Key Insights

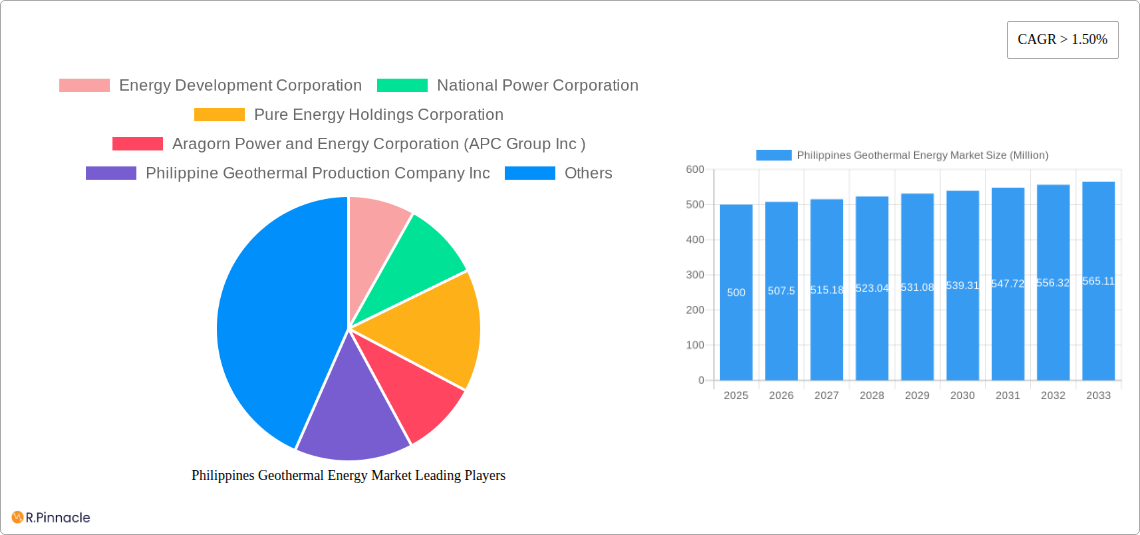

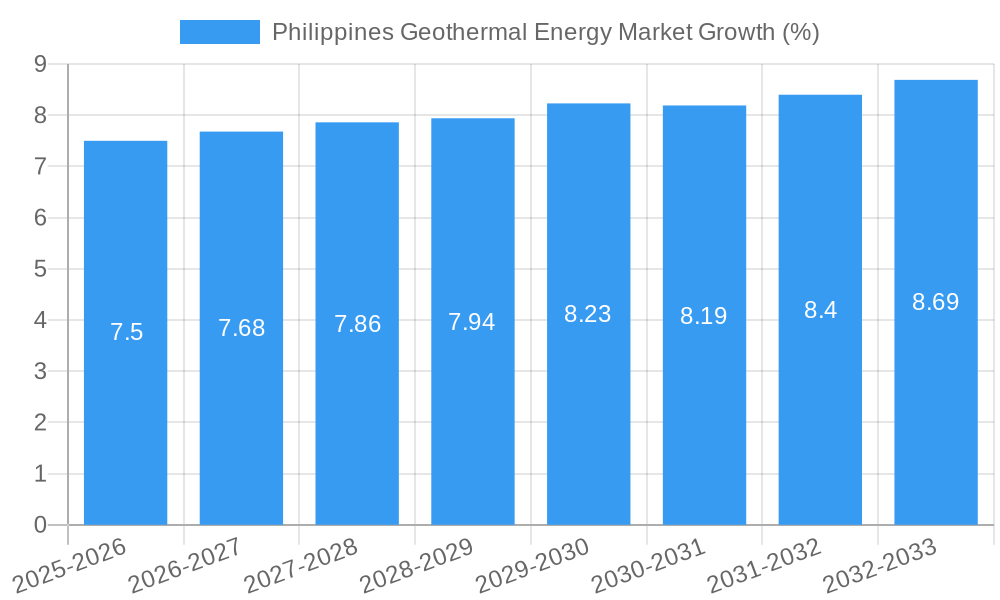

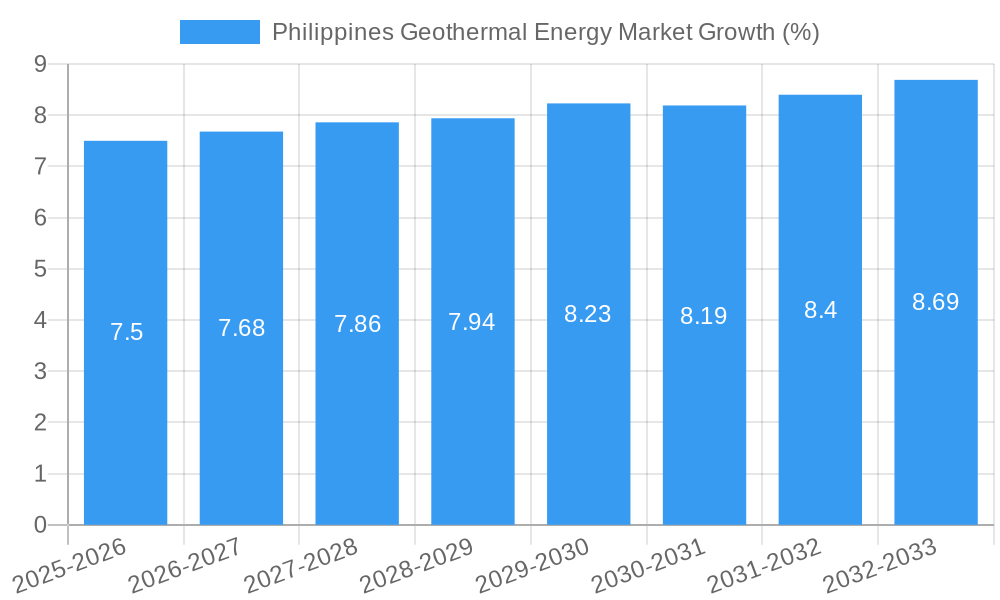

The Philippines Geothermal Energy Market, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 1.50%, presents a compelling investment opportunity. Driven by increasing electricity demand, government support for renewable energy initiatives, and the country's significant geothermal resources, the market is poised for substantial growth. The market is segmented by product type (dry steam, flash steam, and binary cycle plants) and end-user (power generation and direct use applications), with power generation currently dominating. Key players like Energy Development Corporation, National Power Corporation, and Aboitiz Power Corporation are actively contributing to the sector's expansion through investments in new capacity and technological advancements. While the market faces challenges such as high initial investment costs and geographical limitations, the long-term benefits of geothermal energy – its reliability, sustainability, and reduced carbon footprint – outweigh these concerns. The Asia-Pacific region, particularly the Philippines, is experiencing a surge in geothermal energy adoption fueled by a growing awareness of climate change and the need for energy security. This growth trajectory is expected to continue, particularly in regions with accessible geothermal resources and supportive government policies, leading to a considerable market expansion in the forecast period (2025-2033). The ongoing efforts to improve energy efficiency and the diversification of energy sources within the Philippines further solidify the long-term potential of the geothermal energy sector.

Given the 1.5% CAGR and a 2025 market size of XX million (which requires a concrete figure for further calculation), we can reasonably project future market sizes. Assuming a base market size of, for example, ₱500 million in 2025 (this figure is an illustrative example and should be replaced with the actual figure if available), the market size can be projected for subsequent years using the CAGR. The market is segmented into various product types and end-users, with power generation predicted to be the leading end-user sector. The continued government support for renewable energy and the country's inherent geothermal potential will ensure robust growth, despite challenges like the high capital investment required for new projects and the logistical difficulties of accessing geographically dispersed geothermal resources. Strategic partnerships and advancements in geothermal technology will play a pivotal role in overcoming these hurdles and unlocking further growth potential in the coming years.

Philippines Geothermal Energy Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Philippines geothermal energy market, offering actionable insights for industry professionals, investors, and policymakers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a crucial understanding of the market's current state and future trajectory. The report includes detailed segmentation analysis by product type (dry steam, flash steam, binary cycle) and end-user (power generation, direct use), along with profiles of key players such as Energy Development Corporation, National Power Corporation, and Pure Energy Holdings Corporation. The report also analyzes market dynamics, growth drivers, challenges, and emerging opportunities, providing a complete picture of this vital sector in the Philippines.

Philippines Geothermal Energy Market Market Structure & Innovation Trends

The Philippines geothermal energy market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share. Energy Development Corporation (EDC) holds a substantial portion, estimated at xx%, followed by National Power Corporation (NPC) with xx% and other significant players like Pure Energy Holdings Corporation and Aboitiz Power Corporation contributing to the remaining share. Market concentration is influenced by factors such as access to geothermal resources, investment capabilities, and regulatory frameworks.

Innovation in the sector is driven by the need for increased efficiency, reduced costs, and enhanced sustainability. Technological advancements, particularly in binary cycle technology and enhanced geothermal systems (EGS), are key drivers. Regulatory frameworks, such as the Renewable Energy Act of 2008, play a crucial role in incentivizing innovation and investment. Product substitutes, primarily fossil fuels and other renewable energy sources, pose a competitive threat, shaping market dynamics and encouraging continuous improvement. Mergers and acquisitions (M&A) activity, while not frequent, play a significant role in consolidating market share and accelerating technological advancements. Recent M&A deals, though limited in publicly available data, collectively value approximately xx Million. End-user demographics are largely driven by the power generation sector, with direct use applications steadily increasing.

Philippines Geothermal Energy Market Market Dynamics & Trends

The Philippines geothermal energy market is experiencing robust growth, driven by increasing energy demand, government support for renewable energy, and the country's significant geothermal resources. The market's Compound Annual Growth Rate (CAGR) is estimated to be xx% during the forecast period (2025-2033). This growth is fueled by several factors: rising electricity demand, particularly in rapidly urbanizing areas; supportive government policies, including feed-in tariffs and tax incentives, encouraging renewable energy adoption; and consistent efforts by energy companies to expand their geothermal portfolios.

Technological disruptions, including advancements in drilling technologies and the deployment of binary cycle power plants, further enhance the market's growth trajectory. The shift towards more sustainable and environmentally friendly energy sources has increased consumer preference for geothermal energy, driving demand. Competitive dynamics are characterized by both cooperation and competition amongst market players. Joint ventures and partnerships are common, reflecting a collaborative approach to developing and sharing resources. Simultaneously, competition exists in securing projects and optimizing production efficiency. Market penetration of geothermal energy in the overall power generation mix is currently at approximately xx%, projected to rise to xx% by 2033.

Dominant Regions & Segments in Philippines Geothermal Energy Market

The Luzon region holds a dominant position in the Philippines geothermal energy market, accounting for xx% of total installed capacity, primarily due to its rich geothermal resource base and established infrastructure. Other regions like Visayas and Mindanao are also witnessing increased activity, though at a slower pace.

- Key Drivers for Luzon's Dominance:

- High concentration of geothermal resources.

- Well-developed transmission infrastructure.

- Established presence of major geothermal energy companies.

- Proactive government support and policies.

Among the product types, flash steam technology currently holds the largest market share (xx%), followed by dry steam (xx%) and binary cycle (xx%). However, binary cycle is poised for significant growth due to its ability to utilize lower-temperature resources and higher efficiency. The power generation sector constitutes the largest end-user segment (xx%), driven by increasing electricity demand and government support for renewable energy. Direct use applications, while currently smaller, are expected to witness substantial growth due to its growing utilization in various industrial processes and agricultural applications.

Philippines Geothermal Energy Market Product Innovations

Recent advancements focus on improving efficiency and expanding the use of lower-temperature resources. Binary cycle technology has seen significant progress, allowing for the efficient extraction of energy from resources previously considered uneconomical. Enhanced Geothermal Systems (EGS) are also gaining traction, further broadening the potential for geothermal energy development. These innovations improve the market fit by making geothermal energy more competitive in terms of cost and viability in various regions.

Report Scope & Segmentation Analysis

This report segments the Philippines geothermal energy market by product type and end-user.

Product Type:

Dry Steam: This segment accounts for xx% of the market in 2025 and is projected to grow at a CAGR of xx% during the forecast period. Competition is moderate, with established players dominating.

Flash Steam: This segment holds a significant market share (xx% in 2025) and is expected to grow at a CAGR of xx%. Competitive dynamics are similar to the dry steam segment.

Binary Cycle: This segment represents a considerable growth opportunity, with a projected CAGR of xx%, rising from xx% market share in 2025. Increasing adoption of this technology is driving competition.

End-User:

Power Generation: This is the dominant end-user segment, accounting for xx% of the market in 2025 and projected to grow at a CAGR of xx%. High electricity demand fuels fierce competition in this segment.

Direct Use: This segment showcases substantial growth potential, with a projected CAGR of xx% from its current xx% market share in 2025. Increased adoption in industrial and agricultural processes is expected to drive competition.

Key Drivers of Philippines Geothermal Energy Market Growth

Several factors drive the growth of the Philippines geothermal energy market. Government policies promoting renewable energy, including attractive incentives and regulations, are creating a favorable environment for investment and development. The abundance of geothermal resources within the Philippines provides a sustainable and readily available energy source. Technological advancements are also contributing to enhanced efficiency and reduced costs, making geothermal energy more competitive. Finally, the increasing demand for cleaner and more sustainable energy sources aligns with the global push towards renewable energy adoption.

Challenges in the Philippines Geothermal Energy Market Sector

Challenges include the high initial investment costs associated with geothermal power plant development and the need for significant upfront infrastructure investment. Complex geological conditions in certain areas can also increase development risks and costs. Furthermore, securing the necessary permits and navigating regulatory processes can be time-consuming and challenging. These factors, coupled with potential competition from other renewable energy sources, represent barriers to faster market growth.

Emerging Opportunities in Philippines Geothermal Energy Market

Emerging opportunities lie in exploring and exploiting less-developed geothermal resources, particularly in areas outside Luzon. Advancements in Enhanced Geothermal Systems (EGS) offer the potential to tap into resources previously considered inaccessible. Furthermore, the expanding direct use applications of geothermal energy present new avenues for growth, as highlighted by potential use in agriculture and industrial processes.

Leading Players in the Philippines Geothermal Energy Market Market

- Energy Development Corporation (EDC)

- National Power Corporation

- Pure Energy Holdings Corporation

- Aragorn Power and Energy Corporation (APC Group Inc)

- Philippine Geothermal Production Company Inc

- Aboitiz Power Corporation

Key Developments in Philippines Geothermal Energy Market Industry

- October 2022: Energy Development Corp (EDC) partnered with Toshiba Energy Systems & Solutions Corp. and Toshiba (Philippines) Inc. to deliver a 20-MW flash geothermal power project in the southern region of Luzon. This collaboration demonstrates a commitment to expanding geothermal capacity and showcases the adoption of advanced technologies.

Future Outlook for Philippines Geothermal Energy Market Market

The Philippines geothermal energy market holds significant potential for continued growth. Government support, technological advancements, and increasing environmental awareness are expected to drive further expansion. Strategic investments in infrastructure development, coupled with exploration efforts to discover and utilize new resources, will play crucial roles in realizing the market's full potential. The focus on sustainable energy solutions suggests a bright outlook for the sector in the coming years.

Philippines Geothermal Energy Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Philippines Geothermal Energy Market Segmentation By Geography

- 1. Philippines

Philippines Geothermal Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 1.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Gas Production and Infrastructure4.; Increasing Exploration and Production Activities

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Clean Power Sources

- 3.4. Market Trends

- 3.4.1. Deep Geothermal Systems Expected to See Significant Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Philippines Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Philippines

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. China Philippines Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Philippines Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 8. India Philippines Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Philippines Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Philippines Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Philippines Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Philippines Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Energy Development Corporation

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 National Power Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Pure Energy Holdings Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Aragorn Power and Energy Corporation (APC Group Inc )

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Philippine Geothermal Production Company Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Aboitiz Power Corporation

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.1 Energy Development Corporation

List of Figures

- Figure 1: Philippines Geothermal Energy Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Philippines Geothermal Energy Market Share (%) by Company 2024

List of Tables

- Table 1: Philippines Geothermal Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Philippines Geothermal Energy Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 3: Philippines Geothermal Energy Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: Philippines Geothermal Energy Market Volume Gigawatt Forecast, by Production Analysis 2019 & 2032

- Table 5: Philippines Geothermal Energy Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 6: Philippines Geothermal Energy Market Volume Gigawatt Forecast, by Consumption Analysis 2019 & 2032

- Table 7: Philippines Geothermal Energy Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 8: Philippines Geothermal Energy Market Volume Gigawatt Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 9: Philippines Geothermal Energy Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 10: Philippines Geothermal Energy Market Volume Gigawatt Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 11: Philippines Geothermal Energy Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: Philippines Geothermal Energy Market Volume Gigawatt Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: Philippines Geothermal Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 14: Philippines Geothermal Energy Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 15: Philippines Geothermal Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Philippines Geothermal Energy Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 17: China Philippines Geothermal Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: China Philippines Geothermal Energy Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 19: Japan Philippines Geothermal Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Japan Philippines Geothermal Energy Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 21: India Philippines Geothermal Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: India Philippines Geothermal Energy Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 23: South Korea Philippines Geothermal Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea Philippines Geothermal Energy Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 25: Taiwan Philippines Geothermal Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Taiwan Philippines Geothermal Energy Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 27: Australia Philippines Geothermal Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Australia Philippines Geothermal Energy Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 29: Rest of Asia-Pacific Philippines Geothermal Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Asia-Pacific Philippines Geothermal Energy Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 31: Philippines Geothermal Energy Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 32: Philippines Geothermal Energy Market Volume Gigawatt Forecast, by Production Analysis 2019 & 2032

- Table 33: Philippines Geothermal Energy Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 34: Philippines Geothermal Energy Market Volume Gigawatt Forecast, by Consumption Analysis 2019 & 2032

- Table 35: Philippines Geothermal Energy Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 36: Philippines Geothermal Energy Market Volume Gigawatt Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 37: Philippines Geothermal Energy Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 38: Philippines Geothermal Energy Market Volume Gigawatt Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 39: Philippines Geothermal Energy Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 40: Philippines Geothermal Energy Market Volume Gigawatt Forecast, by Price Trend Analysis 2019 & 2032

- Table 41: Philippines Geothermal Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Philippines Geothermal Energy Market Volume Gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Philippines Geothermal Energy Market?

The projected CAGR is approximately > 1.50%.

2. Which companies are prominent players in the Philippines Geothermal Energy Market?

Key companies in the market include Energy Development Corporation, National Power Corporation, Pure Energy Holdings Corporation, Aragorn Power and Energy Corporation (APC Group Inc ), Philippine Geothermal Production Company Inc, Aboitiz Power Corporation.

3. What are the main segments of the Philippines Geothermal Energy Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Gas Production and Infrastructure4.; Increasing Exploration and Production Activities.

6. What are the notable trends driving market growth?

Deep Geothermal Systems Expected to See Significant Market Growth.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Clean Power Sources.

8. Can you provide examples of recent developments in the market?

October 2022: The Philippine renewable energy business Energy Development Corp (EDC) unit partnered with Toshiba Energy Systems & Solutions Corp. and Toshiba (Philippines) Inc. to deliver a 20-MW flash geothermal power project in the southern region of the island of Luzon.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Philippines Geothermal Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Philippines Geothermal Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Philippines Geothermal Energy Market?

To stay informed about further developments, trends, and reports in the Philippines Geothermal Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence