Key Insights

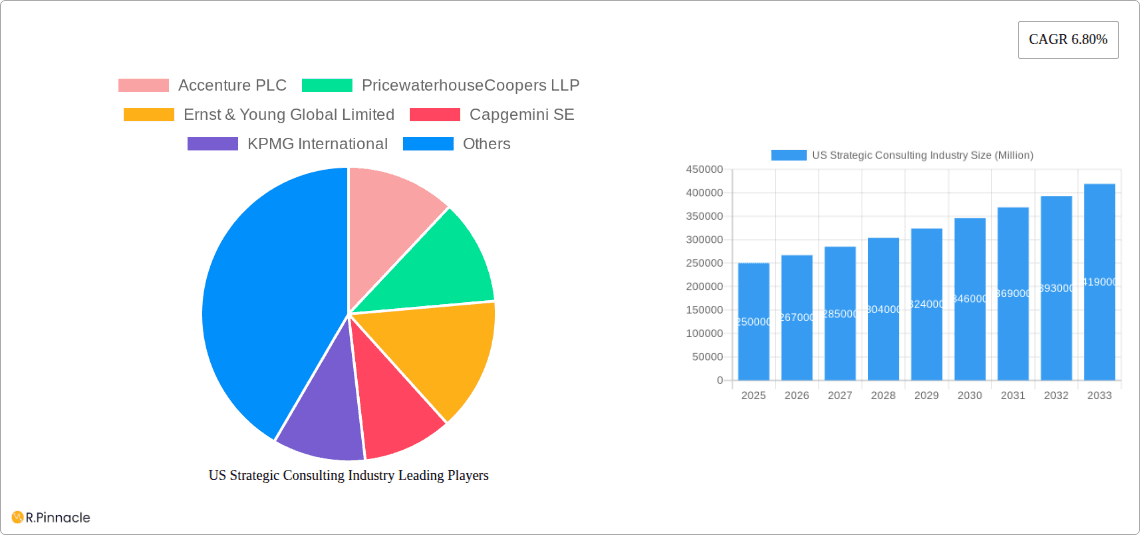

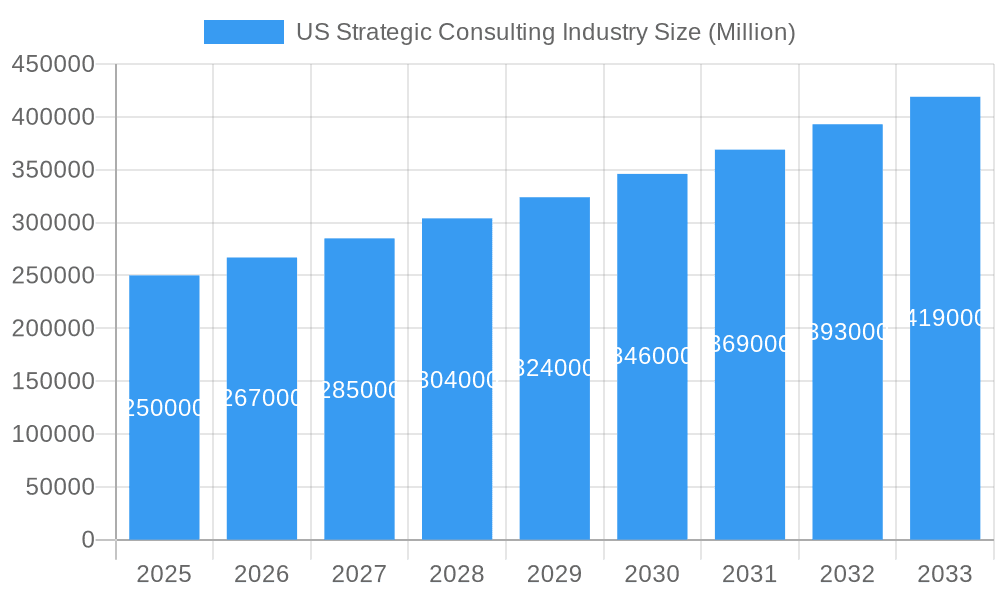

The US strategic consulting industry is a dynamic and lucrative market, experiencing robust growth fueled by increasing business complexities and the need for data-driven decision-making. With a Compound Annual Growth Rate (CAGR) of 6.80% from 2019 to 2033, the market demonstrates significant potential. The industry's expansion is driven by several key factors. Firstly, the rise of digital transformation and the need for companies to adapt to evolving technologies are creating high demand for strategic consulting services. Secondly, the increasing pressure on businesses to enhance operational efficiency and improve profitability is driving them towards expert guidance. Finally, geopolitical uncertainty and economic volatility are compelling organizations to seek strategic insights to navigate these challenging environments. Major players like Accenture, PwC, EY, Capgemini, KPMG, BCG, AT Kearney, McKinsey, Bain, and Roland Berger dominate the landscape, competing based on their specialized expertise, global reach, and established client networks.

US Strategic Consulting Industry Market Size (In Billion)

The industry is segmented by service type (e.g., operations, financial, digital transformation), industry vertical (e.g., healthcare, finance, technology), and client size (e.g., large enterprises, SMEs). While precise market segmentation data is unavailable, we can infer that the segments with the highest growth are likely those related to digital transformation, sustainability consulting, and data analytics. The competitive landscape is highly concentrated, with the top ten firms accounting for a substantial portion of the market share. However, niche players and specialized boutiques are also emerging, focusing on specific industry verticals or consulting methodologies. The market is expected to reach a significant size in the coming years and continues to evolve, requiring continuous innovation and adaptation by existing and new players to remain competitive. Restraints include economic downturns and the potential for increased regulatory scrutiny.

US Strategic Consulting Industry Company Market Share

US Strategic Consulting Industry: Market Analysis & Forecast 2019-2033

This comprehensive report provides an in-depth analysis of the US Strategic Consulting industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on the base year 2025 and forecast period 2025-2033, this report unveils market dynamics, competitive landscapes, and future growth potential. The report analyzes key players including Accenture PLC, PwC, EY, Capgemini, KPMG, BCG, A.T. Kearney, McKinsey & Company, Bain & Company, and Roland Berger.

US Strategic Consulting Industry Market Structure & Innovation Trends

The US Strategic Consulting industry is a dynamic and evolving landscape, characterized by a moderate degree of concentration. In 2024, the top 10 firms are estimated to command approximately 65-70% of the market share, a figure that can fluctuate due to ongoing mergers, acquisitions, and the distinct performance of individual consultancies. The primary engines driving innovation within the sector are the rapid advancements in Artificial Intelligence (AI), sophisticated data analytics, and comprehensive digital transformation strategies. These technological leaps are not only reshaping existing service offerings but are also giving rise to highly specialized consulting domains. Crucially, the industry operates within a complex web of regulatory frameworks, with a significant impact from data privacy legislation (such as CCPA and evolving interpretations of GDPR) and stringent cybersecurity mandates. The emergence of niche technology platforms and specialized advisory firms presents a growing threat of substitution for traditional, broader strategic consulting services. Furthermore, the demographic profile of end-users is undergoing a significant transformation, marked by a heightened and persistent demand for expertise in digital transformation, sustainable business practices, and ESG (Environmental, Social, and Governance) strategies. M&A activity remains a pivotal strategy for growth and capability enhancement. For example, McKinsey & Company's acquisition of Caserta in June 2022, valued at an estimated $100-150 Million, exemplifies a strategic move to bolster digital transformation and analytics capabilities. Over the past five years, average deal values within the sector have ranged from approximately $75 Million to $125 Million.

- Market Concentration: Top 10 firms are projected to control approximately 65-70% of the market in 2024.

- Key Innovation Drivers: Artificial Intelligence (AI), Advanced Data Analytics, Digital Transformation, and ESG Strategy integration.

- Significant Regulatory Frameworks: Evolving data privacy laws (e.g., CCPA, and international equivalents) and stringent cybersecurity regulations.

- M&A Activity: Average deal value between 2019-2024 has been approximately $75 - $125 Million.

US Strategic Consulting Industry Market Dynamics & Trends

The US Strategic Consulting market exhibits robust growth, driven by increasing demand for digital transformation, business process optimization, and strategic guidance across various sectors. Technological disruptions, including the rise of AI and automation, are reshaping the industry, creating both opportunities and challenges. Consumer preferences are shifting towards more agile and data-driven consulting services, necessitating firms to adapt their offerings and methodologies. Competitive dynamics remain intense, with firms vying for market share through strategic partnerships, acquisitions, and service innovation. The CAGR from 2025 to 2033 is projected at xx%, with a market penetration of xx% by 2033 across key sectors.

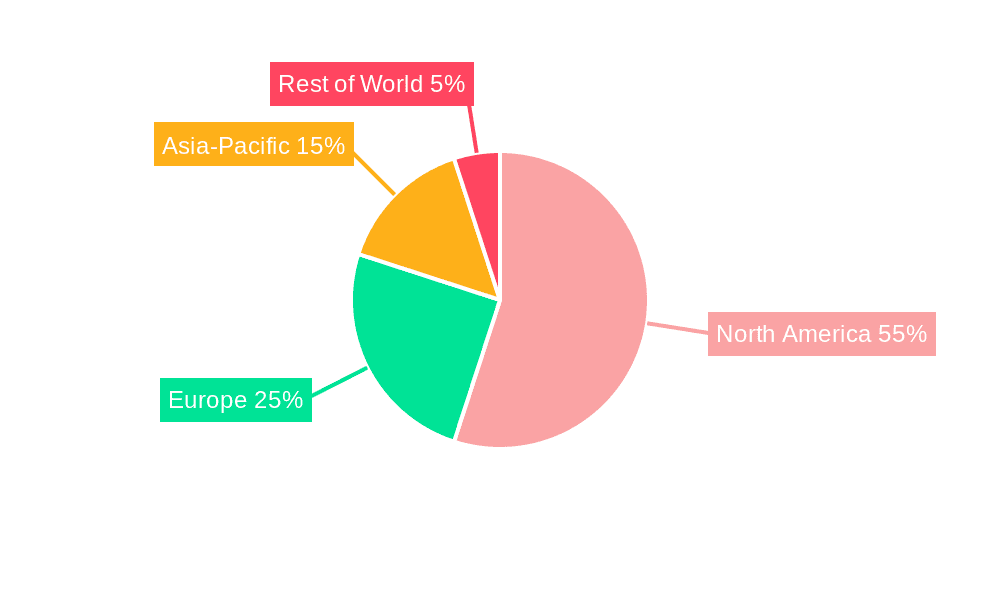

Dominant Regions & Segments in US Strategic Consulting Industry

The Northeastern United States stands as the preeminent geographic hub for the US Strategic Consulting industry. This dominance is primarily concentrated in key financial and technology epicenters such as New York City and Boston. This strategic advantage is underpinned by a confluence of critical factors:

- Concentration of Fortune 500 Companies: These large enterprises represent a substantial and consistent client base, driving significant demand for strategic advisory services.

- Vibrant Venture Capital and Private Equity Ecosystem: The active presence of venture capital and private equity firms fosters an environment of innovation, growth, and expansion, creating opportunities for strategic partnerships and client engagements.

- Exceptional Talent Pool: The region consistently attracts and retains highly skilled professionals with expertise in management, technology, and strategy, forming the backbone of leading consulting firms.

- Advanced Infrastructure: A sophisticated digital infrastructure, including high-speed connectivity and robust technological resources, effectively supports the demands of a knowledge-intensive industry.

Further analysis of market segmentation reveals that the Financial Services and Technology sectors are leading the charge in terms of consulting engagement. This leadership is largely attributed to the relentless pace of digital transformation initiatives and the imperative for these industries to strategically navigate increasingly complex and rapidly evolving market landscapes. The substantial investments these sectors make in forward-looking strategic planning and enhancing operational efficiencies are key contributors to this trend.

US Strategic Consulting Industry Product Innovations

Recent product innovations focus on integrating AI-driven analytics into consulting services, offering clients data-driven insights and predictive capabilities. This includes advanced data visualization tools, predictive modeling, and AI-powered decision support systems. These innovations enable consultants to provide more precise and actionable recommendations, strengthening their competitive advantage and better addressing clients' evolving needs.

Report Scope & Segmentation Analysis

This comprehensive report meticulously segments the US Strategic Consulting industry to provide granular insights. The segmentation is organized by:

- Service Type: Encompassing core areas such as general strategy, operational improvement, technology integration, and specialized digital transformation services.

- Industry Vertical: Covering key sectors including financial services, technology, healthcare, manufacturing, retail, and energy.

- Company Size: Differentiating between large enterprises, small and medium-sized enterprises (SMEs), and emerging businesses.

Each identified segment exhibits distinct growth trajectories, varying market sizes, and unique competitive dynamics. Notably, the digital transformation segment is currently demonstrating the most robust growth, propelled by the widespread adoption of cloud computing, AI, and other advanced digital technologies across a multitude of industries. This segment is expected to continue its upward trend as businesses across all verticals prioritize modernization and digital capabilities.

Key Drivers of US Strategic Consulting Industry Growth

The sustained growth of the US Strategic Consulting industry is propelled by a powerful combination of strategic imperatives and evolving business landscapes. The increasing complexity inherent in modern business environments necessitates expert guidance to formulate and execute effective strategies. Furthermore, continuous technological advancements, particularly in areas like AI-driven analytics and automation, are creating a burgeoning demand for specialized consulting expertise to harness these capabilities. Government initiatives and evolving regulatory landscapes, including those promoting digital infrastructure development and sustainability goals, are also opening up significant new avenues and opportunities for consulting firms to provide strategic support and implement compliant solutions.

Challenges in the US Strategic Consulting Industry Sector

Despite its robust growth, the US Strategic Consulting industry grapples with several persistent challenges. The market is characterized by intense competition from both established players and agile boutique firms, often leading to pressure to optimize pricing and demonstrate tangible ROI. The imperative to adapt to the rapid pace of technological change requires continuous investment in training and development to maintain cutting-edge expertise. Attracting and retaining top-tier talent, given the high demand for skilled consultants, remains a critical hurdle. Moreover, external factors such as potential supply chain disruptions and broader economic uncertainties can directly impact client budgets and their willingness to invest in consulting services, thereby influencing project pipelines and profitability for some firms.

Emerging Opportunities in US Strategic Consulting Industry

Emerging opportunities include expanding into new markets, focusing on sustainability and ESG consulting, and leveraging advanced technologies like AI and blockchain. Growth is also expected in specialized areas like cybersecurity and data analytics consulting, driven by increasing threats and the rising importance of data-driven decision-making.

Leading Players in the US Strategic Consulting Industry Market

Key Developments in US Strategic Consulting Industry

- June 2022: McKinsey & Company acquires Caserta, enhancing its data analytics capabilities.

Future Outlook for US Strategic Consulting Industry Market

The US Strategic Consulting industry is poised for continued growth, driven by the ongoing digital transformation across various sectors, increasing demand for data-driven insights, and the growing need for strategic guidance in navigating complex business environments. Strategic partnerships, investments in new technologies, and the expansion into emerging markets will shape the future landscape. The market is projected to reach xx Million by 2033.

US Strategic Consulting Industry Segmentation

-

1. END-USER INDUSTRY

- 1.1. Financial Services

- 1.2. Life Sciences and Healthcare

- 1.3. Retail

- 1.4. Government

- 1.5. Energy

- 1.6. Other End-user Industries

US Strategic Consulting Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Strategic Consulting Industry Regional Market Share

Geographic Coverage of US Strategic Consulting Industry

US Strategic Consulting Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Investment in Emerging Technologies is Surging Companies Growth Strategy; Adoption of BI and Advanced Data Management Strategies across Multiple End-user Domain

- 3.3. Market Restrains

- 3.3.1. Growing Investment in Emerging Technologies is Surging Companies Growth Strategy; Adoption of BI and Advanced Data Management Strategies across Multiple End-user Domain

- 3.4. Market Trends

- 3.4.1. United States Strategic Consulting Services Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Strategic Consulting Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by END-USER INDUSTRY

- 5.1.1. Financial Services

- 5.1.2. Life Sciences and Healthcare

- 5.1.3. Retail

- 5.1.4. Government

- 5.1.5. Energy

- 5.1.6. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by END-USER INDUSTRY

- 6. North America US Strategic Consulting Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by END-USER INDUSTRY

- 6.1.1. Financial Services

- 6.1.2. Life Sciences and Healthcare

- 6.1.3. Retail

- 6.1.4. Government

- 6.1.5. Energy

- 6.1.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by END-USER INDUSTRY

- 7. South America US Strategic Consulting Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by END-USER INDUSTRY

- 7.1.1. Financial Services

- 7.1.2. Life Sciences and Healthcare

- 7.1.3. Retail

- 7.1.4. Government

- 7.1.5. Energy

- 7.1.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by END-USER INDUSTRY

- 8. Europe US Strategic Consulting Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by END-USER INDUSTRY

- 8.1.1. Financial Services

- 8.1.2. Life Sciences and Healthcare

- 8.1.3. Retail

- 8.1.4. Government

- 8.1.5. Energy

- 8.1.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by END-USER INDUSTRY

- 9. Middle East & Africa US Strategic Consulting Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by END-USER INDUSTRY

- 9.1.1. Financial Services

- 9.1.2. Life Sciences and Healthcare

- 9.1.3. Retail

- 9.1.4. Government

- 9.1.5. Energy

- 9.1.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by END-USER INDUSTRY

- 10. Asia Pacific US Strategic Consulting Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by END-USER INDUSTRY

- 10.1.1. Financial Services

- 10.1.2. Life Sciences and Healthcare

- 10.1.3. Retail

- 10.1.4. Government

- 10.1.5. Energy

- 10.1.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by END-USER INDUSTRY

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Accenture PLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 PricewaterhouseCoopers LLP

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ernst & Young Global Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Capgemini SE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 KPMG International

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Boston Consulting Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 A T Kearney Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 McKinsey & Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bain & Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Roland Berge

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Accenture PLC

List of Figures

- Figure 1: Global US Strategic Consulting Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America US Strategic Consulting Industry Revenue (undefined), by END-USER INDUSTRY 2025 & 2033

- Figure 3: North America US Strategic Consulting Industry Revenue Share (%), by END-USER INDUSTRY 2025 & 2033

- Figure 4: North America US Strategic Consulting Industry Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America US Strategic Consulting Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America US Strategic Consulting Industry Revenue (undefined), by END-USER INDUSTRY 2025 & 2033

- Figure 7: South America US Strategic Consulting Industry Revenue Share (%), by END-USER INDUSTRY 2025 & 2033

- Figure 8: South America US Strategic Consulting Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: South America US Strategic Consulting Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe US Strategic Consulting Industry Revenue (undefined), by END-USER INDUSTRY 2025 & 2033

- Figure 11: Europe US Strategic Consulting Industry Revenue Share (%), by END-USER INDUSTRY 2025 & 2033

- Figure 12: Europe US Strategic Consulting Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe US Strategic Consulting Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa US Strategic Consulting Industry Revenue (undefined), by END-USER INDUSTRY 2025 & 2033

- Figure 15: Middle East & Africa US Strategic Consulting Industry Revenue Share (%), by END-USER INDUSTRY 2025 & 2033

- Figure 16: Middle East & Africa US Strategic Consulting Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: Middle East & Africa US Strategic Consulting Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific US Strategic Consulting Industry Revenue (undefined), by END-USER INDUSTRY 2025 & 2033

- Figure 19: Asia Pacific US Strategic Consulting Industry Revenue Share (%), by END-USER INDUSTRY 2025 & 2033

- Figure 20: Asia Pacific US Strategic Consulting Industry Revenue (undefined), by Country 2025 & 2033

- Figure 21: Asia Pacific US Strategic Consulting Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Strategic Consulting Industry Revenue undefined Forecast, by END-USER INDUSTRY 2020 & 2033

- Table 2: Global US Strategic Consulting Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global US Strategic Consulting Industry Revenue undefined Forecast, by END-USER INDUSTRY 2020 & 2033

- Table 4: Global US Strategic Consulting Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: United States US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Canada US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Mexico US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Global US Strategic Consulting Industry Revenue undefined Forecast, by END-USER INDUSTRY 2020 & 2033

- Table 9: Global US Strategic Consulting Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Brazil US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Argentina US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Global US Strategic Consulting Industry Revenue undefined Forecast, by END-USER INDUSTRY 2020 & 2033

- Table 14: Global US Strategic Consulting Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: United Kingdom US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Germany US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: France US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Italy US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Spain US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Russia US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Benelux US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Nordics US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Global US Strategic Consulting Industry Revenue undefined Forecast, by END-USER INDUSTRY 2020 & 2033

- Table 25: Global US Strategic Consulting Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: Turkey US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Israel US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: GCC US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: North Africa US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Africa US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global US Strategic Consulting Industry Revenue undefined Forecast, by END-USER INDUSTRY 2020 & 2033

- Table 33: Global US Strategic Consulting Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 34: China US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: India US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Japan US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: South Korea US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: ASEAN US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Oceania US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Strategic Consulting Industry?

The projected CAGR is approximately 8.78%.

2. Which companies are prominent players in the US Strategic Consulting Industry?

Key companies in the market include Accenture PLC, PricewaterhouseCoopers LLP, Ernst & Young Global Limited, Capgemini SE, KPMG International, Boston Consulting Group, A T Kearney Inc, McKinsey & Company, Bain & Company, Roland Berge.

3. What are the main segments of the US Strategic Consulting Industry?

The market segments include END-USER INDUSTRY.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Investment in Emerging Technologies is Surging Companies Growth Strategy; Adoption of BI and Advanced Data Management Strategies across Multiple End-user Domain.

6. What are the notable trends driving market growth?

United States Strategic Consulting Services Market.

7. Are there any restraints impacting market growth?

Growing Investment in Emerging Technologies is Surging Companies Growth Strategy; Adoption of BI and Advanced Data Management Strategies across Multiple End-user Domain.

8. Can you provide examples of recent developments in the market?

June 2022 - McKinsey & Company has acquired Caserta, a New York-based data analytics consulting and implementation firm. McKinsey strengthens data capabilities with the Caserta acquisition; Caserta, the firm, works with Fortune 100 companies to roadmap, design, and implement cutting-edge data architectures.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Strategic Consulting Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Strategic Consulting Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Strategic Consulting Industry?

To stay informed about further developments, trends, and reports in the US Strategic Consulting Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence