Key Insights

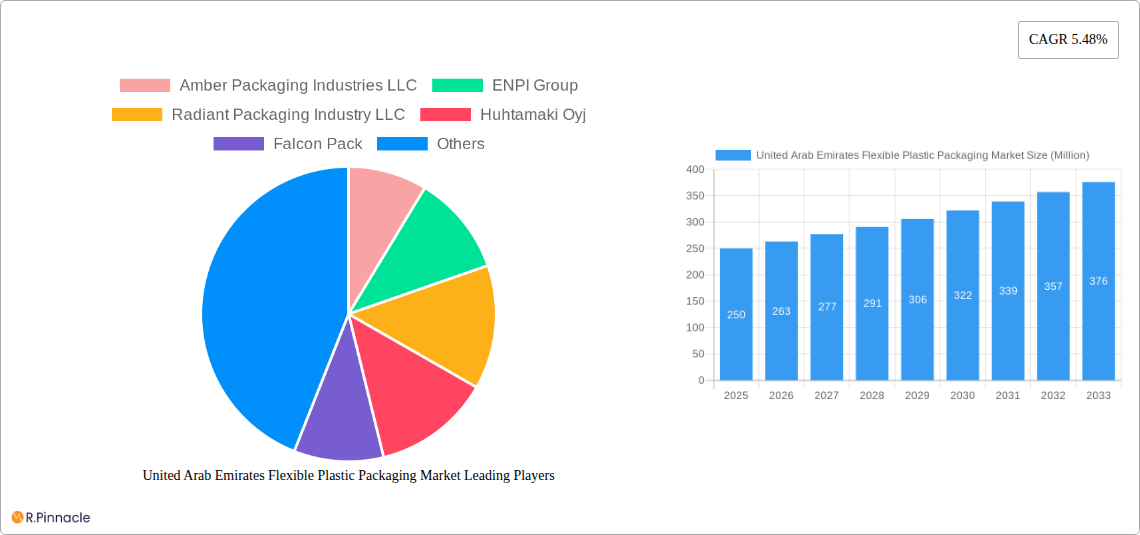

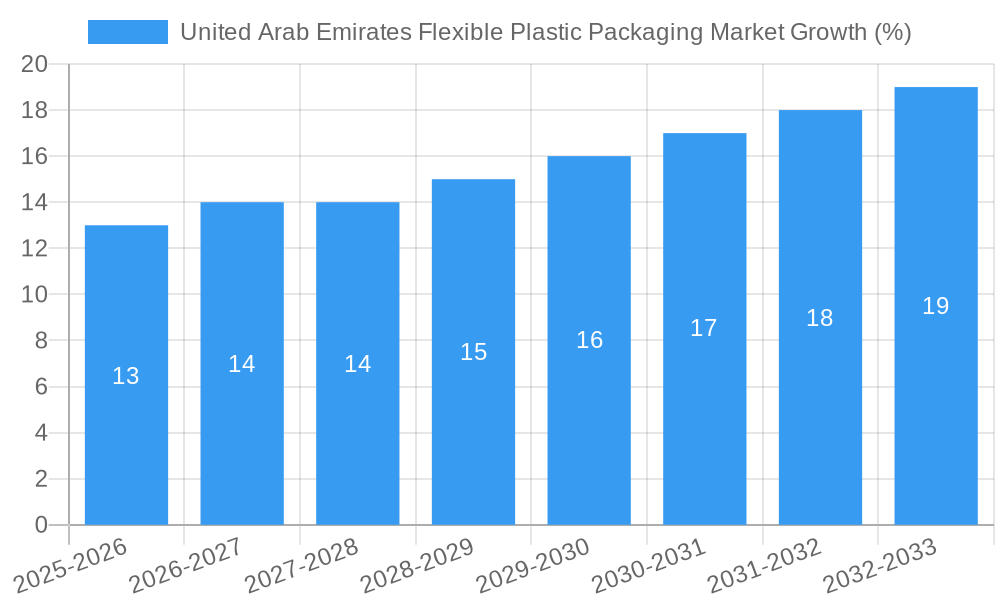

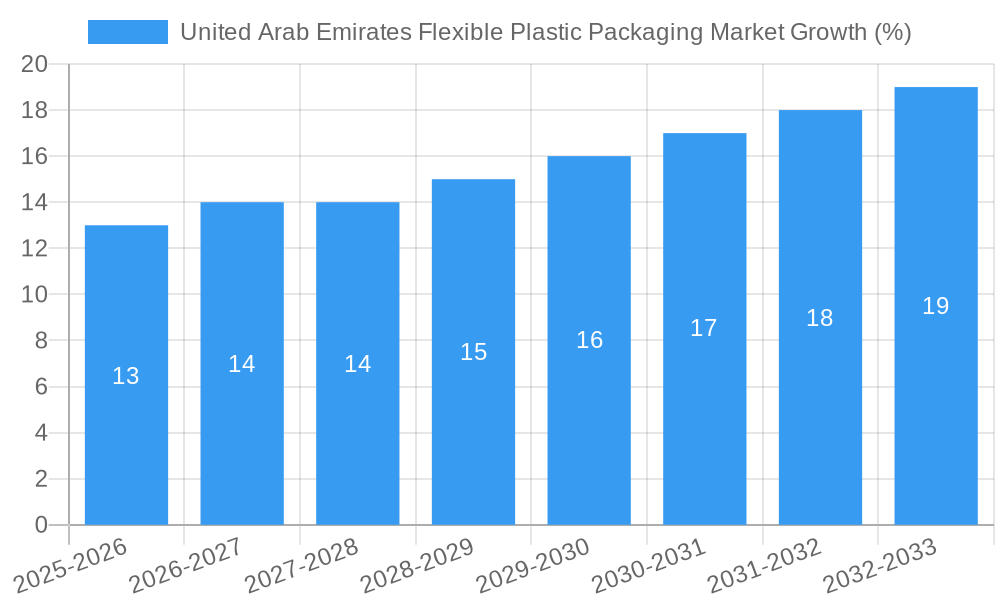

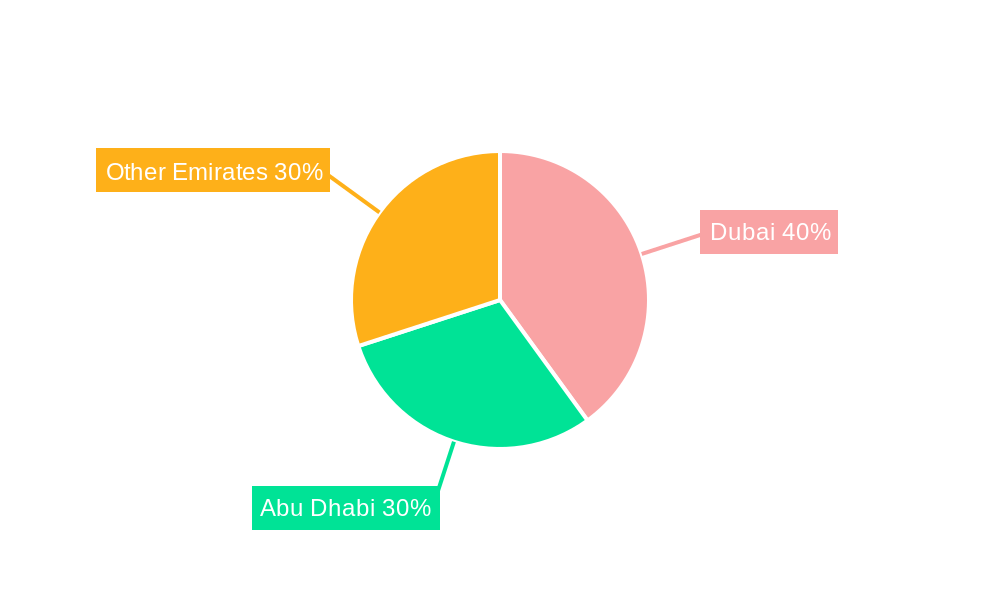

The United Arab Emirates (UAE) flexible plastic packaging market is experiencing robust growth, driven by a thriving food and beverage sector, expanding e-commerce landscape, and increasing consumer demand for convenient and attractively packaged products. The market, estimated at $XX million in 2025, is projected to maintain a Compound Annual Growth Rate (CAGR) of 5.48% from 2025 to 2033, reaching a substantial market size by the end of the forecast period. Key drivers include the UAE's strategic focus on food security, leading to increased demand for efficient packaging solutions, and the rise of organized retail, demanding aesthetically pleasing and functional packaging. Furthermore, the growing tourism sector and significant influx of foreign investments contribute to the market's expansion. While challenges such as stringent environmental regulations and growing concerns about plastic waste present restraints, the market is adapting through the adoption of sustainable packaging solutions, such as biodegradable and recyclable plastics, and innovative packaging designs that minimize material usage. Major players like Amber Packaging Industries LLC, ENPI Group, and Huhtamaki Oyj are actively shaping the market landscape through strategic investments in advanced technologies and expansion into new segments. The market is segmented by material type (polyethylene, polypropylene, etc.), packaging type (pouches, bags, films), and end-use industry (food & beverage, pharmaceuticals, etc.). The regional distribution likely mirrors the UAE's population density, with higher concentration in urban areas like Dubai and Abu Dhabi.

The competitive landscape in the UAE flexible plastic packaging market is characterized by both large multinational companies and smaller, locally-based businesses. These companies compete primarily on price, quality, and innovation. The presence of established international players indicates a sophisticated market with high demand for specialized and high-quality flexible packaging. The continued focus on sustainability is a major area of competition, with companies vying to offer eco-friendly alternatives to traditional plastic packaging. Future growth will likely be driven by technological advancements, particularly in barrier film technology, active packaging, and smart packaging solutions. This ongoing innovation combined with increased consumer awareness around sustainability will further shape the UAE's flexible plastic packaging market, pushing the industry towards more environmentally responsible practices.

United Arab Emirates Flexible Plastic Packaging Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United Arab Emirates (UAE) flexible plastic packaging market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study period spans 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. Discover key market trends, competitive dynamics, and growth opportunities within this dynamic sector. The report utilizes a 7-2 Heat Map Analysis to visualize market dynamics and competitive landscape.

United Arab Emirates Flexible Plastic Packaging Market Structure & Innovation Trends

This section analyzes the UAE flexible plastic packaging market's structure, highlighting market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and M&A activities. We examine market share distribution amongst key players like Amber Packaging Industries LLC, ENPI Group, Radiant Packaging Industry LLC, Huhtamaki Oyj, Falcon Pack, Gulf Packaging Industries Ltd, Cosmoplast Industrial Company LLC, Integrated Plastics Packaging LLC, Hotpack Industries LLC, and Precision Group (list not exhaustive). The report quantifies market concentration through metrics such as the Herfindahl-Hirschman Index (HHI) and explores the impact of recent mergers and acquisitions (M&A) deals, including deal values where available (xx Million). Innovation drivers, such as the demand for sustainable packaging and advancements in materials science, are thoroughly examined. The analysis also considers the influence of regulatory frameworks, the presence of substitute packaging materials, and evolving end-user demographics on market dynamics.

United Arab Emirates Flexible Plastic Packaging Market Market Dynamics & Trends

This section delves into the key dynamics and trends shaping the UAE flexible plastic packaging market. We analyze market growth drivers, technological disruptions, consumer preferences, and competitive dynamics, providing a comprehensive overview of the market landscape. The report provides specific quantitative data, including the Compound Annual Growth Rate (CAGR) and market penetration rates for various segments. We explore factors such as rising disposable incomes, increasing consumption of packaged goods, and the growing e-commerce sector that drive market growth. Conversely, we discuss challenges such as fluctuating raw material prices and environmental concerns. Furthermore, the analysis identifies emerging technological disruptions, such as advancements in flexible packaging materials and printing technologies, which are reshaping the competitive landscape. The influence of consumer preferences towards sustainable and convenient packaging solutions is also examined in detail.

Dominant Regions & Segments in United Arab Emirates Flexible Plastic Packaging Market

This section identifies the leading regions and segments within the UAE flexible plastic packaging market. Through detailed analysis, we pinpoint the dominant regions based on factors such as consumption patterns, industrial concentration, and economic development. We use bullet points to highlight key regional drivers such as economic policies and infrastructure development. Further, a comprehensive assessment of segment dominance is provided, considering factors like growth potential, market size, and competitive intensity.

- Key Drivers for Dominant Regions:

- Favorable government regulations and incentives.

- Robust infrastructure and logistics networks.

- High concentration of key industries (e.g., food and beverage).

- High disposable incomes and consumer spending.

United Arab Emirates Flexible Plastic Packaging Market Product Innovations

This section summarizes recent product developments, applications, and competitive advantages in the UAE flexible plastic packaging market. We discuss technological trends such as the growing adoption of sustainable materials (e.g., biodegradable plastics) and advanced printing techniques that enhance product appeal. We analyze how these innovations are impacting market share and competitive dynamics. The focus is on the market fit of these innovations and their impact on consumer adoption.

Report Scope & Segmentation Analysis

This report segments the UAE flexible plastic packaging market based on material type (e.g., polyethylene, polypropylene, PET), packaging type (e.g., pouches, bags, films), end-use industry (e.g., food & beverage, pharmaceuticals, personal care), and distribution channel. Each segment is analyzed individually, providing growth projections, market size estimations (in Million), and a competitive landscape overview. For example, the food & beverage segment's growth is projected to be xx% during the forecast period, driven by the increasing demand for packaged food and beverages.

Key Drivers of United Arab Emirates Flexible Plastic Packaging Market Growth

This section details the key growth drivers of the UAE flexible plastic packaging market, including technological advancements (e.g., improved barrier properties, lightweight designs), economic factors (e.g., rising disposable incomes, growing consumer spending), and regulatory policies (e.g., food safety standards). Specific examples are provided to illustrate the impact of these drivers on market expansion.

Challenges in the United Arab Emirates Flexible Plastic Packaging Market Sector

This section identifies significant challenges facing the UAE flexible plastic packaging market. This includes regulatory hurdles (e.g., environmental regulations), supply chain disruptions (e.g., fluctuations in raw material prices), and intense competition from both domestic and international players. The analysis includes a quantifiable assessment of the impact of these challenges on market growth. For instance, fluctuations in oil prices are estimated to impact production costs by xx%.

Emerging Opportunities in United Arab Emirates Flexible Plastic Packaging Market

This section highlights emerging opportunities within the UAE flexible plastic packaging market. This includes new market segments (e.g., e-commerce packaging), technological advancements (e.g., active and intelligent packaging), and evolving consumer preferences (e.g., demand for sustainable packaging solutions). The discussion focuses on the potential for growth and market expansion within these areas.

Leading Players in the United Arab Emirates Flexible Packaging Market Market

- Amber Packaging Industries LLC

- ENPI Group

- Radiant Packaging Industry LLC

- Huhtamaki Oyj

- Falcon Pack

- Gulf Packaging Industries Ltd

- Cosmoplast Industrial Company LLC

- Integrated Plastics Packaging LLC

- Hotpack Industries LLC

- Precision Group

- *List Not Exhaustive

Key Developments in United Arab Emirates Flexible Plastic Packaging Market Industry

- December 2023: The Dubai Municipality launched a program to recycle 3 Million plastic packaging units (60 tons of PET plastic), significantly boosting recycling efforts and influencing market sustainability practices.

- May 2024: Huhtamaki Oyj consolidated its UAE manufacturing sites, optimizing operations and enhancing its regional competitive position. This strategic move signals a shift towards efficient production and increased investment in the UAE market.

Future Outlook for United Arab Emirates Flexible Plastic Packaging Market Market

The UAE flexible plastic packaging market is poised for significant growth driven by sustained economic growth, increasing consumption of packaged goods, and the expanding e-commerce sector. Strategic opportunities exist for companies that can innovate in sustainable packaging materials, offer efficient supply chains, and cater to the evolving demands of consumers. The market's future trajectory is positive, with significant potential for expansion and increased market capitalization in the coming years.

United Arab Emirates Flexible Plastic Packaging Market Segmentation

-

1. Material Type

- 1.1. Polyethene (PE)

- 1.2. Bi-oriented Polypropylene (BOPP)

- 1.3. Cast Polypropylene (CPP)

- 1.4. Polyvinyl Chloride (PVC)

- 1.5. Ethylene Vinyl Alcohol (EVOH)

- 1.6. Other Ma

-

2. Product Type

- 2.1. Pouches

- 2.2. Bags

- 2.3. Films and Wraps

- 2.4. Other Product Types (Blister Packs, Liners, etc)

-

3. End-User Industry

-

3.1. Food

- 3.1.1. Candy & Confectionery

- 3.1.2. Frozen Foods

- 3.1.3. Fresh Produce

- 3.1.4. Dairy Products

- 3.1.5. Dry Foods

- 3.1.6. Meat, Poultry, And Seafood

- 3.1.7. Pet Food

- 3.1.8. Other Fo

- 3.2. Beverage

- 3.3. Medical and Pharmaceutical

- 3.4. Personal Care and Household Care

- 3.5. Other En

-

3.1. Food

United Arab Emirates Flexible Plastic Packaging Market Segmentation By Geography

- 1. United Arab Emirates

United Arab Emirates Flexible Plastic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.48% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Food Industry to Propel Demand for Flexible Plastic Packaging; Rising Investment in Packaging Infrastructure

- 3.3. Market Restrains

- 3.3.1. Growing Food Industry to Propel Demand for Flexible Plastic Packaging; Rising Investment in Packaging Infrastructure

- 3.4. Market Trends

- 3.4.1. Polyethylene (PE) is Estimated to Have a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Arab Emirates Flexible Plastic Packaging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Polyethene (PE)

- 5.1.2. Bi-oriented Polypropylene (BOPP)

- 5.1.3. Cast Polypropylene (CPP)

- 5.1.4. Polyvinyl Chloride (PVC)

- 5.1.5. Ethylene Vinyl Alcohol (EVOH)

- 5.1.6. Other Ma

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Pouches

- 5.2.2. Bags

- 5.2.3. Films and Wraps

- 5.2.4. Other Product Types (Blister Packs, Liners, etc)

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Food

- 5.3.1.1. Candy & Confectionery

- 5.3.1.2. Frozen Foods

- 5.3.1.3. Fresh Produce

- 5.3.1.4. Dairy Products

- 5.3.1.5. Dry Foods

- 5.3.1.6. Meat, Poultry, And Seafood

- 5.3.1.7. Pet Food

- 5.3.1.8. Other Fo

- 5.3.2. Beverage

- 5.3.3. Medical and Pharmaceutical

- 5.3.4. Personal Care and Household Care

- 5.3.5. Other En

- 5.3.1. Food

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Amber Packaging Industries LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ENPI Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Radiant Packaging Industry LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Huhtamaki Oyj

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Falcon Pack

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gulf Packaging Industries Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cosmoplast Industrial Company LLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Integrated Plastics Packaging LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hotpack Industries LLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Precision Group*List Not Exhaustive 7 2 Heat Map Analysi

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Amber Packaging Industries LLC

List of Figures

- Figure 1: United Arab Emirates Flexible Plastic Packaging Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Arab Emirates Flexible Plastic Packaging Market Share (%) by Company 2024

List of Tables

- Table 1: United Arab Emirates Flexible Plastic Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Arab Emirates Flexible Plastic Packaging Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 3: United Arab Emirates Flexible Plastic Packaging Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: United Arab Emirates Flexible Plastic Packaging Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 5: United Arab Emirates Flexible Plastic Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United Arab Emirates Flexible Plastic Packaging Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 7: United Arab Emirates Flexible Plastic Packaging Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 8: United Arab Emirates Flexible Plastic Packaging Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 9: United Arab Emirates Flexible Plastic Packaging Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Arab Emirates Flexible Plastic Packaging Market?

The projected CAGR is approximately 5.48%.

2. Which companies are prominent players in the United Arab Emirates Flexible Plastic Packaging Market?

Key companies in the market include Amber Packaging Industries LLC, ENPI Group, Radiant Packaging Industry LLC, Huhtamaki Oyj, Falcon Pack, Gulf Packaging Industries Ltd, Cosmoplast Industrial Company LLC, Integrated Plastics Packaging LLC, Hotpack Industries LLC, Precision Group*List Not Exhaustive 7 2 Heat Map Analysi.

3. What are the main segments of the United Arab Emirates Flexible Plastic Packaging Market?

The market segments include Material Type, Product Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Food Industry to Propel Demand for Flexible Plastic Packaging; Rising Investment in Packaging Infrastructure.

6. What are the notable trends driving market growth?

Polyethylene (PE) is Estimated to Have a Significant Market Share.

7. Are there any restraints impacting market growth?

Growing Food Industry to Propel Demand for Flexible Plastic Packaging; Rising Investment in Packaging Infrastructure.

8. Can you provide examples of recent developments in the market?

May 2024: Finland-based Huhtamaki Oyj, a key player, announced a strategic move. The company is consolidating its three flexible packaging manufacturing sites in the United Arab Emirates. While the Jebel Ali factory will remain operational, Huhtamaki Oyj is set to expand its footprint in Ras Al Khaimah. This consolidation aims to optimize its manufacturing operations and bolster its regional competitive edge.December 2023: The Dubai Municipality initiated a program to collect and recycle 3 million plastic packaging units, totaling a substantial 60 tons of PET plastic. PET plastic, known for its durability, transparency, and lightweight nature, is a staple in packaging water, soft drinks, juices, and food items. Moreover, it stands out for being non-toxic and highly recyclable, further enhancing its appeal.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Arab Emirates Flexible Plastic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Arab Emirates Flexible Plastic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Arab Emirates Flexible Plastic Packaging Market?

To stay informed about further developments, trends, and reports in the United Arab Emirates Flexible Plastic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence