Key Insights

The Singapore waste management market, valued at approximately 819.26 billion in its base year 2025, is forecast to expand at a Compound Annual Growth Rate (CAGR) of 6.9% from 2025 to 2033. This growth is driven by heightened environmental consciousness, stringent regulatory frameworks promoting resource recovery, and the increasing adoption of sustainable practices by businesses. Technological advancements in waste processing and recycling further contribute to market expansion. Key challenges include land scarcity and the high cost of advanced treatment technologies.

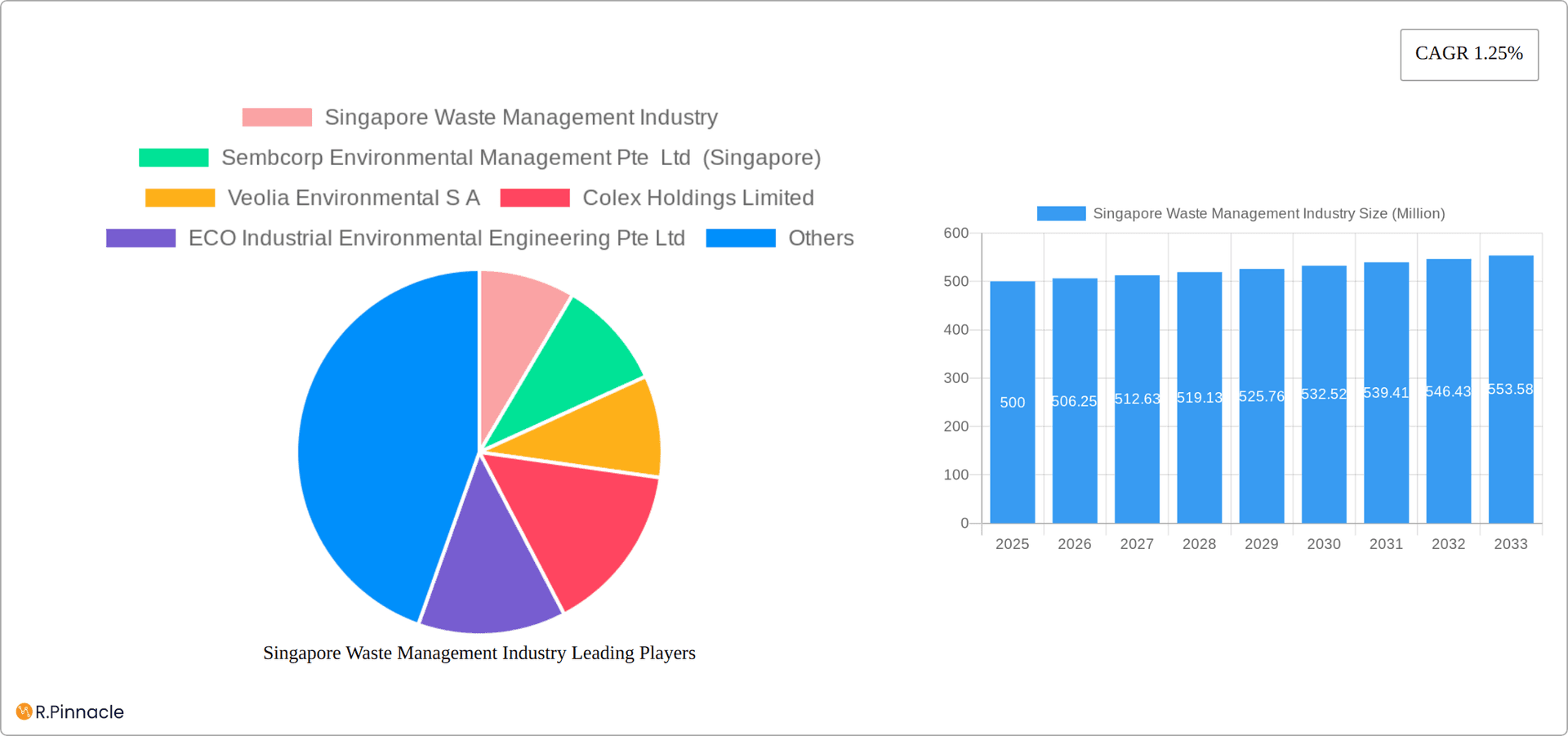

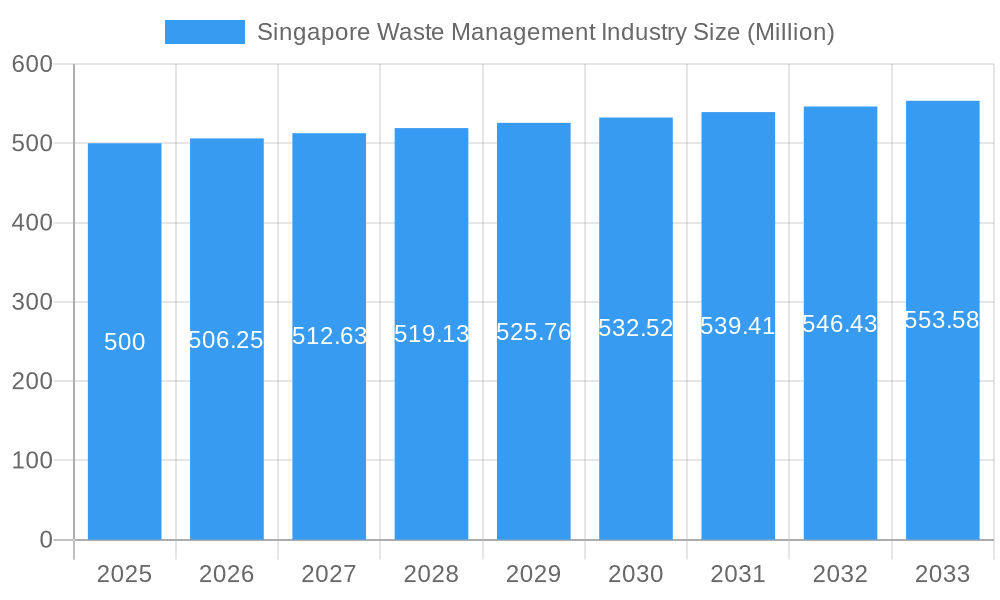

Singapore Waste Management Industry Market Size (In Billion)

Emerging trends shaping Singapore's waste management include a strong emphasis on circular economy principles, fostering innovation in waste-to-energy solutions and recycling infrastructure. Public-private collaborations are enhancing operational efficiency and promoting sustainability. The market is segmented by services such as collection, transportation, treatment, disposal, and recycling, with key players including Sembcorp Environmental Management, Veolia, and Colex Holdings. The forecast period anticipates a move towards integrated, technologically advanced solutions, aligned with the nation's sustainability objectives and the demands of a dense urban environment. Future success depends on adapting to these trends and overcoming existing obstacles.

Singapore Waste Management Industry Company Market Share

Singapore Waste Management Industry Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the Singapore Waste Management Industry, offering crucial insights for industry professionals, investors, and strategic planners. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils the market's dynamics, growth drivers, challenges, and future outlook. The market size is projected to reach xx Million by 2033, showcasing significant growth potential.

Singapore Waste Management Industry Market Structure & Innovation Trends

This comprehensive section delves into the dynamic competitive landscape, key innovation drivers, and the influential regulatory ecosystem shaping the Singapore waste management market. We provide a granular analysis of market concentration, detailing the significant market share held by prominent players such as Sembcorp Environmental Management Pte Ltd (Singapore), Veolia Environmental S.A., and other vital contributors. Furthermore, the report quantifies mergers and acquisitions (M&A) activity within the sector, presenting deal values in Millions and assessing their strategic impact on market consolidation and competitive positioning.

Innovation drivers are critically examined, with a particular focus on government policies actively promoting circular economy initiatives and the rapid advancement of technological solutions in waste-to-energy conversion. The influence of robust regulatory frameworks, including stringent waste disposal regulations and ambitious recycling targets, is thoroughly explored. We also assess the presence and impact of product substitutes on market dynamics. A deep dive into end-user demographics is undertaken to understand their influence on waste generation patterns, alongside an analysis of the prevalence and adoption rates of sustainable waste management practices across diverse consumer groups.

- Market Share Analysis of Top 5 Players (Projected 2025): Sembcorp: xx%, Veolia: xx%, Colex: xx%, ECO Industrial: xx%, Others: xx%

- Total M&A Deal Value (2019-2024): S$ xx Million

- Average Deal Size (2019-2024): S$ xx Million

Singapore Waste Management Industry Market Dynamics & Trends

This section delves into the market's growth trajectory, highlighting key drivers and disruptive influences. We present a detailed analysis of the Compound Annual Growth Rate (CAGR) from 2019 to 2024 and project the CAGR for 2025-2033. The impact of technological advancements, such as AI-powered waste sorting and advanced recycling technologies, is assessed. Changing consumer preferences towards sustainable waste disposal practices and their influence on market demand are explored. Furthermore, the report investigates the competitive landscape, analyzing strategies employed by leading players and their impact on market dynamics. Market penetration rates for various waste management services and technologies are analyzed, providing a comprehensive overview of the sector's evolution. The influence of government initiatives and economic factors on market growth are also explored.

Dominant Regions & Segments in Singapore Waste Management Industry

This section meticulously identifies and analyzes the leading regions and segments within the Singapore waste management market. Through detailed market size analysis, we pinpoint the dominant segment(s) and thoroughly assess the multifaceted factors contributing to their preeminence. Key drivers, encompassing economic policies, strategic infrastructure development, and evolving consumer behavior, are meticulously dissected to provide actionable insights.

-

Key Drivers of Dominance:

- Proactive government incentives promoting waste reduction, resource recovery, and circular economy principles.

- World-class infrastructure for efficient waste collection, advanced processing, and modern disposal facilities.

- High and growing public awareness and commitment to environmental sustainability among consumers and businesses alike.

Singapore Waste Management Industry Product Innovations

This section provides an in-depth examination of cutting-edge product developments within the Singapore waste management sector, highlighting their practical applications and distinct competitive advantages. The focus is squarely on emerging technological trends and their strategic alignment with evolving market needs and sophisticated consumer demands. We discuss significant innovations in areas such as highly efficient waste-to-energy technologies, advanced material recovery and recycling processes, and the integration of smart waste management solutions leveraging IoT and data analytics. The competitive advantages offered by these novel products are thoroughly analyzed, considering their impact on operational efficiency, cost-effectiveness, and overall environmental sustainability.

Report Scope & Segmentation Analysis

This report segments the Singapore waste management market based on waste type (e.g., municipal solid waste, industrial waste, hazardous waste), service type (e.g., collection, processing, disposal, recycling), and technology used (e.g., incineration, anaerobic digestion, composting). Growth projections, market sizes (in Millions), and competitive dynamics are provided for each segment. The report also encompasses detailed market size estimations for the period 2019-2033.

Key Drivers of Singapore Waste Management Industry Growth

This section pinpoints the key factors contributing to the growth of the Singapore waste management market. These include government regulations promoting sustainability, rising environmental awareness among citizens, and technological advancements enabling more efficient and eco-friendly waste management solutions. Economic growth, driving increased waste generation, also contributes significantly to this growth.

Challenges in the Singapore Waste Management Industry Sector

The report critically identifies and analyzes the significant challenges confronting the Singapore waste management industry. These include navigating increasingly stringent environmental regulations, addressing the perpetual challenge of land scarcity for waste disposal facilities, and managing the high capital expenditure required for the implementation and adoption of advanced waste management technologies. Furthermore, we examine the impact of supply chain disruptions and inherent fluctuations in raw material prices, which pose ongoing challenges to market stability and operational predictability. The report quantifies, where possible, the impact of these challenges on projected market growth and strategic investment decisions.

Emerging Opportunities in Singapore Waste Management Industry

This section highlights promising opportunities, such as the growing demand for sustainable waste management solutions, increasing investment in waste-to-energy projects, and the potential for technological breakthroughs in recycling and waste treatment. The emergence of new business models focusing on resource recovery and circular economy principles are also explored.

Leading Players in the Singapore Waste Management Industry Market

- Sembcorp Environmental Management Pte Ltd (Singapore)

- Veolia Environmental S A

- Colex Holdings Limited

- ECO Industrial Environmental Engineering Pte Ltd

- Envipure

- RICTEC PTE LTD

- Industrial Wastes Auction

- Recycling Partners Pte Ltd

- CH E-Recycling

- CITIC Envirotech Ltd

Key Developments in Singapore Waste Management Industry

- 2022 Q3: Sembcorp commissions a state-of-the-art waste-to-energy plant, significantly boosting Singapore's capacity for energy recovery from waste.

- 2021 Q4: The Singaporean government implements enhanced and stricter waste management regulations, signaling a commitment to higher sustainability standards and stricter enforcement.

- 2020 Q1: A strategic merger of two prominent smaller waste management companies, creating a more consolidated entity with expanded service offerings and operational efficiencies. (Further details on synergies and market impact are being compiled.)

(Additional significant key developments and strategic initiatives will be regularly updated.)

Future Outlook for Singapore Waste Management Industry Market

The Singapore waste management market is poised for significant growth, driven by continuous government support, technological advancements, and rising environmental consciousness. Strategic investments in innovative waste management technologies, coupled with a strong focus on resource recovery and circular economy principles, present lucrative opportunities for both established players and new entrants. The market is projected to experience substantial expansion in the forecast period (2025-2033), driven by these factors and the continued implementation of supportive government policies.

Singapore Waste Management Industry Segmentation

-

1. Waste type

- 1.1. Industrial waste

- 1.2. Municipal solid waste

- 1.3. E-waste

- 1.4. Plastic waste

- 1.5. Bio-medical waste

-

2. Disposal methods

- 2.1. Collection

- 2.2. Landfill

- 2.3. Incineration

- 2.4. Recycling

Singapore Waste Management Industry Segmentation By Geography

- 1. Singapore

Singapore Waste Management Industry Regional Market Share

Geographic Coverage of Singapore Waste Management Industry

Singapore Waste Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Recycling is a key trend in the Singaporean waste management industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Waste Management Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Waste type

- 5.1.1. Industrial waste

- 5.1.2. Municipal solid waste

- 5.1.3. E-waste

- 5.1.4. Plastic waste

- 5.1.5. Bio-medical waste

- 5.2. Market Analysis, Insights and Forecast - by Disposal methods

- 5.2.1. Collection

- 5.2.2. Landfill

- 5.2.3. Incineration

- 5.2.4. Recycling

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Waste type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Singapore Waste Management Industry

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sembcorp Environmental Management Pte Ltd (Singapore)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Veolia Environmental S A

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Colex Holdings Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ECO Industrial Environmental Engineering Pte Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Envipure

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 RICTEC PTE LTD

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Indsutrial Wastes Auction

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Recycling Partners Pte Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 CH E-Recycling

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 CITIC Envirotech Ltd**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Singapore Waste Management Industry

List of Figures

- Figure 1: Singapore Waste Management Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Singapore Waste Management Industry Share (%) by Company 2025

List of Tables

- Table 1: Singapore Waste Management Industry Revenue billion Forecast, by Waste type 2020 & 2033

- Table 2: Singapore Waste Management Industry Revenue billion Forecast, by Disposal methods 2020 & 2033

- Table 3: Singapore Waste Management Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Singapore Waste Management Industry Revenue billion Forecast, by Waste type 2020 & 2033

- Table 5: Singapore Waste Management Industry Revenue billion Forecast, by Disposal methods 2020 & 2033

- Table 6: Singapore Waste Management Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Waste Management Industry?

The projected CAGR is approximately 6.9%.

2. Which companies are prominent players in the Singapore Waste Management Industry?

Key companies in the market include Singapore Waste Management Industry, Sembcorp Environmental Management Pte Ltd (Singapore), Veolia Environmental S A, Colex Holdings Limited, ECO Industrial Environmental Engineering Pte Ltd, Envipure, RICTEC PTE LTD, Indsutrial Wastes Auction, Recycling Partners Pte Ltd, CH E-Recycling, CITIC Envirotech Ltd**List Not Exhaustive.

3. What are the main segments of the Singapore Waste Management Industry?

The market segments include Waste type, Disposal methods.

4. Can you provide details about the market size?

The market size is estimated to be USD 819.26 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Recycling is a key trend in the Singaporean waste management industry.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Waste Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Waste Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Waste Management Industry?

To stay informed about further developments, trends, and reports in the Singapore Waste Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence