Key Insights

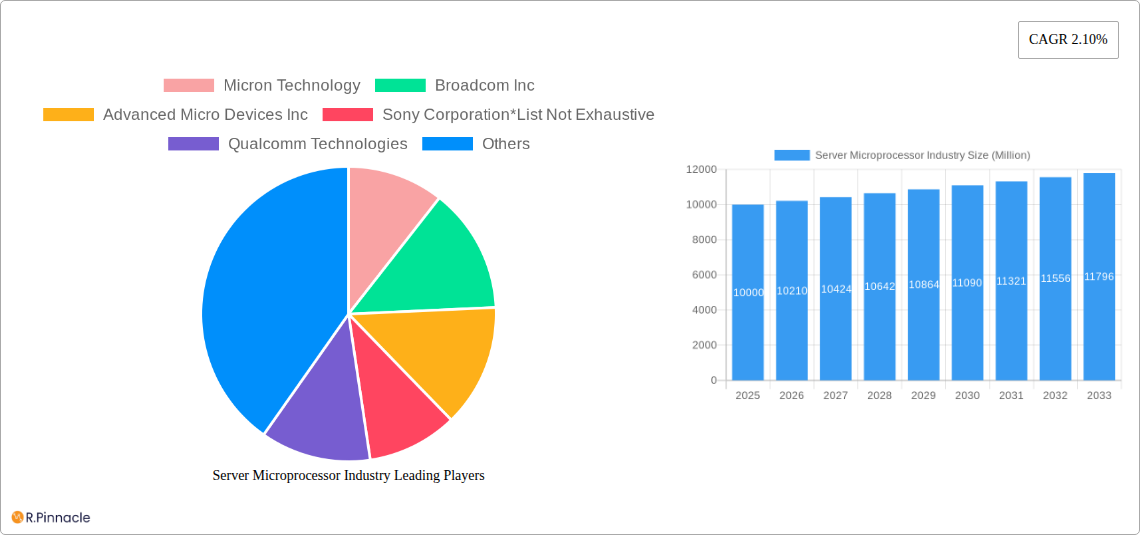

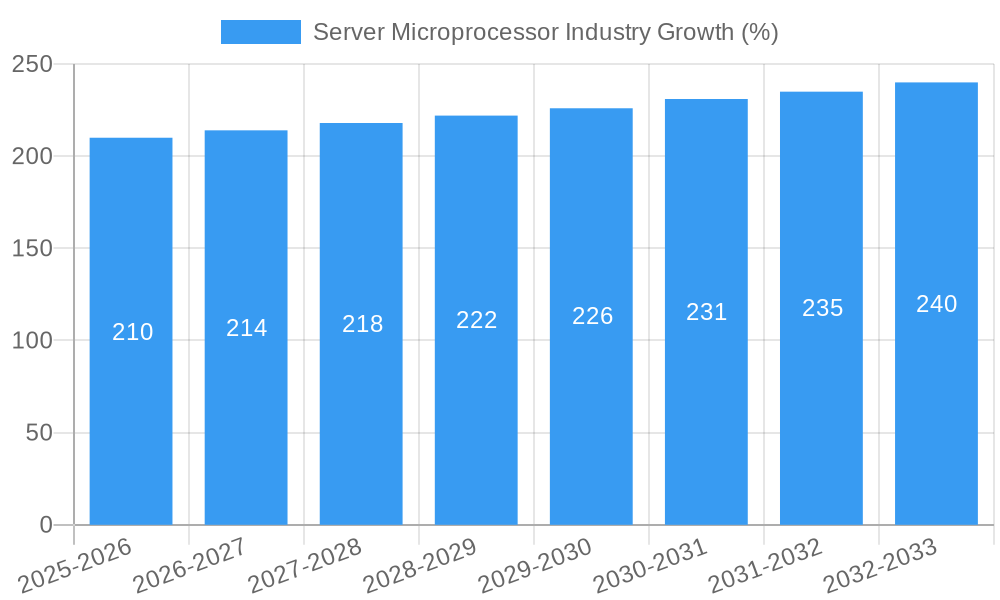

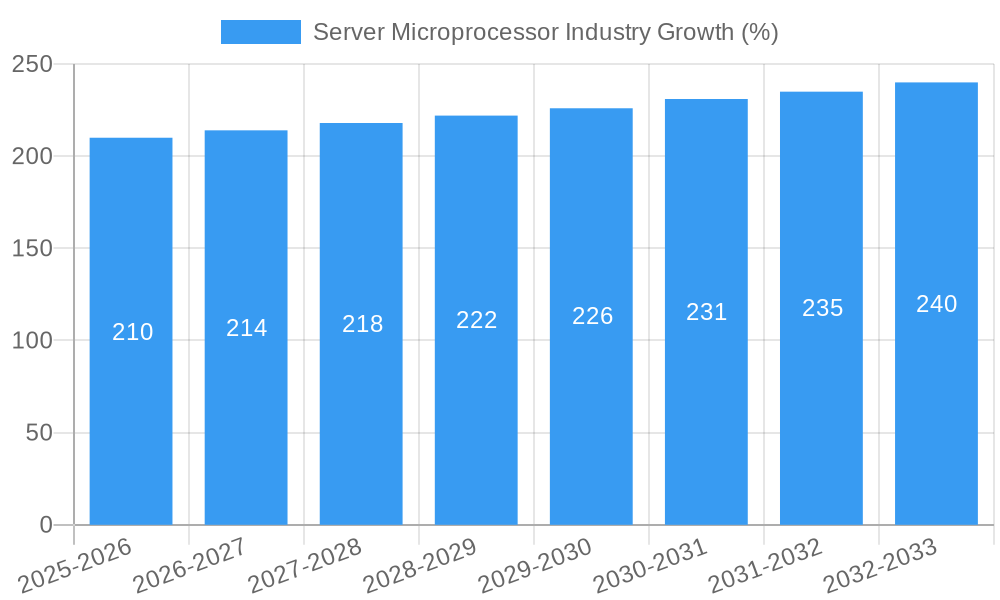

The server microprocessor market, currently valued at approximately $XX million (estimated based on provided CAGR and market trends), is projected to experience steady growth, with a Compound Annual Growth Rate (CAGR) of 2.10% from 2025 to 2033. This growth is driven by several key factors. The increasing demand for high-performance computing (HPC) in data centers, fueled by the proliferation of big data analytics, artificial intelligence (AI), and machine learning (ML) applications, is a primary driver. Furthermore, the rising adoption of cloud computing and the expanding edge computing infrastructure necessitate more powerful and energy-efficient server microprocessors. Technological advancements, such as the development of advanced architectures like Arm and RISC-V, along with improvements in manufacturing processes leading to enhanced performance and reduced power consumption, further contribute to market expansion. Segmentation analysis reveals significant contributions from various application areas, including consumer electronics, enterprise computing, automotive, and industrial sectors. While the market faces certain restraints, such as supply chain disruptions and potential economic downturns, the overall outlook remains positive due to the sustained demand for advanced computing capabilities across diverse industries.

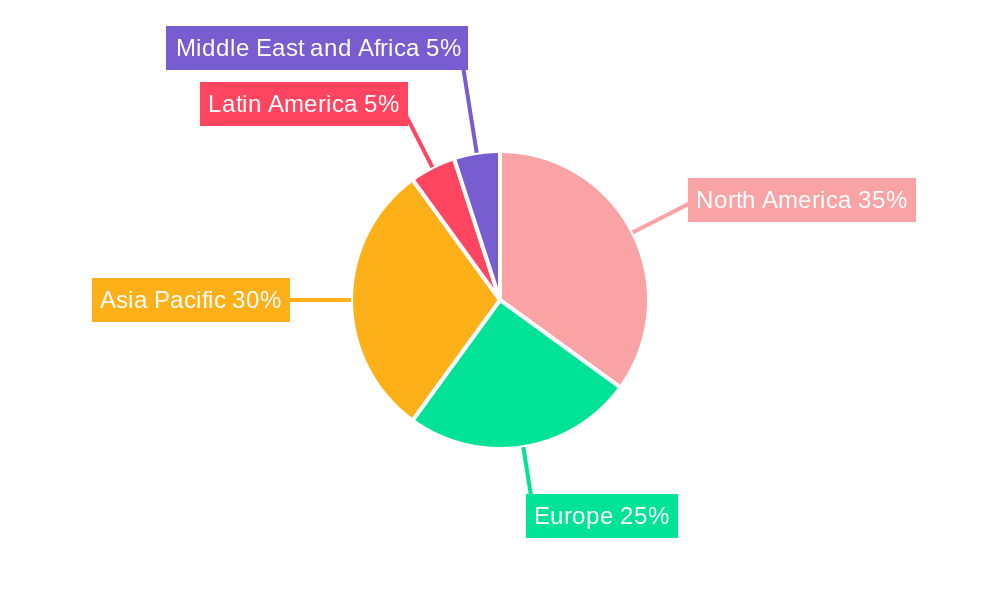

The leading players in the server microprocessor market, including Intel, AMD, and companies like Nvidia (with their GPU offerings increasingly relevant to server applications), are constantly innovating to cater to this growing demand. Competition is fierce, characterized by ongoing advancements in chip architecture, core count, clock speed, and power efficiency. This competitive landscape fosters innovation and drives prices down, benefiting consumers and businesses alike. Geographic distribution shows strong growth potential in the Asia-Pacific region, driven by rapid digitalization and economic expansion in countries like China and India. North America and Europe remain significant markets, representing substantial revenue shares, but their growth rates may be slightly lower than those in the Asia-Pacific region. The market is expected to be segmented by type (APU, CPU, GPU, FPGA) and application (consumer electronics, enterprise computing, automotive, industrial) reflecting the diverse range of applications and evolving technological advancements.

This comprehensive report provides an in-depth analysis of the server microprocessor industry, offering invaluable insights for industry professionals, investors, and strategists. Covering the period 2019-2033, with a focus on 2025, this report examines market dynamics, technological advancements, competitive landscapes, and future growth potential. The global market size is projected to reach xx Million by 2033.

Server Microprocessor Industry Market Structure & Innovation Trends

The server microprocessor market is characterized by a relatively concentrated structure, dominated by a handful of key players like Intel Corporation, AMD, and others. Market share fluctuates based on technological advancements and strategic partnerships. Innovation is driven primarily by the demand for higher processing power, improved energy efficiency, and enhanced security features in data centers and cloud computing environments. Regulatory frameworks, particularly concerning data privacy and security, significantly influence industry practices. The market witnesses frequent M&A activities, with deal values exceeding xx Million in recent years. Product substitutes, such as specialized AI accelerators, are emerging, adding competitive pressure. End-user demographics are largely concentrated in the enterprise sector, particularly amongst hyperscale cloud providers and large corporations.

- Market Concentration: High, with top 5 players holding approximately xx% of market share in 2024.

- Innovation Drivers: Demand for higher performance, energy efficiency, and AI acceleration.

- M&A Activity: Significant activity observed, with deal values exceeding xx Million annually in recent years. (Specific examples of deals and values not available).

- Regulatory Frameworks: Data privacy regulations (GDPR, CCPA) and cybersecurity standards influence product development and market access.

Server Microprocessor Industry Market Dynamics & Trends

The server microprocessor market is experiencing robust growth, driven by the increasing adoption of cloud computing, the proliferation of big data analytics, and the expansion of the Internet of Things (IoT). The CAGR during the forecast period (2025-2033) is estimated to be xx%. Technological disruptions, such as the rise of RISC-V architecture and advancements in AI-specific processors, are reshaping the competitive landscape. Consumer preferences are shifting towards higher performance, energy-efficient, and secure solutions. Competitive dynamics are intense, with major players constantly innovating to maintain market share and expand into new segments. Market penetration in emerging economies is increasing steadily.

Dominant Regions & Segments in Server Microprocessor Industry

The North American region currently holds the largest market share, driven by strong demand from the hyperscale cloud providers and robust IT infrastructure. Within segments, the CPU segment dominates by revenue, followed by GPU and APU. The Enterprise - Computer and Servers application segment accounts for the largest market share, largely fueled by data center expansion and cloud adoption.

- Key Drivers in North America: Strong IT infrastructure investment, presence of major cloud providers, and advanced technological capabilities.

- Key Drivers in Asia Pacific: Rapid growth of data centers, government initiatives, and increasing adoption of cloud computing in emerging economies.

- Segment Dominance: CPU is the largest segment, followed by GPU. The Enterprise - Computer and Servers application segment holds the largest market share.

Server Microprocessor Industry Product Innovations

Recent innovations focus on improving performance per watt, increasing core counts, incorporating advanced security features, and developing specialized processors for AI and machine learning workloads. These innovations cater to the growing demand for high-performance computing in cloud data centers and edge computing environments. The adoption of new architectures like RISC-V represents a significant shift towards open-source alternatives.

Report Scope & Segmentation Analysis

This report segments the server microprocessor market by type (APU, CPU, GPU, FPGA) and by application (Consumer Electronics, Enterprise - Computer and Servers, Automotive, Industrial, Other Applications). Each segment's growth projections, market sizes, and competitive dynamics are analyzed in detail. The Enterprise - Computer and Servers segment is expected to maintain its dominant position throughout the forecast period due to the growing demand for high-performance computing solutions in data centers. The other segments are expected to experience growth driven by increasing adoption in specific application areas.

Key Drivers of Server Microprocessor Industry Growth

The primary growth drivers are the exponential increase in data generation and processing needs, the expanding adoption of cloud computing and edge computing, advancements in AI and machine learning, and government initiatives promoting digital transformation. The development and adoption of 5G and other advanced networking technologies are also significant contributors to market expansion. Furthermore, the increasing demand for high-performance computing in various sectors (automotive, industrial, etc.) fuels growth.

Challenges in the Server Microprocessor Industry Sector

Challenges include supply chain disruptions, intense competition from established and emerging players, high research and development costs, and the increasing complexity of semiconductor manufacturing. Regulatory pressures, such as trade restrictions and data privacy regulations, pose significant hurdles. The shortage of skilled labor and the volatile nature of commodity prices further add to the challenges faced by the industry.

Emerging Opportunities in Server Microprocessor Industry

Emerging opportunities lie in the development of specialized processors for AI and machine learning, the growth of edge computing, the adoption of new architectures like RISC-V, and the increasing demand for high-performance computing in diverse sectors. The expanding use of server microprocessors in autonomous vehicles, industrial automation, and other emerging technologies presents a significant growth avenue. The development of energy-efficient and sustainable server microprocessors is another significant opportunity.

Leading Players in the Server Microprocessor Industry Market

- Micron Technology

- Broadcom Inc

- Advanced Micro Devices Inc

- Sony Corporation

- Qualcomm Technologies

- SK Hynix Inc

- Samsung Technologies

- Nvidia Corporation

- Taiwan Semiconductor Manufacturing Company Limited

- Intel Corporation

Key Developments in Server Microprocessor Industry

- November 2022: KIOXIA America, Inc. announced its collaboration with Ampere to qualify its CD6, CM6, and XD6 Series SSDs with platforms based on Ampere's Altra and Ampere Altra Max Cloud Native Processors. This highlights the growing importance of cloud-optimized architectures.

- April 2022: The Government of India launched the Digital India RISC-V (DIR-V) program, aiming to foster the development and adoption of open-source RISC-V based microprocessors. This signifies a potential shift towards open-source alternatives.

Future Outlook for Server Microprocessor Industry Market

The server microprocessor market is poised for continued robust growth, driven by technological advancements, increasing data volumes, and the expanding adoption of cloud computing and AI. Strategic partnerships, mergers and acquisitions, and the development of innovative technologies will play a crucial role in shaping the future of this dynamic industry. The market is expected to experience a significant expansion in the coming years, driven by diverse applications and the growing demand for sophisticated data processing capabilities.

Server Microprocessor Industry Segmentation

-

1. Type

- 1.1. APU

- 1.2. CPU

- 1.3. GPU

- 1.4. FPGA

-

2. Application

- 2.1. Consumer Electronics

- 2.2. Enterprise - Computer and Servers

- 2.3. Automotive

- 2.4. Industrial

- 2.5. Other Applications

Server Microprocessor Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Server Microprocessor Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Demand for High-performance and Energy-efficient Processors

- 3.3. Market Restrains

- 3.3.1. Decrease in Demand for PCs

- 3.4. Market Trends

- 3.4.1. Consumer electronics Segment is Expected to Drive the Market Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Server Microprocessor Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. APU

- 5.1.2. CPU

- 5.1.3. GPU

- 5.1.4. FPGA

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Consumer Electronics

- 5.2.2. Enterprise - Computer and Servers

- 5.2.3. Automotive

- 5.2.4. Industrial

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Server Microprocessor Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. APU

- 6.1.2. CPU

- 6.1.3. GPU

- 6.1.4. FPGA

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Consumer Electronics

- 6.2.2. Enterprise - Computer and Servers

- 6.2.3. Automotive

- 6.2.4. Industrial

- 6.2.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Server Microprocessor Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. APU

- 7.1.2. CPU

- 7.1.3. GPU

- 7.1.4. FPGA

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Consumer Electronics

- 7.2.2. Enterprise - Computer and Servers

- 7.2.3. Automotive

- 7.2.4. Industrial

- 7.2.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Server Microprocessor Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. APU

- 8.1.2. CPU

- 8.1.3. GPU

- 8.1.4. FPGA

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Consumer Electronics

- 8.2.2. Enterprise - Computer and Servers

- 8.2.3. Automotive

- 8.2.4. Industrial

- 8.2.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Server Microprocessor Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. APU

- 9.1.2. CPU

- 9.1.3. GPU

- 9.1.4. FPGA

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Consumer Electronics

- 9.2.2. Enterprise - Computer and Servers

- 9.2.3. Automotive

- 9.2.4. Industrial

- 9.2.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Server Microprocessor Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. APU

- 10.1.2. CPU

- 10.1.3. GPU

- 10.1.4. FPGA

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Consumer Electronics

- 10.2.2. Enterprise - Computer and Servers

- 10.2.3. Automotive

- 10.2.4. Industrial

- 10.2.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Server Microprocessor Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Server Microprocessor Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Server Microprocessor Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Server Microprocessor Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Server Microprocessor Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Micron Technology

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Broadcom Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Advanced Micro Devices Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Sony Corporation*List Not Exhaustive

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Qualcomm Technologies

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 SK Hynix Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Samsung Technologies

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Nvidia Corporation

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Taiwan Semiconductor Manufacturing Company Limited

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Intel Corporation

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Micron Technology

List of Figures

- Figure 1: Global Server Microprocessor Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Server Microprocessor Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Server Microprocessor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Server Microprocessor Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Server Microprocessor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Server Microprocessor Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Server Microprocessor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Server Microprocessor Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Server Microprocessor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Server Microprocessor Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Server Microprocessor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Server Microprocessor Industry Revenue (Million), by Type 2024 & 2032

- Figure 13: North America Server Microprocessor Industry Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America Server Microprocessor Industry Revenue (Million), by Application 2024 & 2032

- Figure 15: North America Server Microprocessor Industry Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America Server Microprocessor Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Server Microprocessor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Server Microprocessor Industry Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe Server Microprocessor Industry Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe Server Microprocessor Industry Revenue (Million), by Application 2024 & 2032

- Figure 21: Europe Server Microprocessor Industry Revenue Share (%), by Application 2024 & 2032

- Figure 22: Europe Server Microprocessor Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Server Microprocessor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Server Microprocessor Industry Revenue (Million), by Type 2024 & 2032

- Figure 25: Asia Pacific Server Microprocessor Industry Revenue Share (%), by Type 2024 & 2032

- Figure 26: Asia Pacific Server Microprocessor Industry Revenue (Million), by Application 2024 & 2032

- Figure 27: Asia Pacific Server Microprocessor Industry Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Server Microprocessor Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Server Microprocessor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Server Microprocessor Industry Revenue (Million), by Type 2024 & 2032

- Figure 31: Latin America Server Microprocessor Industry Revenue Share (%), by Type 2024 & 2032

- Figure 32: Latin America Server Microprocessor Industry Revenue (Million), by Application 2024 & 2032

- Figure 33: Latin America Server Microprocessor Industry Revenue Share (%), by Application 2024 & 2032

- Figure 34: Latin America Server Microprocessor Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Server Microprocessor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Server Microprocessor Industry Revenue (Million), by Type 2024 & 2032

- Figure 37: Middle East and Africa Server Microprocessor Industry Revenue Share (%), by Type 2024 & 2032

- Figure 38: Middle East and Africa Server Microprocessor Industry Revenue (Million), by Application 2024 & 2032

- Figure 39: Middle East and Africa Server Microprocessor Industry Revenue Share (%), by Application 2024 & 2032

- Figure 40: Middle East and Africa Server Microprocessor Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Server Microprocessor Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Server Microprocessor Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Server Microprocessor Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Server Microprocessor Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Server Microprocessor Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Server Microprocessor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Server Microprocessor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Server Microprocessor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Server Microprocessor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Server Microprocessor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Server Microprocessor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Server Microprocessor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Server Microprocessor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Server Microprocessor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Server Microprocessor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Server Microprocessor Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Global Server Microprocessor Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Global Server Microprocessor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Server Microprocessor Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global Server Microprocessor Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 20: Global Server Microprocessor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global Server Microprocessor Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Global Server Microprocessor Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 23: Global Server Microprocessor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Server Microprocessor Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 25: Global Server Microprocessor Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 26: Global Server Microprocessor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Server Microprocessor Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 28: Global Server Microprocessor Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 29: Global Server Microprocessor Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Server Microprocessor Industry?

The projected CAGR is approximately 2.10%.

2. Which companies are prominent players in the Server Microprocessor Industry?

Key companies in the market include Micron Technology, Broadcom Inc, Advanced Micro Devices Inc, Sony Corporation*List Not Exhaustive, Qualcomm Technologies, SK Hynix Inc, Samsung Technologies, Nvidia Corporation, Taiwan Semiconductor Manufacturing Company Limited, Intel Corporation.

3. What are the main segments of the Server Microprocessor Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Demand for High-performance and Energy-efficient Processors.

6. What are the notable trends driving market growth?

Consumer electronics Segment is Expected to Drive the Market Demand.

7. Are there any restraints impacting market growth?

Decrease in Demand for PCs.

8. Can you provide examples of recent developments in the market?

November 2022 : KIOXIA America, Inc. announced its collaboration with Ampere to qualify its CD6, CM6, and XD6 Series SSDs with platforms based on Ampere's Altra and Ampere Altra Max Cloud Native Processors. To address the demands of the modern cloud, Ampere has designed a server microprocessor architecture from the ground up. Its AArch64-based processors deliver performance, scalability, security, and power efficiency uniquely focused on today's hyperscale cloud and edge computing.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Server Microprocessor Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Server Microprocessor Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Server Microprocessor Industry?

To stay informed about further developments, trends, and reports in the Server Microprocessor Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence