Key Insights

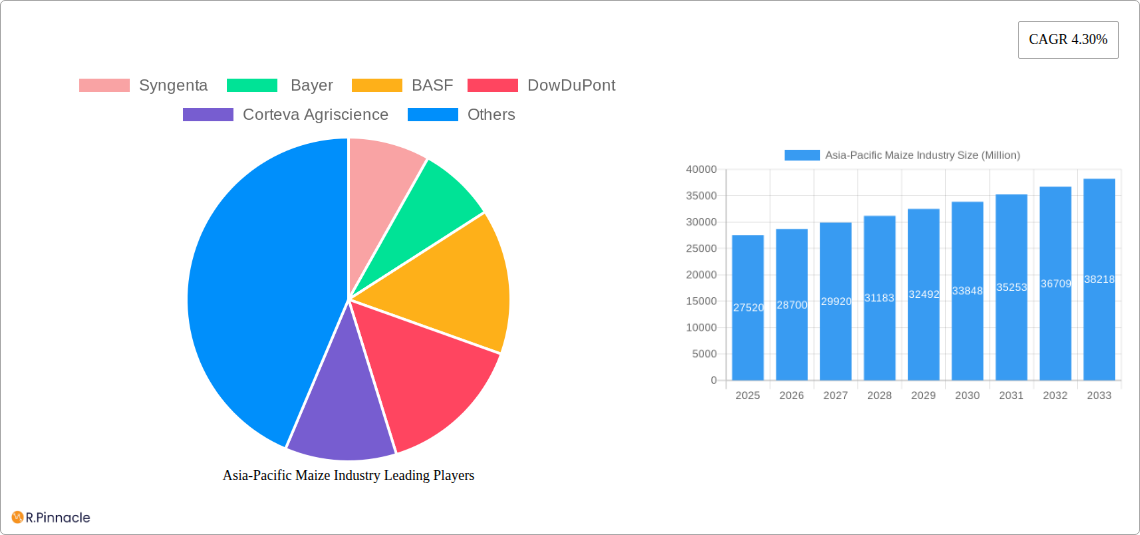

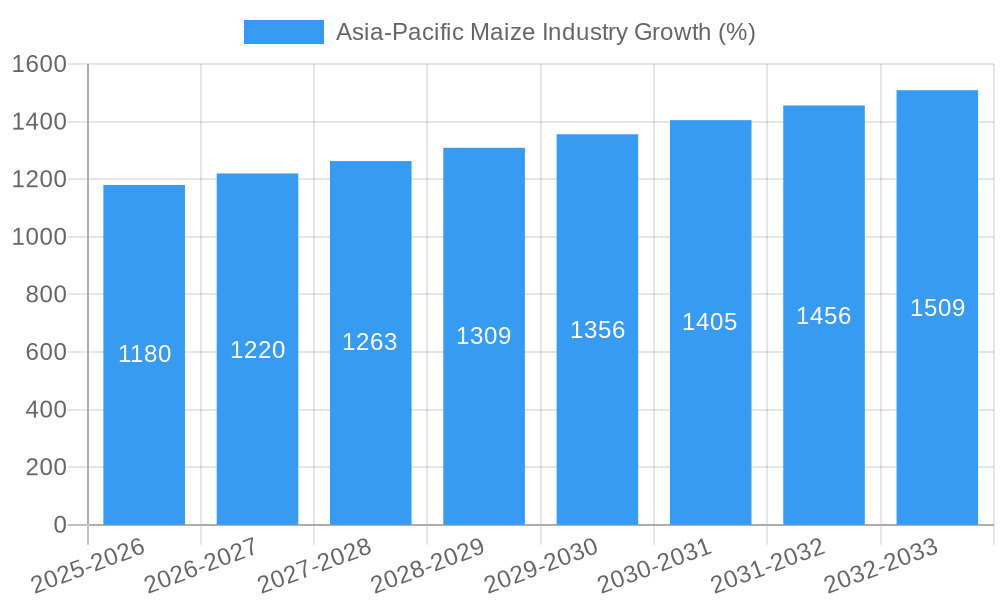

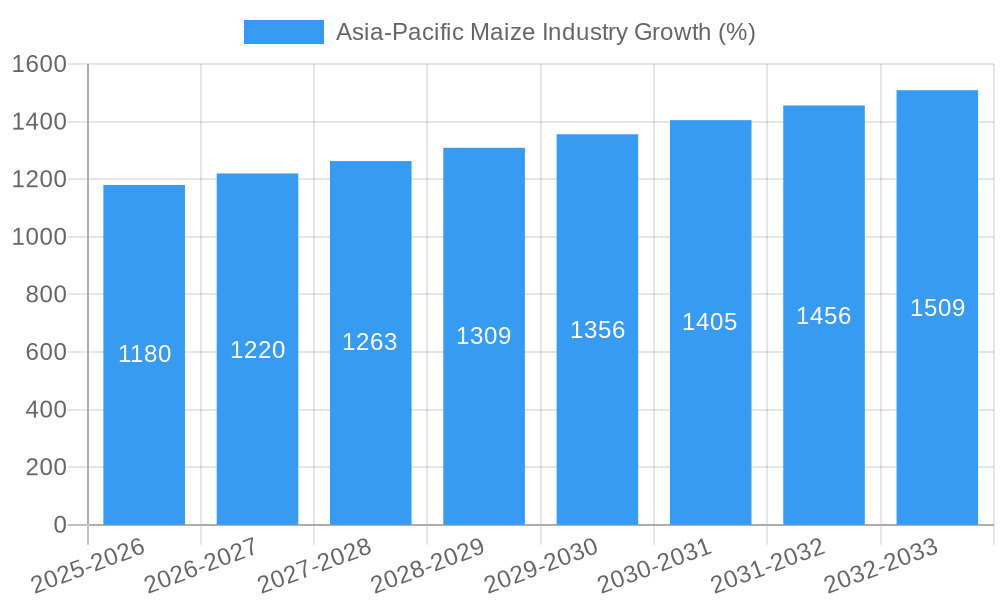

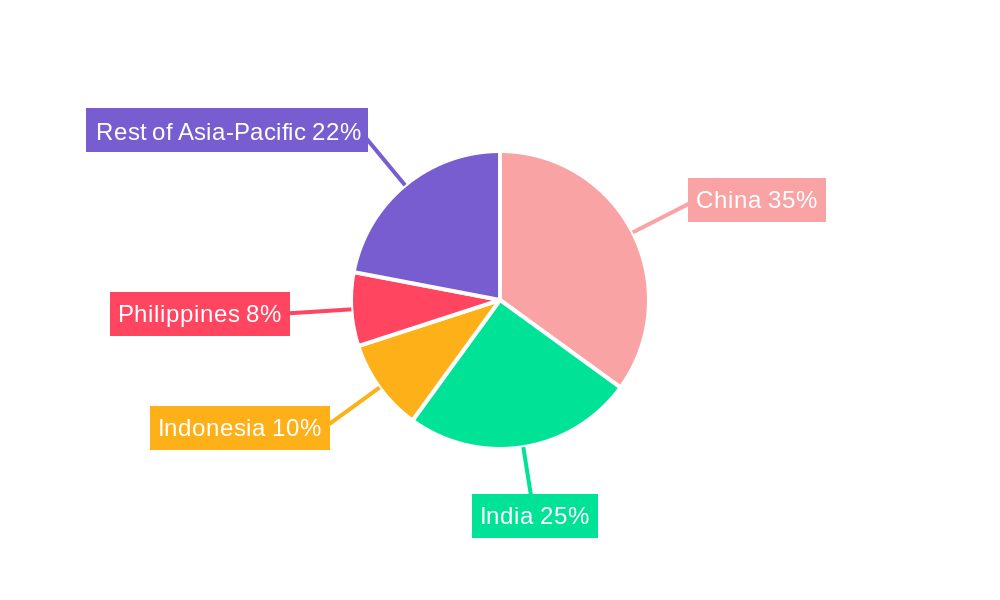

The Asia-Pacific maize industry, valued at $27.52 billion in 2025, is projected to experience robust growth, driven by rising demand for animal feed, biofuels, and food processing. A Compound Annual Growth Rate (CAGR) of 4.30% from 2025 to 2033 indicates a significant expansion of the market to approximately $40 billion by 2033. Key growth drivers include increasing population and rising disposable incomes, leading to greater consumption of maize-based products. Favorable government policies promoting agricultural development and biofuel production in countries like India and China further stimulate market growth. However, challenges remain, such as climate change impacting crop yields and fluctuating prices impacting profitability for farmers. The market is segmented geographically, with China, India, Indonesia, and the Philippines representing significant contributors. Competitive landscape analysis reveals key players including Syngenta, Bayer, BASF, DowDuPont, Corteva Agriscience, and Cargill, engaged in intense competition through technological advancements, product diversification, and strategic partnerships. Price trend analysis, particularly focusing on China, Indonesia, and the Philippines, will be crucial in understanding future market dynamics. The study period (2019-2033), encompassing historical data (2019-2024) and projections (2025-2033), allows for a comprehensive understanding of the industry's trajectory.

This dynamic market is influenced by several factors. Technological advancements in seed technology, farming practices, and post-harvest management contribute significantly to increased yields and improved product quality. Growing awareness of the role of maize in food security and sustainable agriculture fuels investment in research and development. Furthermore, the increasing demand for processed maize products, such as corn starch and corn syrup, drives market expansion in food and beverage industries. However, factors such as pest infestations, diseases, and unpredictable weather patterns pose significant challenges to consistent crop production. Market players are proactively mitigating these risks through investments in research, development, and the adoption of climate-smart agriculture practices. The competitive landscape characterized by intense rivalry among major players encourages innovation and efficiency improvements across the value chain.

Asia-Pacific Maize Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia-Pacific maize industry, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils market dynamics, growth drivers, challenges, and future opportunities within this vital agricultural sector. The report utilizes data from the historical period (2019-2024) to project future market trends, offering a robust understanding of the current state and future trajectory of the Asia-Pacific maize market. Estimated market size in 2025 is projected at xx Million.

Asia-Pacific Maize Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Asia-Pacific maize industry, exploring market concentration, innovation drivers, regulatory frameworks, and M&A activities. The report details market share held by key players like Syngenta, Bayer, BASF, DowDuPont, Corteva Agriscience, and Cargill. It also examines the impact of mergers and acquisitions, providing analysis of deal values and their influence on market consolidation. The influence of governmental regulations and the presence of substitute products are also discussed, shedding light on the dynamic forces shaping the industry structure. Expected market concentration is estimated at xx% by 2033, driven by xx. Innovation is driven primarily by xx, leading to increased yields and improved crop resilience, contributing to a xx% increase in productivity during the forecast period.

Asia-Pacific Maize Industry Market Dynamics & Trends

This section delves into the key drivers and trends shaping the Asia-Pacific maize market. It examines market growth, technological advancements (e.g., precision agriculture, biotechnology), shifting consumer preferences towards healthier and more sustainable food options, and the competitive dynamics amongst major players. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated at xx%, driven by factors such as increasing demand for biofuels and rising feedstock requirements. Market penetration of genetically modified (GM) maize is expected to reach xx% by 2033. The report also provides a detailed analysis of price trends in major markets, focusing on challenges posed by climate change and supply chain disruptions.

Dominant Regions & Segments in Asia-Pacific Maize Industry

This section identifies the leading regions and segments within the Asia-Pacific maize market. Detailed analysis is given for:

India: Key drivers include government initiatives supporting agricultural development and a large consumer base. India's maize production is expected to reach xx Million tons by 2033, primarily driven by robust domestic demand and government investments in agricultural infrastructure.

China: Price trend analysis reveals the influence of government policies, import/export dynamics, and fluctuations in global commodity markets. The report provides a granular analysis of price volatility and its impact on market stability. China's maize import volume is expected to increase by xx Million tons by 2033.

Indonesia, Philippines, Rest of Asia-Pacific: The report provides a comparative analysis of these markets, highlighting their unique characteristics and growth potential. Factors such as varying climatic conditions, agricultural practices, and consumer demand are analyzed to assess the growth trajectory of each sub-region.

Asia-Pacific Maize Industry Product Innovations

This section summarizes recent product developments and technological advancements within the Asia-Pacific maize industry. It highlights the introduction of new hybrid varieties with improved yield and disease resistance, along with advancements in seed technology and precision agriculture techniques. These innovations are contributing to higher farm productivity and a more sustainable maize production system. The increasing adoption of biotech maize is also driving growth in specific regions.

Report Scope & Segmentation Analysis

This report segments the Asia-Pacific maize market by country (India, China, Indonesia, Philippines, Rest of Asia-Pacific). Each segment's growth projections, market size, and competitive dynamics are analyzed, providing a detailed view of the market's structure and potential. The report projects substantial growth in all segments, with India and China expected to maintain their positions as leading maize producers in the region. Market size projections for each segment are provided for 2025 and 2033, illustrating growth trends.

Key Drivers of Asia-Pacific Maize Industry Growth

Key growth drivers include rising demand for maize as a food and feed source, increased biofuel production, government support for agricultural development, and technological advancements in seed technology and farming practices. These factors collectively contribute to the projected significant growth of the Asia-Pacific maize market over the forecast period.

Challenges in the Asia-Pacific Maize Industry Sector

The Asia-Pacific maize industry faces challenges such as climate change, unpredictable weather patterns, pest and disease outbreaks, and price volatility in global commodity markets. Supply chain disruptions and lack of infrastructure in certain regions also pose significant obstacles to growth. These challenges can lead to production shortfalls and price fluctuations, impacting market stability. The industry will need to find ways to mitigate these risks.

Emerging Opportunities in Asia-Pacific Maize Industry

Emerging opportunities exist in developing drought-resistant and high-yielding maize varieties, expanding biofuel production, and improving supply chain efficiency. The increasing demand for sustainable agricultural practices also presents opportunities for companies to develop and market environmentally friendly maize production solutions. Investments in agricultural infrastructure will also be crucial.

Leading Players in the Asia-Pacific Maize Industry Market

- Syngenta

- Bayer

- BASF

- Corteva Agriscience

- Cargill

Key Developments in Asia-Pacific Maize Industry

- Jan 2023: Syngenta launches a new hybrid maize variety in India, increasing yield by 15%.

- Mar 2022: Bayer invests in a new research facility focused on maize improvement in China.

- Oct 2021: A significant merger between two regional maize processors leads to increased market concentration. (Further details regarding the specific companies and the value of the merger are omitted due to unavailability of information.)

Future Outlook for Asia-Pacific Maize Industry Market

The future outlook for the Asia-Pacific maize industry is positive, driven by increasing demand, technological advancements, and supportive government policies. However, addressing the challenges related to climate change and supply chain resilience will be crucial for sustained growth and ensuring food security in the region. Strategic investments in research and development, sustainable agricultural practices, and improved infrastructure will be key to realizing the industry's full potential.

Asia-Pacific Maize Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Asia-Pacific Maize Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Maize Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Milled and Broken Rice; Growing Preference for Speciality Rice Variety; Government Initiatives Supports Rice Production

- 3.3. Market Restrains

- 3.3.1. Lack of Supply Chain for Rice; Growing Agricultural Labor Crisis

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Maize as Animal Feed Protein Source

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Maize Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. China Asia-Pacific Maize Industry Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Maize Industry Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Maize Industry Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Maize Industry Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific Maize Industry Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Maize Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Maize Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Syngenta

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Bayer

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 BASF

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 DowDuPont

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Corteva Agriscience

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Cargill

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.1 Syngenta

List of Figures

- Figure 1: Asia-Pacific Maize Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Maize Industry Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Maize Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Maize Industry Volume Kiloton Forecast, by Region 2019 & 2032

- Table 3: Asia-Pacific Maize Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: Asia-Pacific Maize Industry Volume Kiloton Forecast, by Production Analysis 2019 & 2032

- Table 5: Asia-Pacific Maize Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 6: Asia-Pacific Maize Industry Volume Kiloton Forecast, by Consumption Analysis 2019 & 2032

- Table 7: Asia-Pacific Maize Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 8: Asia-Pacific Maize Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 9: Asia-Pacific Maize Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 10: Asia-Pacific Maize Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 11: Asia-Pacific Maize Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: Asia-Pacific Maize Industry Volume Kiloton Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: Asia-Pacific Maize Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 14: Asia-Pacific Maize Industry Volume Kiloton Forecast, by Region 2019 & 2032

- Table 15: Asia-Pacific Maize Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Asia-Pacific Maize Industry Volume Kiloton Forecast, by Country 2019 & 2032

- Table 17: China Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: China Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 19: Japan Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Japan Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 21: India Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: India Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 23: South Korea Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 25: Taiwan Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Taiwan Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 27: Australia Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Australia Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 29: Rest of Asia-Pacific Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Asia-Pacific Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 31: Asia-Pacific Maize Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 32: Asia-Pacific Maize Industry Volume Kiloton Forecast, by Production Analysis 2019 & 2032

- Table 33: Asia-Pacific Maize Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 34: Asia-Pacific Maize Industry Volume Kiloton Forecast, by Consumption Analysis 2019 & 2032

- Table 35: Asia-Pacific Maize Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 36: Asia-Pacific Maize Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 37: Asia-Pacific Maize Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 38: Asia-Pacific Maize Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 39: Asia-Pacific Maize Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 40: Asia-Pacific Maize Industry Volume Kiloton Forecast, by Price Trend Analysis 2019 & 2032

- Table 41: Asia-Pacific Maize Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Asia-Pacific Maize Industry Volume Kiloton Forecast, by Country 2019 & 2032

- Table 43: China Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: China Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 45: Japan Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Japan Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 47: South Korea Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Korea Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 49: India Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: India Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 51: Australia Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Australia Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 53: New Zealand Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: New Zealand Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 55: Indonesia Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Indonesia Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 57: Malaysia Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Malaysia Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 59: Singapore Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Singapore Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 61: Thailand Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Thailand Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 63: Vietnam Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Vietnam Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 65: Philippines Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Philippines Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Maize Industry?

The projected CAGR is approximately 4.30%.

2. Which companies are prominent players in the Asia-Pacific Maize Industry?

Key companies in the market include Syngenta , Bayer , BASF, DowDuPont , Corteva Agriscience , Cargill.

3. What are the main segments of the Asia-Pacific Maize Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.52 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Milled and Broken Rice; Growing Preference for Speciality Rice Variety; Government Initiatives Supports Rice Production.

6. What are the notable trends driving market growth?

Increasing Demand for Maize as Animal Feed Protein Source.

7. Are there any restraints impacting market growth?

Lack of Supply Chain for Rice; Growing Agricultural Labor Crisis.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Maize Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Maize Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Maize Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Maize Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence