Key Insights

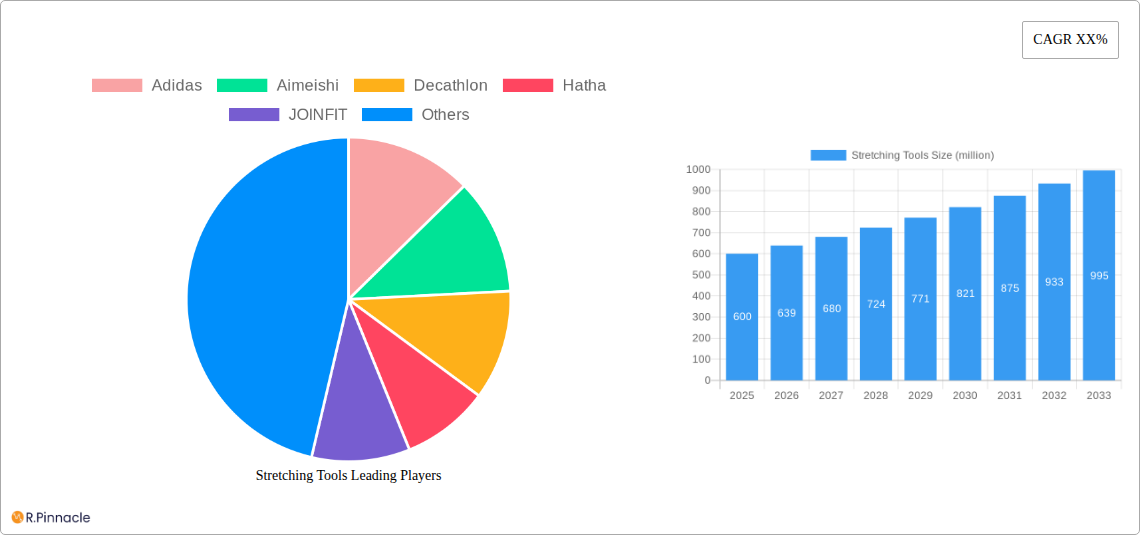

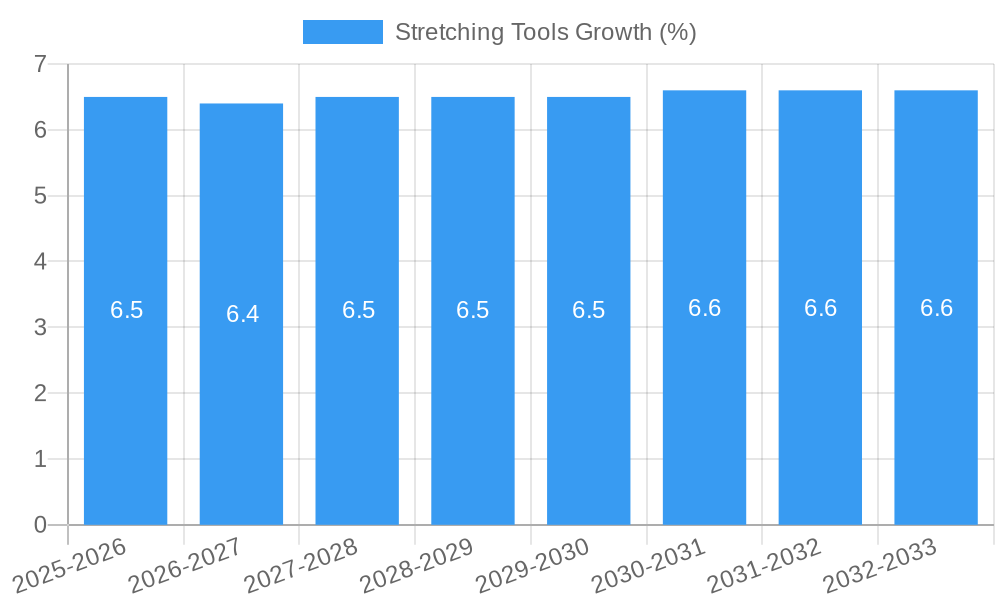

The global Stretching Tools market is poised for significant expansion, projected to reach an estimated market size of $600 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.5% throughout the forecast period of 2025-2033. This growth is primarily fueled by an increasing global awareness of the importance of flexibility, injury prevention, and muscle recovery in both athletic and general wellness contexts. The surge in at-home fitness routines, driven by the lingering effects of pandemic-induced lifestyle changes and the convenience of personal training, has created a substantial demand for accessible and effective stretching tools. Furthermore, the rising prevalence of sedentary lifestyles and work-from-home arrangements has contributed to a growing incidence of musculoskeletal discomfort and chronic pain, positioning stretching tools as a vital solution for pain management and improved physical well-being. The market is characterized by a diverse range of applications, with Online Sales emerging as a dominant channel due to e-commerce convenience and wider product availability, while Offline Sales continue to cater to consumers seeking in-person guidance and product experience.

The market's trajectory is further shaped by evolving consumer preferences and technological advancements. Innovations in material science have led to the development of more durable, ergonomic, and specialized stretching tools, including advanced Foam Rollers with varying densities and textures, and highly targeted Massage Balls designed for deep tissue release. Major brands are investing heavily in product development and marketing, catering to a broad spectrum of users, from professional athletes to individuals seeking everyday relief. However, the market also faces certain restraints. The high cost of some premium or specialized stretching tools can be a barrier for price-sensitive consumers. Additionally, a lack of consumer education regarding the proper usage and benefits of specific stretching tools can limit adoption in certain segments. Despite these challenges, the overarching trend towards proactive health management and the continuous innovation within the industry are expected to drive sustained growth and market penetration in the coming years.

This comprehensive report provides an in-depth analysis of the global Stretching Tools market, offering critical insights for industry professionals, manufacturers, and investors. Covering the historical period from 2019 to 2024, the base year of 2025, and a forecast period extending to 2033, this report delves into market structure, dynamics, regional dominance, product innovations, and future growth opportunities. Leverage our detailed segmentation and extensive competitive landscape analysis to make informed strategic decisions.

Stretching Tools Market Structure & Innovation Trends

The global Stretching Tools market exhibits a moderate to high concentration, with several key players holding significant market share, estimated at over 70 million units sold annually. Innovation serves as a primary driver, with companies continuously investing in research and development to enhance product functionality, user comfort, and therapeutic effectiveness. Regulatory frameworks, while generally supportive of health and wellness products, can influence material sourcing and product safety standards, with an estimated compliance cost impact of 5 million. Product substitutes, such as basic bodyweight exercises and access to professional physiotherapy, exist but are often complemented by stretching tools rather than fully replaced, indicating a strong market for specialized equipment. End-user demographics are diversifying, encompassing not only professional athletes and fitness enthusiasts but also a growing segment of the elderly population and individuals undergoing rehabilitation, projected to contribute an additional 20 million users by 2033. Mergers and acquisitions (M&A) activity is moderate, with significant deals in the past year valued at approximately 50 million, primarily driven by market consolidation and the acquisition of innovative technologies or established brands.

- Market Concentration: Moderate to High, with key players dominating over 70 million units in annual sales.

- Innovation Drivers: Focus on advanced materials, ergonomic design, and smart technology integration.

- Regulatory Frameworks: Evolving standards for safety, material sourcing, and therapeutic claims.

- Product Substitutes: Bodyweight exercises, professional physiotherapy, and other wellness practices.

- End-User Demographics: Athletes, fitness enthusiasts, elderly population, and rehabilitation patients.

- M&A Activities: Moderate, with recent deal values around 50 million aimed at market consolidation and technology acquisition.

Stretching Tools Market Dynamics & Trends

The Stretching Tools market is poised for robust growth, driven by a confluence of escalating health and wellness awareness, a surge in preventative healthcare practices, and the increasing adoption of home-based fitness regimes. The projected Compound Annual Growth Rate (CAGR) for the market stands at an impressive 8.5%, reflecting sustained expansion throughout the forecast period. This growth is fueled by a burgeoning demand for products that aid in muscle recovery, injury prevention, and improved flexibility, particularly among the aging population and individuals with sedentary lifestyles. Technological advancements are playing a pivotal role, with the integration of smart features like app connectivity for guided routines, progress tracking, and personalized feedback becoming a significant differentiator. Consumer preferences are increasingly leaning towards portable, versatile, and aesthetically pleasing stretching tools that can be easily incorporated into daily routines. The competitive landscape is dynamic, characterized by both established global brands and emerging niche players vying for market share through product innovation, strategic partnerships, and aggressive marketing campaigns. Online sales channels have witnessed substantial growth, accounting for an estimated 60% of total market penetration, a trend accelerated by the global pandemic and the continued convenience of e-commerce. Offline sales, though still significant, are evolving, with a greater emphasis on experiential retail and specialized fitness outlets. The market penetration of stretching tools is projected to reach 45% by 2033, driven by increased consumer education and accessibility. Investments in product development and marketing are expected to exceed 100 million annually over the forecast period. The rising disposable income in developing economies and a growing middle class further contribute to the market's upward trajectory, as consumers prioritize their physical well-being. Furthermore, the increasing prevalence of sports-related injuries and the associated demand for effective rehabilitation tools underscore the sustained relevance and growth potential of the stretching tools sector. The integration of virtual reality (VR) and augmented reality (AR) in fitness experiences also presents a novel avenue for enhancing the utility and engagement of stretching tools. The market is responding to the demand for eco-friendly and sustainable product options, with manufacturers exploring recycled materials and ethical production processes. The evolving definition of "fitness" to encompass holistic well-being, including mobility and flexibility, further solidifies the demand for effective stretching solutions. The increasing participation in recreational sports and fitness activities across all age groups also serves as a significant catalyst for market expansion. The rise of online fitness influencers and content creators showcasing the benefits of stretching tools is also shaping consumer perceptions and driving adoption. The shift towards personalized fitness plans and the growing recognition of the importance of pre- and post-workout routines are further propelling the demand for dedicated stretching equipment. The competitive intensity is characterized by a blend of price-based competition and innovation-led strategies, with companies striving to offer superior value propositions.

Dominant Regions & Segments in Stretching Tools

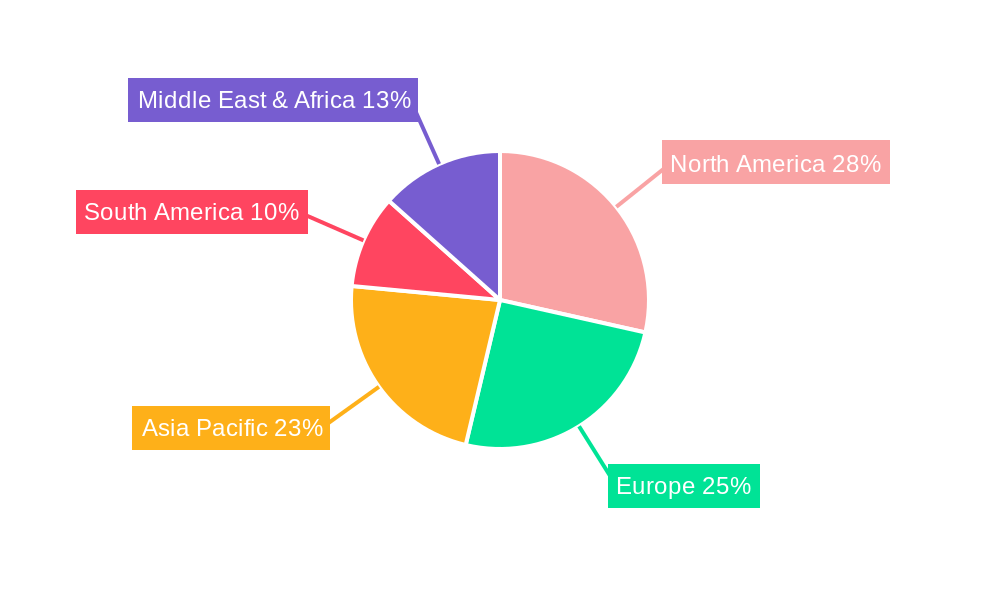

The North America region currently holds the dominant position in the global Stretching Tools market, driven by a high level of health consciousness, a well-developed fitness infrastructure, and a significant disposable income that facilitates the purchase of premium wellness products. Within North America, the United States accounts for the largest market share, attributed to widespread adoption of home fitness equipment and a strong emphasis on preventative healthcare and athletic performance.

Application Segments

- Online Sales: This segment is experiencing exponential growth, fueled by the convenience of e-commerce platforms and the increasing preference of consumers for home-based purchasing. Online sales are projected to capture an estimated 65% of the total market share by 2033, with a CAGR of 9.2%. Key drivers include the accessibility of a wider product range, competitive pricing, and the ease of product research through online reviews and detailed product descriptions. The adoption of advanced digital marketing strategies by companies further bolsters this segment.

- Offline Sales: While online sales are surging, offline sales remain crucial, particularly for specialized fitness retailers and physiotherapy clinics. This segment is expected to maintain a steady growth rate of 6.8% CAGR. Key drivers include the ability for consumers to physically interact with products, receive expert advice from sales associates, and experience the immediate benefits of different tools. The presence of brick-and-mortar stores in health clubs and wellness centers also contributes to sustained offline sales.

Type Segments

- Foam Roller: The Foam Roller segment is projected to lead the market in terms of volume and value, capturing an estimated 35% of the market share by 2033. The projected CAGR for foam rollers is 8.8%. These tools are highly versatile, catering to a wide range of applications from myofascial release to general muscle recovery. Their affordability and ease of use make them popular among both beginners and experienced users. The development of innovative designs, such as vibrating foam rollers and textured surfaces, further enhances their appeal.

- Elastic Band: Elastic bands are another significant segment, expected to hold approximately 25% of the market share by 2033, with a CAGR of 7.9%. Their portability, affordability, and versatility for strength training and flexibility exercises make them a staple in home and gym workouts. The introduction of bands with varying resistance levels and innovative attachment systems expands their applicability.

- Massage Ball: The Massage Ball segment is anticipated to grow at a CAGR of 7.5% and secure around 20% of the market share by 2033. These compact tools are ideal for targeted muscle release and addressing specific trigger points. Their effectiveness in pain relief and improving mobility makes them a popular choice for athletes and individuals experiencing muscle soreness.

- Others: This segment, encompassing products like yoga mats, stretching straps, and massage guns, is expected to grow at a CAGR of 7.0% and represent the remaining 20% of the market share by 2033. The "Others" category benefits from continuous innovation and the introduction of niche products addressing specific therapeutic needs.

Stretching Tools Product Innovations

- Foam Roller: The Foam Roller segment is projected to lead the market in terms of volume and value, capturing an estimated 35% of the market share by 2033. The projected CAGR for foam rollers is 8.8%. These tools are highly versatile, catering to a wide range of applications from myofascial release to general muscle recovery. Their affordability and ease of use make them popular among both beginners and experienced users. The development of innovative designs, such as vibrating foam rollers and textured surfaces, further enhances their appeal.

- Elastic Band: Elastic bands are another significant segment, expected to hold approximately 25% of the market share by 2033, with a CAGR of 7.9%. Their portability, affordability, and versatility for strength training and flexibility exercises make them a staple in home and gym workouts. The introduction of bands with varying resistance levels and innovative attachment systems expands their applicability.

- Massage Ball: The Massage Ball segment is anticipated to grow at a CAGR of 7.5% and secure around 20% of the market share by 2033. These compact tools are ideal for targeted muscle release and addressing specific trigger points. Their effectiveness in pain relief and improving mobility makes them a popular choice for athletes and individuals experiencing muscle soreness.

- Others: This segment, encompassing products like yoga mats, stretching straps, and massage guns, is expected to grow at a CAGR of 7.0% and represent the remaining 20% of the market share by 2033. The "Others" category benefits from continuous innovation and the introduction of niche products addressing specific therapeutic needs.

Stretching Tools Product Innovations

Recent product innovations in the Stretching Tools market focus on enhanced user experience and therapeutic effectiveness. This includes the development of smart stretching tools integrated with mobile applications for guided routines and progress tracking, advanced materials offering superior durability and targeted pressure, and ergonomically designed products that cater to specific muscle groups and rehabilitation needs. Innovations like vibrating foam rollers and resistance bands with adjustable tension provide users with more dynamic and personalized workout experiences. These developments aim to improve user engagement, facilitate effective muscle recovery, and promote injury prevention, thereby offering a competitive advantage in a growing market.

Report Scope & Segmentation Analysis

This report meticulously analyzes the global Stretching Tools market across key segmentation parameters, providing granular insights into each segment's growth trajectory and market dynamics.

- Application: Online Sales: This segment is projected for substantial growth, driven by e-commerce penetration and consumer convenience. Expected market size in 2033 is over 50 million units, with a CAGR of 9.2%. Competitive dynamics are characterized by strong online branding and efficient supply chain management.

- Application: Offline Sales: While growing at a more moderate pace, offline sales remain vital for experiential purchases and expert consultation. Projected market size in 2033 is around 30 million units, with a CAGR of 6.8%. Key players focus on strategic retail placement and in-store promotions.

- Type: Elastic Band: This segment offers high portability and affordability, contributing significantly to market volume. Projected market size in 2033 is approximately 20 million units, with a CAGR of 7.9%. Competitive advantages lie in product variety and resistance levels.

- Type: Foam Roller: The leading segment in terms of versatility and widespread adoption, with a strong CAGR of 8.8%. Projected market size in 2033 is over 28 million units. Innovations in material and design are key competitive differentiators.

- Type: Massage Ball: Known for its targeted therapeutic benefits, this segment is expected to see steady growth. Projected market size in 2033 is around 16 million units, with a CAGR of 7.5%. Competitive focus is on developing specialized balls for specific muscle groups.

- Type: Others: This diverse segment, encompassing niche products, is anticipated to grow at a CAGR of 7.0%. Projected market size in 2033 is approximately 16 million units. Innovation and product specialization are crucial for success in this segment.

Key Drivers of Stretching Tools Growth

The Stretching Tools market is propelled by several significant growth drivers, primarily stemming from the increasing global focus on health and wellness.

- Rising Health and Wellness Consciousness: An escalating awareness of the benefits of regular exercise, flexibility, and injury prevention among the general population is a primary catalyst. This includes a growing understanding of the role of stretching in improving posture, reducing muscle stiffness, and enhancing overall physical performance.

- Growth in Home Fitness Market: The sustained popularity of home-based workouts, amplified by recent global events, has led to a greater demand for compact and effective fitness equipment, including stretching tools. Consumers are investing in equipment that allows them to maintain their fitness routines conveniently and affordably within their homes.

- Aging Population and Rehabilitation Needs: The expanding elderly demographic worldwide presents a significant market opportunity. Stretching tools are increasingly recognized for their role in maintaining mobility, reducing the risk of falls, and aiding in the recovery from age-related physical ailments. Rehabilitation centers and physiotherapy clinics also rely heavily on these tools.

- Technological Advancements: Innovations such as smart connectivity, app integration for guided exercises, and the development of advanced materials are enhancing the appeal and effectiveness of stretching tools, attracting a wider consumer base.

Challenges in the Stretching Tools Sector

Despite its positive growth trajectory, the Stretching Tools sector faces several challenges that could impede its full potential.

- Intense Market Competition: The market is characterized by a large number of manufacturers, leading to significant price pressure and the need for continuous product differentiation to gain market share. This competitive intensity can impact profit margins for smaller players.

- Consumer Education and Awareness Gaps: While awareness is growing, there remain segments of the population who may not fully understand the benefits or proper usage of various stretching tools. This can lead to underutilization or incorrect application, limiting market penetration in certain demographics.

- Supply Chain Volatility: Like many industries, the stretching tools sector can be susceptible to disruptions in the global supply chain, affecting the availability and cost of raw materials and finished products. This can lead to production delays and increased manufacturing costs.

- Counterfeit Products: The proliferation of counterfeit and low-quality products in the market can dilute brand reputation and erode consumer trust, particularly in online channels, impacting the sales of genuine and high-quality stretching tools.

Emerging Opportunities in Stretching Tools

The Stretching Tools market is ripe with emerging opportunities that can further fuel its growth and innovation.

- Smart and Connected Fitness: The integration of IoT technology into stretching tools, offering personalized feedback, guided programs, and progress tracking through mobile apps, presents a significant growth avenue. This caters to the demand for data-driven fitness experiences.

- Personalized Wellness Solutions: Developing stretching tools tailored for specific needs, such as prenatal stretching, post-surgical recovery, or sports-specific training, can tap into niche markets with high demand for specialized solutions.

- Eco-Friendly and Sustainable Products: With growing environmental consciousness, there is an increasing demand for stretching tools made from sustainable, recycled, and biodegradable materials. Manufacturers focusing on eco-friendly production can gain a competitive edge.

- Expansion in Emerging Economies: Untapped potential exists in developing economies where health and wellness awareness is on the rise, and disposable incomes are increasing, creating a fertile ground for market expansion.

Leading Players in the Stretching Tools Market

- Adidas

- Aimeishi

- Decathlon

- Hatha

- JOINFIT

- Jordan Fitness

- LianHong

- LINING

- Lululemon Athletica

- McDavid

- Nike

- RumbleRoller

- TECHNOGYM

- Tokuyo

- Trigger Point

- TruMedical Solutions

Key Developments in Stretching Tools Industry

- 2024 May: Lululemon Athletica launches a new line of innovative yoga and stretching accessories, emphasizing sustainable materials and ergonomic design.

- 2024 March: Trigger Point introduces an advanced vibrating foam roller with app connectivity, aiming to enhance muscle recovery and performance for athletes.

- 2023 December: Decathlon expands its range of affordable and accessible stretching tools, focusing on entry-level consumers and home fitness enthusiasts.

- 2023 October: Nike partners with a leading physiotherapy technology firm to develop smart stretching tools integrated with sports performance analytics.

- 2023 July: RumbleRoller expands its product line to include specialized rollers for targeting specific muscle groups, catering to a more niche segment of the market.

- 2023 April: JOINFIT announces strategic collaborations with fitness influencers to promote the benefits of their diverse range of stretching equipment.

- 2023 January: Adidas unveils new eco-friendly elastic bands made from recycled materials, aligning with its sustainability initiatives.

Future Outlook for Stretching Tools Market

The future outlook for the Stretching Tools market is exceptionally promising, driven by sustained growth in the global health and wellness sector and continuous innovation. The market is expected to witness an accelerated adoption of smart and connected fitness solutions, further integrating stretching into personalized digital wellness ecosystems. Expansion into emerging markets, coupled with an increasing focus on preventative healthcare and rehabilitation, will provide significant growth accelerators. Strategic investments in research and development to create highly specialized and therapeutic stretching tools, alongside a growing consumer preference for sustainable products, will shape the competitive landscape. The increasing integration of stretching tools into holistic wellness programs and corporate wellness initiatives will also contribute to long-term market potential.

Stretching Tools Segmentation

-

1. Application

- 1.1. Online Sales

- 1.2. Offline Sales

-

2. Types

- 2.1. Elastic Band

- 2.2. Foam Roller

- 2.3. Massage Ball

- 2.4. Others

Stretching Tools Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Stretching Tools REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Stretching Tools Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online Sales

- 5.1.2. Offline Sales

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Elastic Band

- 5.2.2. Foam Roller

- 5.2.3. Massage Ball

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Stretching Tools Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online Sales

- 6.1.2. Offline Sales

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Elastic Band

- 6.2.2. Foam Roller

- 6.2.3. Massage Ball

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Stretching Tools Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online Sales

- 7.1.2. Offline Sales

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Elastic Band

- 7.2.2. Foam Roller

- 7.2.3. Massage Ball

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Stretching Tools Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online Sales

- 8.1.2. Offline Sales

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Elastic Band

- 8.2.2. Foam Roller

- 8.2.3. Massage Ball

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Stretching Tools Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online Sales

- 9.1.2. Offline Sales

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Elastic Band

- 9.2.2. Foam Roller

- 9.2.3. Massage Ball

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Stretching Tools Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online Sales

- 10.1.2. Offline Sales

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Elastic Band

- 10.2.2. Foam Roller

- 10.2.3. Massage Ball

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Adidas

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Aimeishi

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Decathlon

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hatha

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 JOINFIT

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Jordan Fitness

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 LianHong

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 LINING

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Lululemon Athletica

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 McDavid

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Nike

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 RumbleRoller

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 TECHNOGYM

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Tokuyo

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Trigger Point

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 TruMedical Solutions

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Adidas

List of Figures

- Figure 1: Global Stretching Tools Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Stretching Tools Revenue (million), by Application 2024 & 2032

- Figure 3: North America Stretching Tools Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Stretching Tools Revenue (million), by Types 2024 & 2032

- Figure 5: North America Stretching Tools Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Stretching Tools Revenue (million), by Country 2024 & 2032

- Figure 7: North America Stretching Tools Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Stretching Tools Revenue (million), by Application 2024 & 2032

- Figure 9: South America Stretching Tools Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Stretching Tools Revenue (million), by Types 2024 & 2032

- Figure 11: South America Stretching Tools Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Stretching Tools Revenue (million), by Country 2024 & 2032

- Figure 13: South America Stretching Tools Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Stretching Tools Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Stretching Tools Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Stretching Tools Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Stretching Tools Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Stretching Tools Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Stretching Tools Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Stretching Tools Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Stretching Tools Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Stretching Tools Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Stretching Tools Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Stretching Tools Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Stretching Tools Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Stretching Tools Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Stretching Tools Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Stretching Tools Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Stretching Tools Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Stretching Tools Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Stretching Tools Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Stretching Tools Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Stretching Tools Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Stretching Tools Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Stretching Tools Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Stretching Tools Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Stretching Tools Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Stretching Tools Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Stretching Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Stretching Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Stretching Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Stretching Tools Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Stretching Tools Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Stretching Tools Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Stretching Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Stretching Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Stretching Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Stretching Tools Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Stretching Tools Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Stretching Tools Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Stretching Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Stretching Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Stretching Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Stretching Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Stretching Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Stretching Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Stretching Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Stretching Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Stretching Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Stretching Tools Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Stretching Tools Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Stretching Tools Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Stretching Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Stretching Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Stretching Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Stretching Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Stretching Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Stretching Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Stretching Tools Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Stretching Tools Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Stretching Tools Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Stretching Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Stretching Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Stretching Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Stretching Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Stretching Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Stretching Tools Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Stretching Tools Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Stretching Tools?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Stretching Tools?

Key companies in the market include Adidas, Aimeishi, Decathlon, Hatha, JOINFIT, Jordan Fitness, LianHong, LINING, Lululemon Athletica, McDavid, Nike, RumbleRoller, TECHNOGYM, Tokuyo, Trigger Point, TruMedical Solutions.

3. What are the main segments of the Stretching Tools?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Stretching Tools," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Stretching Tools report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Stretching Tools?

To stay informed about further developments, trends, and reports in the Stretching Tools, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence