Key Insights

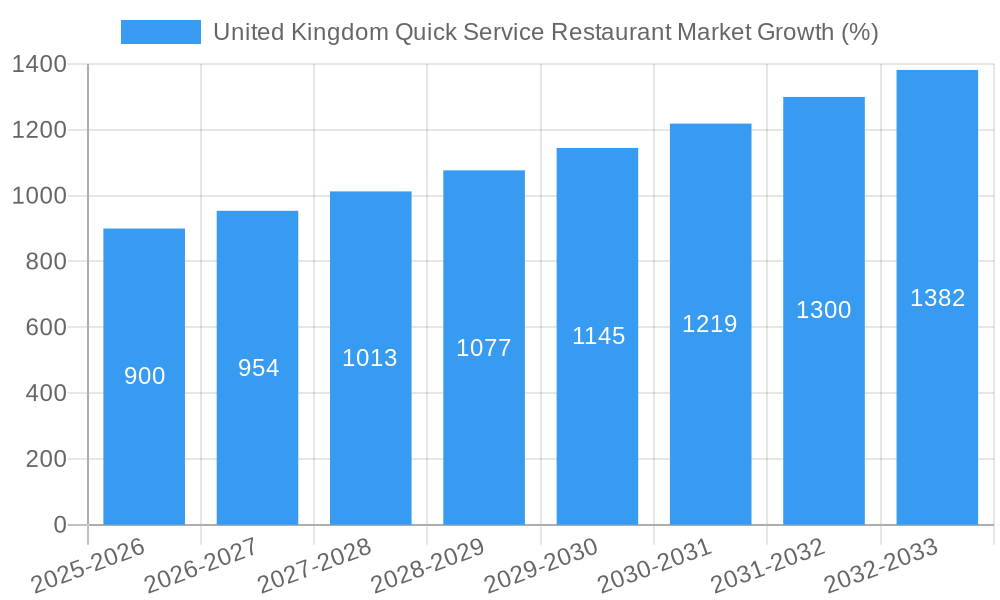

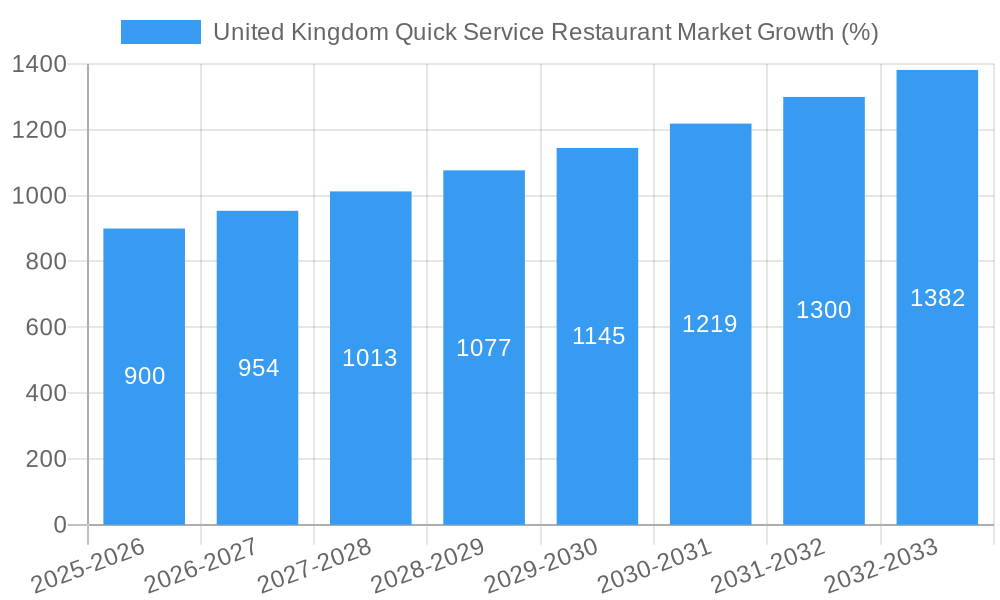

The United Kingdom Quick Service Restaurant (QSR) market is a dynamic and competitive landscape, exhibiting robust growth potential. With a CAGR of 5.67% from 2019-2024 (the historical period), the market is projected to continue its expansion, driven by several key factors. The increasing preference for convenience and affordability among UK consumers fuels the demand for QSR offerings. The diverse culinary landscape, encompassing bakeries, burgers, pizza, and other cuisines, caters to a broad spectrum of tastes and dietary preferences. The significant presence of both chained and independent outlets, distributed across leisure, lodging, retail, and standalone locations, ensures wide accessibility. Growth is further fueled by evolving consumer trends such as the rise of delivery services, health-conscious options within the QSR sector, and the integration of technology for enhanced customer experience (e.g., mobile ordering and payment). However, challenges remain, including rising input costs (ingredients, labor) and increasing competition, particularly from established international chains expanding their presence in the UK. Furthermore, fluctuations in consumer spending due to economic factors can influence market growth.

Within the UK QSR market, specific segments show distinct growth trajectories. The pizza segment, exemplified by the success of Domino's Pizza Group PLC, is likely to maintain strong performance due to its enduring popularity. However, the burger and other QSR cuisines segments are also expected to experience significant growth driven by innovation and the emergence of niche brands. The dominance of chained outlets indicates the influence of established brands, while the presence of independent outlets provides market diversity and potential for localized culinary experiences. The geographic distribution across various locations highlights the broad appeal of QSR, reaching consumers in diverse settings. Analysis suggests the market will continue its growth, though the rate may be influenced by economic factors and the success of new entrants and innovative offerings. Market segmentation analysis reveals opportunities for growth in specific niches, particularly in catering to health-conscious consumers and those seeking unique culinary experiences.

United Kingdom Quick Service Restaurant (QSR) Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the United Kingdom's dynamic Quick Service Restaurant market, offering invaluable insights for industry professionals, investors, and strategists. Covering the period from 2019 to 2033, with a base year of 2025, this report forecasts market trends and identifies key opportunities for growth. The report analyzes market segmentation by cuisine (Bakeries, Burger, Ice Cream, Meat-based Cuisines, Pizza, Other QSR Cuisines), outlet type (Chained Outlets, Independent Outlets), and location (Leisure, Lodging, Retail, Standalone, Travel). Leading players such as Domino's Pizza Group PLC, McDonald's Corporation, and Starbucks Corporation are profiled, providing a competitive landscape analysis.

United Kingdom Quick Service Restaurant Market Market Structure & Innovation Trends

The UK QSR market exhibits a moderately concentrated structure, with established players like McDonald's and Domino's holding significant market share. However, the market also accommodates numerous smaller independent outlets and emerging brands. Innovation is driven by evolving consumer preferences towards healthier options, personalized experiences, and technological advancements like online ordering and delivery services. Regulatory frameworks, including food safety standards and minimum wage legislation, influence operational costs and market dynamics. Product substitutes, such as home-cooked meals and meal delivery services, pose competitive challenges. The end-user demographic is broad, encompassing diverse age groups and income levels. Mergers and acquisitions (M&A) activities are relatively frequent, reflecting market consolidation and expansion strategies. For example, the recent acquisition of Subway illustrates the significant investment appetite within the sector. Estimated M&A deal value in 2024 reached approximately £xx Million, with a predicted increase to £xx Million by 2033.

- Market Concentration: Moderately Concentrated

- Innovation Drivers: Healthier options, personalized experiences, technology (online ordering, delivery)

- Regulatory Framework: Food safety standards, minimum wage

- M&A Activity: Significant, driven by consolidation and expansion; deal values increasing.

United Kingdom Quick Service Restaurant Market Market Dynamics & Trends

The UK QSR market is characterized by strong growth drivers including rising disposable incomes, changing lifestyle patterns (increased demand for convenience), and a growing preference for out-of-home dining. Technological disruptions, such as the proliferation of mobile ordering apps and delivery platforms, are reshaping the customer experience and creating new avenues for growth. Consumer preferences are shifting towards healthier and more sustainable options, prompting QSR chains to adapt their menus and sourcing practices. Competitive dynamics are intense, with established players facing pressure from both smaller independent outlets and international brands. The market is expected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), with a market penetration rate reaching xx% by 2033.

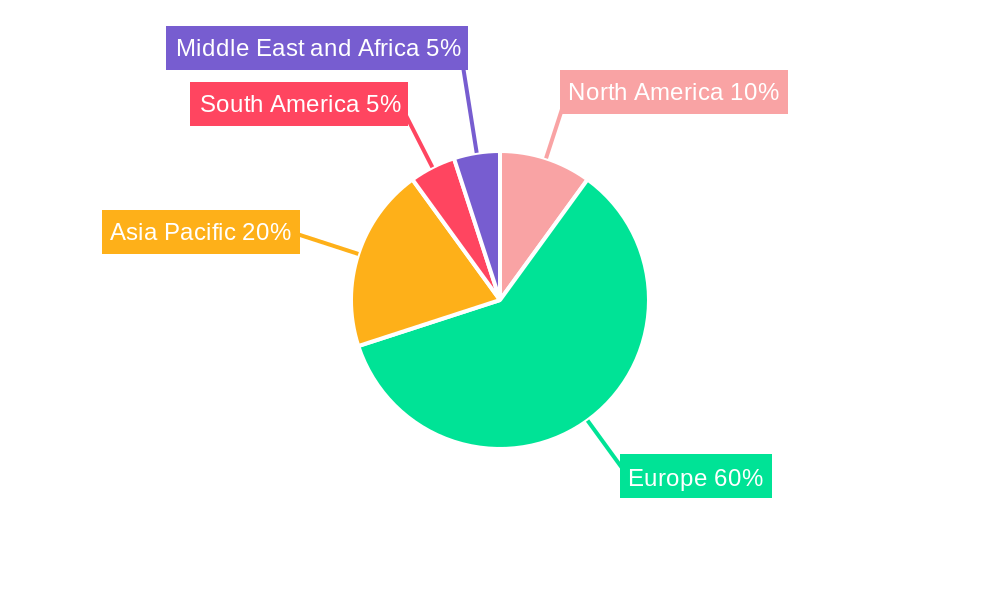

Dominant Regions & Segments in United Kingdom Quick Service Restaurant Market

The dominance within the UK QSR market varies significantly across segments and regions. London and other major metropolitan areas generally exhibit higher market concentration and faster growth compared to more rural areas.

- Cuisine: Pizza and Burger segments consistently rank among the largest, but the "Other QSR Cuisines" category, encompassing diverse offerings, is showing rapid growth.

- Outlet: Chained outlets dominate the market share, benefiting from economies of scale and brand recognition. Independent outlets, while smaller in aggregate, maintain a presence and offer a unique niche appeal.

- Location: Retail locations are highly prevalent due to high foot traffic; standalone outlets are also significant, particularly for larger chains aiming for brand visibility.

The continued expansion of retail infrastructure contributes to the high market share of retail locations. Economic policies that support business growth and consumer spending power further enhance the market dynamism.

United Kingdom Quick Service Restaurant Market Product Innovations

Recent innovations in the UK QSR market include plant-based menu options, personalized meal customization features through mobile apps, and more sustainable packaging solutions in response to consumer demands for ethical and environmentally conscious choices. These innovations enhance competitive advantages by improving customer loyalty and attracting new demographics. Technology plays a significant role, enabling efficient order management, personalized marketing, and improved delivery logistics.

Report Scope & Segmentation Analysis

This report comprehensively segments the UK QSR market across cuisine, outlet type, and location, providing detailed analysis for each category. Growth projections, market sizes (in Millions), and competitive dynamics are analyzed for each segment, offering a detailed understanding of market opportunities and challenges within each sub-sector.

Cuisine: The report analyzes growth trajectories and market size for Bakeries, Burger, Ice Cream, Meat-based Cuisines, Pizza, and Other QSR Cuisines. Outlet: The report provides insights into the competitive dynamics and market sizes for Chained Outlets and Independent Outlets. Location: The report analyses market segmentation for locations including Leisure, Lodging, Retail, Standalone, and Travel.

Key Drivers of United Kingdom Quick Service Restaurant Market Growth

Several factors drive the growth of the UK QSR market. The increasing urban population and busy lifestyles fuel demand for convenience. Rising disposable incomes enable more frequent out-of-home dining. Technological advancements, such as online ordering and delivery services, enhance accessibility and convenience, accelerating market growth. Government initiatives and policies supportive of the food service sector also play a role.

Challenges in the United Kingdom Quick Service Restaurant Market Sector

The UK QSR market faces challenges such as intense competition, rising operational costs (including labor and ingredients), fluctuating supply chain issues impacting ingredient availability and pricing, and increasingly stringent regulatory requirements affecting food safety and environmental standards. These factors can negatively impact profit margins and market expansion.

Emerging Opportunities in United Kingdom Quick Service Restaurant Market

Emerging opportunities exist in areas such as personalized meal customization, expansion into underserved markets (e.g., smaller towns and cities), focus on healthy and sustainable food options (responding to consumer preferences), and leveraging technological advancements to improve operational efficiency and customer service.

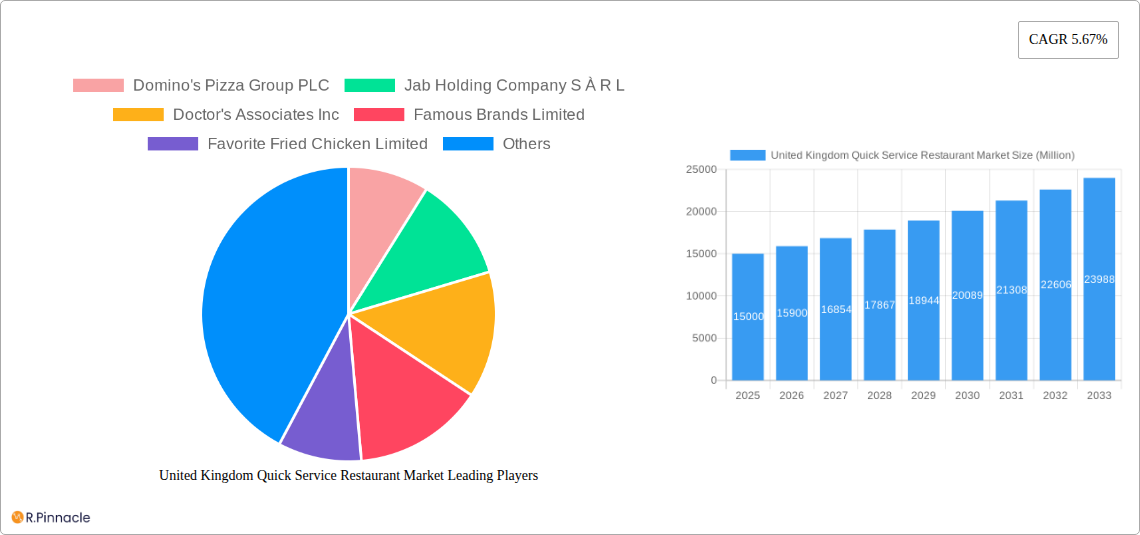

Leading Players in the United Kingdom Quick Service Restaurant Market Market

- Domino's Pizza Group PLC

- Jab Holding Company S À R L

- Doctor's Associates Inc

- Famous Brands Limited

- Favorite Fried Chicken Limited

- Five Guys Enterprises LLC

- Samworth Brothers Limited

- Deep Blue Restaurants Ltd

- Co-operative Group Limited

- Starbucks Corporation

- Costa Coffee

- Greggs Plc

- McDonald's Corporation

- Ben & Jerry's Homemade Holdings Inc

Key Developments in United Kingdom Quick Service Restaurant Market Industry

- August 2023: Subway acquired by Roark Capital for USD 8.95 billion, subject to performance milestones. This significantly impacts market consolidation.

- August 2023: Starbucks plans to invest USD 32.78 million in opening 100 new UK outlets, indicating continued market expansion and confidence.

- January 2023: Five Guys plans further UK expansion, opening new restaurants after a successful 2022. This signals growth in the burger segment.

Future Outlook for United Kingdom Quick Service Restaurant Market Market

The UK QSR market is poised for continued growth, driven by ongoing consumer demand for convenience, technological advancements enhancing operational efficiency and customer experience, and the emergence of new cuisines and healthier options. Strategic opportunities exist for players who can effectively adapt to evolving consumer preferences and leverage technological innovation to optimize operations and enhance customer engagement. The market is expected to maintain a robust growth trajectory throughout the forecast period.

United Kingdom Quick Service Restaurant Market Segmentation

-

1. Cuisine

- 1.1. Bakeries

- 1.2. Burger

- 1.3. Ice Cream

- 1.4. Meat-based Cuisines

- 1.5. Pizza

- 1.6. Other QSR Cuisines

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

United Kingdom Quick Service Restaurant Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Quick Service Restaurant Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.67% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Trend of Ingestible Beauty Products; Growing demand for Nutrient-Enriched Cosmetic Products

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Beauty Supplements Products

- 3.4. Market Trends

- 3.4.1. Consumers inclination towards fast food consumption led to an increasing number of fast food outlets in the country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Quick Service Restaurant Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 5.1.1. Bakeries

- 5.1.2. Burger

- 5.1.3. Ice Cream

- 5.1.4. Meat-based Cuisines

- 5.1.5. Pizza

- 5.1.6. Other QSR Cuisines

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 6. North America United Kingdom Quick Service Restaurant Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1 United States

- 6.1.2 Canada

- 6.1.3 Mexico

- 6.1.4 Rest of North America

- 7. Europe United Kingdom Quick Service Restaurant Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1 Spain

- 7.1.2 United Kingdom

- 7.1.3 Germany

- 7.1.4 France

- 7.1.5 Italy

- 7.1.6 Russia

- 7.1.7 Rest of Europe

- 8. Asia Pacific United Kingdom Quick Service Restaurant Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1 China

- 8.1.2 Japan

- 8.1.3 India

- 8.1.4 Australia

- 8.1.5 Rest of Asia Pacific

- 9. South America United Kingdom Quick Service Restaurant Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1 Brazil

- 9.1.2 Argentina

- 9.1.3 Rest of South America

- 10. Middle East and Africa United Kingdom Quick Service Restaurant Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 South Africa

- 10.1.2 Saudi Arabia

- 10.1.3 Rest of Middle East and Africa

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Domino's Pizza Group PLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Jab Holding Company S À R L

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Doctor's Associates Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Famous Brands Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Favorite Fried Chicken Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Five Guys Enterprises LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Samworth Brothers Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Deep Blue Restaurants Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Co-operative Group Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Starbucks Corporatio

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Costa Coffee

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Greggs Plc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 McDonald's Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Ben & Jerry's Homemade Holdings Inc

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Domino's Pizza Group PLC

List of Figures

- Figure 1: United Kingdom Quick Service Restaurant Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Kingdom Quick Service Restaurant Market Share (%) by Company 2024

List of Tables

- Table 1: United Kingdom Quick Service Restaurant Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Kingdom Quick Service Restaurant Market Revenue Million Forecast, by Cuisine 2019 & 2032

- Table 3: United Kingdom Quick Service Restaurant Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 4: United Kingdom Quick Service Restaurant Market Revenue Million Forecast, by Location 2019 & 2032

- Table 5: United Kingdom Quick Service Restaurant Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United Kingdom Quick Service Restaurant Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Quick Service Restaurant Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Spain United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United Kingdom United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Germany United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: France United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Italy United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Russia United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Europe United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: United Kingdom Quick Service Restaurant Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: China United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Japan United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: India United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Australia United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Asia Pacific United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: United Kingdom Quick Service Restaurant Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Brazil United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Argentina United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of South America United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: United Kingdom Quick Service Restaurant Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: South Africa United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Saudi Arabia United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Middle East and Africa United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: United Kingdom Quick Service Restaurant Market Revenue Million Forecast, by Cuisine 2019 & 2032

- Table 34: United Kingdom Quick Service Restaurant Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 35: United Kingdom Quick Service Restaurant Market Revenue Million Forecast, by Location 2019 & 2032

- Table 36: United Kingdom Quick Service Restaurant Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Quick Service Restaurant Market?

The projected CAGR is approximately 5.67%.

2. Which companies are prominent players in the United Kingdom Quick Service Restaurant Market?

Key companies in the market include Domino's Pizza Group PLC, Jab Holding Company S À R L, Doctor's Associates Inc, Famous Brands Limited, Favorite Fried Chicken Limited, Five Guys Enterprises LLC, Samworth Brothers Limited, Deep Blue Restaurants Ltd, Co-operative Group Limited, Starbucks Corporatio, Costa Coffee, Greggs Plc, McDonald's Corporation, Ben & Jerry's Homemade Holdings Inc.

3. What are the main segments of the United Kingdom Quick Service Restaurant Market?

The market segments include Cuisine, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Trend of Ingestible Beauty Products; Growing demand for Nutrient-Enriched Cosmetic Products.

6. What are the notable trends driving market growth?

Consumers inclination towards fast food consumption led to an increasing number of fast food outlets in the country.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Beauty Supplements Products.

8. Can you provide examples of recent developments in the market?

August 2023: Subway was acquired by private equity firm Roark Capital for USD 8.95 billion. To fully receive the amount, Subway needs to achieve certain cash flow milestones within a period of two or more years after the deal is completed.August 2023: Coffee shop chain Starbucks announced plans to invest USD 32.78 million toward opening 100 new outlets across the United Kingdom in 2023, as it expects its growth momentum to continue.January 2023: Five Guys Enterprises, LLC set to open restaurants in Queensway and Bridgend in 2023 after 20 new sites were opened in 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Quick Service Restaurant Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Quick Service Restaurant Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Quick Service Restaurant Market?

To stay informed about further developments, trends, and reports in the United Kingdom Quick Service Restaurant Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence