Key Insights

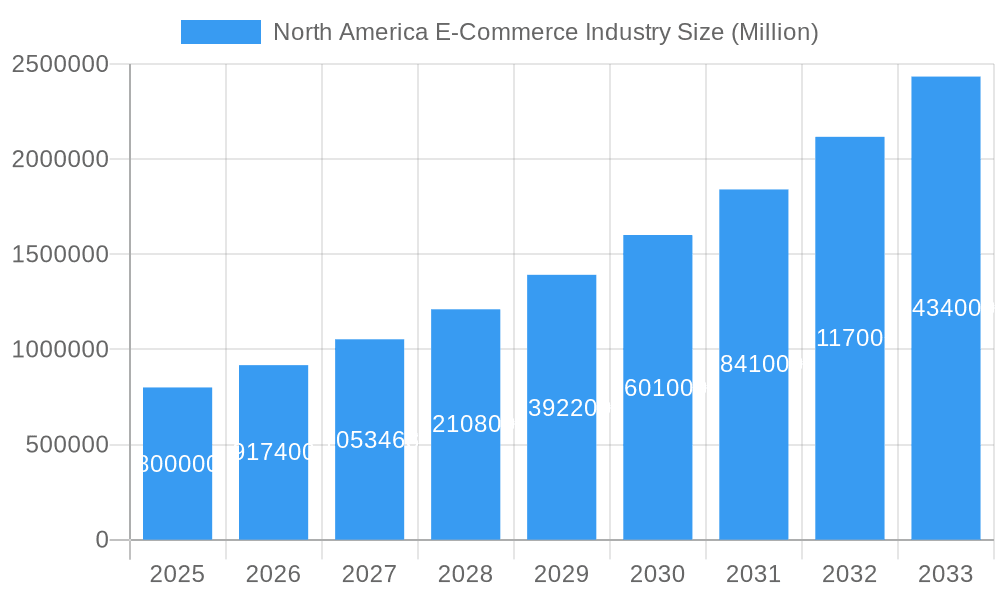

The North American e-commerce market is poised for substantial expansion, projecting a significant growth trajectory from 2025 to 2033. Key growth drivers include rising internet and smartphone penetration, the inherent convenience of online shopping, and the increasing adoption of digital payment solutions. This dynamic market is expected to reach a size of 3333.8 million by 2025, exhibiting a compound annual growth rate (CAGR) of 18.1%. Established e-commerce giants and emerging specialized businesses across various sectors are fueling this robust growth. Investments in logistics, enhanced customer experiences, and data-driven marketing strategies will further propel market expansion. However, factors such as intense competition, data security concerns, and economic volatility may present challenges.

North America E-Commerce Industry Market Size (In Billion)

The North American e-commerce market exhibits strong segmentation, with the Business-to-Consumer (B2C) sector encompassing beauty & personal care, consumer electronics, fashion & apparel, food & beverage, and furniture & home. Geographically, the United States commands the largest market share, followed by Canada and Mexico. The competitive landscape features a blend of large corporations and specialized niche players, underscoring the market's maturity and dynamism. Continued technological advancements, including AI and AR, are expected to shape future e-commerce strategies, creating new opportunities for innovation and growth.

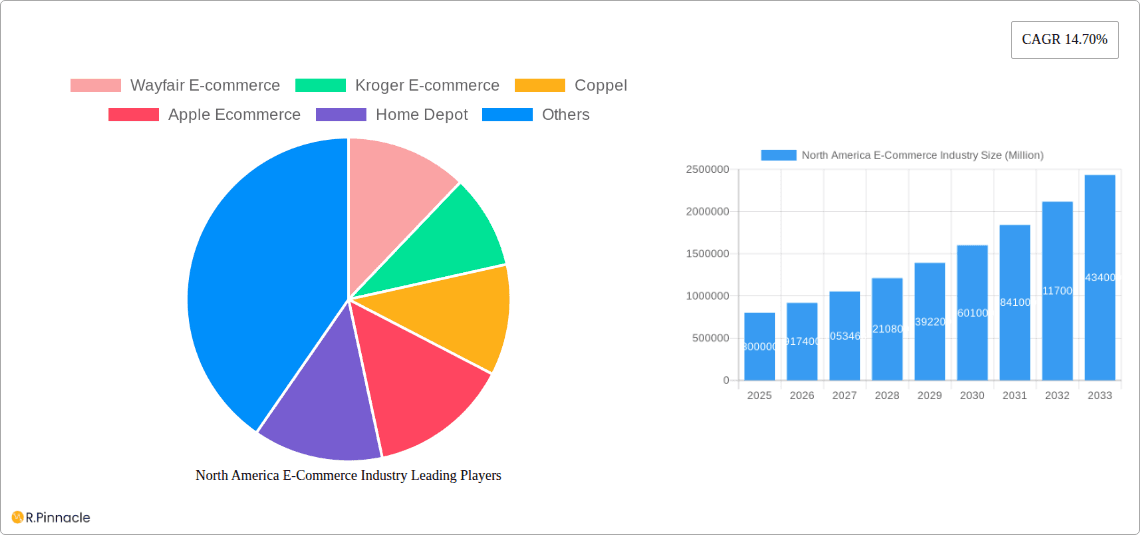

North America E-Commerce Industry Company Market Share

This report offers a comprehensive analysis of the North American e-commerce industry, detailing market structure, dynamics, key players, and future projections. The study covers the period from 2019 to 2033, with 2025 as the base year and 2025-2033 as the forecast period. This research is vital for stakeholders aiming to understand and capitalize on this evolving market.

North America E-Commerce Industry Market Structure & Innovation Trends

This section analyzes the North American e-commerce landscape, examining market concentration, innovation drivers, regulatory frameworks, and competitive activity. The market is highly concentrated, with a few dominant players like Amazon and Walmart commanding significant market share. However, smaller niche players and innovative startups are also emerging, driving competition and innovation.

- Market Concentration: Amazon and Walmart collectively hold an estimated xx% market share in 2025. Other key players include Target, Best Buy, and Wayfair, each contributing significantly to the overall market size.

- Innovation Drivers: Technological advancements in areas such as artificial intelligence (AI), machine learning (ML), and big data analytics are driving personalization, improved customer experience, and optimized logistics. Furthermore, the rise of mobile commerce and social commerce continues to reshape the industry.

- Regulatory Frameworks: Evolving data privacy regulations (e.g., CCPA, GDPR) and antitrust concerns are shaping the competitive landscape and influencing business strategies.

- Product Substitutes: The rise of omnichannel retail, where online and offline channels seamlessly integrate, presents a significant shift, blurring the lines between traditional and e-commerce models.

- End-User Demographics: The e-commerce market caters to a diverse demographic, with significant growth driven by millennials and Gen Z.

- M&A Activities: The past five years have witnessed numerous mergers and acquisitions, with deal values exceeding $xx Million in 2024 alone. These activities reflect the consolidation trend within the industry and the pursuit of strategic expansion.

North America E-Commerce Industry Market Dynamics & Trends

This section delves into the market dynamics shaping the North American e-commerce industry. The market exhibits strong growth, fueled by several key factors. Technological advancements in areas such as AI, ML, and blockchain are transforming the customer experience and operational efficiency. Changing consumer preferences, with a growing preference for convenience and online shopping, also contribute to this growth. The competitive landscape is characterized by intense competition among established players and emerging disruptors.

The market is expected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration continues to rise, with an estimated xx% of total retail sales being conducted online in 2025. This reflects the ongoing shift in consumer behavior towards digital channels.

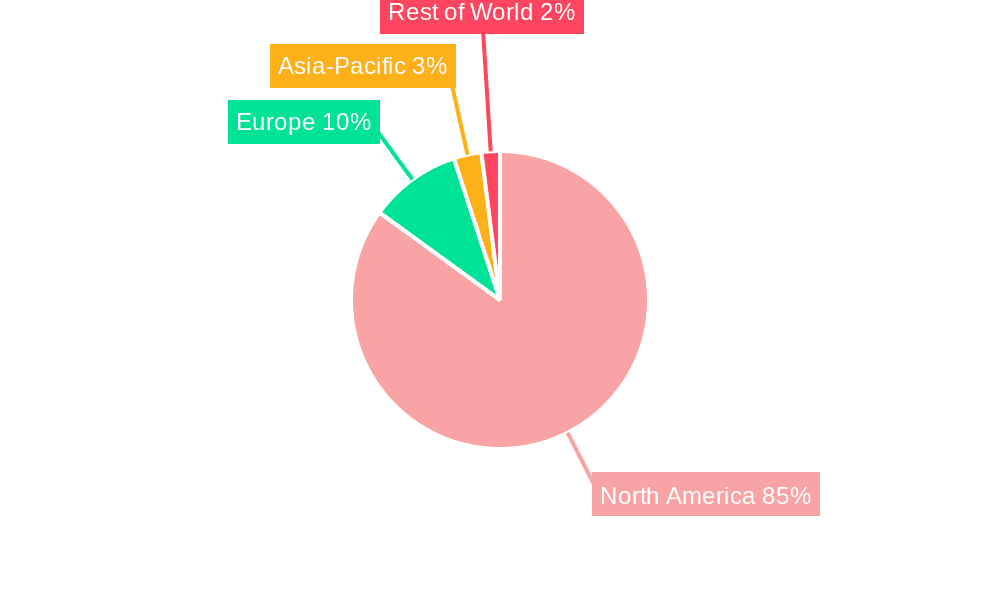

Dominant Regions & Segments in North America E-Commerce Industry

The United States dominates the North American e-commerce market, accounting for a significant majority of the total market value. However, Canada is also experiencing substantial growth. Within the B2C segment, several categories demonstrate strong performance:

- United States: Key drivers include robust digital infrastructure, high internet penetration rates, and a large consumer base with strong purchasing power.

- Canada: Growth is fueled by increasing internet penetration, rising disposable incomes, and government initiatives to support e-commerce development.

- Beauty & Personal Care: This segment benefits from the growing popularity of online beauty reviews and the convenience of online purchasing.

- Consumer Electronics: This segment is driven by the continuous release of new products and the increasing demand for advanced technologies.

- Fashion & Apparel: This segment benefits from online styling tools, virtual try-on technologies, and the rise of social commerce.

- Food & Beverage: This segment is experiencing growth due to the rise of online grocery delivery services and convenience-oriented food delivery platforms.

- Furniture & Home: Online furniture retailers are leveraging immersive technologies such as augmented reality (AR) to enhance the customer experience and drive sales.

North America E-Commerce Industry Product Innovations

Recent years have witnessed significant product innovation in the North American e-commerce space. The adoption of AI-powered personalization engines, improved recommendation systems, and virtual reality (VR)/augmented reality (AR) tools for enhancing the online shopping experience are key trends. These innovations are enhancing customer engagement, boosting conversion rates, and creating competitive advantages for businesses. The integration of blockchain technology for secure and transparent transactions is also gaining traction.

Report Scope & Segmentation Analysis

This report segments the North American e-commerce market by country (United States, Canada) and by B2C e-commerce segments (Beauty & Personal Care, Consumer Electronics, Fashion & Apparel, Food & Beverage, Furniture & Home). Each segment's growth projections, market size, and competitive dynamics are analyzed in detail, offering valuable insights into market trends and opportunities. The market size for each segment is projected to reach xx Million by 2033, with significant variations in growth rates across segments. Competitive landscapes vary significantly across segments, ranging from highly concentrated markets to fragmented ones with numerous players.

Key Drivers of North America E-Commerce Industry Growth

Several factors are driving the growth of the North American e-commerce industry. These include:

- Technological advancements: AI, ML, and big data analytics are transforming customer experience, logistics, and marketing strategies.

- Economic growth: Rising disposable incomes and increasing internet penetration are fueling consumer spending.

- Favorable regulatory environment: Government initiatives supporting e-commerce development are fostering growth.

Challenges in the North America E-Commerce Industry Sector

The North American e-commerce sector faces several challenges:

- Increased competition: The highly competitive landscape necessitates constant innovation and adaptation.

- Supply chain disruptions: Global supply chain issues can impact product availability and delivery times.

- Cybersecurity threats: Protecting customer data and preventing fraud are crucial concerns.

- Regulatory compliance: Adhering to evolving data privacy regulations and antitrust laws is essential.

Emerging Opportunities in North America E-Commerce Industry

Several promising opportunities exist within the North American e-commerce industry:

- Growth of mobile commerce: The increasing use of smartphones for online shopping presents significant growth potential.

- Expansion into new markets: Reaching underserved populations and expanding into rural areas holds substantial opportunities.

- Adoption of new technologies: Leveraging emerging technologies like AR/VR and blockchain can create new competitive advantages.

Leading Players in the North America E-Commerce Industry Market

Key Developments in North America E-Commerce Industry Industry

- 2022 Q4: Amazon launched its new logistics network expansion plan, increasing its delivery capacity.

- 2023 Q1: Walmart partnered with a major logistics provider to improve delivery efficiency.

- 2024 Q2: Target invested heavily in its omnichannel strategy.

Future Outlook for North America E-Commerce Industry Market

The North American e-commerce market is poised for continued strong growth over the forecast period. The ongoing adoption of new technologies, coupled with evolving consumer preferences and supportive regulatory environments, will continue to drive market expansion. Strategic investments in logistics, technology, and customer experience will be crucial for businesses to succeed in this dynamic and competitive market.

North America E-Commerce Industry Segmentation

-

1. Type

- 1.1. B2C E-commerce

- 1.2. B2B E-commerce

-

2. Industry vertical

- 2.1. Beauty & Personal Care

- 2.2. Consumer Electronics

- 2.3. Fashion & Apparel

- 2.4. Food & Beverage

- 2.5. Furniture & Home

North America E-Commerce Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America E-Commerce Industry Regional Market Share

Geographic Coverage of North America E-Commerce Industry

North America E-Commerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in the Adoption of Latest Technology; Increasing Consumer Interest towards Convenient Shopping solutions

- 3.3. Market Restrains

- 3.3.1. Privacy and Copyright Issues among E-sellers and Book Writers

- 3.4. Market Trends

- 3.4.1. Consumer Interest in Convenient Shopping Solutions is driving the E-Commerce market to grow.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America E-Commerce Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. B2C E-commerce

- 5.1.2. B2B E-commerce

- 5.2. Market Analysis, Insights and Forecast - by Industry vertical

- 5.2.1. Beauty & Personal Care

- 5.2.2. Consumer Electronics

- 5.2.3. Fashion & Apparel

- 5.2.4. Food & Beverage

- 5.2.5. Furniture & Home

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Wayfair E-commerce

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kroger E-commerce

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Coppel

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Apple Ecommerce

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Home Depot

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Best Buy

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 COSTCO

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Amazon com Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Target

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Walmart Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Shien

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Wayfair E-commerce

List of Figures

- Figure 1: North America E-Commerce Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: North America E-Commerce Industry Share (%) by Company 2025

List of Tables

- Table 1: North America E-Commerce Industry Revenue million Forecast, by Type 2020 & 2033

- Table 2: North America E-Commerce Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: North America E-Commerce Industry Revenue million Forecast, by Industry vertical 2020 & 2033

- Table 4: North America E-Commerce Industry Volume K Unit Forecast, by Industry vertical 2020 & 2033

- Table 5: North America E-Commerce Industry Revenue million Forecast, by Region 2020 & 2033

- Table 6: North America E-Commerce Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: North America E-Commerce Industry Revenue million Forecast, by Type 2020 & 2033

- Table 8: North America E-Commerce Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 9: North America E-Commerce Industry Revenue million Forecast, by Industry vertical 2020 & 2033

- Table 10: North America E-Commerce Industry Volume K Unit Forecast, by Industry vertical 2020 & 2033

- Table 11: North America E-Commerce Industry Revenue million Forecast, by Country 2020 & 2033

- Table 12: North America E-Commerce Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States North America E-Commerce Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: United States North America E-Commerce Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada North America E-Commerce Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Canada North America E-Commerce Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico North America E-Commerce Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Mexico North America E-Commerce Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America E-Commerce Industry?

The projected CAGR is approximately 18.1%.

2. Which companies are prominent players in the North America E-Commerce Industry?

Key companies in the market include Wayfair E-commerce, Kroger E-commerce, Coppel, Apple Ecommerce, Home Depot, Best Buy, COSTCO, Amazon com Inc, Target, Walmart Inc, Shien.

3. What are the main segments of the North America E-Commerce Industry?

The market segments include Type , Industry vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 3333.8 million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the Adoption of Latest Technology; Increasing Consumer Interest towards Convenient Shopping solutions.

6. What are the notable trends driving market growth?

Consumer Interest in Convenient Shopping Solutions is driving the E-Commerce market to grow..

7. Are there any restraints impacting market growth?

Privacy and Copyright Issues among E-sellers and Book Writers.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America E-Commerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America E-Commerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America E-Commerce Industry?

To stay informed about further developments, trends, and reports in the North America E-Commerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence