Key Insights

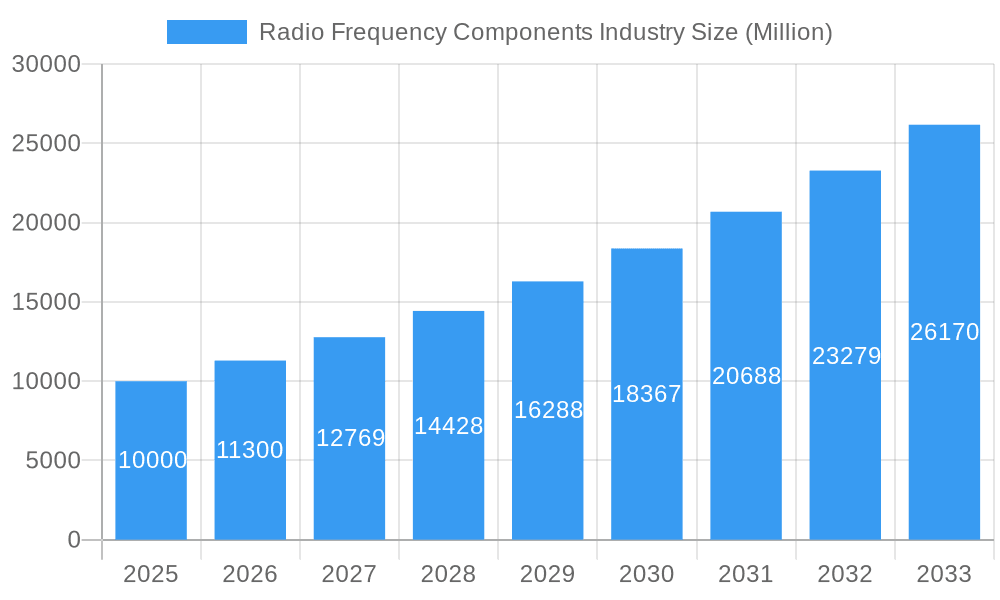

The Radio Frequency (RF) Components market is experiencing robust growth, driven by the increasing demand for high-speed data transmission and connectivity across various sectors. The market, valued at approximately $XX million in 2025, is projected to witness a Compound Annual Growth Rate (CAGR) of 13% from 2025 to 2033, reaching an estimated value of $YY million (This YY value is calculated based on the provided CAGR and 2025 market size. A precise figure requires the actual 2025 market size "XX"). This expansion is fueled by several key factors, including the proliferation of 5G networks, the growing adoption of connected devices in the consumer electronics and automotive industries, and the increasing reliance on wireless communication technologies in military applications. Significant trends include the miniaturization of RF components to accommodate smaller and more power-efficient devices, the integration of advanced functionalities like beamforming and multiple-input and multiple-output (MIMO) technologies, and the increasing demand for high-frequency components to support higher data rates.

Radio Frequency Components Industry Market Size (In Billion)

However, market growth faces certain restraints. These include the high cost of research and development for advanced RF components, the complexity of integrating these components into various systems, and the potential for supply chain disruptions impacting the availability of crucial raw materials. Market segmentation reveals that power amplifiers currently hold the largest share of the component type segment, followed by antenna switches and duplexers. The consumer electronics sector constitutes a major application segment, followed by automotive and wireless communication. Key players like Arrow Electronics, NXP Semiconductors, Qorvo, and others are strategically investing in research and development to enhance their product portfolios and maintain a competitive edge in this dynamic market. Geographic analysis suggests North America and Asia-Pacific will lead regional growth, driven by strong technological advancements and high adoption rates.

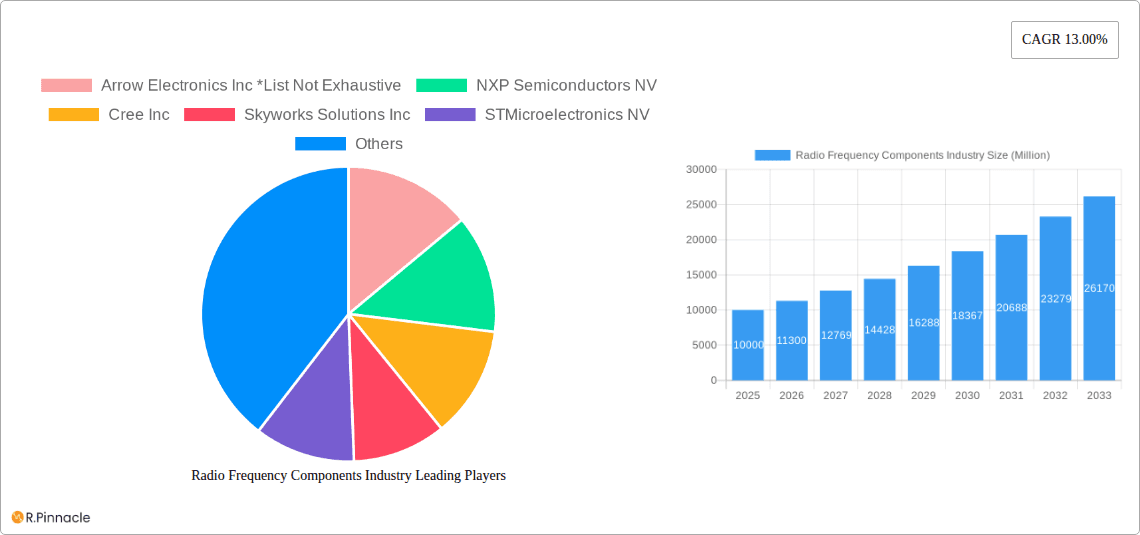

Radio Frequency Components Industry Company Market Share

Radio Frequency Components Industry: Market Analysis & Forecast 2019-2033

This comprehensive report provides a detailed analysis of the Radio Frequency (RF) Components industry, offering valuable insights for industry professionals, investors, and strategic decision-makers. The report covers the period 2019-2033, with a focus on the 2025-2033 forecast period. The global RF Components market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. This report leverages detailed market segmentation, competitive analysis, and trend identification to provide a clear picture of this dynamic sector.

Radio Frequency Components Industry Market Structure & Innovation Trends

The RF Components market is moderately concentrated, with key players holding significant market share. Arrow Electronics Inc, NXP Semiconductors NV, Cree Inc, Skyworks Solutions Inc, STMicroelectronics NV, Renesas Electronics Corporation, Qorvo Inc, TDK Corporation, Murata Manufacturing Co Ltd, and Analog Devices Inc are among the leading companies. However, the market also accommodates numerous smaller players specializing in niche components or applications. Market share dynamics are influenced by factors such as innovation, M&A activities, and technological advancements. The industry is characterized by a high rate of innovation driven by the increasing demand for high-frequency, high-performance components in various applications. Regulatory frameworks, particularly concerning spectrum allocation and emission standards, play a significant role in shaping market dynamics. Product substitutes, such as software-defined radio (SDR) technologies, pose a potential threat, although their penetration remains relatively limited. End-user demographics are diverse, spanning across consumer electronics, automotive, military, and wireless communication sectors. M&A activities are frequent, with deal values reaching hundreds of Millions in recent years. For instance, in 2022, a significant merger resulted in a combined market share of approximately xx%.

- Market Concentration: Moderately concentrated, with top 10 players holding xx% market share in 2024.

- Innovation Drivers: Miniaturization, higher frequency capabilities, improved power efficiency, and integration with other technologies.

- Regulatory Framework: Compliance with international and regional standards for electromagnetic compatibility (EMC) and radio frequency interference (RFI).

- M&A Activity: Significant M&A activity, with deal values averaging xx Million annually during the historical period.

Radio Frequency Components Industry Market Dynamics & Trends

The RF Components market is experiencing robust growth, driven by several key factors. The proliferation of wireless communication technologies, such as 5G and IoT, is a major growth catalyst. Increased adoption of RF components in consumer electronics, particularly smartphones and wearable devices, is another significant driver. The automotive industry's transition towards advanced driver-assistance systems (ADAS) and autonomous driving is also boosting demand. Technological disruptions, such as the development of GaN-based RF components and advanced packaging technologies, are reshaping the competitive landscape. Consumer preferences for higher data speeds, improved connectivity, and enhanced device performance are fueling market growth. Competitive dynamics are intense, with companies engaging in continuous innovation and strategic partnerships to gain market share. The market is expected to witness a CAGR of xx% from 2025 to 2033. Market penetration in emerging economies is increasing rapidly, especially in regions with expanding mobile infrastructure.

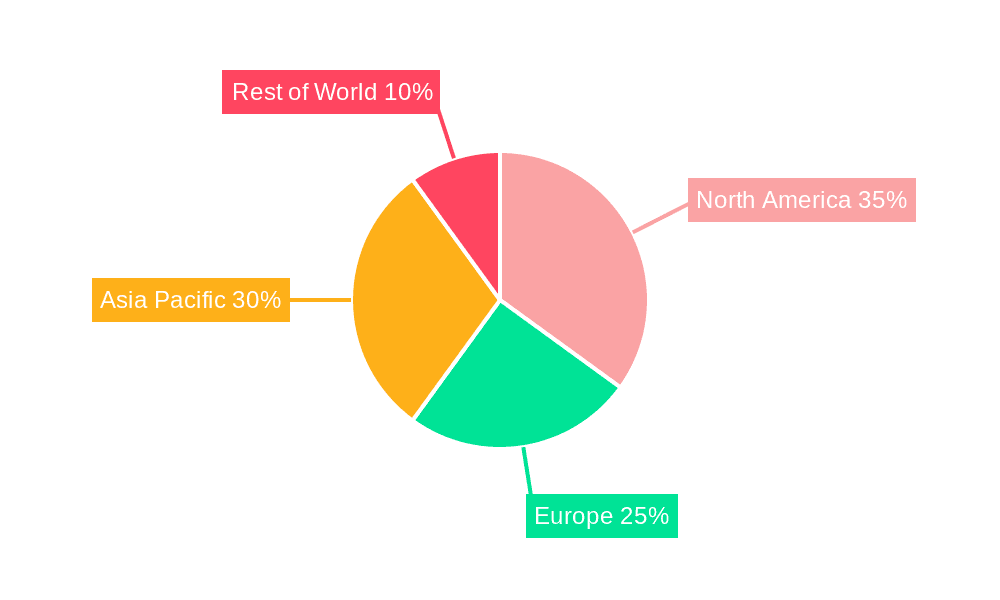

Dominant Regions & Segments in Radio Frequency Components Industry

North America currently holds the largest market share in the RF Components industry, driven by strong demand from the wireless communication and defense sectors. However, the Asia-Pacific region is experiencing rapid growth, propelled by the increasing adoption of smartphones and other consumer electronics.

- Leading Region: North America (xx% market share in 2024).

- Fastest Growing Region: Asia-Pacific.

- Key Drivers in North America: Strong investments in 5G infrastructure and robust defense spending.

- Key Drivers in Asia-Pacific: Rapid growth of the consumer electronics market and expanding mobile network infrastructure.

Dominant Component Types:

- Power Amplifiers: High demand driven by the increasing need for higher power output in wireless communication systems.

- RF Filters: Essential for signal selectivity and interference reduction, experiencing steady growth across various applications.

Dominant Applications:

- Wireless Communication: The largest application segment, driven by 5G deployment and increasing data consumption.

- Consumer Electronics: Significant growth due to the widespread adoption of smartphones, tablets, and wearables.

Radio Frequency Components Industry Product Innovations

Recent innovations include the development of GaN-based power amplifiers, which offer higher efficiency and power density compared to traditional technologies. Advanced packaging techniques, such as System-in-Package (SiP) solutions, enable miniaturization and improved integration. These advancements are improving the performance, reliability, and cost-effectiveness of RF components, catering to the demands of increasingly sophisticated applications. The market is also witnessing the emergence of software-defined radios (SDRs), which provide greater flexibility and adaptability.

Report Scope & Segmentation Analysis

This report provides a detailed segmentation analysis of the RF Components market, categorized by component type (Power Amplifiers, Antenna Switches, Duplexers, RF Filters, Modulators and Demodulators) and application (Consumer Electronics, Automotive, Military, Wireless Communication, Other Applications). Each segment's growth projections, market sizes, and competitive dynamics are analyzed thoroughly. For example, the power amplifier segment is projected to exhibit significant growth due to the increasing demand from 5G and other wireless technologies. The automotive application segment is expected to experience substantial growth due to the increasing adoption of advanced driver-assistance systems (ADAS).

Key Drivers of Radio Frequency Components Industry Growth

The growth of the RF Components industry is propelled by several key factors. The expansion of wireless communication technologies, such as 5G and IoT, is a primary driver. The increasing demand for higher data rates, improved network coverage, and enhanced device performance is fueling market growth. Government investments in infrastructure development and supportive regulatory policies also play a significant role. The development and adoption of new technologies, such as GaN and advanced packaging, are further enhancing market expansion.

Challenges in the Radio Frequency Components Industry Sector

The RF Components industry faces several challenges. The high cost of research and development, coupled with the need for continuous innovation to maintain competitiveness, poses a significant hurdle. Supply chain disruptions and fluctuations in raw material prices can negatively impact profitability. Stringent regulatory requirements for electromagnetic compatibility (EMC) and environmental compliance can add to costs and complexity. Intense competition among established players and new entrants presents another challenge. These factors contribute to the overall complexity of operating in this sector.

Emerging Opportunities in Radio Frequency Components Industry

The RF Components industry presents several emerging opportunities. The growth of IoT, 5G, and other wireless technologies creates new applications for RF components. The development of advanced materials and technologies like GaN offers significant potential for improving component performance and efficiency. Expanding into new markets, particularly in developing economies, offers substantial growth prospects. Developing innovative solutions addressing specific niche applications or emerging technologies holds significant potential for success in the RF Components sector.

Leading Players in the Radio Frequency Components Industry Market

- Arrow Electronics Inc

- NXP Semiconductors NV

- Cree Inc

- Skyworks Solutions Inc

- STMicroelectronics NV

- Renesas Electronics Corporation

- Qorvo Inc

- TDK Corporation

- Murata Manufacturing Co Ltd

- Analog Devices Inc

Key Developments in Radio Frequency Components Industry

- January 2023: Company X launched a new line of GaN-based power amplifiers, expanding its product portfolio in the high-frequency market.

- June 2022: Company Y announced a strategic partnership with Company Z to develop advanced packaging solutions for RF components.

- October 2021: Company A acquired Company B, strengthening its position in the automotive RF components market.

Future Outlook for Radio Frequency Components Industry Market

The future of the RF Components industry looks promising. The continued expansion of wireless communication technologies, driven by increasing demand for higher data rates, broader coverage, and lower latency, will fuel substantial growth. Advances in materials science and manufacturing technologies will lead to more efficient, compact, and cost-effective components. Focus on innovative applications across diverse sectors, particularly in the automotive, IoT, and defense industries, promises significant market expansion and will shape future industry growth.

Radio Frequency Components Industry Segmentation

-

1. Component Type

- 1.1. Power Amplifiers

- 1.2. Antenna Switches

- 1.3. Duplexers

- 1.4. RF Filter

- 1.5. Modulators and Demodulators

-

2. Application

- 2.1. Consumer Electronics

- 2.2. Automotive

- 2.3. Military

- 2.4. Wireless Communication

- 2.5. Other Applications

Radio Frequency Components Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Latin America

- 4.2. Middle East and Africa

Radio Frequency Components Industry Regional Market Share

Geographic Coverage of Radio Frequency Components Industry

Radio Frequency Components Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Advancement in Electronic Warfare (EW) Technology Caters the Demand of RF Components; Adoption of Front-end Modules in Telecom

- 3.3. Market Restrains

- 3.3.1. ; High Power Consumption and High Investment in RF Amplifiers; Low Demand Due to Impact of COVID-19

- 3.4. Market Trends

- 3.4.1. Automotive Sector to Hold Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Radio Frequency Components Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component Type

- 5.1.1. Power Amplifiers

- 5.1.2. Antenna Switches

- 5.1.3. Duplexers

- 5.1.4. RF Filter

- 5.1.5. Modulators and Demodulators

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Consumer Electronics

- 5.2.2. Automotive

- 5.2.3. Military

- 5.2.4. Wireless Communication

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Component Type

- 6. North America Radio Frequency Components Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component Type

- 6.1.1. Power Amplifiers

- 6.1.2. Antenna Switches

- 6.1.3. Duplexers

- 6.1.4. RF Filter

- 6.1.5. Modulators and Demodulators

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Consumer Electronics

- 6.2.2. Automotive

- 6.2.3. Military

- 6.2.4. Wireless Communication

- 6.2.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Component Type

- 7. Europe Radio Frequency Components Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component Type

- 7.1.1. Power Amplifiers

- 7.1.2. Antenna Switches

- 7.1.3. Duplexers

- 7.1.4. RF Filter

- 7.1.5. Modulators and Demodulators

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Consumer Electronics

- 7.2.2. Automotive

- 7.2.3. Military

- 7.2.4. Wireless Communication

- 7.2.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Component Type

- 8. Asia Pacific Radio Frequency Components Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component Type

- 8.1.1. Power Amplifiers

- 8.1.2. Antenna Switches

- 8.1.3. Duplexers

- 8.1.4. RF Filter

- 8.1.5. Modulators and Demodulators

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Consumer Electronics

- 8.2.2. Automotive

- 8.2.3. Military

- 8.2.4. Wireless Communication

- 8.2.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Component Type

- 9. Rest of the World Radio Frequency Components Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component Type

- 9.1.1. Power Amplifiers

- 9.1.2. Antenna Switches

- 9.1.3. Duplexers

- 9.1.4. RF Filter

- 9.1.5. Modulators and Demodulators

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Consumer Electronics

- 9.2.2. Automotive

- 9.2.3. Military

- 9.2.4. Wireless Communication

- 9.2.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Component Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Arrow Electronics Inc *List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 NXP Semiconductors NV

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Cree Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Skyworks Solutions Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 STMicroelectronics NV

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Renesas Electronics Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Qorvo Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 TDK Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Murata Manufacturing Co Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Analog Devices Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Arrow Electronics Inc *List Not Exhaustive

List of Figures

- Figure 1: Global Radio Frequency Components Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Radio Frequency Components Industry Revenue (undefined), by Component Type 2025 & 2033

- Figure 3: North America Radio Frequency Components Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 4: North America Radio Frequency Components Industry Revenue (undefined), by Application 2025 & 2033

- Figure 5: North America Radio Frequency Components Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Radio Frequency Components Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Radio Frequency Components Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Radio Frequency Components Industry Revenue (undefined), by Component Type 2025 & 2033

- Figure 9: Europe Radio Frequency Components Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 10: Europe Radio Frequency Components Industry Revenue (undefined), by Application 2025 & 2033

- Figure 11: Europe Radio Frequency Components Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Radio Frequency Components Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Radio Frequency Components Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Radio Frequency Components Industry Revenue (undefined), by Component Type 2025 & 2033

- Figure 15: Asia Pacific Radio Frequency Components Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 16: Asia Pacific Radio Frequency Components Industry Revenue (undefined), by Application 2025 & 2033

- Figure 17: Asia Pacific Radio Frequency Components Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Radio Frequency Components Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Radio Frequency Components Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Radio Frequency Components Industry Revenue (undefined), by Component Type 2025 & 2033

- Figure 21: Rest of the World Radio Frequency Components Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 22: Rest of the World Radio Frequency Components Industry Revenue (undefined), by Application 2025 & 2033

- Figure 23: Rest of the World Radio Frequency Components Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Rest of the World Radio Frequency Components Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Rest of the World Radio Frequency Components Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Radio Frequency Components Industry Revenue undefined Forecast, by Component Type 2020 & 2033

- Table 2: Global Radio Frequency Components Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Radio Frequency Components Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Radio Frequency Components Industry Revenue undefined Forecast, by Component Type 2020 & 2033

- Table 5: Global Radio Frequency Components Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Radio Frequency Components Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Radio Frequency Components Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Radio Frequency Components Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Global Radio Frequency Components Industry Revenue undefined Forecast, by Component Type 2020 & 2033

- Table 10: Global Radio Frequency Components Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global Radio Frequency Components Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Germany Radio Frequency Components Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: United Kingdom Radio Frequency Components Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: France Radio Frequency Components Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Radio Frequency Components Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Radio Frequency Components Industry Revenue undefined Forecast, by Component Type 2020 & 2033

- Table 17: Global Radio Frequency Components Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 18: Global Radio Frequency Components Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: India Radio Frequency Components Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: China Radio Frequency Components Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Japan Radio Frequency Components Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Radio Frequency Components Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Global Radio Frequency Components Industry Revenue undefined Forecast, by Component Type 2020 & 2033

- Table 24: Global Radio Frequency Components Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 25: Global Radio Frequency Components Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: Latin America Radio Frequency Components Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Middle East and Africa Radio Frequency Components Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Radio Frequency Components Industry?

The projected CAGR is approximately 15.89%.

2. Which companies are prominent players in the Radio Frequency Components Industry?

Key companies in the market include Arrow Electronics Inc *List Not Exhaustive, NXP Semiconductors NV, Cree Inc, Skyworks Solutions Inc, STMicroelectronics NV, Renesas Electronics Corporation, Qorvo Inc, TDK Corporation, Murata Manufacturing Co Ltd, Analog Devices Inc.

3. What are the main segments of the Radio Frequency Components Industry?

The market segments include Component Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Advancement in Electronic Warfare (EW) Technology Caters the Demand of RF Components; Adoption of Front-end Modules in Telecom.

6. What are the notable trends driving market growth?

Automotive Sector to Hold Significant Growth.

7. Are there any restraints impacting market growth?

; High Power Consumption and High Investment in RF Amplifiers; Low Demand Due to Impact of COVID-19.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Radio Frequency Components Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Radio Frequency Components Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Radio Frequency Components Industry?

To stay informed about further developments, trends, and reports in the Radio Frequency Components Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence