 1: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 5: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 7: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Geography 2019 & 2032

- Table 9: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 11: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 13: South Africa Middle East Africa Ice Cream Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South Africa Middle East Africa Ice Cream Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Sudan Middle East Africa Ice Cream Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Sudan Middle East Africa Ice Cream Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: Uganda Middle East Africa Ice Cream Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Uganda Middle East Africa Ice Cream Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Tanzania Middle East Africa Ice Cream Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Tanzania Middle East Africa Ice Cream Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: Kenya Middle East Africa Ice Cream Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Kenya Middle East Africa Ice Cream Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 23: Rest of Africa Middle East Africa Ice Cream Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Africa Middle East Africa Ice Cream Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 25: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 26: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 27: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 28: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 29: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 30: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Geography 2019 & 2032

- Table 31: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 33: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 34: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 35: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 36: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 37: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 38: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Geography 2019 & 2032

- Table 39: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 41: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 42: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 43: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 44: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 45: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 46: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Geography 2019 & 2032

- Table 47: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 48: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 49: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 50: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 51: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 52: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 53: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 54: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Geography 2019 & 2032

- Table 55: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 56: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Africa Ice Cream Industry?

The projected CAGR is approximately 5.41%.

2. Which companies are prominent players in the Middle East Africa Ice Cream Industry?

Key companies in the market include Wells Enterprises Inc, Inspire Brands Inc, Saudia Dairy & Foodstuff Co Ltd, General Mills Inc, Unilever PLC, Mars Incorporated, Graviss Group, IFFCO Group, Gatti Ice Cream*List Not Exhaustive, Nestlé S A.

3. What are the main segments of the Middle East Africa Ice Cream Industry?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 3,343.49 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Low-fat and Non-Dairy Ice Cream Products; Growing Acceptance of Experimental Flavors.

6. What are the notable trends driving market growth?

Demand for Low-fat and Non-dairy Ice Cream Products.

7. Are there any restraints impacting market growth?

Rising Concern over Health Issues Associated with Ice Cream.

8. Can you provide examples of recent developments in the market?

May 2023: Siwar Foods signed a private label and distributor agreement with French company Sarl So Mochi to market and distribute a range of Mochi ice cream in the Middle East, starting with the launch in the Kingdom of Saudi Arabia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Africa Ice Cream Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Africa Ice Cream Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Africa Ice Cream Industry?

To stay informed about further developments, trends, and reports in the Middle East Africa Ice Cream Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence