Key Insights

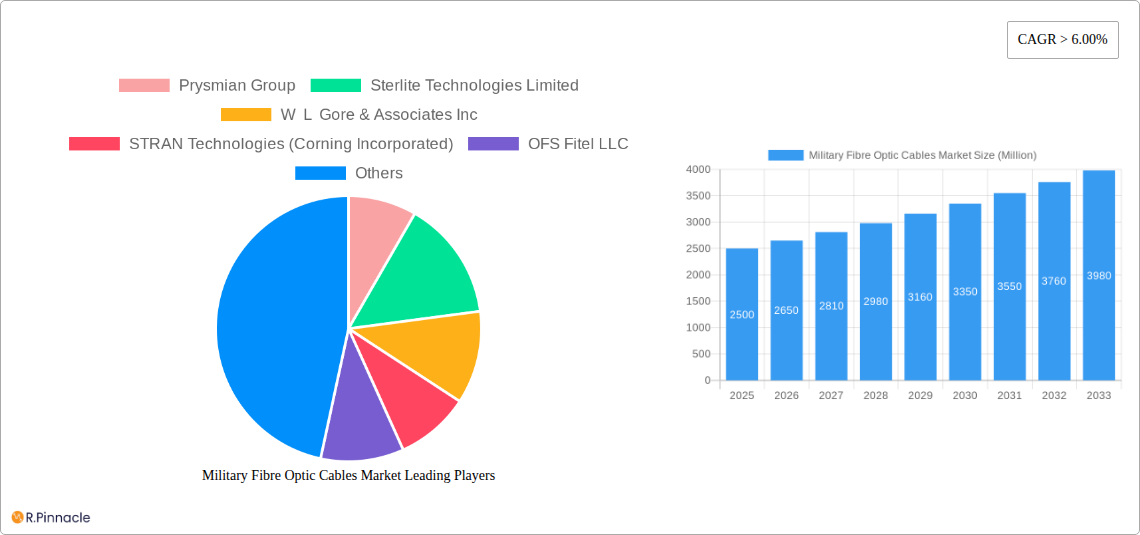

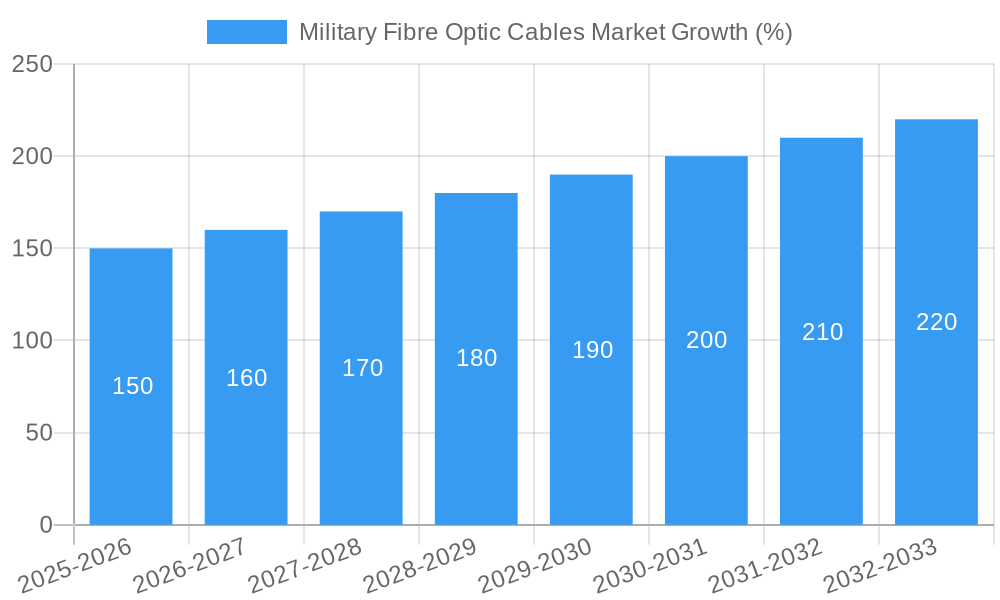

The Military Fibre Optic Cable market is experiencing robust growth, driven by increasing demand for secure and high-bandwidth communication systems within defense applications. The market's Compound Annual Growth Rate (CAGR) exceeding 6% from 2019 to 2024 indicates a significant upward trajectory. This growth is fueled by several key factors, including the modernization of military communication infrastructure, the expanding adoption of advanced technologies like unmanned aerial vehicles (UAVs) and autonomous systems, and the rising need for secure data transmission in challenging environments. The market segmentation reveals a strong preference for single-mode fiber optic cables, offering superior performance for long-distance, high-speed data transmission. Glass optical fiber remains the dominant material due to its inherent robustness and superior signal transmission capabilities. Key players like Prysmian Group, Sterlite Technologies, and Corning Incorporated are strategically investing in R&D and expanding their product portfolios to cater to the growing military needs. The Asia-Pacific region is expected to be a significant contributor to market growth due to increased military spending and technological advancements in the region.

Looking ahead to 2033, continued technological advancements in fiber optic technology, alongside the ongoing global geopolitical landscape, will further propel market expansion. The demand for lightweight, durable, and radiation-hardened cables will drive innovation and product differentiation. While potential restraints like high initial investment costs and the complexity of installation may exist, the strategic importance of secure communication within the military sector will overcome these challenges. The market will likely witness increased competition and consolidation as companies strive to capture market share, potentially leading to mergers and acquisitions. Furthermore, the focus on developing environmentally friendly materials and manufacturing processes will also influence future market trends.

Military Fibre Optic Cables Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Military Fibre Optic Cables Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Spanning the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, growth drivers, challenges, and emerging opportunities within this crucial sector. The report leverages extensive market research and data analysis to deliver actionable intelligence, forecasting market trends and providing a competitive landscape analysis.

Military Fibre Optic Cables Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Military Fibre Optic Cables Market, exploring market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and M&A activities. The market is characterized by a moderately concentrated structure, with key players holding significant market share.

Market Concentration: The top 5 players (Prysmian Group, Sterlite Technologies Limited, W L Gore & Associates Inc, STRAN Technologies (Corning Incorporated), OFS Fitel LLC) account for approximately xx% of the global market share in 2025.

Innovation Drivers: Advancements in fiber optic technology, including the development of higher bandwidth capacity cables and improved durability for military applications, are key drivers. Miniaturization and increased resilience to harsh environmental conditions are also significant factors.

Regulatory Frameworks: Government regulations regarding data security and the use of advanced technologies in defense systems heavily influence market growth. Compliance requirements vary across nations, creating both opportunities and challenges.

Product Substitutes: While limited, alternative communication technologies exert some competitive pressure, prompting continuous innovation within the fibre optic cable segment to maintain its edge.

End-User Demographics: The primary end-users are government defense departments and military contractors. This segment is characterized by high demand for high-performance, secure, and reliable communication systems.

M&A Activities: The market has witnessed moderate M&A activity in recent years, with deal values estimated at xx Million in 2024. These mergers and acquisitions have primarily focused on expanding product portfolios and geographical reach. Examples include the significant Nexans and Terna contract.

Military Fibre Optic Cables Market Dynamics & Trends

The Military Fibre Optic Cables Market is experiencing robust growth, driven by several factors. The increasing adoption of advanced communication technologies within the military, the growing demand for high-bandwidth and secure communication systems, and substantial investments in military modernization programs contribute to this positive growth trajectory. Technological disruptions, such as the development of multicore fibers, significantly improve data transmission capacity. Competitive dynamics are shaped by intense R&D efforts to develop innovative products, leading to a continuous improvement in performance and durability. Market penetration is high among major military powers, with continuous expansion into developing nations driving further growth. The CAGR for the forecast period (2025-2033) is projected to be xx%. Specific details on consumer preferences and regional variations in market dynamics are elaborated within the full report.

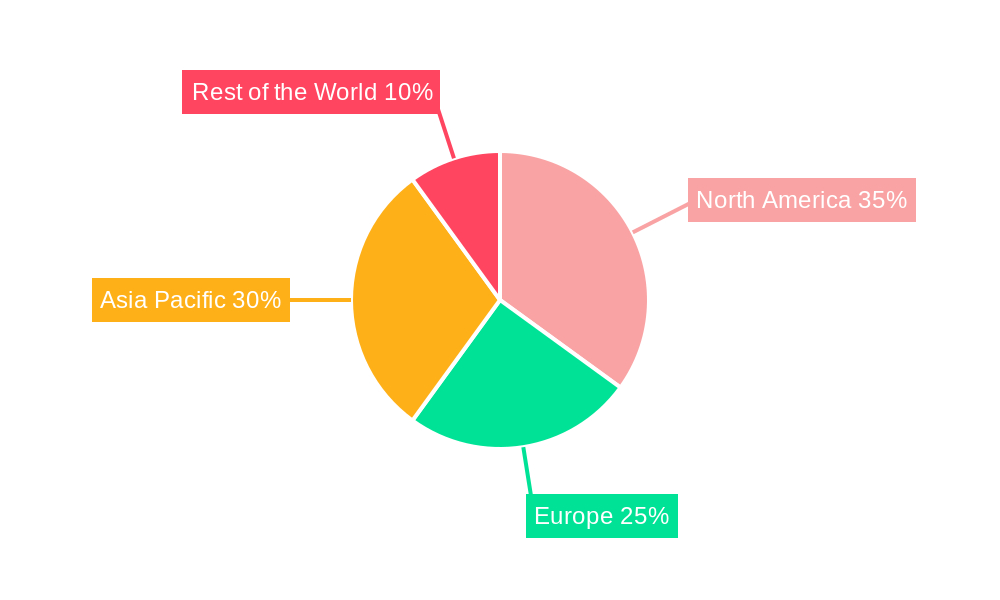

Dominant Regions & Segments in Military Fibre Optic Cables Market

The North American region currently dominates the Military Fibre Optic Cables Market due to substantial military spending and advanced technological infrastructure. However, the Asia-Pacific region is exhibiting high growth potential due to increasing military expenditure and modernization initiatives.

Key Drivers:

- North America: High defense budgets, strong technological advancements, and a well-established defense industry.

- Asia-Pacific: Rapid military modernization, growing defense expenditure, and significant investments in infrastructure development.

Segment Dominance:

- Cable Type: Single-mode fibers hold a significant market share owing to their ability to transmit data over long distances with minimal signal degradation.

- Material Type: Glass optical fibers dominate due to their superior performance characteristics compared to plastic optical fibers, particularly in demanding military applications. A detailed analysis of market share for each segment, including growth projections, is available in the full report.

Military Fibre Optic Cables Market Product Innovations

Recent advancements in Military Fibre Optic Cables focus on enhancing bandwidth, improving durability, and minimizing size and weight. Multicore fibers, like the TeraWave SCUBA 4X Multicore Ocean Fiber from OFS, exemplify this trend. These innovations cater to the increasing demand for high-speed, reliable communication in challenging environments, providing a significant competitive advantage for manufacturers.

Report Scope & Segmentation Analysis

This report comprehensively segments the Military Fibre Optic Cables Market based on cable type (single-mode, multi-mode) and material type (plastic optical fibre, glass optical fibre). Each segment is analyzed based on its current market size, growth projections, and competitive landscape. Specific growth rates and market sizes for each segment are provided in the complete report. For example, the single-mode fiber segment is expected to witness significant growth due to its superior performance in long-distance communication. Similarly, glass optical fibre enjoys dominance owing to its superior performance characteristics.

Key Drivers of Military Fibre Optic Cables Market Growth

Key drivers include increasing defense budgets globally, the rising demand for secure and high-bandwidth communication systems in military applications, advancements in fiber optic technology, and ongoing military modernization efforts. Government regulations mandating secure communication infrastructure further propel market growth.

Challenges in the Military Fibre Optic Cables Market Sector

Challenges include the high cost of advanced fiber optic cables, the complexity of installation and maintenance in demanding environments, and potential supply chain disruptions affecting the availability of raw materials and specialized components. Competitive pressure from alternative communication technologies also poses a challenge.

Emerging Opportunities in Military Fibre Optic Cables Market

Emerging opportunities lie in the development of more resilient and compact fiber optic cables suitable for unmanned aerial vehicles (UAVs) and other advanced military platforms. Expanding applications into emerging markets and developing innovative solutions for underwater and deep-sea communication represent significant growth potential.

Leading Players in the Military Fibre Optic Cables Market Market

- Prysmian Group

- Sterlite Technologies Limited

- W L Gore & Associates Inc

- STRAN Technologies (Corning Incorporated)

- OFS Fitel LLC

- Timbercon Inc

- Nexans

- G&H

- Sumitomo Electric Lightwave Corp

- Infinite Electronics International Inc

- OCC

Key Developments in Military Fibre Optic Cables Market Industry

- November 2021: Nexans and Terna secured a contract exceeding EUR 650 Million for the Tyrrhenian Link project, highlighting the scale of projects in the subsea cable sector.

- March 2023: OFS launched the TeraWave SCUBA 4X Multicore Ocean Fiber, showcasing innovation in high-bandwidth ocean applications.

Future Outlook for Military Fibre Optic Cables Market Market

The Military Fibre Optic Cables Market is poised for continued growth, driven by ongoing technological advancements and increasing military spending. Strategic partnerships, investments in R&D, and expansion into new applications will shape future market dynamics. The market is expected to experience considerable growth due to the aforementioned factors.

Military Fibre Optic Cables Market Segmentation

-

1. Cable Type

- 1.1. Single-mode

- 1.2. Multi-mode

-

2. Material Type

- 2.1. Plastic Optical Fibre

- 2.2. Glass Optical Fibre

Military Fibre Optic Cables Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Military Fibre Optic Cables Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Plastic Optical Fiber to Dominate Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Military Fibre Optic Cables Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cable Type

- 5.1.1. Single-mode

- 5.1.2. Multi-mode

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Plastic Optical Fibre

- 5.2.2. Glass Optical Fibre

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Cable Type

- 6. North America Military Fibre Optic Cables Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Cable Type

- 6.1.1. Single-mode

- 6.1.2. Multi-mode

- 6.2. Market Analysis, Insights and Forecast - by Material Type

- 6.2.1. Plastic Optical Fibre

- 6.2.2. Glass Optical Fibre

- 6.1. Market Analysis, Insights and Forecast - by Cable Type

- 7. Europe Military Fibre Optic Cables Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Cable Type

- 7.1.1. Single-mode

- 7.1.2. Multi-mode

- 7.2. Market Analysis, Insights and Forecast - by Material Type

- 7.2.1. Plastic Optical Fibre

- 7.2.2. Glass Optical Fibre

- 7.1. Market Analysis, Insights and Forecast - by Cable Type

- 8. Asia Pacific Military Fibre Optic Cables Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Cable Type

- 8.1.1. Single-mode

- 8.1.2. Multi-mode

- 8.2. Market Analysis, Insights and Forecast - by Material Type

- 8.2.1. Plastic Optical Fibre

- 8.2.2. Glass Optical Fibre

- 8.1. Market Analysis, Insights and Forecast - by Cable Type

- 9. Rest of the World Military Fibre Optic Cables Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Cable Type

- 9.1.1. Single-mode

- 9.1.2. Multi-mode

- 9.2. Market Analysis, Insights and Forecast - by Material Type

- 9.2.1. Plastic Optical Fibre

- 9.2.2. Glass Optical Fibre

- 9.1. Market Analysis, Insights and Forecast - by Cable Type

- 10. North America Military Fibre Optic Cables Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Military Fibre Optic Cables Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Military Fibre Optic Cables Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Military Fibre Optic Cables Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Prysmian Group

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Sterlite Technologies Limited

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 W L Gore & Associates Inc

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 STRAN Technologies (Corning Incorporated)

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 OFS Fitel LLC

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Timbercon Inc

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Nexans

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 G&H

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Sumitomo Electric Lightwave Corp

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Infinite Electronics International Inc

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 OCC

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.1 Prysmian Group

List of Figures

- Figure 1: Global Military Fibre Optic Cables Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Military Fibre Optic Cables Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Military Fibre Optic Cables Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Military Fibre Optic Cables Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Military Fibre Optic Cables Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Military Fibre Optic Cables Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Military Fibre Optic Cables Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Military Fibre Optic Cables Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Military Fibre Optic Cables Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Military Fibre Optic Cables Market Revenue (Million), by Cable Type 2024 & 2032

- Figure 11: North America Military Fibre Optic Cables Market Revenue Share (%), by Cable Type 2024 & 2032

- Figure 12: North America Military Fibre Optic Cables Market Revenue (Million), by Material Type 2024 & 2032

- Figure 13: North America Military Fibre Optic Cables Market Revenue Share (%), by Material Type 2024 & 2032

- Figure 14: North America Military Fibre Optic Cables Market Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Military Fibre Optic Cables Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Military Fibre Optic Cables Market Revenue (Million), by Cable Type 2024 & 2032

- Figure 17: Europe Military Fibre Optic Cables Market Revenue Share (%), by Cable Type 2024 & 2032

- Figure 18: Europe Military Fibre Optic Cables Market Revenue (Million), by Material Type 2024 & 2032

- Figure 19: Europe Military Fibre Optic Cables Market Revenue Share (%), by Material Type 2024 & 2032

- Figure 20: Europe Military Fibre Optic Cables Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Military Fibre Optic Cables Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Pacific Military Fibre Optic Cables Market Revenue (Million), by Cable Type 2024 & 2032

- Figure 23: Asia Pacific Military Fibre Optic Cables Market Revenue Share (%), by Cable Type 2024 & 2032

- Figure 24: Asia Pacific Military Fibre Optic Cables Market Revenue (Million), by Material Type 2024 & 2032

- Figure 25: Asia Pacific Military Fibre Optic Cables Market Revenue Share (%), by Material Type 2024 & 2032

- Figure 26: Asia Pacific Military Fibre Optic Cables Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Asia Pacific Military Fibre Optic Cables Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Rest of the World Military Fibre Optic Cables Market Revenue (Million), by Cable Type 2024 & 2032

- Figure 29: Rest of the World Military Fibre Optic Cables Market Revenue Share (%), by Cable Type 2024 & 2032

- Figure 30: Rest of the World Military Fibre Optic Cables Market Revenue (Million), by Material Type 2024 & 2032

- Figure 31: Rest of the World Military Fibre Optic Cables Market Revenue Share (%), by Material Type 2024 & 2032

- Figure 32: Rest of the World Military Fibre Optic Cables Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Rest of the World Military Fibre Optic Cables Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Military Fibre Optic Cables Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Military Fibre Optic Cables Market Revenue Million Forecast, by Cable Type 2019 & 2032

- Table 3: Global Military Fibre Optic Cables Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 4: Global Military Fibre Optic Cables Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Military Fibre Optic Cables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Military Fibre Optic Cables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Military Fibre Optic Cables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Military Fibre Optic Cables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Military Fibre Optic Cables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Military Fibre Optic Cables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Military Fibre Optic Cables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Military Fibre Optic Cables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Military Fibre Optic Cables Market Revenue Million Forecast, by Cable Type 2019 & 2032

- Table 14: Global Military Fibre Optic Cables Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 15: Global Military Fibre Optic Cables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Military Fibre Optic Cables Market Revenue Million Forecast, by Cable Type 2019 & 2032

- Table 17: Global Military Fibre Optic Cables Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 18: Global Military Fibre Optic Cables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Global Military Fibre Optic Cables Market Revenue Million Forecast, by Cable Type 2019 & 2032

- Table 20: Global Military Fibre Optic Cables Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 21: Global Military Fibre Optic Cables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Military Fibre Optic Cables Market Revenue Million Forecast, by Cable Type 2019 & 2032

- Table 23: Global Military Fibre Optic Cables Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 24: Global Military Fibre Optic Cables Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Military Fibre Optic Cables Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Military Fibre Optic Cables Market?

Key companies in the market include Prysmian Group, Sterlite Technologies Limited, W L Gore & Associates Inc, STRAN Technologies (Corning Incorporated), OFS Fitel LLC, Timbercon Inc, Nexans, G&H, Sumitomo Electric Lightwave Corp, Infinite Electronics International Inc, OCC.

3. What are the main segments of the Military Fibre Optic Cables Market?

The market segments include Cable Type, Material Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Plastic Optical Fiber to Dominate Market Share.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In November 2021, Nexans and Terna announced a contract of more than EUR 650 million. As per the terms of the contract, Nexans will provide 500km of 500kV HVDC mass-impregnated subsea cable link for the Tyrrhenian Link project to build a new electricity corridor connecting Sicily and Sardinia to Italy's mainland.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Military Fibre Optic Cables Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Military Fibre Optic Cables Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Military Fibre Optic Cables Market?

To stay informed about further developments, trends, and reports in the Military Fibre Optic Cables Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence