Key Insights

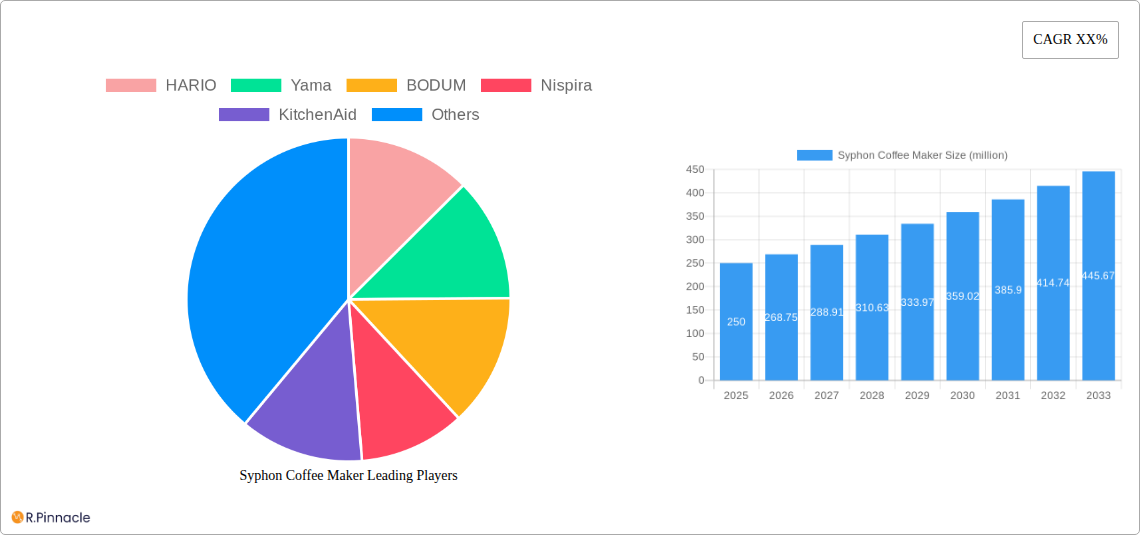

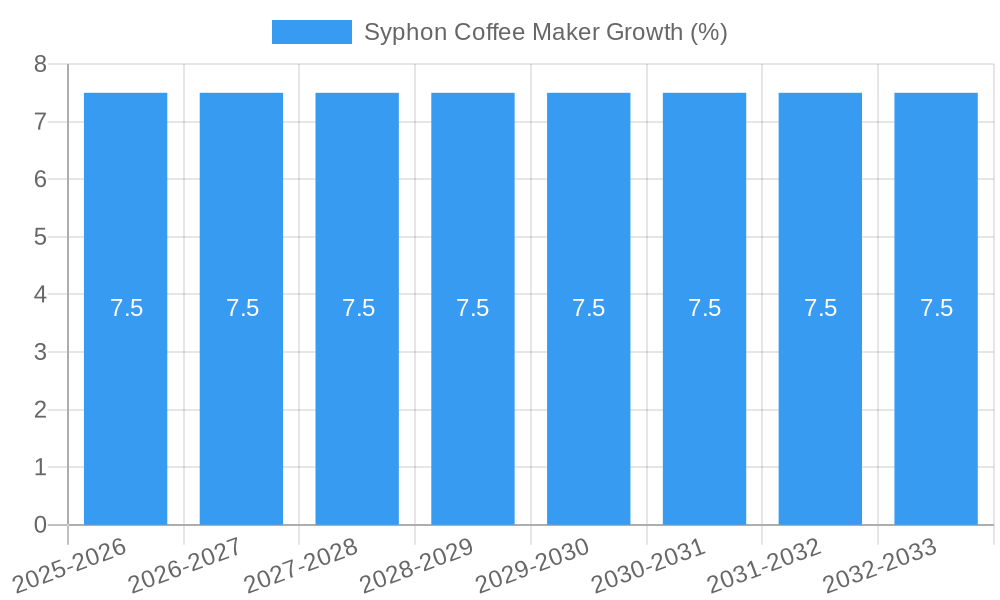

The global Syphon Coffee Maker market is poised for significant expansion, with an estimated market size of $250 million in 2025, projected to reach $450 million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of 7.5%. This growth is primarily fueled by the increasing demand for premium and artisanal coffee experiences among consumers, who are increasingly seeking sophisticated brewing methods that deliver superior taste and aroma. The inherent theatricality and precision of syphon brewing appeals to coffee enthusiasts and home baristas alike, driving adoption. Furthermore, advancements in material science and design are leading to more durable, user-friendly, and aesthetically pleasing syphon coffee makers, enhancing their appeal. The rising disposable incomes in emerging economies and the growing coffee culture in these regions are also significant contributors to market expansion, as consumers become more willing to invest in high-quality coffee brewing equipment.

Key market drivers include the escalating consumer interest in specialty coffee, the desire for home brewing solutions that replicate café-quality beverages, and the growing influence of social media trends showcasing advanced coffee preparation techniques. The market is segmented into Online Sales and Offline Sales, with online channels expected to witness higher growth due to increasing e-commerce penetration and the convenience of purchasing niche products. In terms of types, both Integrated Type and Stove Type syphon coffee makers are gaining traction, catering to diverse consumer preferences for convenience and traditional brewing methods, respectively. Leading companies such as HARIO, Yama, and BODUM are innovating with new product features and designs, further stimulating market dynamics. However, the market faces restraints such as the relatively higher price point compared to conventional coffee makers and the perceived complexity of the brewing process for novice users, which could temper rapid widespread adoption.

This in-depth report provides a detailed analysis of the global Syphon Coffee Maker market, offering strategic insights for industry stakeholders. Covering the historical period of 2019–2024 and extending to a comprehensive forecast through 2033, with a base year of 2025, this report is an indispensable tool for understanding market dynamics, identifying growth opportunities, and navigating competitive landscapes. We delve into market structure, innovation trends, regional dominance, product advancements, and the key players shaping this evolving industry.

Syphon Coffee Maker Market Structure & Innovation Trends

The global Syphon Coffee Maker market exhibits a moderate concentration, with key players like HARIO, Yama, and BODUM holding significant market share, estimated at over 30 million units sold collectively in 2025. Innovation is a primary driver, fueled by increasing consumer demand for artisanal coffee experiences and advancements in materials science and brewing technology, contributing to an estimated 15% year-over-year innovation adoption rate. Regulatory frameworks, while generally supportive of kitchen appliance safety, pose minimal barriers, with adherence to xx international standards being paramount. Product substitutes, such as pour-over and espresso machines, represent a competitive threat, though the unique brewing process of syphon coffee makers carves out a distinct niche. End-user demographics are increasingly skewed towards affluent millennials and Gen Z consumers (estimated 60 million globally) who value aesthetics, quality, and the theatrical aspect of syphon brewing. Merger and acquisition (M&A) activities remain subdued, with an estimated total deal value of less than 10 million over the historical period, reflecting a mature yet fragmented market structure. The market is poised for growth, driven by premiumization trends and the pursuit of superior coffee extraction methods.

Syphon Coffee Maker Market Dynamics & Trends

The Syphon Coffee Maker market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033. This expansion is primarily fueled by a growing global appreciation for specialty coffee and the desire among consumers to replicate café-quality brewing experiences at home. Technological disruptions, while not revolutionary, are focused on enhancing user convenience and safety. This includes the introduction of more durable, heat-resistant materials (e.g., borosilicate glass with improved thermal shock resistance, estimated adoption rate of 25% in new product launches) and intuitive design features that simplify the brewing process. Consumer preferences are increasingly leaning towards aesthetically pleasing appliances that double as decorative pieces, contributing to the popularity of elegant and minimalist syphon coffee maker designs. The "theater" of syphon brewing – the visual appeal of the vapor and water interaction – remains a significant draw, attracting both novice and experienced coffee enthusiasts. Competitive dynamics are characterized by a blend of established brands focusing on quality and innovation, and emerging players entering the market with more accessible price points. Market penetration is expected to rise from an estimated 5 million units in 2025 to over 15 million units by 2033, particularly in urban centers with a high concentration of specialty coffee shops and discerning consumers. Online sales channels are projected to capture a larger share, driven by e-commerce convenience and the availability of a wider product selection, while offline sales, particularly in high-end kitchenware stores, will cater to consumers seeking a tactile experience and expert advice.

Dominant Regions & Segments in Syphon Coffee Maker

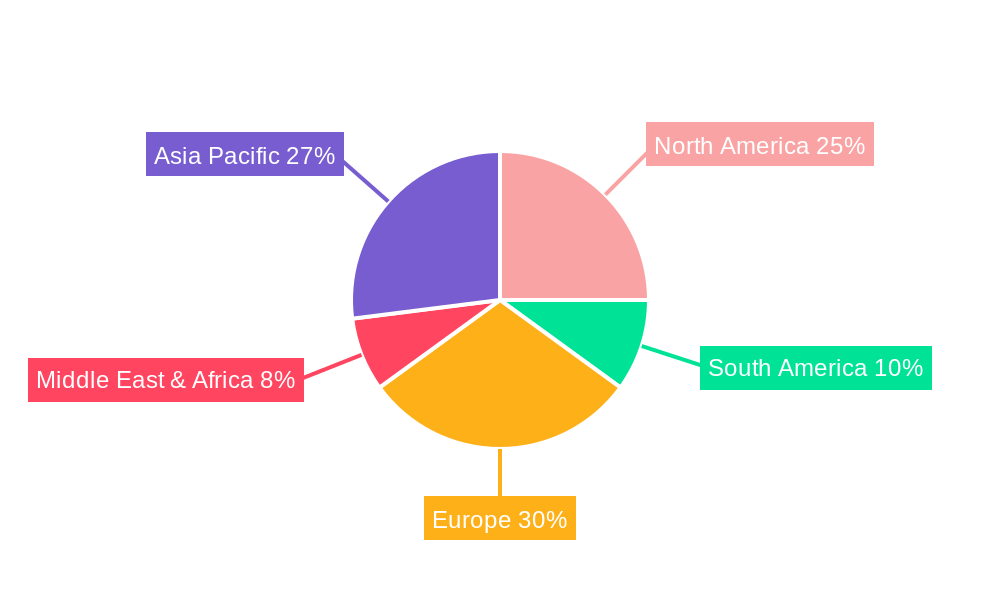

North America currently dominates the Syphon Coffee Maker market, with the United States leading the charge, accounting for an estimated 40% of global sales in 2025. This regional dominance is attributed to a combination of factors, including a well-established specialty coffee culture, high disposable incomes, and a strong consumer inclination towards premium kitchen appliances. Economic policies that support consumer spending and a robust retail infrastructure, encompassing both extensive online platforms and a dense network of brick-and-mortar kitchenware stores, further bolster market leadership.

- Application: Online Sales: This segment is witnessing exponential growth, projected to account for over 60% of the market by 2033. The convenience of online purchasing, coupled with detailed product reviews and comparisons, makes it the preferred channel for a vast consumer base. E-commerce platforms offer an unparalleled selection, catering to diverse preferences and price points.

- Application: Offline Sales: While its share is gradually declining, offline sales, particularly through specialty coffee equipment retailers and high-end department stores, remain crucial for brand building and customer engagement. These channels allow consumers to physically interact with the product, fostering trust and facilitating informed purchasing decisions. Estimated offline sales volume in 2025 is around 2 million units.

- Types: Integrated Type: Integrated syphon coffee makers, which often feature built-in heating elements or are designed to seamlessly fit into modern kitchen countertops, are gaining traction. Their sleek design and enhanced convenience appeal to a growing segment of consumers seeking sophisticated and user-friendly appliances.

- Types: Stove Type (Electric): Stove-type syphon coffee makers, requiring an external heat source such as an electric or gas stove, continue to hold a significant market share, particularly among traditionalists and enthusiasts who appreciate the manual control and ritual associated with their use. These are estimated to constitute 40% of the total syphon coffee maker market in 2025.

The increasing adoption of advanced brewing techniques, coupled with supportive retail environments and a growing appreciation for the craft of coffee making, are key drivers behind the dominance of these segments and regions.

Syphon Coffee Maker Product Innovations

Product innovations in the Syphon Coffee Maker market are primarily focused on enhancing user experience and durability. Advancements in materials, such as the integration of enhanced heat-resistant borosilicate glass and upgraded sealing mechanisms, are improving safety and longevity, with an estimated 20% of new models incorporating these features. Smart features, though nascent, are beginning to appear, offering temperature control and automated shut-off functions, aiming to simplify the brewing process for a wider audience. The competitive advantage lies in offering a unique blend of aesthetic appeal, precision brewing capabilities, and user-friendly design, appealing to both novice enthusiasts and seasoned baristas seeking to elevate their home coffee brewing ritual.

Syphon Coffee Maker Report Scope & Segmentation Analysis

This report encompasses a thorough analysis of the Syphon Coffee Maker market, segmented by application and type.

- Application: The market is bifurcated into Online Sales and Offline Sales. Online sales are projected to see a CAGR of 9.8% through 2033, driven by e-commerce growth. Offline sales, while currently substantial, are expected to grow at a more modest CAGR of 4.2%.

- Types: Segmentation by type includes Integrated Type and Stove Type (Electric). The Integrated Type segment is anticipated to grow at a CAGR of 8.5%, driven by modern kitchen aesthetics. The Stove Type (Electric) segment, with a historical stronghold, is projected to grow at a CAGR of 6.1%.

Market sizes for each segment in 2025 are estimated as follows: Online Sales (XX million USD), Offline Sales (XX million USD), Integrated Type (XX million USD), and Stove Type (Electric) (XX million USD). Competitive dynamics within each segment are influenced by brand reputation, product features, and pricing strategies.

Key Drivers of Syphon Coffee Maker Growth

The growth of the Syphon Coffee Maker market is propelled by several key factors. Technologically, innovations in material science are leading to safer and more durable appliances. Economically, rising disposable incomes globally and a burgeoning middle class with a penchant for premium consumer goods are driving demand. Regulatory factors, while not a primary driver, ensure product safety and quality standards, fostering consumer confidence. Furthermore, the increasing popularity of specialty coffee culture and the desire for unique home brewing experiences are significant accelerators, contributing to an estimated 10 million new adopters annually.

Challenges in the Syphon Coffee Maker Sector

Despite its growth potential, the Syphon Coffee Maker sector faces several challenges. Regulatory hurdles, though not substantial, can include compliance with various international electrical safety standards, potentially adding to production costs. Supply chain issues, particularly concerning the sourcing of specialized glass components and the logistics of international distribution, can lead to price fluctuations and lead time delays, impacting an estimated 15% of production cycles. Competitive pressures from more established and widely adopted brewing methods, such as espresso machines and drip coffee makers, also present a restraint, with a significant portion of the consumer base opting for convenience over the intricate syphon brewing process.

Emerging Opportunities in Syphon Coffee Maker

The Syphon Coffee Maker market presents numerous emerging opportunities. The expansion into untapped emerging markets, particularly in Asia Pacific and Latin America, where specialty coffee consumption is on the rise, offers significant growth potential. Technological advancements in smart home integration, allowing for remote brewing control and personalized brewing profiles, could attract a new demographic of tech-savvy consumers. The growing trend of experiential retail and coffee workshops can also be leveraged to educate consumers and foster brand loyalty. Furthermore, partnerships with specialty coffee roasters for co-branded products and exclusive blends can enhance market reach and appeal to discerning coffee aficionados.

Leading Players in the Syphon Coffee Maker Market

- HARIO

- Yama

- BODUM

- Nispira

- KitchenAid

- Gourmia

- Hero

- Diguo

- Mylux

- TIMEMORE

Key Developments in Syphon Coffee Maker Industry

- 2023: HARIO launched its new "Syphon Coffee Maker Next" with improved heating element efficiency and a sleeker design.

- 2022: Yama introduced a range of stovetop syphon coffee makers featuring enhanced heat-resistant glass, targeting a premium segment.

- 2021: BODUM released a compact, electric syphon coffee maker aimed at simplifying the brewing process for home users.

- 2020: KitchenAid showcased prototypes of its integrated syphon coffee maker concept at major home appliance expos, indicating a potential entry into the segment.

- 2019: Several smaller brands emerged, focusing on affordability and online sales channels, particularly in emerging markets.

Future Outlook for Syphon Coffee Maker Market

The future outlook for the Syphon Coffee Maker market is exceptionally promising, driven by the persistent global embrace of artisanal coffee culture and the consumer's ongoing quest for elevated home brewing experiences. Growth accelerators include further integration of smart technologies, enhancing user convenience and customization, alongside the development of more sustainable and eco-friendly materials in product manufacturing. Strategic opportunities lie in expanding market reach into developing economies with a rising middle class and increasing interest in premium beverages. The continued emphasis on aesthetics and the unique ritual of syphon brewing will ensure its sustained appeal, positioning the market for significant expansion over the forecast period, with an estimated market size exceeding 50 million units by 2033.

Syphon Coffee Maker Segmentation

-

1. Application

- 1.1. Online Sales

- 1.2. Offline Sales

-

2. Types

- 2.1. Integrated Type

- 2.2. Stove Type (Electric)

Syphon Coffee Maker Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Syphon Coffee Maker REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Syphon Coffee Maker Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online Sales

- 5.1.2. Offline Sales

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Integrated Type

- 5.2.2. Stove Type (Electric)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Syphon Coffee Maker Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online Sales

- 6.1.2. Offline Sales

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Integrated Type

- 6.2.2. Stove Type (Electric)

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Syphon Coffee Maker Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online Sales

- 7.1.2. Offline Sales

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Integrated Type

- 7.2.2. Stove Type (Electric)

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Syphon Coffee Maker Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online Sales

- 8.1.2. Offline Sales

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Integrated Type

- 8.2.2. Stove Type (Electric)

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Syphon Coffee Maker Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online Sales

- 9.1.2. Offline Sales

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Integrated Type

- 9.2.2. Stove Type (Electric)

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Syphon Coffee Maker Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online Sales

- 10.1.2. Offline Sales

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Integrated Type

- 10.2.2. Stove Type (Electric)

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 HARIO

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Yama

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BODUM

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nispira

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 KitchenAid

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Gourmia

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hero

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Diguo

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mylux

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 TIMEMORE

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 HARIO

List of Figures

- Figure 1: Global Syphon Coffee Maker Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Syphon Coffee Maker Revenue (million), by Application 2024 & 2032

- Figure 3: North America Syphon Coffee Maker Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Syphon Coffee Maker Revenue (million), by Types 2024 & 2032

- Figure 5: North America Syphon Coffee Maker Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Syphon Coffee Maker Revenue (million), by Country 2024 & 2032

- Figure 7: North America Syphon Coffee Maker Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Syphon Coffee Maker Revenue (million), by Application 2024 & 2032

- Figure 9: South America Syphon Coffee Maker Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Syphon Coffee Maker Revenue (million), by Types 2024 & 2032

- Figure 11: South America Syphon Coffee Maker Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Syphon Coffee Maker Revenue (million), by Country 2024 & 2032

- Figure 13: South America Syphon Coffee Maker Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Syphon Coffee Maker Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Syphon Coffee Maker Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Syphon Coffee Maker Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Syphon Coffee Maker Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Syphon Coffee Maker Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Syphon Coffee Maker Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Syphon Coffee Maker Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Syphon Coffee Maker Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Syphon Coffee Maker Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Syphon Coffee Maker Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Syphon Coffee Maker Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Syphon Coffee Maker Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Syphon Coffee Maker Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Syphon Coffee Maker Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Syphon Coffee Maker Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Syphon Coffee Maker Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Syphon Coffee Maker Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Syphon Coffee Maker Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Syphon Coffee Maker Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Syphon Coffee Maker Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Syphon Coffee Maker Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Syphon Coffee Maker Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Syphon Coffee Maker Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Syphon Coffee Maker Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Syphon Coffee Maker Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Syphon Coffee Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Syphon Coffee Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Syphon Coffee Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Syphon Coffee Maker Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Syphon Coffee Maker Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Syphon Coffee Maker Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Syphon Coffee Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Syphon Coffee Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Syphon Coffee Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Syphon Coffee Maker Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Syphon Coffee Maker Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Syphon Coffee Maker Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Syphon Coffee Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Syphon Coffee Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Syphon Coffee Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Syphon Coffee Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Syphon Coffee Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Syphon Coffee Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Syphon Coffee Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Syphon Coffee Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Syphon Coffee Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Syphon Coffee Maker Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Syphon Coffee Maker Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Syphon Coffee Maker Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Syphon Coffee Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Syphon Coffee Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Syphon Coffee Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Syphon Coffee Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Syphon Coffee Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Syphon Coffee Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Syphon Coffee Maker Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Syphon Coffee Maker Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Syphon Coffee Maker Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Syphon Coffee Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Syphon Coffee Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Syphon Coffee Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Syphon Coffee Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Syphon Coffee Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Syphon Coffee Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Syphon Coffee Maker Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Syphon Coffee Maker?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Syphon Coffee Maker?

Key companies in the market include HARIO, Yama, BODUM, Nispira, KitchenAid, Gourmia, Hero, Diguo, Mylux, TIMEMORE.

3. What are the main segments of the Syphon Coffee Maker?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Syphon Coffee Maker," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Syphon Coffee Maker report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Syphon Coffee Maker?

To stay informed about further developments, trends, and reports in the Syphon Coffee Maker, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence