Key Insights

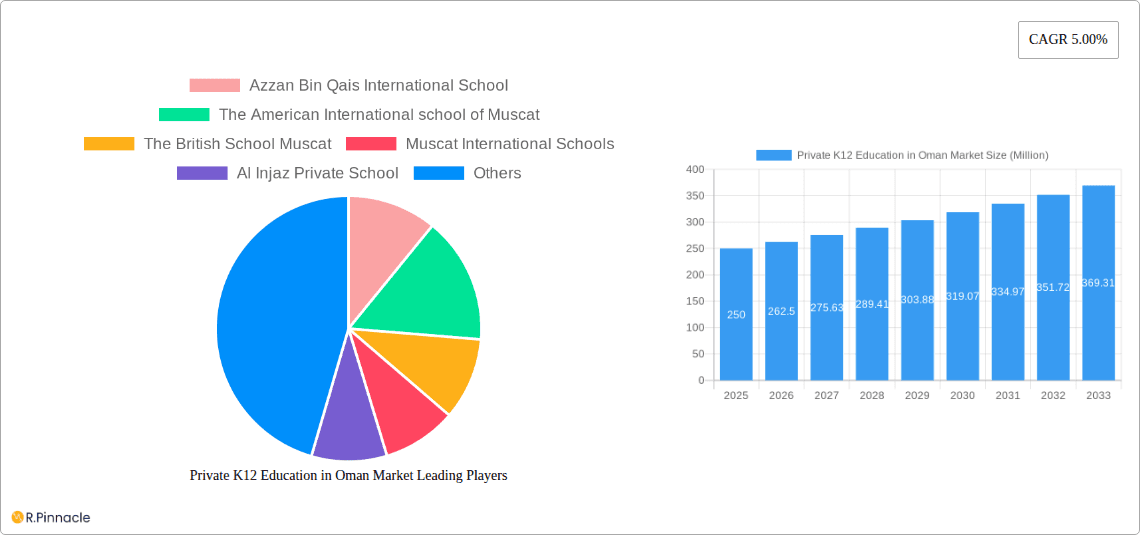

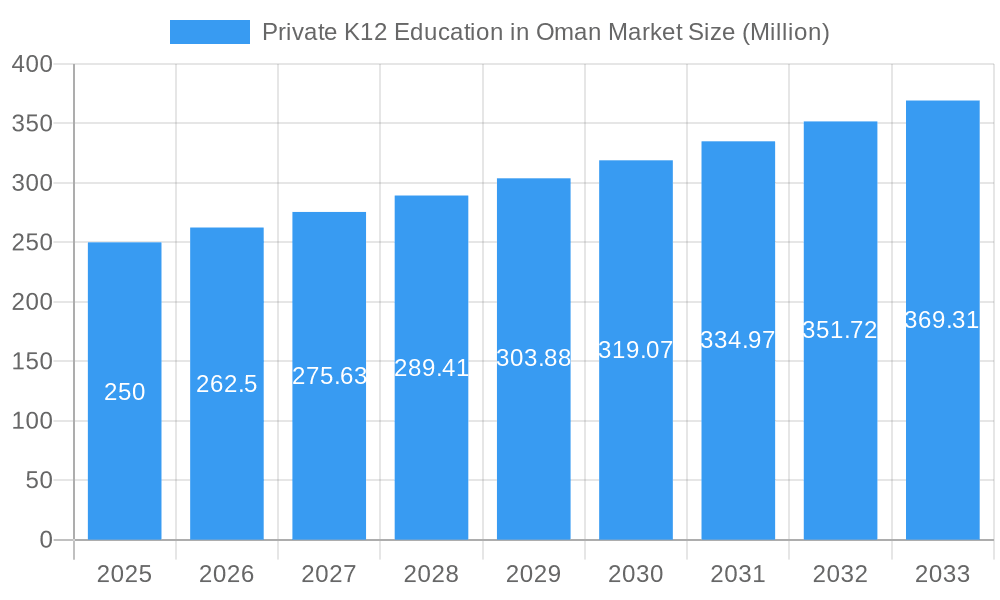

The private K12 education market in Oman is experiencing steady growth, driven by increasing disposable incomes, a rising middle class, and a growing preference for international curricula and high-quality education. The current market size (2025) is estimated to be around $250 million, reflecting a robust demand for private schooling exceeding that of the public sector. This is fueled by parents seeking better learning environments, smaller class sizes, and access to advanced facilities and resources not always available in public schools. A compound annual growth rate (CAGR) of 5% projected through 2033 suggests continued expansion. Key market segments include British, American, and other international curricula, catering to a diverse student population. Prominent schools such as Azzan Bin Qais International School, The American International School of Muscat, and The British School Muscat are key players shaping the market landscape. However, the market faces restraints such as increasing tuition fees, which may restrict access for some families, and government regulations influencing school operations. The ongoing trend towards technology integration in education and the demand for specialized programs (like STEM education) are shaping the competitive landscape and influencing school investments.

Private K12 Education in Oman Market Market Size (In Million)

Continued growth in Oman's private K12 sector is projected over the forecast period (2025-2033), driven by increasing demand for quality education and a burgeoning expatriate population. The expansion is likely to be focused on developing specialized programs, enhancing infrastructure, and attracting highly skilled teachers to meet evolving educational needs. Competition among existing schools will likely intensify, leading to innovative teaching methodologies, specialized learning programs, and improved infrastructure to attract students. Furthermore, strategic partnerships with international education providers are expected to play a significant role in enhancing the quality and reach of private education in the region. The market will continue to be closely linked to Oman's overall economic growth and government policies supporting the education sector.

Private K12 Education in Oman Market Company Market Share

Private K12 Education in Oman Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Private K12 Education market in Oman, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils the market's structure, dynamics, and future potential. The analysis includes detailed market sizing (in Millions), CAGR projections, and competitive landscaping, focusing on key players like Azzan Bin Qais International School, The American International School of Muscat, The British School Muscat, Muscat International Schools, Al Injaz Private School, and The International School of Choueifat - Muscat (list not exhaustive).

Private K12 Education in Oman Market Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory aspects of Oman's private K12 education sector. The market concentration is moderate, with a few dominant players and several smaller schools. Market share data for 2025 reveals that the top 5 players collectively hold approximately xx% of the market, with xx Million in revenue. Innovation is driven by the increasing demand for advanced educational technologies, personalized learning approaches, and international curriculum offerings. The regulatory framework, while supportive of private education, has specific licensing and curriculum standards. M&A activities have been limited in recent years, with only xx major deals recorded between 2019 and 2024, totaling an estimated value of xx Million. Product substitutes, such as online learning platforms and homeschooling, are gaining traction but represent a small percentage of the overall market. The end-user demographics are primarily driven by the expatriate population and high-income Omani families, with a growing focus on STEM education.

Private K12 Education in Oman Market Market Dynamics & Trends

The Omani private K12 education market is experiencing steady growth, driven by factors such as rising disposable incomes, increasing awareness of the benefits of private education, and a growing expatriate population. The market is projected to achieve a CAGR of xx% during the forecast period (2025-2033), reaching a market size of xx Million by 2033. Technological disruptions, such as the adoption of EdTech solutions and online learning platforms, are reshaping the educational landscape. Consumer preferences are shifting towards personalized learning experiences, international curricula, and extracurricular activities. Competitive dynamics are characterized by price competition, differentiation through curriculum offerings and facilities, and the adoption of innovative teaching methodologies. Market penetration of private K12 education in Oman is currently estimated at xx%, indicating significant potential for future expansion.

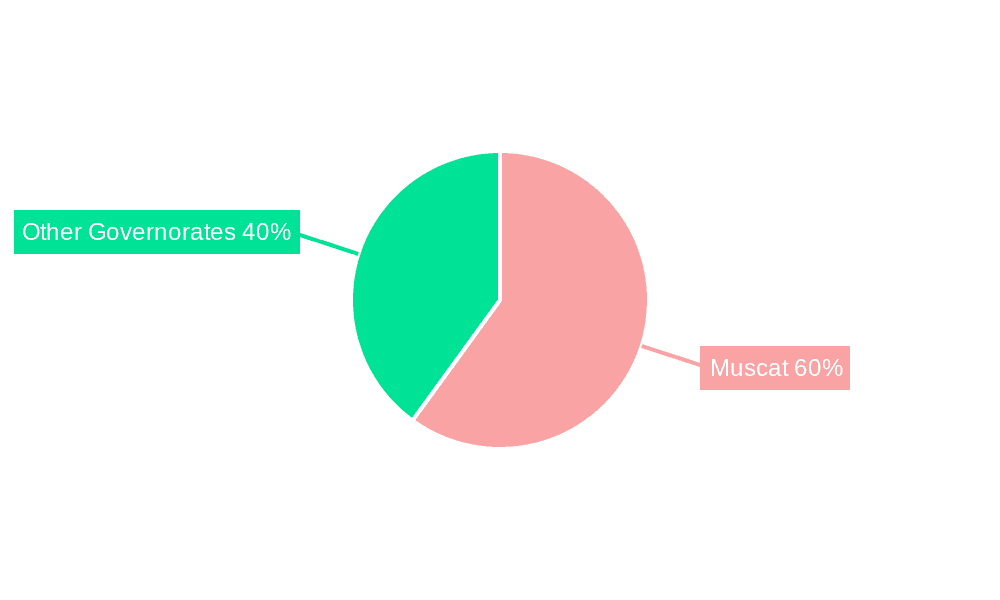

Dominant Regions & Segments in Private K12 Education in Oman Market

The Muscat Governorate is the dominant region in the private K12 education market in Oman, owing to its high concentration of expatriates and a well-established infrastructure. Key drivers for its dominance include:

- High concentration of expatriates: A significant portion of the expatriate population resides in Muscat, fueling demand for international curricula and private education.

- Developed infrastructure: Muscat boasts well-developed infrastructure, including transportation, housing, and other amenities that support the growth of private schools.

- Government support: The Omani government's supportive policies toward private education further contribute to the region's dominance.

The market is segmented by school type (e.g., British, American, International Baccalaureate), grade level (primary, secondary), and curriculum. The international curriculum segment is the fastest growing, reflecting the preference for globally recognized qualifications. A detailed analysis of market size and growth projections for each segment is provided in the full report.

Private K12 Education in Oman Market Product Innovations

Recent product innovations in the Omani private K12 education market center on the integration of technology, focusing on personalized learning and enhanced digital resources. Interactive whiteboards, online learning platforms, and virtual reality tools are gaining prominence. Schools are also offering specialized programs in STEM fields, arts, and sports to cater to diverse student interests. These innovations enhance the learning experience, improve student outcomes, and increase the competitive advantage of schools that embrace them. The market fit is strong, given the increasing demand for quality education and technological advancement.

Report Scope & Segmentation Analysis

This report segments the Omani private K12 education market by school type (e.g., international, national curricula), grade level (primary, secondary), geographic location (governorates), and curriculum type (IB, A levels, etc.). Each segment shows varied growth rates. For instance, the international school segment is projected to maintain a higher CAGR than the national curriculum schools during the forecast period, indicating stronger market demand. Competitive dynamics within each segment vary; some segments are more concentrated, while others present greater opportunities for new entrants.

Key Drivers of Private K12 Education in Oman Market Growth

Several factors are driving the growth of the private K12 education market in Oman. Firstly, the rising disposable incomes of Omani families are increasing their capacity to invest in private education. Secondly, a growing expatriate community necessitates educational institutions that offer international curricula. Finally, the government’s policies encouraging private sector participation in education provide a supportive regulatory environment. These factors combine to fuel the demand and growth in this sector.

Challenges in the Private K12 Education in Oman Market Sector

The private K12 education market in Oman faces several challenges. Stringent regulatory requirements for licensing and curriculum approval can create hurdles for new entrants and expansion. Competition among existing schools is intense, often leading to price wars and reduced profit margins. Furthermore, attracting and retaining qualified teachers remains a critical issue, impacting the quality of education offered. These challenges, if not addressed, could impact the sector’s growth trajectory.

Emerging Opportunities in Private K12 Education in Oman Market

Emerging opportunities lie in catering to the growing demand for specialized programs, such as STEM education and vocational training. The incorporation of advanced technologies, like AI-powered learning platforms and personalized learning tools, presents a significant opportunity for differentiation. Furthermore, expanding into underserved regions and offering flexible learning models, including online and blended learning, will create new avenues for growth.

Leading Players in the Private K12 Education in Oman Market Market

- Azzan Bin Qais International School

- The American International School of Muscat

- The British School Muscat

- Muscat International Schools

- Al Injaz Private School

- The International School of Choueifat - Muscat

Key Developments in Private K12 Education in Oman Market Industry

- January 2023: The American International School of Muscat launched a new STEM program.

- June 2022: The British School Muscat expanded its facilities.

- October 2021: Azzan Bin Qais International School implemented a new online learning platform. (Further developments will be detailed in the full report)

Future Outlook for Private K12 Education in Oman Market Market

The future of the Omani private K12 education market appears promising. Continued economic growth, coupled with increased government support and the adoption of innovative technologies, will likely drive market expansion. The focus on personalized learning, STEM education, and international curricula will shape future growth. Strategic partnerships and investments in EdTech solutions are expected to be key drivers of success in this dynamic market.

Private K12 Education in Oman Market Segmentation

-

1. Source of Revenue

- 1.1. Kindergarten

- 1.2. Primary

- 1.3. Intermediary

- 1.4. Secondary

-

2. Curriculum

- 2.1. American

- 2.2. British

- 2.3. Arabic

- 2.4. CBSE

- 2.5. Others

Private K12 Education in Oman Market Segmentation By Geography

- 1. North Region

- 2. West region

- 3. South Region

- 4. East Region

Private K12 Education in Oman Market Regional Market Share

Geographic Coverage of Private K12 Education in Oman Market

Private K12 Education in Oman Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Government initiatives - National Education Strategy 2040

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Private K12 Education in Oman Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 5.1.1. Kindergarten

- 5.1.2. Primary

- 5.1.3. Intermediary

- 5.1.4. Secondary

- 5.2. Market Analysis, Insights and Forecast - by Curriculum

- 5.2.1. American

- 5.2.2. British

- 5.2.3. Arabic

- 5.2.4. CBSE

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North Region

- 5.3.2. West region

- 5.3.3. South Region

- 5.3.4. East Region

- 5.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 6. North Region Private K12 Education in Oman Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 6.1.1. Kindergarten

- 6.1.2. Primary

- 6.1.3. Intermediary

- 6.1.4. Secondary

- 6.2. Market Analysis, Insights and Forecast - by Curriculum

- 6.2.1. American

- 6.2.2. British

- 6.2.3. Arabic

- 6.2.4. CBSE

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 7. West region Private K12 Education in Oman Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 7.1.1. Kindergarten

- 7.1.2. Primary

- 7.1.3. Intermediary

- 7.1.4. Secondary

- 7.2. Market Analysis, Insights and Forecast - by Curriculum

- 7.2.1. American

- 7.2.2. British

- 7.2.3. Arabic

- 7.2.4. CBSE

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 8. South Region Private K12 Education in Oman Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 8.1.1. Kindergarten

- 8.1.2. Primary

- 8.1.3. Intermediary

- 8.1.4. Secondary

- 8.2. Market Analysis, Insights and Forecast - by Curriculum

- 8.2.1. American

- 8.2.2. British

- 8.2.3. Arabic

- 8.2.4. CBSE

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 9. East Region Private K12 Education in Oman Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 9.1.1. Kindergarten

- 9.1.2. Primary

- 9.1.3. Intermediary

- 9.1.4. Secondary

- 9.2. Market Analysis, Insights and Forecast - by Curriculum

- 9.2.1. American

- 9.2.2. British

- 9.2.3. Arabic

- 9.2.4. CBSE

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Azzan Bin Qais International School

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 The American International school of Muscat

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 The British School Muscat

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Muscat International Schools

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Al Injaz Private School

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 The International School of Choueifat - Muscat**List Not Exhaustive

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.1 Azzan Bin Qais International School

List of Figures

- Figure 1: Global Private K12 Education in Oman Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North Region Private K12 Education in Oman Market Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 3: North Region Private K12 Education in Oman Market Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 4: North Region Private K12 Education in Oman Market Revenue (Million), by Curriculum 2025 & 2033

- Figure 5: North Region Private K12 Education in Oman Market Revenue Share (%), by Curriculum 2025 & 2033

- Figure 6: North Region Private K12 Education in Oman Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North Region Private K12 Education in Oman Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: West region Private K12 Education in Oman Market Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 9: West region Private K12 Education in Oman Market Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 10: West region Private K12 Education in Oman Market Revenue (Million), by Curriculum 2025 & 2033

- Figure 11: West region Private K12 Education in Oman Market Revenue Share (%), by Curriculum 2025 & 2033

- Figure 12: West region Private K12 Education in Oman Market Revenue (Million), by Country 2025 & 2033

- Figure 13: West region Private K12 Education in Oman Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South Region Private K12 Education in Oman Market Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 15: South Region Private K12 Education in Oman Market Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 16: South Region Private K12 Education in Oman Market Revenue (Million), by Curriculum 2025 & 2033

- Figure 17: South Region Private K12 Education in Oman Market Revenue Share (%), by Curriculum 2025 & 2033

- Figure 18: South Region Private K12 Education in Oman Market Revenue (Million), by Country 2025 & 2033

- Figure 19: South Region Private K12 Education in Oman Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: East Region Private K12 Education in Oman Market Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 21: East Region Private K12 Education in Oman Market Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 22: East Region Private K12 Education in Oman Market Revenue (Million), by Curriculum 2025 & 2033

- Figure 23: East Region Private K12 Education in Oman Market Revenue Share (%), by Curriculum 2025 & 2033

- Figure 24: East Region Private K12 Education in Oman Market Revenue (Million), by Country 2025 & 2033

- Figure 25: East Region Private K12 Education in Oman Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Private K12 Education in Oman Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 2: Global Private K12 Education in Oman Market Revenue Million Forecast, by Curriculum 2020 & 2033

- Table 3: Global Private K12 Education in Oman Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Private K12 Education in Oman Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 5: Global Private K12 Education in Oman Market Revenue Million Forecast, by Curriculum 2020 & 2033

- Table 6: Global Private K12 Education in Oman Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Private K12 Education in Oman Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 8: Global Private K12 Education in Oman Market Revenue Million Forecast, by Curriculum 2020 & 2033

- Table 9: Global Private K12 Education in Oman Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Private K12 Education in Oman Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 11: Global Private K12 Education in Oman Market Revenue Million Forecast, by Curriculum 2020 & 2033

- Table 12: Global Private K12 Education in Oman Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Private K12 Education in Oman Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 14: Global Private K12 Education in Oman Market Revenue Million Forecast, by Curriculum 2020 & 2033

- Table 15: Global Private K12 Education in Oman Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Private K12 Education in Oman Market?

The projected CAGR is approximately 5.00%.

2. Which companies are prominent players in the Private K12 Education in Oman Market?

Key companies in the market include Azzan Bin Qais International School, The American International school of Muscat, The British School Muscat, Muscat International Schools, Al Injaz Private School, The International School of Choueifat - Muscat**List Not Exhaustive.

3. What are the main segments of the Private K12 Education in Oman Market?

The market segments include Source of Revenue, Curriculum.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Government initiatives - National Education Strategy 2040.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Private K12 Education in Oman Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Private K12 Education in Oman Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Private K12 Education in Oman Market?

To stay informed about further developments, trends, and reports in the Private K12 Education in Oman Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence