Key Insights

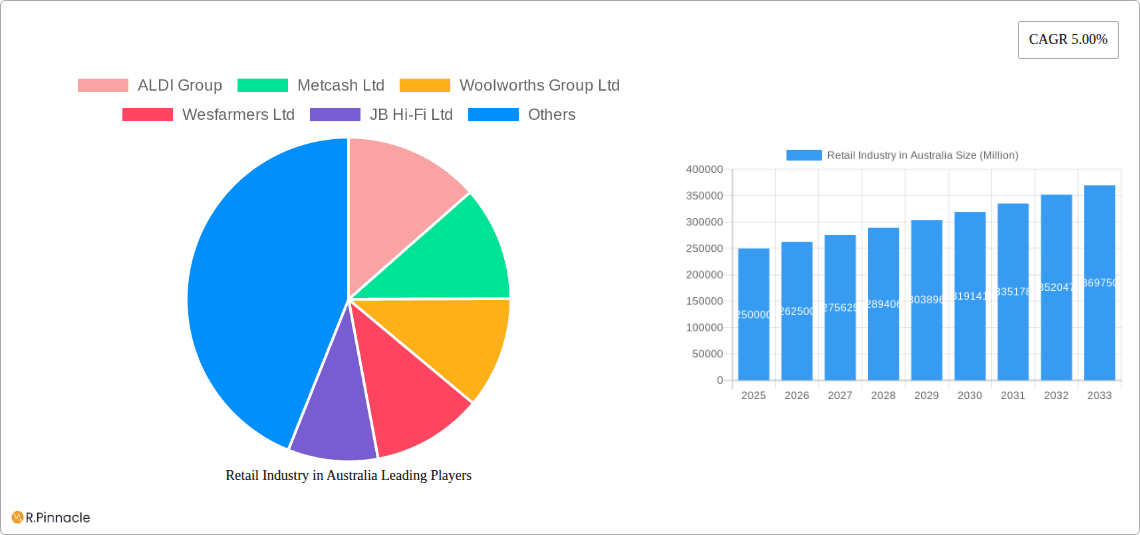

The Australian retail sector, a vital component of the national economy, is projected for substantial expansion. With a projected Compound Annual Growth Rate (CAGR) of 3.1% from 2025 to 2033, the market is estimated to reach 551.11 billion by 2025. This growth is propelled by rising disposable incomes, a growing middle class, and a significant shift towards online and experiential retail. The widespread adoption of omnichannel strategies, integrating physical and digital touchpoints, is a defining trend across all retail segments. The competitive landscape is intense, featuring major players like Coles Group and Woolworths Group Ltd, alongside international discounters such as ALDI Group and rapidly growing online retailers like Kogan.com Ltd. Evolving regulatory frameworks, including those concerning online marketplaces and data privacy, are also shaping market dynamics.

Retail Industry in Australia Market Size (In Billion)

Key industry restraints include economic volatility, inflationary pressures impacting consumer expenditure, and escalating supply chain costs. To maintain profitability under these conditions, retailers must prioritize operational efficiency, strategic pricing, and robust inventory management. Growth in e-commerce necessitates considerable investment in technology, logistics, and customer service infrastructure. Additionally, the increasing consumer focus on sustainability is compelling retailers to embrace eco-friendly practices and ethical sourcing to foster customer loyalty. The forecast period anticipates further market consolidation as smaller businesses face intensified competition from larger entities, alongside a continued acceleration of the digital retail transformation. A thorough understanding of these influential factors is paramount for businesses seeking to effectively navigate the competitive environment and seize future growth prospects.

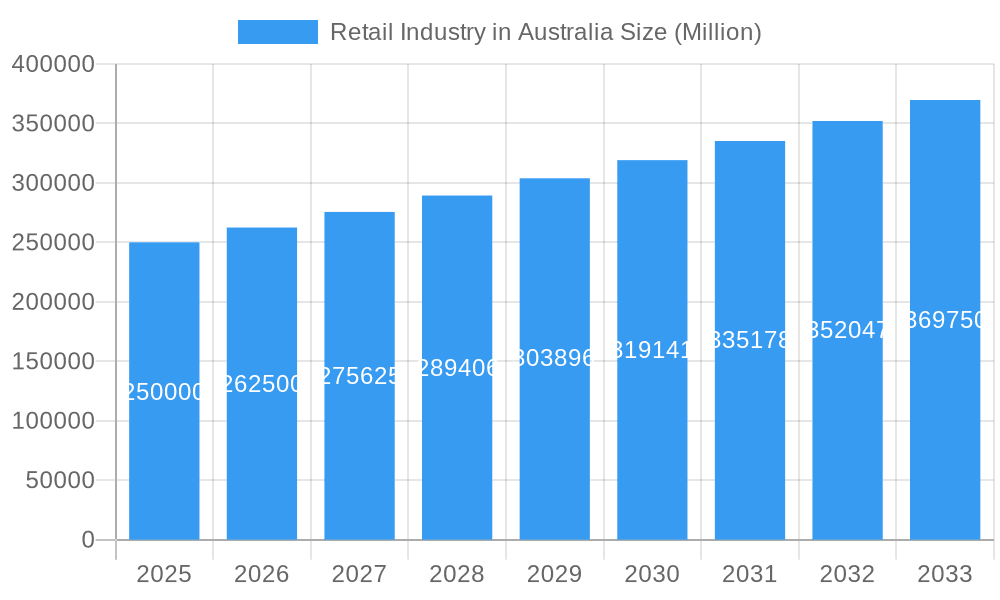

Retail Industry in Australia Company Market Share

Retail Industry in Australia: 2019-2033 Market Report - A Deep Dive into Growth, Innovation & Key Players

This comprehensive report provides an in-depth analysis of the Australian retail industry, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, innovation trends, key players, and future growth potential. The report leverages extensive data analysis and expert insights to provide actionable strategies for navigating this dynamic market.

Retail Industry in Australia Market Structure & Innovation Trends

This section analyzes the competitive landscape, examining market concentration, innovation drivers, regulatory influences, product substitution, and the evolving demographics of end-users. We delve into the significant M&A activities within the sector, providing insights into deal values and their impact on market share. Key players such as Woolworths Group Ltd, Coles Group, Wesfarmers Ltd, and ALDI Group are assessed, along with their strategic maneuvers. The Australian retail landscape is characterized by a high degree of concentration, with a few large players dominating the market. For example, Woolworths and Coles collectively hold an estimated xx% market share in grocery retail. The report further explores how regulatory frameworks, such as those related to consumer protection and data privacy, shape industry practices. M&A activity in the period 2019-2024 totaled approximately $xx Million, with a notable increase in activity in the online retail segment. Innovation drivers include the rise of e-commerce, omnichannel strategies, and the increasing adoption of data analytics for personalized customer experiences.

Retail Industry in Australia Market Dynamics & Trends

This section explores the key drivers and trends shaping the Australian retail market. We analyze market growth, technological disruptions, shifting consumer preferences, and the intense competitive dynamics at play. We present the Compound Annual Growth Rate (CAGR) for the historical period (2019-2024) and provide forecasts for the future (2025-2033). The projected CAGR for the forecast period is estimated at xx%. Market penetration of e-commerce continues to rise, fueled by increased smartphone usage and improved digital infrastructure. Consumer preferences are shifting towards convenience, value, and sustainability, prompting retailers to adapt their strategies and offerings. The competitive landscape is characterized by price wars, loyalty programs, and the ongoing battle for market share between established players and emerging disruptors. The report also investigates the impacts of external factors such as economic fluctuations and evolving consumer confidence on market growth.

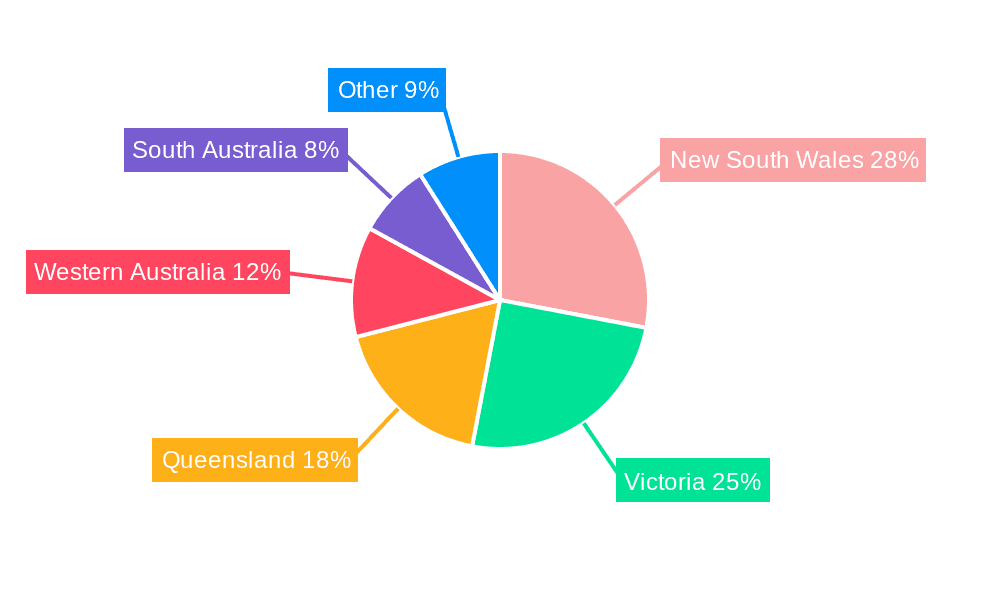

Dominant Regions & Segments in Retail Industry in Australia

This section identifies the leading regions and segments within the Australian retail market. Detailed analysis explores the factors contributing to their dominance.

- Key Drivers of Dominance:

- Stronger economic performance in specific regions.

- Favorable demographics and consumer spending patterns.

- Well-developed retail infrastructure and logistics networks.

- Government policies promoting retail development.

The dominance of specific regions stems from a combination of factors including higher population density, stronger economic activity, and established retail infrastructure. The report provides a granular analysis of regional performance indicators and highlights future growth prospects for each segment and geographic area. This includes a detailed breakdown of market size and potential for future growth in each dominant region.

Retail Industry in Australia Product Innovations

Recent product innovations in the Australian retail sector are largely driven by technological advancements. The integration of Artificial Intelligence (AI) and Machine Learning (ML) has led to improved inventory management, personalized recommendations, and enhanced customer service experiences. The growing emphasis on sustainability and ethical sourcing has also influenced product development, with an increase in eco-friendly and responsibly sourced products. These innovations are improving operational efficiency and attracting environmentally conscious consumers. This is complemented by the rise of subscription services and personalized product offerings, tailored to individual customer needs and preferences.

Report Scope & Segmentation Analysis

This report segments the Australian retail market by various factors, including product category (e.g., grocery, apparel, electronics), retail format (e.g., supermarkets, department stores, online retailers), and geographic region. Growth projections and market sizes are provided for each segment, along with an analysis of competitive dynamics. The grocery segment, for instance, is projected to reach $xx Million by 2033, driven by factors such as population growth and changing consumer habits. The online retail segment exhibits the highest growth potential, fuelled by rising e-commerce adoption. The competitive landscape within each segment is thoroughly analyzed, highlighting key players, their market strategies, and their relative strengths and weaknesses.

Key Drivers of Retail Industry in Australia Growth

Growth in the Australian retail sector is driven by several factors. Firstly, a growing population and rising disposable incomes are boosting consumer spending. Secondly, technological advancements, particularly in e-commerce and omnichannel retail, are creating new opportunities and improving efficiency. Thirdly, favorable government policies and infrastructure development are supporting retail growth in certain regions. Finally, the evolving preferences of Australian consumers, who increasingly seek convenience, value, and personalized experiences, are shaping market trends and driving innovation.

Challenges in the Retail Industry in Australia Sector

The Australian retail industry faces several challenges. Increasing operating costs, including rent and wages, are squeezing profit margins. Intense competition, both from established players and new entrants, is putting pressure on pricing and profitability. Supply chain disruptions and the rising cost of goods are affecting inventory levels and affordability. Furthermore, evolving consumer preferences and the need for continuous adaptation to stay relevant pose an ongoing challenge for retailers. The estimated impact of these challenges on overall industry profitability is approximately xx% reduction in profit margins by 2033.

Emerging Opportunities in Retail Industry in Australia

The Australian retail industry presents numerous emerging opportunities. The growth of e-commerce and the rise of omnichannel retail offer significant potential for expanding reach and engaging customers. The increasing demand for sustainable and ethically sourced products presents opportunities for retailers to differentiate themselves and cater to environmentally conscious consumers. Finally, the adoption of new technologies, such as AI and big data analytics, can improve operational efficiency, personalize customer experiences, and enhance decision-making.

Leading Players in the Retail Industry in Australia Market

- ALDI Group

- Metcash Ltd

- Woolworths Group Ltd

- Wesfarmers Ltd

- JB Hi-Fi Ltd

- Coles Group

- Kmart Australia Ltd

- Myer Group Pty Ltd

- David Jones Properties Pty Ltd

- Kogan.com Ltd *List Not Exhaustive

Key Developments in Retail Industry in Australia Industry

- November 2020: Wesfarmers expands its Kmart footprint with new store openings in Victoria and Western Australia, converting former Target stores and launching a new K Hub in Bairnsdale. This demonstrates a strategic focus on expansion and adapting to changing consumer needs in regional areas.

Future Outlook for Retail Industry in Australia Market

The Australian retail market is poised for continued growth, driven by factors such as population increase, rising disposable incomes, and ongoing technological advancements. Strategic opportunities lie in leveraging e-commerce, omnichannel strategies, and data analytics to enhance customer experiences and improve operational efficiency. Retailers who effectively adapt to evolving consumer preferences, embrace sustainable practices, and invest in innovative technologies will be best positioned to succeed in this dynamic and competitive market. The projected market size for 2033 is estimated at $xx Million, indicating significant growth potential for businesses that can capitalize on the emerging trends and opportunities.

Retail Industry in Australia Segmentation

-

1. Product

- 1.1. Food and Beverages

- 1.2. Personal and Household Care

- 1.3. Apparel, Footwear, and Accessories

- 1.4. Furniture, Toys, and Hobby

- 1.5. Electronic and Household Appliances

- 1.6. Other Products

-

2. Distribution Channel

- 2.1. Supermar

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

Retail Industry in Australia Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Retail Industry in Australia Regional Market Share

Geographic Coverage of Retail Industry in Australia

Retail Industry in Australia REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Demand for Food and Beverages Continues to be Strong Despite the COVID-19 Challenges

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Retail Industry in Australia Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Food and Beverages

- 5.1.2. Personal and Household Care

- 5.1.3. Apparel, Footwear, and Accessories

- 5.1.4. Furniture, Toys, and Hobby

- 5.1.5. Electronic and Household Appliances

- 5.1.6. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermar

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Retail Industry in Australia Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Food and Beverages

- 6.1.2. Personal and Household Care

- 6.1.3. Apparel, Footwear, and Accessories

- 6.1.4. Furniture, Toys, and Hobby

- 6.1.5. Electronic and Household Appliances

- 6.1.6. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermar

- 6.2.2. Specialty Stores

- 6.2.3. Online

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America Retail Industry in Australia Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Food and Beverages

- 7.1.2. Personal and Household Care

- 7.1.3. Apparel, Footwear, and Accessories

- 7.1.4. Furniture, Toys, and Hobby

- 7.1.5. Electronic and Household Appliances

- 7.1.6. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermar

- 7.2.2. Specialty Stores

- 7.2.3. Online

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe Retail Industry in Australia Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Food and Beverages

- 8.1.2. Personal and Household Care

- 8.1.3. Apparel, Footwear, and Accessories

- 8.1.4. Furniture, Toys, and Hobby

- 8.1.5. Electronic and Household Appliances

- 8.1.6. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermar

- 8.2.2. Specialty Stores

- 8.2.3. Online

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa Retail Industry in Australia Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Food and Beverages

- 9.1.2. Personal and Household Care

- 9.1.3. Apparel, Footwear, and Accessories

- 9.1.4. Furniture, Toys, and Hobby

- 9.1.5. Electronic and Household Appliances

- 9.1.6. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermar

- 9.2.2. Specialty Stores

- 9.2.3. Online

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific Retail Industry in Australia Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Food and Beverages

- 10.1.2. Personal and Household Care

- 10.1.3. Apparel, Footwear, and Accessories

- 10.1.4. Furniture, Toys, and Hobby

- 10.1.5. Electronic and Household Appliances

- 10.1.6. Other Products

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermar

- 10.2.2. Specialty Stores

- 10.2.3. Online

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ALDI Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Metcash Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Woolworths Group Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Wesfarmers Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 JB Hi-Fi Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Coles Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kmart Australia Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Myer Group Pty Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 David Jones Properties Pty Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kogan com Ltd**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 ALDI Group

List of Figures

- Figure 1: Global Retail Industry in Australia Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Retail Industry in Australia Revenue (billion), by Product 2025 & 2033

- Figure 3: North America Retail Industry in Australia Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Retail Industry in Australia Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: North America Retail Industry in Australia Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Retail Industry in Australia Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Retail Industry in Australia Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Retail Industry in Australia Revenue (billion), by Product 2025 & 2033

- Figure 9: South America Retail Industry in Australia Revenue Share (%), by Product 2025 & 2033

- Figure 10: South America Retail Industry in Australia Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 11: South America Retail Industry in Australia Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: South America Retail Industry in Australia Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Retail Industry in Australia Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Retail Industry in Australia Revenue (billion), by Product 2025 & 2033

- Figure 15: Europe Retail Industry in Australia Revenue Share (%), by Product 2025 & 2033

- Figure 16: Europe Retail Industry in Australia Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 17: Europe Retail Industry in Australia Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Europe Retail Industry in Australia Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Retail Industry in Australia Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Retail Industry in Australia Revenue (billion), by Product 2025 & 2033

- Figure 21: Middle East & Africa Retail Industry in Australia Revenue Share (%), by Product 2025 & 2033

- Figure 22: Middle East & Africa Retail Industry in Australia Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: Middle East & Africa Retail Industry in Australia Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Middle East & Africa Retail Industry in Australia Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Retail Industry in Australia Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Retail Industry in Australia Revenue (billion), by Product 2025 & 2033

- Figure 27: Asia Pacific Retail Industry in Australia Revenue Share (%), by Product 2025 & 2033

- Figure 28: Asia Pacific Retail Industry in Australia Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Asia Pacific Retail Industry in Australia Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Asia Pacific Retail Industry in Australia Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Retail Industry in Australia Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Retail Industry in Australia Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Global Retail Industry in Australia Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Retail Industry in Australia Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Retail Industry in Australia Revenue billion Forecast, by Product 2020 & 2033

- Table 5: Global Retail Industry in Australia Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Retail Industry in Australia Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Retail Industry in Australia Revenue billion Forecast, by Product 2020 & 2033

- Table 11: Global Retail Industry in Australia Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global Retail Industry in Australia Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Retail Industry in Australia Revenue billion Forecast, by Product 2020 & 2033

- Table 17: Global Retail Industry in Australia Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global Retail Industry in Australia Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Retail Industry in Australia Revenue billion Forecast, by Product 2020 & 2033

- Table 29: Global Retail Industry in Australia Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global Retail Industry in Australia Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Retail Industry in Australia Revenue billion Forecast, by Product 2020 & 2033

- Table 38: Global Retail Industry in Australia Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global Retail Industry in Australia Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Retail Industry in Australia?

The projected CAGR is approximately 3.1%.

2. Which companies are prominent players in the Retail Industry in Australia?

Key companies in the market include ALDI Group, Metcash Ltd, Woolworths Group Ltd, Wesfarmers Ltd, JB Hi-Fi Ltd, Coles Group, Kmart Australia Ltd, Myer Group Pty Ltd, David Jones Properties Pty Ltd, Kogan com Ltd**List Not Exhaustive.

3. What are the main segments of the Retail Industry in Australia?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 551.11 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Demand for Food and Beverages Continues to be Strong Despite the COVID-19 Challenges.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In November 2020, Wesfarmers retail businesses continued to expand their business. Kmart opened new stores in Camberwell and Casey in Victoria and Cockburn in Western Australia, all converted from Target stores, alongside its newest K Hub store in Bairnsdale in regional Victoria.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Retail Industry in Australia," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Retail Industry in Australia report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Retail Industry in Australia?

To stay informed about further developments, trends, and reports in the Retail Industry in Australia, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence