Key Insights

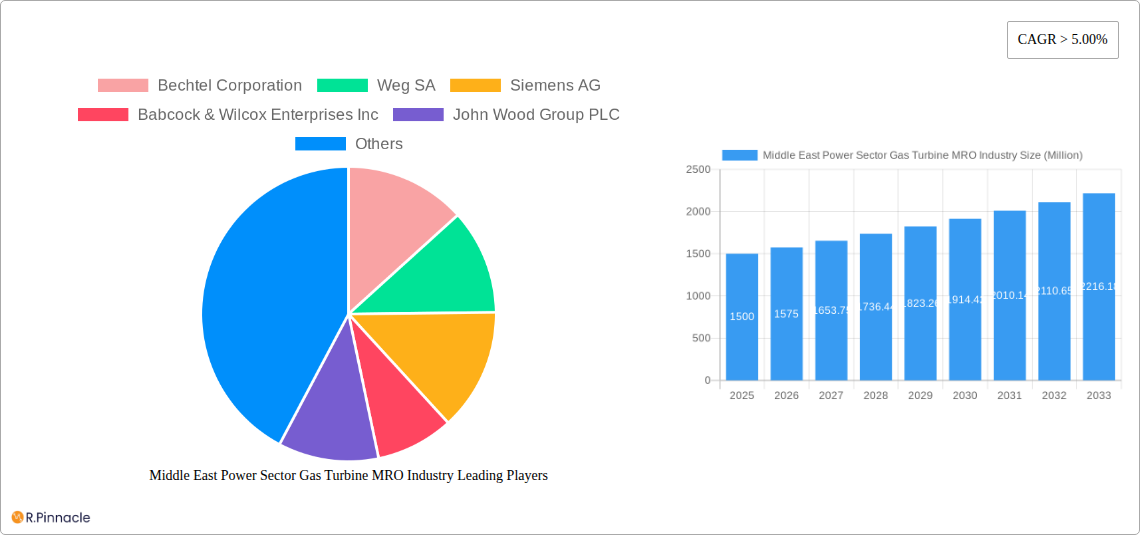

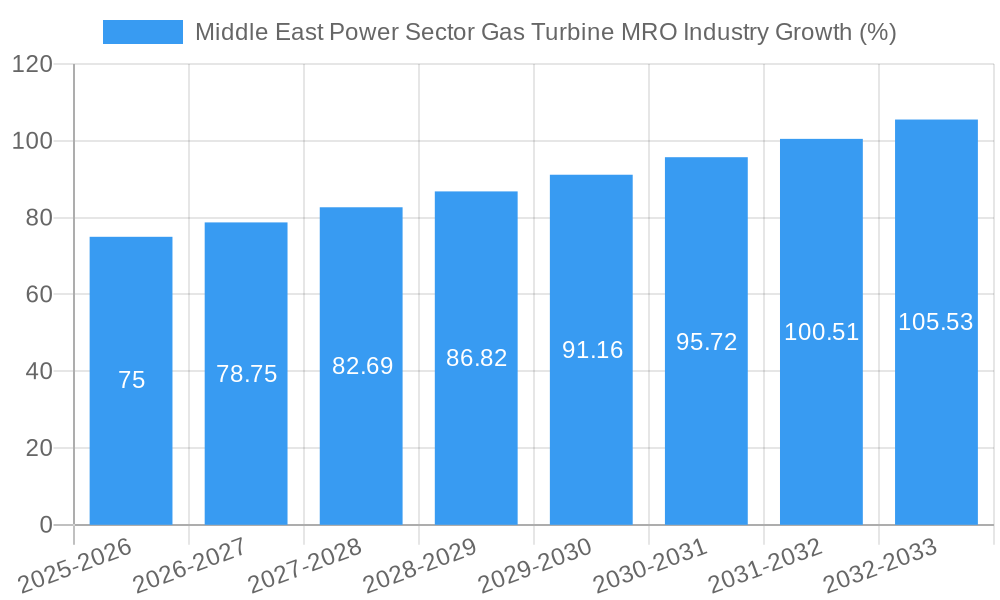

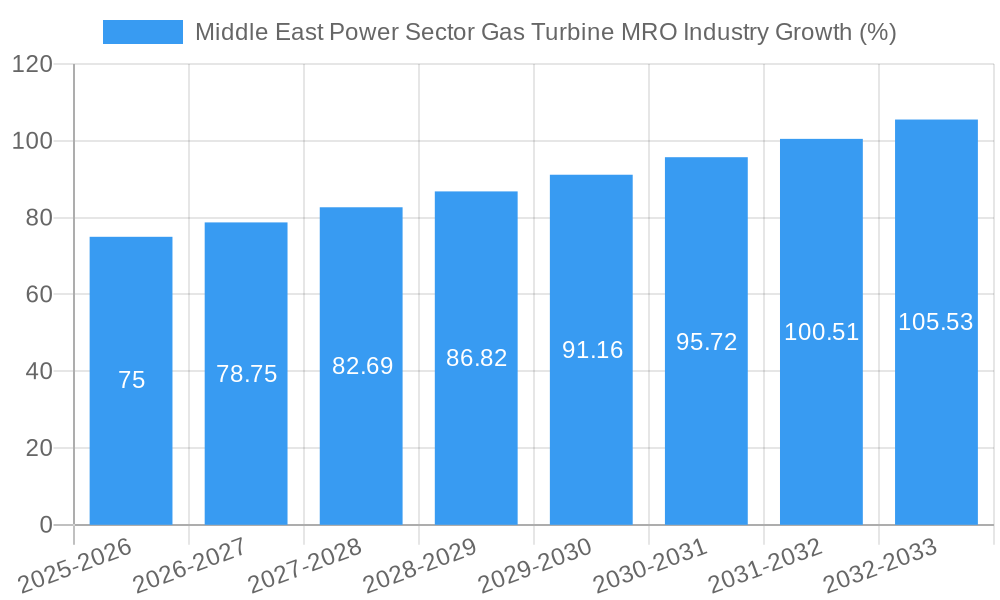

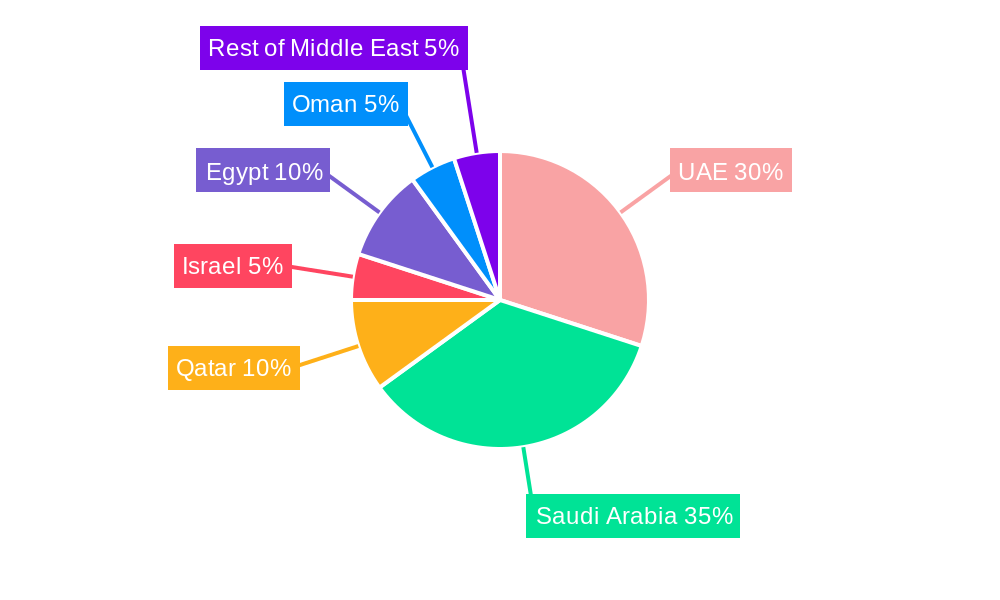

The Middle East Power Sector Gas Turbine Maintenance, Repair, and Overhaul (MRO) market is experiencing robust growth, driven by increasing electricity demand fueled by population growth, industrialization, and infrastructure development across the region. The substantial investments in power generation capacity, particularly in countries like Saudi Arabia, the UAE, and Qatar, are creating significant opportunities for MRO service providers. A Compound Annual Growth Rate (CAGR) exceeding 5% indicates a consistently expanding market, projected to reach a considerable size over the forecast period (2025-2033). Key drivers include the aging gas turbine fleet requiring more frequent maintenance, stringent environmental regulations pushing for optimized performance and reduced emissions, and a growing focus on predictive maintenance technologies to minimize downtime and operational costs. The market is segmented primarily by service type (maintenance, repair, and overhaul), with a significant portion dedicated to preventative maintenance contracts given the importance of consistent power supply. Major players, including Bechtel, Siemens, GE, and others, are actively competing in this market, offering comprehensive MRO services and technological solutions. The competitive landscape is characterized by a mix of global giants and regional specialists, leading to a dynamic and evolving market structure.

The region's commitment to diversifying its energy portfolio and incorporating renewable energy sources is expected to influence the MRO market in the coming years. While this might initially create uncertainty for conventional gas turbine MRO, it also presents opportunities for companies adapting to service hybrid power plants and integrating new technologies. The geographical distribution of the market is largely concentrated in the GCC countries, with the UAE and Saudi Arabia representing significant shares due to their substantial power generation capacities. However, growth is anticipated in other Middle Eastern countries as their infrastructure develops. Challenges remain, such as the volatile geopolitical landscape and the potential for economic fluctuations that could impact investment decisions in the power sector. Nevertheless, the long-term outlook for the Middle East Power Sector Gas Turbine MRO market remains positive, driven by the fundamental need for reliable and efficient power generation.

Middle East Power Sector Gas Turbine MRO Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle East Power Sector Gas Turbine Maintenance, Repair, and Overhaul (MRO) industry, offering critical insights for industry professionals, investors, and strategic decision-makers. Leveraging data from 2019-2024 (Historical Period), with 2025 as the Base Year and Estimated Year, the report projects market trends through 2033 (Forecast Period). The analysis covers market size, growth drivers, challenges, key players, and future opportunities, providing actionable intelligence to navigate this dynamic sector.

Middle East Power Sector Gas Turbine MRO Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape, including market concentration, innovation drivers, regulatory frameworks, and M&A activities within the Middle East power sector gas turbine MRO market. We examine the influence of factors such as product substitutes, end-user demographics, and evolving technological advancements on market structure and dynamics. The report quantifies market share for key players and analyzes the value of significant M&A deals during the study period. For example, the market concentration is assessed via the Herfindahl-Hirschman Index (HHI), revealing a moderately concentrated market with a HHI of xx. Significant M&A activity involving xx Million USD in deals contributed to reshaping the competitive landscape between 2019 and 2024.

- Market Share: Siemens AG holds an estimated xx% market share, followed by General Electric Company with xx%, and Mitsubishi Heavy Industries Ltd with xx%.

- Innovation Drivers: Stringent emission regulations and the increasing demand for higher efficiency gas turbines are driving innovation in MRO services.

- M&A Activity: Consolidation within the sector is anticipated to continue, driven by the need for economies of scale and enhanced technological capabilities.

Middle East Power Sector Gas Turbine MRO Industry Market Dynamics & Trends

This section delves into the key market dynamics and trends influencing the Middle East power sector gas turbine MRO industry. We examine factors driving market growth, including increasing power generation capacity, rising energy demand, and government investments in infrastructure development. The analysis also considers technological disruptions, such as the adoption of digitalization and advanced analytics in MRO operations, and their impact on market dynamics. The report projects a Compound Annual Growth Rate (CAGR) of xx% for the forecast period (2025-2033), with market penetration reaching xx% by 2033. Specific trends include an increasing adoption of predictive maintenance technologies and a shift towards outsourcing MRO services. The competitive dynamics are shaped by factors such as pricing strategies, technological advancements, and service capabilities.

Dominant Regions & Segments in Middle East Power Sector Gas Turbine MRO Industry

This section identifies the leading regions and segments within the Middle East power sector gas turbine MRO market. We analyze the dominance of specific countries and service types (Maintenance, Repair, Overhaul).

- Leading Region: The United Arab Emirates (UAE) is projected to be the leading region, driven by substantial investments in power generation infrastructure and a thriving industrial sector.

- Dominant Segment: The Repair segment is expected to hold the largest market share, owing to the increasing age of existing gas turbines and the need for regular repairs.

Key Drivers for UAE Dominance:

- Extensive investments in renewable energy projects, creating a high demand for MRO services.

- Favorable government policies supporting the growth of the power sector.

- Strong industrial infrastructure and skilled workforce.

Detailed Dominance Analysis: The UAE's strategic geographic location and its role as a major regional energy hub contribute significantly to its dominance. Further, government initiatives promoting energy efficiency and reliability are boosting demand for MRO services.

Middle East Power Sector Gas Turbine MRO Industry Product Innovations

The Middle East power sector gas turbine MRO industry is witnessing significant product innovations, focusing on improving efficiency, reducing downtime, and enhancing the lifespan of gas turbines. These advancements include the introduction of advanced diagnostic tools, predictive maintenance software, and specialized repair techniques. The adoption of these technologies offers significant competitive advantages by allowing for optimized maintenance schedules, reduced operational costs, and improved overall equipment effectiveness. The market is trending toward digitalization, integrating IoT (Internet of Things) devices and cloud-based platforms for remote monitoring and data analytics.

Report Scope & Segmentation Analysis

This report segments the Middle East power sector gas turbine MRO market based on service type: Maintenance, Repair, and Overhaul. Each segment's growth projections, market size, and competitive dynamics are analyzed.

Maintenance: The maintenance segment is characterized by routine inspections and preventative measures. The market size is projected at xx Million in 2025, growing at a CAGR of xx% through 2033.

Repair: The repair segment encompasses corrective actions to address identified faults or damage. This is projected to be the largest segment, valued at xx Million in 2025, with a CAGR of xx% during the forecast period.

Overhaul: The overhaul segment involves comprehensive refurbishment and restoration of gas turbines. The market size is estimated at xx Million in 2025, showing a CAGR of xx% until 2033.

Key Drivers of Middle East Power Sector Gas Turbine MRO Industry Growth

Several factors drive the growth of the Middle East power sector gas turbine MRO industry. These include increasing energy demand due to population growth and industrialization, substantial investments in power generation infrastructure, and the implementation of stringent environmental regulations promoting efficient and reliable power generation. Technological advancements in predictive maintenance and digitalization are also significant drivers. Government policies supporting energy diversification and sustainable development further stimulate industry expansion.

Challenges in the Middle East Power Sector Gas Turbine MRO Industry Sector

The Middle East power sector gas turbine MRO industry faces several challenges. These include the volatility of energy prices, geopolitical instability, skilled labor shortages, and the high cost of advanced technologies. Supply chain disruptions and the complexities of regulatory compliance in different markets further add to the challenges. The intense competition among established players and the emergence of new entrants create pricing pressures that impact profitability. These challenges reduce the overall potential market size by an estimated xx% annually.

Emerging Opportunities in Middle East Power Sector Gas Turbine MRO Industry

Despite the challenges, several opportunities exist. The expanding renewable energy sector and the growing adoption of digital solutions in MRO operations present significant avenues for growth. The development of innovative MRO services tailored to specific customer needs, such as advanced analytics and predictive maintenance, also opens new avenues. Furthermore, exploring emerging markets and expanding into new geographic regions presents significant potential. The increasing demand for energy efficiency and reduced emissions creates opportunities for companies specializing in environmentally friendly MRO solutions.

Leading Players in the Middle East Power Sector Gas Turbine MRO Industry Market

- Bechtel Corporation

- Weg SA

- Siemens AG

- Babcock & Wilcox Enterprises Inc

- John Wood Group PLC

- Sulzer AG

- General Electric Company

- Flour Corporation

- Mitsubishi Heavy Industries Ltd

Key Developments in Middle East Power Sector Gas Turbine MRO Industry Industry

- January 2023: Siemens AG launched a new digital platform for gas turbine MRO services.

- March 2022: General Electric Company and a regional partner announced a joint venture to expand MRO services.

- October 2021: A significant M&A deal involving two major MRO providers consolidated their market share.

Future Outlook for Middle East Power Sector Gas Turbine MRO Industry Market

The Middle East power sector gas turbine MRO industry is poised for continued growth, driven by factors such as increasing energy demand, infrastructure development, and technological advancements. The adoption of digitalization and predictive maintenance technologies will further enhance operational efficiency and reduce costs. Strategic partnerships and collaborations among industry players will play a key role in shaping the future of the market. The focus on sustainability and emission reduction will drive the adoption of innovative and eco-friendly MRO services. The market's long-term potential is significant, presenting lucrative opportunities for companies with robust strategies and technological capabilities.

Middle East Power Sector Gas Turbine MRO Industry Segmentation

-

1. Service Type

- 1.1. Maintenance

- 1.2. Repair

- 1.3. Overhaul

-

2. Geography

- 2.1. Saudi Arabia

- 2.2. United Arab Emirates

- 2.3. Rest of Middle East

Middle East Power Sector Gas Turbine MRO Industry Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. Rest of Middle East

Middle East Power Sector Gas Turbine MRO Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Supportive Government Policies and Incentives4.; Environmental Concerns

- 3.3. Market Restrains

- 3.3.1. 4.; Fossil Fuel Subsidies

- 3.4. Market Trends

- 3.4.1. Maintenance Sector is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Power Sector Gas Turbine MRO Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Maintenance

- 5.1.2. Repair

- 5.1.3. Overhaul

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Saudi Arabia

- 5.2.2. United Arab Emirates

- 5.2.3. Rest of Middle East

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.3.2. United Arab Emirates

- 5.3.3. Rest of Middle East

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Saudi Arabia Middle East Power Sector Gas Turbine MRO Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Maintenance

- 6.1.2. Repair

- 6.1.3. Overhaul

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Saudi Arabia

- 6.2.2. United Arab Emirates

- 6.2.3. Rest of Middle East

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. United Arab Emirates Middle East Power Sector Gas Turbine MRO Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Maintenance

- 7.1.2. Repair

- 7.1.3. Overhaul

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Saudi Arabia

- 7.2.2. United Arab Emirates

- 7.2.3. Rest of Middle East

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Rest of Middle East Middle East Power Sector Gas Turbine MRO Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Maintenance

- 8.1.2. Repair

- 8.1.3. Overhaul

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Saudi Arabia

- 8.2.2. United Arab Emirates

- 8.2.3. Rest of Middle East

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. United Arab Emirates Middle East Power Sector Gas Turbine MRO Industry Analysis, Insights and Forecast, 2019-2031

- 10. Saudi Arabia Middle East Power Sector Gas Turbine MRO Industry Analysis, Insights and Forecast, 2019-2031

- 11. Qatar Middle East Power Sector Gas Turbine MRO Industry Analysis, Insights and Forecast, 2019-2031

- 12. Israel Middle East Power Sector Gas Turbine MRO Industry Analysis, Insights and Forecast, 2019-2031

- 13. Egypt Middle East Power Sector Gas Turbine MRO Industry Analysis, Insights and Forecast, 2019-2031

- 14. Oman Middle East Power Sector Gas Turbine MRO Industry Analysis, Insights and Forecast, 2019-2031

- 15. Rest of Middle East Middle East Power Sector Gas Turbine MRO Industry Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Bechtel Corporation

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Weg SA

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Siemens AG

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Babcock & Wilcox Enterprises Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 John Wood Group PLC

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Sulzer AG

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 General Electric Company

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Flour Corporation

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Mitsubishi Heavy Industries Ltd

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.1 Bechtel Corporation

List of Figures

- Figure 1: Middle East Power Sector Gas Turbine MRO Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East Power Sector Gas Turbine MRO Industry Share (%) by Company 2024

List of Tables

- Table 1: Middle East Power Sector Gas Turbine MRO Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East Power Sector Gas Turbine MRO Industry Revenue Million Forecast, by Service Type 2019 & 2032

- Table 3: Middle East Power Sector Gas Turbine MRO Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Middle East Power Sector Gas Turbine MRO Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Middle East Power Sector Gas Turbine MRO Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United Arab Emirates Middle East Power Sector Gas Turbine MRO Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Saudi Arabia Middle East Power Sector Gas Turbine MRO Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Qatar Middle East Power Sector Gas Turbine MRO Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Israel Middle East Power Sector Gas Turbine MRO Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Egypt Middle East Power Sector Gas Turbine MRO Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Oman Middle East Power Sector Gas Turbine MRO Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Middle East Middle East Power Sector Gas Turbine MRO Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Middle East Power Sector Gas Turbine MRO Industry Revenue Million Forecast, by Service Type 2019 & 2032

- Table 14: Middle East Power Sector Gas Turbine MRO Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: Middle East Power Sector Gas Turbine MRO Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Middle East Power Sector Gas Turbine MRO Industry Revenue Million Forecast, by Service Type 2019 & 2032

- Table 17: Middle East Power Sector Gas Turbine MRO Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: Middle East Power Sector Gas Turbine MRO Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Middle East Power Sector Gas Turbine MRO Industry Revenue Million Forecast, by Service Type 2019 & 2032

- Table 20: Middle East Power Sector Gas Turbine MRO Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Middle East Power Sector Gas Turbine MRO Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Power Sector Gas Turbine MRO Industry?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Middle East Power Sector Gas Turbine MRO Industry?

Key companies in the market include Bechtel Corporation, Weg SA, Siemens AG, Babcock & Wilcox Enterprises Inc, John Wood Group PLC, Sulzer AG, General Electric Company, Flour Corporation, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Middle East Power Sector Gas Turbine MRO Industry?

The market segments include Service Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Supportive Government Policies and Incentives4.; Environmental Concerns.

6. What are the notable trends driving market growth?

Maintenance Sector is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Fossil Fuel Subsidies.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Power Sector Gas Turbine MRO Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Power Sector Gas Turbine MRO Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Power Sector Gas Turbine MRO Industry?

To stay informed about further developments, trends, and reports in the Middle East Power Sector Gas Turbine MRO Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence