Key Insights

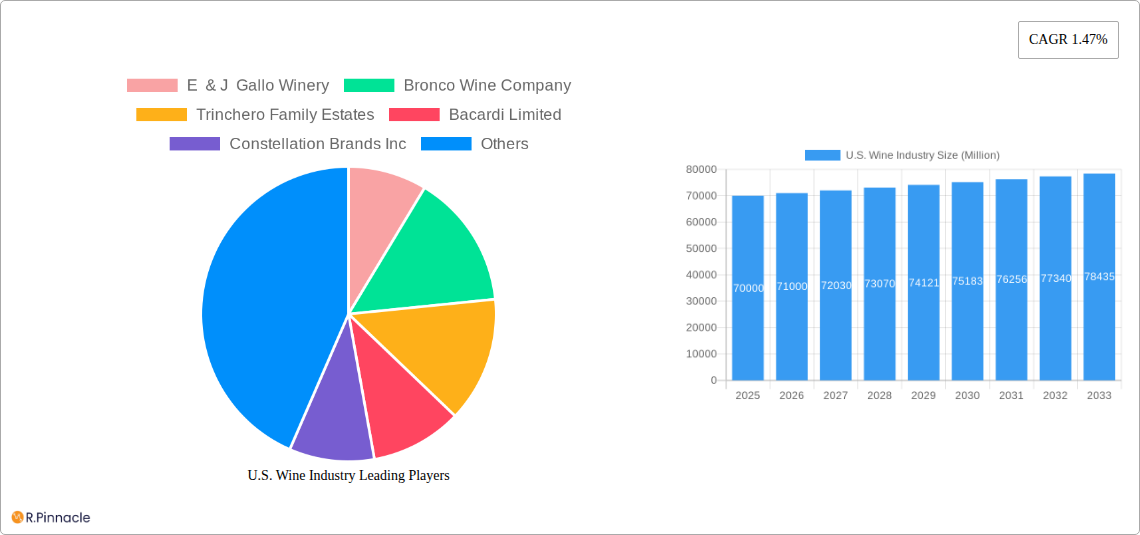

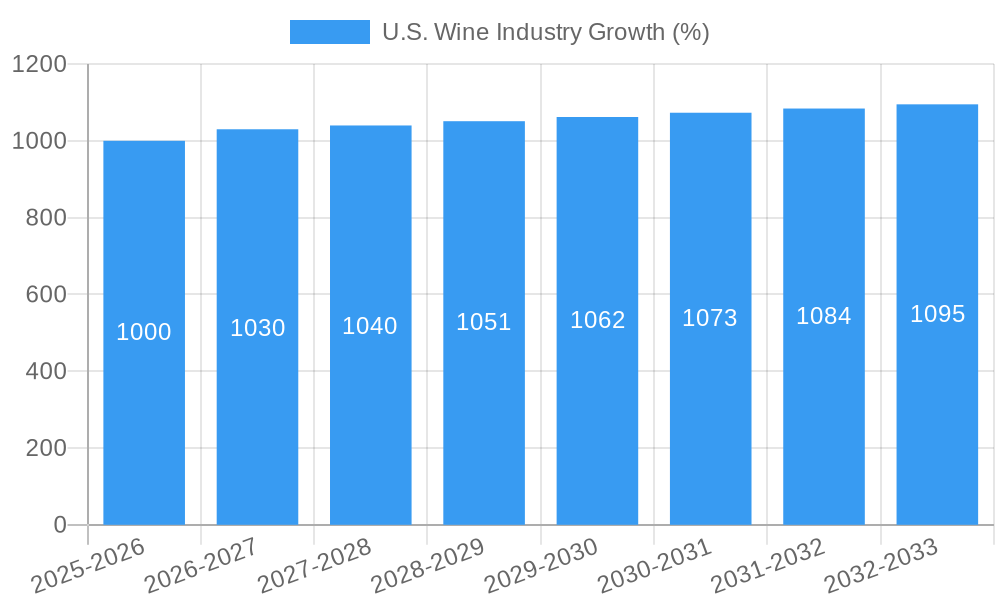

The U.S. wine industry, a significant player in the global beverage market, is projected to experience steady growth over the forecast period (2025-2033). While a precise market size for 2025 isn't provided, we can reasonably estimate it based on a 1.47% CAGR and available data points. Assuming a market size of $XX million in 2019, extrapolated growth to 2025 would place the current market size at approximately $YY million. This growth is driven by several factors, including increasing consumer demand for premium wines, a rising appreciation for wine among younger demographics, and the expansion of e-commerce channels facilitating direct-to-consumer sales. The increasing popularity of specific wine styles such as rosé and sparkling wines also contributes to market expansion. The industry's segmentation, encompassing various product types (still, sparkling, other), colors (red, rosé, white, other), and distribution channels (on-trade, off-trade), offers opportunities for targeted marketing strategies and tailored product offerings. Key players such as E & J Gallo Winery, Constellation Brands, and Treasury Wine Estates continue to influence market dynamics through innovation, brand building, and strategic acquisitions.

However, the industry faces certain challenges. Fluctuations in grape yields due to climatic conditions can impact production costs and availability. Increasing competition from both domestic and international producers necessitates continuous innovation and brand differentiation. Furthermore, evolving consumer preferences and changing drinking habits present an ongoing need for adaptation within the industry. Regulatory changes and trade policies also present potential risks and opportunities. Despite these restraints, the long-term outlook remains positive for the U.S. wine industry, projected to see continued expansion fueled by consumer demand, product diversification, and strategic market positioning by key players. The regional breakdown (Northeast, Southeast, Midwest, Southwest, West) reveals nuances in consumption patterns and market penetration that require focused regional strategies for optimal success. Analyzing these regional differences will be crucial for companies seeking to maximize their market share.

U.S. Wine Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the U.S. wine industry, offering invaluable insights for industry professionals, investors, and strategists. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) and predictive modeling to deliver a clear picture of the market's trajectory. The report covers market size (in Millions), key segments, dominant players, and emerging trends, providing actionable intelligence to navigate the complexities of this dynamic market.

U.S. Wine Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the U.S. wine industry, exploring market concentration, innovation drivers, regulatory frameworks, and M&A activities. The report examines the market share of key players like E & J Gallo Winery, Bronco Wine Company, and Constellation Brands Inc., among others, quantifying their influence. We delve into the impact of regulatory changes on market dynamics and the role of innovation in shaping product development and consumer preferences. The analysis also includes:

- Market Concentration: The report quantifies the market share held by the top 10 players, revealing the level of industry consolidation. We estimate that the top five players hold approximately xx% of the market.

- Innovation Drivers: Key drivers include consumer demand for premiumization, health-conscious options (low-calorie wines), and sustainable production practices.

- Regulatory Framework: The analysis details the impact of alcohol regulations at both federal and state levels on market access and distribution.

- M&A Activity: The report examines significant M&A deals in the industry during the study period, including deal values (in Millions) and their strategic implications for market players. For example, we analyze the impact of xx number of deals valued at $xx Million.

- Product Substitutes: The report assesses the impact of competing alcoholic beverages on market share.

- End-User Demographics: We explore changing consumer preferences and demographics impacting wine consumption patterns, including age, income, and lifestyle trends.

U.S. Wine Industry Market Dynamics & Trends

This section explores the key drivers and trends shaping the U.S. wine market's evolution, including market growth rates, technological disruptions, and changing consumer preferences. We present a comprehensive analysis of market dynamics using specific metrics, such as CAGR and market penetration rates, to provide a clear picture of the industry's growth trajectory. The detailed analysis covers:

- Market Growth Drivers: Factors driving growth include increasing disposable income, changing consumer preferences (premiumization, health consciousness), and expanding distribution channels. We estimate a CAGR of xx% for the forecast period.

- Technological Disruptions: The impact of e-commerce, direct-to-consumer (DTC) sales, and digital marketing on market reach and consumer engagement are analyzed.

- Consumer Preferences: Shifting consumer tastes toward specific wine types (e.g., organic, biodynamic, low-alcohol) and consumption occasions are discussed.

- Competitive Dynamics: The report analyzes the competitive landscape, including pricing strategies, brand positioning, and marketing efforts of key players. Market penetration rates for different wine types are also provided.

Dominant Regions & Segments in U.S. Wine Industry

This section identifies the leading regions and segments within the U.S. wine industry, based on product type (Still Wine, Sparkling Wine, Other Product Types), color (Red Wine, Rosé Wine, White Wine, Other Colors), and distribution channel (On-trade, Off-trade). The analysis includes:

Leading Regions: California remains the dominant wine-producing region, contributing xx% of total U.S. wine production in 2024. Key drivers include favorable climate, established infrastructure, and a strong brand reputation. Other significant regions such as Washington, Oregon, and New York are also analyzed.

Dominant Product Types: Still wine dominates the market, accounting for xx% of total volume. Key drivers include established consumer preference and wide product variety. Sparkling wine represents a smaller but growing segment, with xx% market share, boosted by increasing consumer interest in celebrations and premium options.

Leading Colors: Red wine holds the largest market share (xx%), followed by white wine (xx%) and rosé wine (xx%). Factors influencing color preference, including seasonal trends and regional variations, are explored.

Distribution Channels: The off-trade channel (retail stores, supermarkets) maintains the dominant market share (xx%) due to increased accessibility and convenience. The on-trade (restaurants, bars) channel plays a significant role (xx%) in driving premium wine sales and influencing consumer perceptions. Key drivers for each channel are analyzed in detail, considering factors such as economic policies, infrastructure, and consumer behavior.

U.S. Wine Industry Product Innovations

This section summarizes recent product developments and innovations in the U.S. wine industry. The analysis focuses on technological trends that are influencing product development and market fit. Key examples include the rise of low-calorie wines, canned wine's increasing popularity, and the use of sustainable and organic production methods. The development of new wine blends and flavors, reflecting consumer demand for novel taste experiences, is also highlighted.

Report Scope & Segmentation Analysis

This report segments the U.S. wine market comprehensively by product type (Still Wine, Sparkling Wine, Other Product Types), color (Red Wine, Rosé Wine, White Wine, Other Colors), and distribution channel (On-trade, Off-trade). Each segment’s market size (in Millions) is estimated for the base year (2025) and forecast period (2025-2033), along with growth projections and competitive dynamics. Growth projections are provided for each segment, highlighting the fastest-growing areas within the industry. Competitive dynamics within each segment are also analyzed, exploring factors such as price competition, brand differentiation, and market share distribution.

Key Drivers of U.S. Wine Industry Growth

Key drivers of growth in the U.S. wine industry include increasing consumer spending, a growing preference for premium wines, and a burgeoning e-commerce market. The expanding popularity of wine tourism also contributes positively to industry growth. Favorable regulatory environments in certain states foster industry development, while technological advancements, such as improved winemaking techniques, enhance production efficiency and quality.

Challenges in the U.S. Wine Industry Sector

The U.S. wine industry faces several challenges, including intense competition, fluctuating grape prices, and climate change's effects on grape yields. Supply chain disruptions, particularly those caused by transportation issues, have negatively impacted production and distribution. Further, increased alcohol taxes and stringent regulations pose obstacles to market expansion. These factors influence profitability and production efficiency, making adaptation and innovation crucial for survival in the market.

Emerging Opportunities in U.S. Wine Industry

Emerging opportunities include the growing demand for sustainable and organic wines, along with the expansion of ready-to-drink (RTD) wine options. This includes the rise in popularity of canned wine, appealing to a younger demographic. The increasing interest in wine tourism creates opportunities for wineries to diversify revenue streams. Innovation in wine packaging and marketing techniques, such as utilizing social media and influencer marketing, presents further growth avenues.

Leading Players in the U.S. Wine Industry Market

- E & J Gallo Winery

- Bronco Wine Company

- Trinchero Family Estates

- Bacardi Limited

- Constellation Brands Inc

- The Brown Forman Corporation

- Treasury Wine Estates

- The Wine Group

- Andrew Peller Limited

- Diageo plc

- Truett Hurst Inc

Key Developments in U.S. Wine Industry Industry

- May 2021: Treasury Wine Estates announced a long-term distribution agreement with Republic National Distributing Company (RNDC) covering multiple states.

- February 2022: Ventessa by Mezzacorona launched a new low-calorie wine brand.

- March 2022: Meiomi Wines released a new Red Blend.

Future Outlook for U.S. Wine Industry Market

The U.S. wine industry is poised for continued growth, driven by rising consumer demand for premium and specialized wines, as well as the expansion of e-commerce channels. Strategic investments in sustainable practices and technological innovation will be crucial for maintaining competitiveness. The industry will likely see further consolidation through mergers and acquisitions, and the emergence of new niche players catering to evolving consumer preferences will continue to shape the market landscape. The focus on health-conscious options and sustainable production will drive significant growth in specific segments.

U.S. Wine Industry Segmentation

-

1. Product Type

- 1.1. Still Wine

- 1.2. Sparkling Wine

- 1.3. Other Product Types

-

2. Color

- 2.1. Red Wine

- 2.2. Rose Wine

- 2.3. White Wine

- 2.4. Other Colors

-

3. Distribution Channel

- 3.1. On-trade

-

3.2. Off-trade

- 3.2.1. Supermarkets/Hypermarkets

- 3.2.2. Specialty Stores

- 3.2.3. Online Retail Channels

- 3.2.4. Other Distribution Channels

U.S. Wine Industry Segmentation By Geography

- 1. U.S.

U.S. Wine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.47% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products

- 3.3. Market Restrains

- 3.3.1. High Processing Cost and Low Yield of Natural Food Colors

- 3.4. Market Trends

- 3.4.1. Extensive Vineyard Area Anticipated to Strengthen the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. U.S. Wine Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Still Wine

- 5.1.2. Sparkling Wine

- 5.1.3. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Color

- 5.2.1. Red Wine

- 5.2.2. Rose Wine

- 5.2.3. White Wine

- 5.2.4. Other Colors

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. On-trade

- 5.3.2. Off-trade

- 5.3.2.1. Supermarkets/Hypermarkets

- 5.3.2.2. Specialty Stores

- 5.3.2.3. Online Retail Channels

- 5.3.2.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. U.S.

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Northeast U.S. Wine Industry Analysis, Insights and Forecast, 2019-2031

- 7. Southeast U.S. Wine Industry Analysis, Insights and Forecast, 2019-2031

- 8. Midwest U.S. Wine Industry Analysis, Insights and Forecast, 2019-2031

- 9. Southwest U.S. Wine Industry Analysis, Insights and Forecast, 2019-2031

- 10. West U.S. Wine Industry Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 E & J Gallo Winery

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bronco Wine Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Trinchero Family Estates

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bacardi Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Constellation Brands Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 The Brown Forman Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Treasury Wine Estates

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 The Wine Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Andrew Peller Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Diageo plc*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Truett Hurst Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 E & J Gallo Winery

List of Figures

- Figure 1: U.S. Wine Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: U.S. Wine Industry Share (%) by Company 2024

List of Tables

- Table 1: U.S. Wine Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: U.S. Wine Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: U.S. Wine Industry Revenue Million Forecast, by Color 2019 & 2032

- Table 4: U.S. Wine Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: U.S. Wine Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: U.S. Wine Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Northeast U.S. Wine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Southeast U.S. Wine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Midwest U.S. Wine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Southwest U.S. Wine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: West U.S. Wine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: U.S. Wine Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 13: U.S. Wine Industry Revenue Million Forecast, by Color 2019 & 2032

- Table 14: U.S. Wine Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: U.S. Wine Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the U.S. Wine Industry?

The projected CAGR is approximately 1.47%.

2. Which companies are prominent players in the U.S. Wine Industry?

Key companies in the market include E & J Gallo Winery, Bronco Wine Company, Trinchero Family Estates, Bacardi Limited, Constellation Brands Inc, The Brown Forman Corporation, Treasury Wine Estates, The Wine Group, Andrew Peller Limited, Diageo plc*List Not Exhaustive, Truett Hurst Inc.

3. What are the main segments of the U.S. Wine Industry?

The market segments include Product Type, Color, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products.

6. What are the notable trends driving market growth?

Extensive Vineyard Area Anticipated to Strengthen the Market.

7. Are there any restraints impacting market growth?

High Processing Cost and Low Yield of Natural Food Colors.

8. Can you provide examples of recent developments in the market?

March 2022: Meiomi Wines announced the release of the Red Blend, adding another flavor sourced from Meiomi's signature California regions. The company claims the product has the same premium taste that customers expect but with new, bold flavors and more options.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "U.S. Wine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the U.S. Wine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the U.S. Wine Industry?

To stay informed about further developments, trends, and reports in the U.S. Wine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence