Key Insights

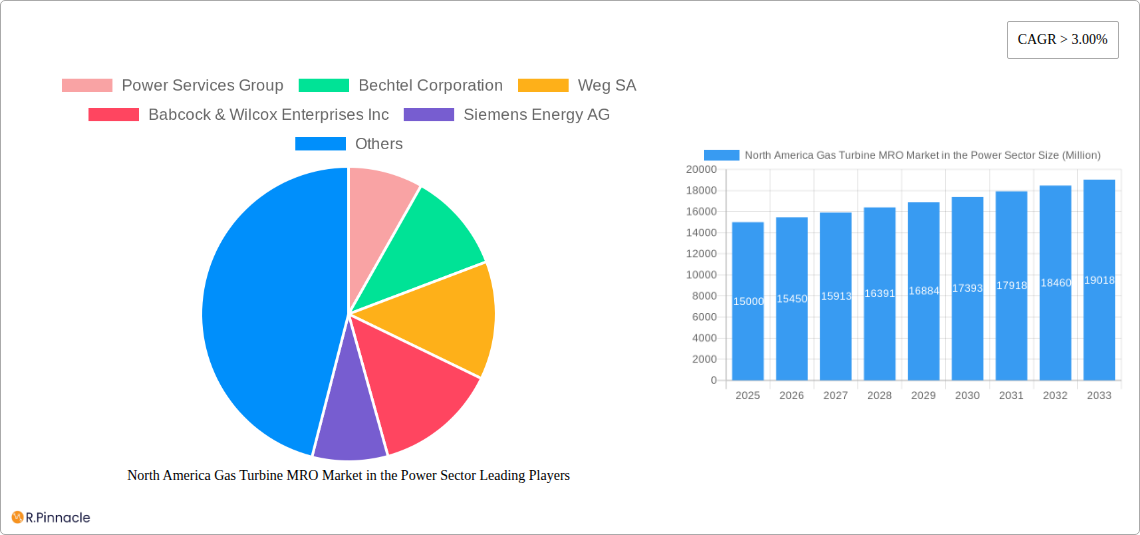

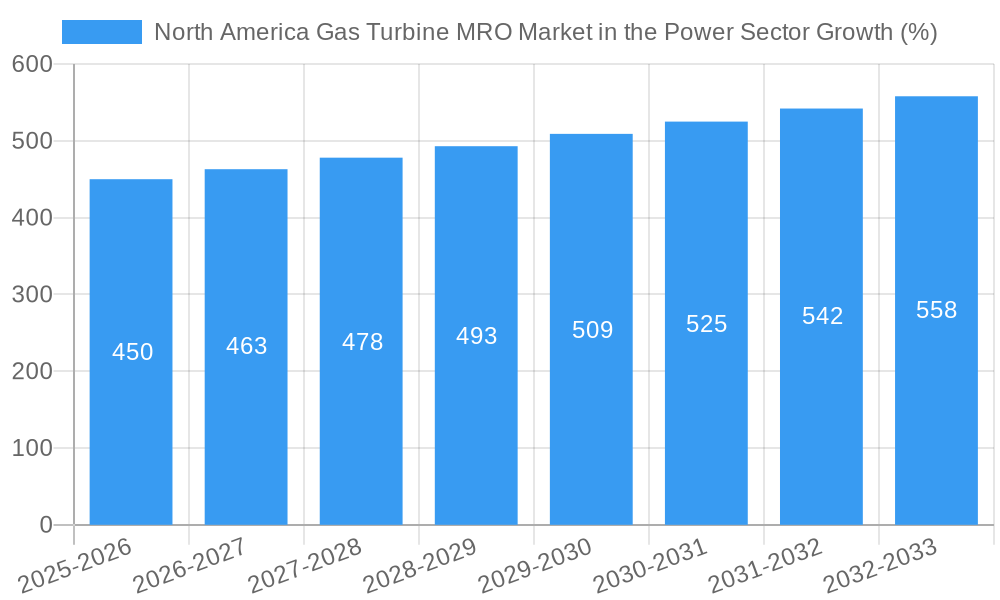

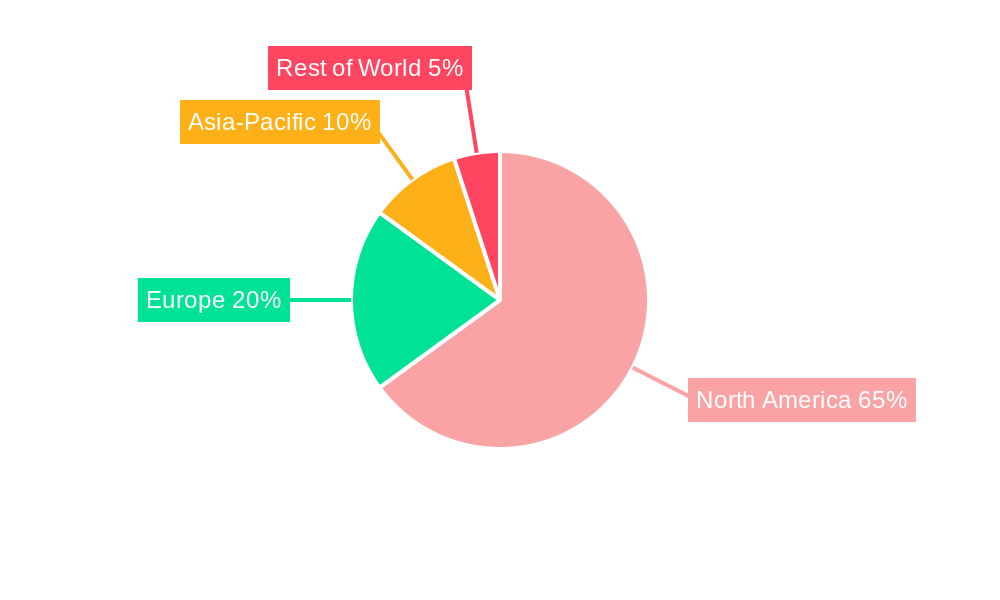

The North American gas turbine MRO (Maintenance, Repair, and Overhaul) market within the power sector is experiencing robust growth, driven by the aging infrastructure of existing power plants and the increasing demand for reliable and efficient power generation. A CAGR exceeding 3% from 2019 to 2024 suggests a continuously expanding market, projected to further expand significantly in the forecast period of 2025-2033. The market is segmented primarily by service type (maintenance, repair, and overhaul), with maintenance likely representing the largest share due to the ongoing operational needs of power plants. Key players such as Power Services Group, Bechtel Corporation, Siemens Energy AG, and General Electric Company are leveraging their expertise and extensive service networks to capture significant market shares. The increasing adoption of advanced technologies for predictive maintenance and digitalization within power generation is a key trend, promoting operational efficiency and reducing downtime, thereby fueling market expansion. However, fluctuating fuel prices and potential regulatory changes could present challenges to market growth. The North American market, particularly the United States, is expected to remain a dominant region due to its substantial power generation capacity and aging infrastructure. Canada and Mexico will also contribute to market growth, albeit at a potentially slower rate compared to the US, reflecting differences in power generation infrastructure and regulatory frameworks.

The robust growth in the North American gas turbine MRO market is further fueled by several factors. Government initiatives promoting renewable energy integration and modernization of existing power plants are creating significant opportunities for MRO services. The shift toward more efficient and environmentally friendly gas turbines is also driving demand for specialized MRO services. Furthermore, the increasing complexity of gas turbine technology necessitates specialized expertise and advanced maintenance techniques, creating a need for skilled technicians and specialized service providers. While competition is intense among established players, opportunities exist for smaller, specialized firms to focus on niche segments within the MRO market. This competition will likely keep prices relatively stable and incentivize continuous innovation and improvement of services. The long-term outlook for the North American gas turbine MRO market remains optimistic, anticipating steady growth throughout the forecast period driven by the continuous need for efficient and reliable power generation.

North America Gas Turbine MRO Market in the Power Sector: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America Gas Turbine MRO (Maintenance, Repair, and Overhaul) market within the power sector, covering the period from 2019 to 2033. It offers valuable insights into market dynamics, key players, growth drivers, and future opportunities, empowering industry professionals to make informed strategic decisions. The report uses 2025 as its base and estimated year, with a forecast period spanning 2025-2033 and a historical period covering 2019-2024. The total market size is predicted to reach xx Million by 2033.

North America Gas Turbine MRO Market in the Power Sector Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory influences shaping the North American gas turbine MRO market. The market is characterized by a moderate level of concentration, with several major players holding significant market share. Key players such as General Electric Company, Siemens Energy AG, and Mitsubishi Heavy Industries Ltd. compete based on technological advancements, service capabilities, and global reach.

- Market Concentration: The market exhibits a moderately consolidated structure with the top five players holding an estimated xx% market share in 2025. This share is projected to slightly decrease to xx% by 2033 due to increased competition from smaller, specialized MRO providers.

- Innovation Drivers: Technological advancements in gas turbine design, predictive maintenance technologies, and digitalization are key innovation drivers. The increasing adoption of digital twins and AI-powered diagnostics is enhancing efficiency and reducing downtime.

- Regulatory Framework: Environmental regulations and emission standards are significantly influencing the market, driving demand for cleaner and more efficient gas turbine maintenance and upgrades. Stringent safety regulations further influence MRO service delivery.

- Product Substitutes: The primary substitute for gas turbine MRO services is the complete replacement of aging turbines with newer, more efficient models. However, the cost-effectiveness of MRO often makes it a preferred choice for extending asset life.

- End-User Demographics: The primary end-users are power generation companies, independent power producers (IPPs), and utility companies. The market is segmented by turbine type, power output, and geographic location.

- M&A Activities: The North American gas turbine MRO market has witnessed several mergers and acquisitions in recent years. While specific deal values are not publicly available for all transactions, the total value of M&A activities within this period is estimated at xx Million.

North America Gas Turbine MRO Market in the Power Sector Market Dynamics & Trends

The North America gas turbine MRO market is experiencing robust growth, driven by factors such as the increasing age of the existing gas turbine fleet, the need for improved operational efficiency, and stringent environmental regulations. The market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration of advanced MRO services, such as predictive maintenance, is increasing, driven by the advantages of reduced downtime and increased operational life. The rise of digitalization and the Industrial Internet of Things (IIoT) is transforming the sector by enabling remote diagnostics and proactive maintenance. Competitive dynamics are intense, with companies focusing on innovation, service diversification, and strategic partnerships to maintain a competitive edge. The market is influenced by fluctuations in energy prices and government policies.

Dominant Regions & Segments in North America Gas Turbine MRO Market in the Power Sector

The report highlights the dominant regions and segments within the North American Gas Turbine MRO market. While specific data is unavailable to identify the single leading region or country, the analysis suggests that the Northeast and Southern US regions are likely to be leading contributors, driven by high power plant concentrations and aging infrastructure. The Southwest region shows significant growth potential.

- Key Drivers for Dominant Regions:

- High concentration of existing gas turbine power plants: Existing infrastructure necessitates robust MRO services.

- Government initiatives promoting renewable energy integration: While seemingly counterintuitive, integrating renewables requires supporting gas turbines for peak demand and grid stability, leading to MRO needs.

- Favorable regulatory frameworks: Supportive policies can accelerate adoption of advanced MRO technologies.

Service Type Dominance: The Overhaul segment is expected to hold the largest market share due to the higher value and complexity of this service. However, Maintenance and Repair segments are also expected to exhibit significant growth, fueled by the increasing need for regular upkeep and quick turnaround times for minor issues.

North America Gas Turbine MRO Market in the Power Sector Product Innovations

Recent innovations in the gas turbine MRO market emphasize predictive maintenance using advanced data analytics and remote diagnostics. Companies are investing in digital solutions to improve efficiency, reduce downtime, and optimize maintenance schedules. The integration of additive manufacturing (3D printing) is also gaining traction for creating customized parts, accelerating repair times and reducing lead times for components. These advancements offer competitive advantages by enhancing operational efficiency and providing improved customer service.

Report Scope & Segmentation Analysis

This report segments the North America Gas Turbine MRO market based on service type: Maintenance, Repair, and Overhaul.

- Maintenance: This segment focuses on routine inspections, lubrication, and cleaning to prevent equipment failures. The market size for maintenance services in 2025 is estimated at xx Million, with a projected CAGR of xx% from 2025 to 2033.

- Repair: This segment covers the restoration of gas turbine components that have failed or are nearing the end of their functional lifespan. The 2025 market size for repair is projected to be xx Million, with anticipated CAGR of xx% during the forecast period.

- Overhaul: This segment involves a comprehensive inspection and refurbishment of gas turbines, often extending their operational lifespan significantly. The 2025 market value of overhaul services is estimated at xx Million, with a projected CAGR of xx% from 2025 to 2033.

The competitive dynamics vary across these segments, with some players specializing in specific areas.

Key Drivers of North America Gas Turbine MRO Market in the Power Sector Growth

The growth of the North American gas turbine MRO market is propelled by several key factors:

- Aging Gas Turbine Fleet: A large portion of gas turbines in the region are nearing the end of their design life, increasing the demand for MRO services.

- Focus on Operational Efficiency: Power generation companies prioritize optimizing their operational efficiency and reducing downtime.

- Stringent Environmental Regulations: Stringent emission standards necessitate regular maintenance and upgrades to comply with regulatory requirements.

- Technological Advancements: The development of advanced MRO technologies such as predictive maintenance and digital solutions further drives market growth.

Challenges in the North America Gas Turbine MRO Market in the Power Sector Sector

Despite the growth potential, the market faces several challenges:

- Supply Chain Disruptions: Global supply chain complexities can impact the availability of spare parts and skilled labor.

- High Capital Expenditures: Investments in advanced MRO technologies and skilled workforce training can be substantial.

- Intense Competition: The market is characterized by fierce competition among various MRO providers. Price pressure can impact profitability.

Emerging Opportunities in North America Gas Turbine MRO Market in the Power Sector

Several emerging trends present significant opportunities:

- Predictive Maintenance: Growing adoption of predictive maintenance technologies offers opportunities for increased efficiency and reduced operational costs.

- Digitalization: The integration of digital technologies allows for remote monitoring, diagnostics, and streamlined maintenance processes.

- Focus on Sustainability: Increased demand for sustainable solutions drives the need for MRO services that improve the environmental performance of gas turbines.

Leading Players in the North America Gas Turbine MRO Market in the Power Sector Market

- Power Services Group

- Bechtel Corporation

- Weg SA

- Babcock & Wilcox Enterprises Inc

- Siemens Energy AG

- Sulzer AG

- General Electric Company

- Flour Corporation

- Mitsubishi Heavy Industries Ltd

Key Developments in North America Gas Turbine MRO Market in the Power Sector Industry

- August 2022: Duke Energy's Lincoln Combustion Turbine Station, powered by Siemens Energy's SGT6-9000HL (60Hz) turbine, achieved Guinness World Record certification as the "highest powerful simple-cycle gas power plant" with an output of 410.9 megawatts. This showcases technological advancements driving demand for high-performance MRO services.

- May 2022: The first two Mitsubishi Power M501JAC gas turbines manufactured in North America commenced commercial operation at J-POWER USA's Jackson Generation Project. This highlights growing domestic manufacturing capabilities, potentially influencing the MRO market landscape.

Future Outlook for North America Gas Turbine MRO Market in the Power Sector Market

The North American gas turbine MRO market is poised for continued growth, driven by the factors outlined above. The increasing adoption of advanced technologies, focus on operational efficiency, and stringent environmental regulations will create significant opportunities for MRO providers. Strategic partnerships, investments in digitalization, and a skilled workforce will be crucial for success in this evolving market. The market is expected to experience sustained growth, driven by the need for extending the lifespan of existing assets and technological advancements in gas turbine maintenance and repair.

North America Gas Turbine MRO Market in the Power Sector Segmentation

-

1. Service Type

- 1.1. Maintenance

- 1.2. Repair

- 1.3. Overhaul

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Rest of North America

North America Gas Turbine MRO Market in the Power Sector Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Gas Turbine MRO Market in the Power Sector REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Supportive Government Policies and Incentives4.; Environmental Concerns

- 3.3. Market Restrains

- 3.3.1. 4.; Fossil Fuel Subsidies

- 3.4. Market Trends

- 3.4.1. Maintenance Service Type Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Gas Turbine MRO Market in the Power Sector Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Maintenance

- 5.1.2. Repair

- 5.1.3. Overhaul

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Rest of North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. United States North America Gas Turbine MRO Market in the Power Sector Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Maintenance

- 6.1.2. Repair

- 6.1.3. Overhaul

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Canada North America Gas Turbine MRO Market in the Power Sector Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Maintenance

- 7.1.2. Repair

- 7.1.3. Overhaul

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Rest of North America North America Gas Turbine MRO Market in the Power Sector Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Maintenance

- 8.1.2. Repair

- 8.1.3. Overhaul

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. United States North America Gas Turbine MRO Market in the Power Sector Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Gas Turbine MRO Market in the Power Sector Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Gas Turbine MRO Market in the Power Sector Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Gas Turbine MRO Market in the Power Sector Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Power Services Group

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Bechtel Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Weg SA

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Babcock & Wilcox Enterprises Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Siemens Energy AG

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Sulzer AG

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 General Electric Company

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Flour Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Mitsubishi Heavy Industries Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 Power Services Group

List of Figures

- Figure 1: North America Gas Turbine MRO Market in the Power Sector Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Gas Turbine MRO Market in the Power Sector Share (%) by Company 2024

List of Tables

- Table 1: North America Gas Turbine MRO Market in the Power Sector Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Gas Turbine MRO Market in the Power Sector Revenue Million Forecast, by Service Type 2019 & 2032

- Table 3: North America Gas Turbine MRO Market in the Power Sector Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: North America Gas Turbine MRO Market in the Power Sector Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Gas Turbine MRO Market in the Power Sector Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Gas Turbine MRO Market in the Power Sector Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Gas Turbine MRO Market in the Power Sector Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Gas Turbine MRO Market in the Power Sector Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Gas Turbine MRO Market in the Power Sector Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Gas Turbine MRO Market in the Power Sector Revenue Million Forecast, by Service Type 2019 & 2032

- Table 11: North America Gas Turbine MRO Market in the Power Sector Revenue Million Forecast, by Geography 2019 & 2032

- Table 12: North America Gas Turbine MRO Market in the Power Sector Revenue Million Forecast, by Country 2019 & 2032

- Table 13: North America Gas Turbine MRO Market in the Power Sector Revenue Million Forecast, by Service Type 2019 & 2032

- Table 14: North America Gas Turbine MRO Market in the Power Sector Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: North America Gas Turbine MRO Market in the Power Sector Revenue Million Forecast, by Country 2019 & 2032

- Table 16: North America Gas Turbine MRO Market in the Power Sector Revenue Million Forecast, by Service Type 2019 & 2032

- Table 17: North America Gas Turbine MRO Market in the Power Sector Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: North America Gas Turbine MRO Market in the Power Sector Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Gas Turbine MRO Market in the Power Sector?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the North America Gas Turbine MRO Market in the Power Sector?

Key companies in the market include Power Services Group, Bechtel Corporation, Weg SA, Babcock & Wilcox Enterprises Inc, Siemens Energy AG, Sulzer AG, General Electric Company, Flour Corporation, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the North America Gas Turbine MRO Market in the Power Sector?

The market segments include Service Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Supportive Government Policies and Incentives4.; Environmental Concerns.

6. What are the notable trends driving market growth?

Maintenance Service Type Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Fossil Fuel Subsidies.

8. Can you provide examples of recent developments in the market?

August 2022: Duke Energy's Lincoln Combustion Turbine Station, powered by Siemens Energy's SGT6-9000HL (60Hz) turbine, has been certified as the "highest powerful simple-cycle gas power plant" with an output of 410.9 megawatts by Guinness World Records. Siemens Energy installed and is now testing its SGT6-9000HL turbine at Duke Energy's Lincoln Combustion Turbine Station near Denver, N.C., some 25 miles north of Charlotte, N.C., as part of an innovative partnership.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Gas Turbine MRO Market in the Power Sector," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Gas Turbine MRO Market in the Power Sector report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Gas Turbine MRO Market in the Power Sector?

To stay informed about further developments, trends, and reports in the North America Gas Turbine MRO Market in the Power Sector, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence