Key Insights

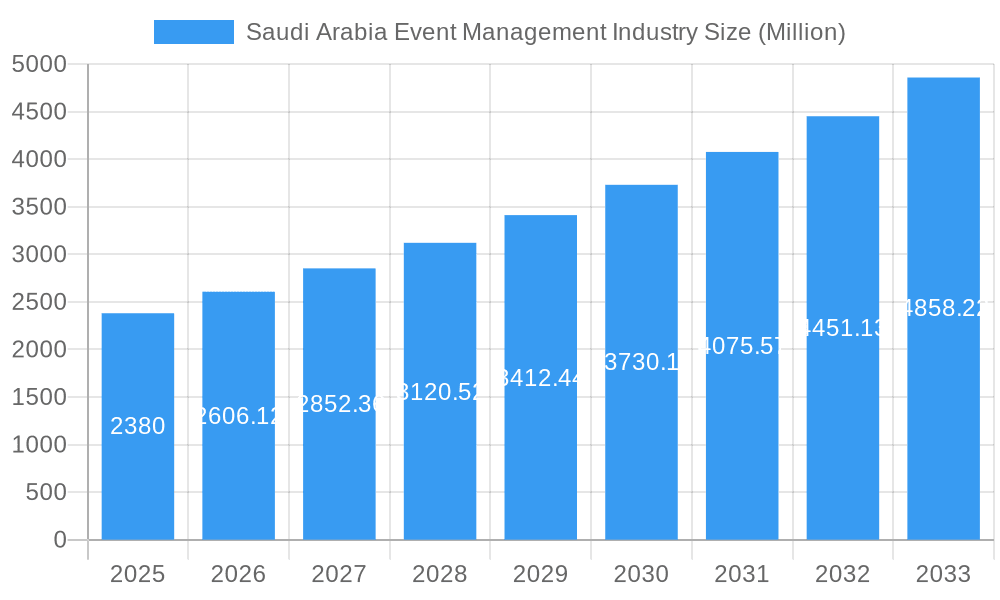

The Saudi Arabian event management industry is experiencing robust growth, projected to reach a market size of $2.38 billion in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 9.74% from 2019 to 2033. This expansion is fueled by several key drivers. The Kingdom's Vision 2030 initiative, focused on diversifying the economy and boosting tourism, is significantly impacting the sector. Large-scale investments in infrastructure, including world-class venues and improved transportation networks, are creating opportunities for a wider range of events, from conferences and exhibitions to concerts and festivals. Furthermore, a burgeoning young population with high disposable income contributes to increased demand for entertainment and experiences, driving participation in events. Government support through streamlined licensing procedures and incentives for event organizers further accelerates market growth. While challenges exist, such as competition for skilled professionals and maintaining event sustainability, the overall trajectory is highly positive.

Saudi Arabia Event Management Industry Market Size (In Billion)

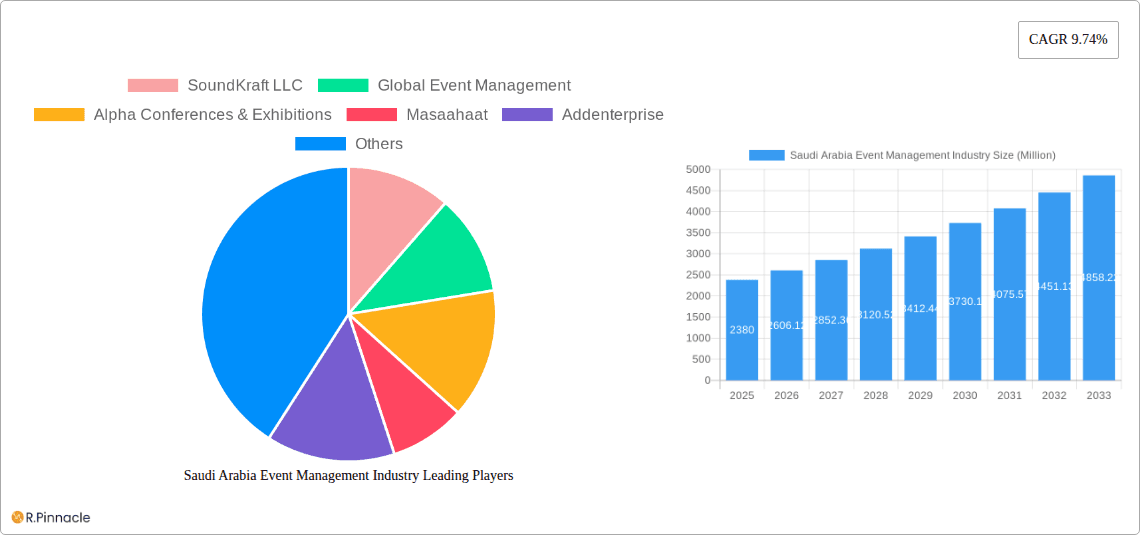

The competitive landscape is characterized by a mix of international and local players, including both large event management companies and specialized firms catering to niche sectors. Companies like SoundKraft LLC, Global Event Management, and Riyadh Exhibitions Company Ltd are prominent examples of organizations shaping the industry. Segmentation within the market includes corporate events, conferences, exhibitions, festivals, and entertainment events. Future growth will likely be driven by technological advancements, including the use of virtual and hybrid event formats, and an increased focus on data-driven strategies to enhance attendee experiences and maximize ROI for event organizers. The forecast period of 2025-2033 presents substantial opportunities for both established players and new entrants, with continued expansion predicted across all event segments. The market's strength lies in its alignment with the Kingdom's economic diversification strategy and the increasing demand for high-quality experiences within the Saudi Arabian market.

Saudi Arabia Event Management Industry Company Market Share

Saudi Arabia Event Management Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Saudi Arabia event management industry, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period 2019-2033, with a focus on 2025, this report delivers crucial data and forecasts to navigate the dynamic landscape of this rapidly expanding sector. The report projects a market size of XX Million by 2025, and explores a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033.

Saudi Arabia Event Management Industry Market Structure & Innovation Trends

The Saudi Arabian event management market exhibits a moderately fragmented structure, with several large players and numerous smaller specialized firms. Key players include SoundKraft LLC, Global Event Management, Alpha Conferences & Exhibitions, Masaahaat, Addenterprise, SELA, Luxury KSA, Heights, Benchmark Events, Riyadh Exhibitions Company Ltd, Markable General Trading LLC, and KonozRetaj (list not exhaustive). Market share data is unavailable for precise calculation. However, we can infer that these major players hold a significant portion of the overall revenue, while a large number of smaller firms focus on niche segments.

Innovation within the industry is driven by several factors:

- Technological advancements: Integration of VR/AR, AI-powered event planning tools, and advanced analytics are reshaping the industry.

- Government initiatives: Vision 2030's focus on diversification and tourism is driving significant investment in infrastructure and large-scale events.

- Changing consumer preferences: Demand for personalized, experiential events, and sustainable practices influences offerings.

Regulatory frameworks, while generally supportive of growth, need further streamlining to ensure ease of doing business. Product substitutes are limited, mainly encompassing in-house event management capabilities within large corporations. The market is witnessing increased M&A activity, though specific deal values remain unavailable for public disclosure. Future M&A will likely focus on consolidating market share, gaining access to new technologies, and expanding service portfolios. The primary end-user demographics are diverse, encompassing both the corporate sector and the rapidly growing leisure and entertainment market.

Saudi Arabia Event Management Industry Market Dynamics & Trends

The Saudi Arabian event management market is experiencing robust growth, fueled by several key drivers. The government's Vision 2030 initiative is a significant catalyst, promoting diversification away from oil dependence and boosting tourism. This leads to increased demand for large-scale events, conferences, and exhibitions, creating substantial opportunities.

Technological disruption is also shaping the market. Digitalization is increasing efficiency in event planning, marketing, and execution. The adoption of innovative technologies, including virtual and hybrid events, expands market reach and enhances attendee engagement.

Consumer preferences are shifting towards personalized experiences, creating demand for tailored event solutions. Furthermore, growing awareness of environmental sustainability is influencing event planning practices. The competitive landscape is dynamic, with both domestic and international players vying for market share. This leads to heightened innovation and improved service quality. The market penetration rate is currently unavailable for this specific analysis, but it is expected to increase as the sector continues to expand its reach.

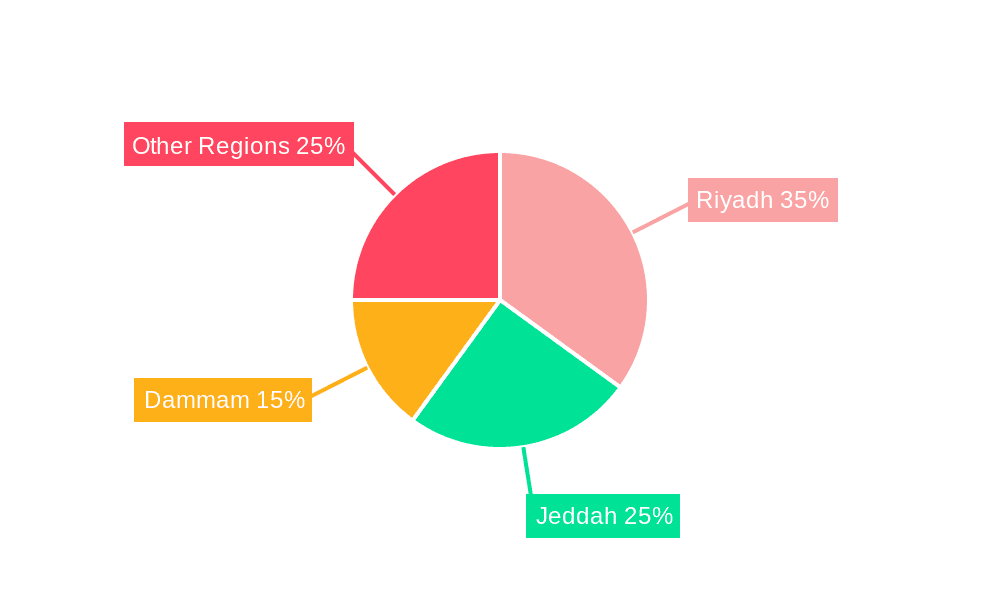

Dominant Regions & Segments in Saudi Arabia Event Management Industry

While data is limited on specific regional breakdowns, Riyadh and Jeddah are likely the dominant regions due to their established infrastructure, larger population centers, and proximity to key transportation hubs. This dominance is further supported by the concentration of major companies and substantial investment in these cities. Key drivers for these regions include:

- Robust infrastructure: Excellent venues, transportation networks, and hospitality sectors facilitate large-scale events.

- Government support: Targeted policies and funding for infrastructure development and tourism enhancement boost the event management sector in these regions.

- High population density: Concentrated populations translate to a larger potential audience for events.

A detailed analysis reveals a significant market segment focused on corporate events, driven by a robust business environment and rising corporate spending on employee engagement and brand building. The other key segment includes large-scale exhibitions, conferences, and entertainment events. These segments benefit from the government's tourism push and the growing demand for leisure activities.

Saudi Arabia Event Management Industry Product Innovations

The event management industry in Saudi Arabia is witnessing significant product innovation, driven by technological advancements and the evolving needs of clients. Virtual and hybrid event solutions are gaining traction, providing greater flexibility and reach. AI-powered event planning tools streamline logistics and improve efficiency. The integration of data analytics provides valuable insights for event optimization, enabling better engagement and ROI. These innovations cater to a market demanding more efficient, engaging, and personalized event experiences.

Report Scope & Segmentation Analysis

This report segments the Saudi Arabian event management market based on event type (corporate, conferences, exhibitions, entertainment, etc.), service type (planning, design, execution, marketing), and region (Riyadh, Jeddah, etc.). Each segment’s market size, growth projections, and competitive landscape are analyzed separately. Detailed market size figures and growth projections for each segment are unavailable and will need further investigation.

Key Drivers of Saudi Arabia Event Management Industry Growth

Several factors fuel the growth of the Saudi Arabia event management industry. Vision 2030's focus on diversification and tourism is a major driver, leading to increased investment in infrastructure and events. The rise of corporate social responsibility and the need for enhanced employee engagement drive corporate event spending. The expanding middle class, with greater disposable income, increases participation in leisure and entertainment events. Additionally, technological innovations such as AI and VR enhance event experiences, supporting market expansion.

Challenges in the Saudi Arabia Event Management Industry Sector

The industry faces challenges including the need for skilled professionals and the high cost of talent acquisition. Regulatory complexities, though supportive of growth in principle, may present operational challenges for some players. The fluctuating oil prices can impact overall economic sentiment and thus, event spending. Furthermore, intense competition from both domestic and international companies necessitates ongoing innovation and differentiation.

Emerging Opportunities in Saudi Arabia Event Management Industry

Significant opportunities exist in leveraging technology for immersive event experiences. The growing popularity of sustainable practices presents opportunities for environmentally conscious event planning. The rising trend towards niche events, catering to specific interests and communities, provides fertile ground for focused growth. Finally, tapping into the growing expatriate population and expanding international tourism will broaden the client base.

Leading Players in the Saudi Arabia Event Management Industry Market

- SoundKraft LLC

- Global Event Management

- Alpha Conferences & Exhibitions

- Masaahaat

- Addenterprise

- SELA

- Luxury KSA

- Heights

- Benchmark Events

- Riyadh Exhibitions Company Ltd

- Markable General Trading LLC

- KonozRetaj (List not exhaustive)

Key Developments in Saudi Arabia Event Management Industry

- December 2023: Comma, a leading PR and event management agency in Saudi Arabia, partnered with ALTER, a UK-based communications agency, to manage ALTER's Saudi operations and collaborate on events.

- January 2024: dmg events is preparing to launch the Saudi Sports and Leisure Facilities (SSLF) Expo and Sports Build Show in Saudi Arabia.

Future Outlook for Saudi Arabia Event Management Industry Market

The Saudi Arabia event management industry is poised for sustained growth, driven by government initiatives, economic diversification, and technological advancements. Opportunities abound in niche markets, sustainable practices, and technological integration. The market's future hinges on adapting to evolving consumer preferences, embracing technological innovation, and navigating the competitive landscape effectively. The projected CAGR suggests a significant expansion of the market in the coming years, presenting promising opportunities for both established players and new entrants.

Saudi Arabia Event Management Industry Segmentation

-

1. End User

- 1.1. Corporate

- 1.2. Individual

- 1.3. Public

-

2. Type

- 2.1. Music Concert

- 2.2. Festivals

- 2.3. Sports

- 2.4. Exhibitions and Conferences

- 2.5. Corporate Events and Seminars

- 2.6. Other Types

-

3. Revenue Source

- 3.1. Ticket Sale

- 3.2. Sponsorship

- 3.3. Other Revenue Sources

Saudi Arabia Event Management Industry Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Event Management Industry Regional Market Share

Geographic Coverage of Saudi Arabia Event Management Industry

Saudi Arabia Event Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.74% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in the Number of Events and Conference in the Country; Raise in Disposable Income and Lifestyle

- 3.3. Market Restrains

- 3.3.1. Increase in the Number of Events and Conference in the Country; Raise in Disposable Income and Lifestyle

- 3.4. Market Trends

- 3.4.1. The Market is Influenced by Major International Events Being Held in Saudi Arabia

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Event Management Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Corporate

- 5.1.2. Individual

- 5.1.3. Public

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Music Concert

- 5.2.2. Festivals

- 5.2.3. Sports

- 5.2.4. Exhibitions and Conferences

- 5.2.5. Corporate Events and Seminars

- 5.2.6. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Revenue Source

- 5.3.1. Ticket Sale

- 5.3.2. Sponsorship

- 5.3.3. Other Revenue Sources

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SoundKraft LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Global Event Management

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Alpha Conferences & Exhibitions

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Masaahaat

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Addenterprise

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SELA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Luxury KSA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Heights

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Benchmark Events

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Riyadh Exhibitions Company Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Markable General Trading LLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 KonozRetaj **List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 SoundKraft LLC

List of Figures

- Figure 1: Saudi Arabia Event Management Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Event Management Industry Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Event Management Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 2: Saudi Arabia Event Management Industry Volume Billion Forecast, by End User 2020 & 2033

- Table 3: Saudi Arabia Event Management Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Saudi Arabia Event Management Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 5: Saudi Arabia Event Management Industry Revenue Million Forecast, by Revenue Source 2020 & 2033

- Table 6: Saudi Arabia Event Management Industry Volume Billion Forecast, by Revenue Source 2020 & 2033

- Table 7: Saudi Arabia Event Management Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Saudi Arabia Event Management Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Saudi Arabia Event Management Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 10: Saudi Arabia Event Management Industry Volume Billion Forecast, by End User 2020 & 2033

- Table 11: Saudi Arabia Event Management Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Saudi Arabia Event Management Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 13: Saudi Arabia Event Management Industry Revenue Million Forecast, by Revenue Source 2020 & 2033

- Table 14: Saudi Arabia Event Management Industry Volume Billion Forecast, by Revenue Source 2020 & 2033

- Table 15: Saudi Arabia Event Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Saudi Arabia Event Management Industry Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Event Management Industry?

The projected CAGR is approximately 9.74%.

2. Which companies are prominent players in the Saudi Arabia Event Management Industry?

Key companies in the market include SoundKraft LLC, Global Event Management, Alpha Conferences & Exhibitions, Masaahaat, Addenterprise, SELA, Luxury KSA, Heights, Benchmark Events, Riyadh Exhibitions Company Ltd, Markable General Trading LLC, KonozRetaj **List Not Exhaustive.

3. What are the main segments of the Saudi Arabia Event Management Industry?

The market segments include End User, Type, Revenue Source.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.38 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the Number of Events and Conference in the Country; Raise in Disposable Income and Lifestyle.

6. What are the notable trends driving market growth?

The Market is Influenced by Major International Events Being Held in Saudi Arabia.

7. Are there any restraints impacting market growth?

Increase in the Number of Events and Conference in the Country; Raise in Disposable Income and Lifestyle.

8. Can you provide examples of recent developments in the market?

January 2024 - dmg events, an international exhibition organizer, is preparing to introduce two upcoming events in Saudi Arabia: the Saudi Sports and Leisure Facilities (SSLF) Expo and Sports Build Show.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Event Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Event Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Event Management Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabia Event Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence