Key Insights

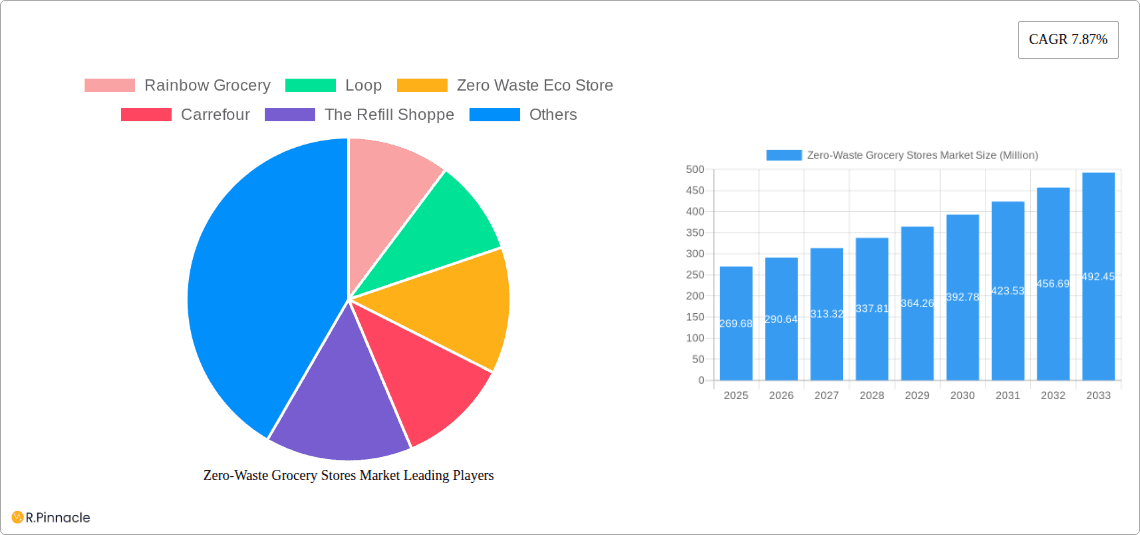

The zero-waste grocery store market is experiencing robust growth, projected to reach \$269.68 million in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 7.87% from 2025 to 2033. This expansion is fueled by increasing consumer awareness of environmental sustainability, a growing preference for reducing plastic waste, and a rising demand for eco-friendly and ethically sourced products. Drivers include the increasing popularity of the zero-waste lifestyle, government initiatives promoting sustainable consumption, and the rise of conscious consumerism. Key trends include the integration of innovative technologies such as online ordering and delivery systems for zero-waste products, the expansion of product offerings beyond staples to include fresh produce and prepared foods, and the development of loyalty programs and community initiatives to foster customer engagement. Despite these positive factors, challenges such as the higher initial investment costs associated with setting up zero-waste infrastructure, the potential for higher prices compared to conventional grocery stores, and overcoming logistical complexities in supply chain management, present potential restraints to market growth. However, the long-term outlook remains positive, as the market benefits from the increasing availability of eco-friendly packaging alternatives and the growing support from both consumers and businesses committed to environmental responsibility. The competitive landscape includes a mix of established supermarkets incorporating zero-waste initiatives (like Carrefour and Lidl) and smaller, specialized zero-waste stores (like Rainbow Grocery and The Refill Shoppe), each targeting different customer segments and market niches. Successful players will likely focus on building strong brand loyalty, offering convenient shopping experiences, and effectively communicating the value proposition of their zero-waste offerings.

Zero-Waste Grocery Stores Market Market Size (In Million)

The market's segmentation is likely based on product type (bulk foods, packaged goods, fresh produce, etc.), store format (independent stores, supermarket sections, online platforms), and geographic location. Future growth will depend on effectively addressing supply chain challenges, leveraging technology to improve efficiency, and educating consumers about the benefits of zero-waste grocery shopping. The increasing availability of reusable containers and packaging solutions will also contribute to market expansion. Strategies focused on educating consumers about the environmental and economic benefits of zero-waste choices and building strong community engagement are vital for long-term success. Expansion into new geographic markets and the development of innovative business models, such as subscription services and bulk-buying options, will be crucial to maintaining strong growth momentum throughout the forecast period.

Zero-Waste Grocery Stores Market Company Market Share

Zero-Waste Grocery Stores Market Report: A Comprehensive Analysis (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning Zero-Waste Grocery Stores market, offering actionable insights for industry professionals, investors, and strategists. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to project future market trends and opportunities. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Zero-Waste Grocery Stores Market Structure & Innovation Trends

The zero-waste grocery stores market is characterized by a fragmented landscape with a mix of large multinational corporations and smaller, independent businesses. Market concentration is relatively low, with no single dominant player controlling a significant market share. However, larger chains like Carrefour are increasingly incorporating zero-waste initiatives, potentially shifting the market dynamics in the coming years. Innovation is driven by consumer demand for sustainable products and packaging alternatives, coupled with regulatory pressure to reduce waste. Key innovations include reusable container systems, bulk dispensing units, and improved supply chain logistics to minimize environmental impact. M&A activity in the sector has been moderate, with deal values averaging xx Million in recent years. Examples include the partnership between Carrefour and GreenYellow. End-user demographics show a strong correlation between higher income levels, environmental awareness, and adoption of zero-waste grocery shopping habits.

- Market Concentration: Low

- Key Innovation Drivers: Consumer demand for sustainability, regulatory pressures.

- M&A Activity: Moderate, with average deal values of xx Million.

- End-User Demographics: Higher income levels, environmentally conscious consumers.

Zero-Waste Grocery Stores Market Dynamics & Trends

The zero-waste grocery stores market is experiencing significant growth, driven by increasing consumer awareness of environmental issues, coupled with the rising popularity of sustainable lifestyles. Technological disruptions, such as improved inventory management systems and online ordering platforms, are further accelerating market expansion. Consumer preferences are shifting towards minimizing plastic waste and supporting businesses with strong environmental commitments. Competitive dynamics are intensifying, with both established supermarket chains and smaller, specialized retailers vying for market share. The market penetration of zero-waste grocery stores is currently estimated at xx%, with projections indicating substantial growth in the forecast period. This expansion is fueled by a growing understanding of the environmental and economic benefits associated with reducing waste.

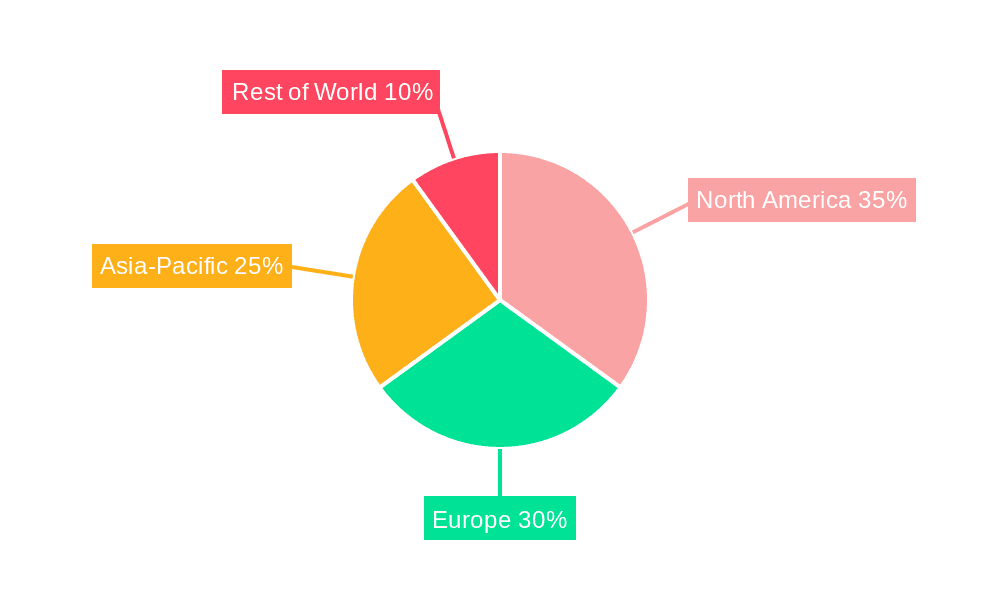

Dominant Regions & Segments in Zero-Waste Grocery Stores Market

While precise market share data by region is not currently available, initial observations suggest that developed nations with strong environmental regulations and a high proportion of environmentally conscious consumers are leading the market. Countries like those in Western Europe and North America are currently showing higher adoption rates, driven by factors like supportive government policies, robust infrastructure, and a strong consumer base. However, growth is expected in developing economies with rising environmental concerns and increasing disposable incomes.

- Key Drivers in Leading Regions:

- Strong consumer demand for sustainability.

- Supportive government policies and regulations.

- Well-developed infrastructure.

Zero-Waste Grocery Stores Market Product Innovations

Recent innovations in the zero-waste grocery market include the development of improved reusable container systems, advanced bulk dispensing technologies, and innovative packaging alternatives. Companies are leveraging technology to enhance traceability and transparency in their supply chains, further increasing consumer trust and market adoption. The focus is on creating products that are both environmentally friendly and convenient for consumers, maximizing market fit.

Report Scope & Segmentation Analysis

This comprehensive report meticulously segments the burgeoning zero-waste grocery stores market into distinct categories, including product type (spanning fresh produce, bulk dry goods, cleaning supplies, personal care items, and more), distribution channel (encompassing both vibrant brick-and-mortar establishments and increasingly popular online platforms), and crucial geographical regions. Each of these segments is characterized by its own unique growth trajectory, distinct competitive landscape, and evolving consumer preferences. The forecast period anticipates substantial growth across all identified segments, with specific sub-segments demonstrating particularly accelerated expansion rates. The competitive dynamics within each segment are intricately shaped by a confluence of factors, including the strength of brand recognition, the efficacy of pricing strategies, the pace of product and service innovation, and the ability to foster strong community engagement.

Key Drivers of Zero-Waste Grocery Stores Market Growth

The remarkable growth trajectory of the zero-waste grocery stores market is propelled by a powerful confluence of interconnected factors. Paramount among these is the escalating environmental consciousness among consumers globally, which is actively steering purchasing decisions towards sustainable and ethical alternatives. Furthermore, supportive government regulations and proactive incentives, designed to curb waste generation and promote circular economy principles, are playing a pivotal role in market expansion. Concurrently, significant technological advancements, such as the development of advanced reusable packaging solutions, sophisticated inventory management systems, and optimized supply chain logistics, are continuously enhancing the operational efficiency, scalability, and overall appeal of zero-waste business models.

Challenges in the Zero-Waste Grocery Stores Market Sector

The zero-waste grocery stores market faces several challenges, including the high initial investment costs for infrastructure and technology. Supply chain complexities and potential disruptions can also impact the efficient operation of zero-waste businesses. Furthermore, consumer behavior and acceptance of new shopping models can pose a barrier to widespread adoption. The lack of standardized regulations and protocols across different regions further complicates market growth.

Emerging Opportunities in Zero-Waste Grocery Stores Market

The dynamic zero-waste grocery stores market is ripe with a spectrum of exciting emerging opportunities poised to fuel future expansion. A significant avenue lies in strategic geographical expansion into new urban and suburban markets that exhibit a demonstrably growing consumer awareness and demand for sustainable shopping options. The ongoing development and widespread adoption of innovative technologies, including AI-powered inventory forecasting, blockchain for supply chain transparency, and personalized digital shopping experiences, hold immense potential to further refine operational efficiencies and elevate the overall customer journey. Moreover, the increasing willingness of larger, established supermarket chains to integrate zero-waste principles and practices into their existing operations and product offerings presents a substantial opportunity for market penetration and mainstream adoption.

Leading Players in the Zero-Waste Grocery Stores Market Market

- Rainbow Grocery

- Loop

- Zero Waste Eco Store

- Carrefour

- The Refill Shoppe

- Just Gaia

- Zero Muda

- EcoRefill

- ecoTopia

- Lidl

Key Developments in Zero-Waste Grocery Stores Market Industry

- July 2024: Carrefour partnered with GreenYellow to install solar panels across its national store network in France, Spain, and Brazil.

- November 2023: Carrefour partnered with Czech Group JIP Retail to expand its product range.

- January 2023: Good Earth Natural Foods partnered with USEFULL to reduce single-use packaging waste.

Future Outlook for Zero-Waste Grocery Stores Market Market

The future outlook for the zero-waste grocery stores market is unequivocally robust and optimistic. This positive trajectory is underpinned by the relentless acceleration of consumer demand for products and services that align with sustainable values, coupled with continuous advancements in relevant technologies. Significant strategic opportunities abound for forward-thinking companies that can adeptly navigate and optimize their efficient and transparent supply chains, embrace cutting-edge innovative technologies to enhance customer experience and operational effectiveness, and compellingly market their unwavering commitment to sustainability and ethical sourcing. Market growth is projected to maintain a vigorous pace, presenting highly attractive and promising investment prospects for both established industry incumbents seeking to diversify and agile new entrants eager to capitalize on this transformative market trend.

Zero-Waste Grocery Stores Market Segmentation

-

1. Distribution Channel

- 1.1. Supermarkets/Hypermarkets

- 1.2. Speciality Stores

- 1.3. Online Stores

Zero-Waste Grocery Stores Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Russia

- 2.5. Italy

- 2.6. Spain

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Zero-Waste Grocery Stores Market Regional Market Share

Geographic Coverage of Zero-Waste Grocery Stores Market

Zero-Waste Grocery Stores Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Environmental Consciousness Driving the Market; Consumer Demand for Eco-friendly Options Fuels Growth of the Market

- 3.3. Market Restrains

- 3.3.1. Rising Environmental Consciousness Driving the Market; Consumer Demand for Eco-friendly Options Fuels Growth of the Market

- 3.4. Market Trends

- 3.4.1 Zero-Waste Grocery Stores Proliferate in Supermarkets and Hypermarkets

- 3.4.2 Propelling Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Zero-Waste Grocery Stores Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.1.1. Supermarkets/Hypermarkets

- 5.1.2. Speciality Stores

- 5.1.3. Online Stores

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6. North America Zero-Waste Grocery Stores Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.1.1. Supermarkets/Hypermarkets

- 6.1.2. Speciality Stores

- 6.1.3. Online Stores

- 6.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 7. Europe Zero-Waste Grocery Stores Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.1.1. Supermarkets/Hypermarkets

- 7.1.2. Speciality Stores

- 7.1.3. Online Stores

- 7.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 8. Asia Pacific Zero-Waste Grocery Stores Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.1.1. Supermarkets/Hypermarkets

- 8.1.2. Speciality Stores

- 8.1.3. Online Stores

- 8.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 9. South America Zero-Waste Grocery Stores Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.1.1. Supermarkets/Hypermarkets

- 9.1.2. Speciality Stores

- 9.1.3. Online Stores

- 9.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 10. Middle East and Africa Zero-Waste Grocery Stores Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.1.1. Supermarkets/Hypermarkets

- 10.1.2. Speciality Stores

- 10.1.3. Online Stores

- 10.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Rainbow Grocery

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Loop

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Zero Waste Eco Store

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Carrefour

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 The Refill Shoppe

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Just Gaia

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Zero Muda

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 EcoRefill

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ecoTopia

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Lidl**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Rainbow Grocery

List of Figures

- Figure 1: Global Zero-Waste Grocery Stores Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Zero-Waste Grocery Stores Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Zero-Waste Grocery Stores Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 4: North America Zero-Waste Grocery Stores Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 5: North America Zero-Waste Grocery Stores Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Zero-Waste Grocery Stores Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 7: North America Zero-Waste Grocery Stores Market Revenue (Million), by Country 2025 & 2033

- Figure 8: North America Zero-Waste Grocery Stores Market Volume (Billion), by Country 2025 & 2033

- Figure 9: North America Zero-Waste Grocery Stores Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Zero-Waste Grocery Stores Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Zero-Waste Grocery Stores Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 12: Europe Zero-Waste Grocery Stores Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 13: Europe Zero-Waste Grocery Stores Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: Europe Zero-Waste Grocery Stores Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 15: Europe Zero-Waste Grocery Stores Market Revenue (Million), by Country 2025 & 2033

- Figure 16: Europe Zero-Waste Grocery Stores Market Volume (Billion), by Country 2025 & 2033

- Figure 17: Europe Zero-Waste Grocery Stores Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Zero-Waste Grocery Stores Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific Zero-Waste Grocery Stores Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 20: Asia Pacific Zero-Waste Grocery Stores Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 21: Asia Pacific Zero-Waste Grocery Stores Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: Asia Pacific Zero-Waste Grocery Stores Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 23: Asia Pacific Zero-Waste Grocery Stores Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Asia Pacific Zero-Waste Grocery Stores Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Zero-Waste Grocery Stores Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Zero-Waste Grocery Stores Market Volume Share (%), by Country 2025 & 2033

- Figure 27: South America Zero-Waste Grocery Stores Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 28: South America Zero-Waste Grocery Stores Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 29: South America Zero-Waste Grocery Stores Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: South America Zero-Waste Grocery Stores Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 31: South America Zero-Waste Grocery Stores Market Revenue (Million), by Country 2025 & 2033

- Figure 32: South America Zero-Waste Grocery Stores Market Volume (Billion), by Country 2025 & 2033

- Figure 33: South America Zero-Waste Grocery Stores Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Zero-Waste Grocery Stores Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Middle East and Africa Zero-Waste Grocery Stores Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 36: Middle East and Africa Zero-Waste Grocery Stores Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 37: Middle East and Africa Zero-Waste Grocery Stores Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 38: Middle East and Africa Zero-Waste Grocery Stores Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 39: Middle East and Africa Zero-Waste Grocery Stores Market Revenue (Million), by Country 2025 & 2033

- Figure 40: Middle East and Africa Zero-Waste Grocery Stores Market Volume (Billion), by Country 2025 & 2033

- Figure 41: Middle East and Africa Zero-Waste Grocery Stores Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Zero-Waste Grocery Stores Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Zero-Waste Grocery Stores Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 2: Global Zero-Waste Grocery Stores Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Zero-Waste Grocery Stores Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Zero-Waste Grocery Stores Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Global Zero-Waste Grocery Stores Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Zero-Waste Grocery Stores Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global Zero-Waste Grocery Stores Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global Zero-Waste Grocery Stores Market Volume Billion Forecast, by Country 2020 & 2033

- Table 9: United States Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United States Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 11: Canada Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 13: Rest of North America Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Rest of North America Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Global Zero-Waste Grocery Stores Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 16: Global Zero-Waste Grocery Stores Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 17: Global Zero-Waste Grocery Stores Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Zero-Waste Grocery Stores Market Volume Billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: United Kingdom Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Germany Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Germany Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: France Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: France Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Russia Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Russia Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Italy Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Italy Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Spain Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Spain Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Europe Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Global Zero-Waste Grocery Stores Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 34: Global Zero-Waste Grocery Stores Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global Zero-Waste Grocery Stores Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Zero-Waste Grocery Stores Market Volume Billion Forecast, by Country 2020 & 2033

- Table 37: India Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: India Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: China Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: China Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: Japan Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Australia Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Australia Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: Rest of Asia Pacific Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Global Zero-Waste Grocery Stores Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 48: Global Zero-Waste Grocery Stores Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 49: Global Zero-Waste Grocery Stores Market Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Global Zero-Waste Grocery Stores Market Volume Billion Forecast, by Country 2020 & 2033

- Table 51: Brazil Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Brazil Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 53: Argentina Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Argentina Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: Rest of South America Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Rest of South America Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: Global Zero-Waste Grocery Stores Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 58: Global Zero-Waste Grocery Stores Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 59: Global Zero-Waste Grocery Stores Market Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Zero-Waste Grocery Stores Market Volume Billion Forecast, by Country 2020 & 2033

- Table 61: United Arab Emirates Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: United Arab Emirates Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: South Africa Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: South Africa Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 65: Rest of Middle East and Africa Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Rest of Middle East and Africa Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Zero-Waste Grocery Stores Market?

The projected CAGR is approximately 7.87%.

2. Which companies are prominent players in the Zero-Waste Grocery Stores Market?

Key companies in the market include Rainbow Grocery, Loop, Zero Waste Eco Store, Carrefour, The Refill Shoppe, Just Gaia, Zero Muda, EcoRefill, ecoTopia, Lidl**List Not Exhaustive.

3. What are the main segments of the Zero-Waste Grocery Stores Market?

The market segments include Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 269.68 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Environmental Consciousness Driving the Market; Consumer Demand for Eco-friendly Options Fuels Growth of the Market.

6. What are the notable trends driving market growth?

Zero-Waste Grocery Stores Proliferate in Supermarkets and Hypermarkets. Propelling Growth.

7. Are there any restraints impacting market growth?

Rising Environmental Consciousness Driving the Market; Consumer Demand for Eco-friendly Options Fuels Growth of the Market.

8. Can you provide examples of recent developments in the market?

July 2024: Carrefour, a prominent supermarket chain, partnered with GreenYellow, a key player in France's energy transition, to install solar panels across its national store network. This joint effort focuses on installing photovoltaic units in the parking lots of 350 hypermarkets and supermarkets in France, Spain, and Brazil.November 2023: Carrefour into a new partnership with Czech Group JIP Retail. All stores of the chain’s network started selling a large range of Carrefour products.January 2023: Good Earth Natural Foods partnered with USEFULL to reduce single-use packaging waste. As part of its commitment to sustainability, Good Earth began offering USEFULL’s tech-enabled, insulated stainless steel cups in its in-store cafes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Zero-Waste Grocery Stores Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Zero-Waste Grocery Stores Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Zero-Waste Grocery Stores Market?

To stay informed about further developments, trends, and reports in the Zero-Waste Grocery Stores Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence