Key Insights

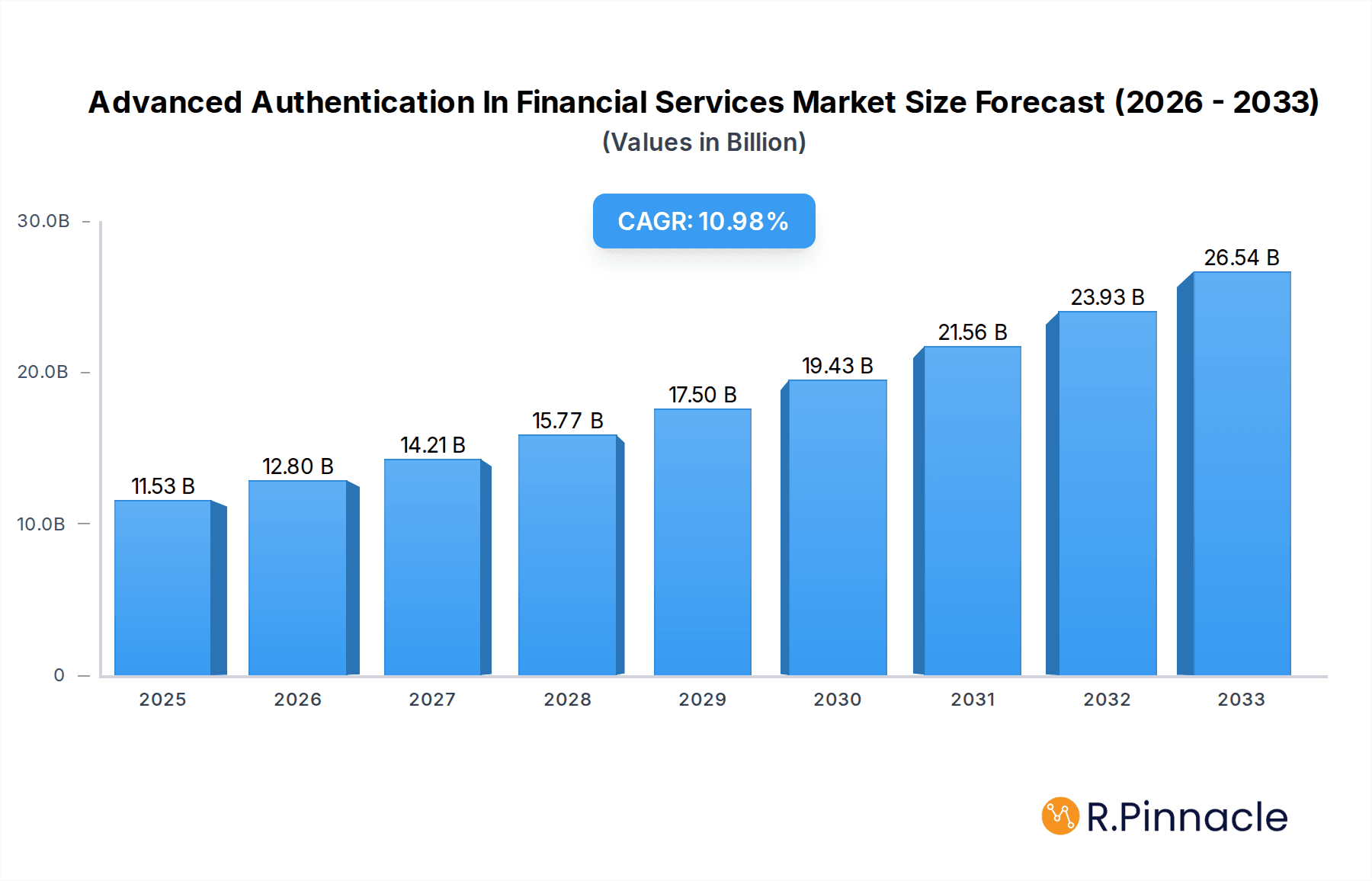

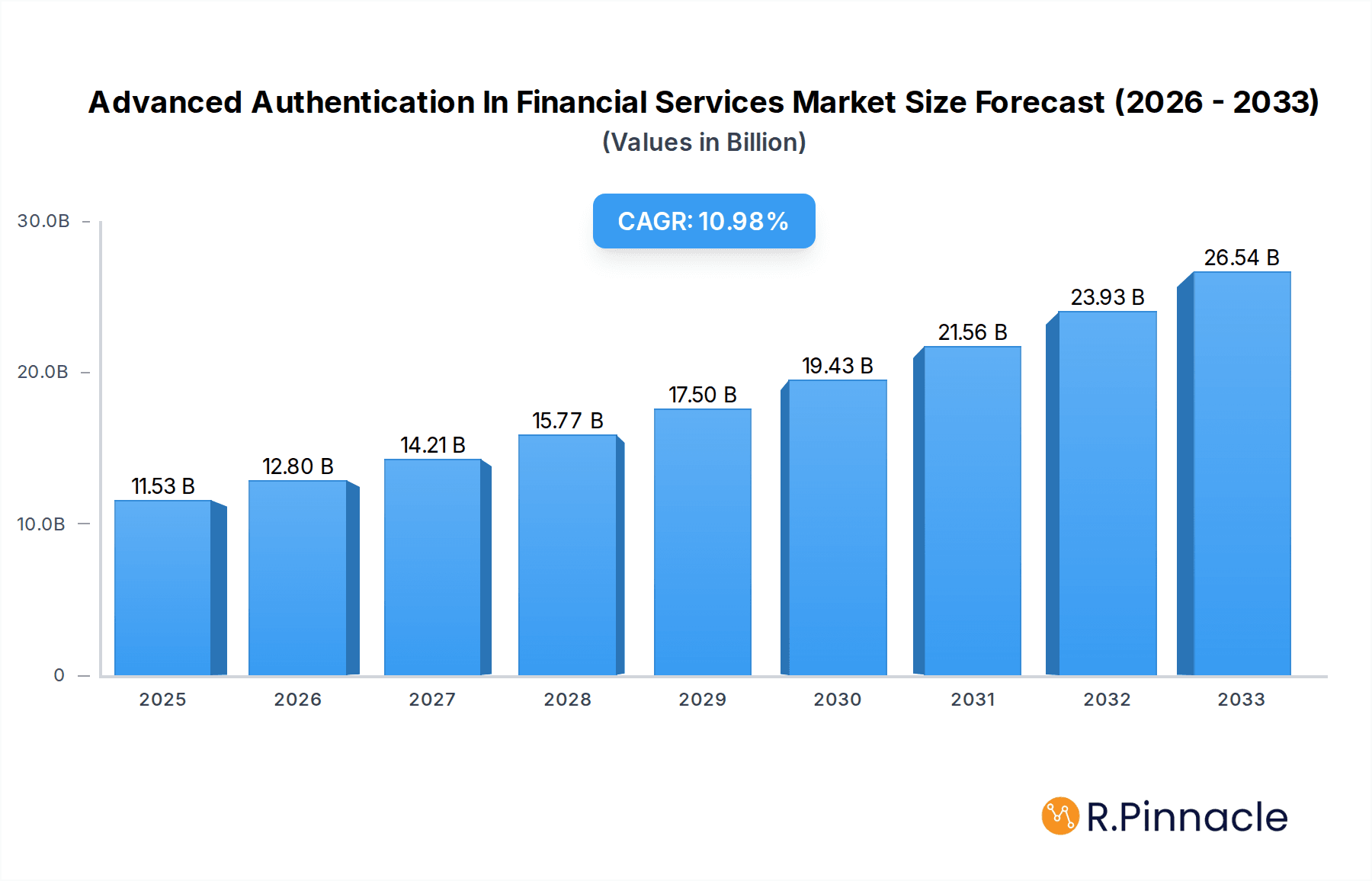

The Advanced Authentication in Financial Services market is poised for robust expansion, projected to reach an impressive $11,530 million by 2025. This growth is fueled by a compelling CAGR of 11% during the forecast period of 2025-2033. The escalating threat landscape, coupled with stringent regulatory mandates for data protection and fraud prevention, are the primary catalysts driving the adoption of sophisticated authentication solutions across the financial sector. Financial institutions are increasingly investing in multi-factor authentication (MFA) and other advanced methods to safeguard sensitive customer data, prevent unauthorized access, and maintain customer trust in an increasingly digital world. The burgeoning adoption of digital banking services, online transactions, and mobile payment solutions further amplifies the need for secure and seamless authentication processes, cementing the market's upward trajectory.

Advanced Authentication In Financial Services Market Size (In Billion)

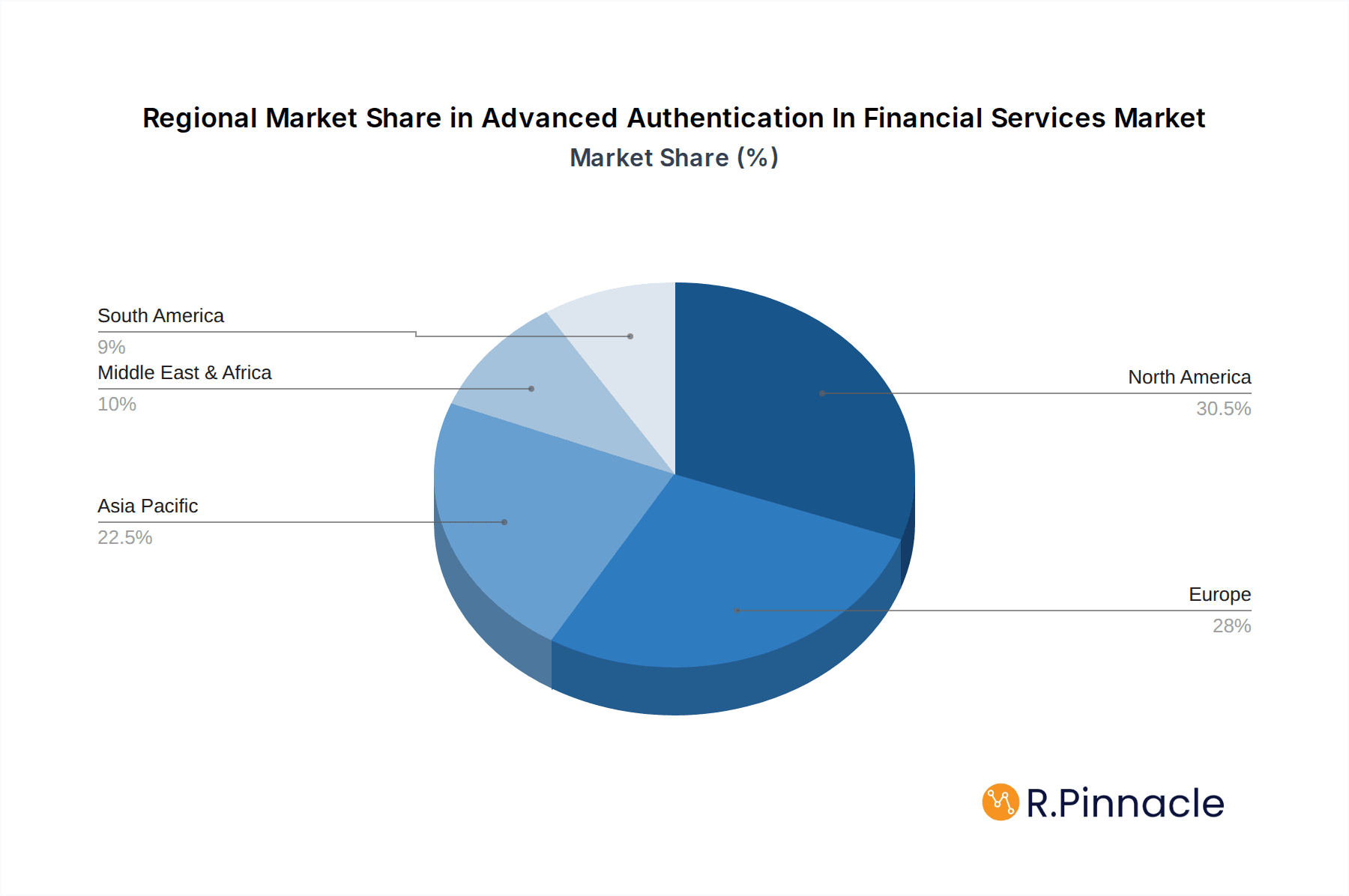

The market is segmented into Large Enterprises and Small and Medium-sized Enterprises (SMEs) for applications, with both segments exhibiting a strong demand for enhanced security. The type segmentation reveals a significant shift towards Multi-factor Authentication (MFA) as the preferred solution over Single-factor Authentication, owing to its superior security capabilities. Key players like Mastercard, Thales, and NEC Corporation are at the forefront, innovating and expanding their offerings to cater to the evolving needs of financial institutions. Geographically, North America and Europe are expected to lead the market due to early adoption of advanced technologies and stricter compliance regimes. However, the Asia Pacific region, driven by the rapid digitalization of financial services and a growing digital-native population, presents substantial growth opportunities. The market is characterized by an ongoing trend of integrating AI and machine learning into authentication systems for adaptive and behavioral analysis, enhancing fraud detection and user experience.

Advanced Authentication In Financial Services Company Market Share

Advanced Authentication in Financial Services Market: Unlocking Security & Growth

Dive deep into the critical landscape of advanced authentication within the financial services sector with this comprehensive report. Analyze emerging trends, market dynamics, and pivotal players shaping the future of secure financial transactions. This report is essential for financial institutions, technology providers, cybersecurity professionals, and investors seeking to understand and capitalize on the rapidly evolving advanced authentication market. With a projected market size of over $XX million by 2033, this study provides actionable insights and data-driven analysis for strategic decision-making.

Advanced Authentication In Financial Services Market Structure & Innovation Trends

The advanced authentication in financial services market exhibits a dynamic structure characterized by a moderate concentration of key players alongside a growing number of innovative solution providers. Innovation is primarily driven by the relentless pursuit of enhanced security to combat sophisticated cyber threats and comply with stringent regulatory frameworks. The evolving threat landscape necessitates continuous advancements in authentication technologies, pushing for solutions that offer both robust security and seamless user experiences. Regulatory bodies globally are increasingly mandating stronger authentication protocols, especially for sensitive financial data, creating a significant impetus for market growth. Product substitutes, while present in the form of less secure traditional methods, are rapidly being overshadowed by advanced solutions like biometrics and behavioral analysis. End-user demographics are diverse, ranging from large enterprises handling millions in transactions to small and medium-sized enterprises requiring scalable and cost-effective security solutions. Mergers and acquisitions (M&A) activities are a notable feature, with transaction values in the hundreds of millions, as established players seek to acquire innovative technologies and expand their market reach. Companies like Secur Envoy Ltd, NEC Corporation, and Ping Identity are actively involved in consolidating market share and driving innovation through strategic partnerships and acquisitions.

Advanced Authentication In Financial Services Market Dynamics & Trends

The advanced authentication in financial services market is poised for significant expansion, driven by a confluence of technological advancements, evolving customer expectations, and an increasingly stringent regulatory environment. The compound annual growth rate (CAGR) is projected to be robust, contributing to a market penetration that will see advanced authentication become the standard for most financial transactions. A primary growth driver is the escalating sophistication and frequency of cyberattacks targeting financial institutions. These attacks, ranging from phishing and malware to advanced persistent threats, necessitate multi-layered security approaches, with multi-factor authentication (MFA) emerging as a critical defense mechanism. Technological disruptions are continuously reshaping the authentication landscape. Innovations in biometrics, including fingerprint scanning, facial recognition, and voice authentication, are offering more convenient and secure alternatives to traditional password-based systems. Furthermore, the rise of behavioral biometrics, which analyzes user patterns and habits, adds another layer of sophisticated fraud detection. Consumer preferences are increasingly leaning towards frictionless and secure authentication methods. Users expect seamless access to their financial accounts without compromising on security, pushing for the adoption of technologies that balance usability with protection. This demand is fueling the development of passwordless authentication solutions and continuous authentication systems. Competitive dynamics within the market are intense, with a mix of established cybersecurity giants and agile startups vying for market share. Companies are investing heavily in research and development to stay ahead of emerging threats and deliver cutting-edge authentication solutions. The increasing adoption of cloud-based financial services also presents a unique set of challenges and opportunities, requiring scalable and secure authentication mechanisms that can adapt to distributed environments. The market penetration of advanced authentication is expected to exceed 70% across all financial services segments by the end of the forecast period, underscoring its indispensable role in modern financial operations.

Dominant Regions & Segments in Advanced Authentication In Financial Services

North America currently stands as the dominant region in the advanced authentication in financial services market, with the United States leading the charge. This dominance is attributed to a combination of factors, including a highly developed financial infrastructure, proactive regulatory bodies like the SEC and FINRA enforcing robust security standards, and a high concentration of large enterprises with substantial cybersecurity budgets. The presence of leading technology innovators and a mature cybersecurity ecosystem further bolsters its position.

Leading Segments:

- Application: Large Enterprises: Large enterprises are a significant segment due to their extensive transaction volumes, sensitive data handling capabilities, and the inherent risks associated with large-scale financial operations. Stringent compliance requirements, such as GDPR and CCPA, coupled with the need to protect millions of customer accounts, drive substantial investment in advanced authentication solutions. Economic policies favoring secure digital transactions and the widespread adoption of advanced IT infrastructure in this segment further solidify their demand.

- Type: Multi-factor Authentication (MFA): Multi-factor authentication is unequivocally the leading type within the advanced authentication market. Its superior security posture compared to single-factor authentication makes it indispensable for financial institutions. The increasing threat of credential stuffing attacks and the growing regulatory mandate for layered security have propelled MFA to the forefront. The low error rates and high confidence levels associated with MFA provide the necessary assurance for handling sensitive financial information.

The Asia-Pacific region is emerging as a rapidly growing market, driven by increasing digital adoption, a burgeoning fintech ecosystem, and government initiatives promoting cybersecurity awareness and adoption. Countries like China, Japan, and India are witnessing substantial growth in financial technology and, consequently, in the demand for advanced authentication solutions. Economic policies aimed at fostering digital economies and the ongoing development of financial infrastructure are key drivers in this region.

Advanced Authentication In Financial Services Product Innovations

Product innovations in advanced authentication for financial services are rapidly evolving to meet the escalating demands for security and user convenience. Key developments include the integration of AI and machine learning into behavioral biometrics, enabling continuous and adaptive authentication that analyzes user behavior in real-time. Passwordless authentication solutions, leveraging biometrics and secure hardware tokens, are gaining traction, offering a seamless yet highly secure user experience. Furthermore, the development of federated identity management solutions that support single sign-on (SSO) across multiple financial applications enhances efficiency without compromising security. These innovations provide significant competitive advantages by reducing fraud, improving customer satisfaction, and ensuring compliance with evolving regulatory mandates.

Report Scope & Segmentation Analysis

This report provides an in-depth analysis of the advanced authentication in financial services market, segmented by application and type.

Application Segments:

- Large Enterprises: This segment is characterized by high transaction volumes, significant data sensitivity, and stringent regulatory compliance needs. Market growth is driven by the need to protect against sophisticated cyber threats and the adoption of advanced security measures, with projected market sizes in the hundreds of millions.

- Small and Medium-sized Enterprises (SMEs): SMEs are increasingly recognizing the importance of robust security as they digitize their operations. The market for advanced authentication in this segment is growing rapidly due to the availability of scalable and cost-effective solutions, with significant expansion anticipated in the coming years.

Type Segments:

- Single-factor Authentication: While still present, this segment is expected to see a decline in market share as advanced solutions become more prevalent and mandated for higher-risk transactions.

- Multi-factor Authentication (MFA): MFA is the dominant and fastest-growing segment. Its ability to provide layered security against various threats makes it essential for all financial institutions, with substantial market share and continued growth projections.

Key Drivers of Advanced Authentication In Financial Services Growth

The growth of the advanced authentication in financial services market is propelled by several critical factors. The increasing volume and sophistication of cyberattacks, including ransomware and phishing attempts, are a primary driver, necessitating stronger security measures. Stringent regulatory mandates, such as PSD2 and upcoming data privacy laws, are compelling financial institutions to implement robust authentication protocols to protect sensitive customer data and comply with legal requirements. The proliferation of digital banking and mobile payment services has expanded the attack surface, further driving the demand for secure authentication solutions. Furthermore, the growing consumer awareness and demand for secure yet convenient access to financial services are pushing for the adoption of advanced technologies like biometrics and passwordless authentication.

Challenges in the Advanced Authentication In Financial Services Sector

Despite robust growth, the advanced authentication in financial services sector faces several challenges. Implementing complex multi-factor authentication solutions can be a significant hurdle, especially for legacy systems, leading to substantial integration costs and potential operational disruptions. Balancing stringent security requirements with user experience remains a delicate act; overly complex authentication processes can lead to user frustration and abandonment. The evolving nature of cyber threats requires continuous investment in research and development, as attackers constantly find new ways to circumvent security measures. Furthermore, varying regulatory landscapes across different jurisdictions can create compliance complexities for global financial institutions. Competition from both established players and new entrants also puts pressure on pricing and innovation.

Emerging Opportunities in Advanced Authentication In Financial Services

Emerging opportunities in advanced authentication for financial services are abundant, driven by technological innovation and changing consumer behaviors. The burgeoning field of AI-powered behavioral biometrics presents a significant opportunity for continuous and adaptive authentication, offering enhanced security without user intervention. The increasing adoption of cloud-based financial services creates a demand for scalable and secure authentication solutions that can manage identities across distributed environments. The push towards a passwordless future, leveraging a combination of biometrics, secure hardware, and device trust, offers immense potential for improving user experience and security. Furthermore, the growing financial inclusion initiatives in emerging economies present a vast untapped market for secure and accessible authentication solutions.

Leading Players in the Advanced Authentication In Financial Services Market

- Secur Envoy Ltd

- NEC Corporation

- Ping Identity

- Dell Inc.

- Absolute Software Corporation

- Valid Soft Group

- Mastercard

- Fujitsu

- Thales

- Broadcom Inc.

Key Developments in Advanced Authentication In Financial Services Industry

- 2023/05: Mastercard launches new AI-powered fraud detection solutions, enhancing biometric authentication capabilities.

- 2023/04: Ping Identity acquires a leading provider of identity orchestration technology to expand its cloud-native offerings.

- 2023/03: Thales announces advancements in FIDO2 security keys, promoting passwordless authentication.

- 2023/02: NEC Corporation showcases its latest facial recognition technology for enhanced security in financial transactions.

- 2023/01: Secur Envoy Ltd partners with a major European bank to implement advanced MFA for its retail banking customers.

- 2022/11: Broadcom Inc. strengthens its identity security portfolio with new multi-factor authentication innovations.

- 2022/09: Dell Inc. integrates advanced security features into its enterprise solutions to protect financial data.

- 2022/07: Absolute Software Corporation enhances its endpoint security platform with improved authentication controls.

- 2022/05: Valid Soft Group introduces a new mobile biometric authentication solution for financial applications.

- 2022/03: Fujitsu announces new cybersecurity initiatives, including advanced authentication for financial services.

Future Outlook for Advanced Authentication In Financial Services Market

The future outlook for the advanced authentication in financial services market is exceptionally bright, characterized by sustained growth and transformative innovation. The increasing reliance on digital financial services, coupled with the ever-present threat of cybercrime, will continue to fuel the demand for robust security solutions. The trend towards passwordless authentication, driven by user demand for convenience and improved security, is expected to accelerate, with biometrics and other advanced methods becoming the norm. The integration of AI and machine learning will further enhance the intelligence and adaptability of authentication systems, enabling proactive threat detection and personalized security. Strategic partnerships and acquisitions will likely continue as companies seek to expand their technology portfolios and market reach. The forecast suggests a market size that will significantly exceed current projections by 2033, solidifying advanced authentication's indispensable role in safeguarding the global financial ecosystem.

Advanced Authentication In Financial Services Segmentation

-

1. Application

- 1.1. Large Enterprises

- 1.2. Small and Medium-sized Enterprises

-

2. Type

- 2.1. Single-factor Authentication

- 2.2. Multi-factor Authentication

Advanced Authentication In Financial Services Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Advanced Authentication In Financial Services Regional Market Share

Geographic Coverage of Advanced Authentication In Financial Services

Advanced Authentication In Financial Services REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Advanced Authentication In Financial Services Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Large Enterprises

- 5.1.2. Small and Medium-sized Enterprises

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Single-factor Authentication

- 5.2.2. Multi-factor Authentication

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Advanced Authentication In Financial Services Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Large Enterprises

- 6.1.2. Small and Medium-sized Enterprises

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Single-factor Authentication

- 6.2.2. Multi-factor Authentication

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Advanced Authentication In Financial Services Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Large Enterprises

- 7.1.2. Small and Medium-sized Enterprises

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Single-factor Authentication

- 7.2.2. Multi-factor Authentication

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Advanced Authentication In Financial Services Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Large Enterprises

- 8.1.2. Small and Medium-sized Enterprises

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Single-factor Authentication

- 8.2.2. Multi-factor Authentication

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Advanced Authentication In Financial Services Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Large Enterprises

- 9.1.2. Small and Medium-sized Enterprises

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Single-factor Authentication

- 9.2.2. Multi-factor Authentication

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Advanced Authentication In Financial Services Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Large Enterprises

- 10.1.2. Small and Medium-sized Enterprises

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Single-factor Authentication

- 10.2.2. Multi-factor Authentication

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Secur Envoy Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 NEC Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ping Identity

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Dell Inc.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Absolute Software Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Valid Soft Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mastercard

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Fujitsu

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Thales

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Broadcom Inc.

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Secur Envoy Ltd

List of Figures

- Figure 1: Global Advanced Authentication In Financial Services Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Advanced Authentication In Financial Services Revenue (million), by Application 2025 & 2033

- Figure 3: North America Advanced Authentication In Financial Services Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Advanced Authentication In Financial Services Revenue (million), by Type 2025 & 2033

- Figure 5: North America Advanced Authentication In Financial Services Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Advanced Authentication In Financial Services Revenue (million), by Country 2025 & 2033

- Figure 7: North America Advanced Authentication In Financial Services Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Advanced Authentication In Financial Services Revenue (million), by Application 2025 & 2033

- Figure 9: South America Advanced Authentication In Financial Services Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Advanced Authentication In Financial Services Revenue (million), by Type 2025 & 2033

- Figure 11: South America Advanced Authentication In Financial Services Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America Advanced Authentication In Financial Services Revenue (million), by Country 2025 & 2033

- Figure 13: South America Advanced Authentication In Financial Services Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Advanced Authentication In Financial Services Revenue (million), by Application 2025 & 2033

- Figure 15: Europe Advanced Authentication In Financial Services Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Advanced Authentication In Financial Services Revenue (million), by Type 2025 & 2033

- Figure 17: Europe Advanced Authentication In Financial Services Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Advanced Authentication In Financial Services Revenue (million), by Country 2025 & 2033

- Figure 19: Europe Advanced Authentication In Financial Services Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Advanced Authentication In Financial Services Revenue (million), by Application 2025 & 2033

- Figure 21: Middle East & Africa Advanced Authentication In Financial Services Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Advanced Authentication In Financial Services Revenue (million), by Type 2025 & 2033

- Figure 23: Middle East & Africa Advanced Authentication In Financial Services Revenue Share (%), by Type 2025 & 2033

- Figure 24: Middle East & Africa Advanced Authentication In Financial Services Revenue (million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Advanced Authentication In Financial Services Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Advanced Authentication In Financial Services Revenue (million), by Application 2025 & 2033

- Figure 27: Asia Pacific Advanced Authentication In Financial Services Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Advanced Authentication In Financial Services Revenue (million), by Type 2025 & 2033

- Figure 29: Asia Pacific Advanced Authentication In Financial Services Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific Advanced Authentication In Financial Services Revenue (million), by Country 2025 & 2033

- Figure 31: Asia Pacific Advanced Authentication In Financial Services Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Advanced Authentication In Financial Services Revenue million Forecast, by Application 2020 & 2033

- Table 2: Global Advanced Authentication In Financial Services Revenue million Forecast, by Type 2020 & 2033

- Table 3: Global Advanced Authentication In Financial Services Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Advanced Authentication In Financial Services Revenue million Forecast, by Application 2020 & 2033

- Table 5: Global Advanced Authentication In Financial Services Revenue million Forecast, by Type 2020 & 2033

- Table 6: Global Advanced Authentication In Financial Services Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States Advanced Authentication In Financial Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada Advanced Authentication In Financial Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Advanced Authentication In Financial Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Global Advanced Authentication In Financial Services Revenue million Forecast, by Application 2020 & 2033

- Table 11: Global Advanced Authentication In Financial Services Revenue million Forecast, by Type 2020 & 2033

- Table 12: Global Advanced Authentication In Financial Services Revenue million Forecast, by Country 2020 & 2033

- Table 13: Brazil Advanced Authentication In Financial Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Advanced Authentication In Financial Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Advanced Authentication In Financial Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Global Advanced Authentication In Financial Services Revenue million Forecast, by Application 2020 & 2033

- Table 17: Global Advanced Authentication In Financial Services Revenue million Forecast, by Type 2020 & 2033

- Table 18: Global Advanced Authentication In Financial Services Revenue million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Advanced Authentication In Financial Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Germany Advanced Authentication In Financial Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: France Advanced Authentication In Financial Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Italy Advanced Authentication In Financial Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Spain Advanced Authentication In Financial Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Russia Advanced Authentication In Financial Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Advanced Authentication In Financial Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Advanced Authentication In Financial Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Advanced Authentication In Financial Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Global Advanced Authentication In Financial Services Revenue million Forecast, by Application 2020 & 2033

- Table 29: Global Advanced Authentication In Financial Services Revenue million Forecast, by Type 2020 & 2033

- Table 30: Global Advanced Authentication In Financial Services Revenue million Forecast, by Country 2020 & 2033

- Table 31: Turkey Advanced Authentication In Financial Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Israel Advanced Authentication In Financial Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: GCC Advanced Authentication In Financial Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Advanced Authentication In Financial Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Advanced Authentication In Financial Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Advanced Authentication In Financial Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Global Advanced Authentication In Financial Services Revenue million Forecast, by Application 2020 & 2033

- Table 38: Global Advanced Authentication In Financial Services Revenue million Forecast, by Type 2020 & 2033

- Table 39: Global Advanced Authentication In Financial Services Revenue million Forecast, by Country 2020 & 2033

- Table 40: China Advanced Authentication In Financial Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: India Advanced Authentication In Financial Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Japan Advanced Authentication In Financial Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Advanced Authentication In Financial Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Advanced Authentication In Financial Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Advanced Authentication In Financial Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Advanced Authentication In Financial Services Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Advanced Authentication In Financial Services?

The projected CAGR is approximately 11%.

2. Which companies are prominent players in the Advanced Authentication In Financial Services?

Key companies in the market include Secur Envoy Ltd, NEC Corporation, Ping Identity, Dell Inc., Absolute Software Corporation, Valid Soft Group, Mastercard, Fujitsu, Thales, Broadcom Inc..

3. What are the main segments of the Advanced Authentication In Financial Services?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 11530 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Advanced Authentication In Financial Services," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Advanced Authentication In Financial Services report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Advanced Authentication In Financial Services?

To stay informed about further developments, trends, and reports in the Advanced Authentication In Financial Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence