Key Insights

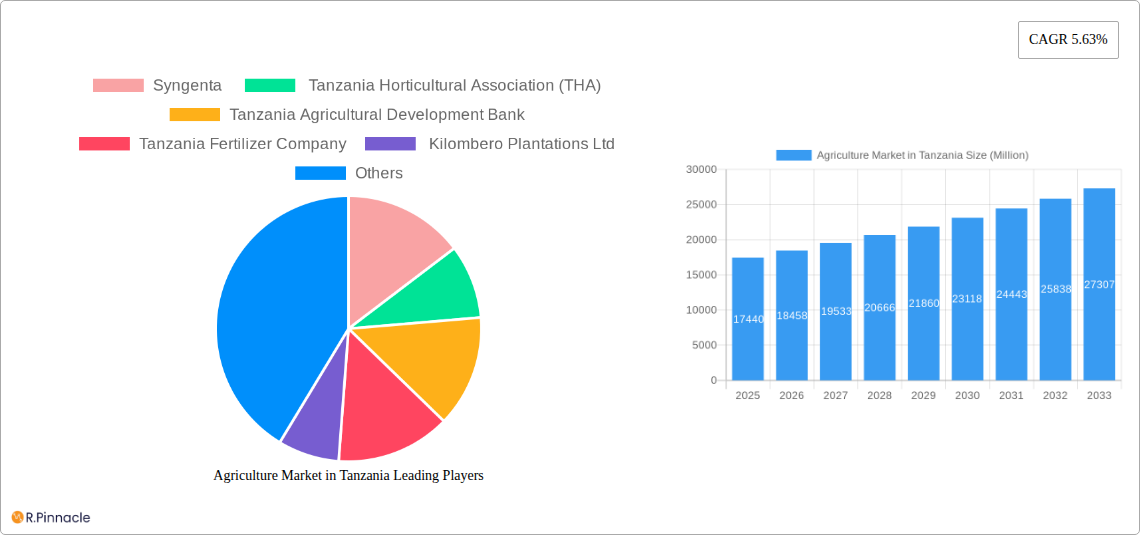

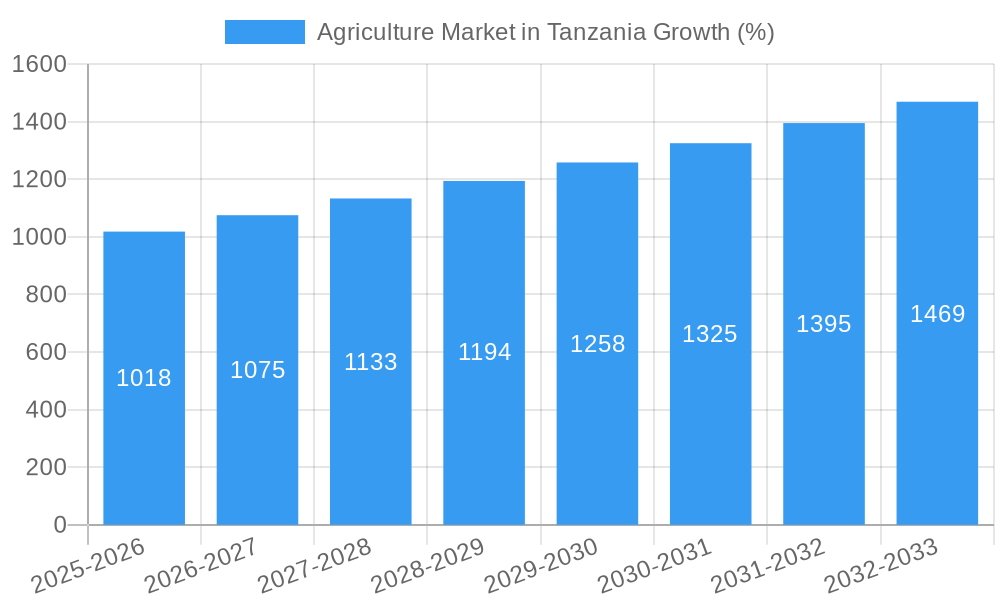

The Tanzanian agriculture market, valued at $17.44 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.63% from 2025 to 2033. This expansion is driven by several factors. Increased government investment in agricultural infrastructure, including irrigation systems and improved storage facilities, is enhancing productivity and reducing post-harvest losses. A growing population fuels rising demand for food crops, fruits, and vegetables, creating a significant market opportunity for producers and suppliers. Furthermore, the adoption of modern farming techniques, such as precision agriculture and the use of improved seeds and fertilizers, contributes to higher yields and improved crop quality. However, challenges remain. Climate change, manifested in erratic rainfall patterns and increased frequency of droughts, poses a significant threat to crop production. Limited access to credit and modern agricultural technologies, particularly in rural areas, hinders the growth potential of many smallholder farmers. Consequently, substantial investment in climate-resilient farming practices and financial support for farmers are crucial to unlock the full potential of Tanzania's agricultural sector. The market is segmented by crop type (food crops/cereals, fruits, vegetables), with food crops likely dominating due to population needs. Key players like Syngenta, Rijk Zwaan, and local associations like the Tanzania Horticultural Association (THA) play pivotal roles in shaping market dynamics.

The market's growth trajectory is expected to be influenced by several key trends. Increased diversification into high-value crops like fruits and vegetables is anticipated, driven by both domestic and export demand. The burgeoning processing and value addition sector provides farmers with greater market access and improved incomes. Furthermore, growing consumer awareness of healthy eating habits is driving demand for organically grown produce, presenting opportunities for sustainable agricultural practices. However, constraints such as land degradation, inadequate access to markets, and limited post-harvest management infrastructure continue to hinder optimal growth. Addressing these challenges through public-private partnerships, investment in research and development, and improvements in rural infrastructure are essential to ensuring the long-term sustainability and growth of the Tanzanian agriculture market. The forecast period of 2025-2033 offers significant opportunities for both domestic and international stakeholders in this vital sector.

This comprehensive report provides a detailed analysis of the Tanzanian agriculture market, offering invaluable insights for industry professionals, investors, and stakeholders. With a focus on market structure, dynamics, and future outlook, this report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report leverages extensive data analysis to provide actionable intelligence, identifying key opportunities and challenges within this dynamic sector.

Agriculture Market in Tanzania Market Structure & Innovation Trends

This section analyzes the Tanzanian agriculture market's structure, focusing on market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and M&A activities. The market exhibits a moderately fragmented structure with several large players and numerous smaller firms. Key players such as Syngenta and Rijk Zwaan significantly influence the seed and technology segments. The Tanzania Agricultural Development Bank (TADB) plays a crucial role in financing agricultural activities.

Market share varies significantly across segments, with food crops like maize and cassava holding the largest share in terms of production volume. Innovation is driven primarily by the need for increased yield, improved crop resilience to climate change, and efficient resource utilization.

- Regulatory Framework: The government plays a significant role, shaping the market through subsidies, regulations, and investment in research and development. Recent policy shifts regarding genetically engineered crops illustrate the dynamic nature of the regulatory landscape.

- Product Substitutes: Limited substitutes exist for staple crops, but there's increasing use of improved crop varieties and fertilizers.

- End-User Demographics: The majority of end-users are smallholder farmers, with a growing number of medium-to-large scale commercial farms.

- M&A Activity: While precise M&A deal values are unavailable (xx Million), the sector has witnessed several smaller acquisitions, primarily focused on enhancing distribution networks and product portfolios. Consolidation is likely to increase in the coming years.

Agriculture Market in Tanzania Market Dynamics & Trends

The Tanzanian agriculture market is experiencing significant growth, driven by increasing population, rising incomes, and growing urbanization. The CAGR for the period 2019-2024 is estimated at xx%, with further growth projected for 2025-2033. This growth is fueled by:

- Technological Disruptions: Adoption of precision agriculture techniques, including the use of mobile apps for information dissemination and improved irrigation, is slowly increasing market penetration.

- Consumer Preferences: Consumer demand for higher-quality, safer food is driving a shift towards sustainable and certified agricultural practices.

- Competitive Dynamics: Increased competition among input suppliers and processors leads to innovation and efficiency improvements. Market penetration by multinational companies alongside the emergence of local players adds complexity.

- Government Initiatives: Government policies and investments aimed at improving infrastructure and access to finance play a crucial role in market dynamics. The African Development Bank Group's USD 73.5 Million investment in boosting food production exemplifies this influence.

Market penetration of improved seed varieties and fertilizers remains relatively low, presenting a significant opportunity for growth.

Dominant Regions & Segments in Agriculture Market in Tanzania

The agricultural sector in Tanzania is geographically diverse; however, regions with favorable climatic conditions and established infrastructure dominate production. Key regions include the Northern Zone (Arusha, Kilimanjaro), the Central Zone (Dodoma, Singida), and the Southern Highlands. The dominance of these regions is driven by:

Economic Policies: Government support programs focused on specific regions and crops.

Infrastructure: Access to irrigation systems, transportation networks, and processing facilities.

Crop Type Dominance:

- Food Crops/Cereals: Maize, rice, and wheat dominate production and consumption. The import and export volumes vary considerably depending on harvest cycles and domestic demand. xx Million tons represent the approximate total market value for food crops in 2025.

- Fruits: Bananas, mangoes, and pineapples are significant crops; however, export potential remains underutilized.

- Vegetables: Tomatoes, onions, and cabbages account for the highest volume of production. Limited access to reliable processing facilities leads to considerable post-harvest losses.

Detailed analysis reveals fluctuations in prices depending on factors such as weather conditions, supply chain efficiency, and market demand.

Agriculture Market in Tanzania Product Innovations

The market is witnessing the introduction of improved seed varieties with higher yields and disease resistance. Technological advancements in irrigation and precision agriculture are improving efficiency and reducing resource waste. Companies like Syngenta and Rijk Zwaan are major players in this area, though the adoption rate among smallholder farmers remains a challenge. This presents opportunities for companies that focus on user-friendly technologies and accessible financing options.

Report Scope & Segmentation Analysis

This report segments the Tanzanian agriculture market by crop type: Food Crops/Cereals, Fruits, and Vegetables. Each segment is analyzed based on production volume, consumption volume and value, import and export volumes and values, and price trends. Growth projections vary across segments, with food crops expected to maintain a dominant share, although the growth rates for fruits and vegetables may be higher due to increasing consumer demand and export opportunities. Competitive dynamics are analyzed within each segment, revealing both national and international players’ varying levels of market participation.

Food Crops/Cereals: This segment is expected to grow at a CAGR of xx% during the forecast period. Market size is projected at xx Million USD in 2025.

Fruits: This segment's growth is expected to be driven by rising exports, resulting in a CAGR of xx% during the forecast period. Market size is projected at xx Million USD in 2025.

Vegetables: This segment faces challenges related to post-harvest losses but is anticipated to show significant growth driven by increased demand. A CAGR of xx% and a market size of xx Million USD in 2025 are projected.

Key Drivers of Agriculture Market in Tanzania Growth

Several key factors drive the growth of Tanzania's agriculture market. Firstly, the rising population fuels increased demand for food. Secondly, government initiatives promoting agricultural investment, such as the USD 73.5 Million from the African Development Bank Group, are boosting productivity. Lastly, the gradual adoption of improved technologies enhances yields and efficiency. These factors contribute to a positive outlook for market expansion.

Challenges in the Agriculture Market in Tanzania Sector

Significant challenges hinder the Tanzanian agriculture market's growth. These include inadequate infrastructure (poor roads and storage facilities), leading to significant post-harvest losses, estimated at xx Million USD annually. Furthermore, limited access to credit and financial services restricts farmers' ability to invest in improved technologies and inputs. The fluctuating prices of agricultural commodities also pose a risk. Regulatory inconsistencies and bureaucratic hurdles complicate operations.

Emerging Opportunities in Agriculture Market in Tanzania

Opportunities exist for enhancing value chains through processing and adding value to agricultural products. Developing export markets for high-value crops, such as fruits and vegetables, presents substantial potential. Investing in agricultural technology and providing improved extension services can improve productivity and resilience to climate change. Focus on sustainable agricultural practices also presents both economic and environmental opportunities.

Leading Players in the Agriculture Market in Tanzania Market

- Syngenta

- Tanzania Horticultural Association (THA)

- Tanzania Agricultural Development Bank

- Tanzania Fertilizer Company

- Kilombero Plantations Ltd

- Rijk Zwaan

- Monsanto

- Tanzania Breweries Limited

- Kilimanjaro Agro Inputs Ltd

- Tanzania Seed Trade Association (TASTA)

Key Developments in Agriculture Market in Tanzania Industry

September 2022: Tanzania's Ministry of Agriculture directed the Tanzania Agriculture Research Institute (TARI) to find a location for genetically engineered (GE) crop trials, potentially reversing the 2021 ban on GE crop research. This could significantly impact future agricultural practices and output.

July 2022: The African Development Bank Group approved USD 73.5 Million to increase food production by a million tonnes over three years. This significant investment will boost the sector's productivity and capacity.

February 2022: AgriFI and ElectrFI, EU-funded initiatives, launched at the EU-Africa Business Forum. This highlights the increasing interest and investment in the Tanzanian agricultural sector from international organizations. This initiative is expected to improve financing and technology access for agricultural businesses.

Future Outlook for Agriculture Market in Tanzania Market

The Tanzanian agriculture market exhibits strong growth potential driven by a growing population, increasing demand for food, and government support. Strategic investments in infrastructure, technology, and value chain development will be crucial for unlocking the sector's full potential. The increased focus on sustainable and climate-smart agriculture further enhances long-term prospects. Addressing challenges related to post-harvest losses, access to finance, and regulatory frameworks will be essential for sustained growth.

Agriculture Market in Tanzania Segmentation

-

1. Crop Typ

- 1.1. Food Crops/Cereals

- 1.2. Fruits

- 1.3. Vegetables

-

2. Crop Typ

- 2.1. Food Crops/Cereals

- 2.2. Fruits

- 2.3. Vegetables

Agriculture Market in Tanzania Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Agriculture Market in Tanzania REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.63% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Technology in Horticulture; Government Initiatives for Self-reliance in Vegetable and Fruit Farming

- 3.3. Market Restrains

- 3.3.1. Limited Resource Availability and Unfavourable Climatic Condition; Increasing Reliance on Imports for Domestic Supply

- 3.4. Market Trends

- 3.4.1. Favorable Government Policies Supporting the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Agriculture Market in Tanzania Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Crop Typ

- 5.1.1. Food Crops/Cereals

- 5.1.2. Fruits

- 5.1.3. Vegetables

- 5.2. Market Analysis, Insights and Forecast - by Crop Typ

- 5.2.1. Food Crops/Cereals

- 5.2.2. Fruits

- 5.2.3. Vegetables

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Crop Typ

- 6. North America Agriculture Market in Tanzania Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Crop Typ

- 6.1.1. Food Crops/Cereals

- 6.1.2. Fruits

- 6.1.3. Vegetables

- 6.2. Market Analysis, Insights and Forecast - by Crop Typ

- 6.2.1. Food Crops/Cereals

- 6.2.2. Fruits

- 6.2.3. Vegetables

- 6.1. Market Analysis, Insights and Forecast - by Crop Typ

- 7. South America Agriculture Market in Tanzania Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Crop Typ

- 7.1.1. Food Crops/Cereals

- 7.1.2. Fruits

- 7.1.3. Vegetables

- 7.2. Market Analysis, Insights and Forecast - by Crop Typ

- 7.2.1. Food Crops/Cereals

- 7.2.2. Fruits

- 7.2.3. Vegetables

- 7.1. Market Analysis, Insights and Forecast - by Crop Typ

- 8. Europe Agriculture Market in Tanzania Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Crop Typ

- 8.1.1. Food Crops/Cereals

- 8.1.2. Fruits

- 8.1.3. Vegetables

- 8.2. Market Analysis, Insights and Forecast - by Crop Typ

- 8.2.1. Food Crops/Cereals

- 8.2.2. Fruits

- 8.2.3. Vegetables

- 8.1. Market Analysis, Insights and Forecast - by Crop Typ

- 9. Middle East & Africa Agriculture Market in Tanzania Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Crop Typ

- 9.1.1. Food Crops/Cereals

- 9.1.2. Fruits

- 9.1.3. Vegetables

- 9.2. Market Analysis, Insights and Forecast - by Crop Typ

- 9.2.1. Food Crops/Cereals

- 9.2.2. Fruits

- 9.2.3. Vegetables

- 9.1. Market Analysis, Insights and Forecast - by Crop Typ

- 10. Asia Pacific Agriculture Market in Tanzania Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Crop Typ

- 10.1.1. Food Crops/Cereals

- 10.1.2. Fruits

- 10.1.3. Vegetables

- 10.2. Market Analysis, Insights and Forecast - by Crop Typ

- 10.2.1. Food Crops/Cereals

- 10.2.2. Fruits

- 10.2.3. Vegetables

- 10.1. Market Analysis, Insights and Forecast - by Crop Typ

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Syngenta

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tanzania Horticultural Association (THA)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Tanzania Agricultural Development Bank

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Tanzania Fertilizer Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kilombero Plantations Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Rijk Zwaan

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Monsanto

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tanzania Breweries Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kilimanjaro Agro Inputs Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Tanzania Seed Trade Association (TASTA)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Syngenta

List of Figures

- Figure 1: Global Agriculture Market in Tanzania Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Tanzania Agriculture Market in Tanzania Revenue (Million), by Country 2024 & 2032

- Figure 3: Tanzania Agriculture Market in Tanzania Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Agriculture Market in Tanzania Revenue (Million), by Crop Typ 2024 & 2032

- Figure 5: North America Agriculture Market in Tanzania Revenue Share (%), by Crop Typ 2024 & 2032

- Figure 6: North America Agriculture Market in Tanzania Revenue (Million), by Crop Typ 2024 & 2032

- Figure 7: North America Agriculture Market in Tanzania Revenue Share (%), by Crop Typ 2024 & 2032

- Figure 8: North America Agriculture Market in Tanzania Revenue (Million), by Country 2024 & 2032

- Figure 9: North America Agriculture Market in Tanzania Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Agriculture Market in Tanzania Revenue (Million), by Crop Typ 2024 & 2032

- Figure 11: South America Agriculture Market in Tanzania Revenue Share (%), by Crop Typ 2024 & 2032

- Figure 12: South America Agriculture Market in Tanzania Revenue (Million), by Crop Typ 2024 & 2032

- Figure 13: South America Agriculture Market in Tanzania Revenue Share (%), by Crop Typ 2024 & 2032

- Figure 14: South America Agriculture Market in Tanzania Revenue (Million), by Country 2024 & 2032

- Figure 15: South America Agriculture Market in Tanzania Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Agriculture Market in Tanzania Revenue (Million), by Crop Typ 2024 & 2032

- Figure 17: Europe Agriculture Market in Tanzania Revenue Share (%), by Crop Typ 2024 & 2032

- Figure 18: Europe Agriculture Market in Tanzania Revenue (Million), by Crop Typ 2024 & 2032

- Figure 19: Europe Agriculture Market in Tanzania Revenue Share (%), by Crop Typ 2024 & 2032

- Figure 20: Europe Agriculture Market in Tanzania Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Agriculture Market in Tanzania Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa Agriculture Market in Tanzania Revenue (Million), by Crop Typ 2024 & 2032

- Figure 23: Middle East & Africa Agriculture Market in Tanzania Revenue Share (%), by Crop Typ 2024 & 2032

- Figure 24: Middle East & Africa Agriculture Market in Tanzania Revenue (Million), by Crop Typ 2024 & 2032

- Figure 25: Middle East & Africa Agriculture Market in Tanzania Revenue Share (%), by Crop Typ 2024 & 2032

- Figure 26: Middle East & Africa Agriculture Market in Tanzania Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa Agriculture Market in Tanzania Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Agriculture Market in Tanzania Revenue (Million), by Crop Typ 2024 & 2032

- Figure 29: Asia Pacific Agriculture Market in Tanzania Revenue Share (%), by Crop Typ 2024 & 2032

- Figure 30: Asia Pacific Agriculture Market in Tanzania Revenue (Million), by Crop Typ 2024 & 2032

- Figure 31: Asia Pacific Agriculture Market in Tanzania Revenue Share (%), by Crop Typ 2024 & 2032

- Figure 32: Asia Pacific Agriculture Market in Tanzania Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Agriculture Market in Tanzania Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Agriculture Market in Tanzania Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Agriculture Market in Tanzania Revenue Million Forecast, by Crop Typ 2019 & 2032

- Table 3: Global Agriculture Market in Tanzania Revenue Million Forecast, by Crop Typ 2019 & 2032

- Table 4: Global Agriculture Market in Tanzania Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Agriculture Market in Tanzania Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Global Agriculture Market in Tanzania Revenue Million Forecast, by Crop Typ 2019 & 2032

- Table 7: Global Agriculture Market in Tanzania Revenue Million Forecast, by Crop Typ 2019 & 2032

- Table 8: Global Agriculture Market in Tanzania Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Agriculture Market in Tanzania Revenue Million Forecast, by Crop Typ 2019 & 2032

- Table 13: Global Agriculture Market in Tanzania Revenue Million Forecast, by Crop Typ 2019 & 2032

- Table 14: Global Agriculture Market in Tanzania Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Brazil Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of South America Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Agriculture Market in Tanzania Revenue Million Forecast, by Crop Typ 2019 & 2032

- Table 19: Global Agriculture Market in Tanzania Revenue Million Forecast, by Crop Typ 2019 & 2032

- Table 20: Global Agriculture Market in Tanzania Revenue Million Forecast, by Country 2019 & 2032

- Table 21: United Kingdom Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Germany Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: France Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Italy Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Spain Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Russia Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Benelux Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Nordics Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Agriculture Market in Tanzania Revenue Million Forecast, by Crop Typ 2019 & 2032

- Table 31: Global Agriculture Market in Tanzania Revenue Million Forecast, by Crop Typ 2019 & 2032

- Table 32: Global Agriculture Market in Tanzania Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Turkey Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Israel Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: GCC Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: North Africa Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: South Africa Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Middle East & Africa Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Agriculture Market in Tanzania Revenue Million Forecast, by Crop Typ 2019 & 2032

- Table 40: Global Agriculture Market in Tanzania Revenue Million Forecast, by Crop Typ 2019 & 2032

- Table 41: Global Agriculture Market in Tanzania Revenue Million Forecast, by Country 2019 & 2032

- Table 42: China Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: India Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Japan Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: South Korea Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: ASEAN Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Oceania Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Asia Pacific Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Agriculture Market in Tanzania?

The projected CAGR is approximately 5.63%.

2. Which companies are prominent players in the Agriculture Market in Tanzania?

Key companies in the market include Syngenta , Tanzania Horticultural Association (THA) , Tanzania Agricultural Development Bank , Tanzania Fertilizer Company , Kilombero Plantations Ltd , Rijk Zwaan , Monsanto , Tanzania Breweries Limited , Kilimanjaro Agro Inputs Ltd , Tanzania Seed Trade Association (TASTA).

3. What are the main segments of the Agriculture Market in Tanzania?

The market segments include Crop Typ, Crop Typ.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.44 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Technology in Horticulture; Government Initiatives for Self-reliance in Vegetable and Fruit Farming.

6. What are the notable trends driving market growth?

Favorable Government Policies Supporting the Market Growth.

7. Are there any restraints impacting market growth?

Limited Resource Availability and Unfavourable Climatic Condition; Increasing Reliance on Imports for Domestic Supply.

8. Can you provide examples of recent developments in the market?

September 2022: Tanzania's Ministry of Agriculture directed the Tanzania Agriculture Research Institute (TARI) to find a location for genetically engineered (GE) crop trials. This decision appeared to overturn the Tanzanian government's (GoT) 2021 ban on all GE crop research trials.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Agriculture Market in Tanzania," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Agriculture Market in Tanzania report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Agriculture Market in Tanzania?

To stay informed about further developments, trends, and reports in the Agriculture Market in Tanzania, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence