Key Insights

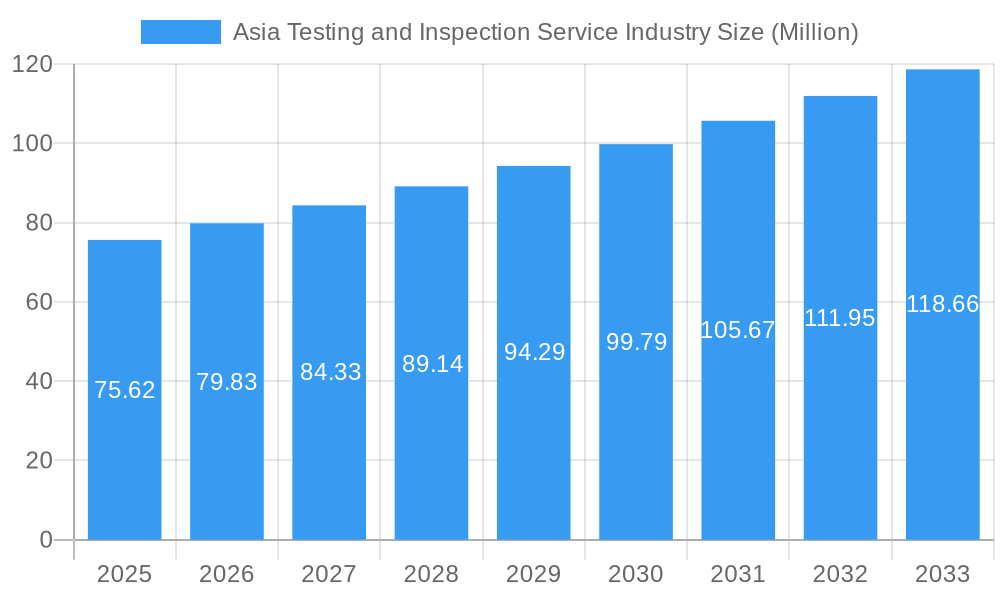

The Asia Testing, Inspection, and Certification (TIC) services market is experiencing robust growth, projected to reach \$75.62 million in 2025 and expand significantly over the forecast period (2025-2033). A Compound Annual Growth Rate (CAGR) of 5.50% reflects the increasing demand driven by several key factors. Stringent government regulations across various sectors, including food safety, automotive standards, and environmental protection, necessitate comprehensive testing and certification. Furthermore, the burgeoning industrial manufacturing, automotive and transportation, oil and gas, and building and infrastructure sectors in the region are major contributors to market expansion. The rising consumer awareness of product quality and safety further fuels the demand for independent TIC services. Growth is also fueled by outsourcing trends as companies increasingly leverage specialized expertise to ensure quality and compliance. While data on specific market segments isn't provided in detail, we can infer that the Industrial Manufacturing, Automotive and Transportation, and Oil & Gas sectors are likely the largest contributors given their significant presence and regulatory demands in Asia. The in-house vs. outsourced segment will likely see a continued shift towards outsourcing, driven by cost efficiency and access to specialized expertise.

Asia Testing and Inspection Service Industry Market Size (In Million)

The market's expansion across Asia is unevenly distributed. High-growth economies like China, India, and other Southeast Asian nations are likely to experience above-average growth, while more mature economies might see a more moderate expansion. The competitive landscape is characterized by both international players such as Intertek, SGS, and Bureau Veritas, and regional companies, indicating a blend of global expertise and local market knowledge. Future growth will depend on technological advancements in testing methodologies, increased adoption of digitalization within TIC services, and continued regulatory enforcement. Addressing potential restraints, such as infrastructure limitations in some areas and the need to maintain testing accuracy and standardization across diverse markets, will be crucial to sustain the positive growth trajectory.

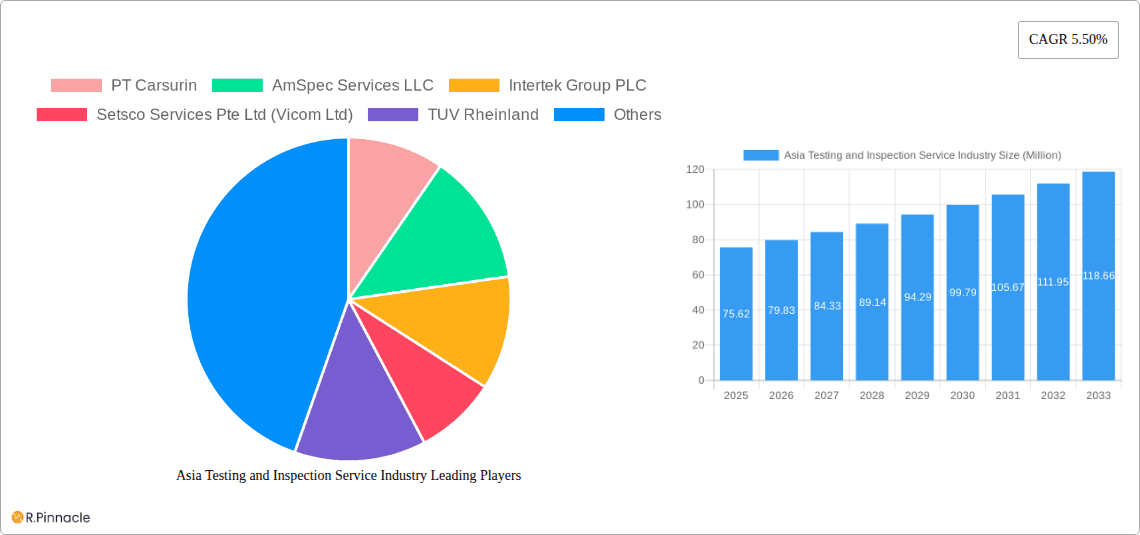

Asia Testing and Inspection Service Industry Company Market Share

Asia Testing and Inspection Service Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia Testing and Inspection Service industry, offering invaluable insights for industry professionals, investors, and strategic planners. The report covers the period 2019-2033, with a focus on 2025, incorporating historical data, current market dynamics, and future projections. Expect detailed breakdowns of market segments, key players, and emerging trends, all supported by robust data and analysis.

Asia Testing and Inspection Service Industry Market Structure & Innovation Trends

The Asia Testing and Inspection Services market is characterized by a moderately concentrated structure, with several multinational corporations holding significant market share. Key players such as SGS Group, Bureau Veritas Group, Intertek Group PLC, and TUV Rheinland dominate the landscape, accounting for an estimated xx% of the total market revenue in 2025. Smaller, regional players, including PT Carsurin, Setsco Services Pte Ltd (Vicom Ltd), and Apave Japan Co Limited, cater to niche markets or specific geographic areas. Market share calculations are based on revenue figures from 2025, which totaled approximately $XX Million.

Innovation within the industry is driven by several factors:

- Stringent Regulatory Frameworks: Increasing government regulations on product safety and quality across various sectors necessitate robust testing and inspection services, creating a consistent demand.

- Technological Advancements: Automation, AI, and big data analytics are transforming testing and inspection processes, leading to increased efficiency and accuracy.

- Product Substitutes: The emergence of new materials and technologies requires the development of specialized testing methods, driving innovation in the service offerings.

- End-User Demographics: The growth of manufacturing and industrial sectors in Asia, coupled with changing consumer preferences for quality and safety, further stimulates innovation.

Mergers and acquisitions (M&A) activity has been significant in recent years, with several large players consolidating their market positions through strategic acquisitions. The total value of M&A deals in the Asia testing and inspection service industry between 2019 and 2024 is estimated at $XX Million. Deals are often driven by expansion into new markets, acquisition of specialized expertise, and achieving economies of scale.

Asia Testing and Inspection Service Industry Market Dynamics & Trends

The Asia Testing and Inspection Services market exhibits robust growth, driven by several key factors. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected at xx%, indicating significant market expansion. Market penetration is increasing steadily, particularly in developing economies experiencing rapid industrialization and urbanization.

Several trends are shaping market dynamics:

- Growing Industrialization: The continuous expansion of manufacturing and industrial activities across Asia fuels demand for testing and inspection services.

- Rising Consumer Awareness: Increasing consumer awareness of product quality and safety is driving demand for certification services.

- Technological Disruption: The adoption of advanced technologies, such as AI and robotics, improves testing efficiency and accuracy.

- Increased Regulatory Scrutiny: Stringent government regulations on product safety and environmental compliance lead to increased demand for testing and inspection.

- Competitive Landscape: The market is characterized by intense competition among established players and new entrants, forcing companies to innovate and offer differentiated services.

- Supply Chain Resilience: Companies are increasingly focusing on enhancing supply chain resilience by implementing comprehensive quality control measures.

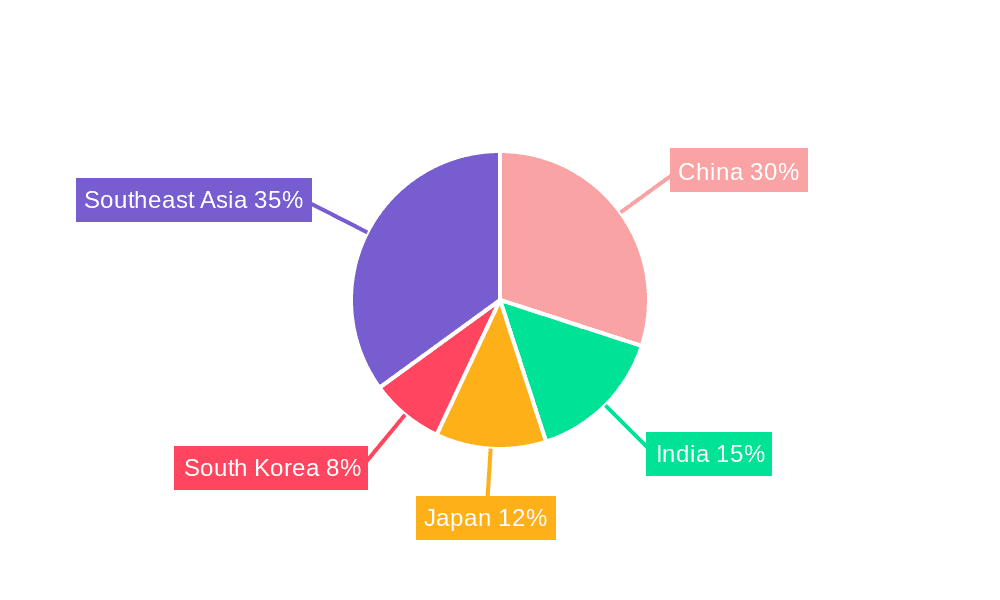

Dominant Regions & Segments in Asia Testing and Inspection Service Industry

China and India are the dominant regions in the Asia testing and inspection service industry, owing to their vast manufacturing bases and rapid economic growth. Other key markets include Japan, South Korea, Singapore, and several Southeast Asian countries.

Key Drivers of Regional Dominance:

- Strong Economic Growth: Rapid economic expansion fosters industrial development and increases demand for testing and inspection services.

- Government Initiatives: Supportive government policies promoting industrial development and quality infrastructure facilitate market growth.

- Favorable Investment Climate: A favorable investment climate attracts foreign investment, leading to the establishment of more testing and inspection facilities.

Dominant Segments:

- By Type: Outsourced testing and inspection services dominate the market due to cost-effectiveness and specialized expertise.

- By Service Type: Testing and inspection services comprise the largest segment, followed by certification services, which are increasingly demanded for international trade compliance.

- By End-User: The industrial manufacturing, automotive and transportation, and oil and gas sectors are major consumers of testing and inspection services, fueled by stringent quality and safety requirements. Other important segments include food and agriculture, building and infrastructure, and consumer goods and retail.

Asia Testing and Inspection Service Industry Product Innovations

Recent innovations include automated testing systems, advanced analytical techniques, and cloud-based data management platforms. These advancements deliver enhanced speed, accuracy, and cost-effectiveness. The integration of AI and machine learning is also improving the efficiency and precision of various testing processes, enabling faster turnaround times and improved decision-making. The market is witnessing increasing adoption of remote inspection technologies, reducing geographical constraints and enhancing operational efficiency. This focus on innovation improves market fit by catering to specific needs and providing competitive advantages.

Report Scope & Segmentation Analysis

This report segments the Asia Testing and Inspection Service market based on type (in-house, outsourced), service type (testing, inspection, certification), and end-user (industrial manufacturing, automotive and transportation, oil and gas, mining, food and agriculture, building and infrastructure, consumer goods and retail, other). Each segment is analyzed in detail, including growth projections, market size, and competitive dynamics. For instance, the outsourced segment is anticipated to experience the highest CAGR driven by the increasing demand for specialized expertise and cost optimization. The industrial manufacturing sector is the largest end-user segment, reflecting its large-scale operations and stringent quality control needs.

Key Drivers of Asia Testing and Inspection Service Industry Growth

The industry's growth is driven by:

- Stringent regulatory compliance: Governments in Asia are increasingly implementing strict regulations concerning product safety, environmental protection, and trade compliance, mandating testing and inspection services.

- Rising consumer demand for quality: Consumers are becoming more discerning, demanding high-quality and safe products.

- Technological advancements: Innovative testing methods and automated systems enhance efficiency and accuracy.

- Expansion of manufacturing and infrastructure: Asia's ongoing industrialization and infrastructure development projects fuel the demand for testing and inspection services.

Challenges in the Asia Testing and Inspection Service Industry Sector

The industry faces challenges such as:

- Intense competition: The market is highly competitive, with numerous established and emerging players.

- Maintaining accreditation and standards: Meeting international and regional accreditation standards and maintaining quality control is essential but costly.

- Skilled labor shortage: Finding and retaining qualified technicians and inspectors is a significant hurdle in many regions.

- Supply chain disruptions: Global supply chain disruptions can negatively impact the timely delivery of testing services.

Emerging Opportunities in Asia Testing and Inspection Service Industry

The industry offers several emerging opportunities:

- Growth in e-commerce: The rapid growth of e-commerce necessitates comprehensive quality control measures for online marketplaces, creating demand for specialized testing and inspection services.

- Expansion into new markets: Untapped markets in emerging economies present opportunities for growth.

- Focus on sustainable practices: Growing emphasis on environmental sustainability leads to increasing demand for green testing and inspection services.

Leading Players in the Asia Testing and Inspection Service Industry Market

- PT Carsurin

- AmSpec Services LLC

- Intertek Group PLC

- Setsco Services Pte Ltd (Vicom Ltd)

- TUV Rheinland

- Apave Japan Co Limited

- Singapore Test Lab Pte Ltd

- SGS Group

- Bureau Veritas Group

- ALS Malaysia (ALS Limited)

- HQTS Group Ltd

- Seoul Inspection & Testing Co Limited

- Cotecna Inspection SA

- PT SUCOFINDO Perseo

- SIRIM QAS International Sdn Bhd

- UL LLC

- ABS Group

- TUV SUD

Key Developments in Asia Testing and Inspection Service Industry

- December 2022: SGS inaugurated a new multidisciplinary 1,300 m2 Center of Excellence Testing Facility in Dubai, focusing on cosmetic and personal care product testing. This expansion strengthens SGS's position in the rapidly growing cosmetics market and enhances its analytical testing capabilities.

- October 2022: Intertek Group PLC launched the "As Advertised" Program, offering end-to-end quality assurance for online marketplaces and third-party sellers. This initiative boosts consumer confidence and improves the overall quality of goods sold online.

Future Outlook for Asia Testing and Inspection Service Market

The Asia Testing and Inspection Services market is poised for continued strong growth, driven by ongoing industrialization, increasing regulatory scrutiny, and rising consumer awareness. Strategic investments in technology, expansion into new markets, and a focus on providing specialized services will be crucial for success. The market will see increased consolidation through mergers and acquisitions, further shaping the competitive landscape. The expanding middle class and increasing disposable income will lead to an increased demand for quality and certified products.

Asia Testing and Inspection Service Industry Segmentation

-

1. Type

- 1.1. In-house

- 1.2. Outsourced

-

2. Service Type

- 2.1. Testing and Inspection

- 2.2. Certification

-

3. End User

- 3.1. Industrial Manufacturing

- 3.2. Automotive and Transportation

- 3.3. Oil and Gas

- 3.4. Mining and Downstream Applications

- 3.5. Food and Agriculture

- 3.6. Building and Infrastructure

- 3.7. Consumer Goods and Retail

- 3.8. Other End Users

Asia Testing and Inspection Service Industry Segmentation By Geography

-

1. Asia

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Indonesia

- 1.6. Malaysia

- 1.7. Singapore

- 1.8. Thailand

- 1.9. Vietnam

- 1.10. Philippines

- 1.11. Bangladesh

- 1.12. Pakistan

Asia Testing and Inspection Service Industry Regional Market Share

Geographic Coverage of Asia Testing and Inspection Service Industry

Asia Testing and Inspection Service Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Emphasis on Adopting Export-friendly Practices by Mitigating Product Recalls and Scope for Counterfeiting and Piracy; Emergence of APAC as a Major Manufacturing Hub to Aid Market Demand for TIC Services

- 3.3. Market Restrains

- 3.3.1. Low Awareness about the Facility Management Services

- 3.4. Market Trends

- 3.4.1. Emergence of APAC as a Major Manufacturing Hub to Aid Market Demand for TIC Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Testing and Inspection Service Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. In-house

- 5.1.2. Outsourced

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Testing and Inspection

- 5.2.2. Certification

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Industrial Manufacturing

- 5.3.2. Automotive and Transportation

- 5.3.3. Oil and Gas

- 5.3.4. Mining and Downstream Applications

- 5.3.5. Food and Agriculture

- 5.3.6. Building and Infrastructure

- 5.3.7. Consumer Goods and Retail

- 5.3.8. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PT Carsurin

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AmSpec Services LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Intertek Group PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Setsco Services Pte Ltd (Vicom Ltd)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TUV Rheinland

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Apave Japan Co Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Singapore Test Lab Pte Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SGS Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bureau Veritas Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ALS Malaysia (ALS Limited)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 HQTS Group Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Seoul Inspection & Testing Co Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Cotecna Inspection SA

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 PT SUCOFINDO Perseo*List Not Exhaustive

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 SIRIM QAS International Sdn Bhd

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 UL LLC

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 ABS Group

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 TUV SUD

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.1 PT Carsurin

List of Figures

- Figure 1: Asia Testing and Inspection Service Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Testing and Inspection Service Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia Testing and Inspection Service Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Asia Testing and Inspection Service Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 3: Asia Testing and Inspection Service Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Asia Testing and Inspection Service Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Asia Testing and Inspection Service Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Asia Testing and Inspection Service Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 7: Asia Testing and Inspection Service Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Asia Testing and Inspection Service Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: China Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: India Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Bangladesh Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Pakistan Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Testing and Inspection Service Industry?

The projected CAGR is approximately 5.50%.

2. Which companies are prominent players in the Asia Testing and Inspection Service Industry?

Key companies in the market include PT Carsurin, AmSpec Services LLC, Intertek Group PLC, Setsco Services Pte Ltd (Vicom Ltd), TUV Rheinland, Apave Japan Co Limited, Singapore Test Lab Pte Ltd, SGS Group, Bureau Veritas Group, ALS Malaysia (ALS Limited), HQTS Group Ltd, Seoul Inspection & Testing Co Limited, Cotecna Inspection SA, PT SUCOFINDO Perseo*List Not Exhaustive, SIRIM QAS International Sdn Bhd, UL LLC, ABS Group, TUV SUD.

3. What are the main segments of the Asia Testing and Inspection Service Industry?

The market segments include Type, Service Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 75.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Emphasis on Adopting Export-friendly Practices by Mitigating Product Recalls and Scope for Counterfeiting and Piracy; Emergence of APAC as a Major Manufacturing Hub to Aid Market Demand for TIC Services.

6. What are the notable trends driving market growth?

Emergence of APAC as a Major Manufacturing Hub to Aid Market Demand for TIC Services.

7. Are there any restraints impacting market growth?

Low Awareness about the Facility Management Services.

8. Can you provide examples of recent developments in the market?

December 2022: SGS inaugurated a new multidisciplinary 1,300 m2 Center of Excellence Testing Facility in Dubai. The laboratory will concentrate on analytical testing - physical, chemical, and microbial contamination - for cosmetic and personal care products. It is ISO/IEC 17025 accredited and has a Class 10,000 cleanroom certification.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Testing and Inspection Service Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Testing and Inspection Service Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Testing and Inspection Service Industry?

To stay informed about further developments, trends, and reports in the Asia Testing and Inspection Service Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence