Key Insights

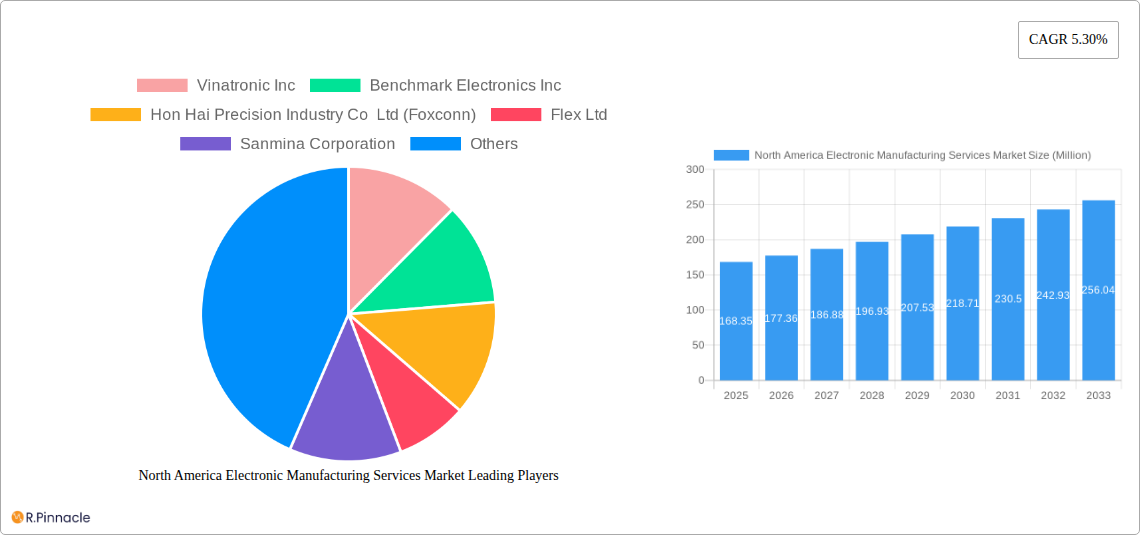

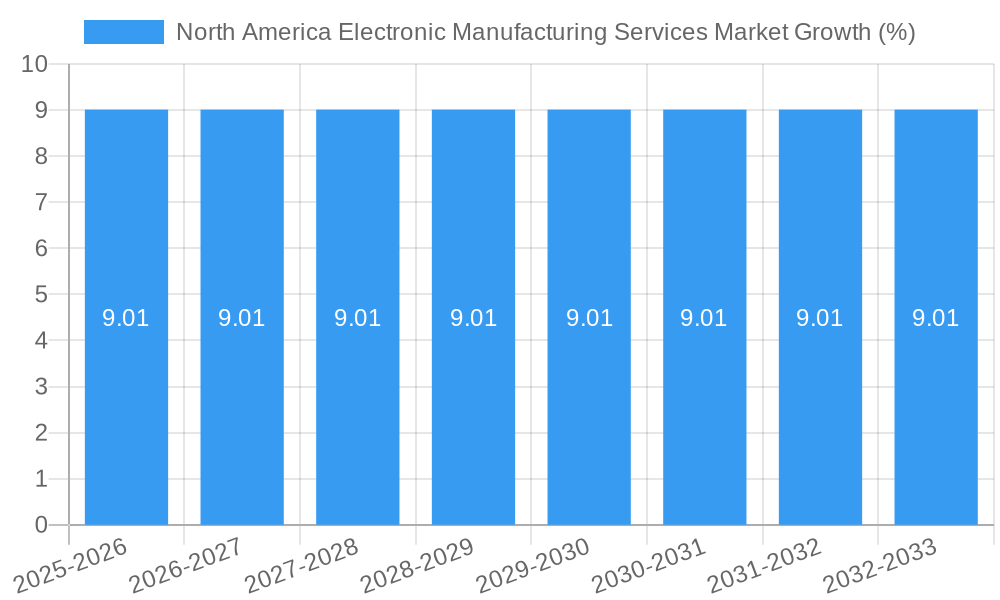

The North American Electronic Manufacturing Services (EMS) market, valued at $168.35 million in 2025, is projected to experience robust growth, driven by increasing demand for electronics across diverse sectors like automotive, healthcare, and consumer electronics. The market's Compound Annual Growth Rate (CAGR) of 5.30% from 2025 to 2033 indicates a significant expansion opportunity. Key drivers include the rising adoption of advanced technologies like 5G and IoT, the need for efficient supply chain management, and the growing preference for outsourcing manufacturing to specialized EMS providers. This allows original equipment manufacturers (OEMs) to focus on core competencies like product design and marketing. Furthermore, increasing automation and the implementation of Industry 4.0 principles are streamlining production processes and improving efficiency, contributing to market growth. However, challenges such as escalating labor costs, supply chain disruptions, and geopolitical uncertainties could potentially restrain market expansion. The market is segmented by service type (design, manufacturing, testing, etc.), industry served (automotive, healthcare, consumer electronics etc.), and geographical distribution. Major players like Flex Ltd, Jabil Inc, and Foxconn dominate the landscape, leveraging their scale and technological expertise to secure contracts from major OEMs. The competitive landscape is characterized by both intense competition and strategic partnerships, resulting in continuous innovation and the development of specialized manufacturing capabilities to meet the evolving needs of the electronics industry.

The forecast period of 2025-2033 anticipates continued growth in the North American EMS market. The rising complexity of electronic devices and the increasing demand for customized solutions are expected to fuel the demand for specialized EMS providers. Growth will likely be uneven across market segments, with sectors exhibiting high technological advancements showing faster growth. The adoption of sustainable manufacturing practices and the focus on reducing environmental impact are also shaping market trends. To maintain a competitive edge, EMS providers are investing heavily in research and development, expanding their manufacturing capacity, and strengthening their global supply chain networks. Future growth will depend heavily on the ability of EMS providers to adapt to rapid technological advancements, manage supply chain vulnerabilities effectively, and meet the increasingly stringent regulatory requirements within the industry.

North America Electronic Manufacturing Services Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America Electronic Manufacturing Services (EMS) market, offering valuable insights for industry professionals, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with a focus on the forecast period of 2025-2033 and a base year of 2025. The report utilizes a robust methodology to analyze market size, growth drivers, challenges, and emerging opportunities, backed by extensive data and expert analysis. Key players like Vinatronic Inc, Benchmark Electronics Inc, Hon Hai Precision Industry Co Ltd (Foxconn), Flex Ltd, and Sanmina Corporation are profiled, offering a competitive landscape analysis. The market is segmented by [Insert Segmentations Here - e.g., service type, end-user industry, geography]. The report projects a market value of xx Million by 2033, demonstrating significant growth potential.

North America Electronic Manufacturing Services Market Structure & Innovation Trends

The North American EMS market exhibits a moderately concentrated structure, with a few large players holding significant market share. However, smaller, specialized firms also thrive, catering to niche segments. Market share data for 2024 shows [Insert Market Share Data Here - e.g., Top 5 companies holding X% collectively]. Innovation is driven by advancements in automation, miniaturization, and the adoption of Industry 4.0 technologies. Regulatory frameworks, including environmental regulations and data privacy laws, significantly influence operational costs and strategies. Product substitutes, such as in-house manufacturing or outsourcing to regions with lower labor costs, pose a continuous challenge. End-user demographics are diversifying, with increased demand from sectors like healthcare, automotive, and renewable energy. M&A activity has been significant, with deals valued at xx Million in the last five years [Insert Specific Deal Values and Companies if Available]. Examples of recent M&A include [Insert Examples Here, if data is available. Otherwise state "Details on specific M&A activities are limited"].

North America Electronic Manufacturing Services Market Dynamics & Trends

The North American EMS market is experiencing robust growth, driven by several factors. Increasing demand for electronic products across various industries, particularly in healthcare, automotive, and consumer electronics, fuels market expansion. The adoption of advanced technologies, such as AI and IoT, is creating new opportunities for EMS providers. Technological disruptions, such as the shift towards 5G and miniaturization, are constantly reshaping the market landscape. Consumer preferences for high-quality, customized electronics put pressure on EMS providers to innovate. Competitive dynamics are shaped by factors such as pricing pressure, technological capabilities, and customer relationships. The market is expected to exhibit a CAGR of xx% during the forecast period (2025-2033), with market penetration steadily increasing across various segments. [Insert More Detailed Analysis about CAGR and Market Penetration].

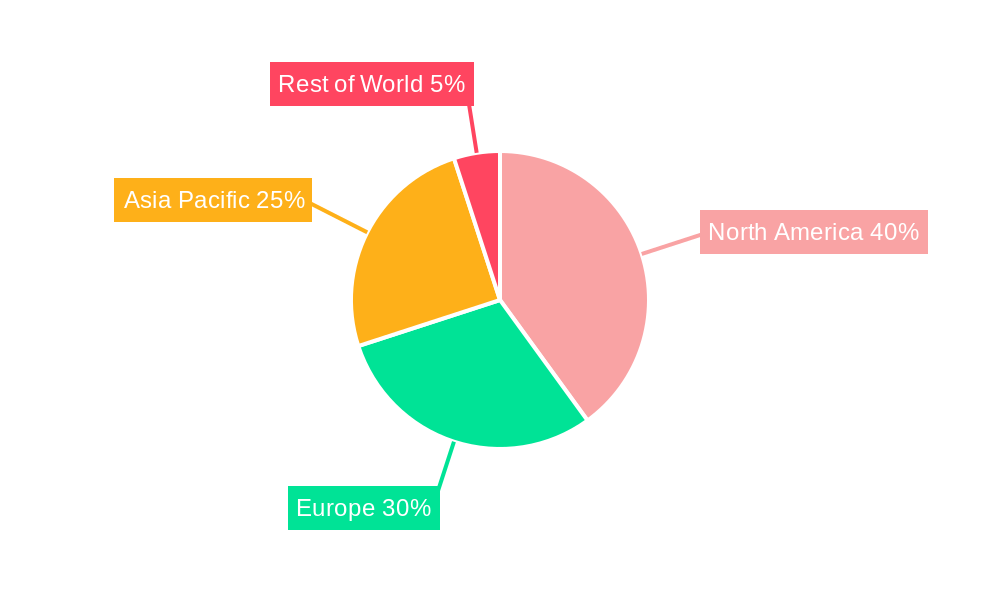

Dominant Regions & Segments in North America Electronic Manufacturing Services Market

The [Insert Dominant Region - e.g., US] is currently the dominant region in the North American EMS market. This dominance is driven by several factors:

- Strong Domestic Demand: High demand for electronics across multiple industries within the US.

- Robust Infrastructure: Well-established infrastructure, including transportation networks and skilled labor pool.

- Government Support: Supportive government policies and incentives fostering technological advancement.

[Insert Paragraph on other regions - e.g., Canada, Mexico], detailing market size and factors influencing their growth or lack thereof. Within the market, the [Insert Dominant Segment - e.g., consumer electronics] segment holds the largest market share, driven by [explain the drivers of segment dominance]. A more detailed analysis of the market segmentation is provided in Section 5.

North America Electronic Manufacturing Services Market Product Innovations

Recent product innovations in the North American EMS market are characterized by a focus on advanced technologies, including miniaturization, high-frequency circuit design, and the integration of smart sensors. These innovations are driving the adoption of EMS services across diverse industries. Companies are increasingly focusing on developing customized solutions and leveraging automation to improve efficiency and reduce costs. The market fit for these innovations is strong, particularly in high-growth sectors such as IoT, automotive electronics, and medical devices.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the North American EMS market, segmented by [Insert Segmentations Here - e.g., service type (design, manufacturing, testing), end-user industry (automotive, aerospace, consumer electronics, healthcare), and geography (US, Canada, Mexico)]. Each segment's market size, growth projections, and competitive dynamics are detailed in this report. [Provide brief description for each segment, if available, e.g., The Consumer Electronics segment is projected to grow at a CAGR of x% due to Y and Z; the Automotive segment is characterized by high demand for … etc.]

Key Drivers of North America Electronic Manufacturing Services Market Growth

Several factors are propelling the growth of the North American EMS market. Technological advancements, particularly in automation and miniaturization, are enhancing efficiency and enabling the production of increasingly complex electronic devices. The increasing demand for electronics in various sectors, fueled by economic growth and technological innovation, also contributes significantly. Furthermore, supportive government policies and incentives aimed at promoting domestic manufacturing are fostering market expansion.

Challenges in the North America Electronic Manufacturing Services Market Sector

The North American EMS market faces several challenges. Rising labor costs and the increasing complexity of electronic devices are driving up production expenses. Supply chain disruptions, particularly those related to component sourcing, can negatively impact production timelines and profitability. Intense competition, both from domestic and international players, puts pressure on pricing and margins. Furthermore, stringent regulatory compliance requirements add to operational costs. Quantifiable impacts vary by company but generally result in reduced profit margins and increased operational complexities.

Emerging Opportunities in North America Electronic Manufacturing Services Market

The North American EMS market presents significant growth opportunities. The rising adoption of IoT and 5G technologies is creating new demand for advanced electronic manufacturing capabilities. Growth in the automotive, medical device, and renewable energy sectors offers opportunities for specialized EMS providers. Focusing on sustainability and environmentally friendly manufacturing practices presents a significant advantage in the market. Emerging trends in personalized electronics and customized solutions also present significant opportunities for companies to differentiate their offerings.

Leading Players in the North America Electronic Manufacturing Services Market Market

- Vinatronic Inc

- Benchmark Electronics Inc

- Hon Hai Precision Industry Co Ltd (Foxconn) Foxconn

- Flex Ltd Flex

- Sanmina Corporation Sanmina

- Jabil Inc Jabil

- SIIX Corporation

- Nortech Systems Incorporated

- Celestica Inc Celestica

- Integrated Micro-electronics Inc

- Creation Technologies LP

- Wistron Corporation Wistron

- Plexus Corporation Plexus

- TRICOR Systems Inc

- Sumitronics Corporation

*List Not Exhaustive

Key Developments in North America Electronic Manufacturing Services Market Industry

- January 2024: Artaflex opened a new facility in Buffalo, New York, expanding its US presence and enhancing its capacity to provide high-quality EMS services.

- October 2023: Marotta Controls awarded a multi-million-dollar contract to TT Electronics' GMS business for the production of electronics for a new military air platform, highlighting the robust demand in the aerospace and defense sector.

Future Outlook for North America Electronic Manufacturing Services Market Market

The North American EMS market is poised for continued growth, driven by technological advancements, increasing demand across various industries, and supportive government policies. The focus on automation, miniaturization, and sustainability will shape future market trends. Strategic partnerships and investments in research and development will be crucial for companies to maintain a competitive edge. The market's potential is significant, with opportunities for both established players and emerging firms to capitalize on the growing demand for advanced electronic manufacturing capabilities.

North America Electronic Manufacturing Services Market Segmentation

-

1. Service Type

- 1.1. Electronics Design and Engineering

- 1.2. Electronics Assembly

- 1.3. Electronics Manufacturing

- 1.4. Other Service Types

-

2. Application

- 2.1. Consumer Electronics

- 2.2. Automotive

- 2.3. Industrial

- 2.4. Aerospace and Defense

- 2.5. Healthcare

- 2.6. IT and Telecom

- 2.7. Other Applications

North America Electronic Manufacturing Services Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Electronic Manufacturing Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing Trends of Miniaturization; Adoption of Emerging Technologies in IIoT (Industrial Internet of Things)

- 3.2.2 Blockchain

- 3.2.3 and Enhanced Communication

- 3.3. Market Restrains

- 3.3.1 Growing Trends of Miniaturization; Adoption of Emerging Technologies in IIoT (Industrial Internet of Things)

- 3.3.2 Blockchain

- 3.3.3 and Enhanced Communication

- 3.4. Market Trends

- 3.4.1. Consumer Electronics to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Electronic Manufacturing Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Electronics Design and Engineering

- 5.1.2. Electronics Assembly

- 5.1.3. Electronics Manufacturing

- 5.1.4. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Consumer Electronics

- 5.2.2. Automotive

- 5.2.3. Industrial

- 5.2.4. Aerospace and Defense

- 5.2.5. Healthcare

- 5.2.6. IT and Telecom

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Vinatronic Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Benchmark Electronics Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hon Hai Precision Industry Co Ltd (Foxconn)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Flex Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sanmina Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Jabil Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SIIX Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nortech Systems Incorporated

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Celestica Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Integrated Micro-electronics Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Creation Technologies LP

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Wistron Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Plexus Corporation

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 TRICOR Systems Inc

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Sumitronics Corporation*List Not Exhaustive

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Vinatronic Inc

List of Figures

- Figure 1: North America Electronic Manufacturing Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Electronic Manufacturing Services Market Share (%) by Company 2024

List of Tables

- Table 1: North America Electronic Manufacturing Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Electronic Manufacturing Services Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: North America Electronic Manufacturing Services Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 4: North America Electronic Manufacturing Services Market Volume Billion Forecast, by Service Type 2019 & 2032

- Table 5: North America Electronic Manufacturing Services Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: North America Electronic Manufacturing Services Market Volume Billion Forecast, by Application 2019 & 2032

- Table 7: North America Electronic Manufacturing Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: North America Electronic Manufacturing Services Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: North America Electronic Manufacturing Services Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 10: North America Electronic Manufacturing Services Market Volume Billion Forecast, by Service Type 2019 & 2032

- Table 11: North America Electronic Manufacturing Services Market Revenue Million Forecast, by Application 2019 & 2032

- Table 12: North America Electronic Manufacturing Services Market Volume Billion Forecast, by Application 2019 & 2032

- Table 13: North America Electronic Manufacturing Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: North America Electronic Manufacturing Services Market Volume Billion Forecast, by Country 2019 & 2032

- Table 15: United States North America Electronic Manufacturing Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United States North America Electronic Manufacturing Services Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 17: Canada North America Electronic Manufacturing Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Canada North America Electronic Manufacturing Services Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 19: Mexico North America Electronic Manufacturing Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Mexico North America Electronic Manufacturing Services Market Volume (Billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Electronic Manufacturing Services Market?

The projected CAGR is approximately 5.30%.

2. Which companies are prominent players in the North America Electronic Manufacturing Services Market?

Key companies in the market include Vinatronic Inc, Benchmark Electronics Inc, Hon Hai Precision Industry Co Ltd (Foxconn), Flex Ltd, Sanmina Corporation, Jabil Inc, SIIX Corporation, Nortech Systems Incorporated, Celestica Inc, Integrated Micro-electronics Inc, Creation Technologies LP, Wistron Corporation, Plexus Corporation, TRICOR Systems Inc, Sumitronics Corporation*List Not Exhaustive.

3. What are the main segments of the North America Electronic Manufacturing Services Market?

The market segments include Service Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 168.35 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Trends of Miniaturization; Adoption of Emerging Technologies in IIoT (Industrial Internet of Things). Blockchain. and Enhanced Communication.

6. What are the notable trends driving market growth?

Consumer Electronics to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Growing Trends of Miniaturization; Adoption of Emerging Technologies in IIoT (Industrial Internet of Things). Blockchain. and Enhanced Communication.

8. Can you provide examples of recent developments in the market?

January 2024: Artaflex, a provider of advanced electronics manufacturing services, opened a new facility in Buffalo, New York. According to the company, the new facility has state-of-the-art technology and a highly skilled workforce to offer the highest-quality electronic manufacturing services. Artaflex's recent expansion in the US market is also driven by the growing demand for reliable and high-quality electronics manufacturing capabilities in the region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Electronic Manufacturing Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Electronic Manufacturing Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Electronic Manufacturing Services Market?

To stay informed about further developments, trends, and reports in the North America Electronic Manufacturing Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence