Key Insights

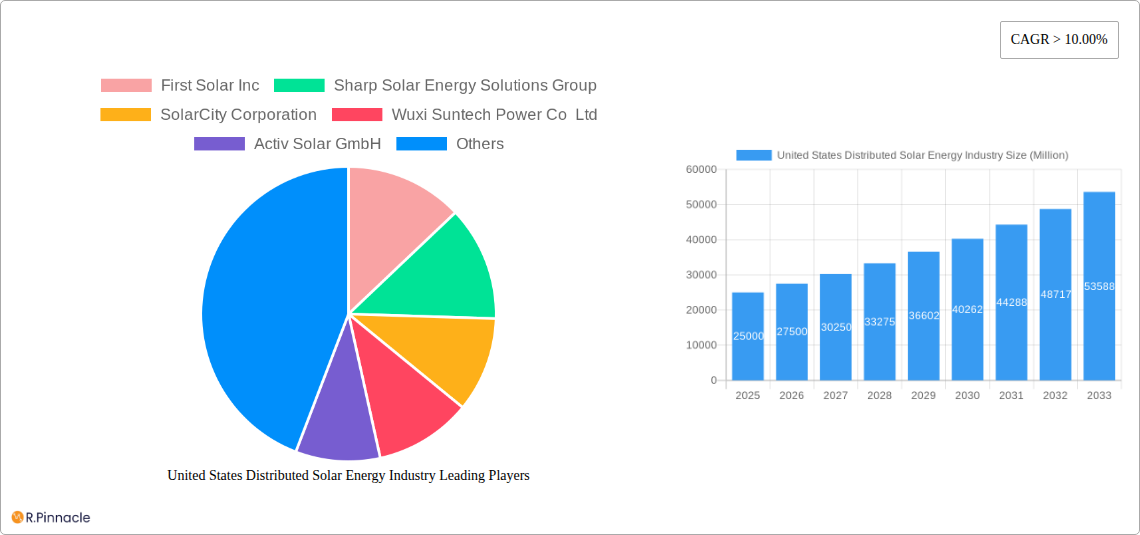

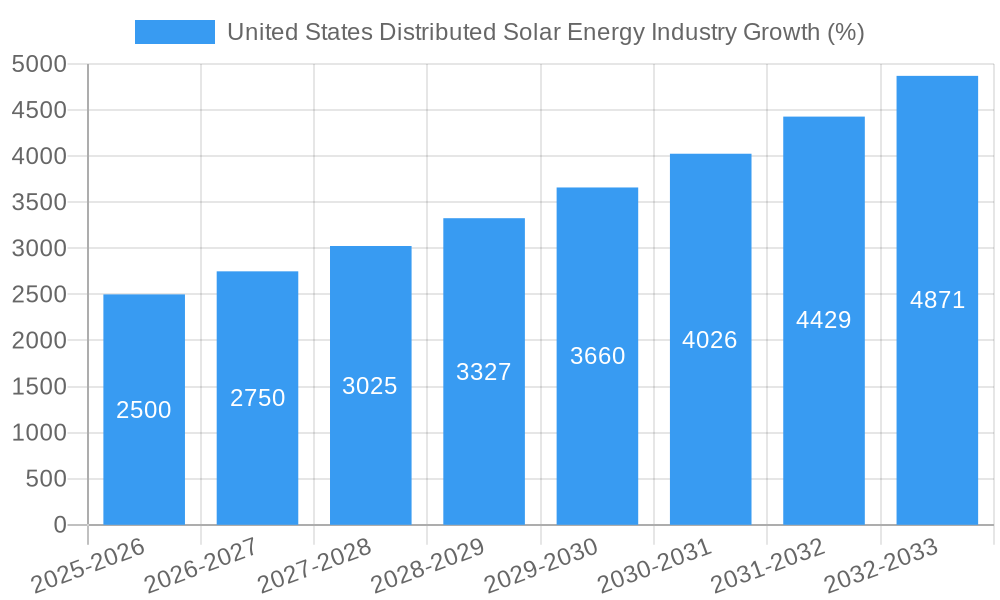

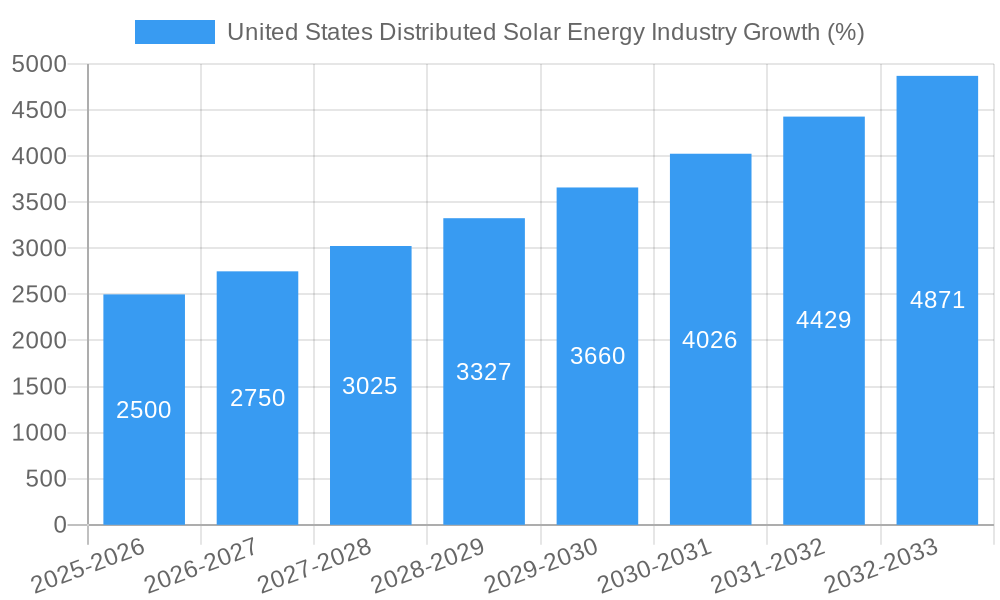

The United States distributed solar energy industry is experiencing robust growth, driven by increasing electricity costs, supportive government policies like tax incentives and net metering, and heightened environmental awareness among consumers and businesses. The market, valued at approximately $25 billion in 2025, is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 10% through 2033. This expansion is fueled by several key trends: a shift towards decentralized energy generation, decreasing solar panel costs, advancements in energy storage technologies like residential battery systems, and increasing adoption of off-grid solutions in remote areas. Significant growth is expected across all segments, with residential installations leading the charge, followed by commercial and industrial sectors. The residential segment benefits from readily available rooftops and decreasing installation costs, while the commercial and industrial segments are driven by corporate sustainability goals and cost savings from self-generated electricity. While challenges remain, such as grid integration complexities and intermittent solar power generation, ongoing technological advancements and government support are mitigating these constraints, ensuring sustained market expansion.

The leading players in this dynamic market include established international companies like First Solar, Canadian Solar, and JinkoSolar, alongside prominent US-based installers like SolarCity (now Tesla Energy) and regional players. Competition is fierce, spurring innovation and driving down prices, making distributed solar energy increasingly accessible. The industry's success hinges on continued technological improvements, particularly in energy storage and smart grid integration, along with sustained policy support and consumer awareness campaigns. Future growth will likely see increased adoption of hybrid systems (combining solar and other energy sources), integration with smart home technologies, and further development of financing options that make solar energy more affordable for a broader range of consumers. The ongoing development of community solar projects is also expected to contribute significantly to the market's growth by reducing the barrier to entry for customers who lack suitable rooftops.

United States Distributed Solar Energy Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the United States distributed solar energy industry, offering valuable insights for industry professionals, investors, and policymakers. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, technological advancements, and key players shaping the future of distributed solar energy in the US.

United States Distributed Solar Energy Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape, including market concentration, innovation drivers, regulatory frameworks, and M&A activities within the US distributed solar energy market. The historical period (2019-2024) and the base year (2025) provide context for the forecast period (2025-2033). We explore the influence of factors such as evolving government policies, technological breakthroughs (e.g., advancements in solar panel efficiency and energy storage), and the increasing adoption of renewable energy sources. Market share analysis for key players like First Solar Inc, Canadian Solar Inc, and Trina Solar Limited will be detailed. Furthermore, the report quantifies the impact of M&A activities, estimating the total value of deals (in Millions) closed during the study period. The analysis will also delve into the dynamics of product substitution, assessing the competitive pressures from emerging technologies and alternative energy solutions. End-user demographics—residential, commercial, and industrial—will be examined to identify key market segments and their growth trajectories.

United States Distributed Solar Energy Industry Market Dynamics & Trends

This section provides a comprehensive analysis of the market's growth trajectory, examining key drivers, technological disruptions, evolving consumer preferences, and competitive dynamics. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) will be presented, along with projections for market penetration across various segments. We will investigate factors driving market expansion, such as declining solar energy costs, increasing government incentives, and growing environmental awareness. This in-depth analysis will also explore how technological advancements, such as improvements in energy storage technologies and smart grid integration, are shaping the industry landscape. We will also discuss the impact of consumer preferences on the market, including the growing demand for aesthetically pleasing solar panel installations and the increasing adoption of energy storage solutions. The competitive dynamics, including the strategies employed by major players to gain market share, are meticulously dissected.

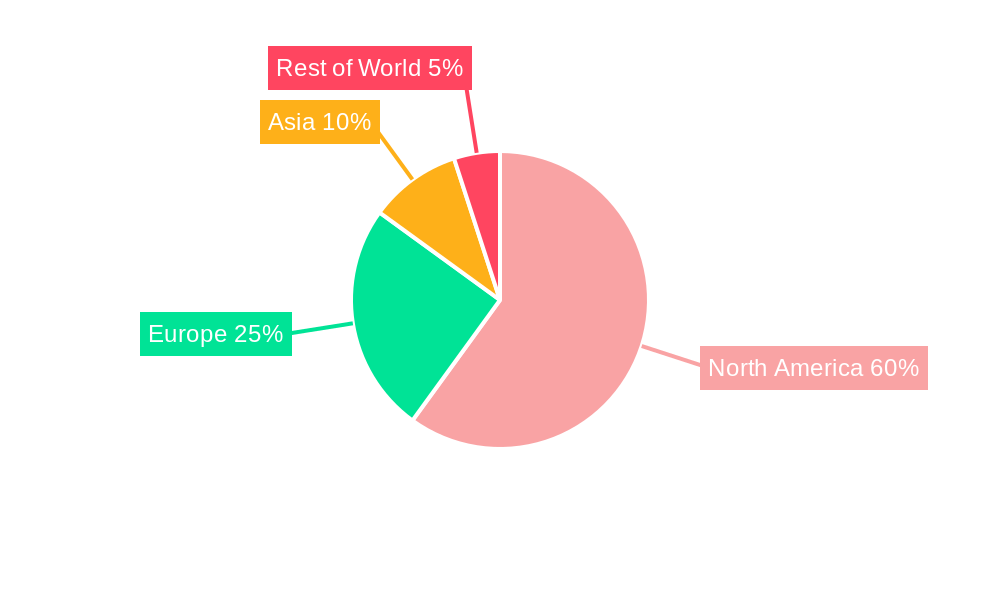

Dominant Regions & Segments in United States Distributed Solar Energy Industry

This section identifies the leading regions, countries, and market segments within the US distributed solar energy industry. We will detail the dominance analysis for each segment (Solar panels, energy storage systems; On-grid, off-grid; Residential, commercial, industrial).

- Key Drivers: The analysis will pinpoint the primary drivers of dominance within each segment. For example, supportive economic policies, robust infrastructure development, and favorable regulatory environments will be highlighted where applicable.

- Dominance Analysis: Detailed analysis will uncover the underlying factors contributing to the leading position of specific regions, countries, or segments. This includes assessing factors such as market size, growth rate, consumer adoption, and the presence of key players.

United States Distributed Solar Energy Industry Product Innovations

This section summarizes the recent product developments, applications, and competitive advantages within the US distributed solar energy market. Technological trends impacting product design, functionality, and market fit will be analyzed. We'll discuss the emergence of new product categories, improvements in existing products, and the competitive positioning of these innovations.

Report Scope & Segmentation Analysis

This section outlines the detailed segmentation of the US distributed solar energy market.

- Product: Solar panels, energy storage systems. Growth projections, market sizes, and competitive dynamics for each product segment will be detailed.

- System Type: On-grid, off-grid. Growth projections, market sizes, and competitive dynamics for each system type will be presented.

- End User: Residential, commercial, industrial. Growth projections, market sizes, and competitive dynamics for each end-user segment will be discussed.

Key Drivers of United States Distributed Solar Energy Industry Growth

This section will identify and analyze the key factors driving the growth of the US distributed solar energy industry. Technological advancements (e.g., increased efficiency of solar panels, improved battery storage), favorable economic conditions (e.g., government incentives, decreasing costs of solar energy), and supportive regulatory frameworks (e.g., net metering policies, renewable portfolio standards) will be detailed with specific examples.

Challenges in the United States Distributed Solar Energy Industry Sector

This section identifies and assesses the major challenges facing the US distributed solar energy industry. Regulatory hurdles (e.g., permitting processes, interconnection challenges), supply chain issues (e.g., material shortages, manufacturing bottlenecks), and intense competitive pressures (e.g., price competition, market saturation in certain segments) will be discussed, quantifying their impact on market growth where possible.

Emerging Opportunities in United States Distributed Solar Energy Industry

This section explores emerging trends and opportunities within the US distributed solar energy sector. Potential new markets (e.g., rural electrification, transportation electrification), innovative technologies (e.g., floating solar, building-integrated photovoltaics), and evolving consumer preferences (e.g., demand for energy independence, aesthetic appeal) will be highlighted.

Leading Players in the United States Distributed Solar Energy Industry Market

- First Solar Inc

- Sharp Solar Energy Solutions Group

- SolarCity Corporation (now Tesla)

- Wuxi Suntech Power Co Ltd

- Activ Solar GmbH

- Canadian Solar Inc

- Juwi Solar inc

- Yingli Solar

- JinkoSolar Holding Co Ltd

- Trina Solar Limited

Key Developments in United States Distributed Solar Energy Industry Industry

- Specific developments with year/month will be listed here. For example: [Month, Year]: Company X launched a new solar panel with xx% efficiency.

Future Outlook for United States Distributed Solar Energy Industry Market

This section summarizes the growth accelerators and strategic opportunities within the US distributed solar energy market, outlining the future market potential and predicting market size for the forecast period (2025-2033). We will address future technological advancements, policy changes, and consumer trends that will shape the industry’s trajectory. The overall outlook and potential for continued growth will be discussed.

United States Distributed Solar Energy Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

United States Distributed Solar Energy Industry Segmentation By Geography

- 1. United States

United States Distributed Solar Energy Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 10.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in Offshore Wind Power Projects4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adopting of Alternative Clean Energy Sources (Ex

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Clean Electricity

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Distributed Solar Energy Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 First Solar Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sharp Solar Energy Solutions Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SolarCity Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Wuxi Suntech Power Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Activ Solar GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Canadian Solar Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Juwi Solar inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Yingli Solar

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 JinkoSolar Holding Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Trina Solar Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 First Solar Inc

List of Figures

- Figure 1: United States Distributed Solar Energy Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Distributed Solar Energy Industry Share (%) by Company 2024

List of Tables

- Table 1: United States Distributed Solar Energy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Distributed Solar Energy Industry Volume gigawatt Forecast, by Region 2019 & 2032

- Table 3: United States Distributed Solar Energy Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: United States Distributed Solar Energy Industry Volume gigawatt Forecast, by Production Analysis 2019 & 2032

- Table 5: United States Distributed Solar Energy Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 6: United States Distributed Solar Energy Industry Volume gigawatt Forecast, by Consumption Analysis 2019 & 2032

- Table 7: United States Distributed Solar Energy Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 8: United States Distributed Solar Energy Industry Volume gigawatt Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 9: United States Distributed Solar Energy Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 10: United States Distributed Solar Energy Industry Volume gigawatt Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 11: United States Distributed Solar Energy Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: United States Distributed Solar Energy Industry Volume gigawatt Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: United States Distributed Solar Energy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 14: United States Distributed Solar Energy Industry Volume gigawatt Forecast, by Region 2019 & 2032

- Table 15: United States Distributed Solar Energy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United States Distributed Solar Energy Industry Volume gigawatt Forecast, by Country 2019 & 2032

- Table 17: United States Distributed Solar Energy Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 18: United States Distributed Solar Energy Industry Volume gigawatt Forecast, by Production Analysis 2019 & 2032

- Table 19: United States Distributed Solar Energy Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 20: United States Distributed Solar Energy Industry Volume gigawatt Forecast, by Consumption Analysis 2019 & 2032

- Table 21: United States Distributed Solar Energy Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 22: United States Distributed Solar Energy Industry Volume gigawatt Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 23: United States Distributed Solar Energy Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 24: United States Distributed Solar Energy Industry Volume gigawatt Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 25: United States Distributed Solar Energy Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 26: United States Distributed Solar Energy Industry Volume gigawatt Forecast, by Price Trend Analysis 2019 & 2032

- Table 27: United States Distributed Solar Energy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: United States Distributed Solar Energy Industry Volume gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Distributed Solar Energy Industry?

The projected CAGR is approximately > 10.00%.

2. Which companies are prominent players in the United States Distributed Solar Energy Industry?

Key companies in the market include First Solar Inc, Sharp Solar Energy Solutions Group, SolarCity Corporation, Wuxi Suntech Power Co Ltd, Activ Solar GmbH, Canadian Solar Inc, Juwi Solar inc, Yingli Solar, JinkoSolar Holding Co Ltd , Trina Solar Limited.

3. What are the main segments of the United States Distributed Solar Energy Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in Offshore Wind Power Projects4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Increasing Demand for Clean Electricity.

7. Are there any restraints impacting market growth?

4.; Increasing Adopting of Alternative Clean Energy Sources (Ex: Solar. Hydro).

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Distributed Solar Energy Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Distributed Solar Energy Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Distributed Solar Energy Industry?

To stay informed about further developments, trends, and reports in the United States Distributed Solar Energy Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence