Key Insights

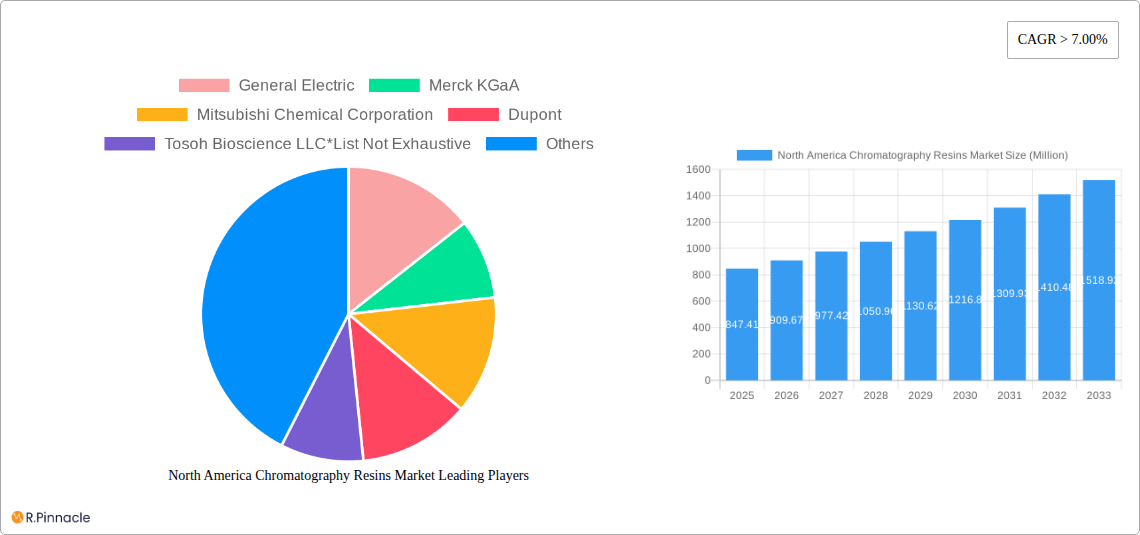

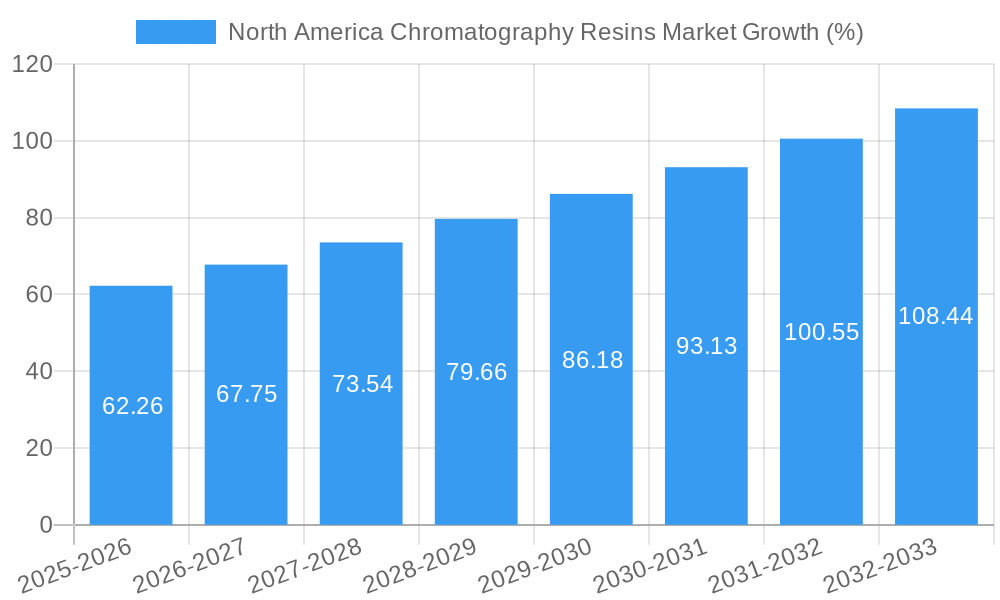

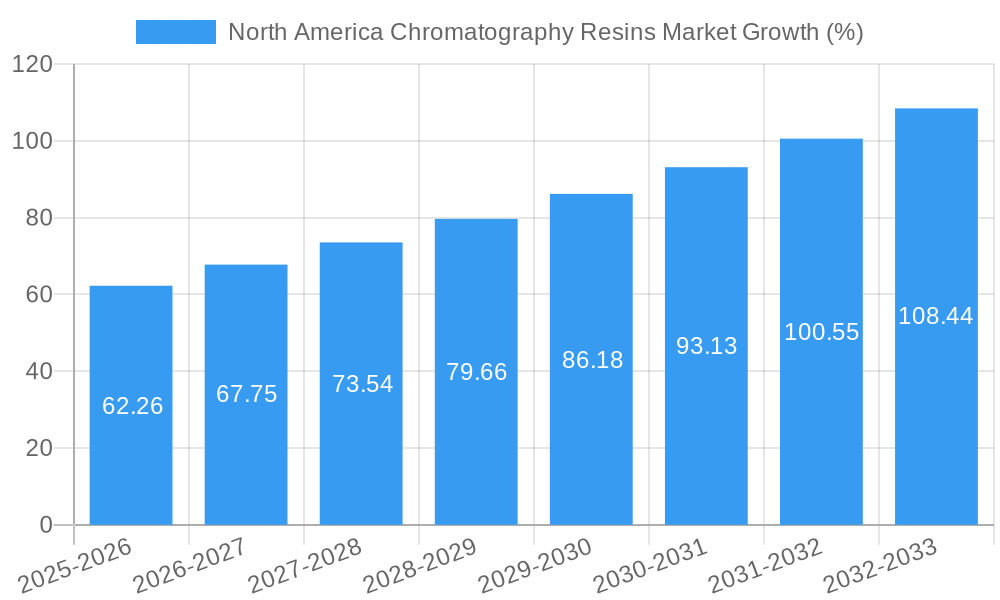

The North America chromatography resins market, valued at $847.41 million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) exceeding 7.00% from 2025 to 2033. This expansion is fueled by several key factors. The pharmaceutical and biopharmaceutical industries are major consumers, leveraging chromatography resins for purification and separation processes in drug development and manufacturing. Stringent regulatory requirements for drug purity are further stimulating demand. Growing adoption of advanced chromatography techniques, such as affinity and ion exchange chromatography, across various end-user industries like food and beverages, and water and environmental agencies (for water purification and analysis), contributes significantly to market growth. Furthermore, the increasing prevalence of chronic diseases globally is indirectly boosting demand, as these often necessitate sophisticated diagnostic and therapeutic approaches reliant on chromatography resin technologies. The market is segmented by origin (natural-based and synthetic-based, with dextran being a prominent synthetic type), technology (ion exchange, affinity, size exclusion, hydrophobic interaction, and others), and end-user industry. The dominance of specific technologies or end-user industries may vary geographically within North America, with the United States likely holding the largest market share due to its advanced healthcare infrastructure and robust pharmaceutical sector. Competition among established players like General Electric, Merck KGaA, and Thermo Fisher Scientific is intense, with ongoing innovation in resin technology and new product launches shaping the market landscape.

While the market enjoys significant growth potential, certain challenges persist. The high cost of advanced chromatography resins, particularly specialized types, can hinder adoption in certain applications, especially in smaller companies. Fluctuations in raw material prices also affect the overall cost structure. However, these restraints are expected to be partially offset by ongoing technological advancements, leading to improved resin efficiency and potentially lower long-term costs. Continuous innovation in chromatography resin technology, focused on increased selectivity, higher capacity, and improved durability, will be crucial for sustained market growth throughout the forecast period. Specific market shares for individual segments within North America are not readily available from the provided data, but considering the region’s advanced healthcare infrastructure and strong pharmaceutical industry, it's highly likely that the US holds a dominant market share.

North America Chromatography Resins Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America Chromatography Resins market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Leveraging rigorous research and data analysis, the report covers market structure, dynamics, dominant segments, innovation trends, and future outlook, covering the period from 2019 to 2033. The base year is 2025, with estimations for 2025 and forecasts extending to 2033.

North America Chromatography Resins Market Structure & Innovation Trends

The North America chromatography resins market exhibits a moderately consolidated structure, with key players holding significant market share. Market concentration is influenced by factors such as technological advancements, regulatory landscapes, and mergers & acquisitions (M&A) activities. The report analyzes the market share of leading companies like General Electric, Merck KGaA, Mitsubishi Chemical Corporation, DuPont, Tosoh Bioscience LLC, Purolite, Agilent Technologies, Avantor Inc, Thermo Fisher Scientific, and GE Healthcare Life Sciences (list not exhaustive). The estimated combined market share of the top five players in 2025 is xx%. Innovation is driven by the rising demand for high-performance resins across various applications, including pharmaceutical drug discovery and production. Regulatory frameworks, particularly those related to drug safety and environmental protection, significantly influence market growth. The substitution of traditional methods with advanced chromatography techniques is also a major market driver. Recent M&A activities, such as the merger of Purolite and Dow's ion exchange resins business, have reshaped the competitive landscape. The total value of M&A deals in the sector between 2019 and 2024 is estimated at $xx Million.

- High Market Concentration: Top five players account for xx% of market share (2025 estimate).

- Innovation Drivers: Demand for high-performance resins, technological advancements.

- Regulatory Frameworks: Stringent regulations impacting drug safety and environmental compliance.

- Product Substitutes: Emergence of alternative separation techniques.

- M&A Activity: Significant consolidation through mergers and acquisitions, notably the Purolite-Dow merger.

North America Chromatography Resins Market Dynamics & Trends

The North America chromatography resins market is experiencing robust growth, driven by a confluence of factors. The pharmaceutical and biotechnology industries are key drivers, fueled by the rising demand for biologics and advanced drug therapies. Water and environmental agencies are also significant consumers, utilizing chromatography resins for water purification and pollution control. The increasing adoption of chromatography techniques in food and beverage testing contributes to market expansion. Technological advancements, particularly in the development of novel resin materials and improved separation techniques, are accelerating market growth. The market is witnessing a shift towards higher-performance resins with improved selectivity, efficiency, and scalability. The estimated Compound Annual Growth Rate (CAGR) from 2025 to 2033 is xx%, with a projected market size of $xx Million in 2033. Competitive dynamics are marked by ongoing innovation, strategic partnerships, and acquisitions. Market penetration of advanced chromatography technologies, like affinity chromatography, is steadily increasing, further boosting market growth.

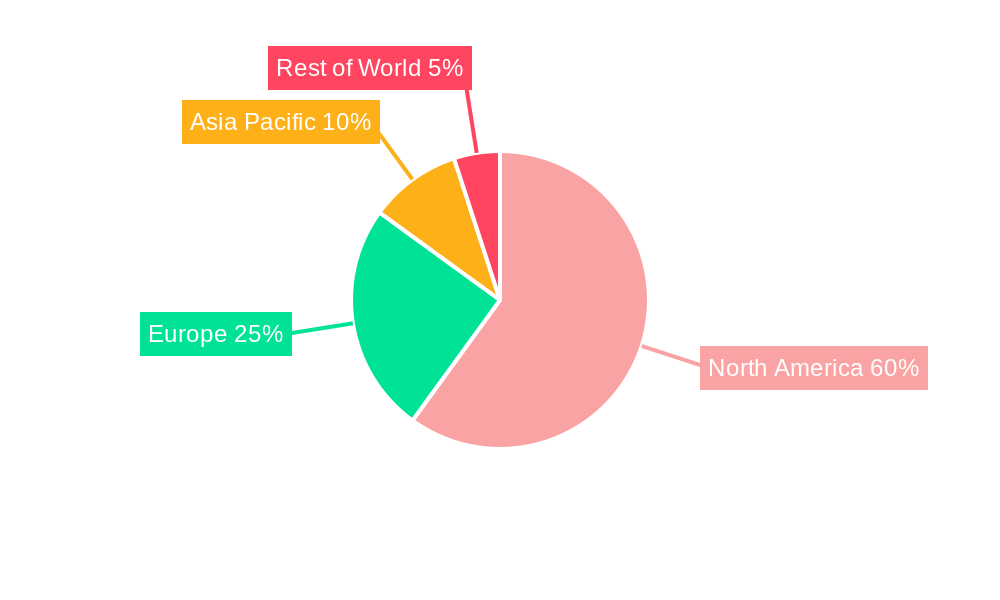

Dominant Regions & Segments in North America Chromatography Resins Market

The pharmaceutical sector represents the largest end-user industry segment, dominating the North America chromatography resins market due to the significant usage of these resins in drug development and production. The US is the leading region, driven by strong pharmaceutical R&D activities and robust regulatory frameworks. Synthetic-based resins (Dextran) hold a significant market share due to their superior performance and adaptability. Ion exchange chromatography resins remain the dominant technology segment owing to its widespread applications and established market presence.

- Key Drivers in the US: Strong pharmaceutical industry, substantial R&D investments, advanced infrastructure.

- Pharmaceutical Dominance: High demand for purification and separation in drug development.

- Synthetic-based Resin Preference: Superior performance characteristics compared to natural-based options.

- Ion Exchange Technology Leadership: Established market presence and versatile applications.

North America Chromatography Resins Market Product Innovations

Recent innovations focus on enhancing resin selectivity, efficiency, and scalability. This includes the development of novel resin materials with improved binding properties and extended lifespans. The launch of next-generation affinity resins by Merck KGaA exemplifies this trend. These innovations are improving the purity and yield of target molecules, particularly biologics and peptides. The market is also seeing the development of resins tailored to specific applications, leading to increased efficiency and reduced processing costs.

Report Scope & Segmentation Analysis

This report segments the North America Chromatography Resins market based on End-user Industry (Pharmaceuticals, Drug Production, Water & Environmental Agencies, Food & Beverages, Other End-user Industries), Origin (Natural-based, Synthetic-based), and Technology (Ion Exchange, Affinity, Size Exclusion, Hydrophobic Interaction, Other Technologies). Each segment's growth projection, market size, and competitive dynamics are analyzed in detail, providing granular insights into the market's structure and future trajectory. Specific growth projections for each segment will be included in the full report. The competitive landscape within each segment varies according to technological innovation and application-specific needs.

Key Drivers of North America Chromatography Resins Market Growth

Several key factors propel the growth of the North America chromatography resins market. These include the increasing demand for biopharmaceuticals, rising environmental concerns driving water purification needs, and continuous advancements in resin technology. Stringent regulatory requirements for drug purity also fuel market expansion, driving the adoption of advanced chromatography techniques. Furthermore, the increasing adoption of process analytical technology (PAT) enhances the efficiency and optimization of chromatographic separations.

Challenges in the North America Chromatography Resins Market Sector

Despite significant growth, the market faces challenges. These include fluctuating raw material prices, intense competition from established and emerging players, and concerns regarding the environmental impact of resin production and disposal. Regulatory changes and compliance costs present additional hurdles. Furthermore, the complexity of large-scale chromatographic processes can limit widespread adoption in some applications.

Emerging Opportunities in North America Chromatography Resins Market

Emerging opportunities lie in the development of novel resin materials with enhanced selectivity and performance characteristics. The growing focus on personalized medicine offers potential for specialized resins tailored to specific therapeutic applications. Expansion into niche markets, such as diagnostics and environmental monitoring, presents further growth prospects.

Leading Players in the North America Chromatography Resins Market Market

- General Electric

- Merck KGaA

- Mitsubishi Chemical Corporation

- Dupont

- Tosoh Bioscience LLC

- Purolite

- Agilent Technologies

- Avantor Inc

- Thermo Fisher Scientific

- GE Healthcare Life Sciences

Key Developments in North America Chromatography Resins Market Industry

- 2022: Merger of Purolite and Dow's Ion Exchange Resins Business.

- 2023: Launch of next-generation affinity resins by Merck KGaA.

- 2024: Expansion of production facilities by Tosoh Bioscience.

Future Outlook for North America Chromatography Resins Market Market

The North America chromatography resins market is poised for sustained growth, driven by continuous technological advancements, increasing demand from key end-user industries, and the ongoing development of novel applications. Strategic partnerships and acquisitions will further shape the competitive landscape, creating opportunities for market expansion and consolidation. The focus on sustainable and environmentally friendly resin materials will also play a crucial role in future market development.

North America Chromatography Resins Market Segmentation

-

1. Origin

-

1.1. Natural-based

- 1.1.1. Agarose

- 1.1.2. Dextran

-

1.2. Synthetic-based

- 1.2.1. Silica Gel

- 1.2.2. Aluminum Oxide

- 1.2.3. Polystyrene

- 1.2.4. Other Synthetic-based Resins

-

1.1. Natural-based

-

2. Technology

- 2.1. Ion Exchange Chromatography Resins

- 2.2. Affinity Chromatography Resins

- 2.3. Size Exclusion Chromatography Resins

- 2.4. Hydrophobic Interaction Chromatography Resins

- 2.5. Other Technologies

-

3. End-user Industry

-

3.1. Pharmaceuticals

- 3.1.1. Biotechnology

- 3.1.2. Drug Discovery

- 3.1.3. Drug Production

- 3.2. Water and Environmental Agencies

- 3.3. Food and Beverages

- 3.4. Other End-user Industries

-

3.1. Pharmaceuticals

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Mexico

North America Chromatography Resins Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Chromatography Resins Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Technological Advancements in Chromatography Resins; Increasing Importance of Chromatography Tests in Drug Approvals

- 3.3. Market Restrains

- 3.3.1. ; High Costs vs. Productivity of Chromatography Systems

- 3.4. Market Trends

- 3.4.1. Increasing Demand from Pharmaceutical Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Chromatography Resins Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Origin

- 5.1.1. Natural-based

- 5.1.1.1. Agarose

- 5.1.1.2. Dextran

- 5.1.2. Synthetic-based

- 5.1.2.1. Silica Gel

- 5.1.2.2. Aluminum Oxide

- 5.1.2.3. Polystyrene

- 5.1.2.4. Other Synthetic-based Resins

- 5.1.1. Natural-based

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Ion Exchange Chromatography Resins

- 5.2.2. Affinity Chromatography Resins

- 5.2.3. Size Exclusion Chromatography Resins

- 5.2.4. Hydrophobic Interaction Chromatography Resins

- 5.2.5. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Pharmaceuticals

- 5.3.1.1. Biotechnology

- 5.3.1.2. Drug Discovery

- 5.3.1.3. Drug Production

- 5.3.2. Water and Environmental Agencies

- 5.3.3. Food and Beverages

- 5.3.4. Other End-user Industries

- 5.3.1. Pharmaceuticals

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Origin

- 6. United States North America Chromatography Resins Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Origin

- 6.1.1. Natural-based

- 6.1.1.1. Agarose

- 6.1.1.2. Dextran

- 6.1.2. Synthetic-based

- 6.1.2.1. Silica Gel

- 6.1.2.2. Aluminum Oxide

- 6.1.2.3. Polystyrene

- 6.1.2.4. Other Synthetic-based Resins

- 6.1.1. Natural-based

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Ion Exchange Chromatography Resins

- 6.2.2. Affinity Chromatography Resins

- 6.2.3. Size Exclusion Chromatography Resins

- 6.2.4. Hydrophobic Interaction Chromatography Resins

- 6.2.5. Other Technologies

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Pharmaceuticals

- 6.3.1.1. Biotechnology

- 6.3.1.2. Drug Discovery

- 6.3.1.3. Drug Production

- 6.3.2. Water and Environmental Agencies

- 6.3.3. Food and Beverages

- 6.3.4. Other End-user Industries

- 6.3.1. Pharmaceuticals

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Origin

- 7. Canada North America Chromatography Resins Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Origin

- 7.1.1. Natural-based

- 7.1.1.1. Agarose

- 7.1.1.2. Dextran

- 7.1.2. Synthetic-based

- 7.1.2.1. Silica Gel

- 7.1.2.2. Aluminum Oxide

- 7.1.2.3. Polystyrene

- 7.1.2.4. Other Synthetic-based Resins

- 7.1.1. Natural-based

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Ion Exchange Chromatography Resins

- 7.2.2. Affinity Chromatography Resins

- 7.2.3. Size Exclusion Chromatography Resins

- 7.2.4. Hydrophobic Interaction Chromatography Resins

- 7.2.5. Other Technologies

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Pharmaceuticals

- 7.3.1.1. Biotechnology

- 7.3.1.2. Drug Discovery

- 7.3.1.3. Drug Production

- 7.3.2. Water and Environmental Agencies

- 7.3.3. Food and Beverages

- 7.3.4. Other End-user Industries

- 7.3.1. Pharmaceuticals

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Origin

- 8. Mexico North America Chromatography Resins Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Origin

- 8.1.1. Natural-based

- 8.1.1.1. Agarose

- 8.1.1.2. Dextran

- 8.1.2. Synthetic-based

- 8.1.2.1. Silica Gel

- 8.1.2.2. Aluminum Oxide

- 8.1.2.3. Polystyrene

- 8.1.2.4. Other Synthetic-based Resins

- 8.1.1. Natural-based

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Ion Exchange Chromatography Resins

- 8.2.2. Affinity Chromatography Resins

- 8.2.3. Size Exclusion Chromatography Resins

- 8.2.4. Hydrophobic Interaction Chromatography Resins

- 8.2.5. Other Technologies

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Pharmaceuticals

- 8.3.1.1. Biotechnology

- 8.3.1.2. Drug Discovery

- 8.3.1.3. Drug Production

- 8.3.2. Water and Environmental Agencies

- 8.3.3. Food and Beverages

- 8.3.4. Other End-user Industries

- 8.3.1. Pharmaceuticals

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Origin

- 9. United States North America Chromatography Resins Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Chromatography Resins Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Chromatography Resins Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Chromatography Resins Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 General Electric

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Merck KGaA

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Mitsubishi Chemical Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Dupont

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Tosoh Bioscience LLC*List Not Exhaustive

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Purolite

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Agilient Technologies

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Avantor Inc

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Thermo Fisher Scientific

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 GE Healthcare Life Sciences

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 General Electric

List of Figures

- Figure 1: North America Chromatography Resins Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Chromatography Resins Market Share (%) by Company 2024

List of Tables

- Table 1: North America Chromatography Resins Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Chromatography Resins Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: North America Chromatography Resins Market Revenue Million Forecast, by Origin 2019 & 2032

- Table 4: North America Chromatography Resins Market Volume K Tons Forecast, by Origin 2019 & 2032

- Table 5: North America Chromatography Resins Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 6: North America Chromatography Resins Market Volume K Tons Forecast, by Technology 2019 & 2032

- Table 7: North America Chromatography Resins Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 8: North America Chromatography Resins Market Volume K Tons Forecast, by End-user Industry 2019 & 2032

- Table 9: North America Chromatography Resins Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 10: North America Chromatography Resins Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 11: North America Chromatography Resins Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: North America Chromatography Resins Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 13: North America Chromatography Resins Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: North America Chromatography Resins Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 15: United States North America Chromatography Resins Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United States North America Chromatography Resins Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: Canada North America Chromatography Resins Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Canada North America Chromatography Resins Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Mexico North America Chromatography Resins Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Mexico North America Chromatography Resins Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: Rest of North America North America Chromatography Resins Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of North America North America Chromatography Resins Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 23: North America Chromatography Resins Market Revenue Million Forecast, by Origin 2019 & 2032

- Table 24: North America Chromatography Resins Market Volume K Tons Forecast, by Origin 2019 & 2032

- Table 25: North America Chromatography Resins Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 26: North America Chromatography Resins Market Volume K Tons Forecast, by Technology 2019 & 2032

- Table 27: North America Chromatography Resins Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 28: North America Chromatography Resins Market Volume K Tons Forecast, by End-user Industry 2019 & 2032

- Table 29: North America Chromatography Resins Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 30: North America Chromatography Resins Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 31: North America Chromatography Resins Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: North America Chromatography Resins Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 33: North America Chromatography Resins Market Revenue Million Forecast, by Origin 2019 & 2032

- Table 34: North America Chromatography Resins Market Volume K Tons Forecast, by Origin 2019 & 2032

- Table 35: North America Chromatography Resins Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 36: North America Chromatography Resins Market Volume K Tons Forecast, by Technology 2019 & 2032

- Table 37: North America Chromatography Resins Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 38: North America Chromatography Resins Market Volume K Tons Forecast, by End-user Industry 2019 & 2032

- Table 39: North America Chromatography Resins Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 40: North America Chromatography Resins Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 41: North America Chromatography Resins Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: North America Chromatography Resins Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 43: North America Chromatography Resins Market Revenue Million Forecast, by Origin 2019 & 2032

- Table 44: North America Chromatography Resins Market Volume K Tons Forecast, by Origin 2019 & 2032

- Table 45: North America Chromatography Resins Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 46: North America Chromatography Resins Market Volume K Tons Forecast, by Technology 2019 & 2032

- Table 47: North America Chromatography Resins Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 48: North America Chromatography Resins Market Volume K Tons Forecast, by End-user Industry 2019 & 2032

- Table 49: North America Chromatography Resins Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 50: North America Chromatography Resins Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 51: North America Chromatography Resins Market Revenue Million Forecast, by Country 2019 & 2032

- Table 52: North America Chromatography Resins Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Chromatography Resins Market?

The projected CAGR is approximately > 7.00%.

2. Which companies are prominent players in the North America Chromatography Resins Market?

Key companies in the market include General Electric, Merck KGaA, Mitsubishi Chemical Corporation, Dupont, Tosoh Bioscience LLC*List Not Exhaustive, Purolite, Agilient Technologies, Avantor Inc, Thermo Fisher Scientific, GE Healthcare Life Sciences.

3. What are the main segments of the North America Chromatography Resins Market?

The market segments include Origin, Technology, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 847.41 Million as of 2022.

5. What are some drivers contributing to market growth?

; Technological Advancements in Chromatography Resins; Increasing Importance of Chromatography Tests in Drug Approvals.

6. What are the notable trends driving market growth?

Increasing Demand from Pharmaceutical Sector.

7. Are there any restraints impacting market growth?

; High Costs vs. Productivity of Chromatography Systems.

8. Can you provide examples of recent developments in the market?

Merger of Purolite and Dow's Ion Exchange Resins Business

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Chromatography Resins Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Chromatography Resins Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Chromatography Resins Market?

To stay informed about further developments, trends, and reports in the North America Chromatography Resins Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence