Key Insights

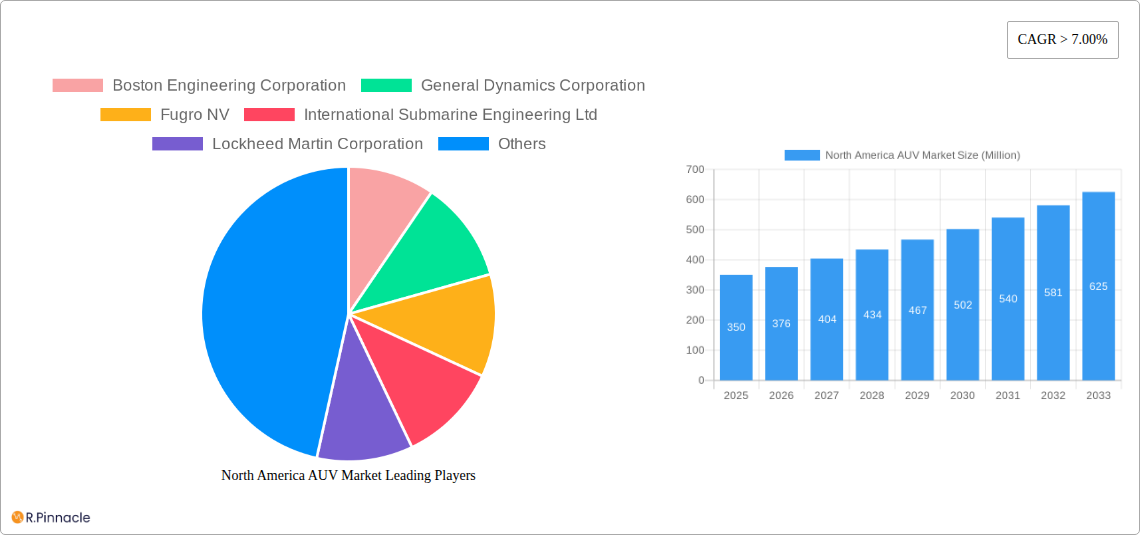

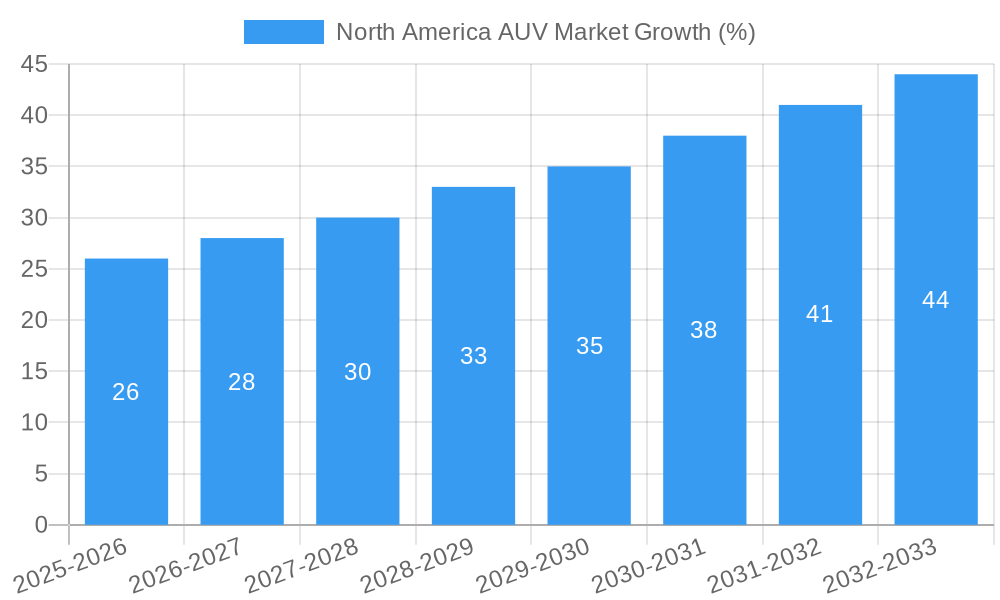

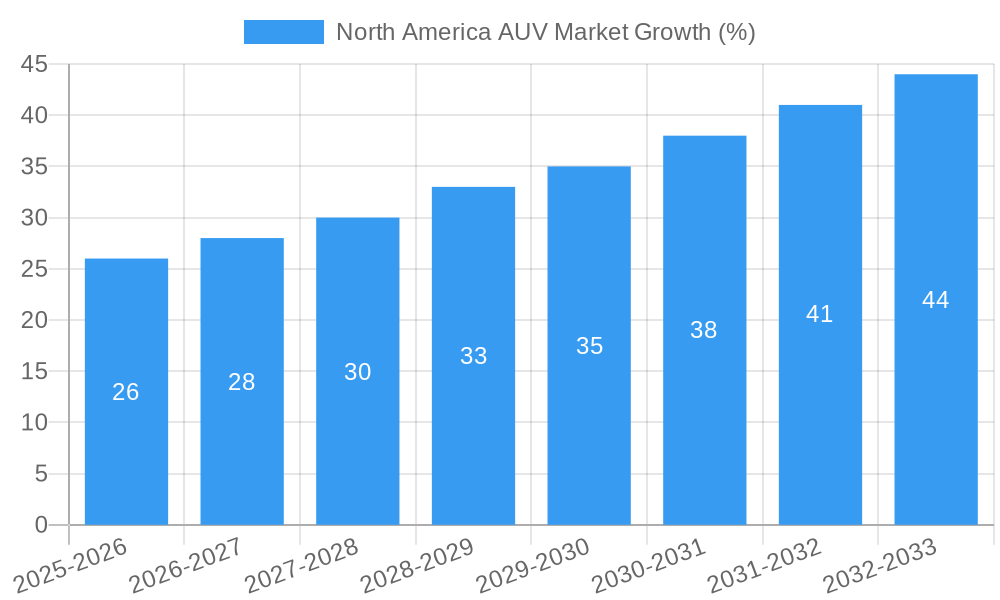

The North American Autonomous Underwater Vehicle (AUV) market is experiencing robust growth, driven by increasing demand across diverse sectors. The market's Compound Annual Growth Rate (CAGR) exceeding 7% from 2019-2033 signifies a substantial expansion. Key drivers include the rising need for efficient subsea operations in the oil and gas industry, heightened defense and security requirements for underwater surveillance and mine countermeasures, and the burgeoning commercial exploration sector for activities such as oceanographic research and infrastructure inspection. Technological advancements, such as improved sensor technologies, enhanced navigation systems, and greater autonomy, further contribute to market expansion. The segmentation reveals a strong presence across key application areas, with Oil and Gas, Defense, and Commercial Exploration sectors leading the market. Leading companies like Boeing, Lockheed Martin, and Oceaneering International are at the forefront of innovation and market share, driving competition and technological advancement. While specific market size figures for 2025 are not provided, estimating based on the given CAGR and the substantial presence of major players suggests a market value likely in the hundreds of millions of dollars for North America alone.

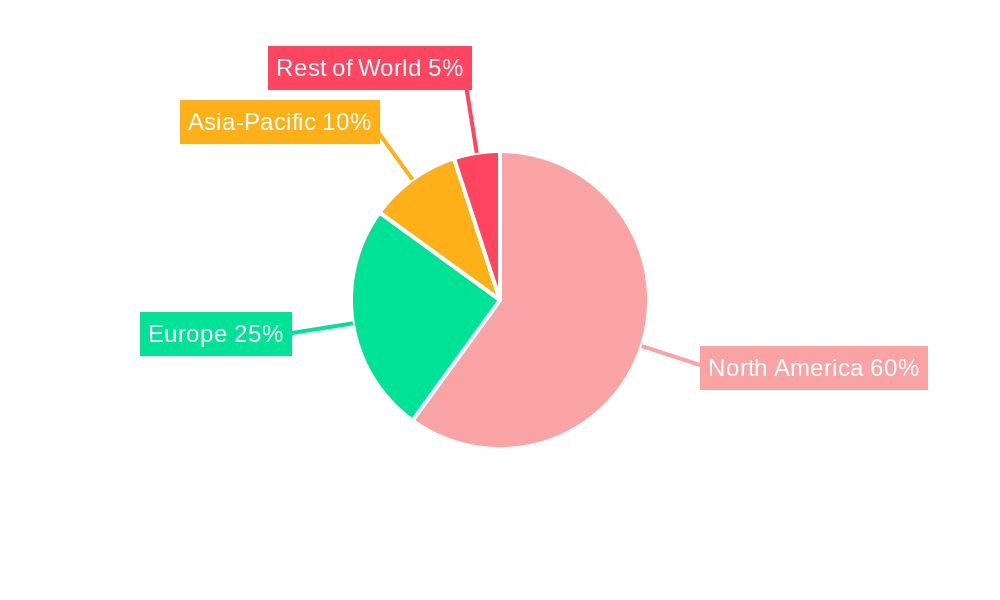

The forecast period (2025-2033) anticipates continued growth, fueled by increasing government investments in defense programs and the growing adoption of AUVs for various commercial applications. However, challenges remain, primarily related to high initial investment costs for AUV systems and the need for robust infrastructure to support their operations. Despite these restraints, the overall outlook remains positive, with projections indicating significant market expansion in the coming years. Geographical concentration is evident, with North America, specifically the United States, Canada, and Mexico, comprising a significant portion of the market due to established technological capabilities and high demand from diverse sectors. The market's future trajectory suggests further investment in research and development, focusing on enhancing AUV capabilities and lowering operational costs to ensure continued expansion.

North America AUV Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America Autonomous Underwater Vehicle (AUV) market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025, this report unveils market size, growth projections, key trends, and competitive dynamics. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

North America AUV Market Market Structure & Innovation Trends

The North America AUV market exhibits a moderately consolidated structure, with several key players holding significant market share.

Market Concentration: While precise market share figures for individual companies are commercially sensitive, Boston Engineering Corporation, General Dynamics Corporation, Fugro NV, International Submarine Engineering Ltd, Lockheed Martin Corporation, Oceaneering International Inc, Teledyne Technologies Incorporated, Boeing Co, Saab AB, L3Harris Technologies, and others, represent the leading forces shaping market dynamics. The market is characterized by both organic growth through product innovation and inorganic expansion through mergers and acquisitions (M&A).

Innovation Drivers: Technological advancements in areas such as sensor technology, AI-powered navigation, and improved battery life are primary innovation drivers. Regulatory frameworks governing AUV operations, particularly concerning data security and environmental impact, influence market growth. The availability of substitute technologies, such as remotely operated vehicles (ROVs), also impacts market competition. End-user demographics, primarily encompassing the oil and gas, defense, and commercial exploration sectors, shape market demand.

M&A Activity: The past five years have seen several significant M&A deals in the AUV sector, though precise deal values remain confidential in many cases. These transactions have led to increased market consolidation and the integration of complementary technologies. The average deal value is estimated at xx Million.

North America AUV Market Market Dynamics & Trends

The North America AUV market is experiencing robust growth fueled by several key factors. The increasing demand for subsea infrastructure inspection and maintenance, driven by aging offshore assets and stricter regulatory compliance standards in the oil and gas sector, is a significant growth catalyst. Furthermore, the growing adoption of AUVs in defense applications for mine countermeasures (MCM), surveillance, and reconnaissance, is pushing market expansion. The expanding commercial exploration market, particularly for underwater resource mapping and surveying, represents another significant driver. Technological disruptions, such as the integration of advanced sensors and artificial intelligence (AI), are enhancing the capabilities of AUVs and expanding their applications, thereby accelerating market growth. Consumer preferences are shifting towards AUVs that offer improved autonomy, reliability, and cost-effectiveness. Competitive dynamics are characterized by intense innovation and strategic partnerships, leading to continuous improvements in AUV technology and functionality. The market is expected to witness continued growth, driven by these factors, resulting in significant market penetration across diverse sectors.

Dominant Regions & Segments in North America AUV Market

The North America AUV market displays significant regional variations. While data on precise regional breakdowns is limited publicly, the Gulf of Mexico and the US East Coast are expected to be leading regions. This is primarily driven by the high concentration of oil and gas activities in these areas, coupled with increasing investments in subsea infrastructure development. The strong defense spending in North America also significantly contributes to regional market dominance.

- Key Drivers for Dominant Regions:

- Robust oil and gas exploration and production activities

- Significant defense budgets and maritime security requirements

- Investments in offshore renewable energy infrastructure

- Favorable government policies and regulations

Dominant Application Segment: The Oil and Gas sector currently holds the largest share of the North America AUV market, primarily due to the extensive use of AUVs for pipeline inspection, subsea surveys, and seabed mapping. This dominance is projected to continue during the forecast period due to the increasing demand for efficient and cost-effective subsea operations. However, the defense sector demonstrates robust growth potential given the increasing focus on autonomous underwater capabilities.

North America AUV Market Product Innovations

Recent years have witnessed significant advancements in AUV technology, including the development of more powerful and energy-efficient propulsion systems, enhanced sensor integration (e.g., multibeam sonar, side-scan sonar, and magnetometers), and improved navigation systems. These innovations have led to AUVs with greater operational range, higher data acquisition rates, and enhanced operational reliability. The integration of AI and machine learning capabilities is enabling AUVs to perform more complex tasks autonomously, significantly reducing operational costs and enhancing overall efficiency.

Report Scope & Segmentation Analysis

This report segments the North America AUV market based on application:

Oil and Gas: This segment is characterized by high growth, driven by the demand for subsea infrastructure inspection and maintenance. The market size is xx Million in 2025, projected to reach xx Million by 2033. Competitive dynamics are shaped by technological advancements and cost-effectiveness.

Defense: This segment displays strong growth potential fueled by increasing defense budgets and the requirement for advanced autonomous underwater capabilities. The market size is estimated at xx Million in 2025, forecasted to reach xx Million by 2033. Competition is driven by technological superiority and government contracts.

Commercial Exploration: This segment experiences steady growth driven by the exploration of underwater resources and marine scientific research. The market size in 2025 is xx Million and is expected to reach xx Million by 2033. Competition focuses on technology advancements and the ability to meet diverse research needs.

Other Applications: This segment includes various niche applications, such as environmental monitoring and scientific research, exhibiting moderate growth. The market size is estimated to be xx Million in 2025 and is expected to reach xx Million by 2033.

Key Drivers of North America AUV Market Growth

Several key factors drive the growth of the North America AUV market:

- Technological advancements: Improvements in battery technology, sensor integration, and AI-powered navigation are increasing AUV capabilities and expanding their applications.

- Increased demand for subsea infrastructure inspection: The aging infrastructure and stricter regulatory compliance standards are pushing the demand for AUV services in the oil and gas sector.

- Growing defense budgets: Increased investment in autonomous underwater capabilities for defense applications is fueling market growth.

- Expanding commercial exploration activities: The demand for underwater resource mapping and scientific research is driving market expansion.

Challenges in the North America AUV Market Sector

Despite its growth potential, the North America AUV market faces several challenges:

- High initial investment costs: The purchase and operation of AUVs require significant capital investment, limiting market entry for smaller players.

- Limited skilled workforce: The shortage of experienced AUV operators and technicians can hamper market growth.

- Regulatory hurdles: Navigating complex regulations surrounding AUV operation and data management can pose challenges for market participants.

- Supply chain disruptions: Potential disruptions to the supply of critical components can impact AUV production and deployment.

Emerging Opportunities in North America AUV Market

Several emerging opportunities are shaping the North America AUV market:

- Integration of advanced sensors: The integration of improved sensors enables AUVs to perform more complex tasks, increasing their capabilities.

- Expansion into new applications: AUVs are finding applications beyond traditional sectors, such as environmental monitoring and aquaculture.

- Development of more autonomous systems: The move towards fully autonomous AUVs is reducing operational costs and improving efficiency.

- Increased adoption of cloud-based data management: Cloud-based data management solutions simplify data analysis and sharing.

Leading Players in the North America AUV Market Market

- Boston Engineering Corporation

- General Dynamics Corporation

- Fugro NV

- International Submarine Engineering Ltd

- Lockheed Martin Corporation

- Oceaneering International Inc

- Teledyne Technologies Incorporated

- Boeing Co

- Saab AB

- L3Harris Technologies

Key Developments in North America AUV Market Industry

August 2022: Oceaneering announced its Freedom AUV achieved Technology Readiness Level 6 for pipeline inspection, validated by industry experts from TotalEnergies, Chevron, and Equinor. This signifies a significant advancement in AUV technology for pipeline inspection, enhancing market competitiveness and driving adoption.

July 2022: Innovative Solutions Canada awarded Cellula Robotics Ltd a contract to develop the Imotus-S AUV for measuring a ship's acoustic and magnetic signature. This underscores the growing interest in AUV applications for defense and maritime security, pushing innovation and market expansion.

Future Outlook for North America AUV Market Market

The North America AUV market is poised for substantial growth, driven by continued technological advancements, expanding applications across various sectors, and increasing investments in subsea infrastructure. Strategic partnerships, focused innovation, and the development of more cost-effective and autonomous systems will further accelerate market expansion. The market's future is bright, presenting significant opportunities for industry players to capitalize on emerging trends and technological breakthroughs.

North America AUV Market Segmentation

-

1. Application

- 1.1. Oil and Gas

- 1.2. Defense

- 1.3. Commercial Exploration

- 1.4. Other Applications

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Rest of North America

North America AUV Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America AUV Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Power

- 3.3. Market Restrains

- 3.3.1. Increasing Demand for Battery Storage Systems and other Cleaner Sources of Standby Power

- 3.4. Market Trends

- 3.4.1. Oil and Gas Application to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America AUV Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Oil and Gas

- 5.1.2. Defense

- 5.1.3. Commercial Exploration

- 5.1.4. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Rest of North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. United States North America AUV Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Oil and Gas

- 6.1.2. Defense

- 6.1.3. Commercial Exploration

- 6.1.4. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Canada North America AUV Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Oil and Gas

- 7.1.2. Defense

- 7.1.3. Commercial Exploration

- 7.1.4. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Rest of North America North America AUV Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Oil and Gas

- 8.1.2. Defense

- 8.1.3. Commercial Exploration

- 8.1.4. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. United States North America AUV Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America AUV Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America AUV Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America AUV Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Boston Engineering Corporation

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 General Dynamics Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Fugro NV

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 International Submarine Engineering Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Lockheed Martin Corporation

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Oceaneering International Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Teledyne Technologies Incorporated

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Boeing Co

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Saab AB*List Not Exhaustive

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 L3Harris Technologies

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Boston Engineering Corporation

List of Figures

- Figure 1: North America AUV Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America AUV Market Share (%) by Company 2024

List of Tables

- Table 1: North America AUV Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America AUV Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: North America AUV Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: North America AUV Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 5: North America AUV Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: North America AUV Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 7: North America AUV Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: North America AUV Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: North America AUV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: North America AUV Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: United States North America AUV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States North America AUV Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Canada North America AUV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America AUV Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America AUV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico North America AUV Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Rest of North America North America AUV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of North America North America AUV Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: North America AUV Market Revenue Million Forecast, by Application 2019 & 2032

- Table 20: North America AUV Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 21: North America AUV Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North America AUV Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 23: North America AUV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: North America AUV Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 25: North America AUV Market Revenue Million Forecast, by Application 2019 & 2032

- Table 26: North America AUV Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 27: North America AUV Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: North America AUV Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 29: North America AUV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: North America AUV Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 31: North America AUV Market Revenue Million Forecast, by Application 2019 & 2032

- Table 32: North America AUV Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 33: North America AUV Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: North America AUV Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 35: North America AUV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: North America AUV Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America AUV Market?

The projected CAGR is approximately > 7.00%.

2. Which companies are prominent players in the North America AUV Market?

Key companies in the market include Boston Engineering Corporation, General Dynamics Corporation, Fugro NV, International Submarine Engineering Ltd, Lockheed Martin Corporation, Oceaneering International Inc, Teledyne Technologies Incorporated, Boeing Co, Saab AB*List Not Exhaustive, L3Harris Technologies.

3. What are the main segments of the North America AUV Market?

The market segments include Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Power.

6. What are the notable trends driving market growth?

Oil and Gas Application to Dominate the Market.

7. Are there any restraints impacting market growth?

Increasing Demand for Battery Storage Systems and other Cleaner Sources of Standby Power.

8. Can you provide examples of recent developments in the market?

August 2022: Oceaneering announced that its Freedom AUV, following a substantial testing and qualification program, has achieved Technology Readiness Level 6 on a 1-9 scale for pipeline inspection, as assessed by an expert industry group with representation from TotalEnergies, Chevron, and Equinor.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America AUV Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America AUV Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America AUV Market?

To stay informed about further developments, trends, and reports in the North America AUV Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence