Key Insights

The Asia-Pacific industrial centrifuge market is poised for substantial expansion, fueled by robust growth in the food and beverage, pharmaceutical, and water treatment sectors. With a projected Compound Annual Growth Rate (CAGR) of 7.4%, the market is expected to reach $1.33 billion by 2024. Key growth drivers include the escalating demand for efficient separation technologies, stringent environmental regulations, and increased infrastructure development, particularly in China, India, and Japan. The continuous operational mode segment leads the market due to its superior processing efficiency, while horizontal centrifuges are favored for their versatility and high capacity. Despite challenges like high initial investment, the long-term benefits of enhanced efficiency and reduced waste are driving adoption. Leading players like Alfa Laval and GEA Group AG are expected to maintain their dominance, alongside emerging opportunities for innovative startups. Government policies promoting industrial growth and sustainability will further accelerate market expansion, with China and India leading regional growth, followed by Japan and South Korea.

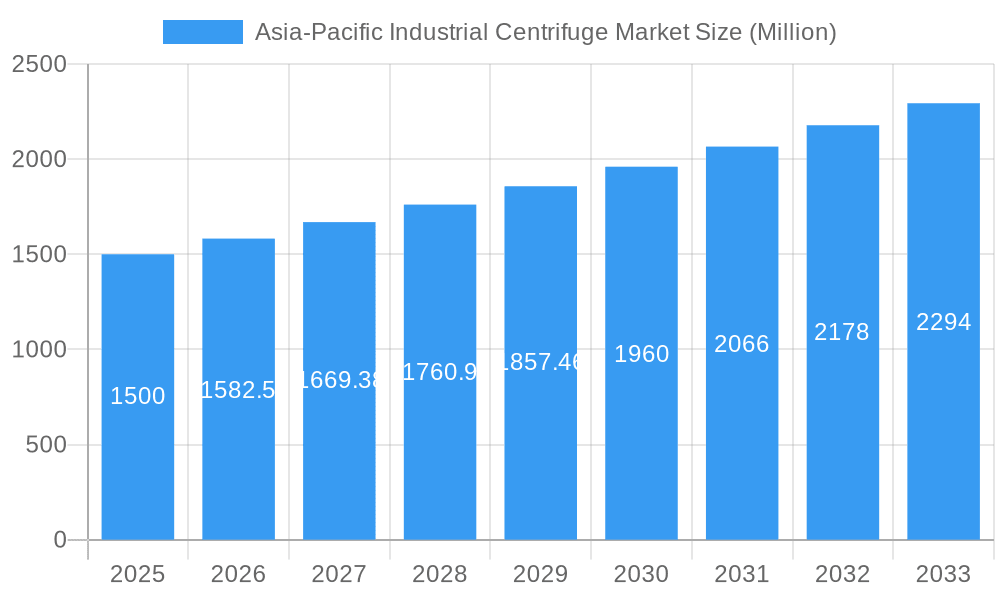

Asia-Pacific Industrial Centrifuge Market Market Size (In Billion)

Market segmentation highlights the diverse applications of industrial centrifuges across key industries. The food and beverage sector utilizes centrifuges for clarification and separation, driven by rising processed food consumption. The pharmaceutical industry relies on high-purity separation for drug manufacturing, stimulating demand for advanced centrifuge technologies. Water and wastewater treatment sectors require efficient equipment for sludge dewatering and purification. The metal and mining industry benefits from centrifuges for mineral processing, and the pulp and paper industry employs them for sludge removal. These varied industry applications, coupled with technological advancements, are propelling the growth of the Asia-Pacific industrial centrifuge market.

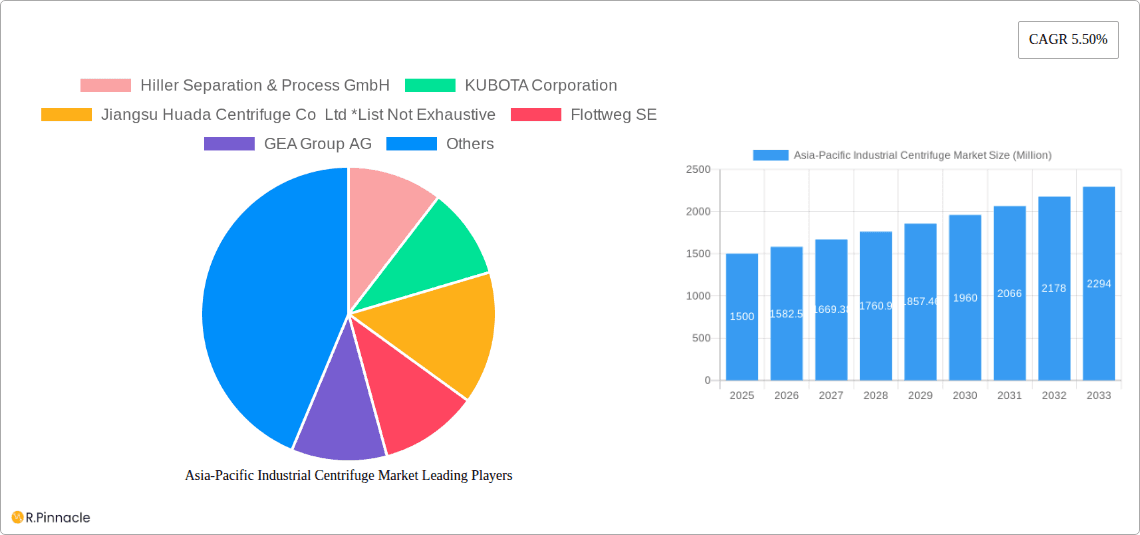

Asia-Pacific Industrial Centrifuge Market Company Market Share

Asia-Pacific Industrial Centrifuge Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Asia-Pacific Industrial Centrifuge Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with 2025 as the base and estimated year. The report forecasts market trends from 2025 to 2033, building upon historical data from 2019-2024. Expect in-depth analysis of market segmentation by industry, centrifuge type, design, and operation mode, alongside a competitive landscape review and future growth projections. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Asia-Pacific Industrial Centrifuge Market Structure & Innovation Trends

The Asia-Pacific industrial centrifuge market exhibits a moderately concentrated structure, with key players like Hiller Separation & Process GmbH, KUBOTA Corporation, Jiangsu Huada Centrifuge Co Ltd, Flottweg SE, GEA Group AG, Ace Industries India Pvt Ltd, TOMOE Engineering Co Ltd, Andritz AG, and Alfa Laval AB holding significant market share. However, the presence of several smaller, regional players indicates a dynamic competitive landscape.

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2025.

- Innovation Drivers: Stringent environmental regulations, increasing demand for efficient separation technologies across diverse industries, and advancements in automation and digitalization are driving innovation.

- Regulatory Frameworks: Government policies promoting industrial efficiency and sustainable practices influence market growth. Variations in regulations across different countries within the region impact market dynamics.

- Product Substitutes: Alternative separation techniques, such as filtration and decantation, compete with centrifuges, although centrifuges often offer superior efficiency and scalability in many applications.

- End-User Demographics: The market is driven by a diverse range of end-users, including the Food and Beverage, Pharmaceutical, Water and Wastewater Treatment, Chemical, Metal and Mining, Power, and Pulp and Paper industries. The growth of these industries directly impacts centrifuge demand.

- M&A Activities: The acquisition of Koki Holdings Co., Ltd.'s centrifugation business by Eppendorf in January 2022 illustrates the strategic importance of M&A in shaping the market landscape. The deal value was not publicly disclosed, but it signifies a move towards expanding product portfolios and market reach. Further M&A activity is anticipated to consolidate market share among key players and drive further innovation. The total value of M&A deals in the past five years is estimated at xx Million.

Asia-Pacific Industrial Centrifuge Market Dynamics & Trends

The Asia-Pacific industrial centrifuge market is experiencing robust growth, driven by several key factors. The increasing demand for efficient and cost-effective separation solutions across various industries, coupled with technological advancements in centrifuge design and operation, fuels market expansion. Growth is particularly strong in countries experiencing rapid industrialization and urbanization, with strong infrastructure investments further supporting market expansion. Consumer preference for higher-quality, sustainably produced goods drives the need for efficient separation technologies in numerous industrial processes. Competitive dynamics are characterized by innovation, product differentiation, and strategic partnerships. The market is expected to experience a compound annual growth rate (CAGR) of xx% during the forecast period (2025-2033), driven by increasing adoption of advanced centrifuge technologies in various sectors. Market penetration of advanced centrifuges, such as high-speed and automated models, is gradually increasing, particularly in developed economies within the region. Technological disruptions, such as the integration of IoT and AI for process optimization, further enhance market growth potential.

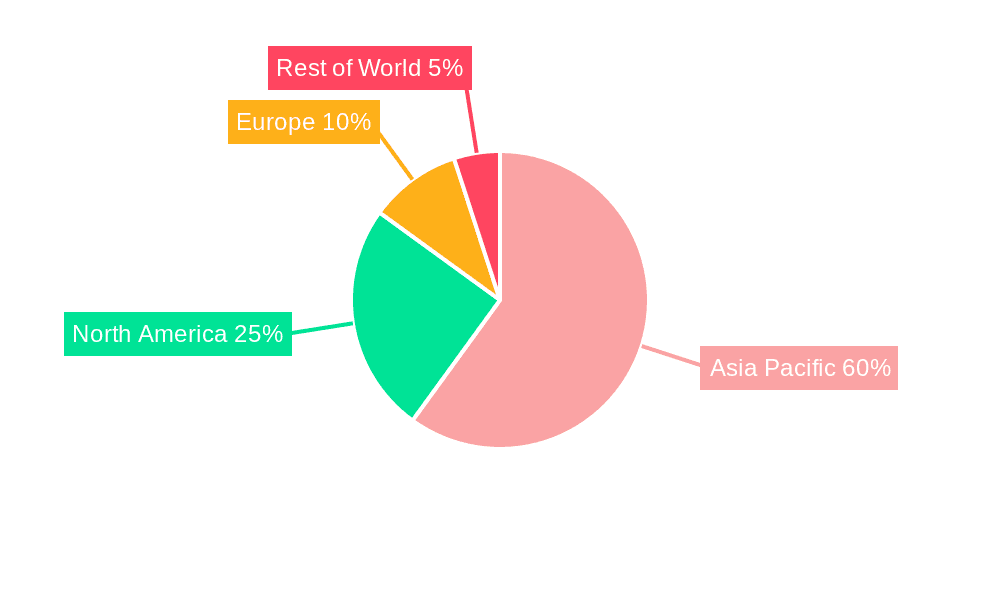

Dominant Regions & Segments in Asia-Pacific Industrial Centrifuge Market

China and India are leading the Asia-Pacific industrial centrifuge market, driven by rapid industrial growth and significant investments in infrastructure. Other countries with significant growth potential include South Korea, Japan, and Australia.

- Key Drivers for China and India:

- Rapid industrialization and urbanization

- Significant investments in infrastructure development

- Growing demand across various industries (Food & Beverage, Chemicals, Water Treatment)

- Favorable government policies supporting industrial growth

- Dominant Segments:

- Industry: The chemical and water & wastewater treatment sectors represent significant market segments due to the large volume of separation processes required. The Food and Beverage industry also shows steady growth due to increasing demand for processed foods and beverages.

- Type: Sedimentation centrifuges hold a larger market share due to their broad applications, but filtering centrifuges are experiencing significant growth driven by the increasing demand for high-purity products, particularly within the pharmaceutical and chemical sectors.

- Design: Horizontal centrifuges are more common in large-scale industrial processes due to their higher throughput capacity. Vertical centrifuges are favoured for smaller-scale operations and specialized applications.

- Operation Mode: Continuous centrifuges dominate the market due to their higher processing efficiency compared to batch centrifuges.

Asia-Pacific Industrial Centrifuge Market Product Innovations

Recent innovations focus on enhancing efficiency, automation, and sustainability. Manufacturers are integrating advanced control systems, improving material handling, and developing centrifuges with reduced energy consumption. These advancements cater to increasing demands for higher throughput, improved product quality, and reduced operational costs. The introduction of new materials for centrifuge construction is also driving innovation, leading to improved durability and extended lifespan. The market is witnessing a rise in specialized centrifuges designed for specific applications, such as those for processing biopharmaceuticals and handling hazardous materials.

Report Scope & Segmentation Analysis

This report segments the Asia-Pacific industrial centrifuge market across several key parameters:

- By Industry: Food and Beverage, Pharmaceutical, Water and Wastewater Treatment, Chemical, Metal and Mining, Power, Pulp and Paper, Others. Each segment is analyzed based on its market size, growth rate, and key drivers. The chemical industry is projected to exhibit the highest growth, followed by water and wastewater treatment.

- By Type: Sedimentation and Filtering. Sedimentation centrifuges are currently the larger segment, but filtering centrifuges are expected to grow faster due to increased demand for high-purity products.

- By Design: Horizontal and Vertical. Horizontal centrifuges hold a larger market share due to higher throughput capacity.

- By Operation Mode: Batch and Continuous. Continuous centrifuges are the dominant segment due to higher efficiency.

Each segment’s growth projections, market size, and competitive dynamics are extensively discussed.

Key Drivers of Asia-Pacific Industrial Centrifuge Market Growth

Several factors drive market growth: growing industrialization and urbanization across the Asia-Pacific region, increasing demand for efficient separation techniques in various industries, stringent environmental regulations promoting cleaner production, technological advancements leading to improved centrifuge efficiency and automation, and favorable government policies supporting industrial development. Investment in infrastructure projects also significantly boosts demand for industrial centrifuges in construction, mining, and water management.

Challenges in the Asia-Pacific Industrial Centrifuge Market Sector

The market faces challenges such as high initial investment costs for advanced centrifuges, fluctuating raw material prices, and the complexities of complying with diverse regulatory frameworks across different countries. Supply chain disruptions due to geopolitical events and global economic conditions can also impact market growth. Competition from alternative separation technologies and the need for skilled technicians to operate and maintain advanced equipment represent further challenges.

Emerging Opportunities in Asia-Pacific Industrial Centrifuge Market

Opportunities exist in developing countries with rapidly growing industrial sectors, and increasing demand for advanced centrifuge technologies in niche applications like biopharmaceuticals and nanomaterials processing. The integration of IoT and AI for process optimization presents significant growth potential. Sustainability initiatives focused on energy-efficient and environmentally friendly centrifuge designs are opening new avenues for market expansion.

Leading Players in the Asia-Pacific Industrial Centrifuge Market Market

- Hiller Separation & Process GmbH

- KUBOTA Corporation

- Jiangsu Huada Centrifuge Co Ltd

- Flottweg SE

- GEA Group AG

- Ace Industries India Pvt Ltd

- TOMOE Engineering Co Ltd

- Andritz AG

- Alfa Laval AB

Key Developments in Asia-Pacific Industrial Centrifuge Market Industry

- January 2022: Eppendorf acquired the centrifugation business of Koki Holdings Co., Ltd., expanding its centrifuge offerings and market reach.

- November 2021: The Weir Group plc introduced the Cavex 2 hydrocyclone, enhancing efficiency and capacity in mining and related industries.

Future Outlook for Asia-Pacific Industrial Centrifuge Market Market

The Asia-Pacific industrial centrifuge market is poised for continued growth, driven by technological advancements, increasing industrialization, and rising demand across various sectors. Strategic partnerships, product innovation, and expansion into emerging markets will be key success factors for companies in this dynamic industry. The focus on sustainability and energy efficiency will further shape future market trends, creating opportunities for companies offering advanced and eco-friendly centrifuge solutions.

Asia-Pacific Industrial Centrifuge Market Segmentation

-

1. Type

- 1.1. Sedimentaion

- 1.2. Filtering

-

2. Design

- 2.1. Horizontal Centrifuge

- 2.2. Vertical Centrifuge

-

3. Operation Mode

- 3.1. Batch

- 3.2. Continous

-

4. Industry

- 4.1. Food and Beverage

- 4.2. Pharmaceutical

- 4.3. Water and Wastewater Treatment

- 4.4. Chemical

- 4.5. Metal and Mining

- 4.6. Power

- 4.7. Pulp and Paper

- 4.8. Others

-

5. Geography

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. Rest of Asia-Pacific

Asia-Pacific Industrial Centrifuge Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Rest of Asia Pacific

Asia-Pacific Industrial Centrifuge Market Regional Market Share

Geographic Coverage of Asia-Pacific Industrial Centrifuge Market

Asia-Pacific Industrial Centrifuge Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Demand from the Downstream Industry

- 3.3. Market Restrains

- 3.3.1. 4.; Adoption of Renewable and Clean Energy Sources

- 3.4. Market Trends

- 3.4.1. Water and Wastewater Treatment Expected to be the Fastest Growing Market Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Industrial Centrifuge Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Sedimentaion

- 5.1.2. Filtering

- 5.2. Market Analysis, Insights and Forecast - by Design

- 5.2.1. Horizontal Centrifuge

- 5.2.2. Vertical Centrifuge

- 5.3. Market Analysis, Insights and Forecast - by Operation Mode

- 5.3.1. Batch

- 5.3.2. Continous

- 5.4. Market Analysis, Insights and Forecast - by Industry

- 5.4.1. Food and Beverage

- 5.4.2. Pharmaceutical

- 5.4.3. Water and Wastewater Treatment

- 5.4.4. Chemical

- 5.4.5. Metal and Mining

- 5.4.6. Power

- 5.4.7. Pulp and Paper

- 5.4.8. Others

- 5.5. Market Analysis, Insights and Forecast - by Geography

- 5.5.1. China

- 5.5.2. India

- 5.5.3. Japan

- 5.5.4. Rest of Asia-Pacific

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. China

- 5.6.2. India

- 5.6.3. Japan

- 5.6.4. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia-Pacific Industrial Centrifuge Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Sedimentaion

- 6.1.2. Filtering

- 6.2. Market Analysis, Insights and Forecast - by Design

- 6.2.1. Horizontal Centrifuge

- 6.2.2. Vertical Centrifuge

- 6.3. Market Analysis, Insights and Forecast - by Operation Mode

- 6.3.1. Batch

- 6.3.2. Continous

- 6.4. Market Analysis, Insights and Forecast - by Industry

- 6.4.1. Food and Beverage

- 6.4.2. Pharmaceutical

- 6.4.3. Water and Wastewater Treatment

- 6.4.4. Chemical

- 6.4.5. Metal and Mining

- 6.4.6. Power

- 6.4.7. Pulp and Paper

- 6.4.8. Others

- 6.5. Market Analysis, Insights and Forecast - by Geography

- 6.5.1. China

- 6.5.2. India

- 6.5.3. Japan

- 6.5.4. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. India Asia-Pacific Industrial Centrifuge Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Sedimentaion

- 7.1.2. Filtering

- 7.2. Market Analysis, Insights and Forecast - by Design

- 7.2.1. Horizontal Centrifuge

- 7.2.2. Vertical Centrifuge

- 7.3. Market Analysis, Insights and Forecast - by Operation Mode

- 7.3.1. Batch

- 7.3.2. Continous

- 7.4. Market Analysis, Insights and Forecast - by Industry

- 7.4.1. Food and Beverage

- 7.4.2. Pharmaceutical

- 7.4.3. Water and Wastewater Treatment

- 7.4.4. Chemical

- 7.4.5. Metal and Mining

- 7.4.6. Power

- 7.4.7. Pulp and Paper

- 7.4.8. Others

- 7.5. Market Analysis, Insights and Forecast - by Geography

- 7.5.1. China

- 7.5.2. India

- 7.5.3. Japan

- 7.5.4. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Japan Asia-Pacific Industrial Centrifuge Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Sedimentaion

- 8.1.2. Filtering

- 8.2. Market Analysis, Insights and Forecast - by Design

- 8.2.1. Horizontal Centrifuge

- 8.2.2. Vertical Centrifuge

- 8.3. Market Analysis, Insights and Forecast - by Operation Mode

- 8.3.1. Batch

- 8.3.2. Continous

- 8.4. Market Analysis, Insights and Forecast - by Industry

- 8.4.1. Food and Beverage

- 8.4.2. Pharmaceutical

- 8.4.3. Water and Wastewater Treatment

- 8.4.4. Chemical

- 8.4.5. Metal and Mining

- 8.4.6. Power

- 8.4.7. Pulp and Paper

- 8.4.8. Others

- 8.5. Market Analysis, Insights and Forecast - by Geography

- 8.5.1. China

- 8.5.2. India

- 8.5.3. Japan

- 8.5.4. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of Asia Pacific Asia-Pacific Industrial Centrifuge Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Sedimentaion

- 9.1.2. Filtering

- 9.2. Market Analysis, Insights and Forecast - by Design

- 9.2.1. Horizontal Centrifuge

- 9.2.2. Vertical Centrifuge

- 9.3. Market Analysis, Insights and Forecast - by Operation Mode

- 9.3.1. Batch

- 9.3.2. Continous

- 9.4. Market Analysis, Insights and Forecast - by Industry

- 9.4.1. Food and Beverage

- 9.4.2. Pharmaceutical

- 9.4.3. Water and Wastewater Treatment

- 9.4.4. Chemical

- 9.4.5. Metal and Mining

- 9.4.6. Power

- 9.4.7. Pulp and Paper

- 9.4.8. Others

- 9.5. Market Analysis, Insights and Forecast - by Geography

- 9.5.1. China

- 9.5.2. India

- 9.5.3. Japan

- 9.5.4. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Hiller Separation & Process GmbH

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 KUBOTA Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Jiangsu Huada Centrifuge Co Ltd *List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Flottweg SE

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 GEA Group AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Ace Industries India Pvt Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 TOMOE Engineering Co Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Andritz AG

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Alfa Laval AB

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Hiller Separation & Process GmbH

List of Figures

- Figure 1: Asia-Pacific Industrial Centrifuge Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Industrial Centrifuge Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Industrial Centrifuge Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Industrial Centrifuge Market Revenue billion Forecast, by Design 2020 & 2033

- Table 3: Asia-Pacific Industrial Centrifuge Market Revenue billion Forecast, by Operation Mode 2020 & 2033

- Table 4: Asia-Pacific Industrial Centrifuge Market Revenue billion Forecast, by Industry 2020 & 2033

- Table 5: Asia-Pacific Industrial Centrifuge Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Asia-Pacific Industrial Centrifuge Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Asia-Pacific Industrial Centrifuge Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Asia-Pacific Industrial Centrifuge Market Revenue billion Forecast, by Design 2020 & 2033

- Table 9: Asia-Pacific Industrial Centrifuge Market Revenue billion Forecast, by Operation Mode 2020 & 2033

- Table 10: Asia-Pacific Industrial Centrifuge Market Revenue billion Forecast, by Industry 2020 & 2033

- Table 11: Asia-Pacific Industrial Centrifuge Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific Industrial Centrifuge Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Industrial Centrifuge Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Asia-Pacific Industrial Centrifuge Market Revenue billion Forecast, by Design 2020 & 2033

- Table 15: Asia-Pacific Industrial Centrifuge Market Revenue billion Forecast, by Operation Mode 2020 & 2033

- Table 16: Asia-Pacific Industrial Centrifuge Market Revenue billion Forecast, by Industry 2020 & 2033

- Table 17: Asia-Pacific Industrial Centrifuge Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: Asia-Pacific Industrial Centrifuge Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Asia-Pacific Industrial Centrifuge Market Revenue billion Forecast, by Type 2020 & 2033

- Table 20: Asia-Pacific Industrial Centrifuge Market Revenue billion Forecast, by Design 2020 & 2033

- Table 21: Asia-Pacific Industrial Centrifuge Market Revenue billion Forecast, by Operation Mode 2020 & 2033

- Table 22: Asia-Pacific Industrial Centrifuge Market Revenue billion Forecast, by Industry 2020 & 2033

- Table 23: Asia-Pacific Industrial Centrifuge Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Asia-Pacific Industrial Centrifuge Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific Industrial Centrifuge Market Revenue billion Forecast, by Type 2020 & 2033

- Table 26: Asia-Pacific Industrial Centrifuge Market Revenue billion Forecast, by Design 2020 & 2033

- Table 27: Asia-Pacific Industrial Centrifuge Market Revenue billion Forecast, by Operation Mode 2020 & 2033

- Table 28: Asia-Pacific Industrial Centrifuge Market Revenue billion Forecast, by Industry 2020 & 2033

- Table 29: Asia-Pacific Industrial Centrifuge Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: Asia-Pacific Industrial Centrifuge Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Industrial Centrifuge Market?

The projected CAGR is approximately 7.4%.

2. Which companies are prominent players in the Asia-Pacific Industrial Centrifuge Market?

Key companies in the market include Hiller Separation & Process GmbH, KUBOTA Corporation, Jiangsu Huada Centrifuge Co Ltd *List Not Exhaustive, Flottweg SE, GEA Group AG, Ace Industries India Pvt Ltd, TOMOE Engineering Co Ltd, Andritz AG, Alfa Laval AB.

3. What are the main segments of the Asia-Pacific Industrial Centrifuge Market?

The market segments include Type, Design, Operation Mode, Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.33 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Demand from the Downstream Industry.

6. What are the notable trends driving market growth?

Water and Wastewater Treatment Expected to be the Fastest Growing Market Segment.

7. Are there any restraints impacting market growth?

4.; Adoption of Renewable and Clean Energy Sources.

8. Can you provide examples of recent developments in the market?

January 2022: Eppendorf acquired the centrifugation business of Koki Holdings Co., Ltd., a Japanese company. With this acquisition, Eppendorf aims to expand its centrifuge offerings, such as the CP-NX and CS-(F)NX series ultracentrifuges. Furthermore, Eppendorf also launched various products, including the CP22N and CP30NX high-speed, floor-standing centrifuges, in 2021. These products have applications in biology, biochemistry, and the cell biology sector.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Industrial Centrifuge Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Industrial Centrifuge Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Industrial Centrifuge Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Industrial Centrifuge Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence