Key Insights

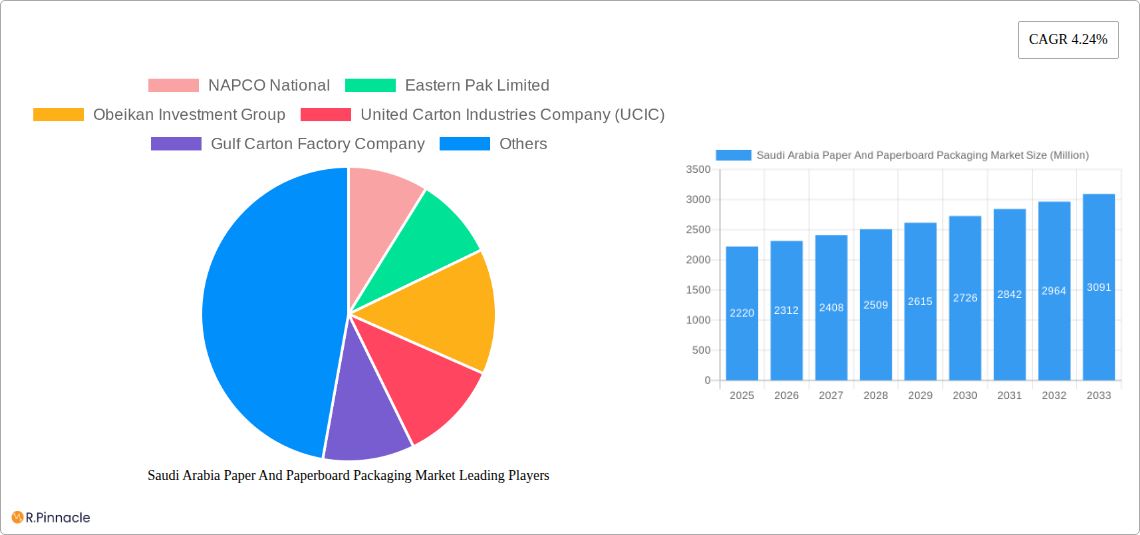

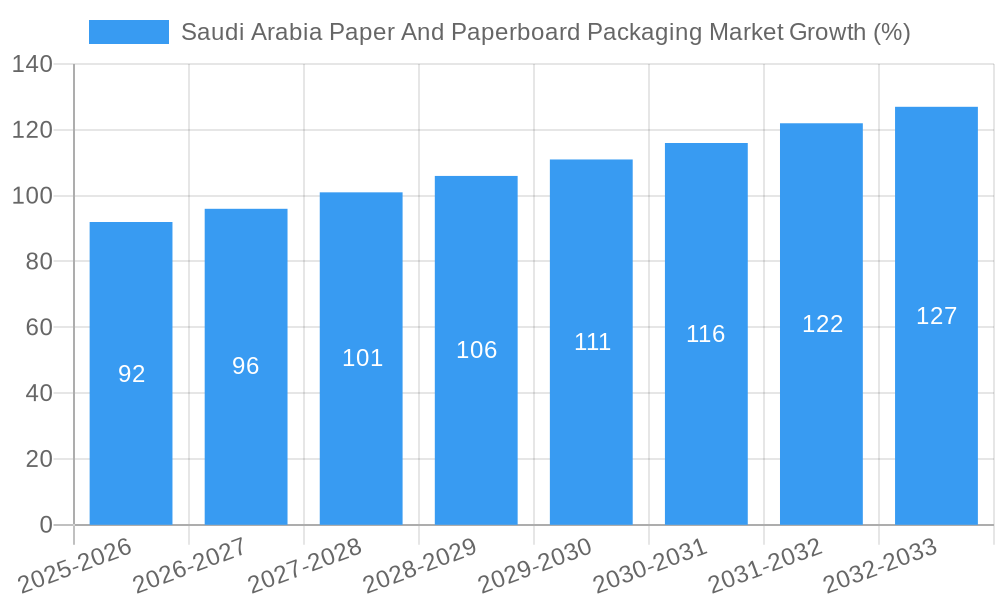

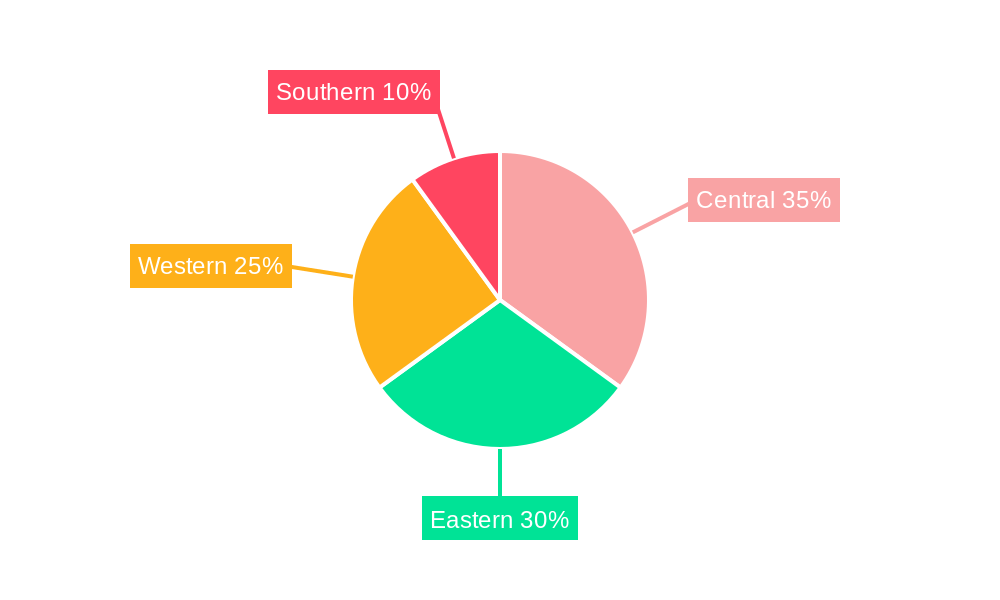

The Saudi Arabia paper and paperboard packaging market, valued at $2.22 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 4.24% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning food and beverage sector, coupled with a rising population and increasing consumer spending, significantly boosts demand for packaging solutions. Furthermore, the healthcare and personal care industries are contributing to market growth, as they require specialized packaging for hygiene and product preservation. Growth is also supported by the increasing adoption of sustainable and eco-friendly packaging materials, reflecting a broader shift towards environmentally conscious practices within the Kingdom. Government initiatives promoting economic diversification and industrial growth further bolster the market's trajectory. However, fluctuations in raw material prices and potential supply chain disruptions pose challenges to sustained growth. The market is segmented by type (folding cartons, corrugated boxes, and other types) and end-user vertical (food and beverage, healthcare, personal care and household care, industrial, and others), offering diverse opportunities for market players. Competition is primarily among domestic and international players, with established companies like NAPCO National and Eastern Pak Limited holding significant market share. Regional variations exist, with central and eastern Saudi Arabia likely exhibiting higher growth rates due to higher population density and industrial activity.

The forecast period from 2025 to 2033 presents promising prospects for the Saudi Arabia paper and paperboard packaging market. The projected CAGR of 4.24% indicates a substantial increase in market size over the next decade. This growth will be influenced by ongoing investments in infrastructure, technological advancements in packaging materials and design, and the Kingdom’s Vision 2030, which prioritizes economic diversification and sustainable development. While challenges such as raw material price volatility and competition remain, the market's inherent growth drivers are expected to outweigh these constraints, leading to sustained expansion throughout the forecast period. The market segmentation offers opportunities for specialized players catering to specific end-user needs and packaging types.

Saudi Arabia Paper and Paperboard Packaging Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Saudi Arabia paper and paperboard packaging market, offering valuable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's structure, dynamics, key players, and future outlook.

Saudi Arabia Paper and Paperboard Packaging Market Structure & Innovation Trends

This section analyzes the competitive landscape, encompassing market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and mergers and acquisitions (M&A) activities. We examine the market share held by key players such as NAPCO National, Eastern Pak Limited, Obeikan Investment Group, United Carton Industries Company (UCIC), Gulf Carton Factory Company, Middle East Paper Company, Gulf East Paper & Plastic Industries LLC, and Western Modern Packaging Co Ltd. The analysis includes an assessment of the impact of recent M&A activity, with estimated deal values analyzed where possible. The report delves into the influence of regulatory changes on innovation and market structure. Furthermore, it explores the emergence of sustainable packaging solutions and their impact on market dynamics. The analysis also includes an assessment of substitute materials and their potential to disrupt the market. Finally, it provides a detailed overview of end-user demographics and their influence on packaging choices. Market share data for major players is provided, along with an analysis of industry concentration. The estimated total M&A deal value for the period 2019-2024 is xx Million.

Saudi Arabia Paper and Paperboard Packaging Market Dynamics & Trends

This section explores the key drivers and trends shaping the Saudi Arabian paper and paperboard packaging market. We analyze market growth drivers, including population growth, rising disposable incomes, and urbanization. The report examines the impact of technological disruptions, such as automation and advancements in packaging materials, on market dynamics. Consumer preferences, including a growing demand for sustainable and eco-friendly packaging, are closely examined. Competitive dynamics, including pricing strategies and product differentiation, are also analyzed. The report provides a detailed analysis of the market’s Compound Annual Growth Rate (CAGR) and market penetration rates for various segments. The projected CAGR for the forecast period (2025-2033) is estimated at xx%. Market penetration for sustainable packaging is projected to reach xx% by 2033.

Dominant Regions & Segments in Saudi Arabia Paper and Paperboard Packaging Market

This section identifies the leading regions and segments within the Saudi Arabian paper and paperboard packaging market. The analysis focuses on market dominance by type (Folding Cartons, Corrugated Boxes, Other Types) and end-user vertical (Food and Beverage, Healthcare, Personal Care and Household Care, Industrial, Other End-user Verticals).

Key Drivers:

- Food and Beverage: Growing food processing industry and increasing demand for packaged food products.

- Healthcare: Rising healthcare expenditure and the need for safe and hygienic packaging in pharmaceutical and medical device industries.

- Economic Policies: Government initiatives promoting industrial growth and infrastructure development.

- Infrastructure: Investments in logistics and supply chain infrastructure to support the packaging industry.

The detailed dominance analysis will identify the leading region and segment, explaining the factors contributing to their market leadership. For example, the Food and Beverage segment is expected to hold the largest market share owing to the expanding food processing and retail sectors.

Saudi Arabia Paper and Paperboard Packaging Market Product Innovations

This section summarizes recent product developments, applications, and competitive advantages in the Saudi Arabian paper and paperboard packaging market. The focus is on technological advancements driving innovation, such as the adoption of sustainable materials, improved printing techniques, and the development of intelligent packaging solutions. The analysis emphasizes the market fit of these new products and their ability to meet changing consumer demands and regulatory requirements. The increasing adoption of smart packaging technologies is driving growth within this segment.

Report Scope & Segmentation Analysis

This report segments the Saudi Arabia paper and paperboard packaging market by type (Folding Cartons, Corrugated Boxes, Other Types) and end-user vertical (Food and Beverage, Healthcare, Personal Care and Household Care, Industrial, Other End-user Verticals). Each segment’s analysis includes growth projections, market size estimates for 2025, and a discussion of competitive dynamics. For example, the folding carton segment is projected to witness significant growth, driven by the increasing demand from the food and beverage industry. The healthcare segment is also expected to demonstrate substantial growth due to the rising demand for pharmaceutical packaging.

Key Drivers of Saudi Arabia Paper and Paperboard Packaging Market Growth

Several factors contribute to the growth of the Saudi Arabia paper and paperboard packaging market. These include increasing consumer spending, growing e-commerce activities, and the expansion of the food and beverage industry. Government initiatives promoting sustainable packaging practices are also driving market growth. Technological advancements, such as the development of biodegradable and recyclable materials, further enhance market expansion. Finally, the growing demand for specialized packaging solutions, such as tamper-evident packaging and modified atmosphere packaging, contributes to overall market growth.

Challenges in the Saudi Arabia Paper and Paperboard Packaging Market Sector

The Saudi Arabia paper and paperboard packaging market faces challenges such as fluctuations in raw material prices, increasing competition, and stringent environmental regulations. The market is also experiencing pressure from substitute packaging materials, leading to pricing competition. Supply chain disruptions and logistical complexities can also impede market growth. Furthermore, the implementation and adherence to environmental regulations pose a significant challenge for market players. These factors combined can negatively impact profit margins.

Emerging Opportunities in Saudi Arabia Paper and Paperboard Packaging Market

The Saudi Arabia paper and paperboard packaging market presents several opportunities for growth. The increasing adoption of sustainable and eco-friendly packaging solutions creates new market segments. Technological advancements, such as the development of intelligent packaging and personalized packaging, offer exciting opportunities for innovation. The expansion of the e-commerce sector and the growing demand for customized packaging solutions further contribute to the market's potential. The focus on sustainability presents a significant opportunity for companies to develop and market environmentally friendly packaging options.

Leading Players in the Saudi Arabia Paper and Paperboard Packaging Market Market

- NAPCO National

- Eastern Pak Limited

- Obeikan Investment Group

- United Carton Industries Company (UCIC)

- Gulf Carton Factory Company

- Middle East Paper Company

- Gulf East Paper & Plastic Industries LLC

- Western Modern Packaging Co Ltd

Key Developments in Saudi Arabia Paper and Paperboard Packaging Market Industry

- April 2023: Hotpack, a UAE-based manufacturer, invested USD 266 Million in a specialized food packaging program in Saudi Arabia, focusing on sustainable and recyclable solutions.

- January 2024: Bank ABC provided a USD 26.94 Million sustainability-linked credit facility to Saudi Paper Manufacturing Company (SPM) for procuring state-of-the-art machinery from Toscotec, boosting efficiency and scale.

Future Outlook for Saudi Arabia Paper and Paperboard Packaging Market Market

The Saudi Arabia paper and paperboard packaging market is poised for significant growth in the coming years. Driven by increasing consumer demand, economic expansion, and government support for sustainable practices, the market is expected to witness a sustained growth trajectory. Strategic investments in innovative packaging technologies and a focus on environmental sustainability will further propel market expansion. The market is expected to benefit from increased focus on e-commerce and the growing demand for customized packaging options.

Saudi Arabia Paper And Paperboard Packaging Market Segmentation

-

1. Type

- 1.1. Folding Cartons

- 1.2. Corrugated Boxes

- 1.3. Other Types

-

2. End-user Vertical

- 2.1. Food and Beverage

- 2.2. Healthcare

- 2.3. Personal Care and Household Care

- 2.4. Industrial

- 2.5. Other End-user Verticals

Saudi Arabia Paper And Paperboard Packaging Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Paper And Paperboard Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.24% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from the Food and Beverage Sector; Regulations on Plastic-based Packaging Products Contributes to Higher Demand; Increasing Demand for Eco-friendly Solutions and Scope for Printing Innovations Propelling the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. Reliance on Other Countries for Raw Materials and Fluctuating Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Folding Cartons to Witness Major Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Paper And Paperboard Packaging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Folding Cartons

- 5.1.2. Corrugated Boxes

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Food and Beverage

- 5.2.2. Healthcare

- 5.2.3. Personal Care and Household Care

- 5.2.4. Industrial

- 5.2.5. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Central Saudi Arabia Paper And Paperboard Packaging Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Saudi Arabia Paper And Paperboard Packaging Market Analysis, Insights and Forecast, 2019-2031

- 8. Western Saudi Arabia Paper And Paperboard Packaging Market Analysis, Insights and Forecast, 2019-2031

- 9. Southern Saudi Arabia Paper And Paperboard Packaging Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 NAPCO National

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Eastern Pak Limited

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Obeikan Investment Group

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 United Carton Industries Company (UCIC)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Gulf Carton Factory Company

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Middle East Paper Company

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Gulf East Paper & Plastic Industries LLC

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Western Modern Packaging Co Lt

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 NAPCO National

List of Figures

- Figure 1: Saudi Arabia Paper And Paperboard Packaging Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Paper And Paperboard Packaging Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Paper And Paperboard Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Paper And Paperboard Packaging Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Saudi Arabia Paper And Paperboard Packaging Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 4: Saudi Arabia Paper And Paperboard Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Saudi Arabia Paper And Paperboard Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Central Saudi Arabia Paper And Paperboard Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Eastern Saudi Arabia Paper And Paperboard Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Western Saudi Arabia Paper And Paperboard Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Southern Saudi Arabia Paper And Paperboard Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Saudi Arabia Paper And Paperboard Packaging Market Revenue Million Forecast, by Type 2019 & 2032

- Table 11: Saudi Arabia Paper And Paperboard Packaging Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 12: Saudi Arabia Paper And Paperboard Packaging Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Paper And Paperboard Packaging Market?

The projected CAGR is approximately 4.24%.

2. Which companies are prominent players in the Saudi Arabia Paper And Paperboard Packaging Market?

Key companies in the market include NAPCO National, Eastern Pak Limited, Obeikan Investment Group, United Carton Industries Company (UCIC), Gulf Carton Factory Company, Middle East Paper Company, Gulf East Paper & Plastic Industries LLC, Western Modern Packaging Co Lt.

3. What are the main segments of the Saudi Arabia Paper And Paperboard Packaging Market?

The market segments include Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.22 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from the Food and Beverage Sector; Regulations on Plastic-based Packaging Products Contributes to Higher Demand; Increasing Demand for Eco-friendly Solutions and Scope for Printing Innovations Propelling the Growth of the Market.

6. What are the notable trends driving market growth?

Folding Cartons to Witness Major Growth.

7. Are there any restraints impacting market growth?

Reliance on Other Countries for Raw Materials and Fluctuating Raw Material Prices.

8. Can you provide examples of recent developments in the market?

January 2024 - Bank ABC (Arab Banking Corporation BSC) closed a EUR 24.9 million (USD 26.94 million) sustainability-linked credit facility for the Saudi Paper Manufacturing Company. The loan amount is planned to support SPM’s expansion plan by funding the procurement of state-of-the-art machinery from Toscotec, which will add efficiencies of scale and scope to SPM’s business.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Paper And Paperboard Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Paper And Paperboard Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Paper And Paperboard Packaging Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Paper And Paperboard Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence