Key Insights

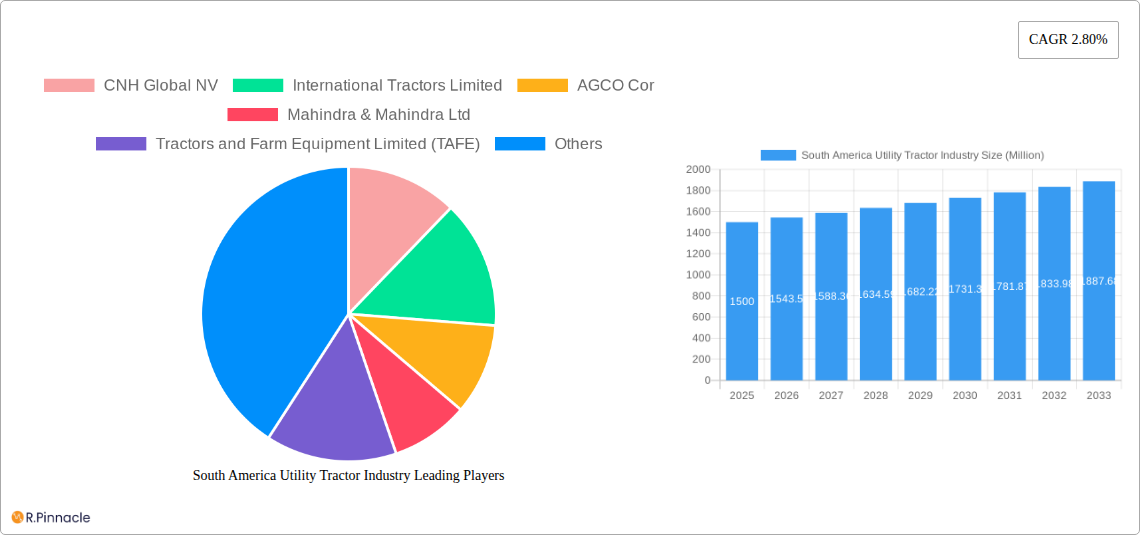

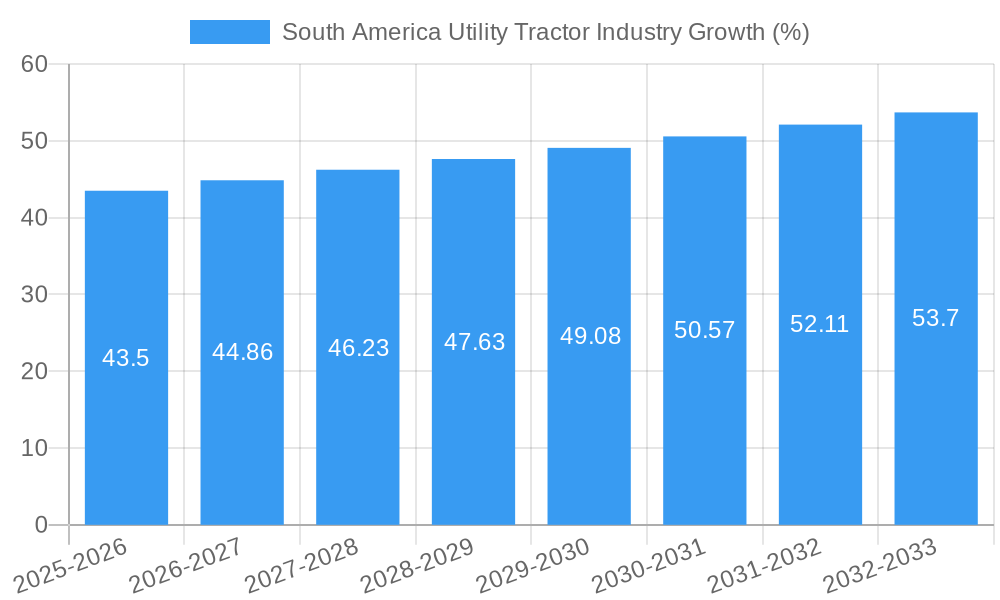

The South American utility tractor market, currently valued at approximately $XX million (assuming a reasonable market size based on global trends and the provided CAGR), is projected to experience steady growth, with a compound annual growth rate (CAGR) of 2.80% from 2025 to 2033. This growth is fueled by several key factors. Firstly, the expanding agricultural sector across Brazil and Argentina, driven by increasing demand for food and biofuels, is a major driver. Modernization of farming practices and a shift towards larger-scale operations necessitate the adoption of more efficient and powerful utility tractors. Secondly, infrastructure development projects, particularly in construction and municipal sectors, contribute to the market's expansion. The increasing urbanization and the need for efficient machinery in these sectors provide a significant demand for utility tractors. Finally, government initiatives supporting agricultural mechanization and infrastructure development further bolster market growth.

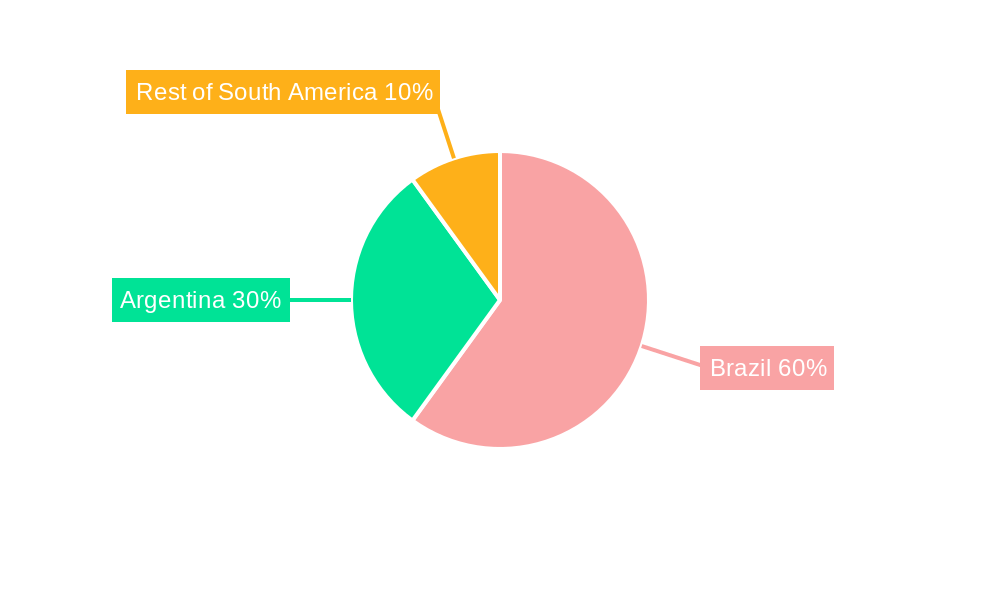

However, certain restraints are anticipated. Fluctuations in commodity prices and economic instability in some South American nations could potentially dampen market growth. Moreover, the availability of financing options for farmers and construction companies, as well as the cost of maintaining and repairing these machines, could present challenges to the market's continuous expansion. Market segmentation reveals significant demand across various tractor types, with compact tractors proving popular for smaller farms and landscaping, while larger, higher horsepower models are preferred for larger-scale agriculture and heavy construction. Key players like CNH Global NV, Mahindra & Mahindra Ltd, and AGCO Corp are actively competing in this market, constantly innovating to meet the specific needs of different segments and geographical regions. Brazil and Argentina represent the largest market segments within South America, benefiting from their extensive agricultural lands and robust infrastructure projects.

South America Utility Tractor Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the South America utility tractor industry, offering crucial insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market dynamics, competitive landscapes, and future growth potential. The report leverages robust data analysis to offer actionable strategies for navigating this dynamic market.

South America Utility Tractor Industry Market Structure & Innovation Trends

This section analyzes the South American utility tractor market's structure, highlighting market concentration, innovation drivers, regulatory landscapes, and competitive activities. The report examines the market share held by key players such as CNH Global NV, International Tractors Limited, AGCO Corp, Mahindra & Mahindra Ltd, Tractors and Farm Equipment Limited (TAFE), Claas KGaA mbH, Kubota Agricultural Machinery, Massey Ferguson, and Deere & Company. We analyze the impact of mergers and acquisitions (M&A), with estimated deal values providing context to the evolving market consolidation. The analysis also explores the influence of governmental regulations on industry growth and innovation, examining the role of product substitutes and the changing demographics of end-users. The report will delve into the key innovation drivers within the industry, including technological advancements, evolving farming practices, and the increasing demand for efficiency and sustainability. Specific metrics such as market share percentages and M&A deal values (in Millions) will be included. For example, we estimate that the combined market share of the top three players in 2025 will be approximately xx%. The total value of M&A deals in the industry between 2019 and 2024 is estimated at $xx Million.

South America Utility Tractor Industry Market Dynamics & Trends

This section explores the key factors influencing the growth and evolution of the South American utility tractor market. We analyze market growth drivers, encompassing economic growth, agricultural expansion, and infrastructure development. Technological disruptions, such as the adoption of precision farming techniques and automation, are examined in detail. Consumer preferences, including the increasing demand for fuel-efficient and technologically advanced tractors, are also analyzed. Competitive dynamics, including pricing strategies, product differentiation, and market entry strategies of key players, are explored. Key metrics such as the Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) and market penetration rates for different tractor types and horsepower segments will be presented. The anticipated CAGR for the overall market during 2025-2033 is projected to be xx%. We will further illustrate the market penetration of specific technological advancements and discuss their contribution to overall growth.

Dominant Regions & Segments in South America Utility Tractor Industry

This section identifies the leading regions, countries, and segments within the South American utility tractor market. We analyze market dominance across different types (Compact, Mid-size, Large), horsepower categories (Below 50 HP, 50-100 HP, Above 100 HP), and applications (Agricultural, Construction, Municipal).

- Key Drivers: The analysis will use bullet points to identify key regional drivers like economic policies, infrastructure investments, and agricultural production levels.

- Dominance Analysis: Paragraphs will provide a detailed analysis explaining the factors contributing to the dominance of specific regions or segments. For example, Brazil's strong agricultural sector might drive high demand for large agricultural tractors. Similarly, the expanding construction and municipal sectors might contribute to growth in the mid-size and compact tractor segments.

South America Utility Tractor Industry Product Innovations

This section summarizes recent product developments, highlighting new applications and competitive advantages. The focus will be on technological trends such as advancements in engine technology, automated features, and precision farming capabilities, and how these innovations enhance market fit and competitive positioning.

Report Scope & Segmentation Analysis

This section details the market segmentation by type (Compact, Mid-size, Large), horsepower (Below 50 HP, 50-100 HP, Above 100 HP), and application (Agricultural, Construction, Municipal). Each segment will have a dedicated paragraph describing its growth projections, market size (in Millions), and competitive dynamics. For example, the compact tractor segment might be driven by increasing demand from small farms and municipal applications.

Key Drivers of South America Utility Tractor Industry Growth

This section outlines the key growth drivers, categorized into technological advancements, economic factors, and regulatory changes. Specific examples of these drivers, with their impact on market expansion, will be provided.

Challenges in the South America Utility Tractor Industry Sector

This section details the challenges faced by the industry, including regulatory hurdles, supply chain disruptions, and intense competition. Quantifiable impacts of these challenges on market growth will be addressed.

Emerging Opportunities in South America Utility Tractor Industry

This section identifies emerging opportunities arising from new markets, technological innovations, or shifting consumer preferences. Specific examples of these opportunities and their potential impact on the market will be highlighted.

Leading Players in the South America Utility Tractor Industry Market

- CNH Global NV

- International Tractors Limited

- AGCO Corp

- Mahindra & Mahindra Ltd

- Tractors and Farm Equipment Limited (TAFE)

- Claas KGaA mbH

- Kubota Agricultural Machinery

- Massey Ferguson

- Deere & Company

Key Developments in South America Utility Tractor Industry Industry

This section will present key developments, including product launches, mergers, and acquisitions, using a year/month format and bullet points. The impact of each development on market dynamics will be assessed.

Future Outlook for South America Utility Tractor Industry Market

This section summarizes the growth accelerators and provides an outlook on the future market potential, identifying key strategic opportunities for industry stakeholders. The report will offer insights into the long-term prospects of the South American utility tractor market, considering factors such as technological advancements, economic growth, and evolving consumer preferences.

South America Utility Tractor Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

South America Utility Tractor Industry Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Utility Tractor Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Legalization of Cannabis; Growing Focus on Health Benefits of Cannabis

- 3.3. Market Restrains

- 3.3.1. Lack of Data on Dosages and Results; Lack of Access to Financial Assistance

- 3.4. Market Trends

- 3.4.1. Rising Labour Scarcity and Wages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Utility Tractor Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Brazil South America Utility Tractor Industry Analysis, Insights and Forecast, 2019-2031

- 7. Argentina South America Utility Tractor Industry Analysis, Insights and Forecast, 2019-2031

- 8. Rest of South America South America Utility Tractor Industry Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 CNH Global NV

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 International Tractors Limited

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 AGCO Cor

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Mahindra & Mahindra Ltd

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Tractors and Farm Equipment Limited (TAFE)

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Claas KGaA mbH

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Kubota Agricultural Machinery

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Massey Ferguson

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Deere & Company

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 CNH Global NV

List of Figures

- Figure 1: South America Utility Tractor Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Utility Tractor Industry Share (%) by Company 2024

List of Tables

- Table 1: South America Utility Tractor Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Utility Tractor Industry Volume Kiloton Forecast, by Region 2019 & 2032

- Table 3: South America Utility Tractor Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: South America Utility Tractor Industry Volume Kiloton Forecast, by Production Analysis 2019 & 2032

- Table 5: South America Utility Tractor Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 6: South America Utility Tractor Industry Volume Kiloton Forecast, by Consumption Analysis 2019 & 2032

- Table 7: South America Utility Tractor Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 8: South America Utility Tractor Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 9: South America Utility Tractor Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 10: South America Utility Tractor Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 11: South America Utility Tractor Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: South America Utility Tractor Industry Volume Kiloton Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: South America Utility Tractor Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 14: South America Utility Tractor Industry Volume Kiloton Forecast, by Region 2019 & 2032

- Table 15: South America Utility Tractor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: South America Utility Tractor Industry Volume Kiloton Forecast, by Country 2019 & 2032

- Table 17: Brazil South America Utility Tractor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Brazil South America Utility Tractor Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 19: Argentina South America Utility Tractor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Argentina South America Utility Tractor Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 21: Rest of South America South America Utility Tractor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of South America South America Utility Tractor Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 23: South America Utility Tractor Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 24: South America Utility Tractor Industry Volume Kiloton Forecast, by Production Analysis 2019 & 2032

- Table 25: South America Utility Tractor Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 26: South America Utility Tractor Industry Volume Kiloton Forecast, by Consumption Analysis 2019 & 2032

- Table 27: South America Utility Tractor Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 28: South America Utility Tractor Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 29: South America Utility Tractor Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 30: South America Utility Tractor Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 31: South America Utility Tractor Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 32: South America Utility Tractor Industry Volume Kiloton Forecast, by Price Trend Analysis 2019 & 2032

- Table 33: South America Utility Tractor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: South America Utility Tractor Industry Volume Kiloton Forecast, by Country 2019 & 2032

- Table 35: Brazil South America Utility Tractor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Brazil South America Utility Tractor Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 37: Argentina South America Utility Tractor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Argentina South America Utility Tractor Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 39: Chile South America Utility Tractor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Chile South America Utility Tractor Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 41: Colombia South America Utility Tractor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Colombia South America Utility Tractor Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 43: Peru South America Utility Tractor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Peru South America Utility Tractor Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 45: Venezuela South America Utility Tractor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Venezuela South America Utility Tractor Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 47: Ecuador South America Utility Tractor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Ecuador South America Utility Tractor Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 49: Bolivia South America Utility Tractor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Bolivia South America Utility Tractor Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 51: Paraguay South America Utility Tractor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Paraguay South America Utility Tractor Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 53: Uruguay South America Utility Tractor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Uruguay South America Utility Tractor Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Utility Tractor Industry?

The projected CAGR is approximately 2.80%.

2. Which companies are prominent players in the South America Utility Tractor Industry?

Key companies in the market include CNH Global NV, International Tractors Limited, AGCO Cor, Mahindra & Mahindra Ltd, Tractors and Farm Equipment Limited (TAFE), Claas KGaA mbH, Kubota Agricultural Machinery, Massey Ferguson, Deere & Company.

3. What are the main segments of the South America Utility Tractor Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Legalization of Cannabis; Growing Focus on Health Benefits of Cannabis.

6. What are the notable trends driving market growth?

Rising Labour Scarcity and Wages.

7. Are there any restraints impacting market growth?

Lack of Data on Dosages and Results; Lack of Access to Financial Assistance.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Utility Tractor Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Utility Tractor Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Utility Tractor Industry?

To stay informed about further developments, trends, and reports in the South America Utility Tractor Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence