Key Insights

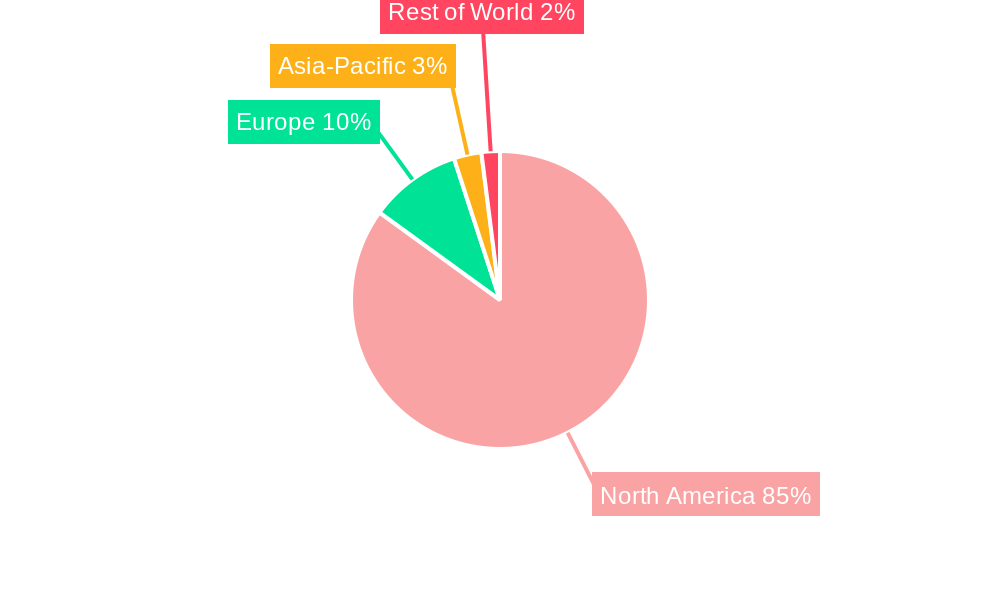

The North American modular construction industry, valued at $33.99 billion in 2025, is projected to experience robust growth, driven by several key factors. The increasing demand for faster construction timelines, particularly in the residential and commercial sectors, is a significant catalyst. Furthermore, the inherent cost-effectiveness and sustainability advantages of modular construction are attracting developers and builders seeking efficient and environmentally conscious solutions. Prefabrication's ability to mitigate labor shortages and material price fluctuations also contributes to its appeal. The market is segmented by building type (permanent modular, relocatable modular), sector (residential, commercial), and geography (United States, Canada, Mexico). The United States constitutes the largest market share within North America, followed by Canada and Mexico. While the specific breakdown of market share between these countries is unavailable, it is reasonable to assume the US holds a significantly larger portion given its overall economic size and construction activity.

Growth is expected to continue at a Compound Annual Growth Rate (CAGR) of 4.61% from 2025 to 2033. This sustained expansion will be fueled by technological advancements in modular design and manufacturing, leading to improved quality, efficiency, and customization options. However, challenges remain, including regulatory hurdles related to building codes and zoning regulations that may vary across different jurisdictions. Overcoming these regulatory obstacles and fostering wider public acceptance of modular construction are crucial for maximizing the industry's growth potential. Key players like Willscot Corporation, Vesta Modular, and Triumph Modular are shaping market dynamics through innovation and strategic expansions. The projected growth signifies a promising future for the North American modular construction industry, with potential for significant expansion across diverse sectors and geographic locations.

North America Modular Construction Industry Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America modular construction industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study covers the period 2019-2033, with a focus on the estimated year 2025 and a forecast period spanning 2025-2033. The report leverages extensive market research to deliver actionable intelligence on market size, growth drivers, challenges, and future opportunities. Market values are expressed in Millions.

North America Modular Construction Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape, encompassing market concentration, innovation drivers, regulatory frameworks, and M&A activities within the North American modular construction industry. The analysis reveals a moderately concentrated market with several key players vying for market share. While precise market share figures for individual companies fluctuate, some leading players like Willscot Corporation, Vesta Modular, and Triumph Modular Corporation consistently hold significant portions of the market. The total market value in 2025 is estimated at $XX Million.

- Market Concentration: The market exhibits moderate concentration, with a few dominant players and a significant number of smaller, specialized firms.

- Innovation Drivers: Technological advancements in prefabrication, sustainable materials, and digital design are key drivers of innovation. Government incentives for sustainable building practices further fuel this trend.

- Regulatory Frameworks: Building codes and regulations vary across North American jurisdictions, impacting design and construction processes. Harmonization efforts and increased focus on green building standards influence industry practices.

- Product Substitutes: Traditional construction methods remain a primary substitute. However, modular construction's speed, cost-effectiveness, and sustainability advantages are increasingly appealing to clients.

- End-User Demographics: The end-user base spans diverse sectors, including residential, commercial, and industrial, creating a diversified market with varying needs and preferences.

- M&A Activities: The industry has witnessed several mergers and acquisitions in recent years, with deal values ranging from $XX Million to $XX Million, reflecting consolidation and expansion strategies. These activities often involve companies aiming to increase their geographic reach and service offerings.

North America Modular Construction Industry Market Dynamics & Trends

The North American modular construction market is experiencing robust growth, driven by several key factors. Increasing urbanization and the demand for affordable, sustainable housing are major catalysts. This trend is further fueled by a growing preference for environmentally responsible building practices and the need for faster construction timelines to address the housing shortage. Technological advancements, such as Building Information Modeling (BIM) and sophisticated manufacturing techniques, are significantly enhancing efficiency, precision, and overall project predictability. These innovations contribute to cost savings and improved quality, making modular construction a highly attractive option for developers and builders. The market is projected to experience substantial growth, with a Compound Annual Growth Rate (CAGR) estimated at XX% for the forecast period (2025-2033). Market penetration is expected to rise from XX% in 2025 to XX% by 2033, indicating a significant shift towards modular construction within the broader North American building landscape. This growth reflects a convergence of economic, environmental, and technological factors pushing the industry forward.

Dominant Regions & Segments in North America Modular Construction Industry

The United States represents the largest market within North America, driven by robust construction activity and a substantial demand for both permanent and relocatable modular buildings across residential and commercial sectors. Canada and Mexico exhibit significant, albeit smaller, market sizes. Within the segments, permanent modular buildings dominate due to their long-term usability in various applications.

- United States: High construction activity, government incentives, and a large population drive market dominance.

- Canada: Strong infrastructure development and government initiatives support market growth.

- Mexico: Growing urbanization and rising construction activity present promising opportunities.

- Permanent Modular: Higher demand due to long-term use and applicability across sectors.

- Relocatable Modular: Cost-effectiveness and flexibility make it suitable for temporary needs.

- Residential Sector: Increasing demand for affordable and sustainable housing fuels significant growth.

- Commercial Sector: Demand for modular offices, retail spaces, and educational facilities is constantly increasing.

North America Modular Construction Industry Product Innovations

The modular construction industry is at the forefront of innovation, constantly developing new methods and materials to enhance its offerings. A major focus is on sustainability, with an increasing emphasis on incorporating eco-friendly materials and energy-efficient designs. This includes the use of recycled content, renewable energy sources, and advanced insulation technologies to minimize environmental impact and reduce operating costs for building owners. Furthermore, the integration of smart home technologies within pre-fabricated components is gaining significant traction, offering enhanced convenience, security, and energy management capabilities. These innovations are not only improving the overall quality and appeal of modular buildings but also streamlining the construction process, leading to faster project completion and reduced labor costs. The use of advanced manufacturing techniques, such as off-site fabrication and pre-assembly, further minimizes on-site construction time and disruptions. This focus on technology and sustainability is positioning modular construction as a leading solution for the future of building.

Report Scope & Segmentation Analysis

This report segments the North American modular construction market by division (permanent and relocatable modular), sector (residential and commercial), and country (United States, Canada, and Mexico). Each segment's growth projection, market size, and competitive dynamics are analyzed separately. The market exhibits diverse growth rates across segments, influenced by factors such as local regulations, economic conditions, and prevailing construction trends. The United States dominates in all segments, followed by Canada and then Mexico.

Key Drivers of North America Modular Construction Industry Growth

Several factors contribute to the growth of the North American modular construction industry. These include:

- Increased Demand for Affordable Housing: Modular construction offers cost-effective solutions.

- Government Initiatives: Policies promoting sustainable building practices and green technologies are bolstering the sector.

- Technological Advancements: Automation and prefabrication improve efficiency and speed.

- Shorter Construction Timelines: Faster project completion reduces overall project costs.

Challenges in the North America Modular Construction Industry Sector

Despite its significant growth potential, the North American modular construction industry faces several challenges:

- Supply Chain Disruptions: Fluctuations in material availability and logistical bottlenecks continue to impact project timelines and budgets, requiring robust supply chain management strategies.

- Regulatory Hurdles: Inconsistent building codes and permitting processes across different regions create complexities and increase project lead times. Standardization and streamlined regulatory frameworks are crucial for accelerating market growth.

- Competition from Traditional Construction: Traditional construction methods remain dominant in many sectors, necessitating a concerted effort to highlight the advantages of modular construction, such as speed, cost-effectiveness, and sustainability.

- Skilled Labor Shortages: The industry faces a shortage of skilled workers proficient in modular construction techniques. Addressing this through training programs and workforce development initiatives is essential for sustained growth.

- Public Perception and Awareness: Overcoming misconceptions and promoting the benefits of modular construction through public education campaigns is critical for wider adoption.

Emerging Opportunities in North America Modular Construction Industry

Emerging opportunities include:

- Growth in Prefabricated Healthcare Facilities: Modular construction excels in creating quickly deployable healthcare structures.

- Expansion in Sustainable Building Materials: Demand for environmentally friendly options increases continuously.

- Integration of Smart Technologies: Modular structures can easily incorporate smart home technology.

- Focus on Disaster Relief and Emergency Housing: Modular construction plays a critical role in quick recovery.

Leading Players in the North America Modular Construction Industry Market

- Willscot Corporation

- Vesta Modular

- Mobile Modular Management Corporation

- Triumph Modular Corporation

- Katerra Inc

- Vanguard Modular Building Systems

- Boxx Modular (Black Diamond Group)

- Satellite Shelters

- Modular Genius

- ATCO Ltd

- Aries Building Systems

- And many other regional and specialized firms.

Key Developments in North America Modular Construction Industry Industry

- 2022 Q4: Willscot Corporation announced a significant investment in expanding its manufacturing capacity.

- 2023 Q1: Triumph Modular launched a new line of sustainable modular buildings.

- 2023 Q3: A merger between two smaller modular construction firms increased market consolidation. (Further details are not available, but the deal value is estimated at $XX Million).

(Note: Further specific development details with dates are not readily available for public access at this time. This section could be expanded with further research.)

Future Outlook for North America Modular Construction Industry Market

The future of the North American modular construction industry is promising. Continued technological advancements, coupled with growing demand for sustainable and cost-effective building solutions, will drive market growth. The industry is poised for further consolidation, with strategic mergers and acquisitions shaping the competitive landscape. Expanding applications in healthcare, disaster relief, and sustainable development present significant opportunities for market expansion. The overall growth potential is considerable, with market projections indicating a strong trajectory over the next decade.

North America Modular Construction Industry Segmentation

-

1. Division

- 1.1. Permanent Modular

- 1.2. Relocatable Modular

-

2. Sector

- 2.1. Residential

- 2.2. Commercial

North America Modular Construction Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Modular Construction Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.61% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surging Application of Blue Hydrogen in Fuel Cell Electric Vehicles; Rising Demand from the Chemical Sector

- 3.3. Market Restrains

- 3.3.1. Loss of Energy During Hydrogen Production; Other Market Restraints

- 3.4. Market Trends

- 3.4.1. Hospitality Industry Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Modular Construction Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Division

- 5.1.1. Permanent Modular

- 5.1.2. Relocatable Modular

- 5.2. Market Analysis, Insights and Forecast - by Sector

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Division

- 6. United States North America Modular Construction Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Modular Construction Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Modular Construction Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Modular Construction Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Willscot Corporation**List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Vesta Modular

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Mobile Modular Management Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Triumph Modular Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Katerra Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Vanguard Modular Building Systems

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Boxx Modular (Black Diamond Group)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Satellite Shelters

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Modular Genius

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 ATCO Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Aries Building Systems

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Willscot Corporation**List Not Exhaustive

List of Figures

- Figure 1: North America Modular Construction Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Modular Construction Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Modular Construction Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Modular Construction Industry Revenue Million Forecast, by Division 2019 & 2032

- Table 3: North America Modular Construction Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 4: North America Modular Construction Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Modular Construction Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Modular Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Modular Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Modular Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Modular Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Modular Construction Industry Revenue Million Forecast, by Division 2019 & 2032

- Table 11: North America Modular Construction Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 12: North America Modular Construction Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America Modular Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Modular Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Modular Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Modular Construction Industry?

The projected CAGR is approximately 4.61%.

2. Which companies are prominent players in the North America Modular Construction Industry?

Key companies in the market include Willscot Corporation**List Not Exhaustive, Vesta Modular, Mobile Modular Management Corporation, Triumph Modular Corporation, Katerra Inc, Vanguard Modular Building Systems, Boxx Modular (Black Diamond Group), Satellite Shelters, Modular Genius, ATCO Ltd, Aries Building Systems.

3. What are the main segments of the North America Modular Construction Industry?

The market segments include Division, Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 33.99 Million as of 2022.

5. What are some drivers contributing to market growth?

Surging Application of Blue Hydrogen in Fuel Cell Electric Vehicles; Rising Demand from the Chemical Sector.

6. What are the notable trends driving market growth?

Hospitality Industry Driving the Market Growth.

7. Are there any restraints impacting market growth?

Loss of Energy During Hydrogen Production; Other Market Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Modular Construction Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Modular Construction Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Modular Construction Industry?

To stay informed about further developments, trends, and reports in the North America Modular Construction Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence