Key Insights

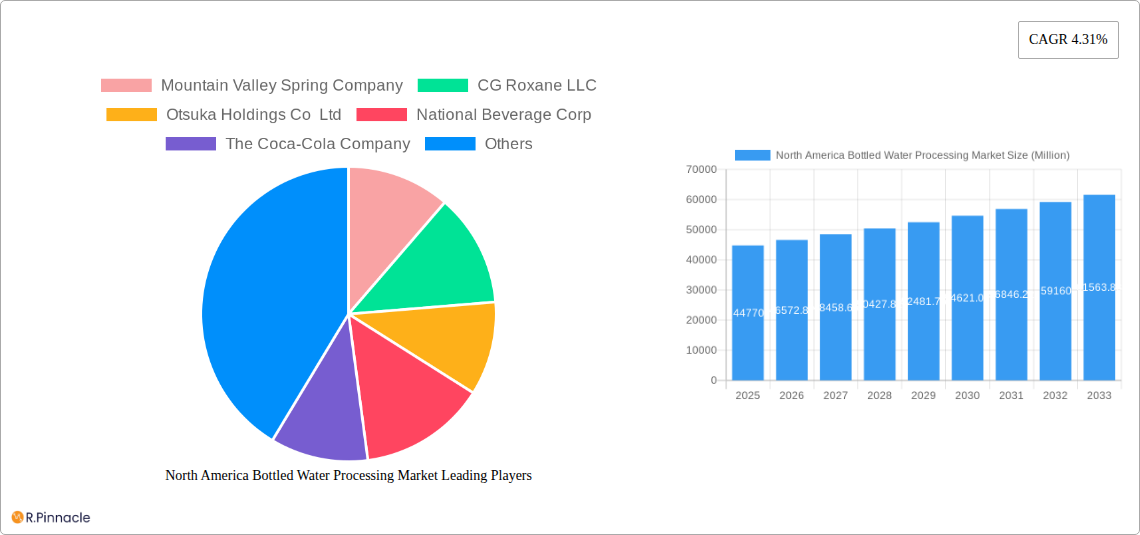

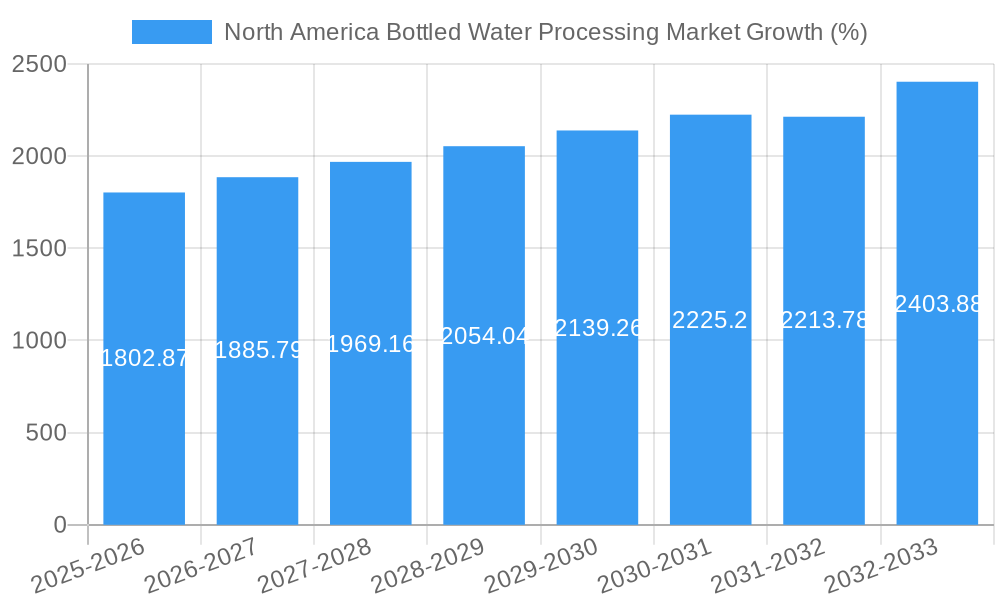

The North America bottled water processing market, valued at $44.77 billion in 2025, is projected to experience robust growth, driven by several key factors. Increasing health consciousness among consumers, coupled with a growing preference for convenient hydration solutions, fuels significant demand for bottled water. This trend is amplified by rising disposable incomes and shifting lifestyles, particularly in urban areas. Furthermore, the market benefits from continuous technological advancements in water purification and processing, leading to higher efficiency and improved product quality. The prevalence of Reverse Osmosis (RO) and Microfiltration (MF) technologies, offering superior purity and safety, contributes significantly to market expansion. Segmentation by application reveals strong demand across still, sparkling, and flavored water categories, with flavored water experiencing particularly rapid growth due to its appealing taste profiles and diverse product offerings. The market's growth is also geographically dispersed, with the United States dominating, followed by Canada and Mexico. However, regional variations in consumer preferences and regulatory landscapes influence market dynamics within each country. The presence of established players like Coca-Cola, PepsiCo, and Nestle Waters, alongside regional and smaller brands, underscores a competitive market landscape characterized by both established brands and emerging players vying for market share. Growth will likely be sustained through innovative product offerings, strategic acquisitions, and expansion into emerging segments. Although potential restraints like environmental concerns related to plastic waste and fluctuating raw material costs exist, the overall market outlook remains positive, indicating a promising growth trajectory.

The bottled water processing equipment market within North America is also experiencing a parallel growth trajectory, driven by the need for efficient and scalable production to meet burgeoning demand. Key equipment segments, including filters, bottle washers, fillers and cappers, and blow molders, are expected to witness significant expansion as companies invest in modernizing their infrastructure and increasing their production capacity. This equipment market is intertwined with the overall bottled water market, demonstrating a strong correlation between production capacity and overall demand. The robust growth predicted for the bottled water market naturally leads to increased investment in equipment, boosting this segment as well. Major equipment manufacturers are likely to benefit from the expansion, while smaller firms will focus on niche segments or specialized equipment, adding diversity to the sector. Competition is keen in the equipment market, focusing on efficiency, innovation, and cost-effectiveness, impacting pricing and technological advancements.

North America Bottled Water Processing Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America bottled water processing market, offering valuable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's structure, dynamics, dominant segments, and future outlook. The report leverages rigorous research methodologies and incorporates data from key players like Mountain Valley Spring Company, CG Roxane LLC, Otsuka Holdings Co Ltd, National Beverage Corp, The Coca-Cola Company, Blue Triton Brands Inc, Groupe Danone, Suntory Beverage & Food Ltd, PepsiCo Inc, and Highland Spring Limited, amongst others.

North America Bottled Water Processing Market Structure & Innovation Trends

This section analyzes the market's competitive landscape, highlighting key players' market share and recent mergers and acquisitions (M&A) activities. We examine the influence of regulatory frameworks, technological innovations (like advancements in filtration technologies), the presence of substitute products, and evolving end-user demographics on market structure. The analysis includes a detailed examination of innovation drivers and their impact on market growth. For example, the increasing demand for sustainable packaging is driving innovation in material science and manufacturing processes within the industry. The report estimates that the total M&A deal value in the period 2019-2024 exceeded $xx Million, with a notable increase in activity during the past three years. Key metrics include:

- Market Concentration: The market exhibits a moderately concentrated structure with the top 10 players controlling approximately xx% of the market share in 2024.

- Innovation Drivers: Sustainability concerns, consumer demand for premium water, and technological advancements in processing and packaging are driving innovation.

- Regulatory Landscape: Government regulations regarding water safety and labeling significantly influence market dynamics.

- M&A Activity: The past five years have witnessed a significant surge in M&A activity, driven by strategic expansion and consolidation. Average deal value is estimated at $xx Million.

North America Bottled Water Processing Market Dynamics & Trends

This section delves into the market's growth trajectory, analyzing key drivers, disruptive technologies, and shifting consumer preferences. We examine the competitive landscape, focusing on strategic positioning, pricing strategies, and brand building activities. The bottled water market in North America is experiencing robust growth, primarily fueled by increasing health consciousness, convenience, and preference for healthier alternatives to sugary drinks. Specific metrics explored include:

- Market Growth: The market is expected to exhibit a CAGR of xx% during the forecast period (2025-2033), driven by rising disposable incomes and changing lifestyles.

- Technological Disruptions: The adoption of advanced filtration and packaging technologies are impacting market dynamics.

- Consumer Preferences: Growing demand for functional water and premium brands is shaping product development.

- Competitive Dynamics: Intense competition amongst major players is shaping pricing strategies and product differentiation.

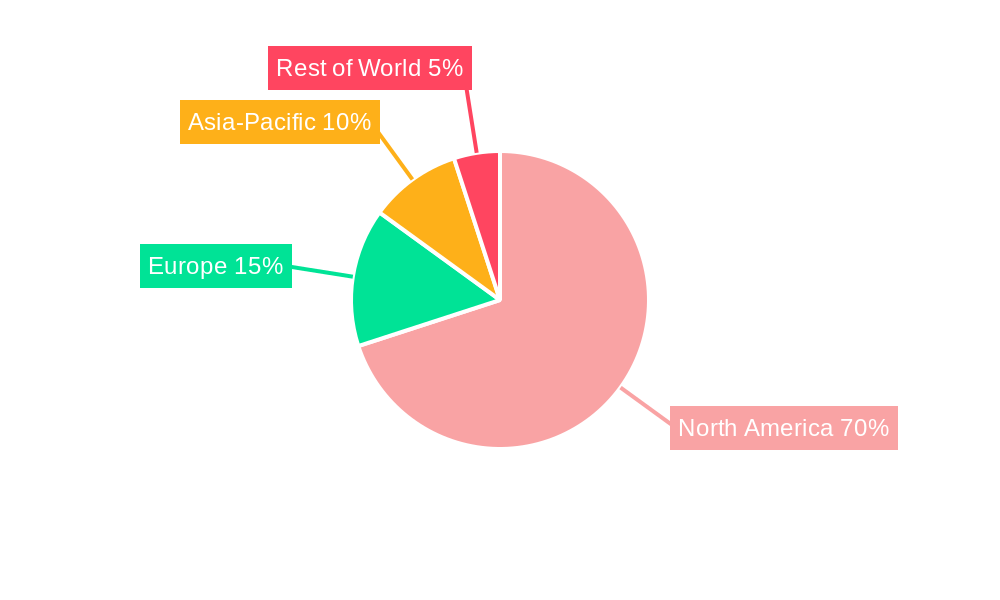

Dominant Regions & Segments in North America Bottled Water Processing Market

This section identifies the leading regions, countries, and market segments by technology, application, and equipment type. We analyze the key factors contributing to their dominance, including economic policies, infrastructure development, and consumer behavior.

- By Region: The United States dominates the market, followed by Canada and Mexico.

- United States: Large population, high disposable income, and established distribution networks contribute to its market leadership.

- Canada: Growing health consciousness and increasing demand for premium bottled water fuel market growth.

- Mexico: Rising urbanization and increasing affordability of bottled water are driving market expansion.

- By Technology: Reverse Osmosis (RO) is the leading technology due to its efficiency and ability to produce high-quality water.

- By Application: Still water constitutes the largest segment due to its wide acceptance and affordability.

- By Equipment Type: The demand for fillers and cappers dominates, followed by blow molders and filters.

North America Bottled Water Processing Market Product Innovations

Recent advancements in filtration technologies, such as advanced membrane filtration and UV sterilization, enhance water quality and safety. New packaging solutions focus on sustainability, employing recycled materials and reducing plastic waste. Innovation in flavors and functional waters caters to diverse consumer preferences, creating new market segments. These advancements contribute to improved product quality, increased efficiency, and sustainable practices within the industry.

Report Scope & Segmentation Analysis

This report comprehensively covers the North America bottled water processing market, segmented by:

- Technology: Reverse Osmosis (RO), Microfiltration (MF), Chlorination, Other Technologies. RO holds the largest market share, projected to grow at xx% CAGR.

- Application: Still Water, Sparkling Water, Flavored Water. Still water dominates, showing a projected xx% CAGR.

- Region: United States, Canada, Mexico. The US maintains a leading position, followed by Canada and Mexico.

- Equipment Type: Filter, Bottle Washer, Filler and Capper, Blow Molder, Other Equipment Types. Fillers and cappers hold the largest market share.

Key Drivers of North America Bottled Water Processing Market Growth

The market's growth is propelled by factors such as increasing health and wellness consciousness among consumers, growing demand for convenience, rising disposable incomes, and supportive government regulations that promote water safety. Additionally, the expanding food service industry and increasing tourism contribute to demand for bottled water.

Challenges in the North America Bottled Water Processing Market Sector

Key challenges include fluctuating raw material costs, intense competition, stringent regulatory requirements regarding water quality and labeling, and concerns related to plastic waste and environmental sustainability. These factors can impact profitability and market expansion.

Emerging Opportunities in North America Bottled Water Processing Market

Emerging opportunities lie in the growing demand for functional waters enriched with vitamins, minerals, or electrolytes; the increasing popularity of sustainable and eco-friendly packaging options; and the expanding e-commerce channels for direct-to-consumer sales. Innovation in water purification technologies and personalized water solutions also present significant opportunities.

Leading Players in the North America Bottled Water Processing Market Market

- Mountain Valley Spring Company

- CG Roxane LLC

- Otsuka Holdings Co Ltd

- National Beverage Corp

- The Coca-Cola Company

- Blue Triton Brands Inc

- Groupe Danone

- Suntory Beverage & Food Ltd

- PepsiCo Inc

- Highland Spring Limited

- 6 Other Companies

Key Developments in North America Bottled Water Processing Market Industry

- Q2 2024: PepsiCo launched a new line of sustainable bottled water.

- Q3 2023: The Coca-Cola Company acquired a regional bottled water producer.

- Q4 2022: New regulations regarding plastic bottle recycling were implemented in California.

- (Further developments to be added based on available data)

Future Outlook for North America Bottled Water Processing Market Market

The North America bottled water processing market is poised for continued growth, driven by evolving consumer preferences, technological advancements, and sustainable packaging solutions. Strategic investments in innovation, efficient distribution networks, and brand building will be key to success in this competitive market. The focus on sustainability and health-conscious choices will further drive market expansion in the coming years.

North America Bottled Water Processing Market Segmentation

-

1. Equipment Type

- 1.1. Filter

- 1.2. Bottle Washer

- 1.3. Filler and Capper

- 1.4. Blow Molder

- 1.5. Other Equipment Types

-

2. Technology

- 2.1. Reverse Osmosis (RO)

- 2.2. Microfiltration (MF)

- 2.3. Chlorination

- 2.4. Other Technologies

-

3. Application

- 3.1. Still Water

- 3.2. Sparkling Water

- 3.3. Flavored Water

North America Bottled Water Processing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Bottled Water Processing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.31% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing awareness among consumers4.; Environment concerns and sustainability

- 3.3. Market Restrains

- 3.3.1. 4.; The cost of production and transportation4.; Regulations and quality standards

- 3.4. Market Trends

- 3.4.1. Booming flavoured water segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Bottled Water Processing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 5.1.1. Filter

- 5.1.2. Bottle Washer

- 5.1.3. Filler and Capper

- 5.1.4. Blow Molder

- 5.1.5. Other Equipment Types

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Reverse Osmosis (RO)

- 5.2.2. Microfiltration (MF)

- 5.2.3. Chlorination

- 5.2.4. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Still Water

- 5.3.2. Sparkling Water

- 5.3.3. Flavored Water

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 6. United States North America Bottled Water Processing Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Bottled Water Processing Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Bottled Water Processing Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Bottled Water Processing Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Mountain Valley Spring Company

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 CG Roxane LLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Otsuka Holdings Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 National Beverage Corp

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 The Coca-Cola Company

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Blue Triton Brands Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Groupe Danone

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Suntory Beverage & Food Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 PepsiCo Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Highland Spring Limited**List Not Exhaustive 6 3 Other Companies (Key Information/Overview

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Mountain Valley Spring Company

List of Figures

- Figure 1: North America Bottled Water Processing Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Bottled Water Processing Market Share (%) by Company 2024

List of Tables

- Table 1: North America Bottled Water Processing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Bottled Water Processing Market Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 3: North America Bottled Water Processing Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: North America Bottled Water Processing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: North America Bottled Water Processing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Bottled Water Processing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Bottled Water Processing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Bottled Water Processing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Bottled Water Processing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Bottled Water Processing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Bottled Water Processing Market Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 12: North America Bottled Water Processing Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 13: North America Bottled Water Processing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 14: North America Bottled Water Processing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States North America Bottled Water Processing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Bottled Water Processing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Bottled Water Processing Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Bottled Water Processing Market?

The projected CAGR is approximately 4.31%.

2. Which companies are prominent players in the North America Bottled Water Processing Market?

Key companies in the market include Mountain Valley Spring Company, CG Roxane LLC, Otsuka Holdings Co Ltd, National Beverage Corp, The Coca-Cola Company, Blue Triton Brands Inc, Groupe Danone, Suntory Beverage & Food Ltd, PepsiCo Inc, Highland Spring Limited**List Not Exhaustive 6 3 Other Companies (Key Information/Overview.

3. What are the main segments of the North America Bottled Water Processing Market?

The market segments include Equipment Type, Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 44.77 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing awareness among consumers4.; Environment concerns and sustainability.

6. What are the notable trends driving market growth?

Booming flavoured water segment.

7. Are there any restraints impacting market growth?

4.; The cost of production and transportation4.; Regulations and quality standards.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Bottled Water Processing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Bottled Water Processing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Bottled Water Processing Market?

To stay informed about further developments, trends, and reports in the North America Bottled Water Processing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence