Key Insights

The European bakery products market, encompassing cakes, pastries, biscuits, bread, morning goods, and other items, is a substantial and dynamic sector. Driven by factors such as increasing consumer demand for convenient and on-the-go food options, growing health consciousness leading to demand for healthier alternatives (e.g., whole-grain breads, gluten-free options), and the expanding popularity of artisanal and premium bakery products, the market exhibits consistent growth. The diverse distribution channels, including supermarkets, convenience stores, specialty stores, and the burgeoning online retail sector, further contribute to market expansion. However, challenges exist, primarily related to fluctuating raw material prices (especially wheat and sugar), intense competition among established players and new entrants, and evolving consumer preferences that necessitate constant product innovation. The market segmentation reveals a strong preference for convenient formats like pre-packaged biscuits and pastries, while the demand for artisanal bread and cakes is also robust, presenting opportunities for specialized bakeries and premium brands.

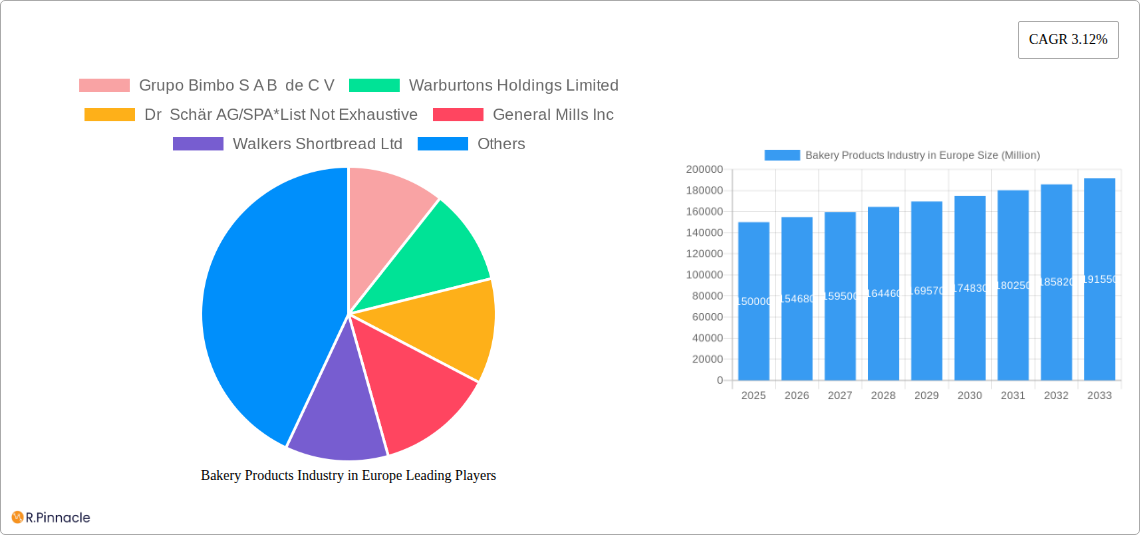

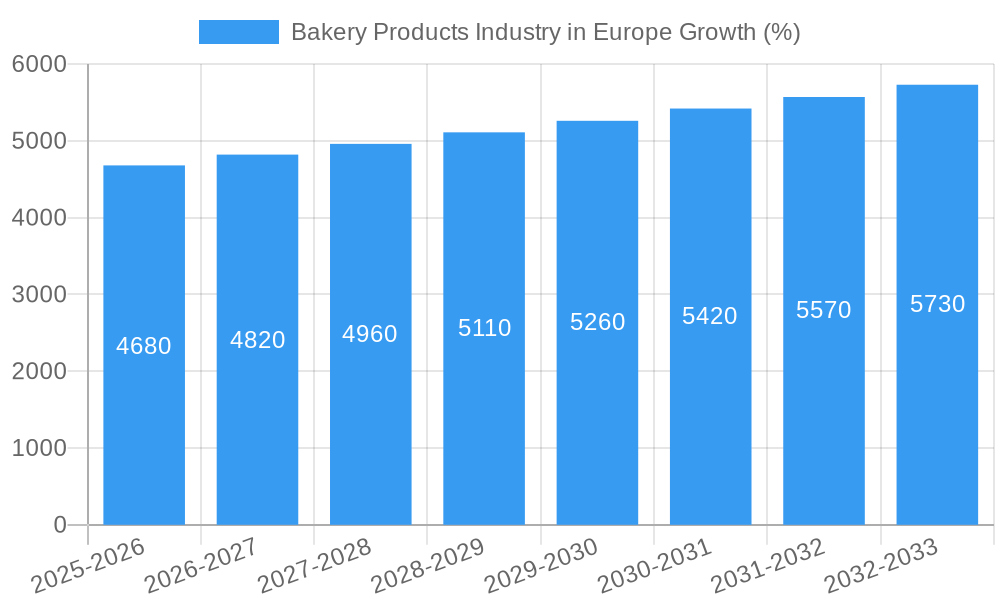

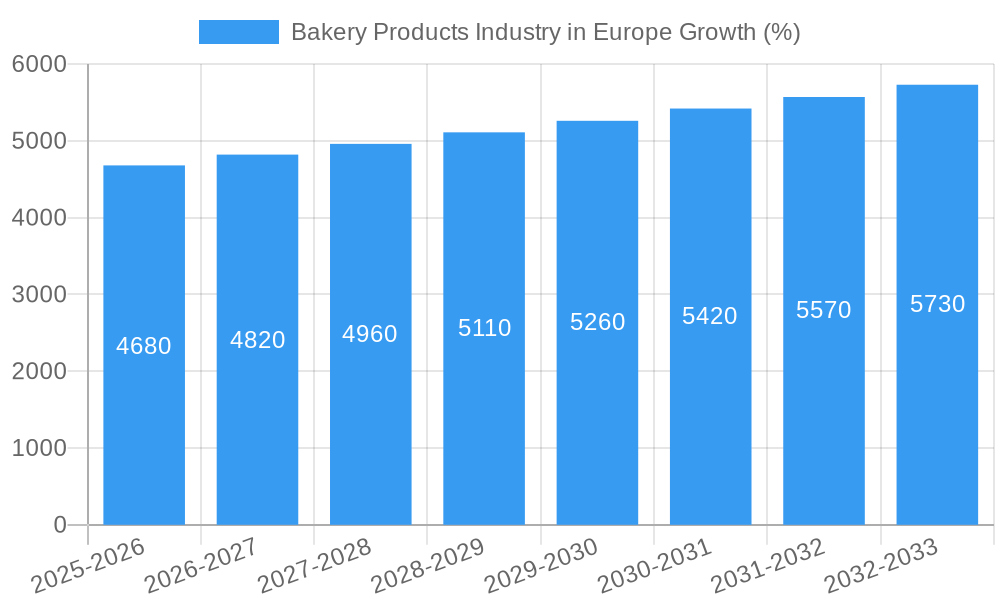

While the provided CAGR of 3.12% offers valuable insight into the market's trajectory, accurately projecting future market values requires consideration of other influential factors beyond this single metric. The base year of 2025 and the study period of 2019-2033 suggest a significant data collection effort already underway. A key trend to note is the increasing prevalence of e-commerce in the bakery sector, allowing smaller, artisanal producers to access wider markets and consumers to discover specialized offerings not previously available in their local areas. This digital transformation necessitates businesses to adjust their strategies to effectively navigate the online marketplace. This growth is expected to be especially significant in regions with high internet penetration and established e-commerce infrastructures, like the UK, Germany, and France. The competitive landscape is dominated by both large multinational corporations and smaller regional players, emphasizing the importance of both brand recognition and local appeal within the market segments.

Bakery Products Industry in Europe: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the European bakery products industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report unveils market dynamics, growth drivers, challenges, and future opportunities within this dynamic sector. The report leverages extensive data analysis and expert insights to deliver actionable intelligence for navigating the complexities of the European bakery market. Expected market size is valued at xx Million in 2025.

Bakery Products Industry in Europe Market Structure & Innovation Trends

The European bakery products market is characterized by a mix of large multinational corporations and smaller regional players. Market concentration is moderate, with several key players holding significant market share. Grupo Bimbo S A B de C V, Warburtons Holdings Limited, and Associated British Foods Plc are among the leading companies, each commanding a substantial portion of the market (specific percentages unavailable, but assumed to be high single digits to low double digits). The market is highly competitive, driven by continuous product innovation, evolving consumer preferences, and intense price competition.

- Market Concentration: Moderate, with a few dominant players and many smaller regional businesses.

- Innovation Drivers: Health and wellness trends (gluten-free, organic, low-sugar options), convenience, and premiumization.

- Regulatory Framework: Strict food safety regulations and labeling requirements influence product development and marketing strategies. HFSS regulations significantly impact product formulations and marketing.

- Product Substitutes: Other convenient snacks, breakfast cereals, and ready-to-eat meals.

- End-User Demographics: Diverse, catering to various age groups, lifestyles, and dietary preferences.

- M&A Activities: Significant M&A activity, driven by consolidation and expansion into new markets (e.g., Dr Schär's acquisition of Just: Gluten Free Bakery). Specific M&A deal values are not publicly available for all transactions, estimated at xx Million annually.

Bakery Products Industry in Europe Market Dynamics & Trends

The European bakery products market exhibits a robust growth trajectory, driven by several key factors. Rising disposable incomes, changing lifestyles, and the increasing preference for convenient and on-the-go food options fuel market expansion. Technological advancements in baking processes and packaging enhance product quality and shelf life, contributing to market growth. The market is witnessing a shift towards healthier options, with growing demand for gluten-free, organic, and low-sugar products. Consumer preference for premium and artisanal bakery items also fuels premium segment growth.

The CAGR for the European bakery products market during the forecast period (2025-2033) is projected to be xx%. Market penetration of healthier bakery options is increasing at a rate of xx% per annum. Competitive dynamics are intense, with established players focusing on product innovation and expansion, while smaller companies specialize in niche segments. Technological disruptions, such as automation in production, are enhancing efficiency and productivity, while e-commerce platforms are revolutionizing distribution channels.

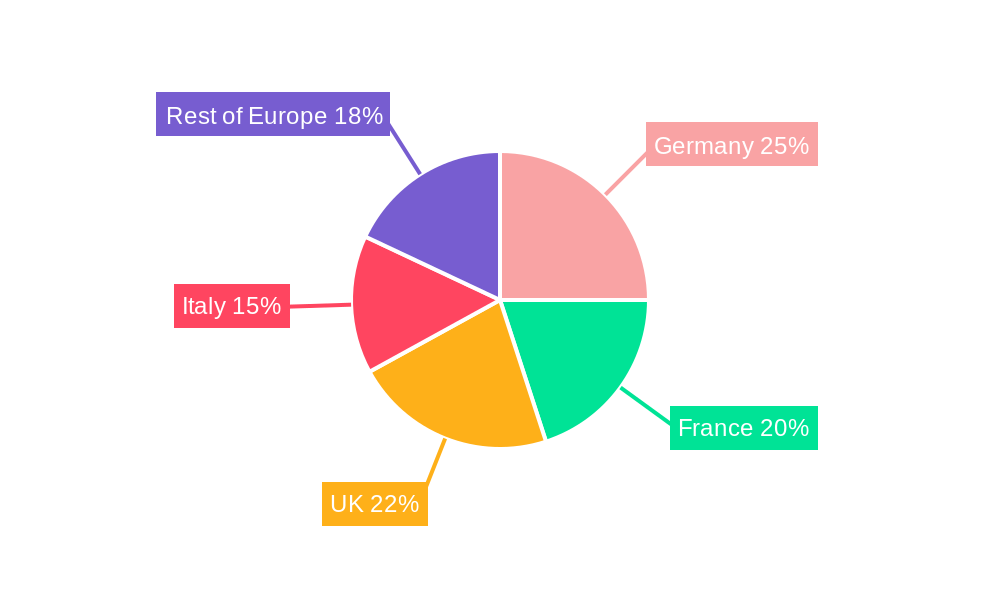

Dominant Regions & Segments in Bakery Products Industry in Europe

Western Europe, particularly countries like the UK, Germany, and France, represent the dominant regions within the European bakery products market.

Leading Segments:

- Product Type: Bread holds the largest market share, followed by biscuits and cakes/pastries. Morning goods and other product types represent smaller but growing segments.

- Distribution Channel: Supermarkets/hypermarkets dominate the distribution landscape, followed by convenience stores and specialty stores. Online retail is experiencing significant growth.

Key Drivers of Regional Dominance:

- High disposable incomes and established retail infrastructure contribute to high consumption in Western Europe.

- Strong consumer preference for traditional bakery products, as well as a willingness to experiment with new and healthier options.

- Favorable economic policies that support the growth of the food industry.

Bakery Products Industry in Europe Product Innovations

Recent product developments focus on healthier options, convenience, and premiumization. Gluten-free products are gaining traction, and manufacturers are innovating with new flavors, textures, and functional ingredients to meet diverse consumer preferences. Technological advancements in baking processes, such as automation and precision fermentation, are improving efficiency and product quality. This leads to improved shelf life and better textures and flavors which are becoming selling points.

Report Scope & Segmentation Analysis

This report segments the European bakery products market by product type (Cakes and Pastries, Biscuits, Bread, Morning Goods, Other Product Types) and distribution channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail Stores, Other Distribution Channel). Each segment's market size, growth projections, and competitive dynamics are analyzed in detail. Detailed growth projections per segment are not available but are assumed to reflect the overall market CAGR mentioned previously.

Key Drivers of Bakery Products Industry in Europe Growth

Several key factors drive the growth of the European bakery products market. These include increasing demand for convenient and ready-to-eat foods, the growing popularity of health-conscious options (gluten-free, organic), and continuous product innovation. Government regulations promoting healthy eating habits further boost demand for healthier bakery products. Technological advancements in production and distribution also contribute to market expansion.

Challenges in the Bakery Products Industry in Europe Sector

The European bakery products industry faces various challenges, including fluctuating raw material prices, intense competition, and stringent regulations regarding food safety and labeling. Supply chain disruptions and rising energy costs add to operational complexities. These factors can impact profitability and hinder market growth, particularly for smaller players. The exact quantifiable impact of these challenges on the market are difficult to pinpoint precisely but are anticipated to contribute to slower than expected growth in certain years.

Emerging Opportunities in Bakery Products Industry in Europe

The European bakery products market presents several emerging opportunities. Growing demand for functional foods, plant-based products, and personalized nutrition presents opportunities for product diversification and expansion into new market segments. The increasing use of e-commerce provides opportunities for direct-to-consumer sales and enhanced market reach.

Leading Players in the Bakery Products Industry in Europe Market

- Grupo Bimbo S A B de C V

- Warburtons Holdings Limited

- Dr Schär AG/SPA

- General Mills Inc

- Walkers Shortbread Ltd

- Associated British Foods Plc

- Mondelēz International Inc

- Alpha Baking Company Inc

- Kellogg Company

- Britannia Industries Limited

Key Developments in Bakery Products Industry in Europe Industry

- April 2021: Walker's Shortbread expands its gluten-free range, exclusively available at Sainsbury's. This expansion caters to the rising demand for gluten-free products.

- February 2022: Dr Schär UK Ltd. acquires Just: Gluten Free Bakery, expanding its presence in the gluten-free market. This acquisition signals consolidation and growth in the health-conscious segment.

- August 2022: Mondelēz International, Inc. innovates and reformulates products to reduce HFSS content across several brands. This demonstrates a proactive response to changing consumer preferences and health regulations.

Future Outlook for Bakery Products Industry in Europe Market

The European bakery products market is poised for continued growth, driven by factors such as evolving consumer preferences, technological advancements, and the increasing demand for healthy and convenient food options. Strategic partnerships, focused product innovation, and expansion into new market segments offer considerable opportunities for growth and profitability. The market is expected to maintain a healthy growth trajectory throughout the forecast period.

Bakery Products Industry in Europe Segmentation

-

1. Product Type

- 1.1. Cakes and Pastries

- 1.2. Biscuits

- 1.3. Bread

- 1.4. Morning Goods

- 1.5. Other Product Types

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Speciality Stores

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channel

Bakery Products Industry in Europe Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. France

- 4. Russia

- 5. Italy

- 6. Spain

- 7. Rest of Europe

Bakery Products Industry in Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.12% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Number Of Social Event Celebration; Innovations In Designs And Flavors

- 3.3. Market Restrains

- 3.3.1. Health Concerns Related To Ingredients

- 3.4. Market Trends

- 3.4.1. Augmented Demand for Convenient Food Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Bakery Products Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cakes and Pastries

- 5.1.2. Biscuits

- 5.1.3. Bread

- 5.1.4. Morning Goods

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Speciality Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channel

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. Germany

- 5.3.3. France

- 5.3.4. Russia

- 5.3.5. Italy

- 5.3.6. Spain

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United Kingdom Bakery Products Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Cakes and Pastries

- 6.1.2. Biscuits

- 6.1.3. Bread

- 6.1.4. Morning Goods

- 6.1.5. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Speciality Stores

- 6.2.4. Online Retail Stores

- 6.2.5. Other Distribution Channel

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Germany Bakery Products Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Cakes and Pastries

- 7.1.2. Biscuits

- 7.1.3. Bread

- 7.1.4. Morning Goods

- 7.1.5. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Speciality Stores

- 7.2.4. Online Retail Stores

- 7.2.5. Other Distribution Channel

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. France Bakery Products Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Cakes and Pastries

- 8.1.2. Biscuits

- 8.1.3. Bread

- 8.1.4. Morning Goods

- 8.1.5. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Speciality Stores

- 8.2.4. Online Retail Stores

- 8.2.5. Other Distribution Channel

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Russia Bakery Products Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Cakes and Pastries

- 9.1.2. Biscuits

- 9.1.3. Bread

- 9.1.4. Morning Goods

- 9.1.5. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Speciality Stores

- 9.2.4. Online Retail Stores

- 9.2.5. Other Distribution Channel

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Italy Bakery Products Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Cakes and Pastries

- 10.1.2. Biscuits

- 10.1.3. Bread

- 10.1.4. Morning Goods

- 10.1.5. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience Stores

- 10.2.3. Speciality Stores

- 10.2.4. Online Retail Stores

- 10.2.5. Other Distribution Channel

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Spain Bakery Products Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Cakes and Pastries

- 11.1.2. Biscuits

- 11.1.3. Bread

- 11.1.4. Morning Goods

- 11.1.5. Other Product Types

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. Supermarkets/Hypermarkets

- 11.2.2. Convenience Stores

- 11.2.3. Speciality Stores

- 11.2.4. Online Retail Stores

- 11.2.5. Other Distribution Channel

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Rest of Europe Bakery Products Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Cakes and Pastries

- 12.1.2. Biscuits

- 12.1.3. Bread

- 12.1.4. Morning Goods

- 12.1.5. Other Product Types

- 12.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.2.1. Supermarkets/Hypermarkets

- 12.2.2. Convenience Stores

- 12.2.3. Speciality Stores

- 12.2.4. Online Retail Stores

- 12.2.5. Other Distribution Channel

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Germany Bakery Products Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 14. France Bakery Products Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 15. Italy Bakery Products Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 16. United Kingdom Bakery Products Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 17. Netherlands Bakery Products Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 18. Sweden Bakery Products Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 19. Rest of Europe Bakery Products Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 20. Competitive Analysis

- 20.1. Market Share Analysis 2024

- 20.2. Company Profiles

- 20.2.1 Grupo Bimbo S A B de C V

- 20.2.1.1. Overview

- 20.2.1.2. Products

- 20.2.1.3. SWOT Analysis

- 20.2.1.4. Recent Developments

- 20.2.1.5. Financials (Based on Availability)

- 20.2.2 Warburtons Holdings Limited

- 20.2.2.1. Overview

- 20.2.2.2. Products

- 20.2.2.3. SWOT Analysis

- 20.2.2.4. Recent Developments

- 20.2.2.5. Financials (Based on Availability)

- 20.2.3 Dr Schär AG/SPA*List Not Exhaustive

- 20.2.3.1. Overview

- 20.2.3.2. Products

- 20.2.3.3. SWOT Analysis

- 20.2.3.4. Recent Developments

- 20.2.3.5. Financials (Based on Availability)

- 20.2.4 General Mills Inc

- 20.2.4.1. Overview

- 20.2.4.2. Products

- 20.2.4.3. SWOT Analysis

- 20.2.4.4. Recent Developments

- 20.2.4.5. Financials (Based on Availability)

- 20.2.5 Walkers Shortbread Ltd

- 20.2.5.1. Overview

- 20.2.5.2. Products

- 20.2.5.3. SWOT Analysis

- 20.2.5.4. Recent Developments

- 20.2.5.5. Financials (Based on Availability)

- 20.2.6 Associated British Foods Plc

- 20.2.6.1. Overview

- 20.2.6.2. Products

- 20.2.6.3. SWOT Analysis

- 20.2.6.4. Recent Developments

- 20.2.6.5. Financials (Based on Availability)

- 20.2.7 Mondelēz International Inc

- 20.2.7.1. Overview

- 20.2.7.2. Products

- 20.2.7.3. SWOT Analysis

- 20.2.7.4. Recent Developments

- 20.2.7.5. Financials (Based on Availability)

- 20.2.8 Alpha Baking Company Inc

- 20.2.8.1. Overview

- 20.2.8.2. Products

- 20.2.8.3. SWOT Analysis

- 20.2.8.4. Recent Developments

- 20.2.8.5. Financials (Based on Availability)

- 20.2.9 Kellogg Company

- 20.2.9.1. Overview

- 20.2.9.2. Products

- 20.2.9.3. SWOT Analysis

- 20.2.9.4. Recent Developments

- 20.2.9.5. Financials (Based on Availability)

- 20.2.10 Britannia Industries Limited

- 20.2.10.1. Overview

- 20.2.10.2. Products

- 20.2.10.3. SWOT Analysis

- 20.2.10.4. Recent Developments

- 20.2.10.5. Financials (Based on Availability)

- 20.2.1 Grupo Bimbo S A B de C V

List of Figures

- Figure 1: Bakery Products Industry in Europe Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Bakery Products Industry in Europe Share (%) by Company 2024

List of Tables

- Table 1: Bakery Products Industry in Europe Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Bakery Products Industry in Europe Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Bakery Products Industry in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Bakery Products Industry in Europe Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Bakery Products Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Bakery Products Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Bakery Products Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Bakery Products Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Bakery Products Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Bakery Products Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Bakery Products Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Bakery Products Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Bakery Products Industry in Europe Revenue Million Forecast, by Product Type 2019 & 2032

- Table 14: Bakery Products Industry in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: Bakery Products Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Bakery Products Industry in Europe Revenue Million Forecast, by Product Type 2019 & 2032

- Table 17: Bakery Products Industry in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 18: Bakery Products Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Bakery Products Industry in Europe Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: Bakery Products Industry in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 21: Bakery Products Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Bakery Products Industry in Europe Revenue Million Forecast, by Product Type 2019 & 2032

- Table 23: Bakery Products Industry in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 24: Bakery Products Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Bakery Products Industry in Europe Revenue Million Forecast, by Product Type 2019 & 2032

- Table 26: Bakery Products Industry in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 27: Bakery Products Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Bakery Products Industry in Europe Revenue Million Forecast, by Product Type 2019 & 2032

- Table 29: Bakery Products Industry in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 30: Bakery Products Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 31: Bakery Products Industry in Europe Revenue Million Forecast, by Product Type 2019 & 2032

- Table 32: Bakery Products Industry in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 33: Bakery Products Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bakery Products Industry in Europe?

The projected CAGR is approximately 3.12%.

2. Which companies are prominent players in the Bakery Products Industry in Europe?

Key companies in the market include Grupo Bimbo S A B de C V, Warburtons Holdings Limited, Dr Schär AG/SPA*List Not Exhaustive, General Mills Inc, Walkers Shortbread Ltd, Associated British Foods Plc, Mondelēz International Inc, Alpha Baking Company Inc, Kellogg Company, Britannia Industries Limited.

3. What are the main segments of the Bakery Products Industry in Europe?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Number Of Social Event Celebration; Innovations In Designs And Flavors.

6. What are the notable trends driving market growth?

Augmented Demand for Convenient Food Products.

7. Are there any restraints impacting market growth?

Health Concerns Related To Ingredients.

8. Can you provide examples of recent developments in the market?

August 2022: Mondelēz International, Inc. continued its strong track record of offering a wide range of snacking options for consumers by innovating to create new products or reformulating products that will not be classified as high in fat, salt, or sugar (HFSS) from beloved brands including belVita, Cadbury Drinking Chocolate, Maynards Bassetts and The Natural Confectionery Company.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bakery Products Industry in Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bakery Products Industry in Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bakery Products Industry in Europe?

To stay informed about further developments, trends, and reports in the Bakery Products Industry in Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence