Key Insights

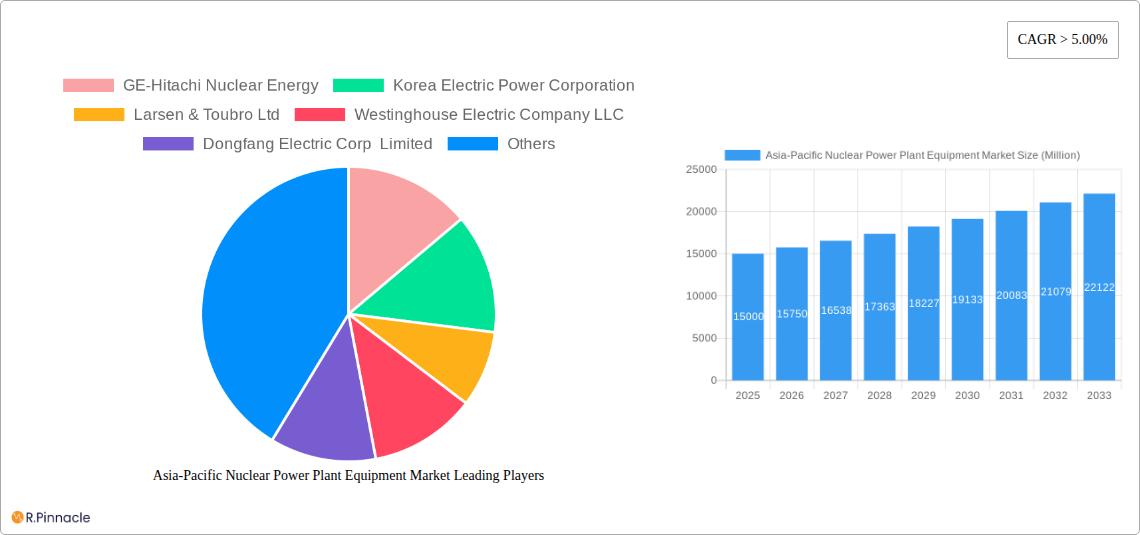

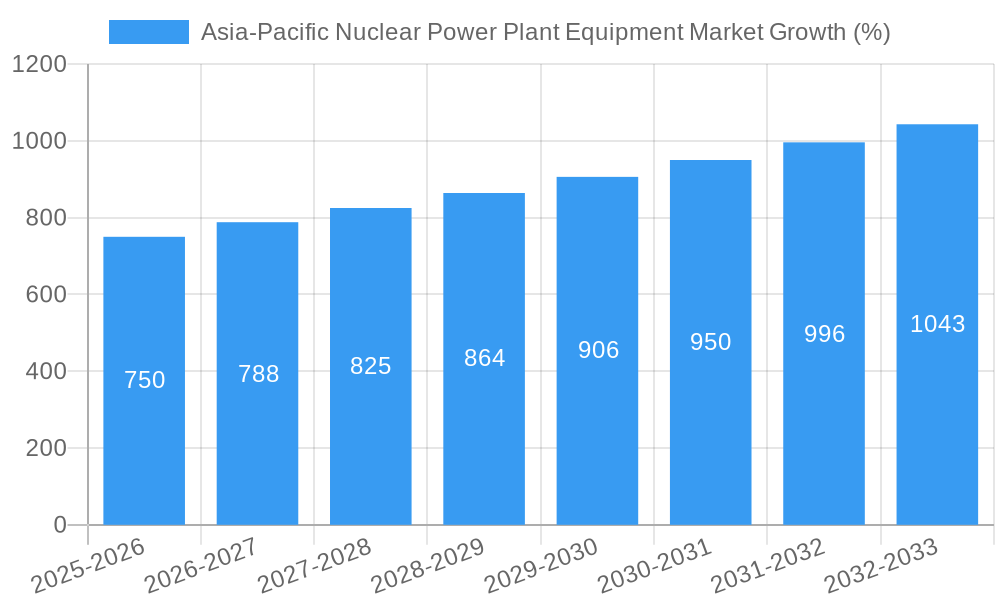

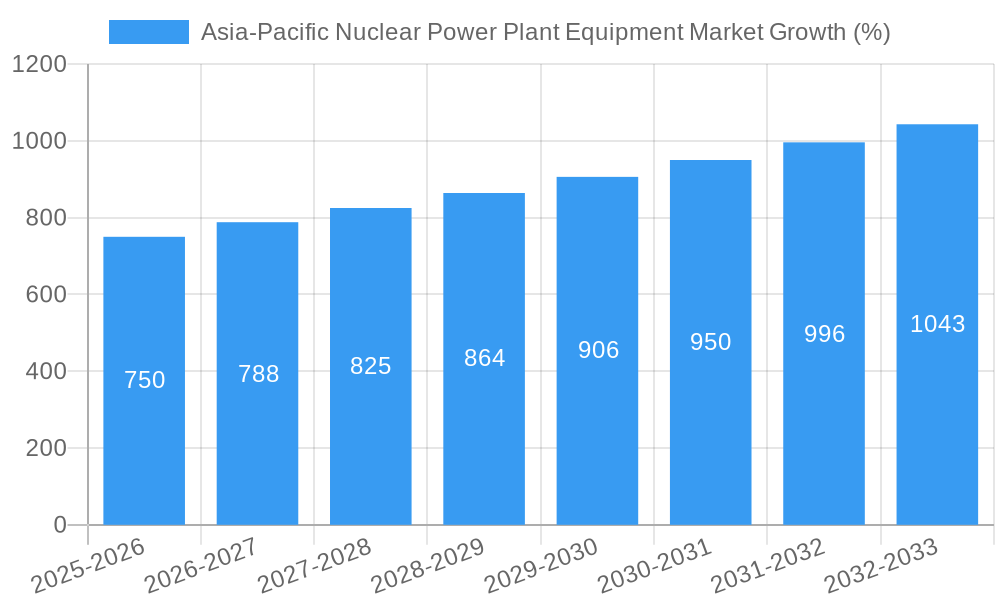

The Asia-Pacific nuclear power plant equipment market is experiencing robust growth, driven by increasing energy demands, stringent emission reduction targets, and the region's commitment to diversifying its energy mix. A compound annual growth rate (CAGR) exceeding 5% from 2019 to 2024 suggests a significant market expansion, with a projected market size exceeding $XX million in 2025 (assuming a base year market size of $Y million, a logical estimate considering the growth rate and provided data). Key drivers include government initiatives promoting nuclear energy as a clean and reliable power source, particularly in countries like China, India, and Japan, which are investing heavily in new nuclear power plant construction and upgrades. Furthermore, advancements in reactor technology, leading to improved safety and efficiency, are fueling market expansion. The segment encompassing Pressurized Water Reactors (PWRs) currently dominates the market, though Pressurized Heavy Water Reactors (PHWRs) are expected to witness considerable growth due to their suitability for certain regional applications. The "Island Equipment" segment within the carrier type category shows higher demand owing to its critical role in reactor operations.

Market restraints include high capital costs associated with nuclear power plant construction and the inherent safety concerns surrounding nuclear technology. However, ongoing technological advancements aimed at enhancing safety features and reducing construction timelines are mitigating these challenges. The competitive landscape is characterized by a mix of established global players like GE-Hitachi, Westinghouse, and Framatome, alongside prominent regional companies such as Larsen & Toubro (India), Dongfang Electric (China), and Doosan (South Korea). This competitive dynamic is fostering innovation and driving down costs, further propelling market growth. The forecast period (2025-2033) anticipates continued expansion, with potential for acceleration based on advancements in small modular reactor (SMR) technology and further government investments within the Asia-Pacific region. Market segmentation by reactor type, carrier type (Island, Auxiliary, Research), and geography provides crucial insights for strategic planning and investment decisions. The Rest of Asia-Pacific segment holds significant untapped potential for growth, representing an attractive area for future market expansion.

This comprehensive report provides an in-depth analysis of the Asia-Pacific Nuclear Power Plant Equipment market, offering valuable insights for industry professionals, investors, and strategic decision-makers. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. Expect detailed segmentation by reactor type (Pressurized Water Reactor, Pressurized Heavy Water Reactor, Other Reactor Types), carrier type (Island Equipment, Auxiliary Equipment, Research Reactor), and geography (China, India, Japan, Rest of Asia-Pacific). Key players such as GE-Hitachi Nuclear Energy, Korea Electric Power Corporation, Larsen & Toubro Ltd, Westinghouse Electric Company LLC, Dongfang Electric Corp Limited, Doosan Corporation, Framatome, and Mitsubishi Heavy Industries Ltd are analyzed.

Asia-Pacific Nuclear Power Plant Equipment Market Market Structure & Innovation Trends

The Asia-Pacific nuclear power plant equipment market exhibits a moderately concentrated structure, with a few large multinational corporations and several regional players dominating various segments. Market share is dynamic, influenced by technological advancements, government policies, and project wins. Innovation is driven by the need for enhanced safety, efficiency, and reduced lifecycle costs. Regulatory frameworks, varying across nations, significantly impact market dynamics, with stringent safety regulations and licensing procedures shaping investment decisions. Product substitutes are limited, primarily focusing on alternative energy sources, although nuclear power retains a strong position in the energy mix due to its baseload capacity. End-user demographics predominantly comprise government-owned utilities and private sector entities involved in power generation. M&A activity has been relatively moderate in recent years, with deal values ranging from USD xx Million to USD xx Million, primarily focused on strategic acquisitions to expand capabilities and geographic reach. Specific metrics on market share will be detailed within the full report.

Asia-Pacific Nuclear Power Plant Equipment Market Market Dynamics & Trends

The Asia-Pacific nuclear power plant equipment market is experiencing significant growth, driven by increasing energy demands and the focus on reliable and low-carbon energy sources. The CAGR for the forecast period (2025-2033) is estimated at xx%, fueled by several factors. Government initiatives to expand nuclear power capacity in several countries, including India and China, are key growth drivers. Technological advancements in reactor design and equipment manufacturing, emphasizing enhanced safety and efficiency, further contribute to market expansion. While consumer preferences indirectly influence market growth through energy demand, the market is primarily driven by governmental policy. Competitive dynamics are characterized by both intense competition among established players and the emergence of new entrants. Market penetration of advanced technologies, such as small modular reactors (SMRs), is expected to increase gradually over the forecast period, though it remains relatively low presently.

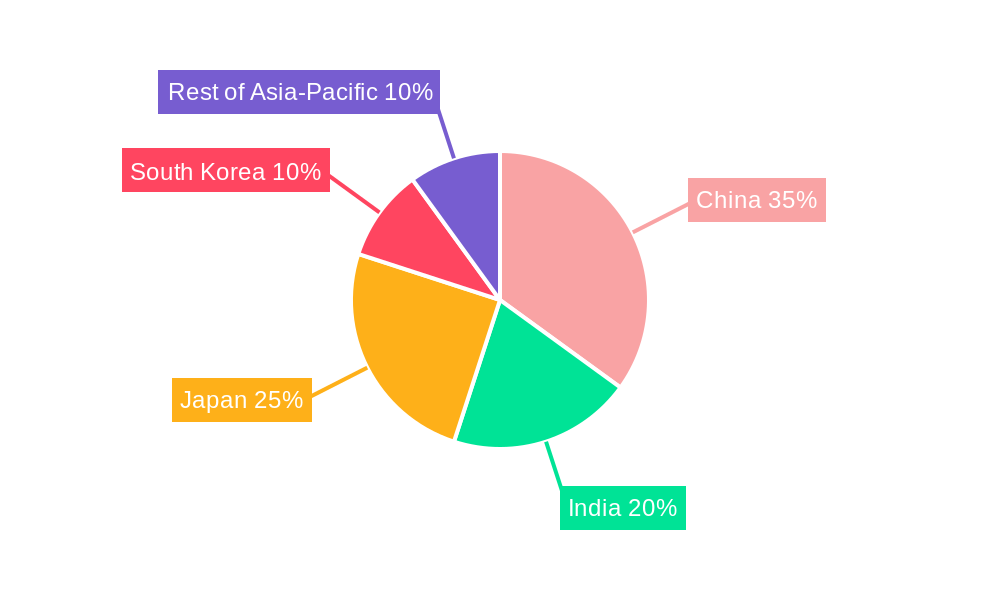

Dominant Regions & Segments in Asia-Pacific Nuclear Power Plant Equipment Market

Leading Region: China and India are the dominant regions, driven by ambitious nuclear expansion programs. Japan, despite the Fukushima incident, continues to play a significant role, while the Rest of Asia-Pacific displays varied growth prospects.

Leading Reactor Type: Pressurized Water Reactors (PWRs) currently hold the largest market share, but Pressurized Heavy Water Reactors (PHWRs), particularly in India, constitute a considerable segment. Other Reactor Types represent a smaller but growing segment, driven by advancements in SMR technology.

Leading Carrier Type: Island Equipment holds the largest market share due to its integral role in nuclear power plant operation. Auxiliary Equipment is also a substantial segment, while Research Reactors constitute a niche market.

Key Drivers:

- China: Large-scale nuclear power development plans and significant investments in infrastructure.

- India: Government commitment to nuclear energy expansion and domestic manufacturing capabilities.

- Japan: Focus on rebuilding nuclear capacity and investing in advanced reactor technologies, despite public concerns.

- Rest of Asia-Pacific: Emerging nuclear power programs in several countries, creating opportunities for equipment suppliers.

The dominance analysis within the full report will provide a deeper understanding of market share and competitive landscapes within each region and segment.

Asia-Pacific Nuclear Power Plant Equipment Market Product Innovations

The Asia-Pacific nuclear power plant equipment market is witnessing continuous product innovations, driven by the need for enhanced safety, efficiency, and cost-effectiveness. Advancements focus on digitalization, automation, and the development of advanced materials. SMRs, characterized by their smaller size and enhanced safety features, are gaining traction. The market fit of these innovations depends on regulatory approvals, cost competitiveness, and the willingness of utilities to adopt newer technologies. Competitive advantages stem from technological leadership, cost efficiency, and strong supply chains.

Report Scope & Segmentation Analysis

This report segments the Asia-Pacific Nuclear Power Plant Equipment market across several key parameters.

Reactor Type: PWR, PHWR, and Other Reactor Types are analyzed, each with individual growth projections and market size estimations. Competitive dynamics vary across these segments, with specific players specializing in particular reactor types.

Carrier Type: Island Equipment, Auxiliary Equipment, and Research Reactors are examined, detailing market sizes, growth rates, and competitive landscapes within each segment.

Geography: China, India, Japan, and the Rest of Asia-Pacific are analyzed, exploring country-specific market dynamics and future growth prospects.

Key Drivers of Asia-Pacific Nuclear Power Plant Equipment Market Growth

The market's growth is primarily driven by the increasing energy demand in the region, coupled with a strong push for low-carbon energy sources. Government policies promoting nuclear power, including substantial investments in infrastructure and regulatory support, significantly contribute. Technological advancements, such as the development of SMRs and improved safety features, also drive growth.

Challenges in the Asia-Pacific Nuclear Power Plant Equipment Market Sector

Significant challenges include the high capital cost of nuclear power plants, stringent safety regulations and licensing procedures, and potential supply chain disruptions. Public perception and acceptance of nuclear energy remain a factor in some regions, potentially impacting project timelines and investments. Furthermore, the intense competition among established players can put pressure on margins.

Emerging Opportunities in Asia-Pacific Nuclear Power Plant Equipment Market

Significant opportunities exist in the growing demand for SMRs, the increasing focus on digitalization and automation in nuclear power plants, and the development of advanced materials for enhanced reactor efficiency and safety. The expansion of nuclear power into emerging economies in the Rest of Asia-Pacific also presents considerable growth potential.

Leading Players in the Asia-Pacific Nuclear Power Plant Equipment Market Market

- GE-Hitachi Nuclear Energy

- Korea Electric Power Corporation

- Larsen & Toubro Ltd

- Westinghouse Electric Company LLC

- Dongfang Electric Corp Limited

- Doosan Corporation

- Framatome

- Mitsubishi Heavy Industries Ltd

Key Developments in Asia-Pacific Nuclear Power Plant Equipment Market Industry

- October 2022: Installation of the reactor pressure vessel at Rooppur 2 in Bangladesh, indicating progress in the country's first nuclear power plant.

- September 2021: BHEL receives a USD 1.32 Billion order for turbine islands for six PHWR units in India.

- July 2021: BHEL secures a USD 170 Million contract to supply steam generators for four PHWR sites in India.

Future Outlook for Asia-Pacific Nuclear Power Plant Equipment Market Market

The Asia-Pacific nuclear power plant equipment market is poised for robust growth over the forecast period, driven by sustained governmental support, technological innovation, and the increasing need for reliable and low-carbon energy. Strategic opportunities exist for companies to capitalize on the expansion of nuclear power capacity, particularly in emerging economies. The development and adoption of SMRs is expected to further stimulate market expansion in the coming years.

Asia-Pacific Nuclear Power Plant Equipment Market Segmentation

-

1. Reactor Type

- 1.1. Pressurized Water Reactor

- 1.2. Pressurized Heavy Water Reactor

- 1.3. Other Reactor Types

-

2. Carrier Type

- 2.1. Island Equipment

- 2.2. Auxiliary Equipment

- 2.3. Research Reactor

-

3. Geogrpahy

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Rest of Asia-Pacific

Asia-Pacific Nuclear Power Plant Equipment Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Nuclear Power Plant Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Global Inclination toward Renewable-based Power Generation4.; Increased Power Demand in Line with the Increasing Population

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Cost

- 3.4. Market Trends

- 3.4.1. Pressurized Water Reactors to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Nuclear Power Plant Equipment Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Reactor Type

- 5.1.1. Pressurized Water Reactor

- 5.1.2. Pressurized Heavy Water Reactor

- 5.1.3. Other Reactor Types

- 5.2. Market Analysis, Insights and Forecast - by Carrier Type

- 5.2.1. Island Equipment

- 5.2.2. Auxiliary Equipment

- 5.2.3. Research Reactor

- 5.3. Market Analysis, Insights and Forecast - by Geogrpahy

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Reactor Type

- 6. China Asia-Pacific Nuclear Power Plant Equipment Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Nuclear Power Plant Equipment Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Nuclear Power Plant Equipment Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Nuclear Power Plant Equipment Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific Nuclear Power Plant Equipment Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Nuclear Power Plant Equipment Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Nuclear Power Plant Equipment Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 GE-Hitachi Nuclear Energy

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Korea Electric Power Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Larsen & Toubro Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Westinghouse Electric Company LLC

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Dongfang Electric Corp Limited

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Doosan Corporation

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Framatome*List Not Exhaustive

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Mitsubishi Heavy Industries Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 GE-Hitachi Nuclear Energy

List of Figures

- Figure 1: Asia-Pacific Nuclear Power Plant Equipment Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Nuclear Power Plant Equipment Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Nuclear Power Plant Equipment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Nuclear Power Plant Equipment Market Revenue Million Forecast, by Reactor Type 2019 & 2032

- Table 3: Asia-Pacific Nuclear Power Plant Equipment Market Revenue Million Forecast, by Carrier Type 2019 & 2032

- Table 4: Asia-Pacific Nuclear Power Plant Equipment Market Revenue Million Forecast, by Geogrpahy 2019 & 2032

- Table 5: Asia-Pacific Nuclear Power Plant Equipment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Asia-Pacific Nuclear Power Plant Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Asia-Pacific Nuclear Power Plant Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Asia-Pacific Nuclear Power Plant Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Asia-Pacific Nuclear Power Plant Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Asia-Pacific Nuclear Power Plant Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Taiwan Asia-Pacific Nuclear Power Plant Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Asia-Pacific Nuclear Power Plant Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Asia-Pacific Asia-Pacific Nuclear Power Plant Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Asia-Pacific Nuclear Power Plant Equipment Market Revenue Million Forecast, by Reactor Type 2019 & 2032

- Table 15: Asia-Pacific Nuclear Power Plant Equipment Market Revenue Million Forecast, by Carrier Type 2019 & 2032

- Table 16: Asia-Pacific Nuclear Power Plant Equipment Market Revenue Million Forecast, by Geogrpahy 2019 & 2032

- Table 17: Asia-Pacific Nuclear Power Plant Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Asia-Pacific Nuclear Power Plant Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Asia-Pacific Nuclear Power Plant Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Asia-Pacific Nuclear Power Plant Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: India Asia-Pacific Nuclear Power Plant Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Asia-Pacific Nuclear Power Plant Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: New Zealand Asia-Pacific Nuclear Power Plant Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Indonesia Asia-Pacific Nuclear Power Plant Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Malaysia Asia-Pacific Nuclear Power Plant Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Singapore Asia-Pacific Nuclear Power Plant Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Thailand Asia-Pacific Nuclear Power Plant Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Vietnam Asia-Pacific Nuclear Power Plant Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Philippines Asia-Pacific Nuclear Power Plant Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Nuclear Power Plant Equipment Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Asia-Pacific Nuclear Power Plant Equipment Market?

Key companies in the market include GE-Hitachi Nuclear Energy, Korea Electric Power Corporation, Larsen & Toubro Ltd, Westinghouse Electric Company LLC, Dongfang Electric Corp Limited, Doosan Corporation, Framatome*List Not Exhaustive, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Asia-Pacific Nuclear Power Plant Equipment Market?

The market segments include Reactor Type, Carrier Type, Geogrpahy.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Global Inclination toward Renewable-based Power Generation4.; Increased Power Demand in Line with the Increasing Population.

6. What are the notable trends driving market growth?

Pressurized Water Reactors to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Initial Cost.

8. Can you provide examples of recent developments in the market?

In October 2022, the Bangladesh government announced the installation of the reactor pressure vessel at Rooppur 2, the second unit of Bangladesh's first nuclear power plant. According to government sources, the overall project was 53% complete, and the first unit was more than 70% complete. It is expected that the production of the first unit on a trial basis will begin in October 2023 and is expected to be fully ready to supply in 2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Nuclear Power Plant Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Nuclear Power Plant Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Nuclear Power Plant Equipment Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Nuclear Power Plant Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence