Key Insights

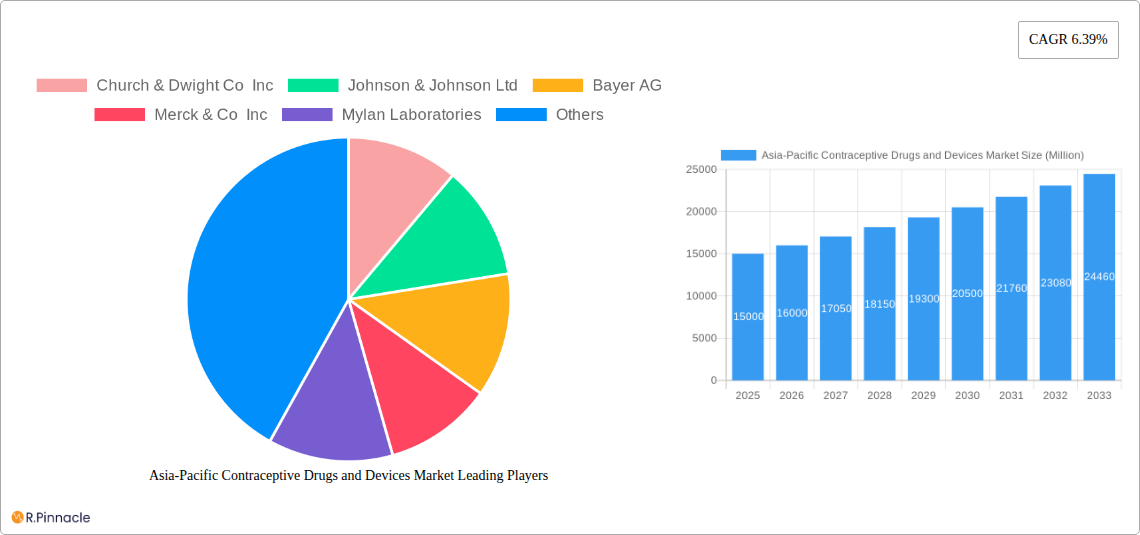

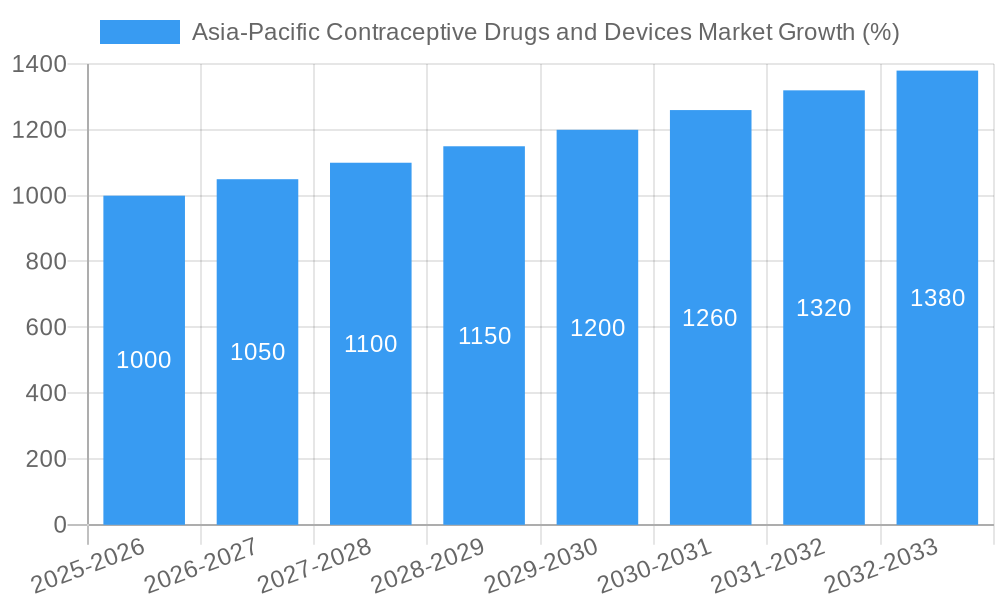

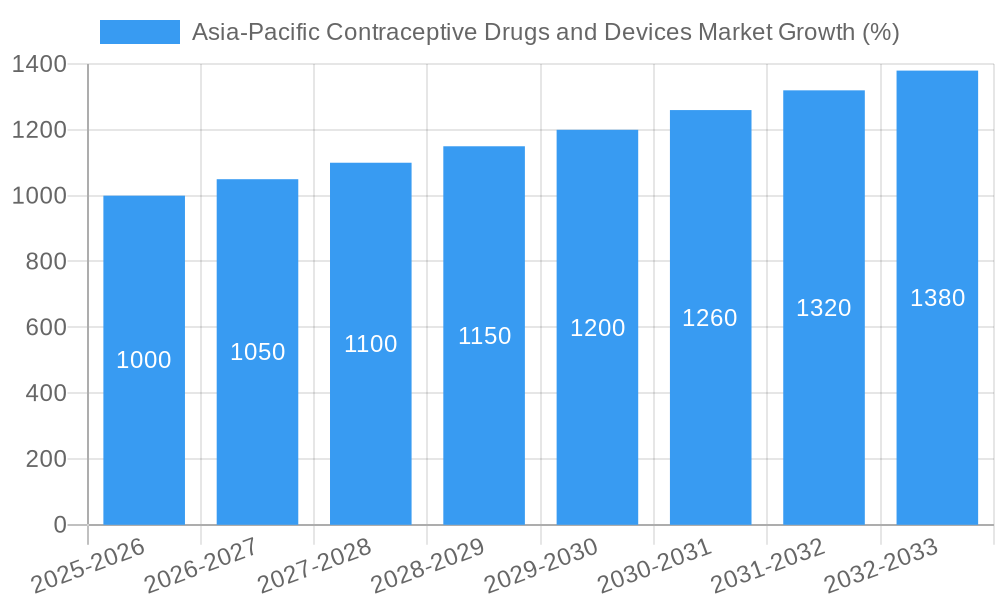

The Asia-Pacific contraceptive drugs and devices market is experiencing robust growth, driven by increasing awareness of family planning, rising urbanization, and government initiatives promoting reproductive health. The market's compound annual growth rate (CAGR) of 6.39% from 2019 to 2024 suggests a significant expansion, projected to continue through 2033. Key segments include contraceptive drugs (oral contraceptives, injectables, implants), and devices (intrauterine devices (IUDs), condoms, etc.). The market is largely fueled by high population growth in countries like India and China, alongside increasing female workforce participation and education levels, which correlate with greater access to and demand for contraceptives. Furthermore, advancements in contraceptive technology, offering more convenient and effective options, are contributing to market expansion. While challenges exist, such as cultural and religious barriers to contraceptive use in certain regions, and inconsistencies in access to healthcare, the overall trajectory points towards sustained growth. The major players, including Church & Dwight, Johnson & Johnson, Bayer, and others, are strategically investing in research and development, expanding their product portfolios, and exploring new distribution channels to capitalize on this burgeoning market. Competition is expected to intensify, leading to innovation and more affordable options for consumers.

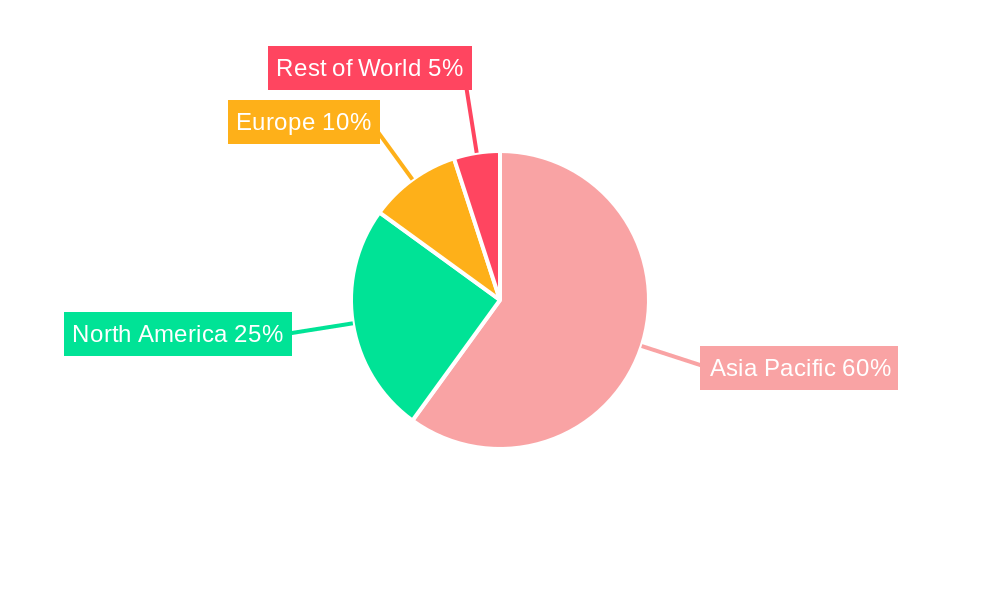

The regional breakdown reveals significant market potential within the Asia-Pacific region, particularly in countries like India, China, and Japan, which are characterized by large populations and evolving demographics. Growth is further spurred by rising disposable incomes and improved healthcare infrastructure in several parts of the region. However, heterogeneity across the region necessitates tailored marketing strategies considering differing cultural norms, healthcare systems, and levels of awareness regarding contraceptive methods. The market is segmented by product type (drugs versus devices), specific contraceptive types (e.g., injectables, IUDs), and gender. This segmentation highlights the diverse needs and preferences of the target market, offering opportunities for companies to develop specialized products and services. The continued expansion of the market is largely dependent on sustained government support, improved access to healthcare, and increased public awareness campaigns focused on family planning.

Asia-Pacific Contraceptive Drugs and Devices Market: A Comprehensive Report (2019-2033)

This meticulously researched report provides a deep dive into the Asia-Pacific contraceptive drugs and devices market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Spanning the period from 2019 to 2033, with a focus on the 2025-2033 forecast, this report analyzes market dynamics, competitive landscapes, and emerging opportunities across various segments. The report leverages extensive data analysis to present actionable intelligence, enabling informed strategic planning. Key market segments including drugs, injectables, and devices, categorized by gender (male and female), are comprehensively examined. The report's findings are supported by robust data and projections, making it an indispensable resource for navigating this dynamic market.

Asia-Pacific Contraceptive Drugs and Devices Market Market Structure & Innovation Trends

This section analyzes the market structure, focusing on concentration, innovation drivers, regulatory landscapes, and competitive activities within the Asia-Pacific region. We examine the market share held by key players like Johnson & Johnson Ltd, Bayer AG, and Pfizer Inc., alongside emerging companies. The report details M&A activities, including deal values (where available), and their impact on market consolidation. We delve into the influence of regulatory frameworks on innovation, highlighting the role of government policies and initiatives in shaping market growth. The analysis includes an assessment of product substitutes and their potential impact on market share distribution. Finally, we explore end-user demographics and their evolving preferences influencing market demand.

- Market Concentration: The Asia-Pacific contraceptive drugs and devices market exhibits a moderately concentrated structure, with a few multinational corporations holding significant market share. However, the presence of numerous regional players contributes to a dynamic competitive landscape. xx% of the market is controlled by the top 5 players in 2025.

- Innovation Drivers: Increasing awareness of family planning, government initiatives promoting reproductive health, and technological advancements in contraceptive methods are key drivers of innovation.

- Regulatory Frameworks: Varied regulatory environments across different countries in the Asia-Pacific region influence product approvals and market access. Harmonization of regulations is a significant ongoing challenge.

- Product Substitutes: The availability of alternative contraceptive methods, including natural family planning and traditional practices, influences market demand for pharmaceutical and device-based contraceptives.

- M&A Activities: The past five years have witnessed several mergers and acquisitions, with deal values totaling approximately xx Million USD, largely driven by consolidation efforts and expansion into new markets. Examples include (specific M&A deals and values if available).

Asia-Pacific Contraceptive Drugs and Devices Market Market Dynamics & Trends

This section explores the key dynamics shaping the Asia-Pacific contraceptive drugs and devices market. We analyze growth drivers, including rising disposable incomes, increasing awareness of family planning, and government support for reproductive healthcare programs. The CAGR for the market is estimated at xx% during the forecast period (2025-2033). We also examine technological disruptions, such as the development of long-acting reversible contraceptives (LARCs) and digital health solutions, and their impact on market penetration. Consumer preferences, particularly regarding convenience, efficacy, and safety, are explored in detail. Finally, we analyze competitive dynamics, including pricing strategies, product differentiation, and marketing initiatives employed by key players. Market penetration for specific contraceptive types (e.g., IUDs, pills) will be detailed with specific data.

Dominant Regions & Segments in Asia-Pacific Contraceptive Drugs and Devices Market

This section identifies the leading regions, countries, and market segments within the Asia-Pacific contraceptive drugs and devices market.

- By Product (Drugs & Devices): The segment analysis details the market share and growth projections for both contraceptive drugs and devices. Data will show the dominance of one segment over the other, with reasons explained.

- By Contraceptive Injectable: This section focuses on injectable contraceptives, exploring market size, growth drivers, and challenges specific to this segment.

- By Gender (Male & Female): The report analyzes the demand for contraceptives across different genders, focusing on the factors driving the growth of each segment. Differences in access and utilization patterns will be highlighted.

- Dominant Regions: [Specific Region] is projected to be the dominant region, driven by factors including [specific drivers, e.g., rising urbanization, government initiatives, economic growth]. Detailed analysis of key countries within this region will be provided. Factors such as increasing healthcare spending and improved access to healthcare will be examined.

Asia-Pacific Contraceptive Drugs and Devices Market Product Innovations

Recent years have witnessed significant product innovations in the Asia-Pacific contraceptive drugs and devices market. These include the development of more effective and user-friendly contraceptives, such as next-generation IUDs and improved formulations of hormonal contraceptives. These innovations are driven by advancements in materials science, drug delivery systems, and digital health technologies. The market is witnessing the emergence of personalized contraceptive options tailored to individual needs and preferences, leading to improved compliance and efficacy.

Report Scope & Segmentation Analysis

This report comprehensively segments the Asia-Pacific contraceptive drugs and devices market based on product type (drugs, injectables, devices), gender (male, female), and geography. Each segment's market size, growth projections, and competitive dynamics are analyzed separately. The report provides detailed forecasts for each segment across the forecast period (2025-2033). The competitive landscape within each segment is analyzed, identifying key players and their market strategies.

Key Drivers of Asia-Pacific Contraceptive Drugs and Devices Market Growth

The growth of the Asia-Pacific contraceptive drugs and devices market is driven by several factors. Rising awareness of family planning and reproductive health, coupled with increased government support for family planning programs, plays a significant role. Furthermore, improving access to healthcare services, particularly in underserved communities, contributes to increased market demand. Economic growth and rising disposable incomes in several Asian countries enhance the affordability of contraceptive options.

Challenges in the Asia-Pacific Contraceptive Drugs and Devices Market Sector

The Asia-Pacific contraceptive drugs and devices market faces several challenges, including variations in regulatory frameworks across different countries, leading to complexities in product registration and distribution. Supply chain disruptions and logistical hurdles in reaching remote areas pose significant obstacles. Furthermore, affordability remains a key barrier to access, particularly for low-income populations. Competition among existing and new entrants also presents a dynamic challenge.

Emerging Opportunities in Asia-Pacific Contraceptive Drugs and Devices Market

The Asia-Pacific contraceptive drugs and devices market presents numerous opportunities for growth. The rising adoption of digital health solutions offers potential for improved access, particularly in rural areas. The development of novel contraceptives with enhanced efficacy and convenience creates significant market potential. Government initiatives to support family planning and reproductive health services open new avenues for market expansion. Increased focus on male contraceptives presents an untapped market segment.

Leading Players in the Asia-Pacific Contraceptive Drugs and Devices Market Market

- Church & Dwight Co Inc

- Johnson & Johnson Ltd

- Bayer AG

- Merck & Co Inc

- Mylan Laboratories

- CooperSurgical Inc

- Allergan PLC (now Abbvie)

- The Female Health Company

- Lupin Pharmaceuticals Ltd

- Pfizer Inc

Key Developments in Asia-Pacific Contraceptive Drugs and Devices Market Industry

- Jan 2023: Launch of a new long-acting reversible contraceptive (LARC) by [Company Name].

- May 2022: Acquisition of [Company A] by [Company B] expands market presence.

- Oct 2021: Government initiative launched to increase access to contraceptives in [Country Name].

- (Add further developments with specific dates and brief descriptions of impact)

Future Outlook for Asia-Pacific Contraceptive Drugs and Devices Market Market

The Asia-Pacific contraceptive drugs and devices market is poised for significant growth in the coming years, driven by continued improvements in healthcare infrastructure, increasing awareness of reproductive health, and the introduction of innovative contraceptive technologies. Strategic partnerships between pharmaceutical companies and government agencies will play a crucial role in enhancing market access and affordability. The focus on personalized medicine and digital health solutions will contribute to the market’s evolution. The increasing demand for long-acting reversible contraceptives and male contraceptives represents significant growth opportunities.

Asia-Pacific Contraceptive Drugs and Devices Market Segmentation

-

1. Product

-

1.1. By Drugs

- 1.1.1. Oral Contraceptives

- 1.1.2. Topical Contraceptives

- 1.1.3. Contraceptive Injectable

-

1.2. By Device

- 1.2.1. Condoms

- 1.2.2. Diaphragms

- 1.2.3. Cervical Caps

- 1.2.4. Sponges

- 1.2.5. Vaginal Rings

- 1.2.6. IUD

- 1.2.7. Other Devices

-

1.1. By Drugs

-

2. Gender

- 2.1. Male

- 2.2. Female

-

3. Geography

-

3.1. Asia-Pacific

- 3.1.1. China

- 3.1.2. Japan

- 3.1.3. India

- 3.1.4. Australia

- 3.1.5. South korea

- 3.1.6. Rest of Asia-Pacific

-

3.1. Asia-Pacific

Asia-Pacific Contraceptive Drugs and Devices Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. India

- 1.4. Australia

- 1.5. South korea

- 1.6. Rest of Asia Pacific

Asia-Pacific Contraceptive Drugs and Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.39% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Incidence of the STDs; Increasing Rate of Unintended Pregnancies; Rise in Government Initiatives

- 3.3. Market Restrains

- 3.3.1. ; High Cost of Devices and Treatment; Side Effects Associated with the Use of Contraceptive Drugs and Devices

- 3.4. Market Trends

- 3.4.1. Oral Contraceptive Segment is Expected to Hold the Largest Market Share in the Asia-Pacific Contraceptive Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Contraceptive Drugs and Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. By Drugs

- 5.1.1.1. Oral Contraceptives

- 5.1.1.2. Topical Contraceptives

- 5.1.1.3. Contraceptive Injectable

- 5.1.2. By Device

- 5.1.2.1. Condoms

- 5.1.2.2. Diaphragms

- 5.1.2.3. Cervical Caps

- 5.1.2.4. Sponges

- 5.1.2.5. Vaginal Rings

- 5.1.2.6. IUD

- 5.1.2.7. Other Devices

- 5.1.1. By Drugs

- 5.2. Market Analysis, Insights and Forecast - by Gender

- 5.2.1. Male

- 5.2.2. Female

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Asia-Pacific

- 5.3.1.1. China

- 5.3.1.2. Japan

- 5.3.1.3. India

- 5.3.1.4. Australia

- 5.3.1.5. South korea

- 5.3.1.6. Rest of Asia-Pacific

- 5.3.1. Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. China Asia-Pacific Contraceptive Drugs and Devices Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Contraceptive Drugs and Devices Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Contraceptive Drugs and Devices Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Contraceptive Drugs and Devices Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific Contraceptive Drugs and Devices Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Contraceptive Drugs and Devices Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Contraceptive Drugs and Devices Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Church & Dwight Co Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Johnson & Johnson Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Bayer AG

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Merck & Co Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Mylan Laboratories

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 CooperSurgical Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Allergan PLC

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 The Female Health Company*List Not Exhaustive

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Lupin Pharmaceuticals Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Pfizer Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Church & Dwight Co Inc

List of Figures

- Figure 1: Asia-Pacific Contraceptive Drugs and Devices Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Contraceptive Drugs and Devices Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Contraceptive Drugs and Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Contraceptive Drugs and Devices Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Asia-Pacific Contraceptive Drugs and Devices Market Revenue Million Forecast, by Gender 2019 & 2032

- Table 4: Asia-Pacific Contraceptive Drugs and Devices Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Asia-Pacific Contraceptive Drugs and Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Asia-Pacific Contraceptive Drugs and Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Asia-Pacific Contraceptive Drugs and Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Asia-Pacific Contraceptive Drugs and Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Asia-Pacific Contraceptive Drugs and Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Asia-Pacific Contraceptive Drugs and Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Taiwan Asia-Pacific Contraceptive Drugs and Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Asia-Pacific Contraceptive Drugs and Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Asia-Pacific Asia-Pacific Contraceptive Drugs and Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Asia-Pacific Contraceptive Drugs and Devices Market Revenue Million Forecast, by Product 2019 & 2032

- Table 15: Asia-Pacific Contraceptive Drugs and Devices Market Revenue Million Forecast, by Gender 2019 & 2032

- Table 16: Asia-Pacific Contraceptive Drugs and Devices Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Asia-Pacific Contraceptive Drugs and Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Asia-Pacific Contraceptive Drugs and Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Asia-Pacific Contraceptive Drugs and Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: India Asia-Pacific Contraceptive Drugs and Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Australia Asia-Pacific Contraceptive Drugs and Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: South korea Asia-Pacific Contraceptive Drugs and Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia Pacific Asia-Pacific Contraceptive Drugs and Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Contraceptive Drugs and Devices Market?

The projected CAGR is approximately 6.39%.

2. Which companies are prominent players in the Asia-Pacific Contraceptive Drugs and Devices Market?

Key companies in the market include Church & Dwight Co Inc, Johnson & Johnson Ltd, Bayer AG, Merck & Co Inc, Mylan Laboratories, CooperSurgical Inc, Allergan PLC, The Female Health Company*List Not Exhaustive, Lupin Pharmaceuticals Ltd, Pfizer Inc.

3. What are the main segments of the Asia-Pacific Contraceptive Drugs and Devices Market?

The market segments include Product, Gender, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Incidence of the STDs; Increasing Rate of Unintended Pregnancies; Rise in Government Initiatives.

6. What are the notable trends driving market growth?

Oral Contraceptive Segment is Expected to Hold the Largest Market Share in the Asia-Pacific Contraceptive Market.

7. Are there any restraints impacting market growth?

; High Cost of Devices and Treatment; Side Effects Associated with the Use of Contraceptive Drugs and Devices.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Contraceptive Drugs and Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Contraceptive Drugs and Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Contraceptive Drugs and Devices Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Contraceptive Drugs and Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence