Key Insights

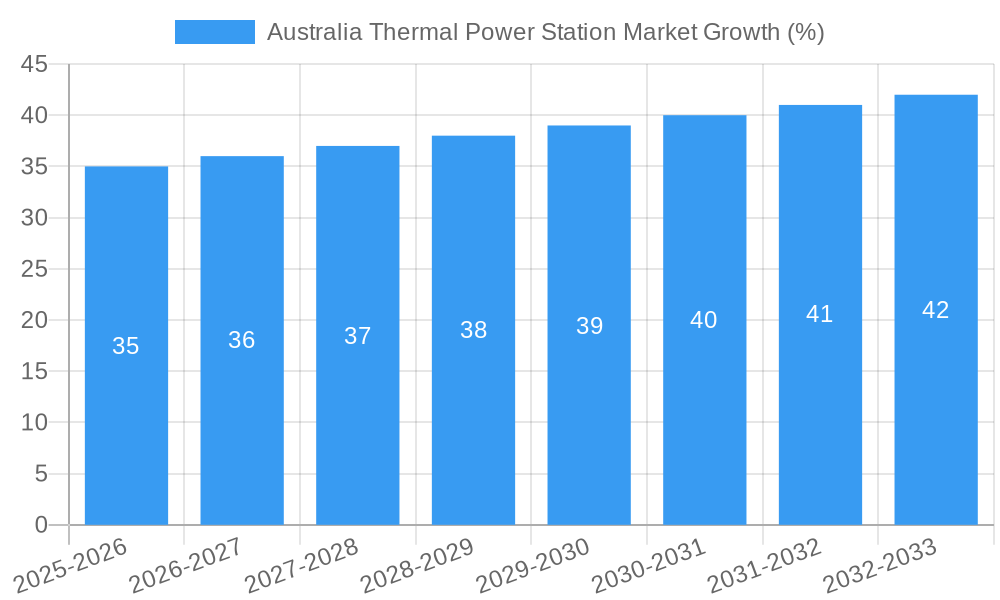

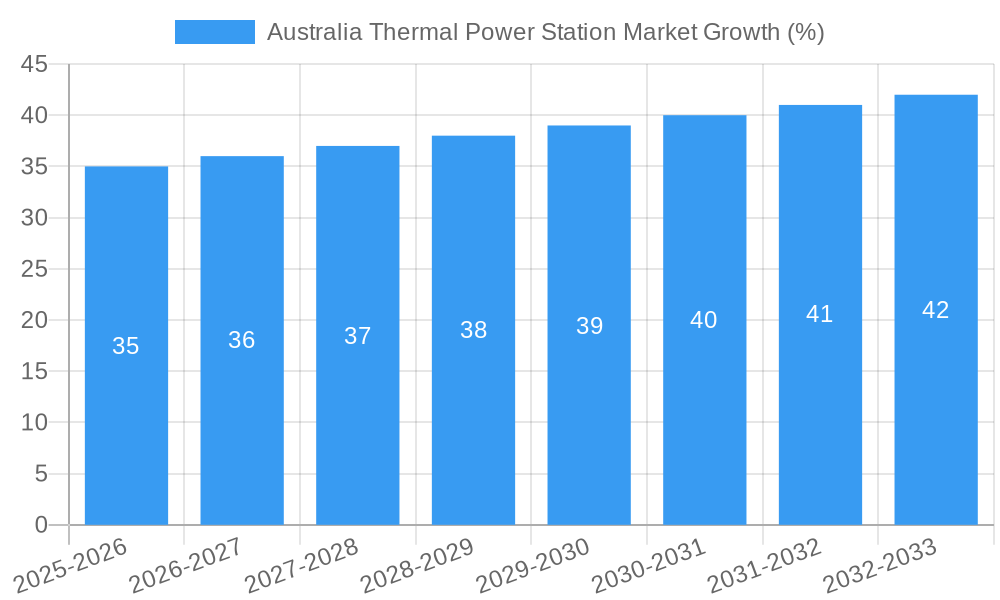

The Australian thermal power station market, valued at approximately $X million in 2025 (assuming a logical market size based on global trends and the provided CAGR), is projected to experience robust growth at a compound annual growth rate (CAGR) exceeding 1.40% from 2025 to 2033. This growth is fueled by several key drivers. Increasing energy demand driven by population growth and industrial expansion necessitates a continued reliance on thermal power generation, at least in the near to mid-term, despite the push towards renewable energy sources. Furthermore, the existing infrastructure of thermal power plants provides a stable base for ongoing operations and potential upgrades. However, the market faces significant constraints, including increasing environmental regulations aimed at curbing greenhouse gas emissions and the rising competitiveness of renewable energy technologies like solar and wind power. This necessitates a strategic shift towards cleaner technologies and potentially, carbon capture and storage (CCS) solutions within existing thermal power facilities. The market segmentation reveals a reliance on diverse fuel sources: oil, natural gas, and coal, each subject to varying levels of government policy and market fluctuations. Key players such as InterGen Services Inc, Stanwell Corporation Limited, Rio Tinto Limited, EnergyAustralia Holdings Ltd, Origin Energy Ltd, Sumitomo Corporation, NRG Energy Inc, and AGL Energy Limited are actively navigating these challenges, balancing operational efficiency with sustainability goals.

The Australian thermal power sector is undergoing a period of significant transformation. While the immediate future sees a continued role for thermal power, long-term sustainability hinges on adapting to stricter environmental policies and the competitive landscape of renewable energy. Companies are likely to invest in efficiency improvements, explore CCS technologies, and diversify their energy portfolios to mitigate risks and ensure long-term viability in a shifting energy market. The regional focus on Australia highlights the specific policy and regulatory environment impacting the market's trajectory, which includes government incentives or penalties on carbon emissions and mandates for renewable energy integration. The forecast period (2025-2033) will be crucial in observing how the market adapts to these pressures, ultimately shaping the long-term outlook for thermal power generation in Australia.

Australia Thermal Power Station Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Australia Thermal Power Station Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033, this report dissects market dynamics, competitive landscapes, and future growth prospects. Key segments analyzed include Oil, Natural Gas, and Coal-based thermal power stations.

Australia Thermal Power Station Market Structure & Innovation Trends

The Australian thermal power station market exhibits a moderately concentrated structure, with several major players holding significant market share. InterGen Services Inc, Stanwell Corporation Limited, Rio Tinto Limited, EnergyAustralia Holdings Ltd, Origin Energy Ltd, Sumitomo Corporation, NRG Energy Inc, and AGL Energy Limited are key participants. While precise market share data for each entity is unavailable (xx%), the market is characterized by ongoing consolidation through mergers and acquisitions (M&A). Recent M&A activity has involved deals valued at approximately $xx Million, primarily driven by a need for economies of scale and diversification of energy portfolios. Innovation within the sector is primarily focused on improving efficiency and reducing emissions, driven by tightening environmental regulations and the increasing cost of fossil fuels. Regulatory frameworks, particularly carbon pricing mechanisms, significantly influence investment decisions and technological adoption. Substitute technologies, including renewable energy sources, are posing an increasing competitive threat. End-user demographics are largely dominated by industrial and commercial sectors, with a smaller contribution from residential consumers.

Australia Thermal Power Station Market Dynamics & Trends

The Australian thermal power station market experienced a compound annual growth rate (CAGR) of xx% during the historical period (2019-2024). Market penetration of coal-fired power plants remains substantial but is projected to decline steadily in favor of natural gas and potentially oil-based power, due to environmental concerns and governmental regulations promoting cleaner energy solutions. The forecast period (2025-2033) anticipates a CAGR of xx%, influenced by factors such as fluctuating energy demand, government policy shifts regarding carbon emissions, and the ongoing transition towards renewable energy sources. Technological disruptions, including advancements in energy storage and grid management, are expected to reshape the landscape. Consumer preferences are evolving toward cleaner energy options, creating pressure on thermal power producers to adopt cleaner technologies or face market share erosion. Competitive dynamics are intensifying with heightened competition from renewable energy providers and increased scrutiny of environmental performance.

Dominant Regions & Segments in Australia Thermal Power Station Market

The dominance of specific regions and segments within the Australian thermal power station market varies according to fuel source.

- Coal: New South Wales and Queensland historically dominated coal-fired power generation due to extensive coal reserves and established infrastructure. However, this dominance is gradually declining due to environmental policies favoring cleaner energy alternatives. Key drivers of past dominance included abundant coal resources, existing power plant infrastructure, and strong industrial demand.

- Natural Gas: Victoria and Western Australia are expected to show increased prominence in natural gas-based thermal power generation due to their natural gas reserves and infrastructure development.

- Oil: Oil-based thermal power generation remains a relatively small segment within the broader Australian market.

While specific regional and segmental market share data is unavailable (xx%), the shift towards natural gas is expected to continue driven by government incentives and the relative ease of transitioning from coal.

Australia Thermal Power Station Market Product Innovations

Recent product innovations in the Australian thermal power station market have focused on improving efficiency and reducing emissions. This includes the adoption of advanced combustion technologies, improved heat recovery systems, and carbon capture and storage (CCS) technologies. These innovations aim to enhance the competitiveness of thermal power plants by reducing operating costs and environmental impact. The market is witnessing increasing adoption of technologies focused on improving plant reliability and reducing maintenance costs.

Report Scope & Segmentation Analysis

This report segments the Australian thermal power station market based on fuel source: Oil, Natural Gas, and Coal.

Coal: This segment is currently the largest but faces declining growth projections due to environmental concerns and government policies. The competitive landscape is characterized by intense rivalry among existing players.

Natural Gas: This segment is experiencing moderate growth and is expected to gain market share as a transition fuel source. Competition in this segment is less intense than the coal segment.

Oil: This segment remains a relatively small portion of the overall market, with limited growth prospects due to its higher cost compared to other fuel options. The competitive landscape is highly concentrated.

Specific market size data for each segment is unavailable (xx Million for each segment).

Key Drivers of Australia Thermal Power Station Market Growth

Key growth drivers for the Australian thermal power station market include the continued demand for electricity in industrial and commercial sectors and the increasing need for energy security. Government initiatives supporting infrastructure development and energy diversification are also significant drivers. Technological advancements focused on increasing efficiency and reducing emissions are playing an increasingly important role.

Challenges in the Australia Thermal Power Station Market Sector

Major challenges facing the Australian thermal power station market include increasingly stringent environmental regulations, the rising cost of fossil fuels, and increasing competition from renewable energy sources. These factors are creating significant pressure on profitability and investment decisions. Supply chain disruptions and difficulties securing financing for new projects represent further obstacles.

Emerging Opportunities in Australia Thermal Power Station Market

Emerging opportunities include the development of hybrid power plants integrating renewable energy sources with thermal power generation. The utilization of advanced technologies for emissions reduction, including CCS, offers significant potential. Furthermore, optimizing existing plants for greater efficiency can create substantial cost savings and enhance competitiveness.

Leading Players in the Australia Thermal Power Station Market Market

- InterGen Services Inc

- Stanwell Corporation Limited

- Rio Tinto Limited

- EnergyAustralia Holdings Ltd

- Origin Energy Ltd

- Sumitomo Corporation

- NRG Energy Inc

- AGL Energy Limited

Key Developments in Australia Thermal Power Station Market Industry

- 2022-Q4: AGL Energy Limited announces plans to accelerate its transition to renewable energy, leading to potential downsizing of thermal power generation assets.

- 2023-Q1: Stanwell Corporation Limited invests in new gas-fired power generation capacity to meet growing energy demand.

- 2023-Q3: Government announces new incentives for carbon capture and storage technology in thermal power plants. (Further specific developments with dates and impacts are unavailable xx).

Future Outlook for Australia Thermal Power Station Market Market

The future of the Australian thermal power station market is characterized by a transition towards cleaner energy sources. While thermal power will likely remain a significant component of the energy mix for the foreseeable future, its role is expected to gradually diminish as renewable energy technologies mature and become more cost-competitive. Strategic opportunities lie in optimizing existing assets, adopting innovative technologies to reduce emissions, and exploring hybrid power generation models that integrate thermal and renewable resources. The continued focus on energy security and reliability will continue to support investment in the sector.

Australia Thermal Power Station Market Segmentation

-

1. Source

- 1.1. Oil

- 1.2. Natural Gas

- 1.3. Coal

Australia Thermal Power Station Market Segmentation By Geography

- 1. Australia

Australia Thermal Power Station Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 1.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Reduction in Energy Bills Due to Self-Power Consumption4.; Increasing Installation of Solar PV Modules in Residential Segment

- 3.3. Market Restrains

- 3.3.1. 4.; High Installation Cost as Compared to Rooftop PV Systems

- 3.4. Market Trends

- 3.4.1. Natural Gas-Based Power to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Thermal Power Station Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Oil

- 5.1.2. Natural Gas

- 5.1.3. Coal

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 InterGen Services Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Stanwell Corporation Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Rio Tinto Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 EnergyAustralia Holdings Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Origin Energy Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sumitomo Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 NRG Energy Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AGL Energy Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 InterGen Services Inc

List of Figures

- Figure 1: Australia Thermal Power Station Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Thermal Power Station Market Share (%) by Company 2024

List of Tables

- Table 1: Australia Thermal Power Station Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Thermal Power Station Market Revenue Million Forecast, by Source 2019 & 2032

- Table 3: Australia Thermal Power Station Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Australia Thermal Power Station Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Australia Thermal Power Station Market Revenue Million Forecast, by Source 2019 & 2032

- Table 6: Australia Thermal Power Station Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Thermal Power Station Market?

The projected CAGR is approximately > 1.40%.

2. Which companies are prominent players in the Australia Thermal Power Station Market?

Key companies in the market include InterGen Services Inc, Stanwell Corporation Limited, Rio Tinto Limited, EnergyAustralia Holdings Ltd, Origin Energy Ltd, Sumitomo Corporation, NRG Energy Inc, AGL Energy Limited.

3. What are the main segments of the Australia Thermal Power Station Market?

The market segments include Source.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Reduction in Energy Bills Due to Self-Power Consumption4.; Increasing Installation of Solar PV Modules in Residential Segment.

6. What are the notable trends driving market growth?

Natural Gas-Based Power to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; High Installation Cost as Compared to Rooftop PV Systems.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Thermal Power Station Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Thermal Power Station Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Thermal Power Station Market?

To stay informed about further developments, trends, and reports in the Australia Thermal Power Station Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence