Key Insights

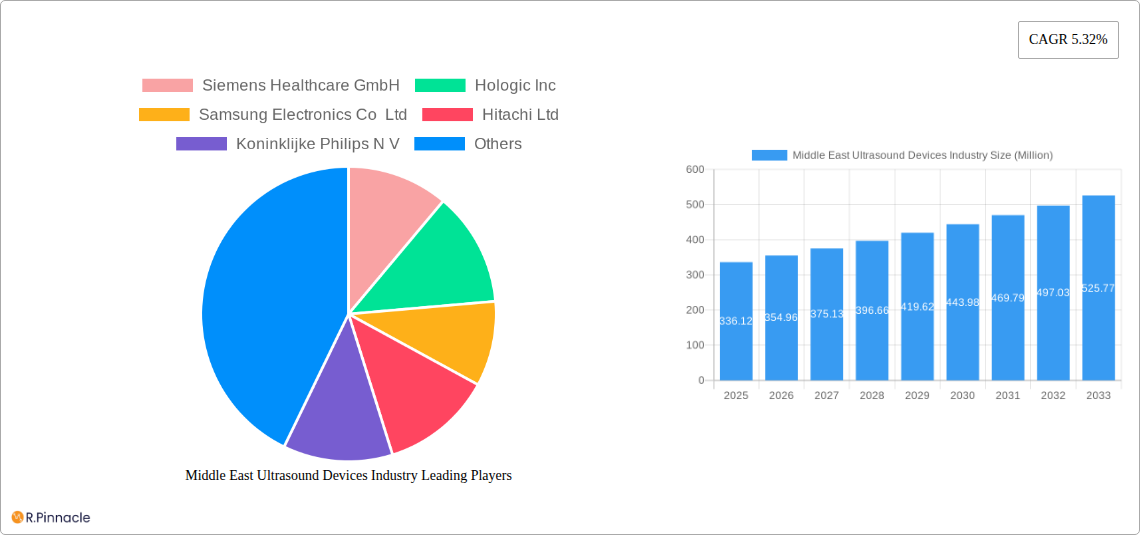

The Middle East ultrasound devices market, valued at $336.12 million in 2025, is projected to experience robust growth, driven by a rising prevalence of chronic diseases, increasing geriatric population, and expanding healthcare infrastructure across the region. Technological advancements, particularly in 3D/4D and Doppler imaging, are further fueling market expansion. The adoption of portable ultrasound systems is increasing due to their convenience and cost-effectiveness, particularly in remote areas with limited access to healthcare. Strong government initiatives focused on improving healthcare access and quality, coupled with rising disposable incomes and increased health awareness among consumers, are contributing to the market's growth trajectory. Significant investments in medical technology and the presence of established healthcare providers are also key drivers.

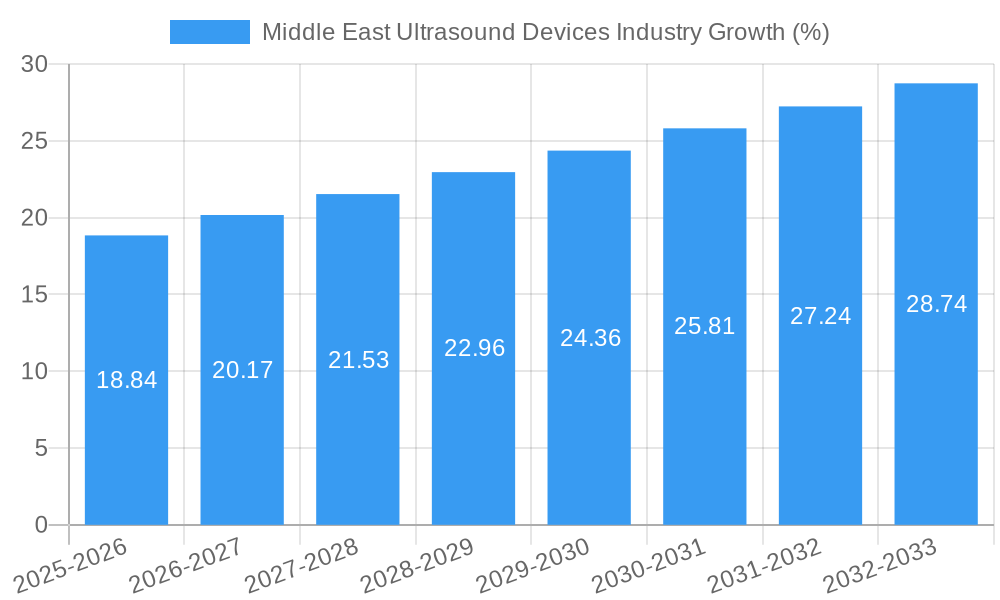

However, the market faces certain challenges. High costs associated with advanced ultrasound systems, coupled with limited reimbursement policies in some countries, may hinder widespread adoption. The need for skilled professionals to operate and interpret ultrasound images presents another constraint. Despite these restraints, the market's overall outlook remains positive, with a projected Compound Annual Growth Rate (CAGR) of 5.32% from 2025 to 2033. This growth will be driven by the increasing demand for diagnostic imaging across various applications, including cardiology, obstetrics/gynecology, and musculoskeletal imaging, with consistent growth expected in segments like portable ultrasound and advanced imaging technologies. The continued development and adoption of AI-driven ultrasound analysis systems is expected to further enhance the market's growth potential.

Middle East Ultrasound Devices Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Middle East ultrasound devices market, offering actionable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market structure, dynamics, leading players, and future growth potential. The report leverages extensive data analysis to forecast market trends and identify key opportunities within this rapidly evolving sector.

Middle East Ultrasound Devices Industry Market Structure & Innovation Trends

The Middle East ultrasound devices market exhibits a moderately concentrated structure, with key players like Siemens Healthcare GmbH, Hologic Inc, Samsung Electronics Co Ltd, and GE Healthcare holding significant market share (estimated at xx% collectively in 2025). Market concentration is influenced by factors such as technological advancements, regulatory approvals, and strategic mergers and acquisitions (M&A). Innovation is driven by the increasing demand for advanced imaging technologies, such as 3D/4D ultrasound and AI-powered diagnostic tools. Regulatory frameworks, while generally supportive of technological advancements, vary across the region, impacting market entry and product approvals. The market experiences competition from substitute technologies, primarily in niche applications; however, ultrasound remains the gold standard for many diagnostic procedures. End-user demographics are largely influenced by the region's growing population and increasing healthcare expenditure. M&A activity has been relatively moderate in recent years, with deal values estimated at xx Million in 2024; however, strategic partnerships and collaborations are increasingly common.

- Market Share (2025 Estimate): Top 5 players - xx%

- M&A Deal Value (2024): xx Million

Middle East Ultrasound Devices Industry Market Dynamics & Trends

The Middle East ultrasound devices market is experiencing robust growth, driven by several key factors. Rising healthcare expenditure, expanding healthcare infrastructure, and increasing prevalence of chronic diseases are major contributors to market expansion. The compound annual growth rate (CAGR) is projected to be xx% during the forecast period (2025-2033). Technological advancements, particularly the adoption of AI-powered solutions and advanced imaging techniques (3D/4D, Doppler), are significantly disrupting the market, leading to improved diagnostic accuracy and efficiency. Consumer preferences are shifting towards portable and user-friendly devices, particularly in remote or underserved areas. Competitive dynamics are shaped by continuous innovation, strategic partnerships, and price competition, fostering a dynamic and evolving market landscape. Market penetration of advanced technologies remains relatively low, presenting substantial opportunities for growth.

Dominant Regions & Segments in Middle East Ultrasound Devices Industry

The GCC countries (e.g., Saudi Arabia, UAE) currently dominate the Middle East ultrasound devices market, driven by high healthcare spending and robust healthcare infrastructure.

Key Drivers:

- High Healthcare Expenditure: Significant investments in public and private healthcare facilities.

- Advanced Healthcare Infrastructure: Presence of well-equipped hospitals and diagnostic centers.

- Favorable Government Policies: Initiatives to improve healthcare access and quality.

Segment Dominance:

- Application: Gynecology/Obstetrics holds the largest market share due to high demand for prenatal care and increasing birth rates.

- Technology: 2D Ultrasound Imaging continues to be the dominant technology due to its cost-effectiveness and widespread adoption. However, 3D/4D and Doppler imaging are rapidly gaining traction.

- Type: Stationary Ultrasound systems currently dominate, but portable ultrasound is showing strong growth due to increasing demand for point-of-care diagnostics.

Detailed analysis of each segment's growth drivers and market share is provided in the full report.

Middle East Ultrasound Devices Industry Product Innovations

Recent product innovations focus on improved image quality, portability, and integration of AI-powered diagnostic tools. Manufacturers are emphasizing user-friendly interfaces, enhanced connectivity features, and cost-effective solutions. Technological trends such as AI-assisted image analysis and cloud-based data management are enhancing the efficiency and accuracy of ultrasound diagnostics, improving their market fit.

Report Scope & Segmentation Analysis

This report segments the Middle East ultrasound devices market by application (Anesthesiology, Cardiology, Gynecology/Obstetrics, Musculoskeletal, Other Applications), technology (2D Ultrasound Imaging, 3D and 4D Ultrasound Imaging, Doppler Imaging, High-intensity Focused Ultrasound), and type (Stationary Ultrasound, Portable Ultrasound). Each segment's growth projections, market sizes, and competitive dynamics are analyzed in detail within the full report, providing a comprehensive view of the market landscape.

Key Drivers of Middle East Ultrasound Devices Industry Growth

The growth of the Middle East ultrasound devices market is fueled by a combination of factors, including rising healthcare spending, increasing prevalence of chronic diseases necessitating frequent diagnostic procedures, government initiatives to improve healthcare infrastructure, and the rising adoption of advanced imaging technologies. The increasing number of specialized medical centers and hospitals further contributes to market expansion.

Challenges in the Middle East Ultrasound Devices Industry Sector

The market faces challenges, including stringent regulatory procedures for medical device approvals, potential supply chain disruptions impacting device availability, and intense competition from both established and emerging players. These factors can significantly influence market growth trajectories and profitability for industry participants.

Emerging Opportunities in Middle East Ultrasound Devices Industry

Emerging opportunities include the increasing adoption of telehealth and remote diagnostics, expanding demand for point-of-care ultrasound in underserved areas, and growth potential in specialized applications such as high-intensity focused ultrasound (HIFU). These trends present considerable potential for market expansion and innovation.

Leading Players in the Middle East Ultrasound Devices Industry Market

- Siemens Healthcare GmbH

- Hologic Inc

- Samsung Electronics Co Ltd

- Hitachi Ltd

- Koninklijke Philips N V

- General Electric Company (GE Healthcare)

- Canon Medical Systems Corporation

- Esaote SpA

- Shenzhen Mindray Bio-Medical Electronics Co Ltd

- Fujifilm Holdings Corporation

Key Developments in Middle East Ultrasound Devices Industry Industry

- May 2022: SonoScape Egypt and the Egyptian Fetal Medicine Foundation (EFMF) introduced AI ultrasound solutions at the 16th ISUOG International Symposium, showcasing the growing adoption of AI in the region.

- January 2022: MGI Tech Co. Ltd. showcased its MGIUS-R3 robotic ultrasound system at Arab Health 2022, highlighting advancements in robotic-assisted ultrasound technology.

Future Outlook for Middle East Ultrasound Devices Industry Market

The Middle East ultrasound devices market is poised for continued strong growth, driven by favorable demographic trends, increasing healthcare spending, and the adoption of innovative technologies. Strategic partnerships, focus on advanced imaging capabilities, and expansion into underserved markets will be crucial for success in this dynamic and competitive landscape. The market is expected to experience significant expansion over the forecast period, with opportunities for both established players and new entrants.

Middle East Ultrasound Devices Industry Segmentation

-

1. Application

- 1.1. Anesthesiology

- 1.2. Cardiology

- 1.3. Gynecology/Obstetrics

- 1.4. Musculoskeletal

- 1.5. Other Applications

-

2. Technology

- 2.1. 2D Ultrasound Imaging

- 2.2. 3D and 4D Ultrasound Imaging

- 2.3. Doppler Imaging

- 2.4. High-intensity Focused Ultrasound

-

3. Type

- 3.1. Stationary Ultrasound

- 3.2. Portable Ultrasound

Middle East Ultrasound Devices Industry Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Ultrasound Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.32% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Incidences of Chronic Diseases; Increasing Government and Private Funding for Research and Development (R&D) in Ultrasound Imaging; Technological Advancements in the Field of Ultrasound

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Framework for Approval of Devices

- 3.4. Market Trends

- 3.4.1. 3D and 4D Ultrasound Imaging Segment is Expected to Show Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Ultrasound Devices Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Anesthesiology

- 5.1.2. Cardiology

- 5.1.3. Gynecology/Obstetrics

- 5.1.4. Musculoskeletal

- 5.1.5. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. 2D Ultrasound Imaging

- 5.2.2. 3D and 4D Ultrasound Imaging

- 5.2.3. Doppler Imaging

- 5.2.4. High-intensity Focused Ultrasound

- 5.3. Market Analysis, Insights and Forecast - by Type

- 5.3.1. Stationary Ultrasound

- 5.3.2. Portable Ultrasound

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. United Arab Emirates Middle East Ultrasound Devices Industry Analysis, Insights and Forecast, 2019-2031

- 7. Saudi Arabia Middle East Ultrasound Devices Industry Analysis, Insights and Forecast, 2019-2031

- 8. Qatar Middle East Ultrasound Devices Industry Analysis, Insights and Forecast, 2019-2031

- 9. Israel Middle East Ultrasound Devices Industry Analysis, Insights and Forecast, 2019-2031

- 10. Egypt Middle East Ultrasound Devices Industry Analysis, Insights and Forecast, 2019-2031

- 11. Oman Middle East Ultrasound Devices Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Middle East Middle East Ultrasound Devices Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Siemens Healthcare GmbH

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Hologic Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Samsung Electronics Co Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Hitachi Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Koninklijke Philips N V

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 General Electric Company (GE Healthcare)

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Canon Medical Systems Corporation

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Esaote SpA*List Not Exhaustive

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Shenzhen Mindray Bio-Medical Electronics Co Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Fujifilm Holdings Corporation

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Siemens Healthcare GmbH

List of Figures

- Figure 1: Middle East Ultrasound Devices Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East Ultrasound Devices Industry Share (%) by Company 2024

List of Tables

- Table 1: Middle East Ultrasound Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East Ultrasound Devices Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Middle East Ultrasound Devices Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: Middle East Ultrasound Devices Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 5: Middle East Ultrasound Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Middle East Ultrasound Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United Arab Emirates Middle East Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Saudi Arabia Middle East Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Qatar Middle East Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Israel Middle East Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Egypt Middle East Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Oman Middle East Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Middle East Middle East Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Middle East Ultrasound Devices Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Middle East Ultrasound Devices Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 16: Middle East Ultrasound Devices Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 17: Middle East Ultrasound Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Saudi Arabia Middle East Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: United Arab Emirates Middle East Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Israel Middle East Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Qatar Middle East Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Kuwait Middle East Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Oman Middle East Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Bahrain Middle East Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Jordan Middle East Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Lebanon Middle East Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Ultrasound Devices Industry?

The projected CAGR is approximately 5.32%.

2. Which companies are prominent players in the Middle East Ultrasound Devices Industry?

Key companies in the market include Siemens Healthcare GmbH, Hologic Inc, Samsung Electronics Co Ltd, Hitachi Ltd, Koninklijke Philips N V, General Electric Company (GE Healthcare), Canon Medical Systems Corporation, Esaote SpA*List Not Exhaustive, Shenzhen Mindray Bio-Medical Electronics Co Ltd, Fujifilm Holdings Corporation.

3. What are the main segments of the Middle East Ultrasound Devices Industry?

The market segments include Application, Technology, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 336.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Incidences of Chronic Diseases; Increasing Government and Private Funding for Research and Development (R&D) in Ultrasound Imaging; Technological Advancements in the Field of Ultrasound.

6. What are the notable trends driving market growth?

3D and 4D Ultrasound Imaging Segment is Expected to Show Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Regulatory Framework for Approval of Devices.

8. Can you provide examples of recent developments in the market?

May 2022: The SonoScape Egypt team, in collaboration with the Egyptian Fetal Medicine Foundation (EFMF), introduced AI ultrasound solutions at the 16th ISUOG International Symposium.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Ultrasound Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Ultrasound Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Ultrasound Devices Industry?

To stay informed about further developments, trends, and reports in the Middle East Ultrasound Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence