Key Insights

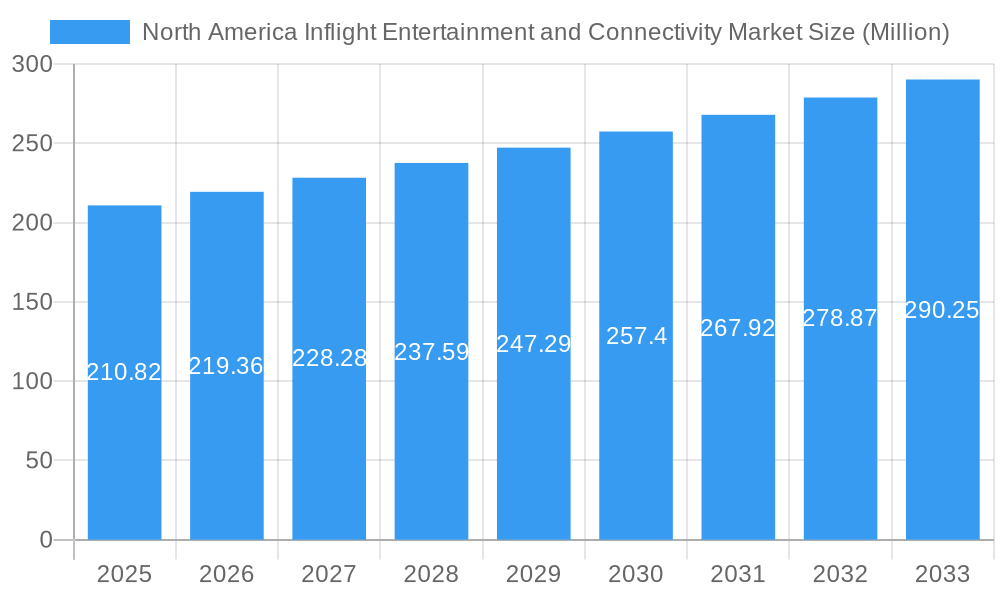

The North American inflight entertainment and connectivity (IFEC) market, valued at $210.82 million in 2025, is projected to experience robust growth, driven by several key factors. The increasing demand for high-speed internet access and diverse entertainment options onboard aircraft is a primary driver. Passengers are increasingly expecting seamless connectivity during flights, mirroring their digital lifestyles on the ground. This fuels the adoption of advanced technologies like satellite-based broadband services and improved Wi-Fi systems, boosting the market for both hardware and connectivity solutions. Furthermore, airlines are recognizing the competitive advantage of offering premium IFEC as a differentiator, particularly in first and business classes, leading to investments in sophisticated systems. The retrofit market segment is anticipated to show considerable growth as airlines upgrade older fleets to incorporate modern IFEC technologies. While initial investment costs can be high, the long-term return on investment is substantial, given the enhanced passenger experience and potential for ancillary revenue generation. This trend extends across all classes of service, though the premium segments will likely see faster adoption rates for the latest technologies.

North America Inflight Entertainment and Connectivity Market Market Size (In Million)

However, the market also faces challenges. Integration complexities, high initial installation and maintenance costs, and the need for continuous technological upgrades can present restraints to market expansion. Regulatory hurdles and the need for consistent high-bandwidth connectivity across varying geographical regions also pose significant obstacles. Competition among various IFEC providers is intense, further influencing market dynamics. Nevertheless, the ongoing advancements in technology, coupled with the increasing passenger demand for improved in-flight experiences, are expected to outweigh these challenges, fostering steady growth throughout the forecast period (2025-2033). The continued growth of air travel, particularly in North America, will further bolster the market's trajectory. The focus is shifting towards personalized entertainment options, increased content diversity, and enhanced user interfaces, creating opportunities for innovative providers to capture significant market share.

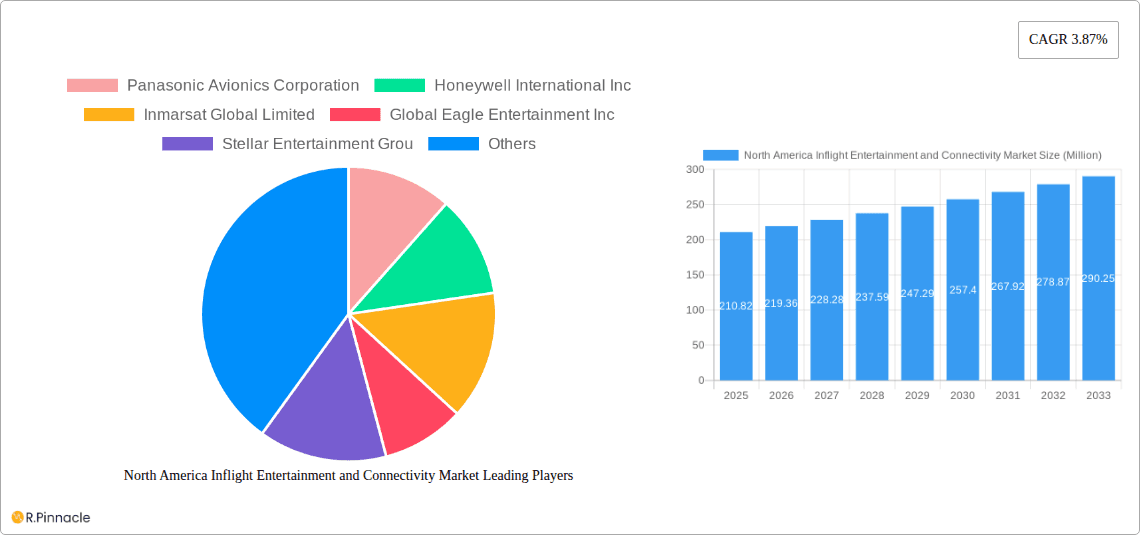

North America Inflight Entertainment and Connectivity Market Company Market Share

North America Inflight Entertainment and Connectivity Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America inflight entertainment and connectivity market, offering valuable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033 (Study Period), with a base year of 2025 and a forecast period of 2025-2033, this report unveils the market's structure, dynamics, and future outlook. The market is segmented by product (Hardware, Content, Connectivity), fit (Line-fit, Retrofit), and class (First Class, Business Class, Economy Class). Key players analyzed include Panasonic Avionics Corporation, Honeywell International Inc, Inmarsat Global Limited, Global Eagle Entertainment Inc, Stellar Entertainment Group, Safran SA, Thales Group, Lufthansa Systems, Gogo Inc, Burrana, and ViaSat Inc. The report's estimated market size in 2025 is xx Million.

North America Inflight Entertainment and Connectivity Market Structure & Innovation Trends

This section analyzes the market's competitive landscape, highlighting key players' market share and M&A activities. The xx Million market shows a moderately concentrated structure, with the top five players holding approximately xx% of the market share in 2025. Innovation is driven by advancements in high-speed broadband technology, 4K display systems, and personalized content delivery. Regulatory frameworks, particularly those concerning data privacy and in-flight connectivity standards, significantly impact market dynamics. The increasing demand for high-quality entertainment and connectivity options fuels the market, creating opportunities for product differentiation and mergers and acquisitions (M&A).

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Innovation Drivers: High-speed broadband, 4K displays, personalized content.

- Regulatory Frameworks: Data privacy, in-flight connectivity standards.

- M&A Activities: A significant number of M&A deals (xx) were recorded between 2019 and 2024, with a total value of approximately xx Million. Examples include partnerships formed for content distribution and technological integration.

North America Inflight Entertainment and Connectivity Market Dynamics & Trends

The North America inflight entertainment and connectivity market exhibits strong growth, driven by factors such as rising air passenger traffic, increasing demand for high-quality in-flight entertainment, and advancements in connectivity technologies. The market is witnessing a significant shift towards personalized and on-demand content, driven by consumer preferences. Technological disruptions, including the adoption of 5G and satellite broadband, are further accelerating market growth. Competitive dynamics are characterized by strategic partnerships, technological innovation, and product differentiation. The CAGR is projected to be xx% during the forecast period (2025-2033), with market penetration expected to reach xx% by 2033.

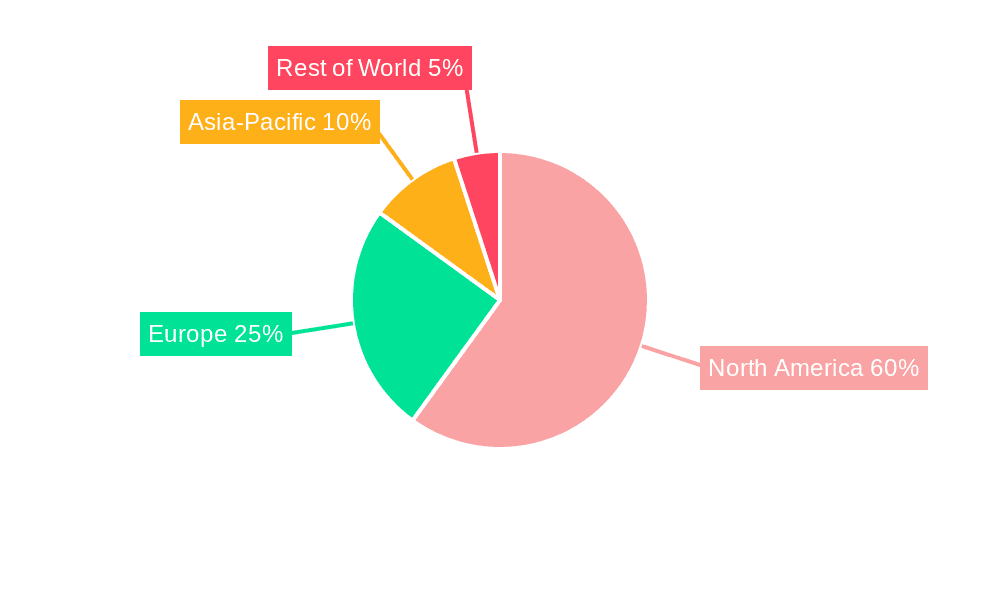

Dominant Regions & Segments in North America Inflight Entertainment and Connectivity Market

The report identifies the leading region/country and segment within the North American market. While specific data requires detailed analysis within the full report, the key drivers for dominance could be analyzed in the following manner:

Leading Region/Country: Analysis will reveal the most dominant region, potentially driven by factors such as high air passenger traffic, robust airline industry, and government support for infrastructure development.

Leading Product Segment: The Hardware segment is likely to be prominent, followed by Connectivity. Specific drivers include technological advancements and increasing demand for high-speed internet access on board.

Leading Fit Segment: The Line-fit segment will likely hold a larger market share compared to the Retrofit segment due to its integration during aircraft manufacturing.

Leading Class Segment: The First and Business Class segments will be more dominant due to the higher spending capacity of passengers in these classes, leading to higher adoption of premium features and services.

Key Drivers: Factors like economic policies promoting air travel, favorable government regulations, and substantial investments in airport infrastructure all contribute to the region's/segment's dominance.

North America Inflight Entertainment and Connectivity Market Product Innovations

Recent product developments focus on enhancing passenger experience through advanced technologies. This includes the integration of 4K displays, high-speed internet access, and personalized content delivery systems. The introduction of features such as improved user interfaces and on-demand streaming services contributes to the market's competitive advantage. Technological advancements, like improved satellite communication and advancements in in-flight WiFi solutions, are shaping future innovations. Market fit is driven by airlines’ efforts to improve passenger satisfaction and enhance their brand image, thereby making such products more attractive.

Report Scope & Segmentation Analysis

This report comprehensively segments the North America inflight entertainment and connectivity market across multiple parameters.

Product: Hardware (displays, seatback systems, etc.), Content (movies, TV shows, games), Connectivity (Wi-Fi, satellite communication). Each segment exhibits unique growth projections and competitive dynamics based on technological advancements and consumer preferences. Growth is largely dependent on technological innovation and overall passenger numbers.

Fit: Line-fit (integrated during aircraft manufacturing), Retrofit (installed in existing aircraft). Market sizes and competitive dynamics vary based on the type of aircraft and airline fleet strategies.

Class: First Class, Business Class, Economy Class. Different classes exhibit varying levels of technological adoption and feature availability.

Key Drivers of North America Inflight Entertainment and Connectivity Market Growth

Several factors are driving the market's growth. Firstly, the rising number of air passengers fuels the demand for better in-flight entertainment. Secondly, technological advancements, particularly in high-speed internet and display technologies, significantly impact the quality of the offered services. Finally, airlines' emphasis on enhancing the overall passenger experience through better in-flight amenities is a crucial driving force.

Challenges in the North America Inflight Entertainment and Connectivity Market Sector

The market faces several challenges. High infrastructure costs for installing and maintaining in-flight connectivity systems pose a significant barrier. Supply chain disruptions, particularly for specialized components, can impact production and delivery timelines. Intense competition among providers, including both established players and new entrants, further increases market pressures. These challenges contribute to price fluctuations and margin pressures.

Emerging Opportunities in North America Inflight Entertainment and Connectivity Market

Several opportunities exist for market expansion. The growing adoption of personalized and on-demand content services opens new avenues for growth. The emergence of new technologies such as 5G and improved satellite broadband solutions presents opportunities for enhanced connectivity solutions. Furthermore, the expanding focus on providing enhanced passenger experiences across all classes will drive growth in the market.

Leading Players in the North America Inflight Entertainment and Connectivity Market Market

- Panasonic Avionics Corporation

- Honeywell International Inc

- Inmarsat Global Limited

- Global Eagle Entertainment Inc

- Stellar Entertainment Group

- Safran SA

- Thales Group

- Lufthansa Systems

- Gogo Inc

- Burrana

- ViaSat Inc

Key Developments in North America Inflight Entertainment and Connectivity Market Industry

January 2021: Panasonic Avionics Corporation and IMG partnered to deliver live sports content to airlines via Sport 24 and Sport 24 Extra channels. This significantly enhanced the in-flight entertainment offerings.

June 2022: Thales upgraded its Avant Up in-flight entertainment system with Optiq 4K QLED HDR display and Pulse charging unit, improving the passenger experience and creating a competitive advantage.

Future Outlook for North America Inflight Entertainment and Connectivity Market Market

The North America inflight entertainment and connectivity market is poised for significant growth, driven by continuous technological advancements, rising passenger numbers, and airlines' focus on enhancing passenger experience. Strategic partnerships, investments in innovative technologies, and expansion into new markets will shape the industry's future. The increasing demand for high-speed internet access and personalized entertainment options will further accelerate market growth in the coming years.

North America Inflight Entertainment and Connectivity Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

North America Inflight Entertainment and Connectivity Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Inflight Entertainment and Connectivity Market Regional Market Share

Geographic Coverage of North America Inflight Entertainment and Connectivity Market

North America Inflight Entertainment and Connectivity Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Connectivity Segment Dominates the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Inflight Entertainment and Connectivity Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Panasonic Avionics Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Honeywell International Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Inmarsat Global Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Global Eagle Entertainment Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Stellar Entertainment Grou

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Safran SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Thales Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Lufthansa Systems

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Gogo Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Burrana

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 ViaSat Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Panasonic Avionics Corporation

List of Figures

- Figure 1: North America Inflight Entertainment and Connectivity Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Inflight Entertainment and Connectivity Market Share (%) by Company 2025

List of Tables

- Table 1: North America Inflight Entertainment and Connectivity Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: North America Inflight Entertainment and Connectivity Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: North America Inflight Entertainment and Connectivity Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: North America Inflight Entertainment and Connectivity Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: North America Inflight Entertainment and Connectivity Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: North America Inflight Entertainment and Connectivity Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: North America Inflight Entertainment and Connectivity Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: North America Inflight Entertainment and Connectivity Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: North America Inflight Entertainment and Connectivity Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: North America Inflight Entertainment and Connectivity Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: North America Inflight Entertainment and Connectivity Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: North America Inflight Entertainment and Connectivity Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States North America Inflight Entertainment and Connectivity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada North America Inflight Entertainment and Connectivity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico North America Inflight Entertainment and Connectivity Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Inflight Entertainment and Connectivity Market?

The projected CAGR is approximately 3.87%.

2. Which companies are prominent players in the North America Inflight Entertainment and Connectivity Market?

Key companies in the market include Panasonic Avionics Corporation, Honeywell International Inc, Inmarsat Global Limited, Global Eagle Entertainment Inc, Stellar Entertainment Grou, Safran SA, Thales Group, Lufthansa Systems, Gogo Inc, Burrana, ViaSat Inc.

3. What are the main segments of the North America Inflight Entertainment and Connectivity Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 210.82 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Connectivity Segment Dominates the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2021, Panasonic Avionics Corporation and IMG extended and expanded their long-standing relationship to deliver live sports content to the world's leading airlines. The companies signed an agreement giving Panasonic Avionics all international in-flight rights to Sport 24 and Sport 24 Extra, the world's only global live sports channels. Airlines that offer Sport 24 and Sport 24 Extra are likely to be able to connect their passengers to unmissable live sporting moments from around the world with live content available in real-time.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Inflight Entertainment and Connectivity Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Inflight Entertainment and Connectivity Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Inflight Entertainment and Connectivity Market?

To stay informed about further developments, trends, and reports in the North America Inflight Entertainment and Connectivity Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence