Key Insights

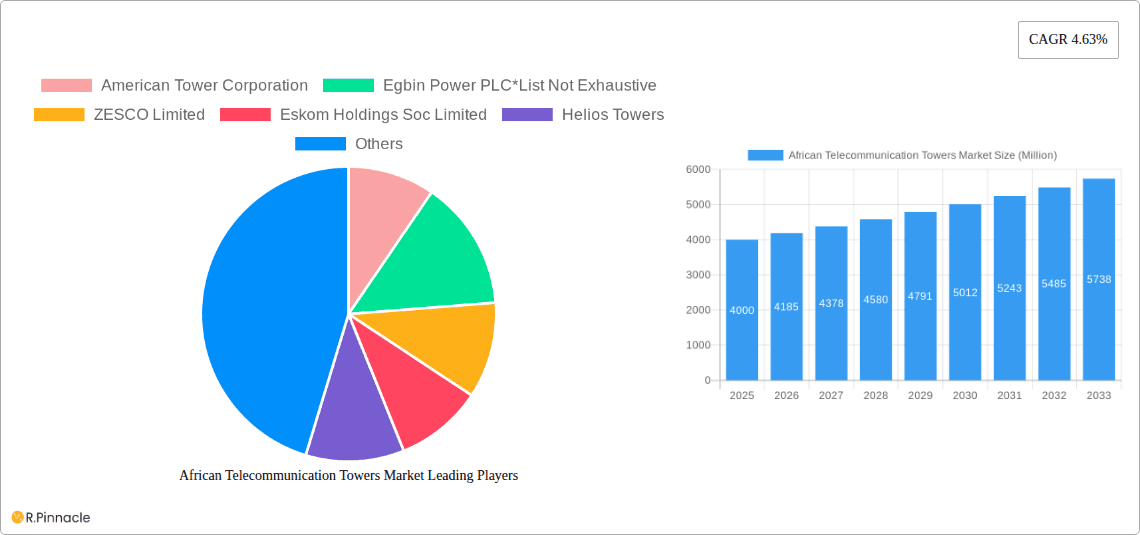

The African telecommunications tower market is poised for substantial growth, fueled by escalating mobile penetration, widespread 4G/5G network expansion, and surging demand for data services throughout the continent. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of 4.63% from 2019 to 2033. While specific figures are pending, the market size in 2025 is estimated to be between $3 to $5 billion. This projection is informed by rapid mobile technology adoption across Africa and significant infrastructure investments by telecom operators and tower companies. Key growth catalysts include government initiatives for digital inclusion, increasing urbanization, and the burgeoning popularity of mobile money and data-intensive applications. Emerging trends such as colocation strategies for enhanced infrastructure efficiency and the rise of independent tower companies (ITCs) are reshaping the market dynamics. Nevertheless, challenges such as uneven infrastructure development, regulatory complexities, and the imperative for substantial investment to reduce the digital divide persist.

African Telecommunication Towers Market Market Size (In Billion)

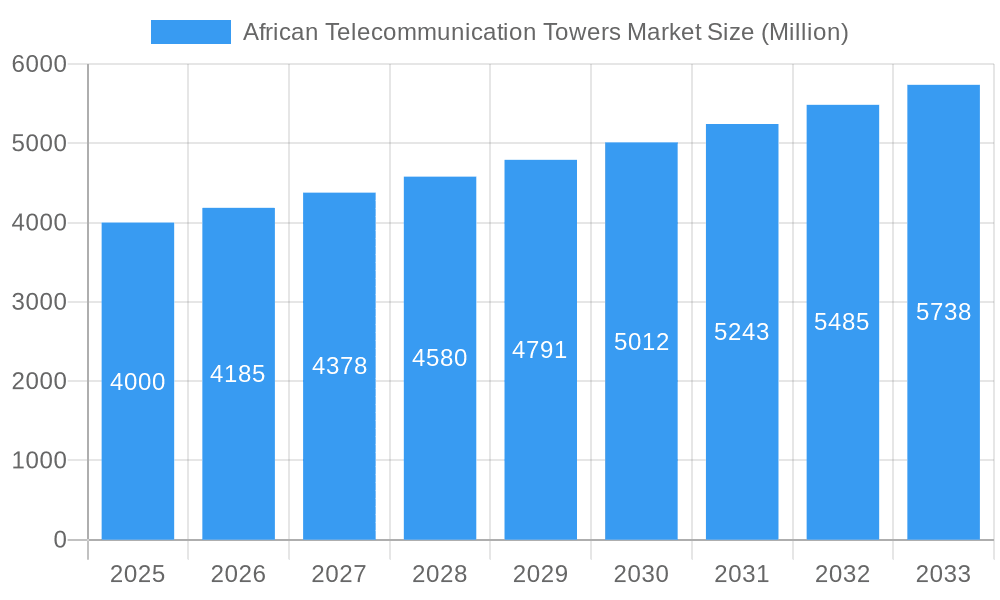

Market segmentation reveals diverse opportunities. The "By Type" segment encompasses macrocells, microcells, and small cells, catering to varied network requirements in urban and rural settings. The "By Generation Source" segment distinguishes between grid-powered towers and those relying on alternative sources like solar or diesel generators, emphasizing the critical need for reliable power. Country-specific analysis, particularly regarding installed capacity, offers granular insights into regional disparities and growth potential. Leading players such as American Tower Corporation, Helios Towers, and IHS Towers are actively expanding their tower portfolios across Africa, underscoring the market's attractiveness and growth prospects. The competitive landscape anticipates increased consolidation and strategic partnerships as companies aim to bolster market share and optimize infrastructure investments. The forecast period of 2025-2033 presents significant opportunities for continued expansion, driven by ongoing technological advancements and a growing mobile user base in Africa.

African Telecommunication Towers Market Company Market Share

African Telecommunication Towers Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the African telecommunication towers market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report unveils market dynamics, growth drivers, challenges, and future opportunities across various segments. The report leverages extensive data analysis and expert insights to present a clear, actionable picture of this rapidly evolving market. Market values are presented in Millions.

African Telecommunication Towers Market Structure & Innovation Trends

This section analyzes the competitive landscape, encompassing market concentration, innovation drivers, regulatory frameworks, and market dynamics. We examine the impact of mergers and acquisitions (M&A) activities on market share, providing a detailed assessment of key players and their strategies. The analysis considers the influence of substitute products and evolving end-user demographics on market growth.

- Market Concentration: The African telecommunication towers market exhibits a [xx]% market concentration with [xx] major players controlling [xx]% of the market share in 2025. This is projected to [increase/decrease] to [xx]% by 2033.

- Innovation Drivers: Key drivers include the expansion of 5G networks, increasing demand for mobile broadband services, and the growing adoption of IoT devices.

- Regulatory Frameworks: The regulatory environment varies significantly across African nations, influencing market entry and investment decisions. We analyze the impact of licensing regulations and spectrum allocation policies on market growth.

- M&A Activity: The past five years have witnessed significant M&A activity, with deal values totaling approximately [xx] Million in 2024. Key acquisitions include [mention specific examples if available].

- Product Substitutes: The increasing adoption of small cells and distributed antenna systems (DAS) presents a competitive challenge to traditional macro towers.

African Telecommunication Towers Market Dynamics & Trends

This section delves into the forces shaping market growth, including technological disruptions, evolving consumer preferences, and competitive dynamics. We project a Compound Annual Growth Rate (CAGR) of [xx]% during the forecast period (2025-2033). Market penetration is expected to reach [xx]% by 2033, driven by factors such as [detailed explanation of driving factors]. We analyze the impact of technological advancements (e.g., 5G, IoT) and changing consumer behavior on market trends and growth trajectory.

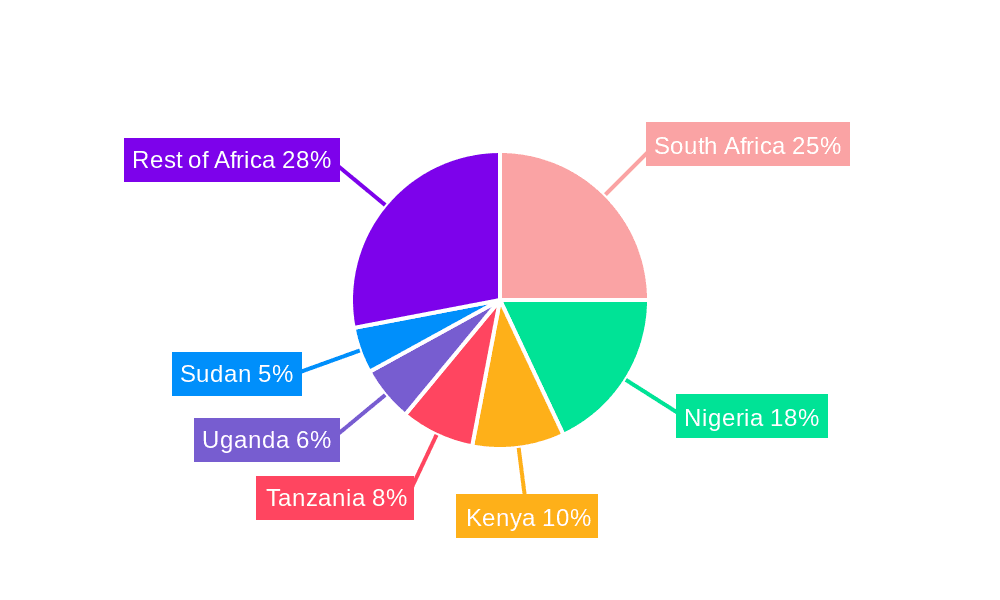

Dominant Regions & Segments in African Telecommunication Towers Market

This section identifies the leading regions and segments within the African telecommunication towers market, focusing on Market Segmentation: By Type, Distribution: By Generation Source, and Other Generation Sources: By Country (Installed Capacity in GW).

- Leading Region: [Specify leading region, e.g., Southern Africa] dominates the market due to [detailed reasons].

- Dominant Segment (By Type): [Specify the dominant segment, e.g., Macro Towers] holds the largest market share due to [reasons].

- Dominant Segment (By Generation Source): [Specify the dominant generation source, e.g., Diesel] currently leads but is expected to see a shift towards [reasons for shift, e.g., renewable energy sources].

- Dominant Country (By Installed Capacity): [Specify the country, e.g., South Africa] with an installed capacity of [xx] GW. Key drivers include [list bullet points like robust infrastructure, favorable government policies, strong economic growth].

African Telecommunication Towers Market Product Innovations

Recent product developments focus on enhancing tower infrastructure to accommodate the increasing demand for 5G and IoT deployments. Innovations include advanced tower designs, improved power solutions, and integrated network management systems. These advancements aim to enhance network capacity, improve energy efficiency, and streamline operations, offering competitive advantages to tower companies in the market.

Report Scope & Segmentation Analysis

This report segments the African telecommunication towers market by:

- By Type: Macro Towers, Micro Towers, Small Cells, and others. [Growth projections and market size for each type].

- By Distribution: On-grid, Off-grid. [Growth projections and market size for each type].

- Other Generation Sources: By Country (Installed Capacity in GW): [List countries and their respective installed capacities]. [Market size and growth projections for each country].

Key Drivers of African Telecommunication Towers Market Growth

The growth of the African telecommunication towers market is fueled by several factors: the rapid expansion of mobile network coverage, increasing smartphone penetration, rising demand for mobile data, and supportive government policies promoting infrastructure development across the continent. Furthermore, the increasing adoption of 5G technology is creating significant opportunities for tower companies.

Challenges in the African Telecommunication Towers Market Sector

Challenges include securing permits and licenses, navigating complex regulatory frameworks, addressing infrastructure gaps, and managing energy supply constraints in certain regions. These challenges can lead to delays in project implementation and increase operational costs. Competition among tower companies also creates pressure on pricing and profitability.

Emerging Opportunities in African Telecommunication Towers Market

Emerging opportunities include the expansion of 5G networks, the growing adoption of IoT devices, and the development of shared infrastructure models. These opportunities offer significant growth potential for tower companies that can adapt to technological advancements and meet the evolving needs of mobile network operators. Investing in renewable energy solutions for tower power and expanding into underserved areas will also offer opportunities for expansion and market share gain.

Leading Players in the African Telecommunication Towers Market Market

- American Tower Corporation

- Egbin Power PLC

- ZESCO Limited

- Eskom Holdings SOC Limited

- Helios Towers

- IHS Towers (IHS Holdings Ltd)

Key Developments in African Telecommunication Towers Market Industry

- April 2023: Egbin Power PLC announced the construction of a 1,900MW gas-fuelled power plant in Lagos, Nigeria, potentially impacting the energy supply for telecommunication towers.

- March 2023: Axian Telecom's network upgrade in Madagascar with Ericsson demonstrates the increasing focus on enhancing network infrastructure and efficiency, driving demand for advanced tower technologies.

Future Outlook for African Telecommunication Towers Market Market

The African telecommunication towers market is poised for robust growth in the coming years, driven by increasing mobile penetration, the rollout of 5G networks, and the expanding adoption of IoT devices. Strategic partnerships, investments in renewable energy solutions, and innovative tower designs will be crucial for success in this dynamic market. The market's long-term potential is significant, offering substantial opportunities for both existing players and new entrants.

African Telecommunication Towers Market Segmentation

-

1. Ownership

- 1.1. Operator Owned

- 1.2. Joint Venture

- 1.3. Private Owned

- 1.4. MNO Captive

-

2. Fuel Type

- 2.1. Renewable

- 2.2. Non-Renewable

-

3. Market Outlook

-

3.1. Cost of

- 3.1.1. Off-grid

- 3.1.2. Bad-grid

- 3.2. Green En

- 3.3. Key Developments and Trends

-

3.1. Cost of

-

4. Type

- 4.1. Generation

- 4.2. Distribution

-

5. Generation Source

- 5.1. Renewable

- 5.2. Hydro

- 5.3. Other Generation Sources

African Telecommunication Towers Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

African Telecommunication Towers Market Regional Market Share

Geographic Coverage of African Telecommunication Towers Market

African Telecommunication Towers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the Penetration of Smartphones5.1.2 5G Deployments Driving Momentum for Tower Leasing; Evolution of Mobile Networks and Rapid Rise in Data Traffic

- 3.3. Market Restrains

- 3.3.1. Heavy Capex Associated with Advanced Telecom Infrastructure

- 3.4. Market Trends

- 3.4.1. Private Owned Telecom Towers to Register Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. African Telecommunication Towers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 5.1.1. Operator Owned

- 5.1.2. Joint Venture

- 5.1.3. Private Owned

- 5.1.4. MNO Captive

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Renewable

- 5.2.2. Non-Renewable

- 5.3. Market Analysis, Insights and Forecast - by Market Outlook

- 5.3.1. Cost of

- 5.3.1.1. Off-grid

- 5.3.1.2. Bad-grid

- 5.3.2. Green En

- 5.3.3. Key Developments and Trends

- 5.3.1. Cost of

- 5.4. Market Analysis, Insights and Forecast - by Type

- 5.4.1. Generation

- 5.4.2. Distribution

- 5.5. Market Analysis, Insights and Forecast - by Generation Source

- 5.5.1. Renewable

- 5.5.2. Hydro

- 5.5.3. Other Generation Sources

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 American Tower Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Egbin Power PLC*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ZESCO Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Eskom Holdings Soc Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Helios Towers

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 IHS Towers (IHS Holdings Ltd)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 American Tower Corporation

List of Figures

- Figure 1: African Telecommunication Towers Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: African Telecommunication Towers Market Share (%) by Company 2025

List of Tables

- Table 1: African Telecommunication Towers Market Revenue billion Forecast, by Ownership 2020 & 2033

- Table 2: African Telecommunication Towers Market Volume Thousand Forecast, by Ownership 2020 & 2033

- Table 3: African Telecommunication Towers Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 4: African Telecommunication Towers Market Volume Thousand Forecast, by Fuel Type 2020 & 2033

- Table 5: African Telecommunication Towers Market Revenue billion Forecast, by Market Outlook 2020 & 2033

- Table 6: African Telecommunication Towers Market Volume Thousand Forecast, by Market Outlook 2020 & 2033

- Table 7: African Telecommunication Towers Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: African Telecommunication Towers Market Volume Thousand Forecast, by Type 2020 & 2033

- Table 9: African Telecommunication Towers Market Revenue billion Forecast, by Generation Source 2020 & 2033

- Table 10: African Telecommunication Towers Market Volume Thousand Forecast, by Generation Source 2020 & 2033

- Table 11: African Telecommunication Towers Market Revenue billion Forecast, by Region 2020 & 2033

- Table 12: African Telecommunication Towers Market Volume Thousand Forecast, by Region 2020 & 2033

- Table 13: African Telecommunication Towers Market Revenue billion Forecast, by Ownership 2020 & 2033

- Table 14: African Telecommunication Towers Market Volume Thousand Forecast, by Ownership 2020 & 2033

- Table 15: African Telecommunication Towers Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 16: African Telecommunication Towers Market Volume Thousand Forecast, by Fuel Type 2020 & 2033

- Table 17: African Telecommunication Towers Market Revenue billion Forecast, by Market Outlook 2020 & 2033

- Table 18: African Telecommunication Towers Market Volume Thousand Forecast, by Market Outlook 2020 & 2033

- Table 19: African Telecommunication Towers Market Revenue billion Forecast, by Type 2020 & 2033

- Table 20: African Telecommunication Towers Market Volume Thousand Forecast, by Type 2020 & 2033

- Table 21: African Telecommunication Towers Market Revenue billion Forecast, by Generation Source 2020 & 2033

- Table 22: African Telecommunication Towers Market Volume Thousand Forecast, by Generation Source 2020 & 2033

- Table 23: African Telecommunication Towers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: African Telecommunication Towers Market Volume Thousand Forecast, by Country 2020 & 2033

- Table 25: Nigeria African Telecommunication Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nigeria African Telecommunication Towers Market Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 27: South Africa African Telecommunication Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: South Africa African Telecommunication Towers Market Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 29: Egypt African Telecommunication Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Egypt African Telecommunication Towers Market Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 31: Kenya African Telecommunication Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Kenya African Telecommunication Towers Market Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 33: Ethiopia African Telecommunication Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Ethiopia African Telecommunication Towers Market Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 35: Morocco African Telecommunication Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Morocco African Telecommunication Towers Market Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 37: Ghana African Telecommunication Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Ghana African Telecommunication Towers Market Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 39: Algeria African Telecommunication Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Algeria African Telecommunication Towers Market Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 41: Tanzania African Telecommunication Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Tanzania African Telecommunication Towers Market Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 43: Ivory Coast African Telecommunication Towers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Ivory Coast African Telecommunication Towers Market Volume (Thousand) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the African Telecommunication Towers Market?

The projected CAGR is approximately 3.4%.

2. Which companies are prominent players in the African Telecommunication Towers Market?

Key companies in the market include American Tower Corporation, Egbin Power PLC*List Not Exhaustive, ZESCO Limited, Eskom Holdings Soc Limited, Helios Towers, IHS Towers (IHS Holdings Ltd).

3. What are the main segments of the African Telecommunication Towers Market?

The market segments include Ownership, Fuel Type, Market Outlook, Type, Generation Source.

4. Can you provide details about the market size?

The market size is estimated to be USD 101.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Penetration of Smartphones5.1.2 5G Deployments Driving Momentum for Tower Leasing; Evolution of Mobile Networks and Rapid Rise in Data Traffic.

6. What are the notable trends driving market growth?

Private Owned Telecom Towers to Register Significant Growth.

7. Are there any restraints impacting market growth?

Heavy Capex Associated with Advanced Telecom Infrastructure.

8. Can you provide examples of recent developments in the market?

April 2023: Egbin Power PLC announced the construction of its Power Station in Lagos, Nigeria, with a 1,900MW gas-fuelled power plant. The project is now undergoing permitting. It will be built in a single step. The project's development is anticipated to begin in 2024, with commercial operations beginning in 2025.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Thousand.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "African Telecommunication Towers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the African Telecommunication Towers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the African Telecommunication Towers Market?

To stay informed about further developments, trends, and reports in the African Telecommunication Towers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence