Key Insights

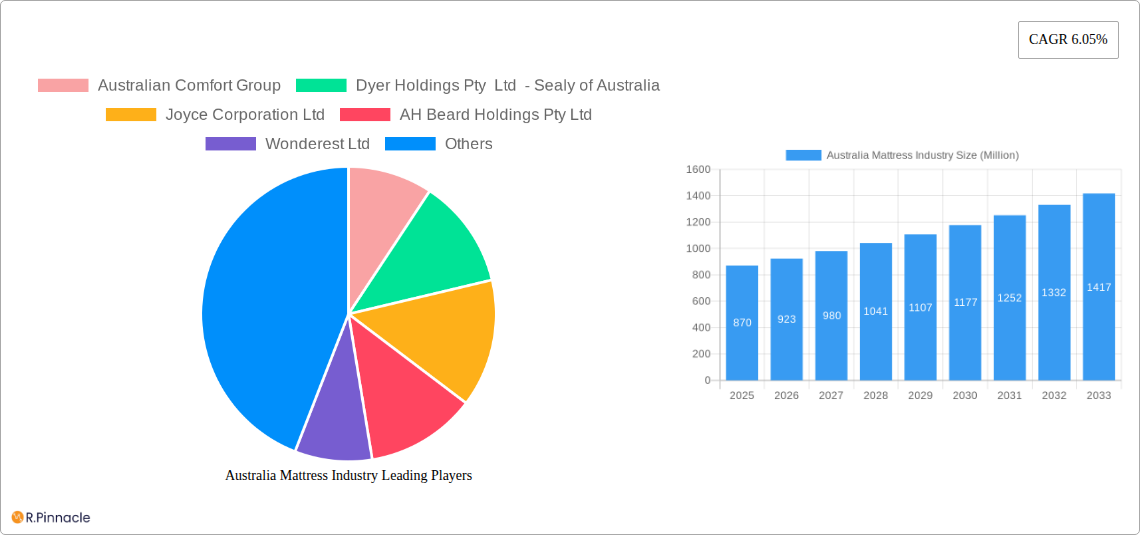

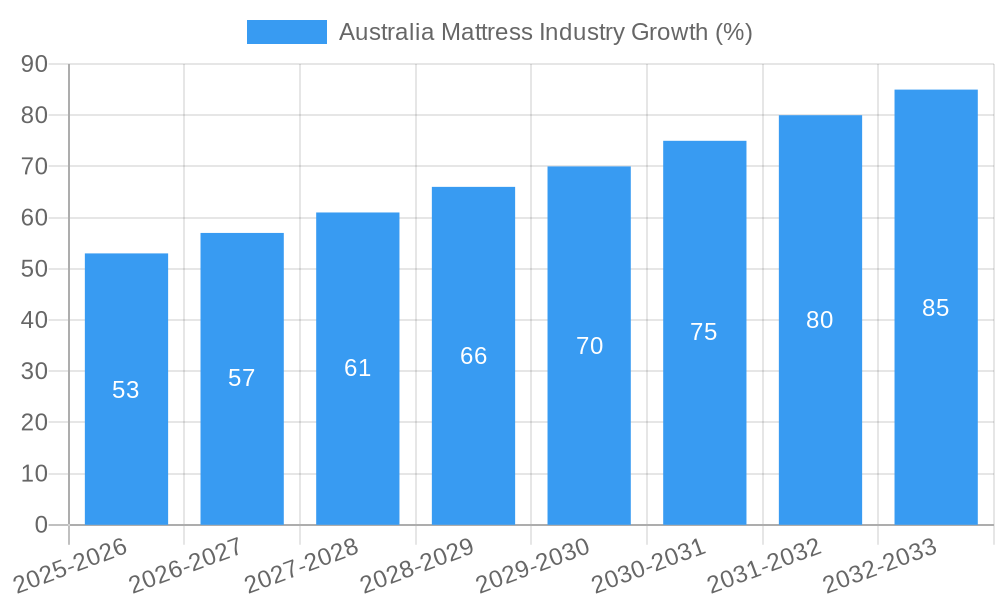

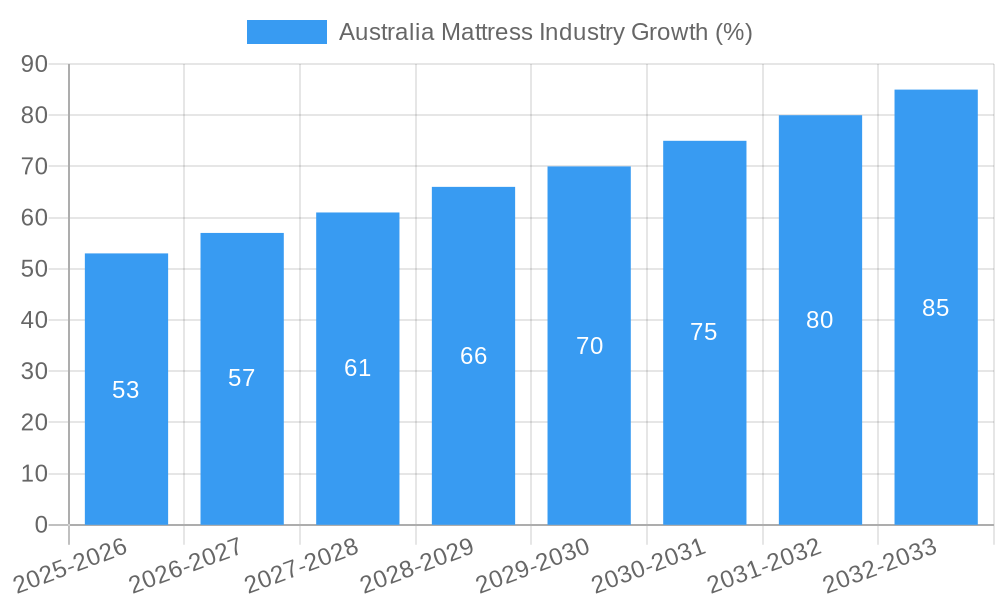

The Australian mattress market, valued at $0.87 billion in 2025, is projected to experience robust growth, driven by several key factors. Rising disposable incomes, increasing awareness of sleep hygiene and its impact on overall health, and a preference for higher-quality, technologically advanced mattresses are fueling demand. The shift towards online purchasing, facilitated by e-commerce platforms and direct-to-consumer brands like Koala Sleep and Sleeping Duck Mattress, is also significantly impacting the market landscape. Furthermore, innovative mattress technologies, such as memory foam, latex, and hybrid options, cater to diverse consumer preferences and needs, stimulating market expansion. The growing popularity of adjustable beds and smart sleep technology further contributes to this upward trend. Competition is intense, with established players like Sealy and AH Beard facing challenges from agile, digitally native brands. While factors like economic downturns could potentially restrain growth, the long-term outlook remains positive, with a projected Compound Annual Growth Rate (CAGR) of 6.05% from 2025 to 2033.

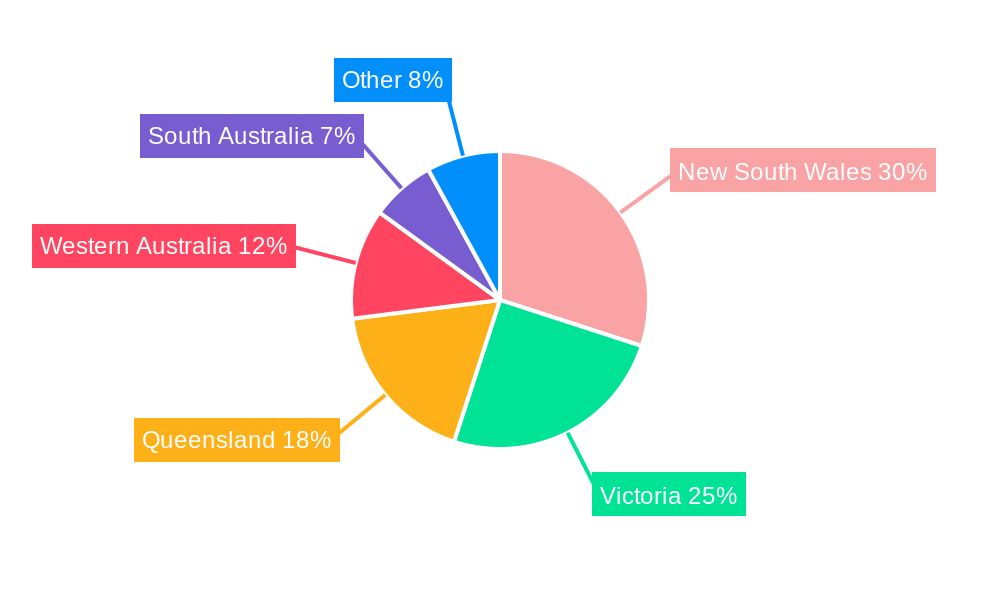

The market segmentation is evolving, with a clear division between traditional retailers and online-only brands. The increasing focus on sustainability and eco-friendly materials is also creating new opportunities for brands that prioritize ethical sourcing and manufacturing practices. The geographic distribution likely mirrors Australia's population density, with major metropolitan areas driving the majority of sales. However, growing regional populations may unlock opportunities for expansion in the coming years. Price sensitivity remains a factor, with budget-conscious consumers seeking value-for-money options, while others are prepared to invest in premium products for enhanced comfort and health benefits. Therefore, manufacturers must strategically target diverse consumer segments with tailored product offerings and marketing strategies to capitalize on the market's growth potential.

Australia Mattress Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Australian mattress industry, offering valuable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's structure, dynamics, and future potential. The report leverages extensive data analysis and expert insights to deliver actionable strategies for navigating the evolving landscape of the Australian mattress market. The total market size is estimated to be at $XX Million in 2025.

Australia Mattress Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Australian mattress market, examining market concentration, key innovation drivers, regulatory frameworks, and the impact of product substitutes. We delve into end-user demographics, highlighting key trends influencing purchasing decisions. Furthermore, we explore mergers and acquisitions (M&A) activities within the industry, analyzing deal values and their impact on market share.

Market Concentration: The Australian mattress industry exhibits a moderately concentrated structure, with several key players holding significant market share. Australian Comfort Group, Dyer Holdings Pty Ltd (Sealy of Australia), Joyce Corporation Ltd, AH Beard Holdings Pty Ltd, and Wonderest Ltd are prominent examples. However, the rise of online brands like Koala Sleep Pty Ltd, Sleeping Duck Mattress, and Ecosa Mattress is increasing competition.

Market Share Distribution (2025 Estimate): Australian Comfort Group (XX%), Dyer Holdings Pty Ltd (Sealy of Australia) (XX%), Joyce Corporation Ltd (XX%), AH Beard Holdings Pty Ltd (XX%), Wonderest Ltd (XX%), with remaining share distributed amongst other players including emerging online brands.

M&A Activity: The historical period (2019-2024) witnessed approximately XX M&A deals, with a total estimated value of $XX Million. These transactions largely involved smaller companies being acquired by larger players aiming to expand their product portfolios or geographic reach.

Innovation Drivers: Technological advancements in materials science (e.g., memory foam, hybrid mattresses), increasing consumer demand for personalized comfort, and the rise of e-commerce are key innovation drivers. Sustainability concerns are also impacting product development, with a growing focus on eco-friendly materials and manufacturing processes.

Australia Mattress Industry Market Dynamics & Trends

This section examines the dynamic forces shaping the Australian mattress market. We analyze market growth drivers, technological disruptions, evolving consumer preferences, and the intensifying competitive landscape. Key metrics like Compound Annual Growth Rate (CAGR) and market penetration are used to illustrate market trends and opportunities.

The Australian mattress market is projected to experience a CAGR of XX% during the forecast period (2025-2033), driven by factors such as rising disposable incomes, increasing urbanization, and a growing awareness of the importance of sleep hygiene. Technological advancements in mattress design and materials are also contributing to market growth, with consumers increasingly seeking technologically advanced features. The rise of online retailers has significantly impacted market penetration, offering consumers greater choice and convenience. Competition is fierce, with both established players and emerging online brands vying for market share through innovative product offerings, targeted marketing, and competitive pricing strategies. Consumer preferences are shifting towards specialized mattresses (e.g., adjustable bases, eco-friendly options), influencing product development and marketing strategies.

Dominant Regions & Segments in Australia Mattress Industry

This section identifies the leading regions and segments within the Australian mattress market. We analyze the key drivers behind their dominance, including economic policies, infrastructure development, and consumer behavior.

Dominant Region: Major metropolitan areas such as Sydney, Melbourne, Brisbane, and Perth account for the largest share of the market due to higher population density, increased disposable income, and higher housing prices.

Key Drivers:

- Economic Growth: Strong economic conditions in major cities drive consumer spending on home furnishings, including mattresses.

- Housing Market: A robust housing market, particularly in major cities, contributes to the demand for new mattresses.

- Population Growth: Population growth in urban areas fuels demand for housing and, consequently, mattresses.

- Tourism: Tourist spending contributes to the demand for mattresses, especially in hotels and short-term rental accommodations.

The market is further segmented by product type (e.g., innerspring, memory foam, latex, hybrid), price point, and distribution channel (online vs. offline). Each segment exhibits distinct growth dynamics and competitive landscapes, influenced by factors such as consumer preferences, technological innovation, and retail strategies.

Australia Mattress Industry Product Innovations

The Australian mattress industry is witnessing continuous product innovation, driven by advancements in materials science, manufacturing techniques, and consumer preferences. New materials, such as advanced foams and hybrid constructions, offer enhanced comfort, support, and durability. Technological integrations, like smart sleep-tracking features, are becoming increasingly common. These innovations cater to the growing demand for personalized sleep solutions and address specific health and wellness concerns.

Report Scope & Segmentation Analysis

This report segments the Australian mattress market based on product type (innerspring, memory foam, latex, hybrid), price range (budget, mid-range, premium), distribution channel (online, offline), and consumer demographics (age, income). Each segment exhibits unique growth trajectories and competitive dynamics. For example, the online channel is experiencing rapid growth, driven by consumer convenience and access to wider product selections. The premium segment shows strong growth potential, driven by consumer demand for higher quality and technologically advanced products.

Key Drivers of Australia Mattress Industry Growth

Several factors drive the growth of the Australian mattress industry. Rising disposable incomes allow consumers to invest in higher-quality sleep products. Urbanization concentrates populations in areas with higher purchasing power. Increased awareness of the importance of sleep quality and its impact on overall health is a significant driver. Technological advancements offer increasingly sophisticated sleep solutions, enhancing comfort and health benefits. Finally, a growing preference for online shopping enhances accessibility and convenience.

Challenges in the Australia Mattress Industry Sector

The Australian mattress industry faces several challenges. Fluctuating raw material prices and supply chain disruptions impact manufacturing costs and profitability. Intense competition from both established and new players necessitates continuous innovation and marketing efforts. The increasing focus on sustainability necessitates environmentally friendly manufacturing practices. Lastly, stringent regulatory frameworks require continuous compliance.

Emerging Opportunities in Australia Mattress Industry

Emerging opportunities exist in the Australian mattress market. Growth in e-commerce provides avenues for expanding market reach and reducing distribution costs. A growing interest in personalized sleep solutions creates opportunities for customized products and services. The increasing focus on sustainable products opens opportunities for eco-friendly mattresses and packaging.

Leading Players in the Australia Mattress Industry Market

- Australian Comfort Group

- Dyer Holdings Pty Ltd - Sealy of Australia

- Joyce Corporation Ltd

- AH Beard Holdings Pty Ltd

- Wonderest Ltd

- Koala Sleep Pty Ltd

- Sleeping Duck Mattress

- Ecosa Mattress

- Tontine Pty Ltd

- Tempur Australia Pty Ltd (List Not Exhaustive)

Key Developments in Australia Mattress Industry Industry

- December 2022: Koala launches the "Bed Sofa," a new sofa bed design.

- May 2023: Koala expands its product line with three new sofa bed models.

Future Outlook for Australia Mattress Industry Market

The Australian mattress industry is poised for continued growth, driven by evolving consumer preferences, technological advancements, and a focus on health and wellness. Opportunities lie in personalized sleep solutions, sustainable products, and innovative retail strategies. The industry will likely see further consolidation, with larger players acquiring smaller companies to expand their market share. The focus on premium and specialized products will likely intensify.

Australia Mattress Industry Segmentation

-

1. Type

- 1.1. Spring Mattresses

- 1.2. Memory Foam Mattresses

- 1.3. Latex Mattresses

- 1.4. Other Mattresses

-

2. Distribution Channel

- 2.1. Online

- 2.2. Offline

-

3. End Users

- 3.1. Residential

- 3.2. Commercial

Australia Mattress Industry Segmentation By Geography

- 1. Australia

Australia Mattress Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.05% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Residential Construction; Increase In Tourism Contributing To The Growth Of The Mattress Market

- 3.3. Market Restrains

- 3.3.1. Growing Residential Construction; Increase In Tourism Contributing To The Growth Of The Mattress Market

- 3.4. Market Trends

- 3.4.1. Hotel Industry is Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Mattress Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Spring Mattresses

- 5.1.2. Memory Foam Mattresses

- 5.1.3. Latex Mattresses

- 5.1.4. Other Mattresses

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by End Users

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Australian Comfort Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dyer Holdings Pty Ltd - Sealy of Australia

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Joyce Corporation Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AH Beard Holdings Pty Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Wonderest Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Koala Sleep Pty Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sleeping Duck Mattress

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ecosa Mattress

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Tontine Pty Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tempur Australia Pty Ltd **List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Australian Comfort Group

List of Figures

- Figure 1: Australia Mattress Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Mattress Industry Share (%) by Company 2024

List of Tables

- Table 1: Australia Mattress Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Mattress Industry Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Australia Mattress Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Australia Mattress Industry Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Australia Mattress Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: Australia Mattress Industry Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 7: Australia Mattress Industry Revenue Million Forecast, by End Users 2019 & 2032

- Table 8: Australia Mattress Industry Volume Billion Forecast, by End Users 2019 & 2032

- Table 9: Australia Mattress Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Australia Mattress Industry Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Australia Mattress Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Australia Mattress Industry Volume Billion Forecast, by Type 2019 & 2032

- Table 13: Australia Mattress Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 14: Australia Mattress Industry Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 15: Australia Mattress Industry Revenue Million Forecast, by End Users 2019 & 2032

- Table 16: Australia Mattress Industry Volume Billion Forecast, by End Users 2019 & 2032

- Table 17: Australia Mattress Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Australia Mattress Industry Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Mattress Industry?

The projected CAGR is approximately 6.05%.

2. Which companies are prominent players in the Australia Mattress Industry?

Key companies in the market include Australian Comfort Group, Dyer Holdings Pty Ltd - Sealy of Australia, Joyce Corporation Ltd, AH Beard Holdings Pty Ltd, Wonderest Ltd, Koala Sleep Pty Ltd, Sleeping Duck Mattress, Ecosa Mattress, Tontine Pty Ltd, Tempur Australia Pty Ltd **List Not Exhaustive.

3. What are the main segments of the Australia Mattress Industry?

The market segments include Type, Distribution Channel, End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.87 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Residential Construction; Increase In Tourism Contributing To The Growth Of The Mattress Market.

6. What are the notable trends driving market growth?

Hotel Industry is Driving the Market Growth.

7. Are there any restraints impacting market growth?

Growing Residential Construction; Increase In Tourism Contributing To The Growth Of The Mattress Market.

8. Can you provide examples of recent developments in the market?

In May 2023, Koala launched a new venture into sofa beds. The well-known firm has now introduced three gorgeous sofa bed designs, each of which has already gained a tonne of traction with consumers searching for comfort, style, and most importantly, functionality in their living rooms.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Mattress Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Mattress Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Mattress Industry?

To stay informed about further developments, trends, and reports in the Australia Mattress Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence