Key Insights

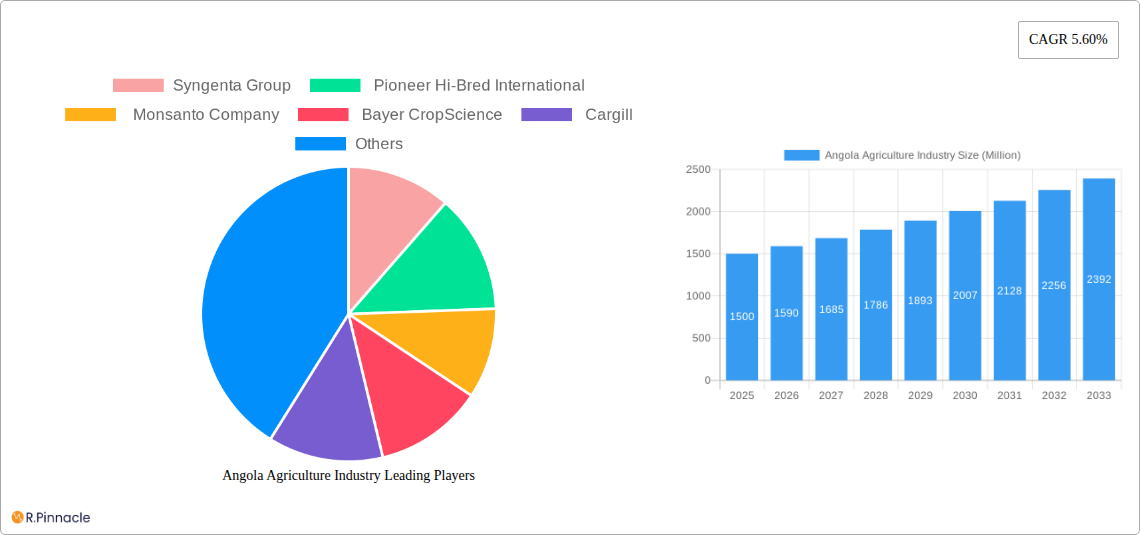

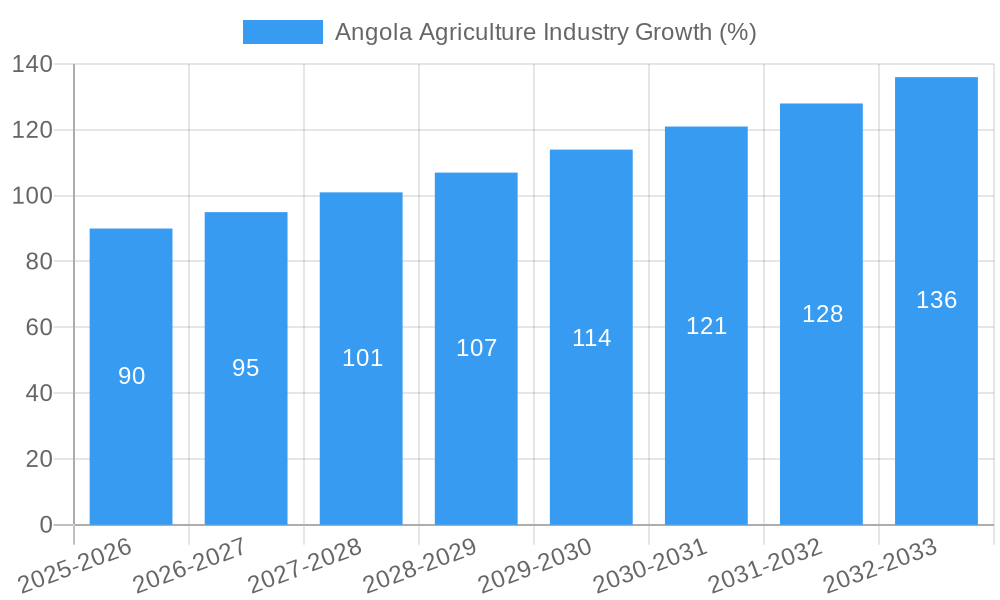

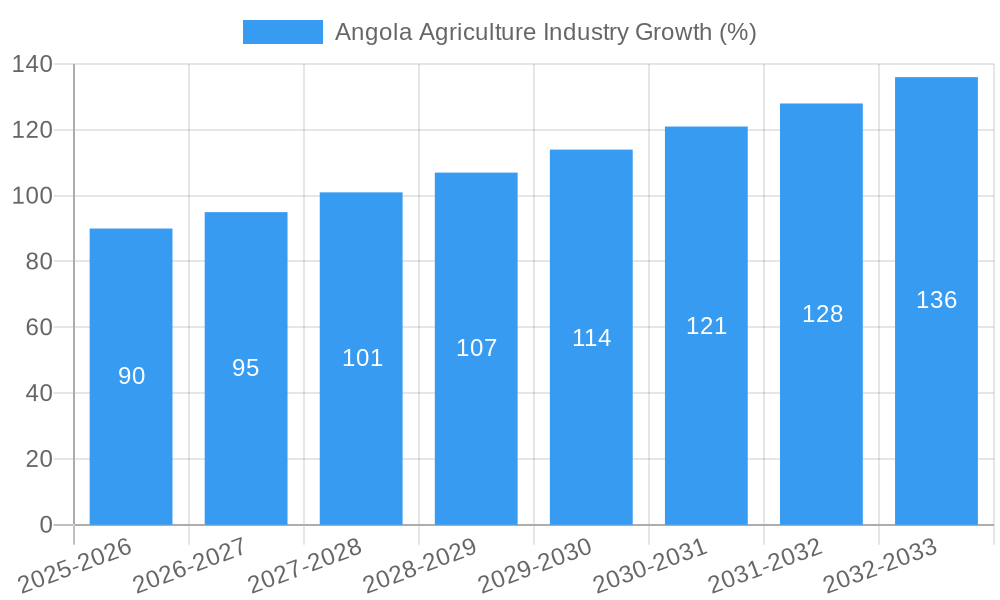

The Angolan agriculture industry, while possessing significant untapped potential, currently faces challenges hindering its full contribution to the national economy. The market size, estimated at $1.5 billion in 2025, is projected to experience a Compound Annual Growth Rate (CAGR) of 5.6% from 2025 to 2033, reaching an estimated $2.5 billion by 2033. This growth is driven by increasing domestic demand for food, spurred by a growing population and urbanization, coupled with government initiatives promoting agricultural diversification and improved farming techniques. Key drivers include investments in irrigation infrastructure, the expansion of arable land, and the introduction of improved crop varieties. However, significant constraints remain, including limited access to finance and technology for smallholder farmers, inadequate storage and transportation facilities leading to post-harvest losses, and the impact of climate change on crop yields. The industry is segmented by crop type (cereal crops like maize and rice holding the largest share, followed by oilseeds, fruits, and vegetables) and application (consumption being the primary driver, followed by processing and export). Major players include both international companies (adapting their strategies to the local context) and domestic agricultural businesses. The focus on improving efficiency across the value chain, attracting foreign investment, and empowering local farmers is crucial for realizing the sector's growth potential.

Successful navigation of these challenges will require a multi-pronged approach. This includes targeted investments in research and development to enhance crop productivity and resilience, improved access to credit and agricultural extension services for farmers, development of robust market infrastructure to reduce post-harvest losses, and policies that encourage private sector participation and foreign direct investment. Furthermore, addressing climate change impacts through sustainable agricultural practices and promoting value addition through processing and export will be essential for unlocking the long-term growth and economic benefits of the Angolan agricultural sector. By focusing on these key areas, Angola can transform its agriculture industry into a significant driver of economic growth and food security.

Angola Agriculture Industry: Market Analysis & Forecast Report (2019-2033)

Unlocking the Potential of Angola's Agricultural Sector: A Comprehensive Market Analysis

This comprehensive report provides an in-depth analysis of the Angola agriculture industry, offering invaluable insights for industry professionals, investors, and policymakers. The report covers the period from 2019 to 2033, with a focus on market dynamics, key players, and future growth prospects. The study reveals a market poised for significant expansion, driven by technological advancements, supportive government policies, and increasing consumer demand. With a projected market size exceeding xx Million by 2033, Angola presents a compelling investment opportunity within the agricultural sector. This report provides the crucial data and analysis necessary to navigate this dynamic landscape.

Angola Agriculture Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory environment of Angola's agriculture sector. The market is characterized by a mix of large multinational corporations and smaller local players.

Market Concentration: The market exhibits moderate concentration, with key players like Syngenta Group, Pioneer Hi-Bred International, Monsanto Company, Bayer CropScience, and Cargill holding significant market share, estimated collectively at xx%. However, numerous smaller, local businesses also contribute to the overall market activity.

Innovation Drivers: Technological advancements in seed genetics, precision farming, and crop protection are driving innovation within the sector. Government initiatives focused on agricultural modernization and investment in research and development (R&D) further contribute to this positive trend.

Regulatory Framework: The regulatory landscape is evolving, with increasing emphasis on sustainable agricultural practices and food safety regulations. These regulations, while potentially creating short-term challenges, ultimately create a more standardized and sustainable environment for long-term growth.

Product Substitutes: Limited availability of substitutes for staple crops restricts significant market disruption from alternatives.

End-User Demographics: The majority of end-users are local farmers, with a growing segment of larger-scale commercial operations emerging.

M&A Activities: While precise figures on M&A deal values are unavailable currently (xx Million), the sector has witnessed an increasing number of mergers and acquisitions, largely driven by larger companies seeking to expand their market presence and access local expertise.

Angola Agriculture Industry Market Dynamics & Trends

Angola's agriculture industry is experiencing robust growth, driven by several key factors. The compound annual growth rate (CAGR) for the period 2025-2033 is projected at xx%, indicating substantial market expansion. This growth is propelled by increased domestic demand, coupled with growing export opportunities. Technological disruptions, such as the adoption of precision agriculture techniques, further enhance productivity and efficiency. Government initiatives aimed at improving agricultural infrastructure, including irrigation systems and storage facilities, are also contributing factors. Furthermore, evolving consumer preferences, particularly toward higher-quality and processed food products, are stimulating market growth. Competitive dynamics are characterized by both collaboration and competition, with larger companies investing in local partnerships while simultaneously competing for market share. Market penetration of improved seed varieties and fertilizers is steadily increasing, further stimulating output. The report offers specific figures for these market parameters within its detailed analysis.

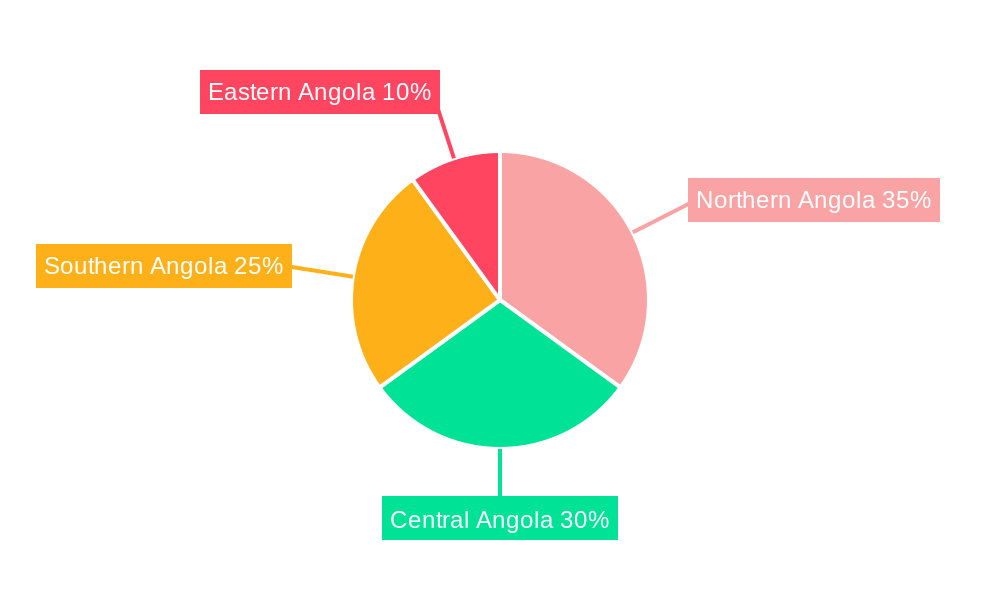

Dominant Regions & Segments in Angola Agriculture Industry

The report identifies key regions and segments within the Angolan agricultural landscape based on crop type and application.

By Crop Type:

Cereal Crops: Maize, rice, and wheat represent the dominant segment, driven by high domestic consumption and relatively favorable growing conditions. Key growth drivers include government support programs aimed at boosting grain production, along with investments in improved seed varieties.

Oilseeds: Sunflower and soybean cultivation are increasingly important, fueled by growing demand for edible oils and the potential for export opportunities. Infrastructure development, including processing facilities, is crucial for this segment's future growth.

Fruits and Vegetables: This segment demonstrates significant growth potential, driven by increasing urbanization and changing consumer preferences. However, challenges remain in terms of post-harvest losses and inadequate cold storage infrastructure.

Others: Other crops contribute to the overall market diversity, with specific growth patterns dependent on factors like government policies and local market demands.

By Application:

Consumption: Direct consumption remains the primary application, reflecting the largely agrarian nature of the Angolan economy.

Processing: The processing sector is gradually expanding, driven by investments in food processing facilities and increasing demand for value-added products.

Export: Export opportunities are growing, although challenges remain in terms of logistical infrastructure and market access.

Angola Agriculture Industry Product Innovations

Recent years have witnessed notable advancements in agricultural technology within Angola. This includes the introduction of high-yielding seed varieties, improved fertilizers, and more efficient irrigation systems. These innovations contribute to increased crop yields, enhanced crop quality, and reduced reliance on traditional, less efficient practices. The ongoing adoption of precision agriculture techniques further enhances productivity and resource utilization, improving overall efficiency and sustainability within the sector.

Report Scope & Segmentation Analysis

This report segments the Angolan agriculture market by crop type (cereal crops, oilseeds, fruits, vegetables, others) and application (consumption, processing, export). Each segment is analyzed in terms of market size, growth projections, and competitive dynamics. The analysis reveals significant growth potential across various segments, highlighting the multifaceted nature of investment opportunities within the industry.

Key Drivers of Angola Agriculture Industry Growth

Several factors contribute to the growth of the Angolan agricultural industry: increased government investment in agricultural infrastructure, the introduction of improved farming techniques and technologies, and favorable climatic conditions for a range of crops. Furthermore, growing domestic demand, spurred by population growth and rising incomes, presents a significant opportunity for increased production and sales. Favorable government policies supporting agricultural development further propel the sector's advancement.

Challenges in the Angola Agriculture Industry Sector

The Angolan agricultural sector faces several challenges. Inadequate infrastructure, including poor road networks and limited storage facilities, hinders efficient transportation and post-harvest management. Access to credit and financing remains a constraint for many farmers, limiting investment in improved technology and practices. Furthermore, climate change poses a significant risk, impacting crop yields and overall productivity. These challenges, if not addressed effectively, could impede the sector's growth trajectory.

Emerging Opportunities in Angola Agriculture Industry

The Angolan agricultural sector presents numerous opportunities. Growing demand for processed foods creates potential for value addition and increased profitability. The expansion of export markets offers the chance to access larger consumer bases and higher revenue streams. Furthermore, investments in sustainable agricultural practices can enhance environmental sustainability and boost long-term profitability.

Leading Players in the Angola Agriculture Industry Market

- Syngenta Group

- Pioneer Hi-Bred International

- Monsanto Company

- Bayer CropScience

- Cargill

Key Developments in Angola Agriculture Industry Industry

- 2022: Government announces a significant investment program to improve irrigation infrastructure across key agricultural regions.

- 2023: Several large-scale agricultural projects initiated, focused on improving crop yields and enhancing export capabilities.

- 2024: Introduction of a new fertilizer subsidy program aimed at supporting smallholder farmers.

Future Outlook for Angola Agriculture Industry Market

The future outlook for Angola's agriculture industry remains positive. Continued government support, coupled with technological advancements and increasing private investment, is expected to drive significant growth. The sector is well-positioned to capitalize on increasing domestic demand and expanding export opportunities. The report concludes that Angola's agricultural sector presents a compelling investment opportunity, offering significant returns for those who can navigate the market's complexities and effectively capitalize on its growth potential.

Angola Agriculture Industry Segmentation

- 1. Cereals and Grains

- 2. Pulses and Oilseeds

- 3. Fruits and Vegetables

- 4. Commercial Crops

- 5. Cereals and Grains

- 6. Pulses and Oilseeds

- 7. Fruits and Vegetables

- 8. Commercial Crops

Angola Agriculture Industry Segmentation By Geography

- 1. Angola

Angola Agriculture Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Food Security Concerns; Inclination Toward a Healthy Lifestyle

- 3.3. Market Restrains

- 3.3.1. ; Unfavorable Climatic Conditions; Higher Market Entry Cost

- 3.4. Market Trends

- 3.4.1. Favorable Government Policies Encouraging Agricultural Production

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Angola Agriculture Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cereals and Grains

- 5.2. Market Analysis, Insights and Forecast - by Pulses and Oilseeds

- 5.3. Market Analysis, Insights and Forecast - by Fruits and Vegetables

- 5.4. Market Analysis, Insights and Forecast - by Commercial Crops

- 5.5. Market Analysis, Insights and Forecast - by Cereals and Grains

- 5.6. Market Analysis, Insights and Forecast - by Pulses and Oilseeds

- 5.7. Market Analysis, Insights and Forecast - by Fruits and Vegetables

- 5.8. Market Analysis, Insights and Forecast - by Commercial Crops

- 5.9. Market Analysis, Insights and Forecast - by Region

- 5.9.1. Angola

- 5.1. Market Analysis, Insights and Forecast - by Cereals and Grains

- 6. UAE Angola Agriculture Industry Analysis, Insights and Forecast, 2019-2031

- 7. South Africa Angola Agriculture Industry Analysis, Insights and Forecast, 2019-2031

- 8. Saudi Arabia Angola Agriculture Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of MEA Angola Agriculture Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Syngenta Group

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Pioneer Hi-Bred International

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Monsanto Company

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Bayer CropScience

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Cargill

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.1 Syngenta Group

List of Figures

- Figure 1: Angola Agriculture Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Angola Agriculture Industry Share (%) by Company 2024

List of Tables

- Table 1: Angola Agriculture Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Angola Agriculture Industry Revenue Million Forecast, by Cereals and Grains 2019 & 2032

- Table 3: Angola Agriculture Industry Revenue Million Forecast, by Pulses and Oilseeds 2019 & 2032

- Table 4: Angola Agriculture Industry Revenue Million Forecast, by Fruits and Vegetables 2019 & 2032

- Table 5: Angola Agriculture Industry Revenue Million Forecast, by Commercial Crops 2019 & 2032

- Table 6: Angola Agriculture Industry Revenue Million Forecast, by Cereals and Grains 2019 & 2032

- Table 7: Angola Agriculture Industry Revenue Million Forecast, by Pulses and Oilseeds 2019 & 2032

- Table 8: Angola Agriculture Industry Revenue Million Forecast, by Fruits and Vegetables 2019 & 2032

- Table 9: Angola Agriculture Industry Revenue Million Forecast, by Commercial Crops 2019 & 2032

- Table 10: Angola Agriculture Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 11: Angola Agriculture Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: UAE Angola Agriculture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: South Africa Angola Agriculture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Saudi Arabia Angola Agriculture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of MEA Angola Agriculture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Angola Agriculture Industry Revenue Million Forecast, by Cereals and Grains 2019 & 2032

- Table 17: Angola Agriculture Industry Revenue Million Forecast, by Pulses and Oilseeds 2019 & 2032

- Table 18: Angola Agriculture Industry Revenue Million Forecast, by Fruits and Vegetables 2019 & 2032

- Table 19: Angola Agriculture Industry Revenue Million Forecast, by Commercial Crops 2019 & 2032

- Table 20: Angola Agriculture Industry Revenue Million Forecast, by Cereals and Grains 2019 & 2032

- Table 21: Angola Agriculture Industry Revenue Million Forecast, by Pulses and Oilseeds 2019 & 2032

- Table 22: Angola Agriculture Industry Revenue Million Forecast, by Fruits and Vegetables 2019 & 2032

- Table 23: Angola Agriculture Industry Revenue Million Forecast, by Commercial Crops 2019 & 2032

- Table 24: Angola Agriculture Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Angola Agriculture Industry?

The projected CAGR is approximately 5.60%.

2. Which companies are prominent players in the Angola Agriculture Industry?

Key companies in the market include Syngenta Group , Pioneer Hi-Bred International, Monsanto Company , Bayer CropScience , Cargill.

3. What are the main segments of the Angola Agriculture Industry?

The market segments include Cereals and Grains, Pulses and Oilseeds, Fruits and Vegetables, Commercial Crops, Cereals and Grains, Pulses and Oilseeds, Fruits and Vegetables, Commercial Crops.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Food Security Concerns; Inclination Toward a Healthy Lifestyle.

6. What are the notable trends driving market growth?

Favorable Government Policies Encouraging Agricultural Production.

7. Are there any restraints impacting market growth?

; Unfavorable Climatic Conditions; Higher Market Entry Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Angola Agriculture Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Angola Agriculture Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Angola Agriculture Industry?

To stay informed about further developments, trends, and reports in the Angola Agriculture Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence