Key Insights

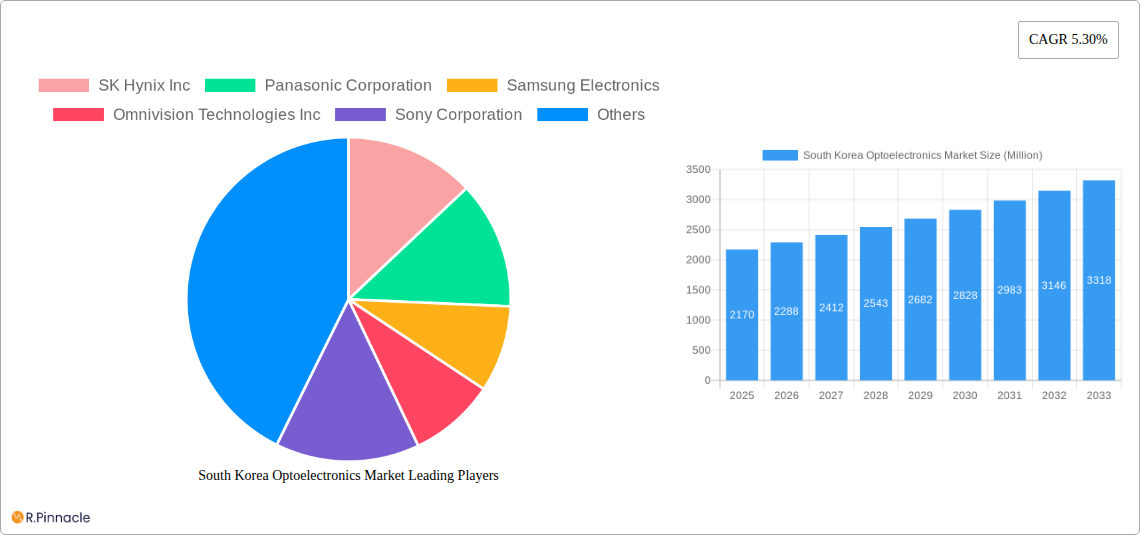

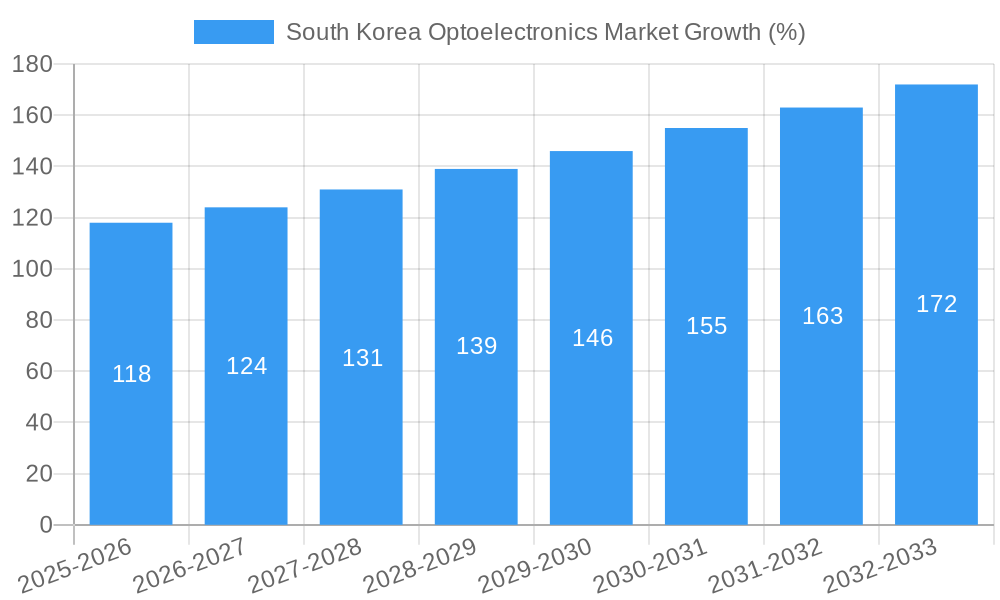

The South Korean optoelectronics market, valued at $2.17 billion in 2025, is projected to experience robust growth, driven by increasing demand from key sectors like consumer electronics, automotive, and industrial automation. The Compound Annual Growth Rate (CAGR) of 5.30% from 2025 to 2033 indicates a significant expansion of the market over the forecast period. This growth is fueled by several key factors. The rise of advanced driver-assistance systems (ADAS) and autonomous vehicles in the automotive sector is creating substantial demand for high-performance optoelectronic components. Simultaneously, the proliferation of smartphones, smart TVs, and other consumer electronics featuring advanced display technologies and sensor capabilities continues to boost market growth. Furthermore, the increasing adoption of automation in industrial settings is driving demand for sophisticated optical sensors and control systems. Stringent government regulations promoting energy efficiency and technological advancements further contribute to the market's positive trajectory. While challenges such as supply chain disruptions and intense competition among established players exist, the overall outlook for the South Korean optoelectronics market remains optimistic.

The competitive landscape in South Korea's optoelectronics market is intensely dynamic. Key players like Samsung Electronics, SK Hynix, and LG Display (although not explicitly listed, a major player in the South Korean electronics market and likely involved in optoelectronics) hold significant market share, leveraging their technological expertise and strong domestic presence. However, the market also witnesses the participation of global giants such as Sony, Panasonic, and Texas Instruments, leading to intense competition and continuous innovation. The success of individual companies depends on factors such as their ability to develop and manufacture advanced optoelectronic components, their capacity to cater to the demands of diverse sectors, and their responsiveness to evolving technological trends. Smaller, specialized companies are also making inroads, particularly in niche segments like advanced lighting solutions and specialized sensor applications. Strategic partnerships and mergers and acquisitions are likely to further shape the market landscape in the coming years.

South Korea Optoelectronics Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the South Korea optoelectronics market, offering valuable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report examines market dynamics, innovation trends, and key players shaping the future of this rapidly evolving sector. The report's findings are based on rigorous research and data analysis, offering actionable intelligence to navigate the complexities of the South Korean optoelectronics landscape. The market size is projected to reach xx Million by 2033.

South Korea Optoelectronics Market Structure & Innovation Trends

This section analyzes the competitive landscape of the South Korea optoelectronics market, including market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and M&A activities. The market is characterized by a high degree of competition among both domestic and international players. Leading companies such as Samsung Electronics, SK Hynix Inc., and LG Display hold significant market share, but the market also features numerous smaller, specialized firms.

Market Concentration: The market exhibits a moderately concentrated structure, with a few dominant players controlling a significant portion of the market share. The exact figures for market share are currently being calculated and will be included in the final report. However, preliminary data suggests a Herfindahl-Hirschman Index (HHI) value of xx.

Innovation Drivers: Government support for R&D, advancements in semiconductor technology, and the growing demand for high-performance optoelectronic components in various applications drive innovation in this market.

Regulatory Frameworks: The regulatory environment plays a critical role in shaping market dynamics. Stringent quality standards and environmental regulations impact product development and manufacturing processes.

Product Substitutes: While direct substitutes are limited, advancements in other technologies, such as micro-electromechanical systems (MEMS), could potentially impact market growth.

End-User Demographics: Key end-user segments include consumer electronics, automotive, telecommunications, and industrial applications. Growth in these sectors directly influences the demand for optoelectronic components.

M&A Activities: The South Korea optoelectronics market has witnessed several mergers and acquisitions in recent years, particularly involving smaller companies being acquired by larger corporations. The total value of these deals from 2019 to 2024 is estimated to be approximately xx Million.

South Korea Optoelectronics Market Dynamics & Trends

This section delves into the key factors influencing the growth and evolution of the South Korea optoelectronics market. The market is expected to experience substantial growth during the forecast period, driven by several key factors. The Compound Annual Growth Rate (CAGR) is projected to be xx% from 2025 to 2033. Market penetration of optoelectronics in various applications, particularly in the automotive and consumer electronics sectors, is also expected to rise significantly.

Technological advancements, particularly in areas such as miniaturization, higher performance, and energy efficiency, are driving market expansion. Consumer preferences are shifting towards more sophisticated and feature-rich electronic devices, further boosting demand. Intense competition among market players fosters innovation and drives prices down, making optoelectronic components more accessible.

Dominant Regions & Segments in South Korea Optoelectronics Market

The Gyeonggi-do region currently holds the dominant position in the South Korea optoelectronics market due to a high concentration of manufacturing facilities and established supply chains. Seoul also plays a significant role due to its robust infrastructure and proximity to key players.

- Key Drivers for Gyeonggi-do's Dominance:

- Strong government support for technology development and investment.

- Presence of major semiconductor manufacturers and related industries.

- Well-developed infrastructure, including skilled workforce and logistics networks.

The market is further segmented by product type (e.g., LEDs, lasers, photodiodes, image sensors), application (e.g., consumer electronics, automotive, industrial), and technology (e.g., organic LEDs, micro-LEDs). While a detailed breakdown of segment dominance requires further analysis within the complete report, early estimates suggest the consumer electronics segment is the largest.

South Korea Optoelectronics Market Product Innovations

Recent innovations in the South Korea optoelectronics market highlight the trend towards miniaturization, higher performance, and energy efficiency. New products featuring advanced materials and manufacturing processes are emerging, catering to the growing demand for smaller, faster, and more energy-efficient devices across various applications. The focus on improving the performance metrics of existing products is also a notable trend.

Report Scope & Segmentation Analysis

This report provides a comprehensive overview of the South Korea optoelectronics market, segmented by product type, application, and technology. Each segment is analyzed in detail, providing insights into market size, growth projections, and competitive dynamics.

Product Type: This segment encompasses LEDs, lasers, photodiodes, image sensors, and other optoelectronic components. Growth is driven by technological advancements and diversification of applications.

Application: This includes consumer electronics, automotive, industrial, telecommunications, and medical applications. Market size variations across segments are significant, with consumer electronics and automotive showing the fastest growth.

Technology: This covers various technologies used in optoelectronic components, such as organic LEDs (OLEDs), micro-LEDs, and other emerging technologies. The competitive landscape varies across segments, with different technological strengths among the companies.

Key Drivers of South Korea Optoelectronics Market Growth

Several key factors fuel the growth of the South Korea optoelectronics market:

Technological advancements: Continuous innovations in materials science and manufacturing processes lead to improved performance, efficiency, and cost reduction.

Government support: Policies and funding initiatives promote research, development, and technological innovation in the sector.

Robust electronics industry: The presence of global electronics giants drives significant demand for optoelectronic components.

Growing demand in emerging applications: Expanding applications in areas like automotive, healthcare, and smart cities stimulate market expansion.

Challenges in the South Korea Optoelectronics Market Sector

The South Korea optoelectronics market faces certain challenges that could impede its growth:

Intense global competition: Foreign competitors pose a significant challenge, especially in price-sensitive markets.

Supply chain disruptions: Global events and geopolitical factors can disrupt the supply chain, impacting production and costs.

Fluctuations in raw material prices: Price volatility of essential materials can impact the profitability of optoelectronics manufacturers.

Stringent regulatory standards: Compliance with strict regulations adds to the cost and complexity of product development.

Emerging Opportunities in South Korea Optoelectronics Market

The South Korea optoelectronics market presents various opportunities:

Growth of the automotive sector: The increasing adoption of advanced driver-assistance systems (ADAS) and autonomous driving features drives demand for high-performance optoelectronic components.

Expansion of the consumer electronics market: The continual demand for sophisticated consumer electronics fuels the need for advanced optoelectronic solutions.

Development of new applications: Emerging applications in fields such as virtual reality (VR) and augmented reality (AR) open up new market avenues.

Adoption of environmentally friendly technologies: The focus on energy efficiency and sustainable manufacturing creates opportunities for environmentally friendly optoelectronic solutions.

Leading Players in the South Korea Optoelectronics Market Market

- SK Hynix Inc

- Panasonic Corporation

- Samsung Electronics

- Omnivision Technologies Inc

- Sony Corporation

- Osram Licht AG

- Koninklijke Philips NV

- Vishay Intertechnology Inc

- Texas Instruments Inc

- LITE-ON Technology Corporation

- Rohm Co Ltd (ROHM SEMICONDUCTOR)

- Mitsubishi Electric Corporation

- Broadcom Inc

- Sharp Corporation

Key Developments in South Korea Optoelectronics Market Industry

November 2023: Sony Semiconductor Solutions Corporation (SSS) launched the IMX992 short-wavelength infrared (SWIR) image sensor, featuring 5.32 effective megapixels and a 3.45 μm pixel size. This innovation enhances high-definition imaging across a broad spectrum.

September 2023: OmniVision introduced its OX08D10 8-megapixel CMOS image sensor with TheiaCel technology, improving automotive safety through enhanced image quality for ADAS and autonomous driving.

Future Outlook for South Korea Optoelectronics Market Market

The South Korea optoelectronics market is poised for continued growth, driven by technological advancements, increasing demand from key industries, and supportive government policies. Strategic partnerships, investments in R&D, and the adoption of innovative manufacturing techniques will play a crucial role in shaping the future of this dynamic market. The market is expected to witness significant expansion in various applications, creating lucrative opportunities for businesses to capitalize on.

South Korea Optoelectronics Market Segmentation

-

1. Device Type

- 1.1. LED

- 1.2. Laser Diode

- 1.3. Image Sensors

- 1.4. Optocouplers

- 1.5. Photovoltaic cells

- 1.6. Other Device Types

-

2. End User

- 2.1. Automotive

- 2.2. Aerospace and Defense

- 2.3. Consumer Electronics

- 2.4. Information Technology

- 2.5. Healthcare

- 2.6. Residential and Commercial

- 2.7. Industrial

- 2.8. Other End Users

South Korea Optoelectronics Market Segmentation By Geography

- 1. South Korea

South Korea Optoelectronics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Smart Consumer Electronics and Next-generation Technologies; Increasing Industrial Applications of the Technology; Expansion of the Li-Fi Market

- 3.3. Market Restrains

- 3.3.1. Growing Demand for Smart Consumer Electronics and Next-generation Technologies; Increasing Industrial Applications of the Technology; Expansion of the Li-Fi Market

- 3.4. Market Trends

- 3.4.1. The Image Sensors Segment is Anticipated to Drive the Demand for the Studied Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Optoelectronics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. LED

- 5.1.2. Laser Diode

- 5.1.3. Image Sensors

- 5.1.4. Optocouplers

- 5.1.5. Photovoltaic cells

- 5.1.6. Other Device Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Automotive

- 5.2.2. Aerospace and Defense

- 5.2.3. Consumer Electronics

- 5.2.4. Information Technology

- 5.2.5. Healthcare

- 5.2.6. Residential and Commercial

- 5.2.7. Industrial

- 5.2.8. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 SK Hynix Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Panasonic Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Samsung Electronics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Omnivision Technologies Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sony Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Osram Licht AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Koninklijke Philips NV

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vishay Intertechnology Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Texas Instruments Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LITE-ON Technology Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Rohm Co Ltd (ROHM SEMICONDUCTOR)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Mitsubishi Electric Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Broadcom Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Sharp Corporatio

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 SK Hynix Inc

List of Figures

- Figure 1: South Korea Optoelectronics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Korea Optoelectronics Market Share (%) by Company 2024

List of Tables

- Table 1: South Korea Optoelectronics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Korea Optoelectronics Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: South Korea Optoelectronics Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 4: South Korea Optoelectronics Market Volume Billion Forecast, by Device Type 2019 & 2032

- Table 5: South Korea Optoelectronics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 6: South Korea Optoelectronics Market Volume Billion Forecast, by End User 2019 & 2032

- Table 7: South Korea Optoelectronics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: South Korea Optoelectronics Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: South Korea Optoelectronics Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 10: South Korea Optoelectronics Market Volume Billion Forecast, by Device Type 2019 & 2032

- Table 11: South Korea Optoelectronics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 12: South Korea Optoelectronics Market Volume Billion Forecast, by End User 2019 & 2032

- Table 13: South Korea Optoelectronics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: South Korea Optoelectronics Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Optoelectronics Market?

The projected CAGR is approximately 5.30%.

2. Which companies are prominent players in the South Korea Optoelectronics Market?

Key companies in the market include SK Hynix Inc, Panasonic Corporation, Samsung Electronics, Omnivision Technologies Inc, Sony Corporation, Osram Licht AG, Koninklijke Philips NV, Vishay Intertechnology Inc, Texas Instruments Inc, LITE-ON Technology Corporation, Rohm Co Ltd (ROHM SEMICONDUCTOR), Mitsubishi Electric Corporation, Broadcom Inc, Sharp Corporatio.

3. What are the main segments of the South Korea Optoelectronics Market?

The market segments include Device Type, End User .

4. Can you provide details about the market size?

The market size is estimated to be USD 2.17 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Smart Consumer Electronics and Next-generation Technologies; Increasing Industrial Applications of the Technology; Expansion of the Li-Fi Market.

6. What are the notable trends driving market growth?

The Image Sensors Segment is Anticipated to Drive the Demand for the Studied Market.

7. Are there any restraints impacting market growth?

Growing Demand for Smart Consumer Electronics and Next-generation Technologies; Increasing Industrial Applications of the Technology; Expansion of the Li-Fi Market.

8. Can you provide examples of recent developments in the market?

November 2023- Sony Semiconductor Solutions Corporation (SSS) unveiled its latest innovation, the IMX992 short-wavelength infrared (SWIR) image sensor. It features a 5.32 effective megapixels. As per the company, its SSS' pioneering Cu-Cu connection technology enables it to achieve a robust pixel size of just 3.45 μm, the smallest in the SWIR sensor realm. Moreover, the sensor's pixel structure has been optimized to enhance light capture efficiency. It also features an optimized pixel structure for efficiently capturing light. It enables high-definition imaging across a broad spectrum ranging from visible to invisible short-wavelength infrared regions (wavelength: 0.4 to 1.7 μm).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Optoelectronics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Optoelectronics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Optoelectronics Market?

To stay informed about further developments, trends, and reports in the South Korea Optoelectronics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence