Key Insights

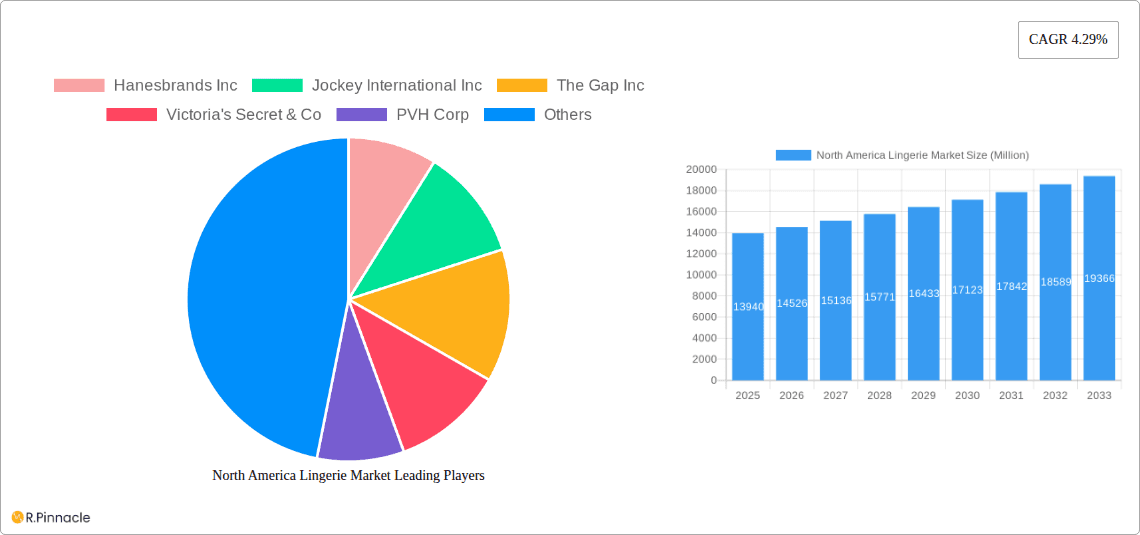

The North American lingerie market, valued at $13.94 billion in 2025, is projected to experience steady growth, driven by several key factors. Increasing disposable incomes, particularly among millennial and Gen Z consumers, are fueling demand for premium and comfortable lingerie. The rise of body positivity movements and a shift towards inclusivity in sizing and styles are also contributing to market expansion. E-commerce platforms offer convenient access to a wider variety of brands and styles, further boosting market growth. The market is segmented by product type (brassieres, briefs, and other products) and distribution channel (supermarkets/hypermarkets, specialty stores, and online retail stores). Brassieres currently hold the largest market share, reflecting their essential role in women's wardrobes. Online retail is experiencing significant growth, surpassing traditional brick-and-mortar channels in recent years, fueled by enhanced online shopping experiences and targeted advertising. However, the market also faces challenges, including economic fluctuations impacting consumer spending and increased competition from both established and emerging brands. Successful players are focusing on innovation, brand building, and strategic partnerships to maintain their market position.

North America Lingerie Market Market Size (In Billion)

Despite these restraints, the projected Compound Annual Growth Rate (CAGR) of 4.29% from 2025 to 2033 suggests a positive outlook for the North American lingerie market. This growth is expected to be fueled by the continued expansion of the online retail segment and the growing demand for sustainable and ethically sourced lingerie. Brand loyalty remains a key factor, with established players like Hanesbrands, Jockey, and Victoria's Secret continuing to hold significant market share. However, smaller, niche brands focusing on specific needs (e.g., sustainable materials, inclusive sizing) are also gaining traction. Future growth will depend on successfully adapting to evolving consumer preferences, incorporating technological advancements in product design and marketing, and navigating economic uncertainty. The market is expected to see a continued shift towards personalized experiences and customized products, catering to the diverse needs and preferences of the modern consumer.

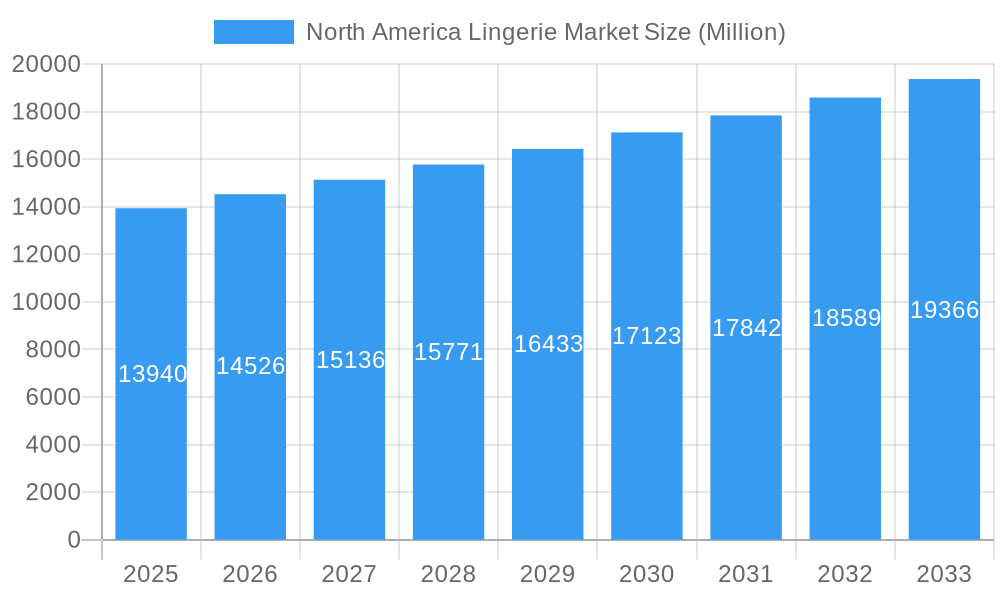

North America Lingerie Market Company Market Share

North America Lingerie Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America lingerie market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market trends, competitive dynamics, and future growth opportunities within this dynamic sector.

North America Lingerie Market Structure & Innovation Trends

The North American lingerie market is characterized by a mix of established players and emerging brands, resulting in a moderately concentrated market structure. Key players like Hanesbrands Inc, Jockey International Inc, The Gap Inc, Victoria's Secret & Co, PVH Corp, The Natori Company Incorporated, Fullbeauty Brands, AEO Inc, Nike Inc, and La Perla compete across various product segments and distribution channels. Market share is constantly shifting due to innovation and changing consumer preferences. While precise market share figures for each company are proprietary, Victoria’s Secret & Co and Hanesbrands Inc are estimated to hold significant portions of the market in 2025, accounting for xx Million and xx Million in revenue respectively.

Innovation in the lingerie market is driven by several factors:

- Technological advancements: AI-powered fitting technologies (as seen with DOUBL’s innovative bra) and personalized online shopping experiences (Victoria’s Secret & Co.’s partnership with Google Cloud) are reshaping the customer journey.

- Sustainability concerns: Growing consumer demand for eco-friendly and ethically sourced materials is pushing brands to adopt more sustainable practices.

- Inclusivity: A focus on body positivity and inclusivity is leading to a wider range of sizes, styles, and designs catering to diverse customer needs.

Mergers and acquisitions (M&A) activity in the industry remains moderate, with deal values ranging from xx Million to xx Million in recent years, mostly driven by strategies for expanding product portfolios or distribution channels. Regulatory frameworks, while not overly restrictive, focus primarily on labeling, safety, and fair advertising practices. The primary product substitutes are loungewear and casual clothing which are gaining considerable traction among younger consumers.

North America Lingerie Market Market Dynamics & Trends

The North America lingerie market is experiencing dynamic growth, driven by several key factors:

The market is witnessing a strong CAGR (Compound Annual Growth Rate) of xx% during the forecast period (2025-2033), fueled by increasing disposable incomes, changing fashion trends, and a growing awareness of body positivity and self-care. This growth is particularly evident in online retail channels, which are rapidly gaining market penetration.

Technological disruptions are transforming the industry, with AI-driven personalized experiences and enhanced e-commerce platforms improving customer engagement and satisfaction. Consumer preferences are shifting towards comfort, functionality, and sustainability, with a strong demand for seamless, supportive bras and sustainable materials. Competitive dynamics are intensifying, with established brands facing increased pressure from smaller, innovative players who are focusing on niche markets and direct-to-consumer models. The market penetration of online retail channels is projected to surpass xx% by 2033, significantly impacting the traditional retail landscape.

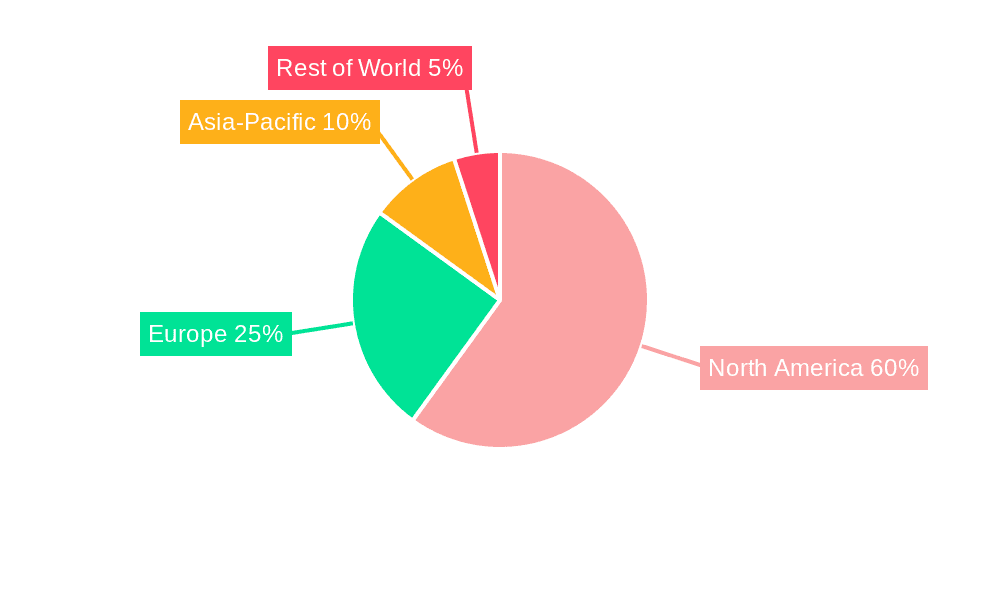

Dominant Regions & Segments in North America Lingerie Market

The North American lingerie market shows regional variations, with the US dominating overall sales. This dominance can be attributed to:

- Strong consumer spending: Higher disposable incomes and a preference for fashion-forward apparel drive demand.

- Mature retail infrastructure: Robust online and brick-and-mortar retail networks ensure wide product availability.

- Favorable economic conditions: Relatively stable economic conditions enhance purchasing power.

By Product Type:

- Brassiere: Remains the largest segment due to its essential nature and broad range of styles and functionalities.

- Briefs: A consistent performer, driven by everyday usage and diverse offerings in material and design.

- Other Product Types: This segment, encompassing shapewear, sleepwear, and other lingerie items, exhibits moderate growth fueled by evolving fashion trends and increased consumer awareness.

By Distribution Channel:

- Online Retail Stores: The fastest-growing segment, driven by convenience, wider selection, and targeted marketing.

- Specialty Stores: Maintain a strong presence, offering expert advice and personalized service.

- Supermarkets/Hypermarkets: A smaller segment catering to price-sensitive customers.

- Other Distribution Channels: Includes direct-to-consumer brands and smaller boutiques that provide unique selections.

North America Lingerie Market Product Innovations

Recent product innovations in the North American lingerie market reflect a trend towards personalization, comfort, and sustainability. The development of AI-powered bra fitting (DOUBL) exemplifies this trend, offering a convenient and accurate way to determine the correct bra size. Similarly, partnerships like Victoria's Secret & Co. and Google Cloud highlight the use of AI to enhance the online shopping experience, delivering more personalized and inclusive offerings. These innovations aim to better meet diverse customer preferences and improve the overall shopping experience. The increased availability of sustainable materials, such as organic cotton and recycled fabrics, is also improving the appeal of more environmentally friendly products.

Report Scope & Segmentation Analysis

This report segments the North America lingerie market by product type (brassieres, briefs, other product types) and distribution channel (supermarkets/hypermarkets, specialty stores, online retail stores, other distribution channels). Each segment’s growth projections, market sizes, and competitive dynamics are analyzed in detail. For example, the online retail segment is projected to witness the highest CAGR, driven by increased digital adoption and e-commerce penetration. The brassiere segment consistently holds the largest market share due to its necessity, while the ‘other product types’ segment presents opportunities for diversification and innovation. Competitive dynamics are shaped by the balance between established brands and newer entrants innovating with technology and sustainable practices.

Key Drivers of North America Lingerie Market Growth

Several factors drive growth in the North America lingerie market:

- Rising disposable incomes: Increased purchasing power allows consumers to spend more on apparel, including lingerie.

- Technological advancements: AI-powered fitting and personalized shopping experiences enhance customer satisfaction and drive sales.

- Changing fashion trends: Evolving styles and designs maintain consumer interest and stimulate demand.

- Increased focus on body positivity and inclusivity: Brands are expanding their product lines to cater to a more diverse customer base.

Challenges in the North America Lingerie Market Sector

Despite its growth, the North America lingerie market faces several challenges:

- Intense competition: Established brands face pressure from both smaller, niche players and major international competitors, impacting profitability.

- Supply chain disruptions: Global events and economic volatility can create challenges in sourcing materials and manufacturing.

- Changing consumer preferences: Keeping up with evolving trends and providing value-added features while maintaining affordability remains critical.

Emerging Opportunities in North America Lingerie Market

The North America lingerie market presents significant opportunities:

- Expansion into niche markets: Catering to underserved segments (e.g., plus-size, sustainable, specialized sports bras) presents untapped potential.

- Leveraging technology: Integrating AI, AR/VR, and personalized recommendations can elevate the customer experience.

- Sustainable materials: Offering eco-friendly and ethically sourced products aligns with growing consumer demand.

Leading Players in the North America Lingerie Market Market

- Hanesbrands Inc

- Jockey International Inc

- The Gap Inc

- Victoria's Secret & Co

- PVH Corp

- The Natori Company Incorporated

- Fullbeauty Brands

- AEO Inc

- Nike Inc

- La Perla

Key Developments in North America Lingerie Market Industry

- January 2024: Victoria's Secret & Co. and Google Cloud announced a strategic, multi-year partnership to leverage AI for personalized shopping experiences.

- March 2024: ThirdLove partnered with Neiman Marcus to expand its reach into the luxury market.

- March 2024: DOUBL launched an AI-fitted bra, revolutionizing the bra-fitting process through smartphone technology.

Future Outlook for North America Lingerie Market Market

The North America lingerie market is poised for continued growth, driven by technological innovation, changing consumer preferences, and a focus on sustainability. Strategic partnerships, product diversification, and investments in e-commerce will be crucial for brands to succeed in this dynamic market. The market's potential is significant, especially as new technologies and evolving consumer demands continue to reshape the industry landscape.

North America Lingerie Market Segmentation

-

1. Product Type

- 1.1. Brassiere

- 1.2. Briefs

- 1.3. Other Product Types

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Specialty Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Lingerie Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Lingerie Market Regional Market Share

Geographic Coverage of North America Lingerie Market

North America Lingerie Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.29% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Influence of Endorsements and Aggressive Marketing; Inclination Toward Healthy Lifestyle and Athleisure

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Influence of Endorsements and Aggressive Marketing

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Lingerie Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Brassiere

- 5.1.2. Briefs

- 5.1.3. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Specialty Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Lingerie Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Brassiere

- 6.1.2. Briefs

- 6.1.3. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Specialty Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Lingerie Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Brassiere

- 7.1.2. Briefs

- 7.1.3. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Specialty Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America Lingerie Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Brassiere

- 8.1.2. Briefs

- 8.1.3. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Specialty Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of North America North America Lingerie Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Brassiere

- 9.1.2. Briefs

- 9.1.3. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Specialty Stores

- 9.2.3. Online Retail Stores

- 9.2.4. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Hanesbrands Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Jockey International Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 The Gap Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Victoria's Secret & Co

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 PVH Corp

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 The Natori Company Incorporated

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Fullbeauty Brands *List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 AEO Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Nike Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 La Perla

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Hanesbrands Inc

List of Figures

- Figure 1: North America Lingerie Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Lingerie Market Share (%) by Company 2025

List of Tables

- Table 1: North America Lingerie Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: North America Lingerie Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: North America Lingerie Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: North America Lingerie Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Lingerie Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: North America Lingerie Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 7: North America Lingerie Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: North America Lingerie Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: North America Lingerie Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: North America Lingerie Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 11: North America Lingerie Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: North America Lingerie Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: North America Lingerie Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: North America Lingerie Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 15: North America Lingerie Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: North America Lingerie Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: North America Lingerie Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 18: North America Lingerie Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 19: North America Lingerie Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: North America Lingerie Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Lingerie Market?

The projected CAGR is approximately 4.29%.

2. Which companies are prominent players in the North America Lingerie Market?

Key companies in the market include Hanesbrands Inc, Jockey International Inc, The Gap Inc, Victoria's Secret & Co, PVH Corp, The Natori Company Incorporated, Fullbeauty Brands *List Not Exhaustive, AEO Inc, Nike Inc, La Perla.

3. What are the main segments of the North America Lingerie Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Influence of Endorsements and Aggressive Marketing; Inclination Toward Healthy Lifestyle and Athleisure.

6. What are the notable trends driving market growth?

Influence of Endorsements and Aggressive Marketing.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

March 2024: ThirdLove partnered with Neiman Marcus to expand its reach and gain access to luxury shoppers through the department store across America.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Lingerie Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Lingerie Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Lingerie Market?

To stay informed about further developments, trends, and reports in the North America Lingerie Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence