Key Insights

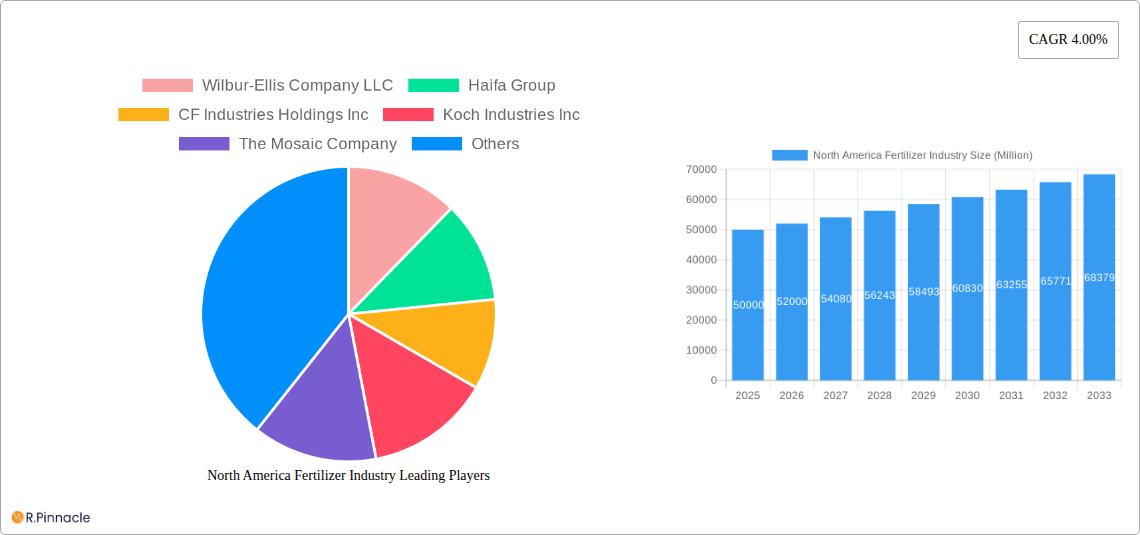

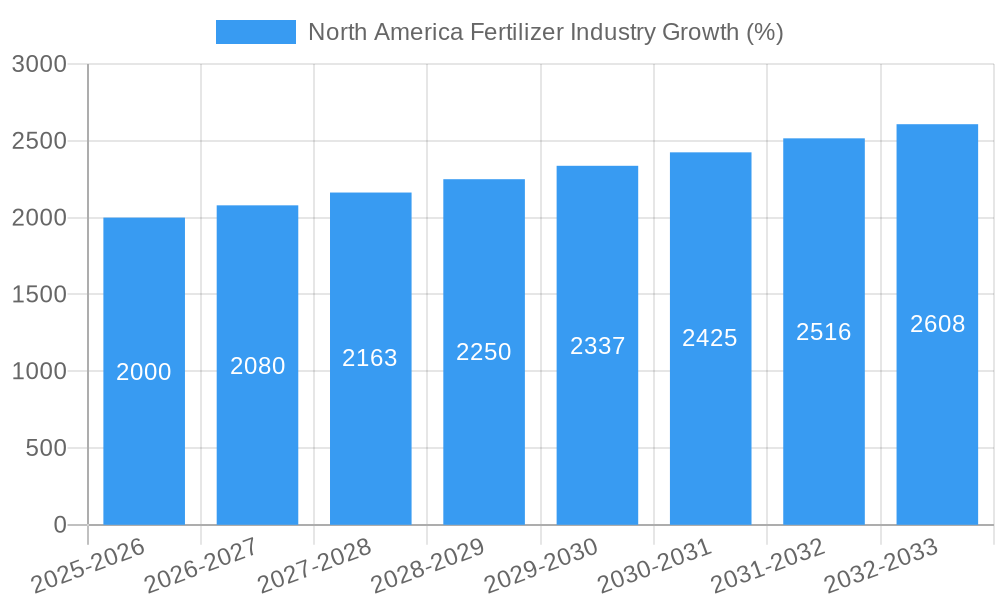

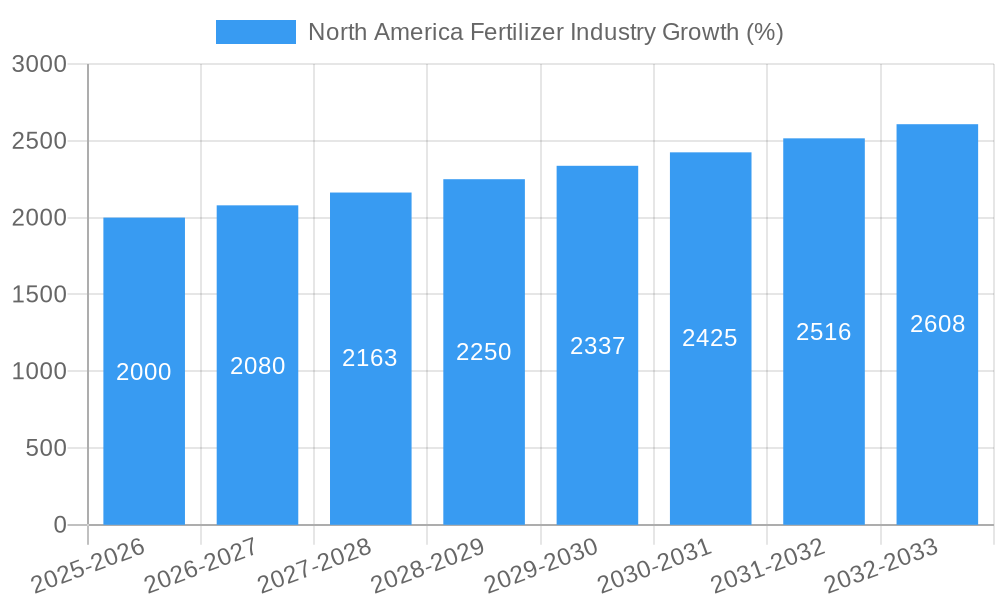

The North American fertilizer market, encompassing the United States, Canada, and Mexico, is a significant agricultural input sector projected to experience steady growth. Driven by increasing demand for food and feed, coupled with expanding acreage dedicated to high-value crops like horticultural products and turf & ornamentals, the market is poised for expansion throughout the forecast period (2025-2033). A compound annual growth rate (CAGR) of 4.00% suggests a consistent, albeit moderate, increase in market value. This growth is fueled by several key factors: technological advancements in fertilizer application (e.g., fertigation) leading to improved nutrient use efficiency, a rising focus on sustainable agricultural practices, and government initiatives promoting crop yield enhancement. While the market faces restraints such as fluctuating raw material prices and environmental concerns surrounding fertilizer runoff, the overall positive outlook is supported by the robust demand from key agricultural segments. The segmentation by fertilizer type (straight, conventional, specialty), application mode (fertigation, foliar, soil), and crop type highlights the market's diversity and caters to the specific needs of various agricultural operations across North America. Major players, including Wilbur-Ellis Company LLC, Haifa Group, and Nutrien Ltd, actively contribute to innovation and market competition. The competitive landscape is expected to remain dynamic, with companies focusing on product diversification and strategic partnerships to expand their market share.

The continued growth in the North American fertilizer market hinges on factors such as the prevailing economic conditions and government policies impacting agricultural subsidies and environmental regulations. Furthermore, climate change impacts, including altered growing seasons and increased water scarcity, may influence fertilizer demand and adoption of efficient application techniques. While the current market size (2025) is not specified, assuming a logical estimate based on reported CAGRs and industry data, we can project a substantial increase in market value over the next decade. The dominance of the United States within the North American market is expected to continue due to its vast agricultural production. However, the Canadian and Mexican markets also present growth opportunities, driven by expanding agricultural sectors and government support for agricultural modernization. The market's performance will strongly depend on the ability of fertilizer producers to adapt to evolving agricultural practices, environmental concerns, and global economic fluctuations.

North America Fertilizer Industry Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America fertilizer industry, covering the period 2019-2033, with a focus on market dynamics, key players, and future growth prospects. The report is essential for industry professionals, investors, and researchers seeking actionable insights into this vital sector. The base year is 2025, with estimates for 2025 and a forecast period extending to 2033. The historical period covered is 2019-2024.

North America Fertilizer Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, regulatory environment, and key industry trends within the North American fertilizer market. The analysis incorporates data from the historical period (2019-2024) and projects trends into the forecast period (2025-2033).

Market Concentration: The North American fertilizer market is moderately concentrated, with several large multinational corporations holding significant market share. Nutrien Ltd., CF Industries Holdings Inc., and The Mosaic Company are among the leading players, collectively accounting for approximately xx% of the market in 2024. Smaller players, such as Wilbur-Ellis Company LLC and The Andersons Inc., cater to niche markets or specific geographic regions.

Innovation Drivers: Key innovation drivers include the development of sustainable fertilizers, precision agriculture technologies, and improved nutrient-use efficiency. The demand for higher crop yields, coupled with environmental concerns, is accelerating innovation in fertilizer formulations and application methods.

Regulatory Framework: Stringent environmental regulations concerning nutrient runoff and greenhouse gas emissions are shaping the industry landscape. Compliance costs are influencing the adoption of more sustainable and efficient fertilizer technologies.

Product Substitutes: Organic fertilizers and biofertilizers are emerging as potential substitutes for conventional chemical fertilizers, albeit with limited market penetration as of 2024. The long-term impact of these substitutes remains to be seen.

M&A Activities: Mergers and acquisitions have played a significant role in shaping the market structure. Recent deals, such as The Andersons' acquisition of Mote Farm Service, Inc. (October 2022), indicate a continued focus on expanding distribution networks and market reach. The total value of M&A transactions in the North American fertilizer industry between 2019 and 2024 is estimated at USD xx Million.

North America Fertilizer Industry Market Dynamics & Trends

This section explores the key factors driving market growth, technological disruptions, consumer preferences, and competitive dynamics within the North American fertilizer industry.

The North American fertilizer market is projected to experience substantial growth during the forecast period (2025-2033), driven primarily by increasing agricultural production, rising demand for high-yield crops, and government initiatives promoting food security. The market is expected to exhibit a CAGR of xx% between 2025 and 2033. Technological advancements, such as precision farming techniques and the development of specialized fertilizers for specific crops, contribute to enhanced efficiency and productivity. Changing consumer preferences toward sustainably produced food are influencing demand for eco-friendly fertilizer solutions. However, fluctuations in raw material prices and intense competition among key players exert considerable influence on market dynamics and profit margins. Market penetration of specialty fertilizers is expected to increase significantly in the coming years.

Dominant Regions & Segments in North America Fertilizer Industry

This section identifies the leading regions and segments within the North American fertilizer market, detailing the factors contributing to their dominance.

Dominant Region: The United States holds the largest market share in North America, driven by its extensive agricultural land and significant crop production. Canada and Mexico also contribute substantially to the overall market. The Rest of North America segment represents a smaller but growing market.

Dominant Segments:

- Type: Straight fertilizers dominate the market due to their cost-effectiveness and widespread availability. However, the demand for specialty fertilizers is rapidly increasing due to their targeted nutrient profiles.

- Form: Conventional fertilizers currently maintain a significant market share; however, the adoption of specialty fertilizers is gaining traction, driven by their precision and efficiency.

- Application Mode: Soil application remains the dominant method, although fertigation and foliar application are experiencing growth due to their improved nutrient-use efficiency.

- Crop Type: Corn, soybeans, and wheat remain the major consumers of fertilizers, with significant demand from the horticultural crops and turf & ornamental segments.

Key Drivers: Economic factors such as stable agricultural commodity prices and government support for agricultural practices influence regional and segmental performance.

North America Fertilizer Industry Product Innovations

Recent advancements in fertilizer technology have focused on developing products with enhanced nutrient-use efficiency, reduced environmental impact, and improved crop yields. Innovations include controlled-release fertilizers, biofertilizers, and specialized formulations for specific crops. These innovations aim to address concerns related to nutrient runoff and optimize fertilizer application for maximum crop performance while minimizing environmental risks. The market is witnessing a shift toward more sustainable and precise fertilizer solutions that align with the growing demand for eco-friendly agricultural practices.

Report Scope & Segmentation Analysis

This report segments the North American fertilizer market by type (straight, specialty), form (conventional, specialty), application mode (fertigation, foliar, soil), crop type (horticultural crops, turf & ornamental), and country (Canada, Mexico, United States, Rest of North America). Each segment's market size, growth projections, and competitive dynamics are analyzed in detail. For instance, the specialty fertilizer segment is projected to exhibit a higher growth rate than conventional fertilizers due to the increasing demand for precise nutrient management.

Key Drivers of North America Fertilizer Industry Growth

The North American fertilizer market’s growth is driven by several factors: growing global food demand leading to increased crop production, government incentives and subsidies for sustainable agriculture, technological advancements in fertilizer formulation and application, and increasing awareness of efficient nutrient management practices.

Challenges in the North America Fertilizer Industry Sector

The industry faces challenges including volatile raw material prices, stringent environmental regulations, supply chain disruptions, and intense competition. These factors impact profitability and operational efficiency, demanding continuous adaptation and innovation for sustainable growth.

Emerging Opportunities in North America Fertilizer Industry

The industry is presenting promising opportunities, such as the growing adoption of precision agriculture, the increasing demand for eco-friendly fertilizers, and the expansion into emerging markets. The potential for partnerships and collaborations aimed at developing innovative solutions is considerable.

Leading Players in the North America Fertilizer Industry Market

- Wilbur-Ellis Company LLC

- Haifa Group

- CF Industries Holdings Inc

- Koch Industries Inc

- The Mosaic Company

- The Andersons Inc

- Yara International AS

- Nutrien Ltd

- ICL Group Ltd

- Sociedad Quimica y Minera de Chile SA

Key Developments in North America Fertilizer Industry

- January 2023: ICL's strategic partnership with General Mills for specialty phosphate solutions signals a shift towards collaborations and specialized product offerings.

- October 2022: The Andersons' acquisition of Mote Farm Service, Inc. strengthens their retail network and market penetration.

- August 2022: Koch Industries' investment in its Kansas nitrogen plant demonstrates a focus on expanding production capacity to meet rising demand.

Future Outlook for North America Fertilizer Industry Market

The North American fertilizer market exhibits strong growth potential driven by ongoing technological advancements, increasing agricultural productivity, and supportive government policies. The focus on sustainability and precision agriculture will continue to shape market trends, creating opportunities for innovative companies to thrive in this dynamic sector.

North America Fertilizer Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

North America Fertilizer Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Fertilizer Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Awareness of Landscaping Maintenance; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Shortage of Skilled Labor; Wastage of High Amount of Water For Irrigating Lawns

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Fertilizer Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. United States North America Fertilizer Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Fertilizer Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Fertilizer Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Fertilizer Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Wilbur-Ellis Company LLC

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Haifa Group

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 CF Industries Holdings Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Koch Industries Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 The Mosaic Company

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 The Andersons Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Yara International AS

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Nutrien Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 ICL Group Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Sociedad Quimica y Minera de Chile SA

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Wilbur-Ellis Company LLC

List of Figures

- Figure 1: North America Fertilizer Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Fertilizer Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Fertilizer Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Fertilizer Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: North America Fertilizer Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: North America Fertilizer Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: North America Fertilizer Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: North America Fertilizer Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: North America Fertilizer Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: North America Fertilizer Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States North America Fertilizer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada North America Fertilizer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico North America Fertilizer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of North America North America Fertilizer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: North America Fertilizer Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 14: North America Fertilizer Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 15: North America Fertilizer Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 16: North America Fertilizer Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 17: North America Fertilizer Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 18: North America Fertilizer Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: United States North America Fertilizer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Canada North America Fertilizer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Mexico North America Fertilizer Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Fertilizer Industry?

The projected CAGR is approximately 4.00%.

2. Which companies are prominent players in the North America Fertilizer Industry?

Key companies in the market include Wilbur-Ellis Company LLC, Haifa Group, CF Industries Holdings Inc, Koch Industries Inc, The Mosaic Company, The Andersons Inc, Yara International AS, Nutrien Ltd, ICL Group Ltd, Sociedad Quimica y Minera de Chile SA.

3. What are the main segments of the North America Fertilizer Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Awareness of Landscaping Maintenance; Technological Advancements.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Shortage of Skilled Labor; Wastage of High Amount of Water For Irrigating Lawns.

8. Can you provide examples of recent developments in the market?

January 2023: ICL has entered into a strategic partnership agreement with General Mills, in which it will be the supplier of strategic specialty phosphate solutions to General Mills. The long-term agreement will also focus on international expansion.October 2022: The Andersons entered into an agreement to acquire the assets of Mote Farm Service, Inc. to expand thier retail farm center network.August 2022: Koch invested around USD 30 million in the Kansas nitrogen plant to increase UAN production by 35,000 tons per year to meet growing UAN demand across western Kansas and eastern Colorado.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Fertilizer Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Fertilizer Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Fertilizer Industry?

To stay informed about further developments, trends, and reports in the North America Fertilizer Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence