Key Insights

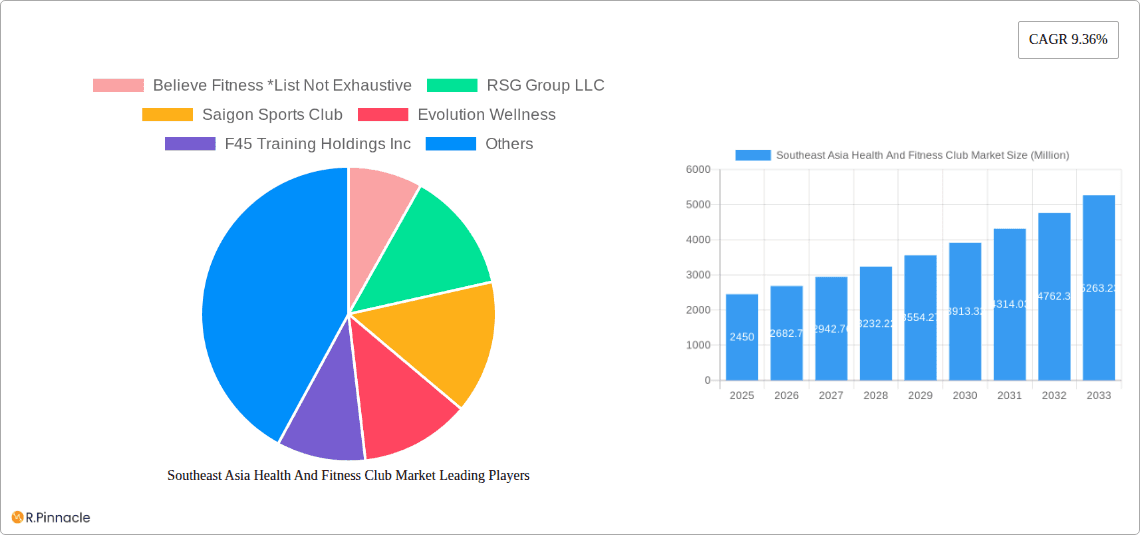

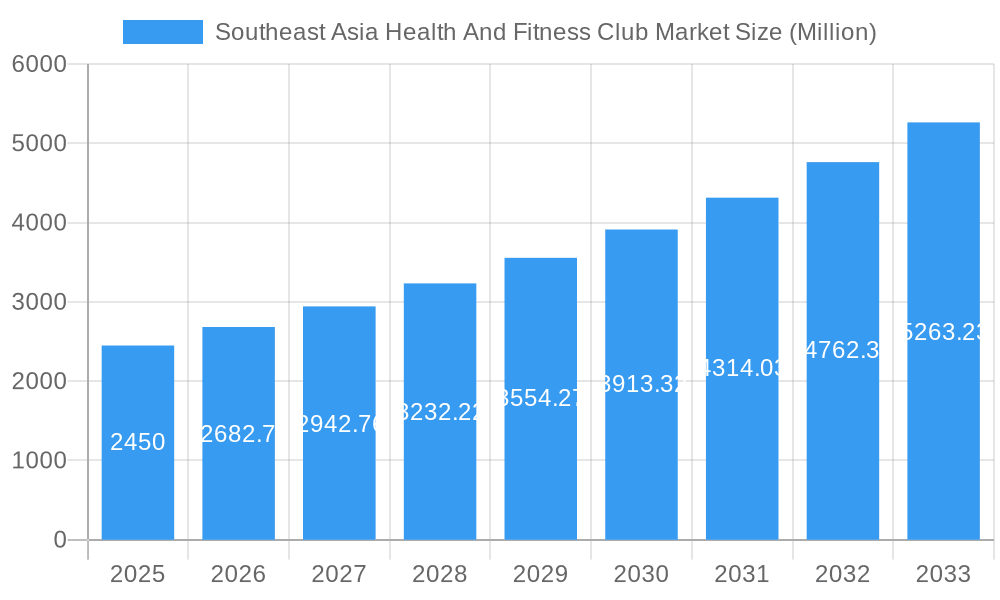

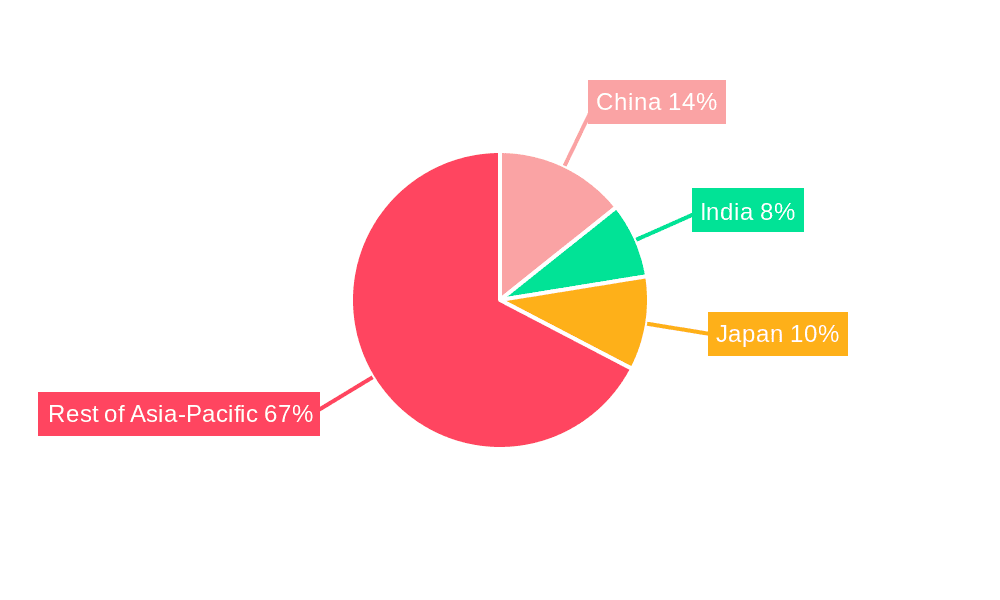

The Southeast Asia health and fitness club market exhibits robust growth, projected to reach $2.45 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 9.36% from 2025 to 2033. This expansion is fueled by several key drivers. Rising health consciousness among the burgeoning middle class is a significant factor, coupled with increasing disposable incomes enabling individuals to invest in wellness services. Furthermore, the growing popularity of fitness trends like high-intensity interval training (HIIT) and functional fitness, along with the rise of boutique fitness studios offering specialized programs, are contributing to market growth. The market is segmented by outlet type (chained vs. independent) and service type (membership fees, personal training, other services). Chained outlets, offering standardized services and economies of scale, are expected to dominate the market. Personal training and instruction services represent a significant revenue stream, reflecting a preference for personalized fitness guidance. While the market faces restraints such as the price sensitivity of certain consumer segments and competition from home-based fitness solutions, the long-term outlook remains positive due to the sustained focus on health and wellness across Southeast Asia. Key players in the market, including Believe Fitness, RSG Group LLC, and others, are strategically investing in expanding their offerings and geographical reach to capitalize on this growth opportunity. The Asia-Pacific region, particularly countries like China, India, and Japan, are pivotal growth engines for this market.

Southeast Asia Health And Fitness Club Market Market Size (In Billion)

The market's segmentation provides further insights into growth dynamics. The increasing preference for personalized fitness plans is driving the growth of personal training services. The rise of digital fitness platforms and the convenience they offer presents a competitive challenge, but the market is likely to adapt through innovative strategies such as hybrid models integrating in-person and digital services. The concentration of market share within the larger chains demonstrates the benefits of scale and brand recognition, but smaller, independent studios are successfully carving out niches by offering specialized and personalized services. Future growth will be influenced by factors including economic growth, government health initiatives promoting fitness, and the evolution of fitness technology. The continued focus on health and wellness within Southeast Asia, along with innovative approaches by market players, will likely sustain this positive trajectory.

Southeast Asia Health And Fitness Club Market Company Market Share

Southeast Asia Health & Fitness Club Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Southeast Asia health and fitness club market, offering invaluable insights for industry professionals, investors, and strategists. The study period covers 2019-2033, with 2025 as the base and estimated year. We project robust growth, driven by evolving consumer preferences and technological advancements. This report is essential for understanding the market's current state and future trajectory.

Southeast Asia Health And Fitness Club Market Market Structure & Innovation Trends

The Southeast Asia health and fitness club market exhibits a diverse structure, with a mix of large international chains and smaller independent operators. Market concentration is moderate, with a few key players like RSG Group LLC, Evolution Wellness, and F45 Training Holdings Inc holding significant market share (estimated at xx% combined in 2025). However, a large number of independent outlets contribute substantially to the overall market size. The market is witnessing increasing M&A activity, with deal values exceeding USD xx Million in the past five years. Innovation is driven by technological advancements such as AI-powered fitness programs and virtual reality experiences. Regulatory frameworks vary across Southeast Asian nations, impacting market entry and operations. Product substitutes, including home fitness equipment and online workout platforms, pose a competitive threat, though the in-person social aspect of fitness clubs remains a strong draw. End-user demographics are expanding, with increased participation from younger generations and a growing focus on wellness among older populations.

- Market Share (2025): RSG Group LLC (xx%), Evolution Wellness (xx%), F45 Training Holdings Inc (xx%), Others (xx%)

- M&A Deal Value (2019-2024): USD xx Million

- Key Innovation Drivers: AI-powered fitness, Virtual Reality fitness experiences, wearable technology integration

Southeast Asia Health And Fitness Club Market Market Dynamics & Trends

The Southeast Asia health and fitness club market is experiencing significant growth, driven by rising disposable incomes, increasing health awareness, and a growing preference for convenient, high-quality fitness facilities. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033). Technological disruptions, such as the integration of wearable technology and fitness apps, are transforming the fitness experience, enabling personalized training and data-driven insights. Consumer preferences are shifting towards boutique fitness studios offering specialized services and community-driven environments. The competitive landscape is dynamic, with established players expanding their footprint and new entrants disrupting the market with innovative offerings. Market penetration is increasing, particularly in urban areas, but significant untapped potential exists in rural regions.

Dominant Regions & Segments in Southeast Asia Health And Fitness Club Market

While the entire region shows significant growth, specific countries like Singapore and Malaysia are leading the market due to higher disposable incomes and a robust fitness culture. Within segments, the chained outlet sector dominates, representing xx% of the market in 2025, reflecting the economies of scale and brand recognition of larger operators. Membership fees are the primary revenue driver for most clubs (xx% of revenue in 2025), though the demand for personal training and instruction services is steadily rising.

- Leading Region/Country: Singapore, Malaysia

- Dominant Segment (Outlet): Chained Outlets

- Dominant Segment (Service Type): Membership Fees

Key Drivers for Dominant Segments:

- Chained Outlets: Brand recognition, economies of scale, consistent service quality, wider reach.

- Membership Fees: Stable revenue stream, predictable income for clubs.

Southeast Asia Health And Fitness Club Market Product Innovations

Recent innovations include the introduction of AI-powered fitness programs, virtual reality workout experiences, and the integration of wearable technology for personalized training. These advancements cater to evolving consumer preferences for convenient, engaging, and data-driven fitness solutions. The market is witnessing a rise in specialized fitness studios, such as yoga studios and CrossFit boxes, as well as hybrid models that combine traditional gym memberships with specialized classes. These innovations enhance the overall fitness experience and create competitive advantages for clubs that adopt them.

Report Scope & Segmentation Analysis

This report segments the Southeast Asia health and fitness club market by outlet type (chained and independent) and service type (membership fees, personal training and instruction services, and other service types). Growth projections for each segment vary, with chained outlets expected to maintain a larger market share, while the demand for personalized training services is anticipated to show significant growth. Competitive dynamics vary across segments, with intense competition in the chained outlet sector and more fragmented competition among independent operators. Market size for each segment is estimated, with chained outlets accounting for the majority in 2025.

Key Drivers of Southeast Asia Health And Fitness Club Market Growth

The market's growth is propelled by several key factors: rising disposable incomes in many Southeast Asian countries provide more people with the financial resources to invest in fitness; increased health awareness, driven by rising rates of lifestyle diseases, is motivating individuals to prioritize fitness and wellness; and the expanding middle class fuels increased demand for high-quality fitness facilities. Furthermore, government initiatives promoting healthy lifestyles and advancements in fitness technology enhance the sector's appeal and accessibility.

Challenges in the Southeast Asia Health And Fitness Club Market Sector

The industry faces hurdles like intense competition, particularly among larger chains; the emergence of affordable home fitness alternatives and online workout programs; and the varying regulatory environments across the region. These factors, combined with operational costs and the need for consistent investment in equipment and technology, can impact profitability. Additionally, attracting and retaining skilled fitness instructors is an ongoing challenge.

Emerging Opportunities in Southeast Asia Health And Fitness Club Market

Significant opportunities exist in untapped rural markets; the increasing demand for specialized fitness classes and personalized training programs presents expansion possibilities; and integrating technology and leveraging data analytics to enhance the customer experience can provide competitive advantages. Moreover, partnerships with health insurance providers and corporate wellness programs can broaden market reach and increase revenue streams.

Leading Players in the Southeast Asia Health And Fitness Club Market Market

- Believe Fitness

- RSG Group LLC

- Saigon Sports Club

- Evolution Wellness

- F45 Training Holdings Inc

- Elite Fitness

- Slimmers World

- Self Esteem Brands

- Pure International

- Virgin Group

Key Developments in Southeast Asia Health And Fitness Club Market Industry

- November 2023: Anytime Fitness partnered with Apple Fitness+, offering a free 30-day trial to Apple Fitness+ users. This strategic partnership expands Anytime Fitness’ reach and enhances its brand appeal.

- January 2024: Virgin Active invested USD 5 Million in upgrading Singaporean clubs, creating holistic wellness havens and incorporating high-end Technogym equipment. This showcases a focus on premium services and improved customer experience.

- January 2024: Anytime Fitness launched the second season of ‘Be Fit Fest,’ featuring AI video technology. This demonstrates the integration of technology to enhance engagement and provide innovative workout options.

Future Outlook for Southeast Asia Health And Fitness Club Market Market

The Southeast Asia health and fitness club market is poised for continued expansion, driven by sustained economic growth, increasing health consciousness, and technological advancements. Strategic partnerships, innovative service offerings, and targeted marketing strategies will be crucial for success. The market will likely witness further consolidation, with larger players acquiring smaller operators and expanding their market share. The focus on personalization, technology integration, and holistic wellness will shape the future of the industry.

Southeast Asia Health And Fitness Club Market Segmentation

-

1. Service Type

- 1.1. Membership Fees

- 1.2. Personal Training and Instruction Services

- 1.3. Other Service Types

-

2. Outlet

- 2.1. Chained Outlet

- 2.2. Independent Outlet

-

3. Geography

- 3.1. Singapore

- 3.2. Malaysia

- 3.3. Thailand

- 3.4. Indonesia

- 3.5. Philippines

- 3.6. Vietnam

- 3.7. Rest of Southeast Asia

Southeast Asia Health And Fitness Club Market Segmentation By Geography

- 1. Singapore

- 2. Malaysia

- 3. Thailand

- 4. Indonesia

- 5. Philippines

- 6. Vietnam

- 7. Rest of Southeast Asia

Southeast Asia Health And Fitness Club Market Regional Market Share

Geographic Coverage of Southeast Asia Health And Fitness Club Market

Southeast Asia Health And Fitness Club Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.36% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Inclination Toward Healthy Lifestyle; Strategic Expansion by Health & Fitness Clubs

- 3.3. Market Restrains

- 3.3.1. Rise in Popularity of Outdoor Activities

- 3.4. Market Trends

- 3.4.1. Inclination Toward a Healthy Lifestyle

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Southeast Asia Health And Fitness Club Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Membership Fees

- 5.1.2. Personal Training and Instruction Services

- 5.1.3. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlet

- 5.2.2. Independent Outlet

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Singapore

- 5.3.2. Malaysia

- 5.3.3. Thailand

- 5.3.4. Indonesia

- 5.3.5. Philippines

- 5.3.6. Vietnam

- 5.3.7. Rest of Southeast Asia

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Singapore

- 5.4.2. Malaysia

- 5.4.3. Thailand

- 5.4.4. Indonesia

- 5.4.5. Philippines

- 5.4.6. Vietnam

- 5.4.7. Rest of Southeast Asia

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Singapore Southeast Asia Health And Fitness Club Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Membership Fees

- 6.1.2. Personal Training and Instruction Services

- 6.1.3. Other Service Types

- 6.2. Market Analysis, Insights and Forecast - by Outlet

- 6.2.1. Chained Outlet

- 6.2.2. Independent Outlet

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Singapore

- 6.3.2. Malaysia

- 6.3.3. Thailand

- 6.3.4. Indonesia

- 6.3.5. Philippines

- 6.3.6. Vietnam

- 6.3.7. Rest of Southeast Asia

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Malaysia Southeast Asia Health And Fitness Club Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Membership Fees

- 7.1.2. Personal Training and Instruction Services

- 7.1.3. Other Service Types

- 7.2. Market Analysis, Insights and Forecast - by Outlet

- 7.2.1. Chained Outlet

- 7.2.2. Independent Outlet

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Singapore

- 7.3.2. Malaysia

- 7.3.3. Thailand

- 7.3.4. Indonesia

- 7.3.5. Philippines

- 7.3.6. Vietnam

- 7.3.7. Rest of Southeast Asia

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Thailand Southeast Asia Health And Fitness Club Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Membership Fees

- 8.1.2. Personal Training and Instruction Services

- 8.1.3. Other Service Types

- 8.2. Market Analysis, Insights and Forecast - by Outlet

- 8.2.1. Chained Outlet

- 8.2.2. Independent Outlet

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Singapore

- 8.3.2. Malaysia

- 8.3.3. Thailand

- 8.3.4. Indonesia

- 8.3.5. Philippines

- 8.3.6. Vietnam

- 8.3.7. Rest of Southeast Asia

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Indonesia Southeast Asia Health And Fitness Club Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Membership Fees

- 9.1.2. Personal Training and Instruction Services

- 9.1.3. Other Service Types

- 9.2. Market Analysis, Insights and Forecast - by Outlet

- 9.2.1. Chained Outlet

- 9.2.2. Independent Outlet

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Singapore

- 9.3.2. Malaysia

- 9.3.3. Thailand

- 9.3.4. Indonesia

- 9.3.5. Philippines

- 9.3.6. Vietnam

- 9.3.7. Rest of Southeast Asia

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Philippines Southeast Asia Health And Fitness Club Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Membership Fees

- 10.1.2. Personal Training and Instruction Services

- 10.1.3. Other Service Types

- 10.2. Market Analysis, Insights and Forecast - by Outlet

- 10.2.1. Chained Outlet

- 10.2.2. Independent Outlet

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Singapore

- 10.3.2. Malaysia

- 10.3.3. Thailand

- 10.3.4. Indonesia

- 10.3.5. Philippines

- 10.3.6. Vietnam

- 10.3.7. Rest of Southeast Asia

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Vietnam Southeast Asia Health And Fitness Club Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Service Type

- 11.1.1. Membership Fees

- 11.1.2. Personal Training and Instruction Services

- 11.1.3. Other Service Types

- 11.2. Market Analysis, Insights and Forecast - by Outlet

- 11.2.1. Chained Outlet

- 11.2.2. Independent Outlet

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. Singapore

- 11.3.2. Malaysia

- 11.3.3. Thailand

- 11.3.4. Indonesia

- 11.3.5. Philippines

- 11.3.6. Vietnam

- 11.3.7. Rest of Southeast Asia

- 11.1. Market Analysis, Insights and Forecast - by Service Type

- 12. Rest of Southeast Asia Southeast Asia Health And Fitness Club Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Service Type

- 12.1.1. Membership Fees

- 12.1.2. Personal Training and Instruction Services

- 12.1.3. Other Service Types

- 12.2. Market Analysis, Insights and Forecast - by Outlet

- 12.2.1. Chained Outlet

- 12.2.2. Independent Outlet

- 12.3. Market Analysis, Insights and Forecast - by Geography

- 12.3.1. Singapore

- 12.3.2. Malaysia

- 12.3.3. Thailand

- 12.3.4. Indonesia

- 12.3.5. Philippines

- 12.3.6. Vietnam

- 12.3.7. Rest of Southeast Asia

- 12.1. Market Analysis, Insights and Forecast - by Service Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Believe Fitness *List Not Exhaustive

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 RSG Group LLC

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Saigon Sports Club

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Evolution Wellness

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 F45 Training Holdings Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Elite Fitness

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Slimmers World

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Self Esteem Brands

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Pure International

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Virgin Group

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Believe Fitness *List Not Exhaustive

List of Figures

- Figure 1: Southeast Asia Health And Fitness Club Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Southeast Asia Health And Fitness Club Market Share (%) by Company 2025

List of Tables

- Table 1: Southeast Asia Health And Fitness Club Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Southeast Asia Health And Fitness Club Market Revenue Million Forecast, by Outlet 2020 & 2033

- Table 3: Southeast Asia Health And Fitness Club Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Southeast Asia Health And Fitness Club Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Southeast Asia Health And Fitness Club Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 6: Southeast Asia Health And Fitness Club Market Revenue Million Forecast, by Outlet 2020 & 2033

- Table 7: Southeast Asia Health And Fitness Club Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Southeast Asia Health And Fitness Club Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Southeast Asia Health And Fitness Club Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 10: Southeast Asia Health And Fitness Club Market Revenue Million Forecast, by Outlet 2020 & 2033

- Table 11: Southeast Asia Health And Fitness Club Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Southeast Asia Health And Fitness Club Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Southeast Asia Health And Fitness Club Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 14: Southeast Asia Health And Fitness Club Market Revenue Million Forecast, by Outlet 2020 & 2033

- Table 15: Southeast Asia Health And Fitness Club Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Southeast Asia Health And Fitness Club Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Southeast Asia Health And Fitness Club Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 18: Southeast Asia Health And Fitness Club Market Revenue Million Forecast, by Outlet 2020 & 2033

- Table 19: Southeast Asia Health And Fitness Club Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Southeast Asia Health And Fitness Club Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Southeast Asia Health And Fitness Club Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 22: Southeast Asia Health And Fitness Club Market Revenue Million Forecast, by Outlet 2020 & 2033

- Table 23: Southeast Asia Health And Fitness Club Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 24: Southeast Asia Health And Fitness Club Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Southeast Asia Health And Fitness Club Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 26: Southeast Asia Health And Fitness Club Market Revenue Million Forecast, by Outlet 2020 & 2033

- Table 27: Southeast Asia Health And Fitness Club Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 28: Southeast Asia Health And Fitness Club Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Southeast Asia Health And Fitness Club Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 30: Southeast Asia Health And Fitness Club Market Revenue Million Forecast, by Outlet 2020 & 2033

- Table 31: Southeast Asia Health And Fitness Club Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 32: Southeast Asia Health And Fitness Club Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Southeast Asia Health And Fitness Club Market?

The projected CAGR is approximately 9.36%.

2. Which companies are prominent players in the Southeast Asia Health And Fitness Club Market?

Key companies in the market include Believe Fitness *List Not Exhaustive, RSG Group LLC, Saigon Sports Club, Evolution Wellness, F45 Training Holdings Inc, Elite Fitness, Slimmers World, Self Esteem Brands, Pure International, Virgin Group.

3. What are the main segments of the Southeast Asia Health And Fitness Club Market?

The market segments include Service Type , Outlet , Geography .

4. Can you provide details about the market size?

The market size is estimated to be USD 2.45 Million as of 2022.

5. What are some drivers contributing to market growth?

Inclination Toward Healthy Lifestyle; Strategic Expansion by Health & Fitness Clubs.

6. What are the notable trends driving market growth?

Inclination Toward a Healthy Lifestyle.

7. Are there any restraints impacting market growth?

Rise in Popularity of Outdoor Activities.

8. Can you provide examples of recent developments in the market?

January 2024: Anytime Fitness launched the second season of ‘Be Fit Fest,’ an annual campaign of the franchise organization, by introducing an AI video.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Southeast Asia Health And Fitness Club Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Southeast Asia Health And Fitness Club Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Southeast Asia Health And Fitness Club Market?

To stay informed about further developments, trends, and reports in the Southeast Asia Health And Fitness Club Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence