Key Insights

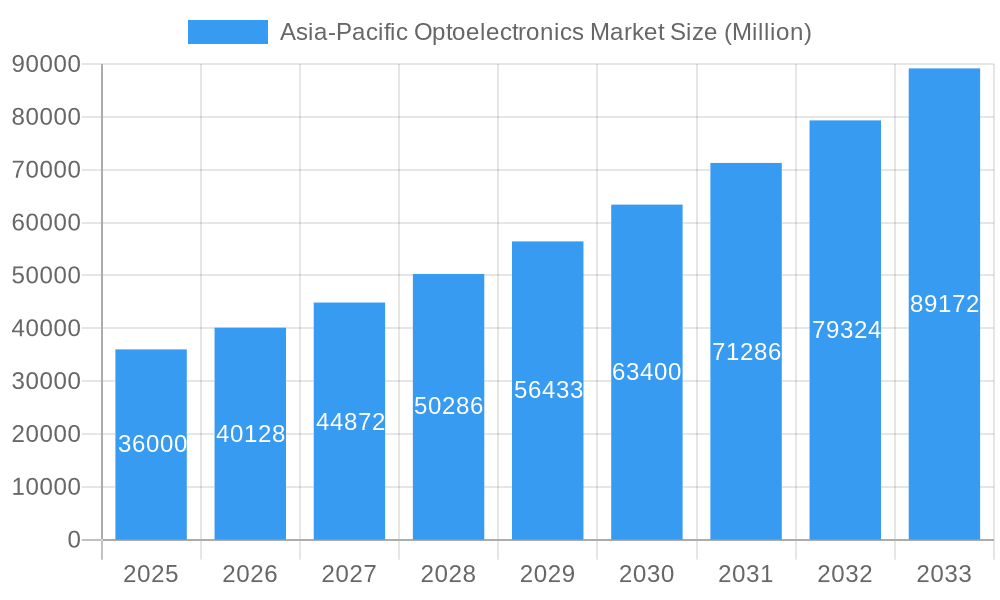

The Asia-Pacific optoelectronics market, valued at $36 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 11.20% from 2025 to 2033. This expansion is fueled by several key factors. The surging demand for advanced driver-assistance systems (ADAS) and electric vehicles (EVs) in the automotive sector is a significant contributor, alongside the increasing adoption of optoelectronics in consumer electronics, particularly smartphones and wearables, which feature sophisticated camera systems and display technologies. Furthermore, the growth of the healthcare industry, with its increasing reliance on advanced medical imaging and diagnostic equipment incorporating optoelectronic components, is a powerful driver. Technological advancements, such as the development of miniaturized and highly efficient components, and the integration of optoelectronics with other technologies like AI and IoT, also contribute to market expansion. China, Japan, South Korea, and India are expected to be the major contributors to regional growth, reflecting their established manufacturing bases and burgeoning technological innovation.

Asia-Pacific Optoelectronics Market Market Size (In Billion)

Growth within specific segments is also noteworthy. The LED segment, owing to its energy efficiency and cost-effectiveness, is anticipated to maintain a dominant market share. However, the laser diode segment is projected to experience the highest growth rate, driven by increasing applications in high-precision manufacturing, optical communication, and advanced medical procedures. The strong growth in the automotive and consumer electronics end-user industries will further propel demand for optoelectronic components. While regulatory hurdles and the potential for supply chain disruptions pose challenges, the overall outlook for the Asia-Pacific optoelectronics market remains exceptionally positive, with significant growth opportunities over the forecast period.

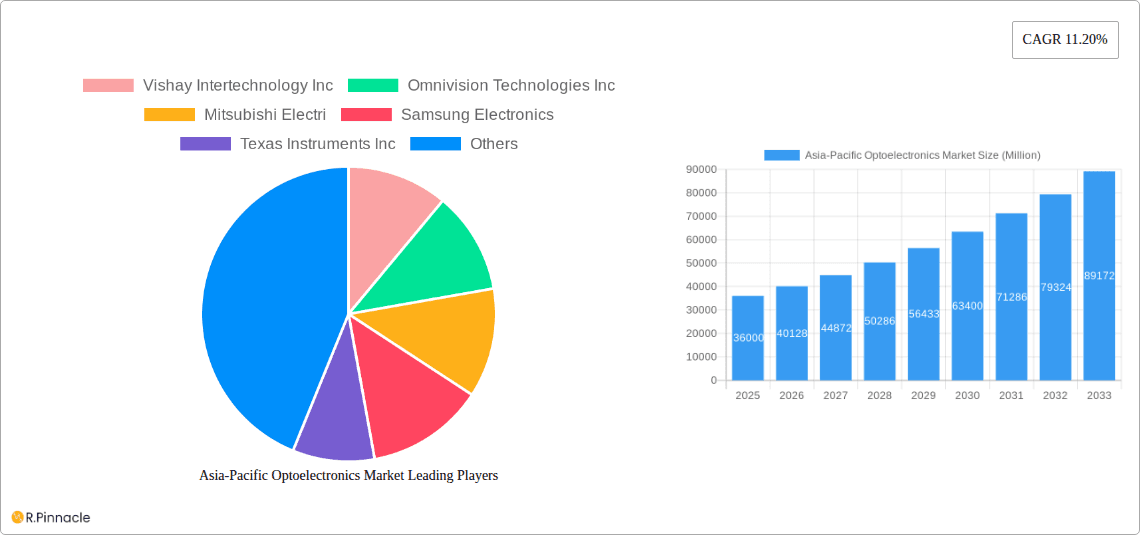

Asia-Pacific Optoelectronics Market Company Market Share

Asia-Pacific Optoelectronics Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia-Pacific optoelectronics market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, growth drivers, challenges, and emerging opportunities. The report segments the market by component type (LED, Laser Diode, Image Sensors, Optocouplers, Photovoltaic cells, Other Component Types) and end-user industry (Automotive, Aerospace & Defense, Consumer Electronics, Information Technology, Healthcare, Residential and Commercial, Industrial, Other End-User Industries), providing granular data and future projections. Key players like Vishay Intertechnology Inc, Omnivision Technologies Inc, and Samsung Electronics are analyzed to understand their market positioning and strategies.

Asia-Pacific Optoelectronics Market Structure & Innovation Trends

The Asia-Pacific optoelectronics market exhibits a moderately concentrated structure, with a handful of multinational corporations holding significant market share. However, the presence of numerous smaller, specialized players fosters competition and innovation. Market share data for 2025 reveals that Samsung Electronics holds approximately xx% market share, followed by Sony Corporation at xx% and Texas Instruments Inc at xx%. The remaining share is distributed amongst other players, indicating a dynamic competitive landscape.

Innovation in the sector is primarily driven by the increasing demand for advanced functionalities in consumer electronics, automotive, and industrial applications. Government initiatives promoting technological advancements, such as those focused on renewable energy and smart cities, further stimulate innovation. Regulatory frameworks related to energy efficiency and environmental protection influence product development and adoption. Product substitutes, such as alternative lighting technologies, pose a competitive threat, prompting continuous innovation to maintain market relevance. End-user demographics, with a rising middle class and increasing disposable income, fuel demand for optoelectronic products.

Mergers and acquisitions (M&A) play a vital role in shaping the market structure. While precise M&A deal values for the period are unavailable (xx Million), several strategic acquisitions have resulted in increased market consolidation and technological advancements. For example, the acquisition of (insert example if available, otherwise state "an example acquisition") in [Year] resulted in [briefly describe the outcome].

Asia-Pacific Optoelectronics Market Market Dynamics & Trends

The Asia-Pacific optoelectronics market is experiencing robust growth, projected to achieve a CAGR of xx% during the forecast period (2025-2033). This growth is driven by several factors:

Technological advancements: Miniaturization, increased energy efficiency, and enhanced functionalities in optoelectronic components are key drivers. The development of advanced materials and manufacturing processes continually improve product performance and reduce costs.

Rising demand from key end-user industries: The automotive sector, particularly electric vehicles and advanced driver-assistance systems (ADAS), are significant growth contributors. The burgeoning consumer electronics market, with a focus on high-resolution displays and sophisticated imaging technologies, fuels further demand.

Government support and investments: Government initiatives promoting technological development, smart city infrastructure, and renewable energy technologies create favorable market conditions.

Expanding applications in new sectors: The increasing adoption of optoelectronics in healthcare, industrial automation, and aerospace and defense sectors contributes to market expansion.

Competitive dynamics are characterized by intense competition amongst established players and emerging companies. Market penetration is particularly high in the consumer electronics and automotive sectors. The rapid pace of technological change necessitates continuous innovation and adaptation to remain competitive. Pricing pressures, especially in the LED and photovoltaic cell segments, impact profit margins.

Dominant Regions & Segments in Asia-Pacific Optoelectronics Market

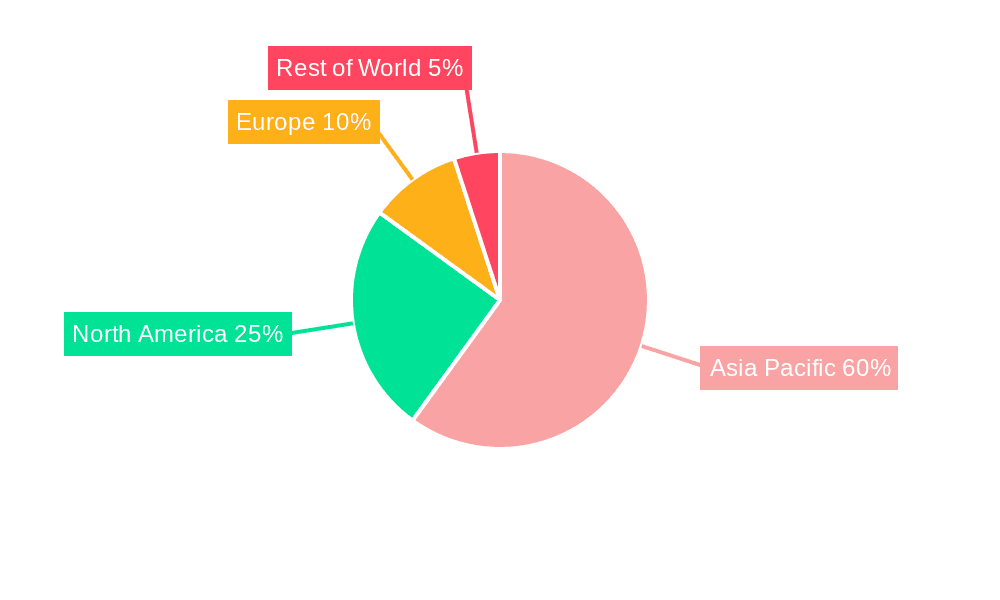

Dominant Region: China emerges as the dominant region in the Asia-Pacific optoelectronics market, owing to its large and rapidly growing consumer electronics and automotive industries. Strong government support for technological advancements and a robust manufacturing base further contribute to its leadership.

Dominant Segments:

By Component Type: The LED segment is currently the largest, driven by widespread adoption in lighting, displays, and automotive applications. Image sensors also demonstrate significant growth, propelled by the increasing demand for high-resolution cameras in smartphones and other consumer electronics.

By End-User Industry: The consumer electronics segment is the largest, driven by the massive growth in smartphone sales and the rising demand for high-resolution displays and sophisticated imaging technologies. The automotive sector is experiencing fast growth due to the adoption of ADAS and electric vehicles.

Key Drivers:

- China: Robust manufacturing base, substantial government investment in technological infrastructure, significant demand from the consumer electronics sector.

- South Korea: Strong presence of leading consumer electronics manufacturers.

- Japan: Advanced technological capabilities and a focus on high-quality components.

- India: Rapidly expanding market for consumer electronics driven by increasing disposable incomes.

These regions are characterized by favorable economic policies, growing infrastructure, and strong technological expertise, fueling the market's expansion.

Asia-Pacific Optoelectronics Market Product Innovations

Recent innovations include significant advancements in image sensor technology, such as Onsemi's AR0822 with improved low-light performance and low-power consumption, catering to the security and surveillance markets. The introduction of high-efficiency diode lasers by IPG Photonics Corporation enhances industrial heating and drying applications, offering superior efficiency. Samsung Electronics' 200MP ISOCELL HP2 sensor represents a leap in mobile photography. These developments highlight the ongoing pursuit of higher performance, greater efficiency, and broader application possibilities.

Report Scope & Segmentation Analysis

By Component Type: The report analyzes the market size, growth projections, and competitive dynamics within each component type segment (LED, Laser Diode, Image Sensors, Optocouplers, Photovoltaic cells, and Other Component Types).

By End-User Industry: The report provides a detailed analysis of the market size, growth forecasts, and competitive landscapes for each end-user industry segment (Automotive, Aerospace & Defense, Consumer Electronics, Information Technology, Healthcare, Residential and Commercial, Industrial, and Other End-User Industries).

Key Drivers of Asia-Pacific Optoelectronics Market Growth

Technological advancements, particularly in miniaturization, energy efficiency, and functionality, are key growth drivers. The rising demand from consumer electronics, automotive, and industrial sectors fuels further market expansion. Government initiatives promoting technological development and renewable energy contribute to market growth.

Challenges in the Asia-Pacific Optoelectronics Market Sector

Challenges include intense competition, pricing pressures, supply chain disruptions, and regulatory hurdles related to environmental compliance and energy efficiency. The rapid pace of technological innovation necessitates continuous adaptation and investment to maintain competitiveness. The impact of these challenges on market growth is estimated at xx Million in revenue loss annually.

Emerging Opportunities in Asia-Pacific Optoelectronics Market

Emerging opportunities lie in the growing adoption of optoelectronics in new sectors, such as healthcare, 5G infrastructure, and Internet of Things (IoT) devices. The development of novel materials and manufacturing processes, such as advanced packaging and 3D integration, further opens avenues for growth. The focus on sustainability and energy efficiency provides further opportunities for the development of eco-friendly optoelectronic solutions.

Leading Players in the Asia-Pacific Optoelectronics Market Market

- Vishay Intertechnology Inc

- Omnivision Technologies Inc

- Mitsubishi Electric

- Samsung Electronics

- Texas Instruments Inc

- Koninklijke Philips N.V.

- Stanley Electric Co

- Rohm Co Ltd (ROHM SEMICONDUCTOR)

- General Electric Company

- Osram Licht AG

- Panasonic Corporation

- Sony Corporation

Key Developments in Asia-Pacific Optoelectronics Market Industry

- March 2023: Onsemi announced its AR0822 image sensor, enhancing capabilities in low-light applications.

- January 2023: IPG Photonics launched high-efficiency diode laser solutions for industrial heating.

- January 2023: Samsung Electronics unveiled its 200MP ISOCELL HP2 image sensor for premium smartphones.

Future Outlook for Asia-Pacific Optoelectronics Market Market

The Asia-Pacific optoelectronics market is poised for continued growth, driven by technological advancements, increasing demand from key sectors, and favorable government policies. Strategic opportunities exist in developing innovative products and expanding into new applications, particularly within the rapidly evolving IoT, 5G, and automotive sectors. The market's future potential is significant, offering substantial returns for businesses that can adapt and innovate.

Asia-Pacific Optoelectronics Market Segmentation

-

1. Component type

- 1.1. LED

- 1.2. Laser Diode

- 1.3. Image Sensors

- 1.4. Optocouplers

- 1.5. Photovoltaic cells

- 1.6. Other Component Types

-

2. End User Industry

- 2.1. Automotive

- 2.2. Aerospace & Defense

- 2.3. Consumer Electronics

- 2.4. Information Technology

- 2.5. Healthcare

- 2.6. Residential and Commercial

- 2.7. Industrial

- 2.8. Other End-User Industries

-

3. Geography

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

Asia-Pacific Optoelectronics Market Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. South Korea

Asia-Pacific Optoelectronics Market Regional Market Share

Geographic Coverage of Asia-Pacific Optoelectronics Market

Asia-Pacific Optoelectronics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing demand for Smart Consumer Electronics; Increasing Industrial Applications of the Technology

- 3.3. Market Restrains

- 3.3.1. High Manufacturing and Fabricating Costs

- 3.4. Market Trends

- 3.4.1. Healthcare Sector is Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Optoelectronics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component type

- 5.1.1. LED

- 5.1.2. Laser Diode

- 5.1.3. Image Sensors

- 5.1.4. Optocouplers

- 5.1.5. Photovoltaic cells

- 5.1.6. Other Component Types

- 5.2. Market Analysis, Insights and Forecast - by End User Industry

- 5.2.1. Automotive

- 5.2.2. Aerospace & Defense

- 5.2.3. Consumer Electronics

- 5.2.4. Information Technology

- 5.2.5. Healthcare

- 5.2.6. Residential and Commercial

- 5.2.7. Industrial

- 5.2.8. Other End-User Industries

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. Japan

- 5.3.3. India

- 5.3.4. South Korea

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Component type

- 6. China Asia-Pacific Optoelectronics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component type

- 6.1.1. LED

- 6.1.2. Laser Diode

- 6.1.3. Image Sensors

- 6.1.4. Optocouplers

- 6.1.5. Photovoltaic cells

- 6.1.6. Other Component Types

- 6.2. Market Analysis, Insights and Forecast - by End User Industry

- 6.2.1. Automotive

- 6.2.2. Aerospace & Defense

- 6.2.3. Consumer Electronics

- 6.2.4. Information Technology

- 6.2.5. Healthcare

- 6.2.6. Residential and Commercial

- 6.2.7. Industrial

- 6.2.8. Other End-User Industries

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. Japan

- 6.3.3. India

- 6.3.4. South Korea

- 6.1. Market Analysis, Insights and Forecast - by Component type

- 7. Japan Asia-Pacific Optoelectronics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component type

- 7.1.1. LED

- 7.1.2. Laser Diode

- 7.1.3. Image Sensors

- 7.1.4. Optocouplers

- 7.1.5. Photovoltaic cells

- 7.1.6. Other Component Types

- 7.2. Market Analysis, Insights and Forecast - by End User Industry

- 7.2.1. Automotive

- 7.2.2. Aerospace & Defense

- 7.2.3. Consumer Electronics

- 7.2.4. Information Technology

- 7.2.5. Healthcare

- 7.2.6. Residential and Commercial

- 7.2.7. Industrial

- 7.2.8. Other End-User Industries

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. Japan

- 7.3.3. India

- 7.3.4. South Korea

- 7.1. Market Analysis, Insights and Forecast - by Component type

- 8. India Asia-Pacific Optoelectronics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component type

- 8.1.1. LED

- 8.1.2. Laser Diode

- 8.1.3. Image Sensors

- 8.1.4. Optocouplers

- 8.1.5. Photovoltaic cells

- 8.1.6. Other Component Types

- 8.2. Market Analysis, Insights and Forecast - by End User Industry

- 8.2.1. Automotive

- 8.2.2. Aerospace & Defense

- 8.2.3. Consumer Electronics

- 8.2.4. Information Technology

- 8.2.5. Healthcare

- 8.2.6. Residential and Commercial

- 8.2.7. Industrial

- 8.2.8. Other End-User Industries

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. Japan

- 8.3.3. India

- 8.3.4. South Korea

- 8.1. Market Analysis, Insights and Forecast - by Component type

- 9. South Korea Asia-Pacific Optoelectronics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component type

- 9.1.1. LED

- 9.1.2. Laser Diode

- 9.1.3. Image Sensors

- 9.1.4. Optocouplers

- 9.1.5. Photovoltaic cells

- 9.1.6. Other Component Types

- 9.2. Market Analysis, Insights and Forecast - by End User Industry

- 9.2.1. Automotive

- 9.2.2. Aerospace & Defense

- 9.2.3. Consumer Electronics

- 9.2.4. Information Technology

- 9.2.5. Healthcare

- 9.2.6. Residential and Commercial

- 9.2.7. Industrial

- 9.2.8. Other End-User Industries

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. Japan

- 9.3.3. India

- 9.3.4. South Korea

- 9.1. Market Analysis, Insights and Forecast - by Component type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Vishay Intertechnology Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Omnivision Technologies Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Mitsubishi Electri

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Samsung Electronics

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Texas Instruments Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Koninklijke Philips N V

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Stanley Electric Co

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Rohm Co Ltd (ROHM SEMICONDUCTOR)

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 General Electric Company

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Osram Licht AG

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Panasonic Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Sony Corporation

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Vishay Intertechnology Inc

List of Figures

- Figure 1: Asia-Pacific Optoelectronics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Optoelectronics Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Optoelectronics Market Revenue Million Forecast, by Component type 2020 & 2033

- Table 2: Asia-Pacific Optoelectronics Market Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 3: Asia-Pacific Optoelectronics Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Asia-Pacific Optoelectronics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Optoelectronics Market Revenue Million Forecast, by Component type 2020 & 2033

- Table 6: Asia-Pacific Optoelectronics Market Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 7: Asia-Pacific Optoelectronics Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Asia-Pacific Optoelectronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Asia-Pacific Optoelectronics Market Revenue Million Forecast, by Component type 2020 & 2033

- Table 10: Asia-Pacific Optoelectronics Market Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 11: Asia-Pacific Optoelectronics Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific Optoelectronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Optoelectronics Market Revenue Million Forecast, by Component type 2020 & 2033

- Table 14: Asia-Pacific Optoelectronics Market Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 15: Asia-Pacific Optoelectronics Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Asia-Pacific Optoelectronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Asia-Pacific Optoelectronics Market Revenue Million Forecast, by Component type 2020 & 2033

- Table 18: Asia-Pacific Optoelectronics Market Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 19: Asia-Pacific Optoelectronics Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Asia-Pacific Optoelectronics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Optoelectronics Market?

The projected CAGR is approximately 11.20%.

2. Which companies are prominent players in the Asia-Pacific Optoelectronics Market?

Key companies in the market include Vishay Intertechnology Inc, Omnivision Technologies Inc, Mitsubishi Electri, Samsung Electronics, Texas Instruments Inc, Koninklijke Philips N V, Stanley Electric Co, Rohm Co Ltd (ROHM SEMICONDUCTOR), General Electric Company, Osram Licht AG, Panasonic Corporation, Sony Corporation.

3. What are the main segments of the Asia-Pacific Optoelectronics Market?

The market segments include Component type, End User Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 36 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing demand for Smart Consumer Electronics; Increasing Industrial Applications of the Technology.

6. What are the notable trends driving market growth?

Healthcare Sector is Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

High Manufacturing and Fabricating Costs.

8. Can you provide examples of recent developments in the market?

March 2023: Onsemi recently announced a unique, innovative image sensor, the AR0822. The device's embedded high dynamic range feature and optimized near-infrared response are necessary for applications with tricky lighting conditions, such as security and surveillance, doorbell cameras, body cameras, and robotics. The sensor's low-power architecture and Wake-on-Motion elements are designed to reduce system power significantly.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Optoelectronics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Optoelectronics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Optoelectronics Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Optoelectronics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence