Key Insights

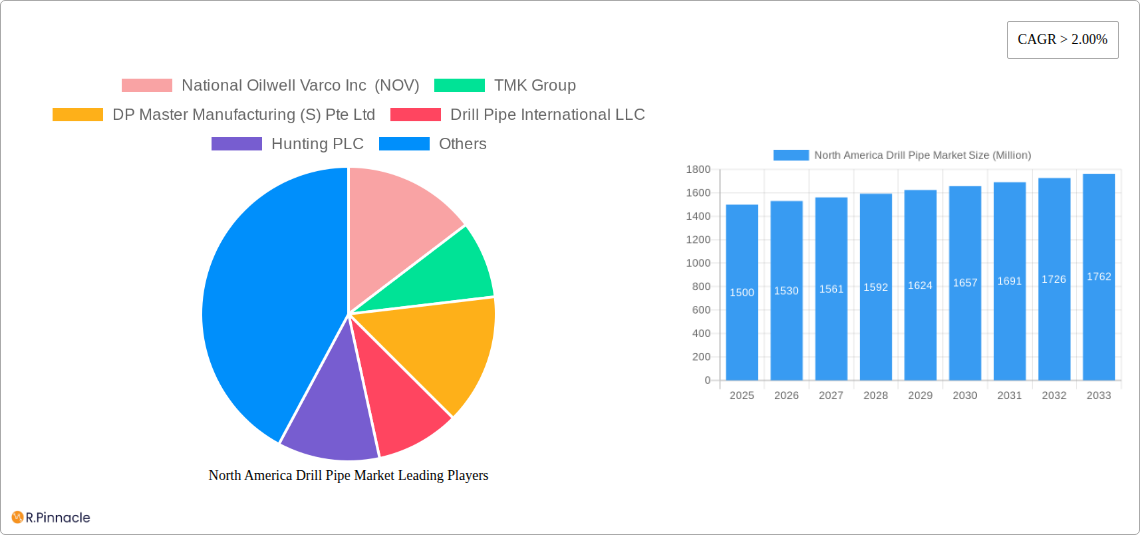

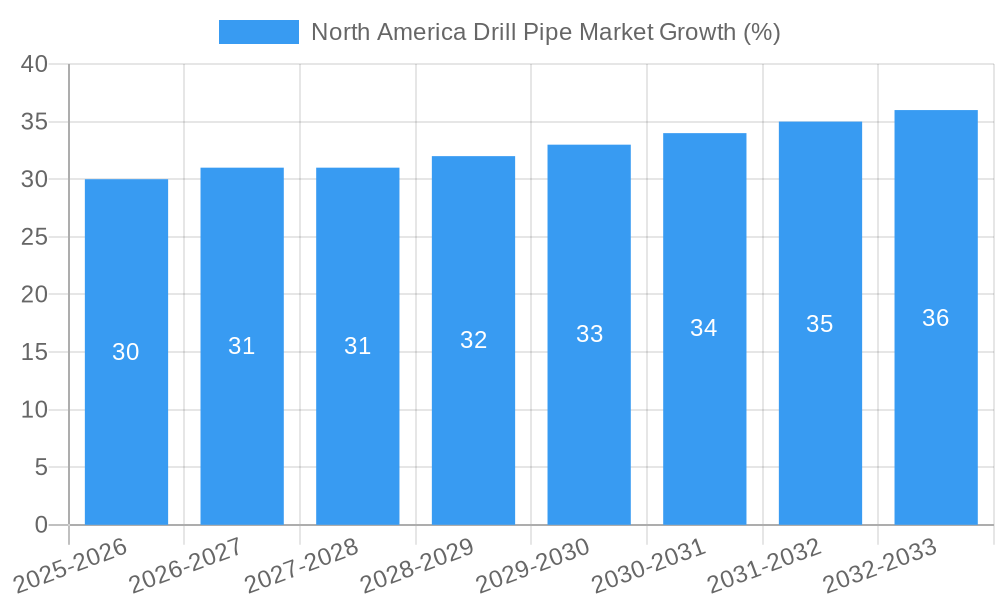

The North American drill pipe market, encompassing standard and heavy-weight drill pipes, drill collars, and various grades (premium and API), is experiencing steady growth, driven primarily by increasing oil and gas exploration and production activities across onshore and offshore regions of the United States, Canada, and Mexico. The market's Compound Annual Growth Rate (CAGR) exceeding 2.00% indicates a consistent expansion, projected to continue through 2033. This growth is fueled by investments in new drilling projects, particularly in unconventional shale gas formations, and the ongoing need for equipment upgrades and replacements within existing operations. The premium grade drill pipe segment is anticipated to command a significant market share due to its superior durability and efficiency, leading to reduced operational costs and downtime. While the market faces restraints such as fluctuating oil prices and environmental regulations impacting drilling activities, the overall outlook remains positive, supported by consistent demand and technological advancements in drill pipe manufacturing and materials. Major players like National Oilwell Varco, TMK Group, and Tenaris are actively involved in supplying these critical components, contributing to the market's competitiveness and fostering innovation.

The onshore segment currently dominates the North American drill pipe market due to the prevalence of onshore drilling operations, particularly in shale gas plays. However, the offshore segment is expected to witness significant growth over the forecast period, driven by increasing investments in deepwater exploration and production projects. The demand for heavy-weight drill pipes is likely to increase due to the need for more robust equipment in challenging geological formations. Furthermore, the ongoing focus on improving drilling efficiency and safety is driving the demand for premium grade drill pipes. The competitive landscape is characterized by a mix of established international players and regional manufacturers, leading to a dynamic market with a constant push for innovation in materials science and manufacturing processes. Successful companies will need to adapt to fluctuating market conditions, invest in research and development, and maintain a strong focus on quality and customer service to thrive in this demanding environment.

This in-depth report provides a comprehensive analysis of the North America drill pipe market, offering actionable insights for industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report is essential for understanding current market dynamics and forecasting future trends. The study period is 2019-2033, the base year is 2025, the estimated year is 2025, and the forecast period is 2025-2033. The historical period covered is 2019-2024.

North America Drill Pipe Market Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory influences shaping the North American drill pipe market. The market exhibits moderate concentration, with key players holding significant but not dominant shares. Market share data for 2024 reveals that the top five players (NOV, TMK Group, Tenaris S.A., Hunting PLC, and Hilong Group) collectively accounted for approximately xx% of the market. Innovation is driven by the demand for enhanced durability, efficiency, and safety in drilling operations, leading to continuous advancements in materials science and manufacturing processes. Regulatory frameworks, particularly concerning environmental compliance and safety standards, significantly impact market operations. Product substitutes, such as advanced drilling technologies, present competitive pressures. The market has witnessed several M&A activities in recent years, with deal values ranging from xx Million to xx Million. These activities reflect the strategic efforts of companies to expand their market presence and product portfolios. End-user demographics include major oil and gas exploration and production companies across onshore and offshore operations.

- Market Concentration: Moderate, with top 5 players holding xx% market share (2024).

- Innovation Drivers: Enhanced durability, efficiency, and safety.

- Regulatory Framework: Environmental compliance and safety standards.

- M&A Activity: Deals valued between xx Million and xx Million.

North America Drill Pipe Market Market Dynamics & Trends

The North America drill pipe market is projected to experience a CAGR of xx% during the forecast period (2025-2033), driven by increasing oil and gas exploration and production activities. Technological advancements, such as the development of high-strength steel alloys and improved thread connection designs, are enhancing drill pipe performance and extending operational lifecycles. Consumer preferences are shifting towards premium-grade drill pipes with enhanced durability and resistance to corrosion, which command higher prices. Competitive dynamics are characterized by intense rivalry among established players and the emergence of new entrants, leading to pricing pressures and continuous innovation. Market penetration of premium grade drill pipes is estimated to be around xx% in 2025 and is expected to increase to xx% by 2033. The ongoing shift toward extended reach drilling and horizontal drilling further fuels demand for specialized drill pipes.

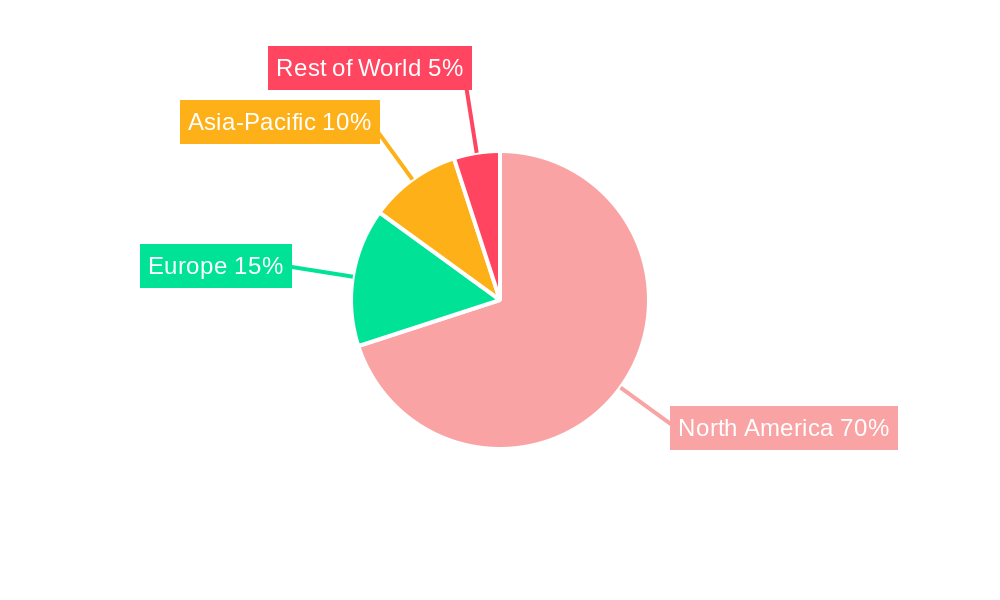

Dominant Regions & Segments in North America Drill Pipe Market

The US dominates the North America drill pipe market, driven by extensive oil and gas reserves and a robust exploration and production sector. Texas and other key energy-producing states within the US contribute significantly to overall market demand.

Key Drivers:

- US: Extensive oil and gas reserves, robust exploration and production sector.

- Canada: Oil sands development and offshore exploration activities.

- Mexico: Growing energy sector investments.

Segment Dominance:

- Type: Standard drill pipes hold the largest market share due to their wide applicability. However, Heavy Weight Drill Pipes and Drill Collars are gaining traction due to demands of complex drilling projects.

- Grade: Premium grade drill pipes are experiencing increased demand driven by the requirements for enhanced performance and longevity in challenging drilling conditions.

- Deployment: Onshore deployment currently holds a larger market share than offshore, owing to higher exploration and production activities in onshore regions. However, offshore drilling is also increasing, creating demand for corrosion-resistant and specialized drill pipes.

North America Drill Pipe Market Product Innovations

Recent product innovations focus on enhancing drill pipe strength, fatigue resistance, and corrosion resistance. The introduction of advanced thread connection technologies, such as the PTECH+ connection (introduced by TSC in March 2022), offers improved torsional properties and fatigue resistance, crucial for extended reach drilling. These innovations translate to improved drilling efficiency, reduced downtime, and extended drill pipe lifespan, directly impacting operational costs and overall productivity. The market is witnessing a growing adoption of lightweight yet high-strength materials to improve drilling efficiency and reduce transportation costs.

Report Scope & Segmentation Analysis

This report segments the North America drill pipe market by:

- Type: Standard Drill Pipe, Heavy Weight Drill Pipe, Drill Collar. Each segment exhibits varying growth trajectories depending on application needs and technological advancements. Growth projections for each type will be detailed in the full report.

- Grade: Premium Grade, API Grade. Premium grade pipes command a higher price point and witness stronger growth due to their improved performance characteristics. Market size and share data will be presented for each grade in the complete report.

- Deployment: Onshore, Offshore. Each segment has unique needs and challenges related to operational conditions, which impact material selection and pricing. The competitive dynamics also vary between onshore and offshore deployment.

Key Drivers of North America Drill Pipe Market Growth

The North America drill pipe market is primarily driven by the increasing demand for oil and gas, supported by economic growth and rising energy consumption. Technological advancements, such as the development of higher-strength steel alloys and improved manufacturing techniques, are leading to more efficient and durable drill pipes. Government initiatives promoting domestic energy production and favorable regulatory environments further contribute to the market growth.

Challenges in the North America Drill Pipe Market Sector

The market faces challenges including fluctuating oil and gas prices, impacting investment decisions in exploration and production. Supply chain disruptions and material cost volatility pose significant risks to manufacturing costs and market stability. Intense competition from both established and new market entrants exerts pressure on pricing and profit margins. These challenges often lead to delays in project timelines and affect the overall profitability of the sector.

Emerging Opportunities in North America Drill Pipe Market

Emerging opportunities lie in the growing adoption of advanced drilling techniques, such as extended reach drilling and horizontal drilling, increasing demand for specialized drill pipes. The development of lightweight, high-strength materials and improved thread connection designs presents significant opportunities for innovation and market differentiation. Moreover, a growing focus on sustainability and environmental compliance presents opportunities for manufacturers to offer eco-friendly drill pipe solutions.

Leading Players in the North America Drill Pipe Market Market

- National Oilwell Varco Inc (NOV)

- TMK Group

- DP Master Manufacturing (S) Pte Ltd

- Drill Pipe International LLC

- Hunting PLC

- Challenger International Inc

- Tejas Tubular Products Inc

- Hilong Group

- Tenaris S A

- Workstrings International

- Texas Steel Conversion Inc (TSC)

Key Developments in North America Drill Pipe Market Industry

- March 2022: Texas Steel Conversion (TSC) acquired the PTECH+ thread connection technology, enhancing drill pipe performance in extended lateral drilling. This development is expected to significantly impact the market share of TSC and increase demand for drill pipes with this technology.

- February 2022: The CBSA received a complaint alleging dumping and subsidization of Chinese-origin drill pipes, potentially leading to trade disputes and impacting market dynamics. This development may lead to increased prices and reduced availability of drill pipes from China.

Future Outlook for North America Drill Pipe Market Market

The North America drill pipe market is poised for continued growth, driven by increasing oil and gas exploration and production activities, technological advancements, and supportive government policies. Strategic opportunities exist for companies focusing on innovation, cost optimization, and the development of sustainable drilling solutions. The continued adoption of extended reach drilling techniques and the increasing demand for high-performance drill pipes will further propel market expansion in the coming years.

North America Drill Pipe Market Segmentation

-

1. Type

- 1.1. Standard Drill Pipe

- 1.2. Heavy Weight Drill Pipe

- 1.3. Drill Collar

-

2. Grade

- 2.1. Premium Grade

- 2.2. API Grade

-

3. Deployment

- 3.1. Onshore

- 3.2. Offshore

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Mexico

North America Drill Pipe Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Drill Pipe Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Uninterrupted and Reliable Power Supply and Heavy Deployment of DG (diesel generator) Set4.; Improvement in Technology of Diesel Generator

- 3.3. Market Restrains

- 3.3.1. 4.; The Growing Trend of Renewable Power Generation

- 3.4. Market Trends

- 3.4.1. Onshore to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Drill Pipe Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Standard Drill Pipe

- 5.1.2. Heavy Weight Drill Pipe

- 5.1.3. Drill Collar

- 5.2. Market Analysis, Insights and Forecast - by Grade

- 5.2.1. Premium Grade

- 5.2.2. API Grade

- 5.3. Market Analysis, Insights and Forecast - by Deployment

- 5.3.1. Onshore

- 5.3.2. Offshore

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Drill Pipe Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Standard Drill Pipe

- 6.1.2. Heavy Weight Drill Pipe

- 6.1.3. Drill Collar

- 6.2. Market Analysis, Insights and Forecast - by Grade

- 6.2.1. Premium Grade

- 6.2.2. API Grade

- 6.3. Market Analysis, Insights and Forecast - by Deployment

- 6.3.1. Onshore

- 6.3.2. Offshore

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Drill Pipe Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Standard Drill Pipe

- 7.1.2. Heavy Weight Drill Pipe

- 7.1.3. Drill Collar

- 7.2. Market Analysis, Insights and Forecast - by Grade

- 7.2.1. Premium Grade

- 7.2.2. API Grade

- 7.3. Market Analysis, Insights and Forecast - by Deployment

- 7.3.1. Onshore

- 7.3.2. Offshore

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Drill Pipe Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Standard Drill Pipe

- 8.1.2. Heavy Weight Drill Pipe

- 8.1.3. Drill Collar

- 8.2. Market Analysis, Insights and Forecast - by Grade

- 8.2.1. Premium Grade

- 8.2.2. API Grade

- 8.3. Market Analysis, Insights and Forecast - by Deployment

- 8.3.1. Onshore

- 8.3.2. Offshore

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. United States North America Drill Pipe Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Drill Pipe Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Drill Pipe Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Drill Pipe Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 National Oilwell Varco Inc (NOV)

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 TMK Group

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 DP Master Manufacturing (S) Pte Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Drill Pipe International LLC

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Hunting PLC

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Challenger International Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Tejas Tubular Products Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Hilong Group

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Tenaris S A

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Workstrings International

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Texas Steel Conversion Inc (TSC)

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 National Oilwell Varco Inc (NOV)

List of Figures

- Figure 1: North America Drill Pipe Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Drill Pipe Market Share (%) by Company 2024

List of Tables

- Table 1: North America Drill Pipe Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Drill Pipe Market Volume Tonnes Forecast, by Region 2019 & 2032

- Table 3: North America Drill Pipe Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: North America Drill Pipe Market Volume Tonnes Forecast, by Type 2019 & 2032

- Table 5: North America Drill Pipe Market Revenue Million Forecast, by Grade 2019 & 2032

- Table 6: North America Drill Pipe Market Volume Tonnes Forecast, by Grade 2019 & 2032

- Table 7: North America Drill Pipe Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 8: North America Drill Pipe Market Volume Tonnes Forecast, by Deployment 2019 & 2032

- Table 9: North America Drill Pipe Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 10: North America Drill Pipe Market Volume Tonnes Forecast, by Geography 2019 & 2032

- Table 11: North America Drill Pipe Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: North America Drill Pipe Market Volume Tonnes Forecast, by Region 2019 & 2032

- Table 13: North America Drill Pipe Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: North America Drill Pipe Market Volume Tonnes Forecast, by Country 2019 & 2032

- Table 15: United States North America Drill Pipe Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United States North America Drill Pipe Market Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 17: Canada North America Drill Pipe Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Canada North America Drill Pipe Market Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 19: Mexico North America Drill Pipe Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Mexico North America Drill Pipe Market Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 21: Rest of North America North America Drill Pipe Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of North America North America Drill Pipe Market Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 23: North America Drill Pipe Market Revenue Million Forecast, by Type 2019 & 2032

- Table 24: North America Drill Pipe Market Volume Tonnes Forecast, by Type 2019 & 2032

- Table 25: North America Drill Pipe Market Revenue Million Forecast, by Grade 2019 & 2032

- Table 26: North America Drill Pipe Market Volume Tonnes Forecast, by Grade 2019 & 2032

- Table 27: North America Drill Pipe Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 28: North America Drill Pipe Market Volume Tonnes Forecast, by Deployment 2019 & 2032

- Table 29: North America Drill Pipe Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 30: North America Drill Pipe Market Volume Tonnes Forecast, by Geography 2019 & 2032

- Table 31: North America Drill Pipe Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: North America Drill Pipe Market Volume Tonnes Forecast, by Country 2019 & 2032

- Table 33: North America Drill Pipe Market Revenue Million Forecast, by Type 2019 & 2032

- Table 34: North America Drill Pipe Market Volume Tonnes Forecast, by Type 2019 & 2032

- Table 35: North America Drill Pipe Market Revenue Million Forecast, by Grade 2019 & 2032

- Table 36: North America Drill Pipe Market Volume Tonnes Forecast, by Grade 2019 & 2032

- Table 37: North America Drill Pipe Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 38: North America Drill Pipe Market Volume Tonnes Forecast, by Deployment 2019 & 2032

- Table 39: North America Drill Pipe Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 40: North America Drill Pipe Market Volume Tonnes Forecast, by Geography 2019 & 2032

- Table 41: North America Drill Pipe Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: North America Drill Pipe Market Volume Tonnes Forecast, by Country 2019 & 2032

- Table 43: North America Drill Pipe Market Revenue Million Forecast, by Type 2019 & 2032

- Table 44: North America Drill Pipe Market Volume Tonnes Forecast, by Type 2019 & 2032

- Table 45: North America Drill Pipe Market Revenue Million Forecast, by Grade 2019 & 2032

- Table 46: North America Drill Pipe Market Volume Tonnes Forecast, by Grade 2019 & 2032

- Table 47: North America Drill Pipe Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 48: North America Drill Pipe Market Volume Tonnes Forecast, by Deployment 2019 & 2032

- Table 49: North America Drill Pipe Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 50: North America Drill Pipe Market Volume Tonnes Forecast, by Geography 2019 & 2032

- Table 51: North America Drill Pipe Market Revenue Million Forecast, by Country 2019 & 2032

- Table 52: North America Drill Pipe Market Volume Tonnes Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Drill Pipe Market?

The projected CAGR is approximately > 2.00%.

2. Which companies are prominent players in the North America Drill Pipe Market?

Key companies in the market include National Oilwell Varco Inc (NOV), TMK Group, DP Master Manufacturing (S) Pte Ltd, Drill Pipe International LLC, Hunting PLC, Challenger International Inc, Tejas Tubular Products Inc, Hilong Group, Tenaris S A, Workstrings International, Texas Steel Conversion Inc (TSC).

3. What are the main segments of the North America Drill Pipe Market?

The market segments include Type, Grade, Deployment, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Uninterrupted and Reliable Power Supply and Heavy Deployment of DG (diesel generator) Set4.; Improvement in Technology of Diesel Generator.

6. What are the notable trends driving market growth?

Onshore to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Growing Trend of Renewable Power Generation.

8. Can you provide examples of recent developments in the market?

March 2022: Texas Steel Conversion (TSC) announced that it has purchased the patents, associated trademarks, licenses, and other thread connection technology known as the PTECH+ thread connection. The PTECH+ family of drill pipe thread connections combines exceptional torsional properties and fatigue resistance that are essential in extended lateral oil and gas drilling.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Drill Pipe Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Drill Pipe Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Drill Pipe Market?

To stay informed about further developments, trends, and reports in the North America Drill Pipe Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence